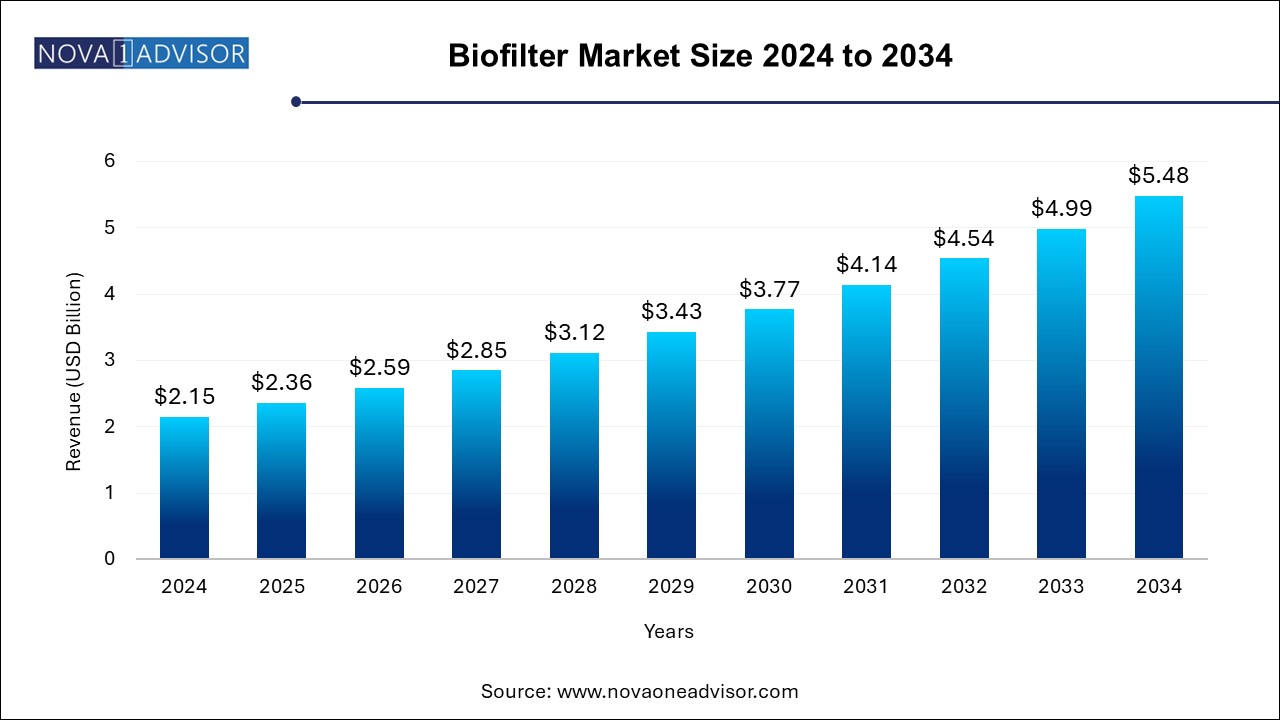

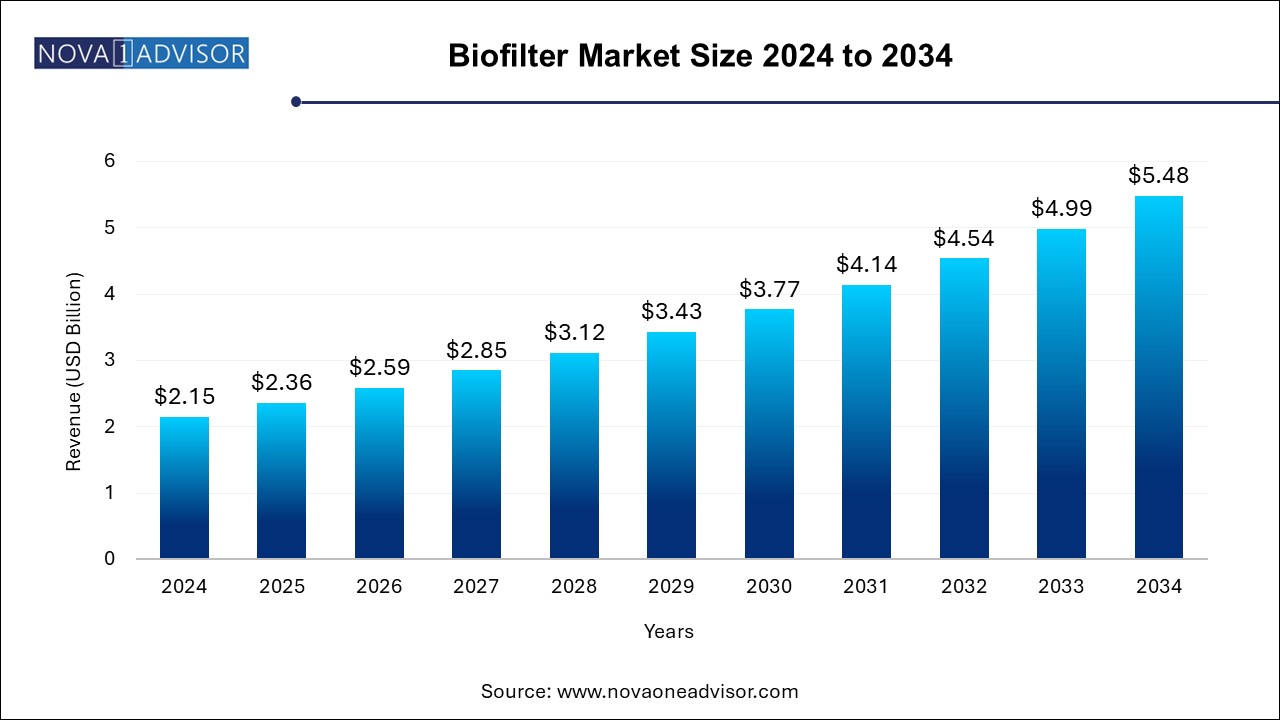

Biofilter Market Size and Growth

The biofilter market size was exhibited at USD 2.15 billion in 2024 and is projected to hit around USD 5.48 billion by 2034, growing at a CAGR of 9.8% during the forecast period 2024 to 2034.

Biofilter Market Key Takeaways:

- The activated carbon biofilter segment held largest share of 24.2% of the biofilter market in 2024.

- Biological aerated filter (BAFs) is the fastest-growing sub-segment in the market. It is expected to grow at a CAGR of 13.6% between 2025 and 2030.

- The ceramic ring segment held the largest market share of 33.8% in 2024.

- Bio balls are anticipated to witness a significant growth rate of 10.5% from 2024 to 2034.

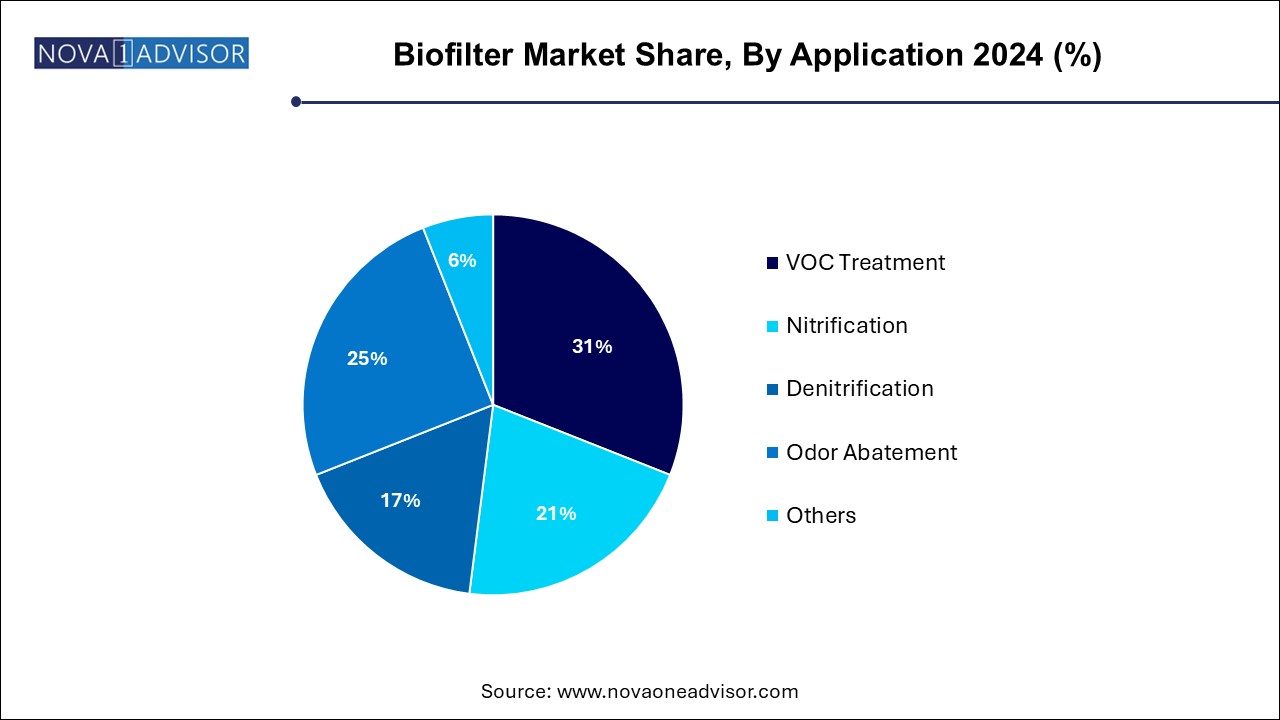

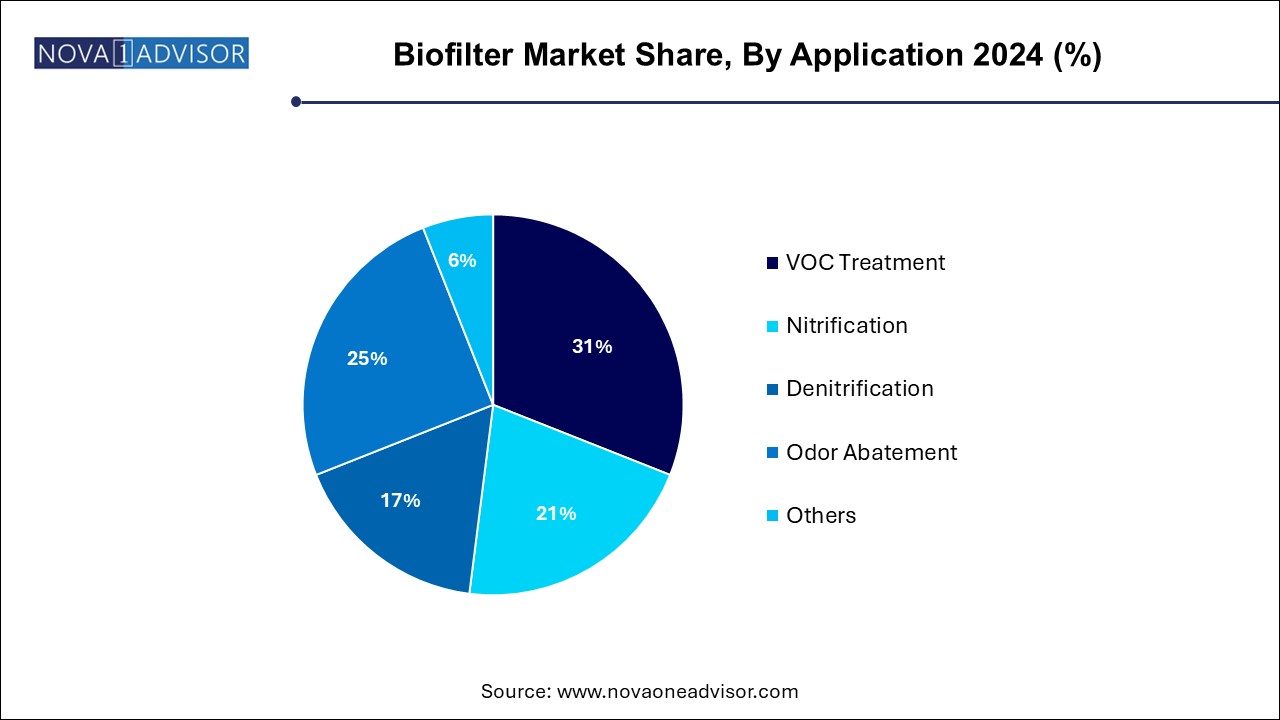

- Volatile organic compounds (VOC) treatment held the largest market share of 31.0% in in 2024.

- Odor abatement is projected to have the fastest growth rate of 12.9% during the forecasted period.

- Aquaculture segment held the largest market share of 23.7% in 2024.

- North America biofilter market accounted for the largest share of 43.4% in the biofilter market in 2024.

Market Overview

The biofilter market has emerged as a critical segment within the environmental and industrial waste management ecosystem, driven by increasing global awareness surrounding pollution control, environmental sustainability, and water purification. Biofilters, which utilize living materials to capture and biologically degrade pollutants, are extensively applied in air and water treatment systems. The evolution of biofiltration technologies has significantly transformed sectors like chemical processing, aquaculture, stormwater management, and biopharma industries, providing efficient, cost-effective, and eco-friendly solutions.

Biofiltration systems function by channeling contaminated air or water through a filter medium that supports microbial life. These microorganisms metabolize pollutants, converting them into harmless by-products such as carbon dioxide, water, and biomass. Ongoing innovations in filter media and microbial cultures have considerably expanded the performance and lifespan of biofilters, while modular and scalable designs have improved adaptability across a wide range of applications.

With governments worldwide tightening emission and discharge regulations, especially for volatile organic compounds (VOCs), nitrogenous wastes, and industrial odors, the biofilter market has gained significant traction. Additionally, urbanization, growing industrial output, and increased investment in wastewater infrastructure have fueled market demand. As industries increasingly prioritize sustainability, the adoption of biofilters is anticipated to rise across emerging economies and technologically mature regions alike.

Major Trends in the Market

-

Rise in Hybrid Biofiltration Systems: Integration of physical, chemical, and biological filtration components to enhance treatment efficiency and adaptability to variable inflow quality.

-

Growing Popularity of Modular Biofilter Units: Portable, scalable biofilters are gaining ground due to ease of installation and lower capital expenditure, particularly in temporary and decentralized installations.

-

Use of AI and IoT in Monitoring Biofilters: Smart sensors and AI-based predictive maintenance systems are being increasingly employed to monitor microbial health, airflow, and nutrient levels in real-time.

-

Shift toward Sustainable Filter Media: Manufacturers are replacing plastic-based filter media with biodegradable or recycled materials to align with circular economy goals.

-

Increased Investment in Aquaculture Biofiltration: Rapid growth of inland fish farms and recirculating aquaculture systems (RAS) is driving demand for biofilters to maintain optimal water quality.

-

Adoption in Indoor Air Quality Management: Biofilters are being incorporated into HVAC systems in commercial and residential buildings to reduce airborne VOCs and pathogens.

-

Biofilter Research in Space Missions: Experimental research is underway to develop compact biofilter systems for use in controlled life support systems in spacecraft and extraterrestrial habitats.

Report Scope of Biofilter Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.36 Billion |

| Market Size by 2034 |

USD 5.48 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 9.8% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Filter Media, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Aquael, Aquaneering, Inc.; AZOO BIO CORPORATION; EHEIM GmBh & Co. KG; Pentair Aquatic Eco-systems, Inc; Aqua Design Amano Co.,Ltd.; Veolia Water Technologies; Zoo Med Laboratories, Inc.; Waterlife Research Ind. Ltd |

Key Market Driver: Stricter Environmental Regulations

One of the strongest drivers for the biofilter market is the tightening of environmental regulations globally, particularly regarding emissions of hazardous pollutants like VOCs, ammonia, hydrogen sulfide, and nitrogen oxides. Regulatory bodies such as the U.S. Environmental Protection Agency (EPA), the European Environment Agency (EEA), and respective national authorities in Asia-Pacific have established stringent thresholds for pollutant discharge into the air and water systems. For instance, the Clean Air Act amendments in the U.S. mandate industries to adopt best-available technologies for controlling VOC emissions—many of which rely on biofiltration systems.

These regulations push industries, especially chemical, petrochemical, and pharmaceutical manufacturers, to invest in robust air and water treatment infrastructure. Compared to thermal oxidation or chemical scrubbing, biofilters offer a greener, energy-efficient, and cost-effective solution. This has led to large-scale deployment in municipal wastewater plants, food processing units, and manufacturing hubs. Furthermore, carbon neutrality goals pursued by several countries add further momentum to the biofiltration movement.

Despite their benefits, biofilters face operational constraints under extreme environmental conditions, which poses a significant restraint to their broader adoption. High variability in temperature, humidity, or pH can adversely affect the viability of microbial communities responsible for pollutant degradation. In cold climates, microbial activity can slow down significantly, reducing system efficiency. Similarly, the presence of toxic compounds in influent streams can inhibit microbial growth, leading to system failure.

Industries operating in harsh or highly variable environments often prefer alternative treatment methods such as activated carbon filters or chemical scrubbers, which offer more consistent performance. The need for frequent monitoring, replacement of filter media, and nutrient dosing further increases maintenance complexity, especially in remote or resource-constrained settings. Until advanced, resilient microbial strains and self-regulating control systems become widespread, performance unpredictability remains a limiting factor.

Key Market Opportunity: Expansion of Recirculating Aquaculture Systems (RAS)

A prominent opportunity for the biofilter market lies in the rapid global expansion of recirculating aquaculture systems (RAS), especially in landlocked and urbanized regions. RAS represents a closed-loop aquaculture model where water is continuously treated and reused, enabling high-density fish farming with minimal environmental impact. Biofilters are integral to RAS, particularly in nitrification and denitrification processes essential for maintaining water quality.

As fish protein demand rises amid depleting wild stocks, governments and private investors are aggressively funding RAS projects. For example, Nordic Aquafarms in the U.S. and Kingfish Zeeland in the Netherlands are developing large-scale RAS facilities, each requiring sophisticated biofiltration. With regulatory support and advances in aquaculture technology, the biofilter market stands to benefit enormously from this trend. Furthermore, the customization of biofilter designs for specific fish species and climates opens up lucrative opportunities for biofilter manufacturers and service providers.

Biofilter Market By Type Insights

Biological Aerated Biofilter Systems dominated the type segment due to their widespread application in wastewater treatment and air purification. These systems combine aeration with microbial degradation, making them highly effective against organic contaminants and odors. Municipalities across Europe and North America have extensively deployed this technology in centralized wastewater treatment plants. Moreover, their relatively simple design and moderate operating costs make them suitable for retrofitting into existing facilities.

Fluidized Bed Filters are projected to be the fastest-growing segment. They offer superior treatment efficiency due to enhanced surface area for microbial growth and improved mass transfer rates. Their usage is expanding in aquaculture and chemical industries where high pollutant loads are common. Unlike fixed-film filters, fluidized systems adapt more easily to changes in inflow composition, making them ideal for dynamic applications. As their design becomes more compact and energy-efficient, demand is expected to surge.

Moving Bed Filter Media currently dominates the filter media segment, thanks to its self-cleaning properties and high durability. These media are often made from polyethylene or polypropylene and provide a large surface area for microbial colonization. Moving bed biofilm reactors (MBBR) are particularly favored in compact systems like RAS, containerized wastewater units, and portable air purifiers.

Bio Balls are anticipated to be the fastest-growing media type, especially in the aquaponics and food & beverage industry. Their affordability and ease of handling make them popular in decentralized systems. Additionally, research into 3D-printed and biodegradable bio balls is opening new avenues for sustainable filtration. Startups in Southeast Asia and Latin America are utilizing bio balls in small-scale aquaculture and greywater recycling, driving localized growth.

Biofilter Market By Application Insights

VOC Treatment continues to dominate the application segment, driven by demand from paint, coating, and petrochemical industries. Regulatory mandates in developed economies are compelling firms to invest in VOC capture technologies. Biofilters provide a chemical-free and economical method for degrading compounds like benzene, toluene, and xylene.

Nitrification is expected to grow at the fastest pace, especially in aquaculture and water reuse sectors. Maintaining optimal ammonia and nitrite levels is essential in closed-loop systems, and biofilters provide a biological route to convert these into less harmful nitrates. Innovations in nitrifying bacteria cultures and real-time ammonia sensors are improving performance and reliability.

Biofilter Market By End-use Insights

Water & Wastewater Collection remains the leading end-use segment, backed by large-scale government and industrial investments. Municipal and industrial players rely on biofilters to meet effluent discharge standards and reduce operational costs. Additionally, infrastructure modernization programs across Europe and the U.S. are replacing outdated systems with biofiltration units.

Aquaculture is expected to witness the highest CAGR, supported by the growth of urban fish farming and sustainability concerns. Countries like Norway, Canada, and India are seeing rapid deployment of biofilters in inland fish farms. Moreover, integrated aquaponics systems which combine plant and fish farming use biofilters to maintain water chemistry and nutrient cycles, boosting demand further.

Biofilter Market By Regional Insights

North America currently leads the global biofilter market, owing to its robust regulatory landscape, high industrialization levels, and advanced wastewater treatment infrastructure. The U.S. Environmental Protection Agency (EPA) mandates emission controls for VOCs and nitrogen compounds, which has spurred biofilter adoption in various industries. Moreover, significant investments in R&D, such as those by the National Science Foundation and private companies, have led to innovation in microbial formulations and filter materials. The demand for biofilters is also supported by aquaculture growth in the Pacific Northwest and the Great Lakes region.

Asia Pacific is the fastest-growing market for biofilters, driven by rapid urbanization, industrial expansion, and environmental degradation. Countries such as China, India, and Vietnam are aggressively implementing biofiltration technologies in municipal wastewater and industrial effluent treatment. Rising public awareness about air pollution and increasing investments in aquaculture particularly in coastal and rural communities have created a fertile market. Government initiatives like “Clean Ganga Mission” in India and stricter emission controls in China further reinforce demand.

Some of the prominent players in the biofilter market include:

Biofilter Market Recent Development

-

In February 2024, Veolia Water Technologies announced the successful commissioning of a large-scale biofilter unit at a wastewater treatment facility in Ontario, Canada, expected to reduce ammonia levels by over 90%.

-

In March 2024, BioAir Solutions launched an AI-enabled modular biofilter system named “EcoSmart,” aimed at odor control in food processing plants across Europe.

-

In January 2024, Evoqua Water Technologies signed a strategic partnership with a Southeast Asian aquaculture firm to develop integrated biofiltration systems for large RAS facilities in Vietnam and Indonesia.

-

In April 2024, AquaShield Inc. introduced biodegradable bio balls made from corn starch polymer, targeting urban aquaponics and greywater reuse applications in Latin America.

-

In November 2023, GEA Group AG expanded its product line by acquiring a Netherlands-based startup specializing in denitrification biofilters, aiming to enhance its footprint in the European water treatment market.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the biofilter market

By Type

- Biological Aerated Biofilter System

- Denitrification Biofilter Systems

- Activated Carbon Biofilters

- Fixed Films

- Fluidized Bed Filter

By Filter Media

- Ceramic Rings

- Bio Balls

- Moving Bed Filter Media

- Others

By Application

- VOC Treatment

- Nitrification

- Denitrification

- Odor Abatement

- Others

By End-use

- Storm Water Management

- Water & Wastewater collection

- Chemical processing

- Food & Beverage

- Aquaculture

- Biopharma industry

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)