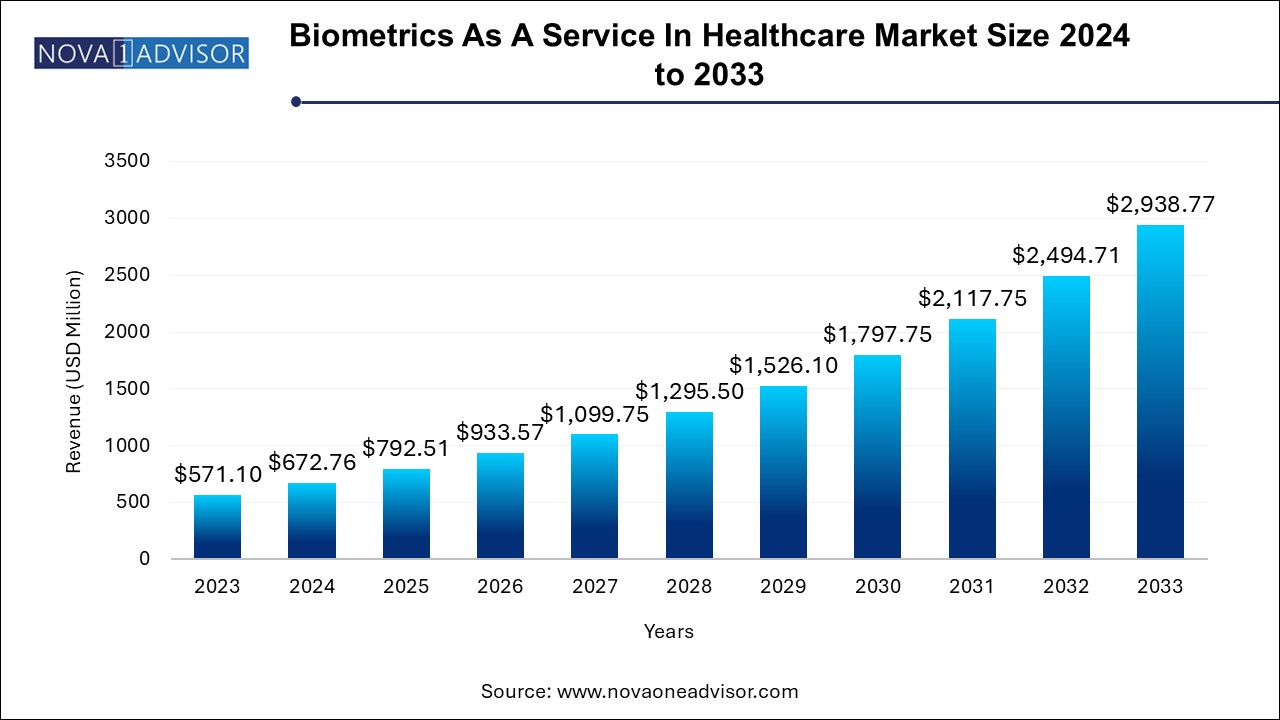

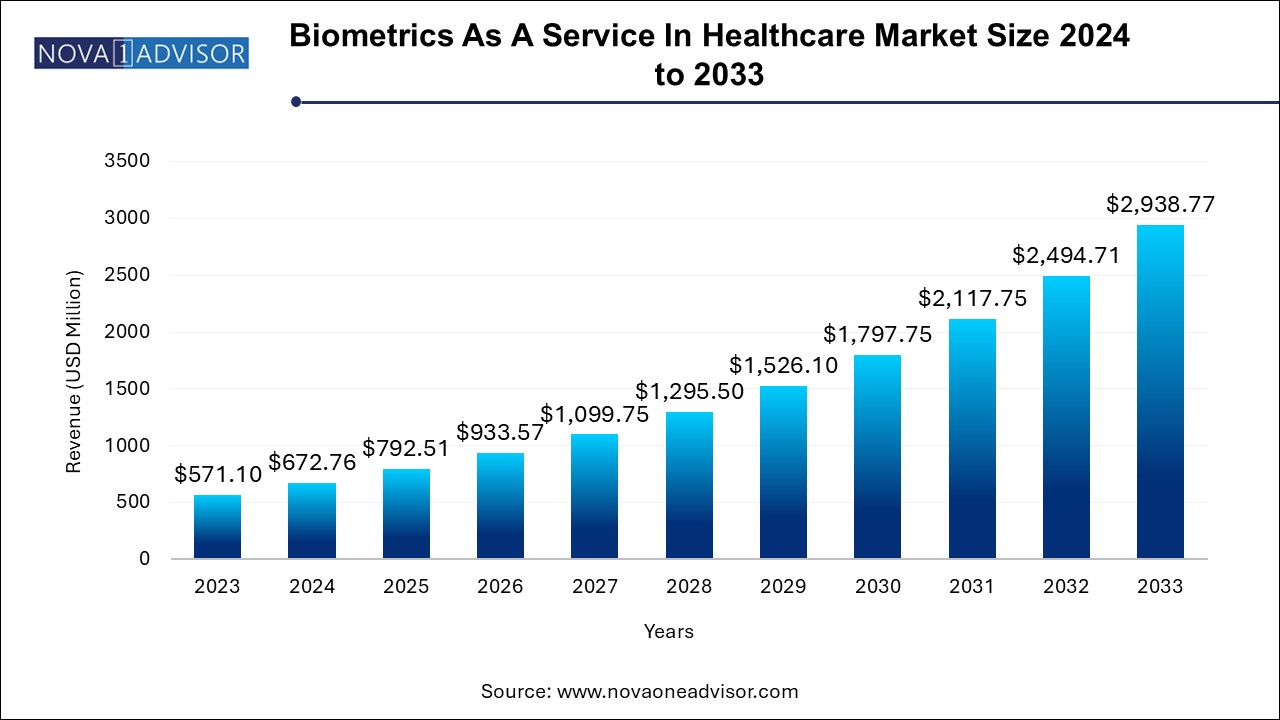

The global biometrics as a service in healthcare market size was exhibited at USD 571.10 million in 2023 and is projected to hit around USD 2,938.77 million by 2033, growing at a CAGR of 17.8% during the forecast period of 2024 to 2033.

Key Takeaways:

- In 2023, North America dominated the market in terms of the revenue share of 50.0%

- The multimodal segment dominated the market with the largest market share of 56.0% in 2023.

- Based on application, the mobile application segment held the dominant share of over 41.1% in 2023

- The fingerprint recognition segment held the largest market share of 49.4% in 2023.

Market Overview

The Biometrics as a Service (BaaS) in Healthcare Market represents a rapidly expanding segment of the digital health transformation, merging biometric identification technologies with cloud-based services to enhance security, patient verification, and administrative efficiency in medical settings. As healthcare systems worldwide grapple with data security threats, regulatory compliance mandates, and the need for seamless patient experience, BaaS emerges as a vital solution enabling identity management and secure access across distributed healthcare ecosystems.

BaaS in healthcare allows providers to implement biometric verification—such as fingerprint scanning, facial recognition, iris detection, and voice biometrics—without maintaining complex on-premises hardware or infrastructure. Cloud-based platforms enable these services to be deployed rapidly across clinics, hospitals, telehealth environments, and mobile health applications, supporting secure authentication for both patients and staff. Moreover, BaaS ensures robust interoperability across departments and networks, reducing the risk of misidentification, insurance fraud, and unauthorized data access.

With the growing adoption of electronic health records (EHRs), telemedicine, and patient portals, the need for advanced, scalable identity and access management is more pronounced than ever. Biometric-as-a-service models are well-positioned to meet this demand, particularly in settings where cybersecurity budgets are limited but the need for compliance with standards such as HIPAA, GDPR, or HITECH is non-negotiable.

Major Trends in the Market

-

Expansion of Contactless Biometric Modalities: COVID-19 has accelerated demand for touchless systems such as facial and iris recognition for hygienic and frictionless patient interactions.

-

Integration with Telehealth and Mobile Health Platforms: Biometric authentication is being incorporated into virtual care platforms to verify remote users and ensure secure access to health data.

-

Cloud-Native Identity Management Systems: Cloud-first deployment strategies are driving BaaS adoption in both large hospital networks and smaller clinics.

-

Multimodal Biometric Adoption: Healthcare providers are increasingly opting for combinations of biometric modalities to improve accuracy and minimize false positives.

-

AI and Machine Learning for Biometric Accuracy: Advanced algorithms are enhancing the speed, reliability, and accuracy of biometric systems in dynamic clinical environments.

-

Compliance-Centric Deployments: Regulatory requirements are a key driver of BaaS investment, with providers needing tools that support HIPAA, HITECH, and global data privacy laws.

-

Rise of Biometric Patient Portals: Hospitals are deploying biometric-enabled portals that allow patients to securely access and manage their own health records from anywhere.

Biometrics As A Service In Healthcare Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 571.10 Million |

| Market Size by 2033 |

USD 2,938.77 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 17.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, Scanner Type, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thales,Fujitsu,Aware, Inc.,BIO-key International,MorphoTrust USA,NextGate, Imprivata, Inc.,Suprema,Imageware,M2SYS Technology |

Market Driver: Increasing Focus on Data Security and Regulatory Compliance

One of the most significant drivers propelling the Biometrics as a Service in healthcare market is the rising focus on securing patient data amid escalating cyber threats and tightening regulatory scrutiny. Healthcare data breaches have increased both in frequency and severity, with malicious actors targeting EHR systems, insurance databases, and patient records for identity theft or ransomware attacks.

Biometrics particularly when delivered through secure cloud services offer an effective mechanism for reinforcing multi-factor authentication protocols and ensuring that only authorized individuals can access sensitive systems. Biometric identification is inherently more secure than password-based systems because it relies on unique physical traits that are nearly impossible to replicate or steal. For instance, facial recognition solutions integrated with cloud platforms can grant physicians access to EHRs in real time, even while working remotely, without risking credential compromise.

In addition, compliance with regulatory frameworks such as HIPAA (U.S.), GDPR (EU), and regional equivalents mandates rigorous identity and access controls, further fueling demand for biometric services. BaaS provides healthcare organizations with a compliant, upgradable, and scalable path to meet these requirements while enhancing the user experience.

Market Restraint: Privacy Concerns and Ethical Considerations

Despite the strong value proposition, a major restraint in this market is the growing concern over privacy and the ethical implications of biometric data collection and storage. Biometrics are inherently sensitive because they involve immutable traits such as fingerprints or facial features. If compromised, these identifiers cannot be changed like passwords, making breaches particularly damaging.

In healthcare settings, patients may be reluctant to share biometric data due to fears of surveillance, profiling, or unauthorized third-party use. Furthermore, there are challenges related to consent management and data transparency—especially in vulnerable populations or under jurisdictions with underdeveloped data protection laws.

Moreover, cloud-based models, while scalable and cost-efficient, increase reliance on third-party vendors. This raises concerns about data sovereignty, contractual clarity, and shared responsibility models in cybersecurity. Regulatory inconsistencies between jurisdictions—such as the EU’s GDPR and more lenient frameworks elsewhere—can complicate global deployments. Addressing these issues will require a combination of transparent privacy policies, anonymization protocols, and enhanced public education.

Market Opportunity: Demand for Remote Patient Identity Verification in Telehealth

A compelling opportunity lies in the surging demand for biometric identity verification within the expanding telehealth and mobile health (mHealth) ecosystem. The pandemic has transformed remote care from a peripheral offering to a core delivery channel, but it has also raised questions around secure access, impersonation, and data integrity in digital healthcare platforms.

Biometrics as a service enables real-time, high-assurance verification for patients logging into telehealth sessions, mobile apps, or virtual prescription portals. For example, a facial scan or voice sample can be used to authenticate a user before a teleconsultation begins, ensuring that protected health information (PHI) is not exposed to unauthorized individuals. Similarly, biometric authentication allows caregivers and providers to securely log into remote care dashboards, verify prescriptions, or access patient histories.

Vendors offering API-driven, plug-and-play biometric solutions for digital health platforms are particularly well-positioned to capture this opportunity. As telehealth scales across rural areas, elderly populations, and international markets, identity assurance will become a foundational requirement and a differentiating feature for healthcare platforms.

Segmental Analysis

By Type

Unimodal biometric systems currently dominate the market, primarily due to their lower cost, ease of integration, and widespread familiarity. These systems rely on a single biometric trait—such as a fingerprint or facial scan—for identification. In healthcare, unimodal systems are already used in outpatient settings, nursing stations, and administrative functions. For example, fingerprint-based access is a standard in hospital time-tracking systems for employees, while facial recognition is increasingly being used for patient registration kiosks and telemedicine logins.

Multimodal biometric solutions are the fastest-growing type, owing to their enhanced accuracy, reduced error rates, and improved resistance to spoofing or environmental interference. Combining modalities—such as facial recognition with voice or fingerprint—allows healthcare providers to verify identities in dynamic settings, such as in-home care or emergency departments. Multimodal systems are particularly beneficial in environments with high data sensitivity, such as mental health clinics or infectious disease centers, where secure access to records and restricted zones is mission-critical. As the cost of these systems decreases and AI enhances their speed and usability, adoption is expected to accelerate.

By Application

Site access control is the dominant application segment, as healthcare facilities increasingly deploy biometric authentication at physical entry points and secure zones. Biometric-enabled doors, badge systems, and workstation logins help prevent unauthorized access to operating rooms, pharmacies, data centers, and administrative areas. Hospitals seeking to meet OSHA, HIPAA, and JCI accreditation standards are investing in BaaS platforms to centralize and streamline access control through cloud dashboards.

Mobile application integration is the fastest-growing use case, driven by the proliferation of mobile health apps, remote patient monitoring, and digital prescription platforms. Biometric verification in mHealth apps ensures secure logins, prescription pickups, and real-time access to health records. Hospitals are also embedding biometric login capabilities into their patient portals and mobile EHR systems to allow both staff and patients seamless access while on the move. This trend is especially pronounced in regions with widespread smartphone adoption and growing digital health infrastructure.

By Scanner Type

Fingerprint recognition dominates the scanner type segment, due to its affordability, accuracy, and broad familiarity among both patients and healthcare staff. Fingerprint-based biometric time clocks and patient registration terminals are common in hospitals and clinics, and legacy hardware compatibility makes it easy to implement fingerprint-based BaaS without extensive upgrades. They are widely used for clinician access to records, clock-in systems, and medication dispensing verification.

Facial recognition is the fastest-growing scanner type, particularly due to its contactless nature and integration potential with cameras already present on mobile devices and computers. Facial recognition systems are being adopted for telemedicine, visitor management, and secure entry systems. The shift toward touchless interfaces in the post-pandemic era has accelerated this trend, making facial recognition one of the most attractive options for cloud-based deployments. Enhanced by AI, modern systems are now capable of recognizing users with masks, varying lighting, or motion, significantly improving utility in healthcare environments.

Regional Analysis

North America leads the global Biometrics as a Service in Healthcare Market, driven by high digital health maturity, stringent data protection laws, and advanced infrastructure. The United States, in particular, is home to key players such as Microsoft Azure, IBM, and AWS, which offer BaaS platforms tailored to healthcare. The presence of large hospital networks, digital health startups, and regulatory bodies like the FDA and HHS accelerates adoption. The U.S. healthcare system’s complexity and emphasis on HIPAA compliance also necessitate robust identity verification tools, creating a fertile ground for BaaS deployment.

Asia-Pacific is the fastest-growing region, fueled by the rapid expansion of digital healthcare services, rising cybersecurity awareness, and government investments in health IT. Countries such as India, China, Japan, and South Korea are deploying biometric systems in public healthcare facilities for patient identification, telehealth, and fraud prevention in health insurance schemes. For example, India’s Ayushman Bharat Digital Mission includes digital health IDs with biometric linkage for more than 1 billion citizens. As smartphone penetration, telemedicine, and cloud computing infrastructure grow in the region, APAC will become a major growth engine for biometric healthcare services.

Some of the prominent players in the biometrics as a service in healthcare market include:

- Thales

- Fujitsu

- Aware, Inc.

- BIO-key International

- MorphoTrust USA

- NextGate, Imprivata, Inc.

- Suprema

- Imageware

- M2SYS Technology

Recent Developments

-

NEC Corporation (April 2025): Announced a new BaaS solution for hospitals in Japan that combines facial and voice recognition for patient authentication in outpatient clinics.

-

Imprivata (March 2025): Launched a cloud-native multimodal BaaS platform for hospital IT teams to streamline secure login access across desktop, mobile, and virtual environments.

-

IDEMIA (February 2025): Partnered with a major European healthcare provider to deploy touchless fingerprint systems for vaccine distribution programs in rural regions.

-

BioCatch (January 2025): Expanded behavioral biometrics capabilities for healthcare client portals, allowing for anomaly detection in remote patient sessions.

-

Microsoft Azure (December 2024): Released an AI-driven biometric SDK specifically optimized for healthcare applications, with compliance features for HIPAA and GDPR.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global biometrics as a service in healthcare market.

Type

Application

- Site Access Control

- Time Recording

- Mobile Application

- Web and Workplace

Scanner Type

- Fingerprint Recognition

- Iris Recognition

- Palm Recognition

- Facial Recognition

- Voice Recognition

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)