Biosensors Market Size and Growth 2026 to 2035

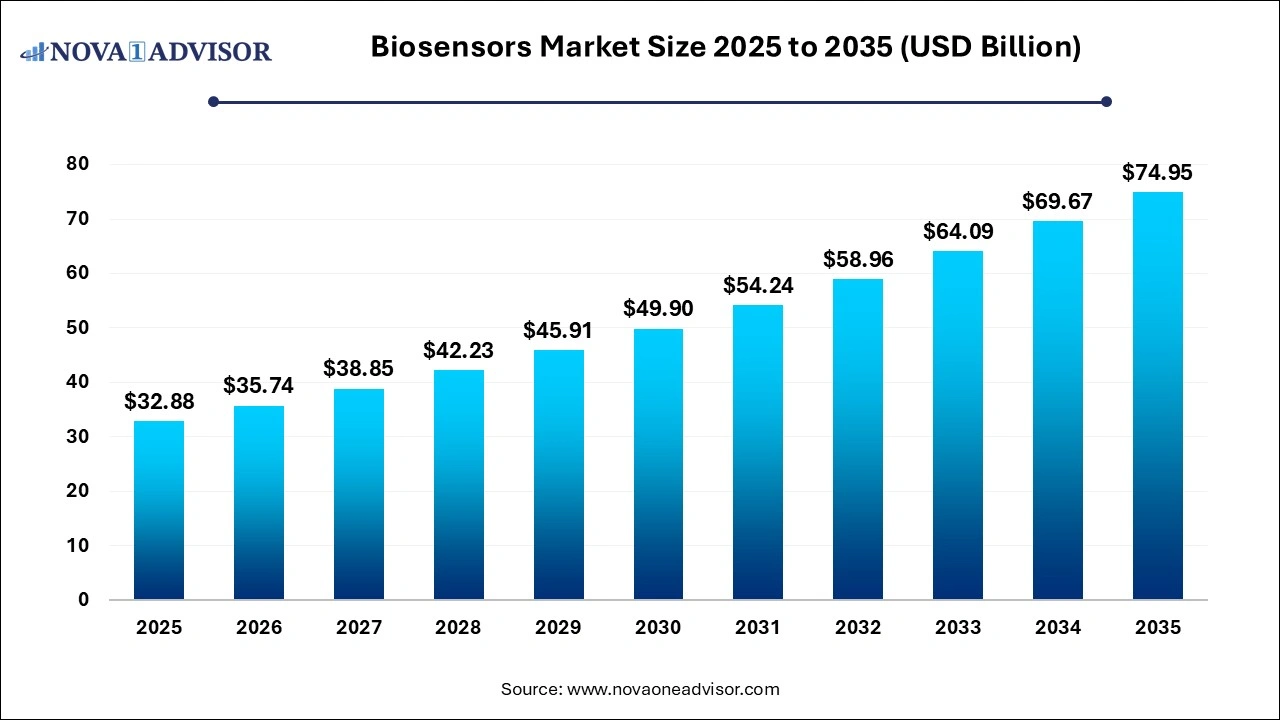

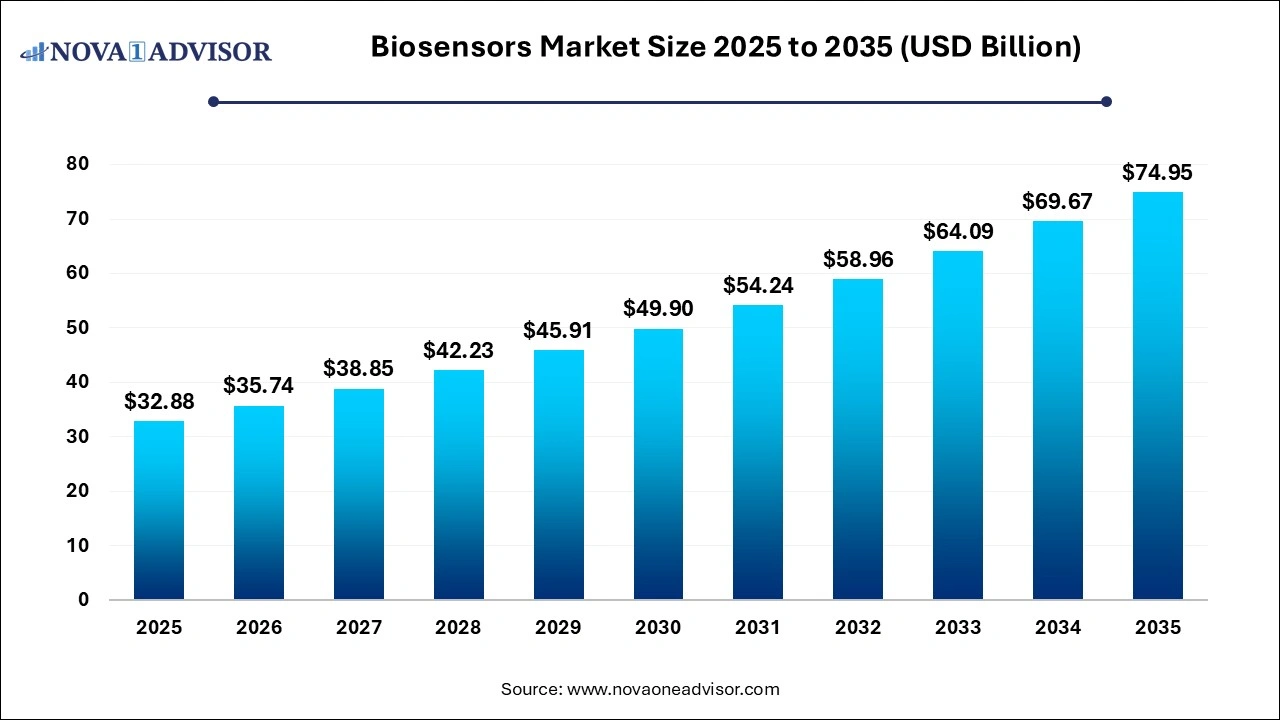

The biosensors market size was exhibited at USD 32.88 billion in 2025 and is projected to hit around USD 74.95 billion by 2035, growing at a CAGR of 8.59% during the forecast period 2026 to 2035.

Biosensors Market Overview

The biosensors market stands at the intersection of biotechnology, electronics, and digital diagnostics offering highly sensitive and rapid detection solutions across medical, environmental, industrial, and agricultural applications. Biosensors are analytical devices that convert a biological response into an electrical signal, enabling the precise monitoring of physiological, chemical, or biological data.

The growing importance of real-time, non-invasive, and cost-effective diagnostic tools has significantly boosted the demand for biosensors in the last decade. A surge in chronic disease prevalence, heightened awareness of preventive healthcare, and increased adoption of point-of-care (POC) and home diagnostic solutions have catalyzed their market relevance. Biosensors play a critical role in disease diagnosis (especially for diabetes and cardiovascular disease), drug discovery, food quality assurance, environmental monitoring, and security/bio-defense applications.

Technological convergence—particularly in nanotechnology, artificial intelligence (AI), and wearable electronics is pushing the boundaries of biosensor functionality. From simple blood glucose meters to wearable ECG biosensors, implantable drug-monitoring chips, and smartphone-integrated diagnostic systems, biosensor innovations are redefining the paradigm of remote, continuous, and personalized health monitoring.

Governments across the globe are also investing in biosensor development to improve disease outbreak surveillance, enhance agricultural productivity, and ensure environmental safety. The market is therefore expected to experience substantial growth, driven by innovation, rising healthcare needs, and regulatory support for digital health infrastructure.

Major Trends in the Biosensors Market

-

Integration of AI and Machine Learning in Biosensing: Smart algorithms are enhancing biosensor sensitivity, data interpretation, and decision support systems.

-

Growth in Wearable Biosensors: Increased consumer focus on health and wellness is driving demand for wristband and skin-patch biosensors.

-

Lab-on-a-Chip (LOC) Platforms: Miniaturized biosensors capable of multi-analyte testing are gaining prominence in POC diagnostics.

-

Flexible and Stretchable Electronics: Biosensors embedded in textiles, tattoos, or skin patches are advancing non-invasive monitoring.

-

Rise of Electrochemical Sensing in Healthcare: Electrochemical biosensors remain dominant due to high specificity and cost-effectiveness.

-

Bioprinting and Nanomaterials: Use of nanowires, carbon nanotubes, and graphene is improving biosensor sensitivity and portability.

-

Demand from the Food and Agriculture Sector: Biosensors are being deployed to detect toxins, pathogens, and pesticides in real time.

-

Environmental Monitoring Applications Expand: Biosensors for heavy metal detection, pH monitoring, and water toxicity analysis are gaining traction.

Report Scope of Biosensors Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 35.74 Billion |

| Market Size by 2035 |

USD 74.95 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.59% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Technology, By Application, By End-user |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Abbott Laboratories; Medtronic; Biosensors International Group; Pinnacle Technology, Inc.; Dupont. ; Sensirion AG; Thermo Fisher Scientific, Inc.; F. Hoffmann-La Roche AG; Siemens Healthineers; Zimmer & Peacock AS; Metrohm AG; DexCom, Inc.; Universal Biosensors, Inc.; Johnson & Johnson Services, Inc.; Nix Biosensors; Cyrcadia Health; Lifescank |

Biosensors Market Dynamics

Driver

Rising Demand for Point-of-Care and Home Diagnostics

The most prominent driver of the biosensors market is the increasing global demand for point-of-care and home-based diagnostic solutions, especially post-pandemic. Patients and clinicians are increasingly shifting toward decentralized healthcare systems that emphasize early detection, personalized monitoring, and faster treatment decisions.

In particular, blood glucose biosensors have witnessed exponential adoption among diabetic patients for self-monitoring of blood sugar levels. Similarly, pregnancy kits, ovulation predictors, cholesterol monitors, and infectious disease biosensors have become mainstream in home healthcare. These products reduce hospital visits, improve patient compliance, and support real-time disease management.

Additionally, the aging global population and rising prevalence of chronic illnesses such as cardiovascular disease, cancer, and kidney disorders demand constant health monitoring. This is fostering the uptake of wearable and implantable biosensors capable of capturing physiological data in real time and transmitting it to mobile apps or cloud platforms. As consumer expectations shift toward convenience, biosensors are becoming indispensable tools for continuous, on-demand health information.

Restraint

Sensor Stability and Biocompatibility Challenges

Despite the immense potential of biosensors, a significant restraint is the challenge of ensuring long-term stability, accuracy, and biocompatibility—particularly for implantable or continuous-use devices. Biosensors rely on biological recognition elements (enzymes, antibodies, cells), which can degrade over time, reducing sensitivity and reliability.

In implantable applications, biosensor surfaces must resist biofouling and immune reactions to remain functional. Environmental biosensors face stability issues due to exposure to fluctuating pH levels, humidity, and chemical contaminants. Manufacturing reproducibility, calibration variability, and limited shelf life of biological components are additional technical concerns.

Furthermore, regulatory approval for novel biosensing platforms can be stringent due to safety concerns, especially for wearable and implantable applications. Addressing these limitations through better material science, biocompatible coatings, and closed-loop calibration systems remains an area of active R&D.

Opportunity

Expansion in Agricultural and Environmental Monitoring

An exciting opportunity lies in the expansion of biosensors into agricultural and environmental applications, where real-time, on-site monitoring is increasingly vital. In agriculture, biosensors can be used to detect pesticide residues, monitor soil nutrients, identify plant pathogens, and optimize irrigation cycles. These capabilities align well with precision farming initiatives and efforts to reduce environmental degradation caused by over-fertilization and excessive chemical use.

In environmental monitoring, biosensors are being deployed to track heavy metal contamination, toxins in water bodies, and air quality parameters. With growing concerns about pollution, water scarcity, and ecological imbalances, governments and environmental agencies are investing in biosensor networks for early warning systems and compliance tracking.

The miniaturization and wireless capability of modern biosensors allow them to be embedded in autonomous monitoring devices, drones, and robotic systems. As sustainability takes center stage, biosensors offer a scalable and cost-efficient approach to safeguard natural ecosystems while supporting data-driven decision-making in agricultural policy and environmental stewardship.

By Technology Insights

Electrochemical biosensors dominated the market in 2025, primarily due to their low cost, high specificity, and scalability across medical and non-medical applications. These sensors measure the concentration of analytes through changes in electrical signals and are widely used in glucose monitoring, cholesterol testing, and drug detection. Their ease of integration into portable and wearable platforms further strengthens their market share.

In particular, glucose monitoring strips and wearable electrochemical sensors for blood analysis are widely adopted in home diagnostics. As material innovation continues especially with carbon nanotubes and graphene-based electrodes—electrochemical biosensors are expected to remain the workhorse of the industry due to their adaptability and commercial viability.

Optical biosensors are the fastest-growing segment, driven by their application in high-sensitivity detection, especially in drug discovery, cancer biomarker testing, and food safety. These biosensors detect changes in light properties (e.g., absorbance, fluorescence, SPR) in response to biological interactions. Recent advances in photonic biosensors and the integration of optical platforms into smartphone-based diagnostics are accelerating growth in this segment. Optical biosensors also enable real-time, label-free detection, which is increasingly valued in pharmaceutical R&D and high-throughput screening.

By Application Insights

Medical applications held the largest share, largely due to the widespread use of biosensors in blood glucose monitoring, pregnancy detection, cholesterol tracking, and POC testing for infectious diseases. Diabetes management remains the cornerstone of biosensor deployment, with glucose biosensors forming a multibillion-dollar sub-market. Moreover, biosensors are being used to monitor cardiac biomarkers, detect respiratory viruses, and manage personalized drug regimens.

With the growing penetration of biosensors in wearable health tech such as ECG biosensors, smart patches, and sleep monitoring wearables the medical segment will continue to drive major revenues. Devices capable of continuous, minimally invasive diagnostics are revolutionizing chronic disease management, hospital care, and preventive health.

Food toxicity detection is emerging as a fast-growing application, particularly due to increasing regulatory oversight, consumer awareness, and export compliance in the food industry. Biosensors capable of detecting pathogens like Salmonella, E. coli, Listeria, and aflatoxins are becoming essential for real-time quality assurance in meat, dairy, seafood, and packaged foods. These tools reduce the reliance on lengthy culture-based tests and help prevent foodborne outbreaks. Portable biosensor kits are increasingly being adopted by food safety inspectors and processing units for on-site testing.

By End-user Insights

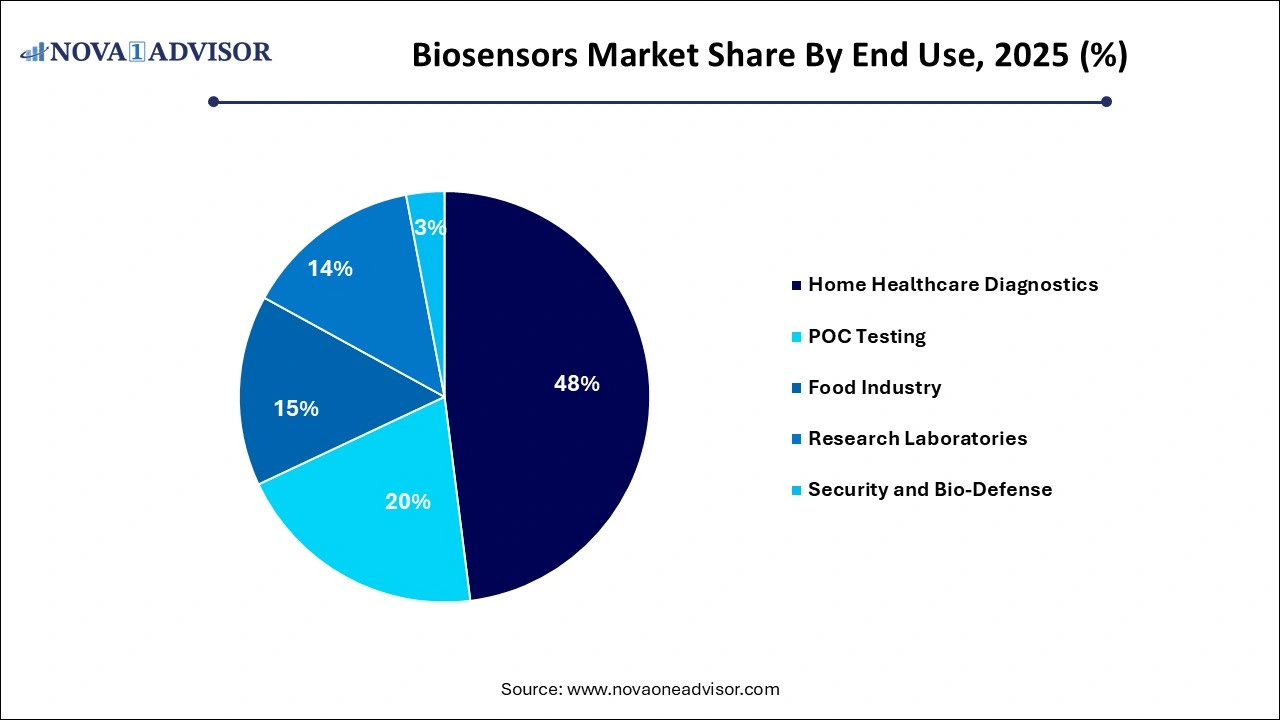

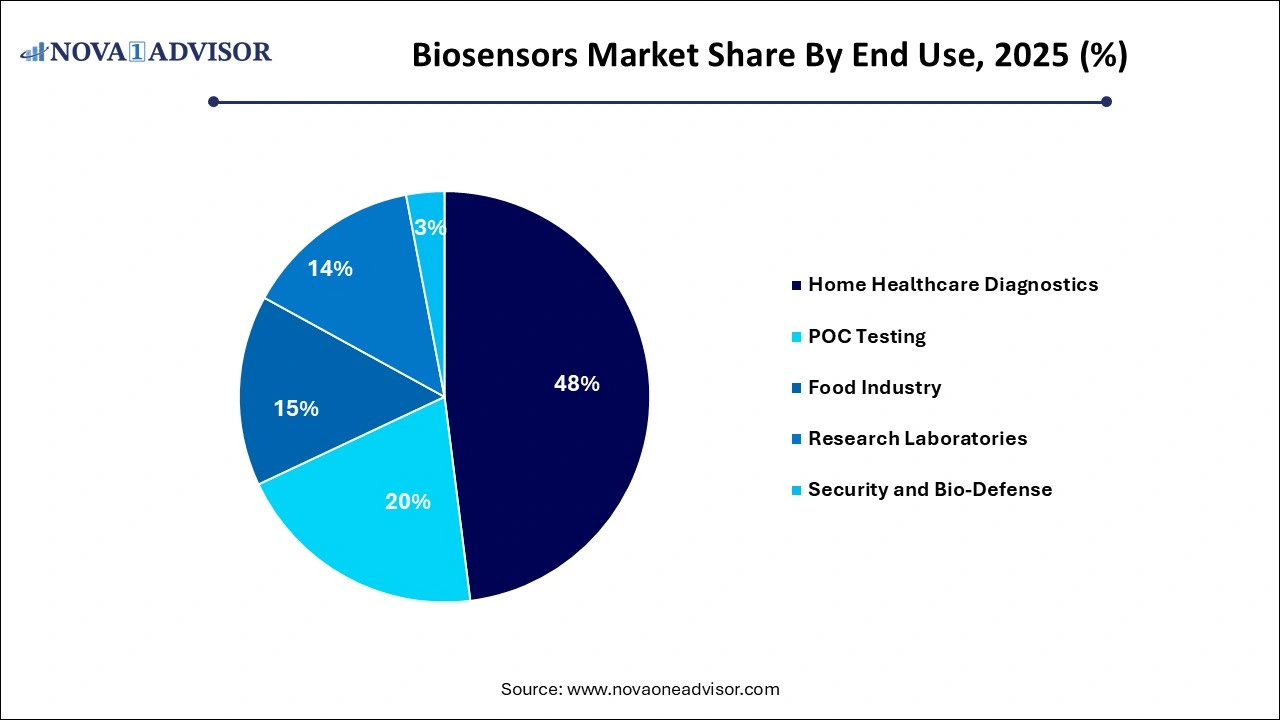

Home healthcare diagnostics dominated the end-user segment, owing to the sheer volume of glucose biosensor usage and rising consumer engagement in personal health monitoring. Portable devices for ovulation, pregnancy, urinalysis, and bclood holesterol are becoming household staples, enabling early detection and preventive care. The convenience, privacy, and cost-efficiency of at-home biosensor kits have positioned this segment as a key growth contributor.

POC testing facilities are the fastest-growing segment, as hospitals, clinics, and urgent care centers increasingly adopt biosensor-enabled rapid diagnostic tests to improve patient turnaround time and treatment decisions. In infectious diseases, for instance, biosensors capable of detecting COVID-19, influenza, and respiratory syncytial virus (RSV) within minutes are becoming invaluable. The use of biosensor strips, cartridges, and digital readers in emergency care and resource-limited settings is transforming patient triage and case management.

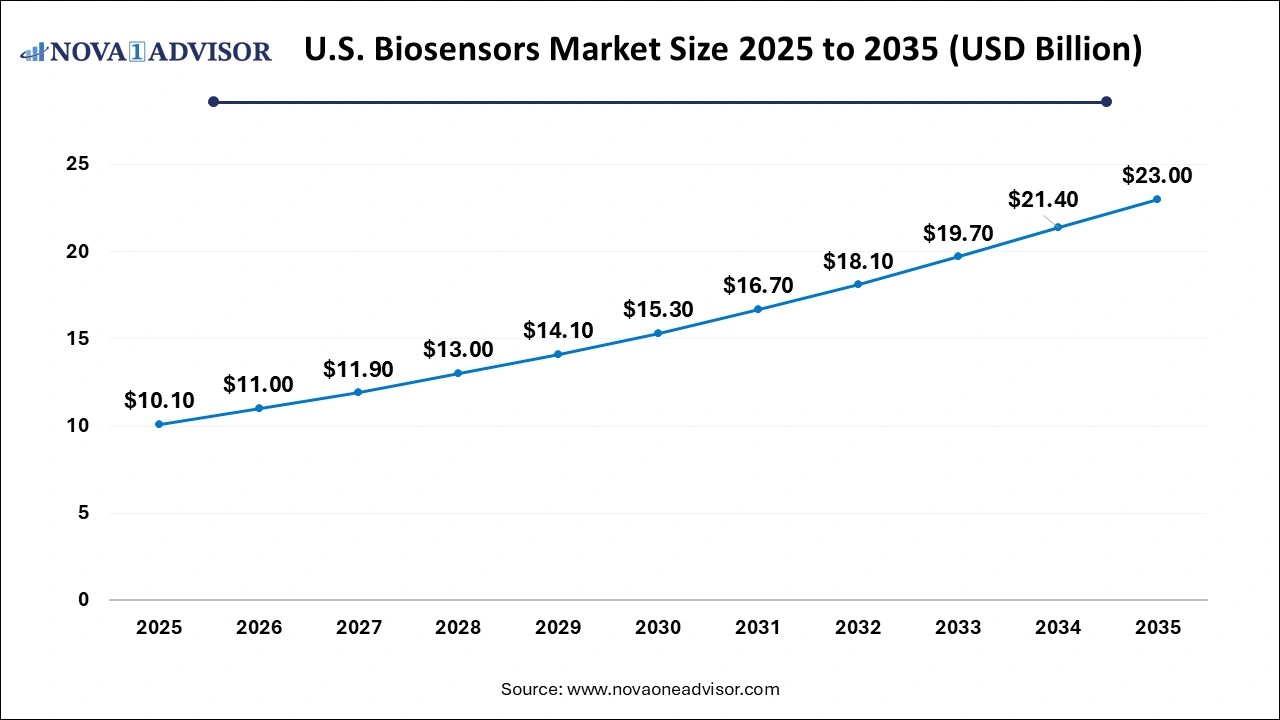

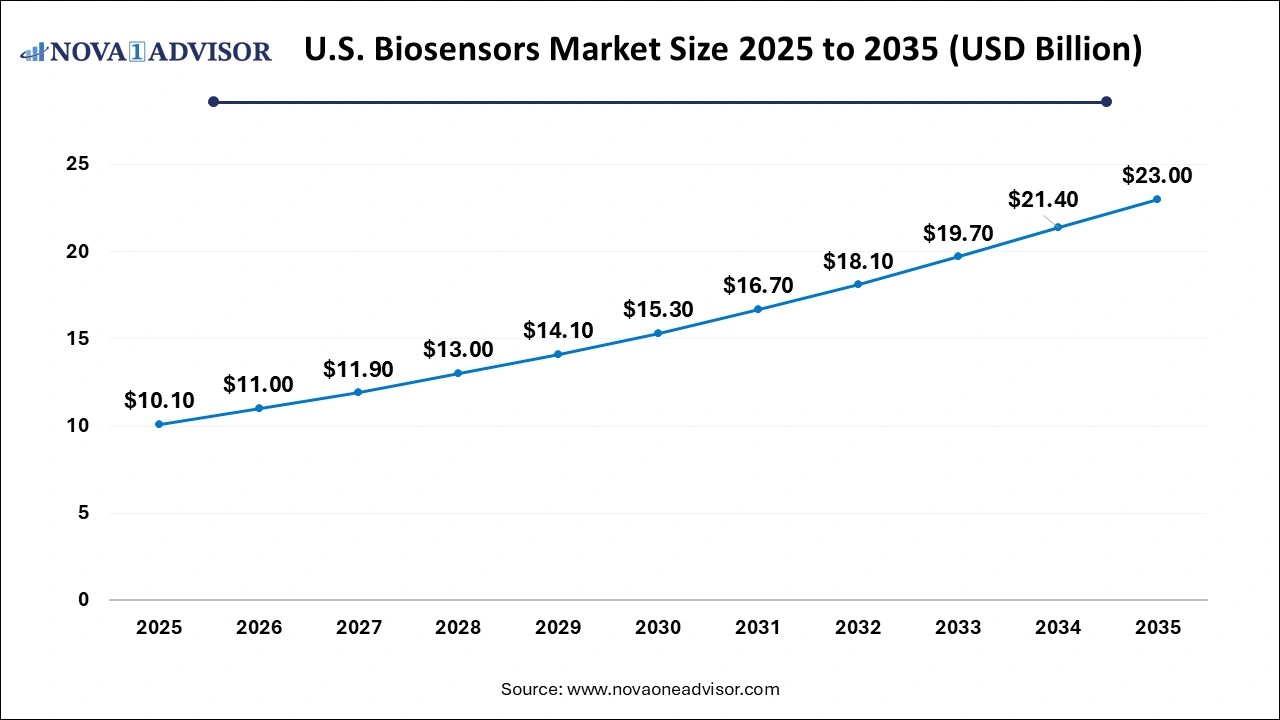

U.S. Biosensors Market Size and Growth 2026 to 2035

The U.S. biosensors market size is evaluated at USD 10.1 billion in 2025 and is projected to be worth around USD 23.0 billion by 2035, growing at a CAGR of 8.58% from 2026 to 2035.

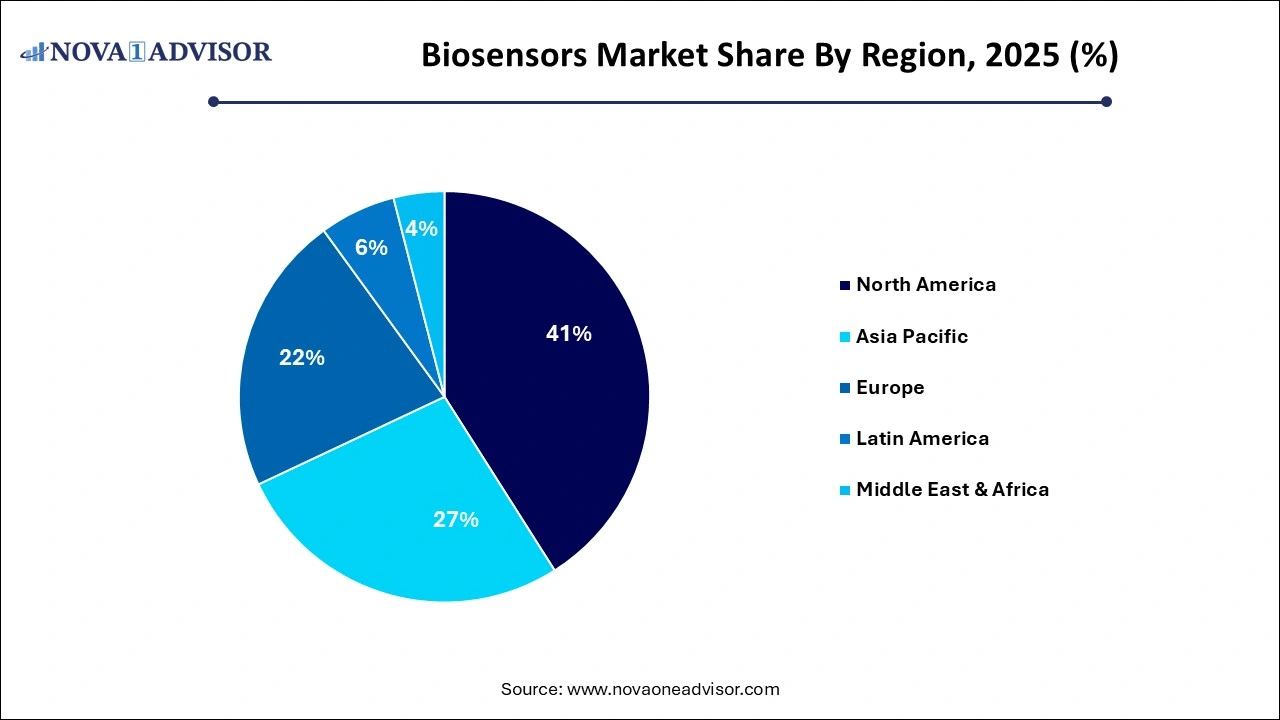

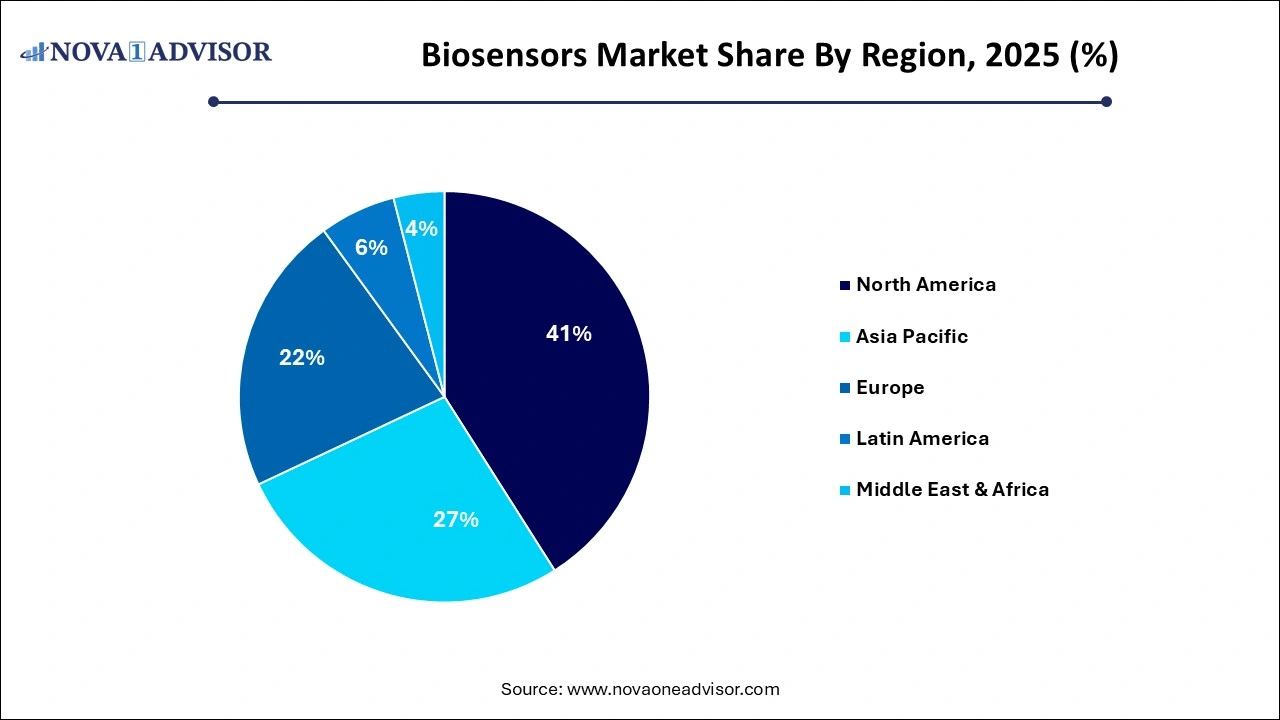

North America held the largest share of more than 41% of the revenue in 2025, driven by strong healthcare infrastructure, widespread adoption of wearable health technologies, and robust investment in biosensor R&D. The U.S. is home to major players in medical devices manufacturing and diagnostics innovation, with substantial funding from the NIH, DARPA, and private equity firms supporting biosensor startups and product development.

North America held the largest share of more than 41% of the revenue in 2025, driven by strong healthcare infrastructure, widespread adoption of wearable health technologies, and robust investment in biosensor R&D. The U.S. is home to major players in medical devices manufacturing and diagnostics innovation, with substantial funding from the NIH, DARPA, and private equity firms supporting biosensor startups and product development.

Moreover, the integration of biosensor platforms into digital health ecosystems—via mobile apps, EHRs, and cloud-based platforms is most advanced in the region. The FDA’s proactive stance on digital diagnostics and telehealth devices has also accelerated market entry for new biosensor models, especially in POC and home-use formats.

Asia Pacific is expected to witness the fastest growth, owing to a large and aging population, increasing prevalence of chronic diseases, and rising health awareness in emerging economies. Countries like China, India, Japan, and South Korea are rapidly advancing in biosensor manufacturing and deployment, with substantial government initiatives to digitize healthcare and reduce diagnostic delays.

In addition to medical applications, biosensors are gaining popularity in agriculture (soil health monitoring), food safety (contamination detection), and environmental compliance (air and water quality sensors). The presence of a growing middle class, expanding e-commerce access to home diagnostics, and domestic tech startups is accelerating biosensor adoption across the region.

Some of the prominent players in the biosensors market include:

Biosensors Market Recent Developments

-

In February 2025, Abbott announced the FDA approval of its FreeStyle Libre 4 biosensor for continuous glucose monitoring with Bluetooth connectivity and AI-powered hypoglycemia prediction.

-

In December 2024, Roche Diagnostics launched a next-generation POC biosensor platform capable of simultaneous detection of influenza, RSV, and COVID-19 antigens within 15 minutes.

-

In October 2024, a collaboration between Samsung and MIT produced a wearable biosensor patch that measures lactate, glucose, and hydration levels for athletes and clinical users.

-

In August 2024, Bio-Rad Laboratories acquired a startup focused on optical biosensors for foodborne pathogen detection, strengthening its footprint in the food safety market.

-

In June 2024, Siemens Healthineers introduced an AI-enabled biosensor for early sepsis detection in ICU settings, aiming to reduce mortality through faster intervention.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the biosensors market

By Technology

- Thermal

- Electrochemical

- Piezoelectric

- Optical

By Application

-

- Cholesterol

- Blood Glucose

- Blood Gas Analyzer

- Pregnancy Testing

- Drug Discovery

- Infectious Disease

- Food Toxicity

- Bioreactor

- Agriculture

- Environment

- Others

By End-user

- Home Healthcare Diagnostics

- POC Testing

- Food Industry

- Research Laboratories

- Security and Bio-Defense

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

POC testing facilities are the fastest-growing segment, as hospitals, clinics, and urgent care centers increasingly adopt biosensor-enabled rapid diagnostic tests to improve patient turnaround time and treatment decisions. In infectious diseases, for instance, biosensors capable of detecting COVID-19, influenza, and respiratory syncytial virus (RSV) within minutes are becoming invaluable. The use of biosensor strips, cartridges, and digital readers in emergency care and resource-limited settings is transforming patient triage and case management.

POC testing facilities are the fastest-growing segment, as hospitals, clinics, and urgent care centers increasingly adopt biosensor-enabled rapid diagnostic tests to improve patient turnaround time and treatment decisions. In infectious diseases, for instance, biosensors capable of detecting COVID-19, influenza, and respiratory syncytial virus (RSV) within minutes are becoming invaluable. The use of biosensor strips, cartridges, and digital readers in emergency care and resource-limited settings is transforming patient triage and case management. North America held the largest share of more than 41% of the revenue in 2025, driven by strong healthcare infrastructure, widespread adoption of wearable health technologies, and robust investment in biosensor R&D. The U.S. is home to major players in

North America held the largest share of more than 41% of the revenue in 2025, driven by strong healthcare infrastructure, widespread adoption of wearable health technologies, and robust investment in biosensor R&D. The U.S. is home to major players in  Asia Pacific is expected to witness the fastest growth, owing to a large and aging population, increasing prevalence of chronic diseases, and rising health awareness in emerging economies. Countries like China, India, Japan, and South Korea are rapidly advancing in biosensor manufacturing and deployment, with substantial government initiatives to digitize healthcare and reduce diagnostic delays.

Asia Pacific is expected to witness the fastest growth, owing to a large and aging population, increasing prevalence of chronic diseases, and rising health awareness in emerging economies. Countries like China, India, Japan, and South Korea are rapidly advancing in biosensor manufacturing and deployment, with substantial government initiatives to digitize healthcare and reduce diagnostic delays.