Biomarkers Market Size and Trends

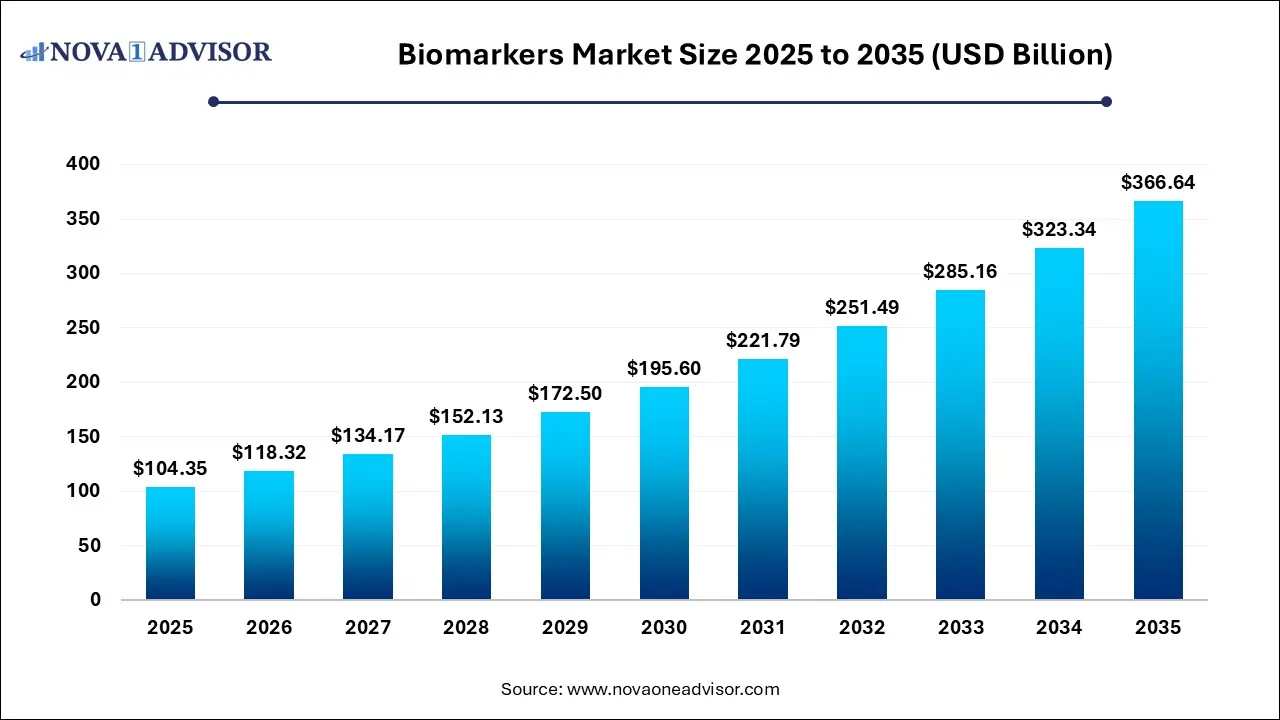

The biomarkers market size was exhibited at USD 104.35 billion in 2025 and is projected to hit around USD 366.64 billion by 2035, growing at a CAGR of 13.39% during the forecast period 2026 to 2035.

Biomarkers Market Key Takeaways:

- The safety segment held the largest revenue share of 37.62% in 2025.

- The efficacy biomarkers segment is expected to grow at the fastest CAGR from 2026 to 2035.

- The consumables segment led the market in 2025.

- The services segment is anticipated to exhibit a lucrative CAGR over the projected period.

- The drug discovery & development segment dominated the market in 2025.

- The diagnostics segment is projected to register the fastest CAGR from 2026 to 2035.

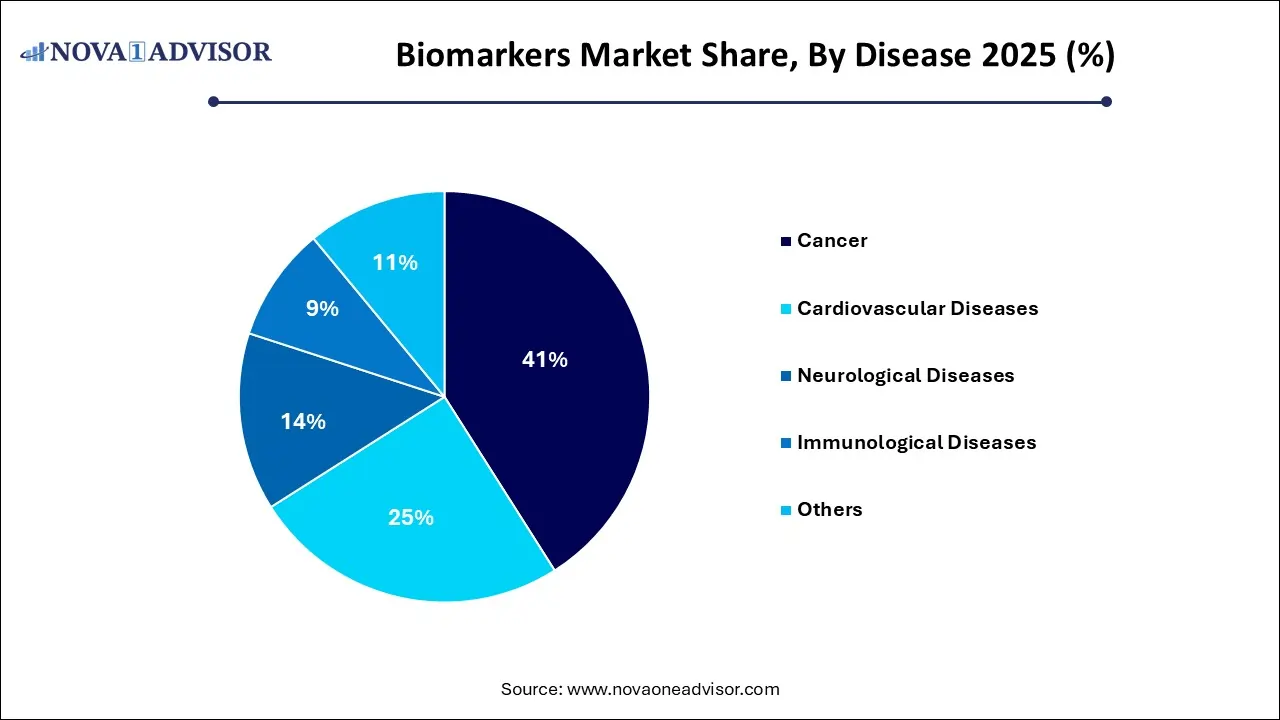

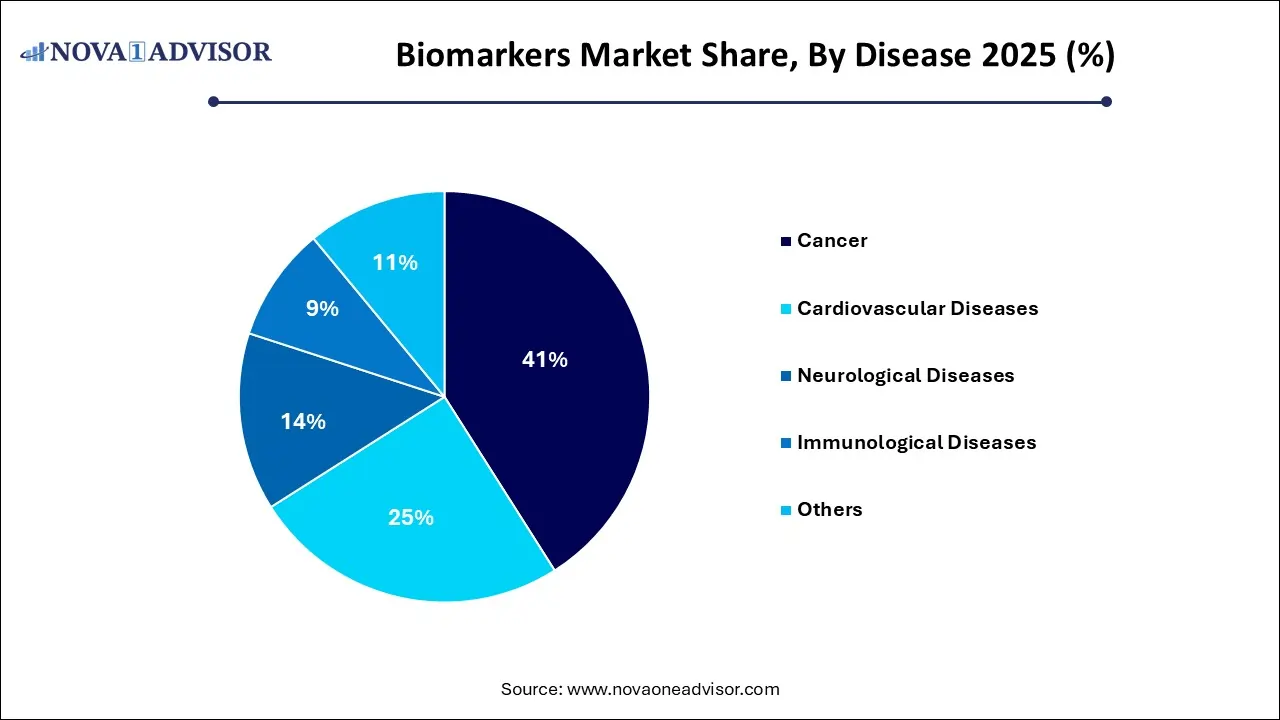

- The cancer segment led the market in 2025 and is expected to retain its dominance from 2026 to 2035.

- The immunological diseases segment is expected to attain the fastest CAGR from 2026 to 2035.

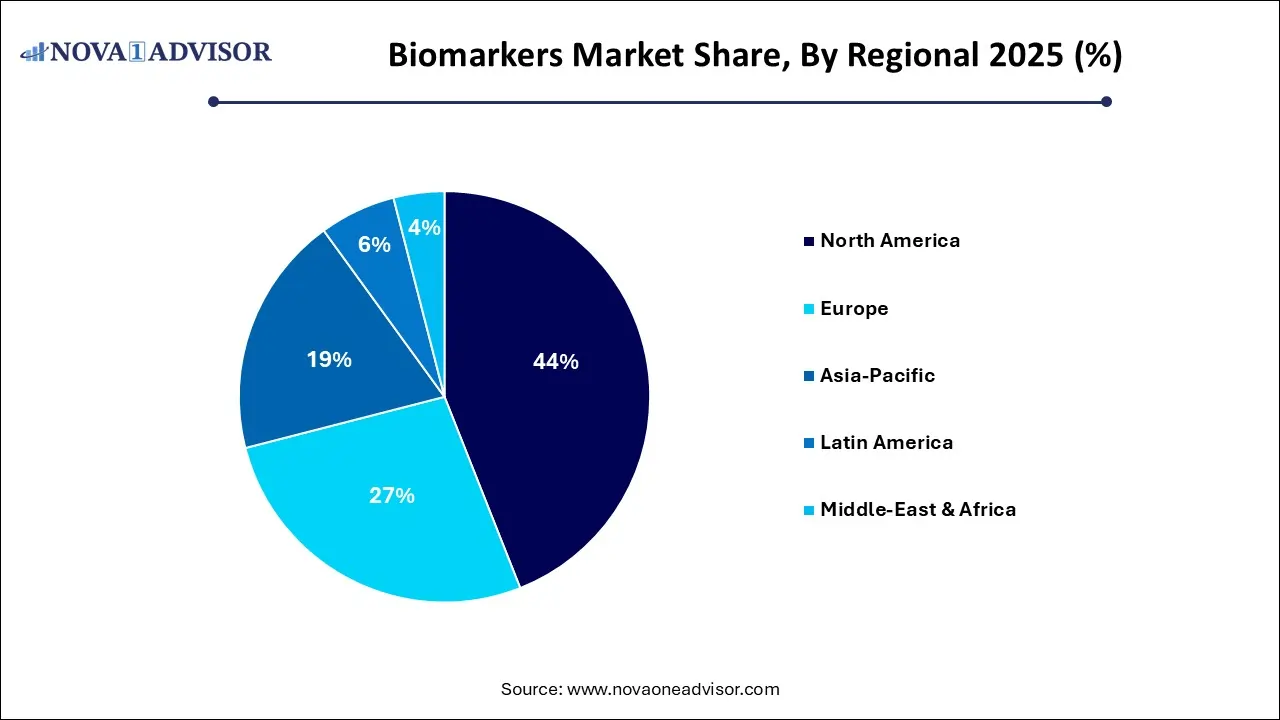

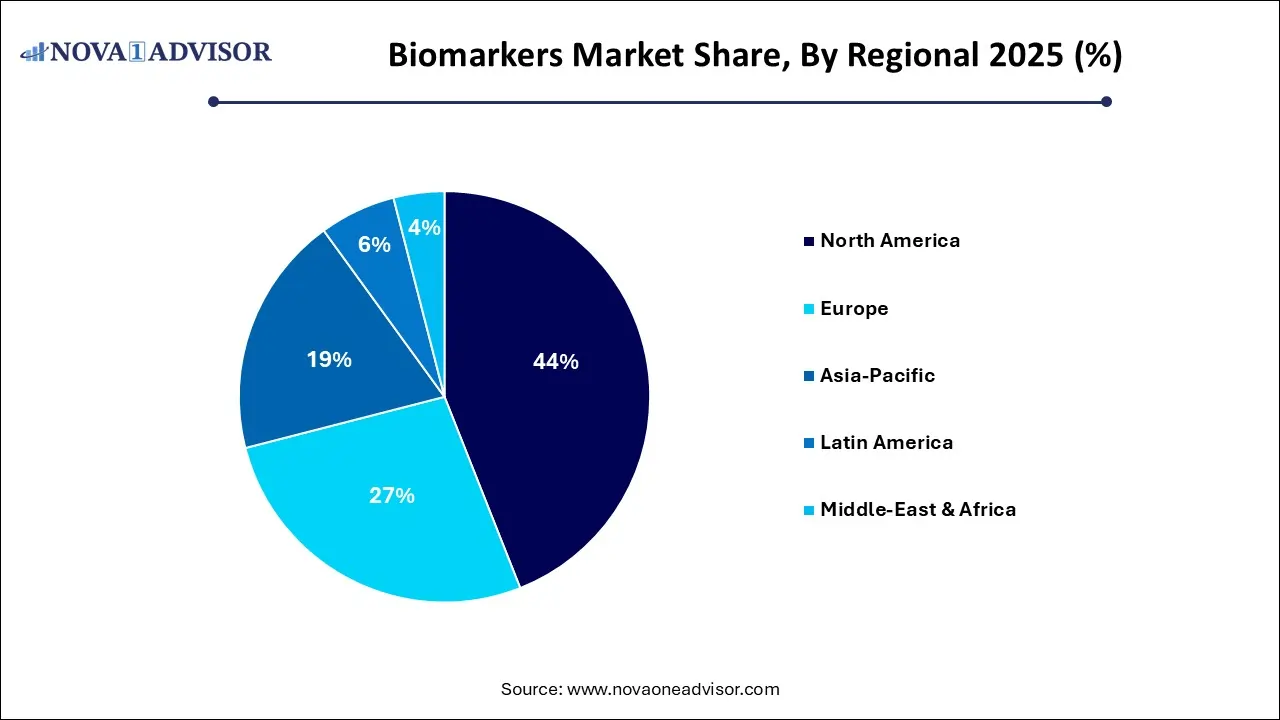

- North America led the market with a revenue share of 44.0% in 2025.

- Asia Pacific is anticipated to attain the fastest CAGR from 2026 to 2035.

Market Overview

The biomarkers market is one of the most transformative and rapidly expanding sectors within the healthcare and life sciences industry. Biomarkers biological molecules found in blood, tissues, or other body fluids are indicators of a normal or abnormal biological process, or a response to a therapeutic intervention. They play a pivotal role in disease diagnosis, prognosis, treatment selection, and therapeutic monitoring, making them indispensable tools across clinical and research settings.

In the era of precision medicine and personalized healthcare, the importance of biomarkers has become more pronounced. Biomarkers are being integrated into every stage of the healthcare continuum from early disease detection and risk assessment to stratified therapy and patient outcome monitoring. For example, HER2 overexpression in breast cancer is routinely tested using biomarkers to guide decisions about trastuzumab (Herceptin) therapy. Similarly, biomarkers like troponin are vital in diagnosing and assessing the severity of acute coronary syndromes.

Beyond clinical diagnostics, biomarkers are revolutionizing drug development by enabling better patient selection, real-time efficacy monitoring, and safety assessment in trials. Regulatory agencies like the U.S. FDA and EMA increasingly accept biomarkers as surrogate endpoints or companion diagnostics, further integrating them into drug pipelines. As the healthcare industry pivots toward value-based care, and the demand for non-invasive, cost-effective, and real-time diagnostic tools increases, the global biomarkers market is poised for sustained and exponential growth.

Major Trends in the Market

-

Proliferation of Companion Diagnostics: The co-development of biomarkers with targeted therapies is expanding, particularly in oncology and immunotherapy.

-

Integration with Multi-Omics Technologies: Biomarkers are increasingly identified and validated through genomics, proteomics, metabolomics, and transcriptomics.

-

Adoption of AI in Biomarker Discovery: Artificial intelligence and machine learning are accelerating the identification of novel biomarkers from complex datasets.

-

Rise of Liquid Biopsies: Non-invasive testing for circulating tumor DNA (ctDNA), microRNAs, and exosomes is gaining popularity for real-time disease monitoring.

-

Personalized Medicine Expansion: Biomarkers are foundational to the personalization of therapy in cancer, neurology, and rare diseases.

-

Use in Clinical Trials: Predictive and pharmacodynamic biomarkers are being utilized to improve patient recruitment and measure therapeutic response in real-time.

-

Increasing Focus on Validation and Standardization: The industry is emphasizing rigorous validation protocols and regulatory harmonization for clinical biomarkers.

-

Biomarker Use in Preventive and Wellness Healthcare: Biomarkers are finding applications in disease risk prediction, early intervention, and health monitoring in asymptomatic individuals.

Report Scope of Biomarkers Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 118.32 Billion |

| Market Size by 2035 |

USD 366.64 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 13.39% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Product, Application, Disease, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

F. Hoffmann-La Roche AG.; Abbott; Epigenomics AG; General Electric; Johnson & Johnson Services, Inc.; Thermo Fisher Scientific Inc.; Bio-Rad Laboratories, Inc.; Siemens Healthineers AG; QIAGEN; Merck KGaA; PerkinElmer Inc.; Agilent Technologies, Inc.; Eurofins Scientific |

Key Market Driver: Growth in Targeted Therapies and Personalized Medicine

The primary driver propelling the biomarkers market forward is the growing emphasis on targeted therapies and personalized medicine. Personalized medicine relies on identifying the right treatment for the right patient at the right time, and biomarkers are central to this paradigm. They help in identifying specific molecular targets, stratifying patient populations, and monitoring therapeutic responses.

In oncology, for example, biomarker-based stratification has become routine. Drugs like pembrolizumab are prescribed based on PD-L1 expression, and EGFR mutations guide the use of tyrosine kinase inhibitors in lung cancer. In cardiology, biomarkers such as NT-proBNP help assess the severity of heart failure and guide therapy adjustments. The global push toward minimizing trial-and-error medicine, coupled with the increasing development of high-value biologics and immunotherapies, continues to elevate the role of biomarkers in clinical decision-making and drug development.

Key Market Restraint: Regulatory Complexity and Biomarker Validation Challenges

While the market potential is vast, regulatory challenges and the complexity of biomarker validation act as major restraints. Biomarker discovery is data-intensive and resource-consuming, and translating these discoveries into validated clinical tools involves stringent scientific, analytical, and clinical validation steps. The lack of standardized protocols for biomarker validation often leads to reproducibility issues and delays in regulatory approvals.

Furthermore, the use of biomarkers as surrogate endpoints in clinical trials or as companion diagnostics requires regulatory endorsement. This process is rigorous and can vary significantly across jurisdictions, creating uncertainty and compliance burdens for developers. Even within approved biomarker categories, integration into clinical practice requires alignment with guidelines, reimbursement policies, and clinical education, which can slow adoption.

Key Market Opportunity: Expansion of Biomarker Applications in Neurology

A rapidly emerging opportunity lies in the expansion of biomarker applications in neurological diseases, such as Alzheimer’s, Parkinson’s, multiple sclerosis (MS), and ALS. Traditionally, neurological conditions have lacked reliable biomarkers for early detection and disease monitoring. However, recent advances in cerebrospinal fluid (CSF) and blood-based biomarkers, imaging modalities, and digital phenotyping are changing this landscape.

For instance, biomarkers such as phosphorylated tau (p-tau) and beta-amyloid (Aβ42/40) are now recognized for their ability to detect early pathological changes in Alzheimer’s disease, even before clinical symptoms manifest. The FDA recently approved a blood test for Alzheimer’s biomarkers, a move that could revolutionize diagnosis and enable early therapeutic intervention. Similarly, neurofilament light chain (NfL) is gaining attention as a prognostic and pharmacodynamic biomarker in multiple sclerosis and ALS. As neurodegenerative diseases increase globally due to aging populations, neurological biomarkers present a massive growth frontier for diagnostics and drug development companies.

Biomarkers Market By Type Insights

Efficacy biomarkers dominated the market, as they are central to determining whether a drug or intervention is achieving the intended therapeutic effect. These biomarkers are frequently used in clinical trials and translational research, where demonstrating biological activity and improvement is essential for drug progression. In cancer immunotherapy, for example, the level of tumor-infiltrating lymphocytes (TILs) or changes in cytokine profiles are monitored as efficacy biomarkers. Pharmaceutical companies are heavily reliant on efficacy biomarkers to make real-time go/no-go decisions during drug development, contributing to this segment’s dominance.

Predictive biomarkers are the fastest-growing segment, primarily due to their role in guiding personalized therapy. These biomarkers help predict a patient’s likely response or resistance to a particular treatment, thus enabling optimal therapeutic selection. EGFR, BRAF, and KRAS mutations are widely used predictive biomarkers in oncology. Their value lies not just in selecting the best therapy but also in sparing patients from ineffective or harmful treatments. As personalized medicine expands, the demand for predictive biomarker panels across disease domains is accelerating rapidly.

Biomarkers Market By Product Insights

Consumables accounted for the largest share in the product segment, given their repeated use in biomarker testing processes. Reagents, assay kits, antibodies, and detection agents are used across diagnostic labs, research institutes, and pharmaceutical trials. The demand for biomarker-specific assays, ELISA kits, PCR reagents, and immunoassay consumables continues to rise with the proliferation of biomarker-based testing. As laboratories seek reliable and reproducible results, the importance of high-quality consumables becomes paramount.

Software is the fastest-growing product segment, owing to the need to process, interpret, and visualize complex biomarker datasets. Bioinformatics platforms, AI-based discovery tools, and analytics dashboards are being deployed to derive actionable insights from high-throughput omics data. As biomarkers increasingly emerge from large-scale genomics and proteomics studies, software tools that facilitate data mining, pathway analysis, and integration into EHRs are gaining traction among healthcare providers and researchers alike.

Biomarkers Market By Application Insights

Diagnostics dominated the application segment, given the widespread use of biomarkers in disease detection and monitoring. From cancer to infectious diseases and cardiovascular disorders, biomarkers provide early warning signs and disease staging capabilities. Tests like PSA for prostate cancer, troponin for heart attack, and D-dimer for thrombosis are routinely employed in clinical practice. Diagnostic biomarkers have become an essential part of standard-of-care algorithms, driving consistent demand across hospitals and labs.

Drug discovery and development is the fastest-growing application, driven by the pharmaceutical industry's reliance on biomarkers for patient stratification, efficacy monitoring, and regulatory compliance. Biomarkers are integral to adaptive trial designs, helping reduce attrition and improve study efficiency. With the rise of targeted therapies and rare disease drug development, biomarkers are helping sponsors meet regulatory expectations for precision trials and companion diagnostics.

Biomarkers Market By Disease Insights

Cancer remains the dominant disease segment, accounting for the largest biomarker use in diagnostics, therapeutics, and clinical trials. Biomarkers like HER2, CA-125, PD-L1, and BRCA mutations have revolutionized cancer detection, subtype classification, and personalized treatment. Liquid biopsies using ctDNA are further expanding cancer biomarker applications, allowing for non-invasive monitoring and recurrence tracking. With cancer prevalence rising globally and precision oncology becoming standard practice, this segment continues to thrive.

Neurological diseases are the fastest-growing segment, with advancements in Alzheimer’s, Parkinson’s, and MS biomarker discovery. Traditionally underserved, the neurology field is now benefitting from innovations in CSF testing, blood-based diagnostics, and neuroimaging markers. The development of disease-modifying therapies for conditions like Alzheimer’s requires sensitive biomarkers to identify preclinical stages and measure response—creating significant momentum in this space.

Biomarkers Market By Regional Insights

North America dominates the global biomarkers market, fueled by strong R&D infrastructure, favorable regulatory frameworks, and high healthcare spending. The U.S., in particular, is a global hub for biomarker innovation, with major contributions from academic centers, biopharmaceutical companies, and diagnostics firms. Regulatory support from the FDA such as the Biomarker Qualification Program and a high number of clinical trials incorporating biomarkers make North America the epicenter of biomarker commercialization.

Asia-Pacific is the fastest-growing region, driven by expanding healthcare infrastructure, increasing disease burden, and growing investments in personalized medicine. Countries like China, Japan, South Korea, and India are strengthening their genomics and diagnostics capabilities, with public-private partnerships emerging to support biomarker-based research. For instance, China’s National Precision Medicine Strategy aims to integrate genomic and biomarker data into population health programs. As healthcare digitization accelerates and clinical trial activity grows in the region, biomarker adoption is set to expand rapidly.

Some of the prominent players in the biomarkers market include:

- F. Hoffmann-La Roche AG

- Epigenomics AG

- Abbott

- Thermo Fisher Scientific Inc

- General Electric

- Eurofins Scientific

- Johnson & Johnson Services, Inc.

- QIAGEN

- Bio-Rad Laboratories, Inc.

- Siemens Healthineers AG

- Merck KGaA

- PerkinElmer Inc.

- Agilent Technologies, Inc.

Biomarkers Market Recent Developments

-

March 2025: Illumina Inc. partnered with Roche Diagnostics to develop next-generation sequencing-based companion diagnostics that integrate novel biomarkers for solid tumors.

-

February 2025: Biogen Inc. and Eisai Co. received FDA approval for their Alzheimer’s drug Leqembi, which uses amyloid-beta biomarkers for patient selection and treatment monitoring.

-

January 2025: QIAGEN launched a multiplex biomarker assay platform targeting early detection of lung and colorectal cancers using ctDNA and protein markers.

-

November 2024: Foundation Medicine announced the expansion of its liquid biopsy test, FoundationOne Liquid CDx, with additional biomarkers to predict immunotherapy response.

-

October 2024: Thermo Fisher Scientific introduced a new line of AI-powered software tools for multi-omics biomarker discovery, aimed at reducing the time to validation.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the biomarkers market

By Type

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

By Product

- Consumable

- Services

- Software

By Application

- Diagnostics

- Drug Discovery & Development

- Personalized Medicine

- Disease Risk Assessment

- Others

By Disease

-

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

-

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

-

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

-

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

-

- Safety Biomarkers

- Efficacy Biomarkers

- Predictive Biomarkers

- Surrogate Biomarkers

- Pharmacodynamic Biomarkers

- Prognostics Biomarkers

- Validation Biomarkers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)