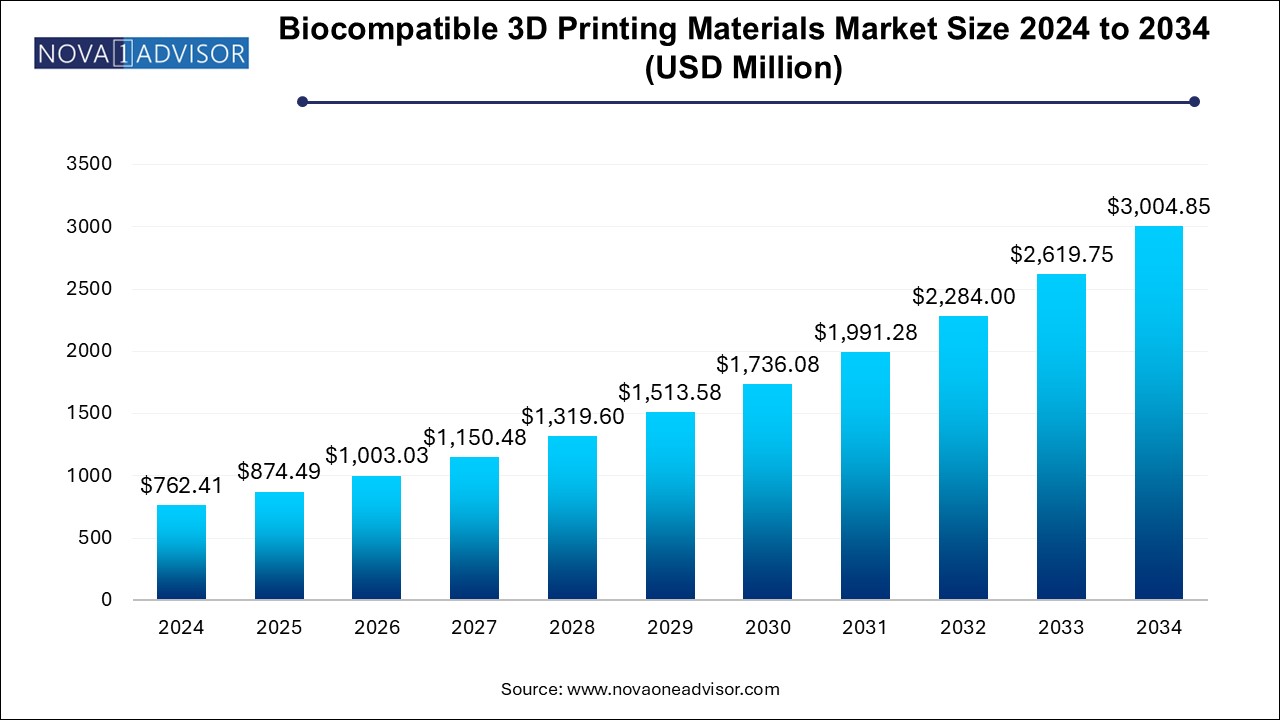

Biocompatible 3D Printing Materials Market Size and Growth

The biocompatible 3D printing materials market size was exhibited at USD 762.41 million in 2024 and is projected to hit around USD 3004.85 million by 2034, growing at a CAGR of 14.7% during the forecast period 2025 to 2034.

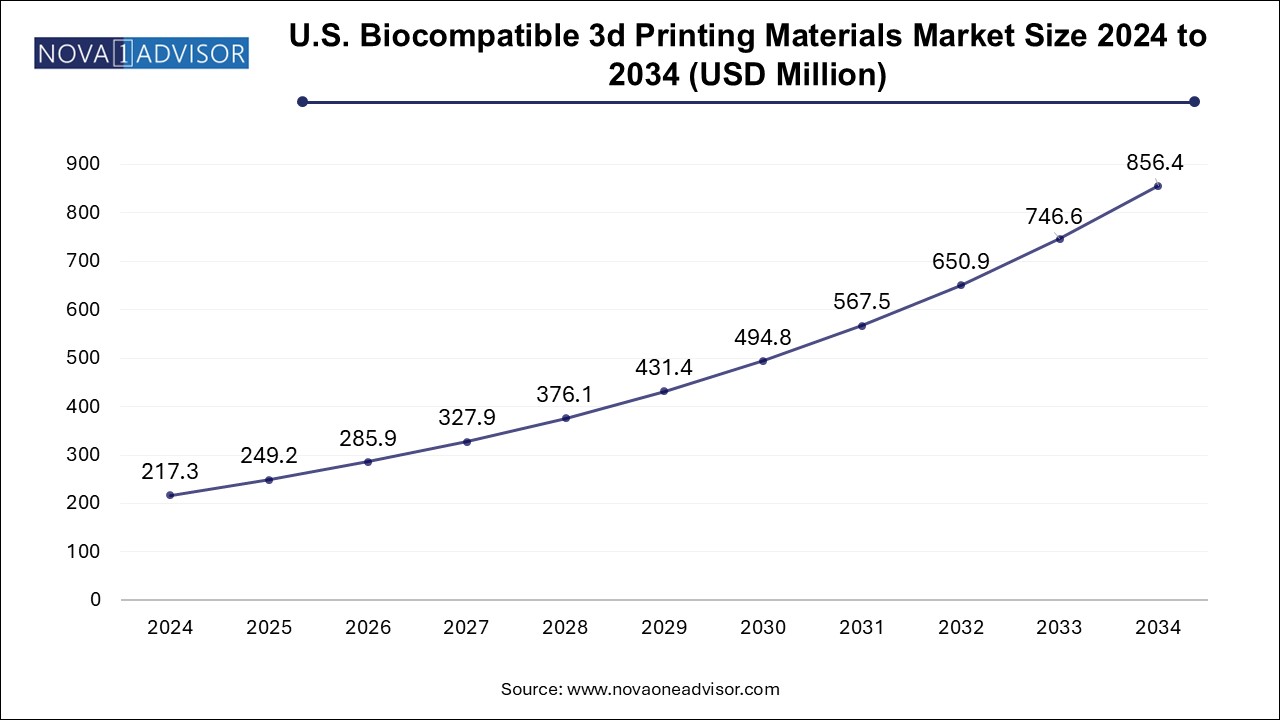

U.S. Biocompatible 3D Printing Materials Market Size and Growth 2025 to 2034

The U.S. biocompatible 3D printing materials market size is evaluated at USD 217.3 million in 2024 and is projected to be worth around USD 856.4 million by 2034, growing at a CAGR of 13.27% from 2025 to 2034.

North America held the largest market share in 2024, thanks to a well-established healthcare system, robust R&D funding, and early adoption of 3D printing in medical applications. The United States, in particular, has seen wide-scale implementation of 3D printing in orthopedic centers, dental clinics, and academic hospitals. Regulatory clarity from the FDA regarding additive-manufactured medical devices has further accelerated market entry for biocompatible materials. Key players like 3D Systems, Stratasys, and Evonik operate advanced facilities and collaborate with leading research universities to develop next-generation materials for healthcare use.

Government initiatives such as the NIH’s 3D Print Exchange and the Veterans Affairs (VA) 3D Printing Network have further supported innovation in personalized medicine and patient-specific surgical solutions. Additionally, the high prevalence of chronic diseases, rising geriatric population, and emphasis on cutting-edge healthcare technologies solidify North America's leadership position in this market.

Asia Pacific is projected to be the fastest-growing region, driven by rapid healthcare infrastructure development, increasing awareness of personalized medical solutions, and growing investment in biotechnology and 3D printing. Countries like China, India, South Korea, and Japan are investing heavily in additive manufacturing facilities, medical R&D centers, and regulatory modernization. China’s "Made in China 2025" and India's "Make in India" initiatives encourage the domestic production of medical devices and materials, opening the door for local and international players.

Additionally, Asia Pacific’s large patient population and rising demand for cost-effective medical treatments are leading hospitals and clinics to adopt 3D printing as a viable solution. Several universities and tech start-ups in the region are actively involved in developing bio-inks and biodegradable materials for implants and regenerative medicine. As clinical trial activity increases and local manufacturing scales, the region is poised to significantly influence global market dynamics.

Market Overview

The biocompatible 3D printing materials market is emerging as a dynamic and transformative segment of the global healthcare and additive manufacturing industries. These materials are specifically engineered to be compatible with the human body, enabling the safe fabrication of medical implants, prosthetics, dental devices, surgical instruments, and tissue engineering scaffolds. With the convergence of biomedicine and advanced manufacturing, biocompatible materials are playing a vital role in personalized healthcare, regenerative medicine, and next-generation surgical planning.

Biocompatible 3D printing materials span across various categories such as polymers, metals, and bio-inks. Polymers like polycaprolactone (PCL), polyether ether ketone (PEEK), and medical-grade photopolymers are used extensively in surgical guides, orthotic braces, and hearing aids. Metals such as titanium and cobalt-chrome alloys are used in the creation of dental implants, spinal fusion devices, and orthopedic components. Meanwhile, emerging materials in tissue engineering, including hydrogel-based bio-inks and collagen composites, are unlocking opportunities for printing living tissues and organ structures.

The adoption of 3D printing in healthcare is fueled by the ability to create patient-specific solutions with high precision, reduced waste, and faster prototyping cycles. Hospitals, research institutions, dental clinics, and orthopedic centers are increasingly turning to 3D printing technologies not just for cost savings, but also for their ability to produce custom implants and devices in-house or through on-demand supply chains. Regulatory bodies such as the U.S. Food and Drug Administration (FDA) have begun to recognize 3D-printed medical devices and implants, accelerating the pathway to commercialization.

As the healthcare industry transitions from mass production to personalized treatment, the biocompatible 3D printing materials market is set to become a cornerstone of innovation. The increasing aging population, rising incidence of orthopedic conditions, dental disorders, and cancer-related reconstructive surgeries continue to drive demand. Furthermore, government and private investment in biofabrication research, especially in regions like North America, Europe, and Asia Pacific, signals a robust long-term market trajectory.

Major Trends in the Market

-

Growth of Personalized Healthcare Solutions: Rising demand for patient-specific implants and prosthetics is accelerating the adoption of customized 3D printing materials.

-

Expansion of Tissue Engineering Applications: Hydrogel-based bio-inks and cell-laden materials are increasingly being used in experimental and commercial bioprinting.

-

Integration of AI and Simulation Software: AI-powered modeling platforms are being used to optimize 3D-printed designs for anatomical accuracy and material efficiency.

-

Regulatory Support and Standardization Efforts: Health authorities are releasing guidelines to standardize testing, approval, and usage of biocompatible printed materials.

-

Strategic Collaborations and R&D Partnerships: Material manufacturers are collaborating with universities and healthcare institutions to develop next-generation biomaterials.

-

Growth in Dental and Audiology Applications: The use of resins and flexible polymers in dental implants, aligners, and hearing aids continues to expand.

-

Sustainable and Eco-Friendly Biopolymers: Environmentally friendly, biodegradable options are being explored for temporary implants and disposable surgical tools.

-

Localization of Manufacturing in Hospitals: Point-of-care 3D printing labs within healthcare settings are enhancing the demand for user-friendly biocompatible materials.

Report Scope of Biocompatible 3D Printing Materials Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 874.49 Million |

| Market Size by 2034 |

USD 3004.85 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 14.7% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Formlabs Inc.; 3D Systems Inc.; Evonik Industries AG; Stratasys Ltd.; Concept Laser Gmbh; Renishaw plc; ENVISIONTEC US LLC; Cellink; DETAX Ettlingen; Hoganas AB |

Market Driver: Increasing Demand for Customized Implants and Medical Devices

The key driver propelling the biocompatible 3D printing materials market is the surging demand for personalized medical devices and implants. Traditional manufacturing techniques are often limited in producing complex geometries required for fitting a patient’s unique anatomy. In contrast, 3D printing allows for precise customization based on CT or MRI scans, resulting in better anatomical fit, reduced surgical time, and improved patient outcomes.

For example, orthopedic surgeons are now using 3D-printed titanium implants tailored for individual patients suffering from trauma or joint degeneration. Similarly, dental practitioners are leveraging biocompatible photopolymers to produce same-day crowns and aligners. Hearing aid manufacturers are also capitalizing on custom-fit shells made from medical-grade resins. This shift toward precision medicine is creating consistent demand for high-performance, body-safe 3D printing materials.

Market Restraint: High Cost and Regulatory Barriers for Advanced Biomaterials

A notable restraint in the biocompatible 3D printing materials market is the high cost of material development, qualification, and regulatory approval. Developing biocompatible materials requires rigorous testing to meet ISO, ASTM, and country-specific health authority standards. This includes assessments for cytotoxicity, genotoxicity, immunogenicity, and mechanical performance. Moreover, advanced materials like titanium powder for 3D printing or bioresorbable polymers often come with high production costs and limited shelf life.

In addition, regulatory pathways remain complex and lengthy. For example, in the U.S., 3D-printed implants must undergo Class II or III FDA clearance depending on application and intended use. The lack of universal global standards for 3D-printed medical materials also limits cross-border commercialization. For start-ups or smaller material providers, the investment in compliance and validation can act as a significant entry barrier, curbing innovation and slowing market expansion.

Market Opportunity: Expansion of Bioprinting and Tissue Engineering Applications

One of the most promising opportunities lies in the expanding field of bioprinting and tissue engineering, where 3D printing is being used to fabricate living tissues, scaffolds, and potentially functional organs. Researchers and biotech firms are experimenting with hydrogel-based bio-inks that contain living cells, growth factors, and biodegradable polymers to construct tissue layers for regenerative purposes.

The long-term vision includes printing organs like kidneys, livers, and heart tissues using patient-derived cells—eliminating the need for donors and reducing the risk of rejection. Although this application is still largely in the experimental phase, it has seen significant investment from public institutions and private companies. Firms developing biocompatible, cell-supportive printing materials for this niche will be well-positioned as the field transitions from labs to clinics. As printing technologies advance and regulatory frameworks evolve, the market for tissue-compatible materials is expected to witness exponential growth.

Biocompatible 3D Printing Materials Market By Type Insights

The Polymers dominated the biocompatible 3D printing materials market in 2024, owing to their widespread use in prosthetics, dental devices, surgical models, and hearing aids. Materials such as PEEK, PLA, PETG, and photopolymer resins offer flexibility, biocompatibility, and cost efficiency. These materials are extensively used in stereolithography (SLA), fused deposition modeling (FDM), and digital light processing (DLP) technologies. Moreover, polymers are relatively easy to process, sterilize, and customize, making them ideal for rapid prototyping and low-risk patient contact applications. Hospitals and dental labs often prefer polymer-based materials for short lead times and affordability.

Metals are projected to be the fastest-growing type, primarily due to the increasing adoption of titanium and cobalt-chrome alloys in orthopedic and dental implants. These materials offer superior strength, corrosion resistance, and osseointegration properties, which are essential for permanent implants. With the growth of metal additive manufacturing techniques like selective laser melting (SLM) and electron beam melting (EBM), healthcare providers can now create highly complex implants that match patient-specific anatomy. The rising number of spinal, cranial, and maxillofacial surgeries using 3D-printed metallic implants will continue to drive this segment.

Biocompatible 3D Printing Materials Market By Application Insights

The Implants and prosthesis led the market in 2024, as 3D-printed biocompatible materials are increasingly used to produce orthopedic joints, dental implants, and limb prosthetics. Customization, weight reduction, and the ability to create porous structures for better bone integration have made 3D-printed implants more attractive than traditional implants. Titanium, PEEK, and medical-grade nylon are widely adopted in this application. From hip sockets to cranial plates, the precision and durability offered by 3D printing provide a clear clinical advantage, making this segment foundational to the market’s growth.

Tissue engineering is expected to be the fastest-growing application, fueled by breakthroughs in stem cell research, regenerative medicine, and organ-on-chip technologies. 3D bioprinting of vascular structures, skin tissues, and bone scaffolds is rapidly advancing, particularly in academic research and specialized biotech firms. Materials like alginate, gelatin methacrylate (GelMA), and collagen composites are being explored for their compatibility with live cells and their potential in mimicking native tissue environments. As regulatory frameworks adapt and 3D bioprinters improve, the commercial viability of tissue engineering materials will increase exponentially.

Some of the prominent players in the biocompatible 3D printing materials market include:

Biocompatible 3D Printing Materials Market Recent Developments

-

In February 2025, 3D Systems announced a partnership with CollPlant Biotechnologies to develop bio-inks for regenerative medicine, with a focus on 3D-printed tissue scaffolds.

-

In December 2024, Evonik Industries launched a new medical-grade PEEK filament designed for orthopedic and spinal implants using FDM technology.

-

In October 2024, Stratasys introduced a portfolio of biocompatible photopolymers optimized for hearing aids and dental aligners, expanding its presence in end-use applications.

-

In August 2024, Materialise signed a distribution agreement with a Chinese hospital network to supply custom craniofacial implants made from 3D-printed titanium.

-

In June 2024, Desktop Health (a subsidiary of Desktop Metal) released Flexcera Base+, a durable, biocompatible resin for dental prosthetics, receiving FDA 510(k) clearance.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biocompatible 3D printing materials market

By Type

By Application

- Implants & Prosthesis

- Prototyping & Surgical Guides

- Tissue Engineering

- Hearing Aids

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)