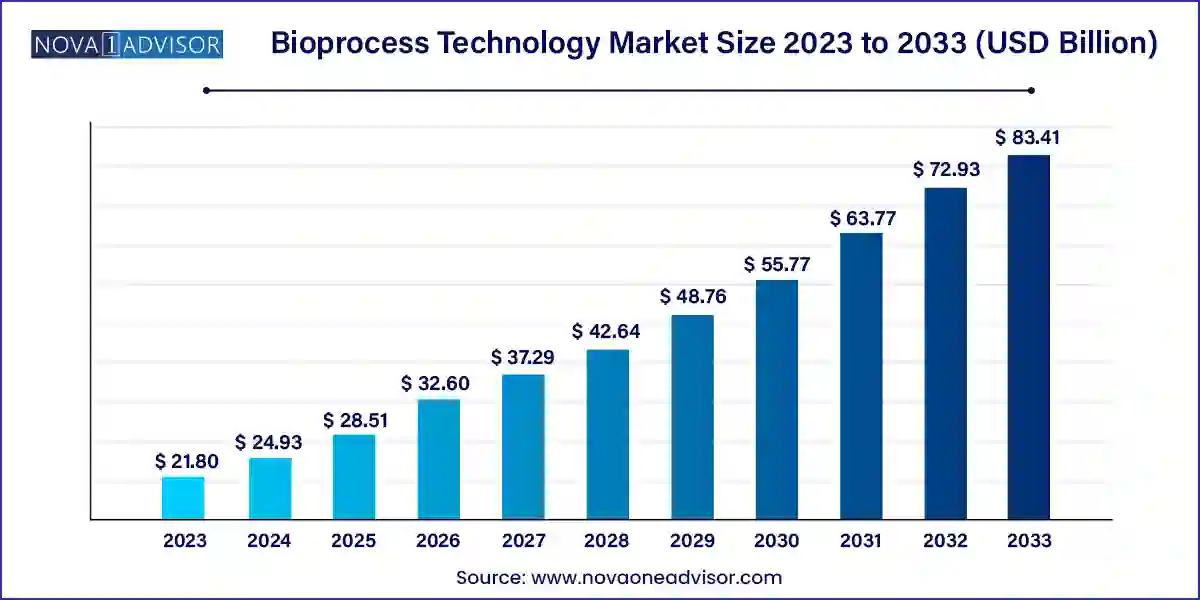

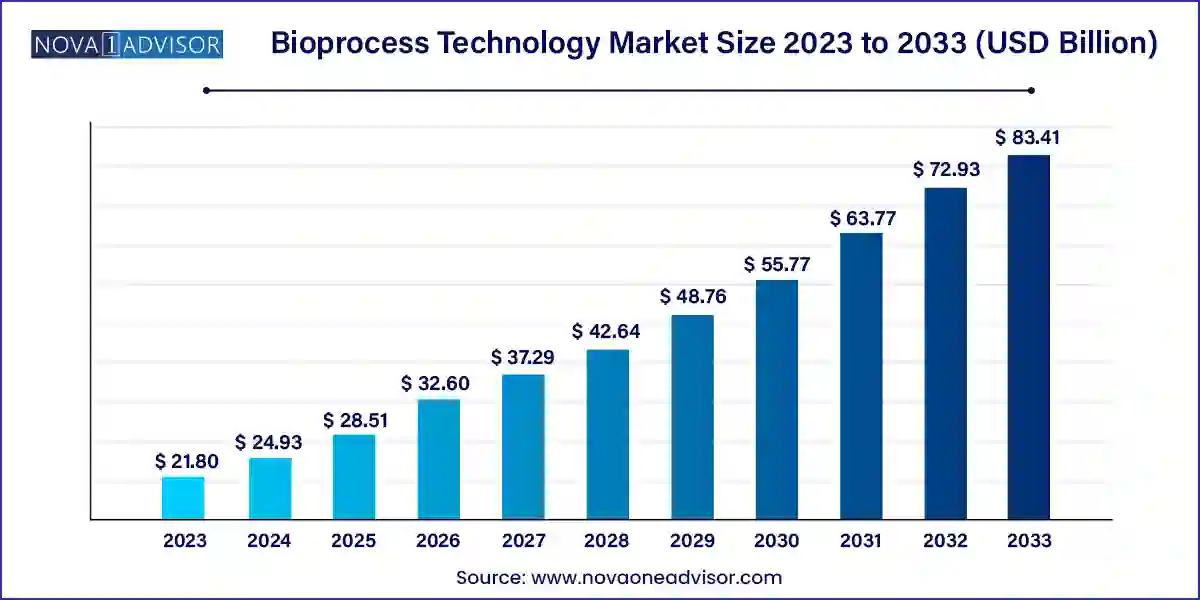

The global bioprocess technology market size was exhibited at USD 21.80 billion in 2023 and is projected to hit around USD 83.41 billion by 2033, growing at a CAGR of 14.36% during the forecast period 2024 to 2033.

Key Takeaways:

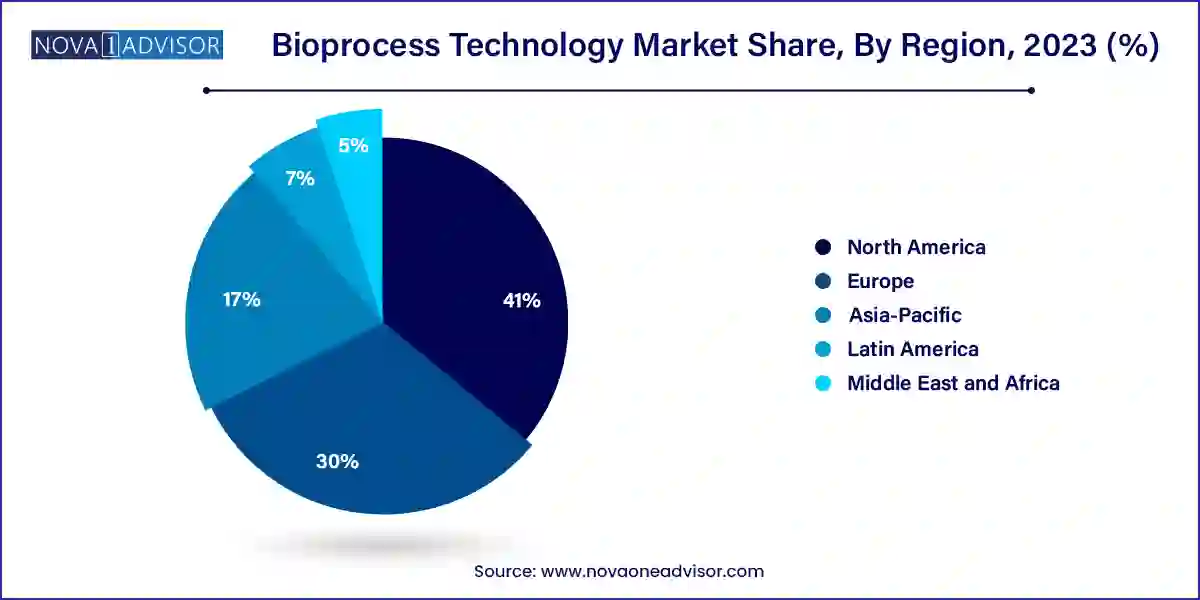

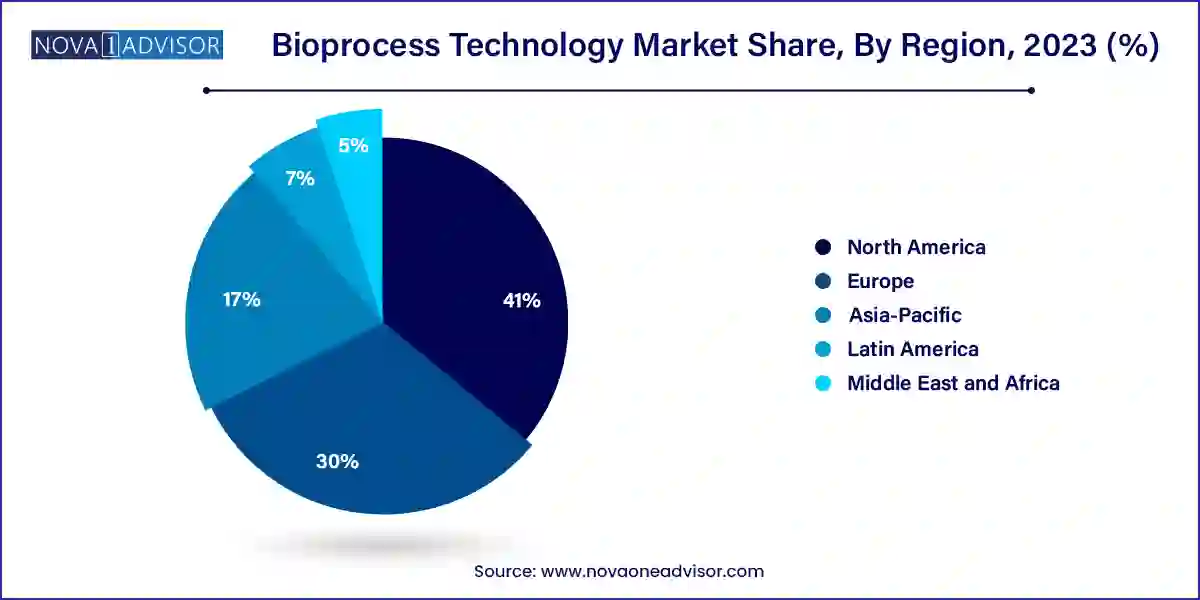

- By geography, North America is anticipated to lead the market from 2023 to 2033 and account for more than 41% of revenue share in 2023.

- By product type, the biologics safety testing segment is anticipated to expand quickly from 2023 to 2033.

- By application, the recombinant proteins are expected to have a rapid increase from 2023 to 2033.

- By end-use, the biopharmaceutical companies are expected to hold the greatest market share from 2023 to 2033.

Market Overview

Bioprocess technology is the cornerstone of modern biotechnology, playing a pivotal role in the manufacturing of biopharmaceuticals, biosimilars, antibiotics, enzymes, and biofuels. It encompasses a series of scientific and engineering processes used to produce biologically derived substances under controlled environments. From upstream processes like cell culture and cell line development to downstream processes like purification and flow cytometry, bioprocess technology facilitates the scalable and reproducible production of complex biological products.

As biopharmaceuticals such as monoclonal antibodies, recombinant proteins, and gene therapies gain prominence in global healthcare, the importance of precise, scalable, and regulatory-compliant bioprocesses has surged. This has led to the rapid adoption of advanced bioprocess platforms and equipment in research institutes, contract manufacturers, and pharmaceutical companies.

Moreover, the rise in infectious diseases, the global expansion of biosimilars, increasing R&D expenditure in life sciences, and supportive government policies have further propelled the market forward. Bioprocess technologies are now being applied beyond healthcare, such as in the food and feed industries where microbial fermentation is used to enhance nutritional value or extend shelf life.

The market’s landscape is evolving with increasing automation, single-use technologies, and AI-driven process analytics. From batch to continuous bioprocessing, manufacturers are investing in systems that increase yield, reduce contamination risk, and meet strict global regulatory standards.

Major Trends in the Market

-

Adoption of Single-Use Bioprocessing Systems

Companies are increasingly moving away from traditional stainless steel reactors toward single-use systems to reduce contamination risk and streamline validation.

-

Integration of Automation and AI in Biomanufacturing

Real-time data analytics and artificial intelligence are enabling predictive process controls, optimizing yields, and minimizing human error.

-

Continuous Bioprocessing Gaining Traction

The shift from batch processing to continuous production allows for real-time quality monitoring, higher productivity, and cost efficiency.

-

Growing Demand for Biosimilars Driving Cell Line Innovation

The expiration of biologic patents is pushing investment in faster, high-yielding cell line development platforms.

-

Decentralization and Outsourcing to CMOs and CROs

Biopharma companies are increasingly outsourcing manufacturing and research to reduce overhead and accelerate product development timelines.

Report Scope of The Bioprocess Technology Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 24.93 Billion |

| Market Size by 2033 |

USD 83.41 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 14.36% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

By Product Type, By Application, By End-Use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Philips Healthcare, Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., Becton, Dickinson, and Company, Sartorius Group, Abbott Laboratories, Danaher, Alere Inc. and Others. |

Market Driver: Rising Demand for Biopharmaceuticals

The most significant driver of the bioprocess technology market is the surging demand for biopharmaceuticals globally. These products ranging from vaccines, monoclonal antibodies, and recombinant hormones to novel cell and gene therapies offer targeted treatments with fewer side effects compared to traditional small-molecule drugs.

As chronic diseases, cancer, and autoimmune conditions continue to burden global healthcare systems, governments and private entities are investing heavily in biopharmaceutical R&D. For instance, the global response to COVID-19 showcased the agility and scalability of bioprocessing platforms, with mRNA vaccines being produced at unprecedented speeds using advanced bioprocess tools.

This growing reliance on biologics requires high-throughput, compliant, and cost-effective bioprocessing systems that can scale from lab to commercial volumes. As companies expand their biologics pipeline, the demand for robust bioprocess platforms continues to rise, positioning bioprocess technology as a strategic enabler of innovation.

Market Restraint: High Capital Investment and Operational Complexity

Despite its immense potential, the bioprocess technology market is constrained by the high capital and operational costs associated with setting up and running bioprocess facilities. Building a GMP-compliant biomanufacturing facility requires substantial investment in equipment, cleanroom design, environmental controls, and quality management systems.

Additionally, bioprocesses are inherently complex, requiring rigorous control of variables such as pH, temperature, and nutrient composition. Any deviation can result in batch failure or inconsistent product quality. Hiring and retaining skilled professionals with experience in bioprocess engineering, regulatory compliance, and bioanalytics is also challenging and costly.

For small biotech startups or organizations in emerging economies, these barriers can be prohibitive, limiting their ability to bring novel biologics to market without substantial financial backing or partnerships.

Market Opportunity: Technological Advancements in Cell Culture and Bioprocess Optimization

A significant opportunity within the bioprocess technology market lies in the continued advancement of cell culture technologies and bioprocess optimization strategies. Innovations in chemically defined media, perfusion culture systems, and high-throughput screening tools are enabling faster development and scale-up of production-ready cell lines.

Moreover, real-time monitoring tools and AI-powered modeling software are allowing manufacturers to anticipate process deviations, predict optimal harvest times, and improve batch-to-batch consistency. Hybrid bioprocessing systems combining elements of batch and continuous production—are also emerging to enhance efficiency while maintaining process flexibility.

This convergence of biological innovation with digital and mechanical engineering is enabling companies to shorten development cycles, increase yields, and reduce waste unlocking both economic and therapeutic value.

Segments:

Bioprocess Technology Market By Product Type Insights

Based on the product category, the biologics safety testing market is anticipated to expand quickly over the next few years. Manufacturers assess the safety of biologics for impurities such as viruses, bacteria, and mycoplasma. The validation and process control of finished goods, as well as the quality control of raw materials, depend on this procedure the most. The market expansion is attributed to factors including rising pharmaceutical outsourcing and increasing government backing for the biotechnology and pharmaceutical industries.

Bioprocess Technology Market By Application Insights

Recombinant proteins are expected to have a rapid increase over the forecast period based on application. The market is expanding because of an increase in demand for recombinant proteins in medicinal applications. The most effective treatments for a variety of illnesses, including cancer, diabetes, infectious infections, anemia, and hemophilia, are provided by recombinant therapeutic proteins. Antibodies, interleukin, hormones, anticoagulants, enzymes, and FC fusion proteins are examples of frequently used therapeutic proteins. As a result, the segment is expanding as the incidence of chronic diseases like cancer and diabetes rises.

Bioprocess Technology Market By End Use Insights

The category of biopharmaceutical firms is expected to hold the greatest market share during the projection period by end-use. The production of a variety of next-generation or highly innovative biopharmaceutical products using Bioprocess technology has grown in popularity in the market for Bioprocess technology over the past few years.

Due to continual technological advancements in Bioprocessing techniques, the range of their applications has further enlarged. Further fostering the segment's growth is the constantly expanding interest in fields of life science such as biotechnology, pharmacology, and toxicology as well as the rising need for improved Bioprocess technology for the creation of innovative pharmaceuticals and vaccines.

Bioprocess Technology Market By Regional Insights

North America is anticipated to lead the market during the forecast period an accounted more than 41% of revenue share in 2023. The existence of large companies, the high frequency of chronic diseases treated mostly with biopharmaceuticals in the area, and the developed healthcare infrastructure all contribute to the market's growth. In addition, favorable government efforts and a rise in research partnership numbers are among the factors anticipated to fuel market expansion. Due to its pro-healthcare legislation, large patient population, and developed healthcare market, the U.S. has the largest share in this region.

The market is expanding because of rising biotechnology and pharmaceutical companies' spending on research and development. India Brand Equity Foundation estimates that India’s biotech sector accounts for 2% of the global market. About 800 companies make up India's biotechnology sector, which was projected to be worth $11.6 billion by the end of 2021. In order to grow this sector into an industry that will be USD 100 billion by 2025, the government invested USD 5 billion to create human resources, infrastructure, and research efforts.

Furthermore, biopharma is one of the largest sectors across the globe. Several international businesses have aggressively partnered with Indian businesses because of India's promising generic biotechnology future. The Telangana government biotech and pharma Flagship event named BioAsia 2017 was able to attract investment of about 507.3 million USD. For biotechnology, sector agreements were signed by 37 companies at the Global Summit of Gujarat which took place in the same year. The high cost of the instruments and the rigorous regulatory laws, however, are the downsides of the market expansion.

Recent Developments

-

January 2025 – Thermo Fisher Scientific launched a next-generation single-use bioreactor platform designed for cell and gene therapy applications, offering scalable perfusion capability and enhanced process control.

-

February 2025 – Samsung Biologics announced its Phase IV expansion in South Korea to become the world's largest single-site biomanufacturing facility, including new state-of-the-art upstream and downstream bioprocess technologies.

-

March 2025 – A European biotech startup received funding to develop AI-driven bioprocess optimization tools aimed at improving yields and reducing production costs for biosimilars.

Some of the prominent players in the Bioprocess technology market include:

- Philips Healthcare

- Hoffmann-La Roche Ltd.

- Thermo Fisher Scientific Inc.

- Becton, Dickinson, and Company

- Sartorius Group

- Abbott Laboratories

- Danaher

- Alere Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global bioprocess technology market.

By Product Type

- Biologics Safety Testing

- Cell Culture

- Cell Expansion

- Cell Line Development

- Flow Cytometry

- Tangential Flow Filtration

- Flow Cytometry

By Application

- Antibiotics

- Biosimilars

- Recombinant Proteins

- Others

By End-Use

- Biopharmaceutical Companies

- Contract Manufacturing Organization

- Academic Research Institutes

- Food and Feed Industry

- Contract Research Organization

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)