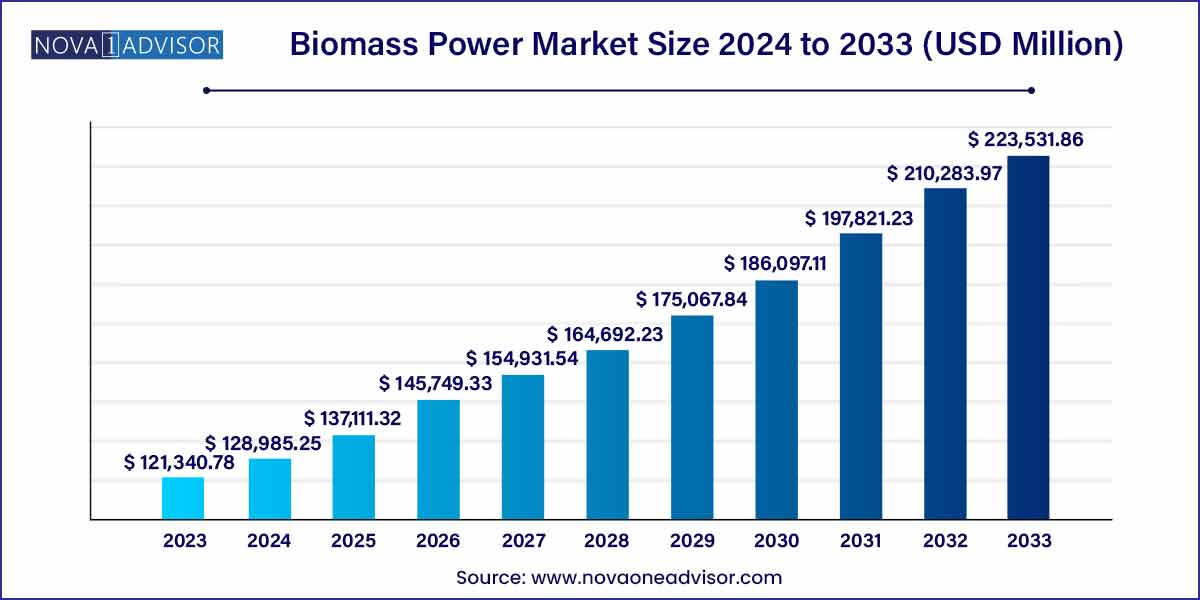

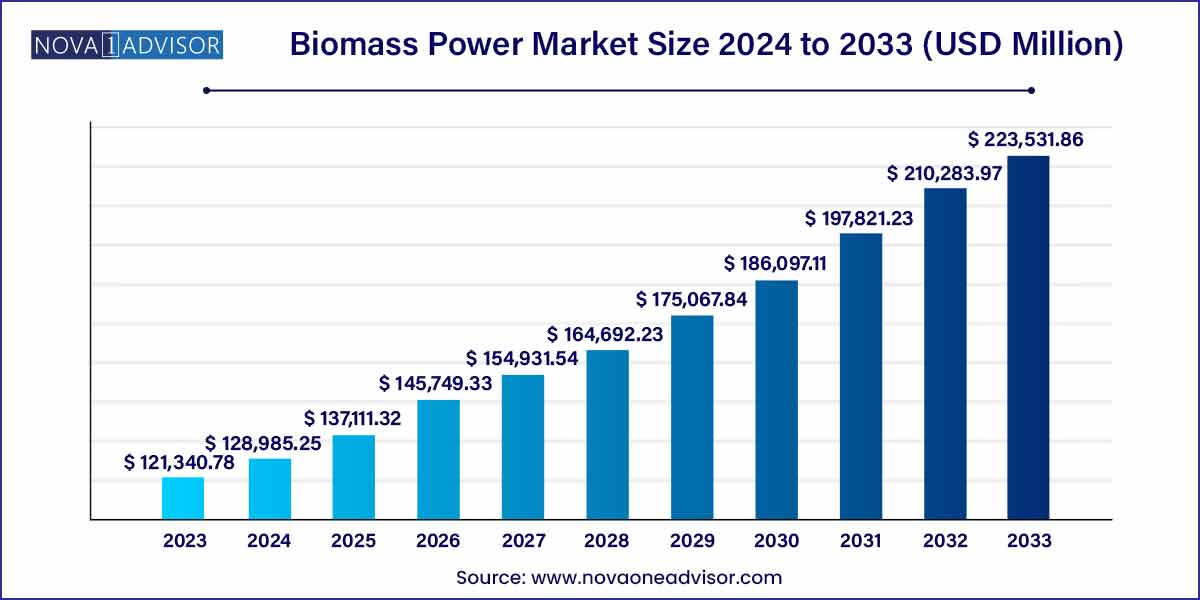

The global biomass power market size was exhibited at USD 121,340.78 million in 2023 and is projected to hit around USD 223,531.86 million by 2033, growing at a CAGR of 6.3% during the forecast period of 2024 to 2033.

Key Takeaways:

- Europe was the largest regional market in 2023 and accounted for a revenue share of more than 40.0%.

- In terms of revenue, the combustion segment dominated the market in 2023 and accounted for the maximum share of more than 88.0% of global revenue.

- In terms of revenue, the solid biofuel segment accounted for the maximum revenue share of 88.0% in 2023.

Biomass Power Market: Overview

In recent years, the global energy landscape has witnessed a significant shift towards sustainable and renewable sources. Among these, biomass power has emerged as a promising contender, offering a renewable energy solution with the potential to mitigate carbon emissions and reduce dependence on fossil fuels. This overview delves into the dynamics of the biomass power market, providing insights into its growth trajectory, key drivers, challenges, and future prospects.

Biomass Power Market Groth

The growth of the biomass power market is fueled by several key factors. Firstly, increasing global awareness and concern about climate change have driven a shift towards renewable energy sources, including biomass power, as a means to reduce carbon emissions and mitigate environmental impact. Additionally, supportive government policies, incentives, and subsidies have incentivized investments in biomass power projects, creating a conducive environment for market expansion. Moreover, biomass power offers enhanced energy security by diversifying the energy mix and reducing reliance on fossil fuels, thus bolstering its attractiveness as a sustainable energy solution. Furthermore, continuous advancements in biomass conversion technologies have improved efficiency and lowered costs, making biomass power more competitive in the energy market. Lastly, biomass power presents an opportunity to address waste management challenges by converting organic waste materials into valuable energy resources, further driving market growth.

Biomass Power Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 121,340.78 Million |

| Market Size by 2033 |

USD 223,531.86 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 6.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Feedstock, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Mitsubishi Power Ltd.; Suez; Xcel Energy Inc.; Ramboll Group A/S; Babcock & Wilcox Enterprises, Inc.; Orsted A/S; Ameresco Inc; General Electric; Veolia; Vattenfall AB |

Biomass Power Market Dynamics

- Environmental Concerns and Regulatory Support:

The dynamics of the biomass power market are intricately tied to growing environmental concerns and supportive regulatory frameworks. With increasing awareness about climate change and the urgent need to reduce greenhouse gas emissions, biomass power has emerged as a viable solution to meet sustainability goals. Governments worldwide have implemented policies, incentives, and subsidies to promote the development and deployment of biomass power projects. These supportive measures include renewable energy targets, feed-in tariffs, tax incentives, and renewable energy credits, which have incentivized investments in biomass power infrastructure.

- Technological Advancements and Cost Competitiveness:

Another significant dynamic shaping the biomass power market is continuous technological advancements and improving cost competitiveness. Over the years, significant strides have been made in biomass conversion technologies, such as combustion, gasification, pyrolysis, and anaerobic digestion, enhancing efficiency and performance. These technological innovations have resulted in higher biomass-to-energy conversion rates, improved operational flexibility, and reduced emissions, making biomass power more attractive from both environmental and economic perspectives. Additionally, economies of scale, research and development investments, and process optimization have contributed to lowering the overall cost of biomass power generation, narrowing the gap with conventional energy sources. As a result, biomass power has become increasingly competitive in energy markets, attracting investment interest from utilities, independent power producers, and renewable energy developers.

Biomass Power Market Restraint

- Feedstock Availability and Logistics Challenges:

One of the primary restraints affecting the biomass power market is the availability and logistics challenges associated with biomass feedstock. While biomass resources such as wood, agricultural residues, and organic waste hold significant potential for energy production, their availability and supply can be inconsistent and geographically dispersed. Moreover, competition for biomass feedstock from other sectors such as food, feed, and materials industries can further exacerbate supply constraints. Additionally, the logistics of sourcing, transporting, and storing biomass feedstock pose logistical challenges, particularly for large-scale biomass power plants located far from biomass sources. These logistical complexities can increase operational costs, reduce plant efficiency, and limit the scalability of biomass power projects, thereby impeding market growth.

- Technological Limitations and Conversion Efficiency:

Another significant restraint facing the biomass power market relates to technological limitations and conversion efficiency issues. While advancements in biomass conversion technologies have improved overall efficiency and performance, challenges remain in achieving optimal conversion rates and energy output. Factors such as feedstock characteristics, biomass composition, and operating conditions can impact the efficiency of biomass-to-energy conversion processes, leading to suboptimal performance and energy losses. Additionally, certain biomass conversion technologies, such as gasification and pyrolysis, require precise control and sophisticated equipment, which can increase capital costs and operational complexities. Moreover, variability in feedstock quality and moisture content can affect combustion efficiency and emissions control, further limiting the overall efficiency of biomass power plants.

Biomass Power Market Opportunity

- Circular Economy Integration and Waste Management Solutions:

An exciting opportunity within the biomass power market lies in its integration with the circular economy principles and waste management solutions. Biomass power plants have the unique ability to convert organic waste materials, such as agricultural residues, forestry residues, and municipal solid waste, into valuable energy resources, thereby addressing waste management challenges and promoting resource efficiency. By leveraging biomass power generation as a means to valorize organic waste streams, stakeholders can create closed-loop systems where waste materials are transformed into renewable energy, biofuels, and bioproducts. This integration not only reduces the environmental burden of waste disposal but also contributes to the diversification of energy sources and the creation of new revenue streams.

- Biomass Co-firing and Combined Heat and Power (CHP) Applications:

Another promising opportunity in the biomass power market lies in the expansion of biomass co-firing and combined heat and power (CHP) applications. Biomass co-firing involves the combustion of biomass alongside coal or other fossil fuels in existing power plants, allowing for the utilization of existing infrastructure while reducing greenhouse gas emissions and dependence on fossil fuels. This approach offers a cost-effective and scalable pathway for integrating biomass into the energy mix, particularly in regions with abundant biomass resources and coal-fired power plants. Furthermore, combined heat and power (CHP) systems enable the simultaneous generation of electricity and useful heat from biomass feedstocks, maximizing energy efficiency and reducing overall energy costs. Biomass CHP applications are well-suited for industrial facilities, district heating networks, and community-scale energy projects, providing localized energy solutions and supporting sustainable development objectives.

Biomass Power Market Challenges

- Feedstock Availability and Sustainability:

One of the primary challenges facing the biomass power market is ensuring consistent and sustainable feedstock availability. Biomass feedstocks, such as wood residues, agricultural residues, and energy crops, are subject to fluctuations in availability due to factors such as seasonal variability, land use competition, and biomass supply chain constraints. Additionally, sourcing biomass feedstocks in a sustainable manner presents challenges related to land use, biodiversity conservation, and ecosystem impacts. Without proper management and regulation, biomass harvesting and procurement practices can lead to deforestation, soil degradation, and habitat loss, undermining the environmental benefits of biomass power generation. Furthermore, competition for biomass feedstocks from other sectors, such as biofuels production and livestock feed, can exacerbate feedstock availability challenges, driving up costs and limiting biomass power plant operations.

- Technological Complexity and Efficiency:

Another significant challenge in the biomass power market is the technological complexity and efficiency of biomass conversion processes. While biomass power plants utilize various conversion technologies, such as combustion, gasification, and anaerobic digestion, each technology has its unique requirements, operating parameters, and efficiency limitations. Achieving optimal performance and efficiency in biomass conversion processes requires precise control of factors such as feedstock characteristics, moisture content, and combustion conditions, which can be challenging to achieve consistently. Moreover, certain biomass conversion technologies, such as gasification and pyrolysis, require sophisticated equipment and expertise, increasing capital costs and operational complexities.

Segmental Analysis

By Technology

Combustion technology dominates the market, as it is the most mature and widely used method of biomass power generation. Combustion involves burning solid biomass to generate steam, which drives turbines to produce electricity. This method is favored in large-scale plants due to its simplicity and adaptability to different biomass types. Examples include municipal waste-to-energy plants and co-firing systems in existing coal plants.

Gasification is the fastest-growing technology, especially in developed countries investing in cleaner, more efficient solutions. Gasification converts biomass into syngas (a mixture of hydrogen and carbon monoxide) through partial oxidation, which can be used in gas turbines or converted into biofuels. Gasification offers lower emissions and greater fuel flexibility, although it requires more complex and costly equipment.

By Feedstock

Solid biofuel remains the largest feedstock category, driven by the global trade in wood pellets, briquettes, and forest/agricultural residues. Countries like Canada, the U.S., and Russia are major exporters of wood pellets to the EU and Asia. Solid biofuels are used in combustion and co-firing systems due to their ease of handling and consistent energy output.

Biogas is the fastest-growing feedstock, particularly in regions prioritizing waste-to-energy solutions. Derived from anaerobic digestion of organic waste (including food waste, animal manure, and wastewater sludge), biogas can be used for electricity, heat, or upgraded to biomethane for grid injection. Germany, India, and Sweden are leading adopters of biogas plants, supported by favorable policies and rural development programs.

Regional Analysis

Europe dominates the biomass power market, accounting for a substantial share of global capacity and consumption. The EU’s Renewable Energy Directive (RED II), carbon neutrality commitments, and strong district heating infrastructure support biomass as a mainstream energy source. Countries like Germany, the UK, Sweden, and Finland have made significant investments in CHP plants and sustainable pellet imports.

Asia-Pacific is the fastest-growing region, led by aggressive energy diversification policies in China, India, Thailand, and Japan. China is ramping up biomass-fired capacity to reduce its dependence on coal and manage agricultural waste. India’s National Bio-Energy Mission supports biomass co-generation in sugar mills and decentralized systems in rural areas. Japan is turning to imported biomass to replace nuclear energy post-Fukushima.

Some of the prominent players in the biomass power market include:

- Mitsubishi Heavy Industries, Ltd.

- Suez

- Xcel Energy Inc.

- Ramboll Group A/S

- Babcock & Wilcox Enterprises, Inc.

- Orsted A/S

- Ameresco

- General Electric

- Veolia

- Vattenfall

Recent Developments

-

Drax Group (UK, April 2025): Announced the expansion of its biomass pellet production in Canada and the U.S. to meet growing demand from UK and EU power plants.

-

ReEnergy Holdings (U.S., March 2025): Partnered with the U.S. Army to operate mobile biomass plants for clean energy in military operations.

-

NTPC (India, February 2025): Expanded its agricultural residue co-firing initiative across thermal plants in North India, using paddy straw to mitigate stubble burning.

-

ENGIE (France, January 2025): Signed a deal with a Malaysian palm oil company to develop biomass power from palm kernel shells and empty fruit bunches.

-

Veolia (France, December 2024): Commissioned a new CHP biomass plant in Finland, integrated with district heating and powered entirely by forest waste.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global biomass power market.

Technology

- Combustion

- Gasification

- Anaerobic Digestion

Feedstock

- Solid Biofuel

- Liquid Biofuel

- Biogas

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)