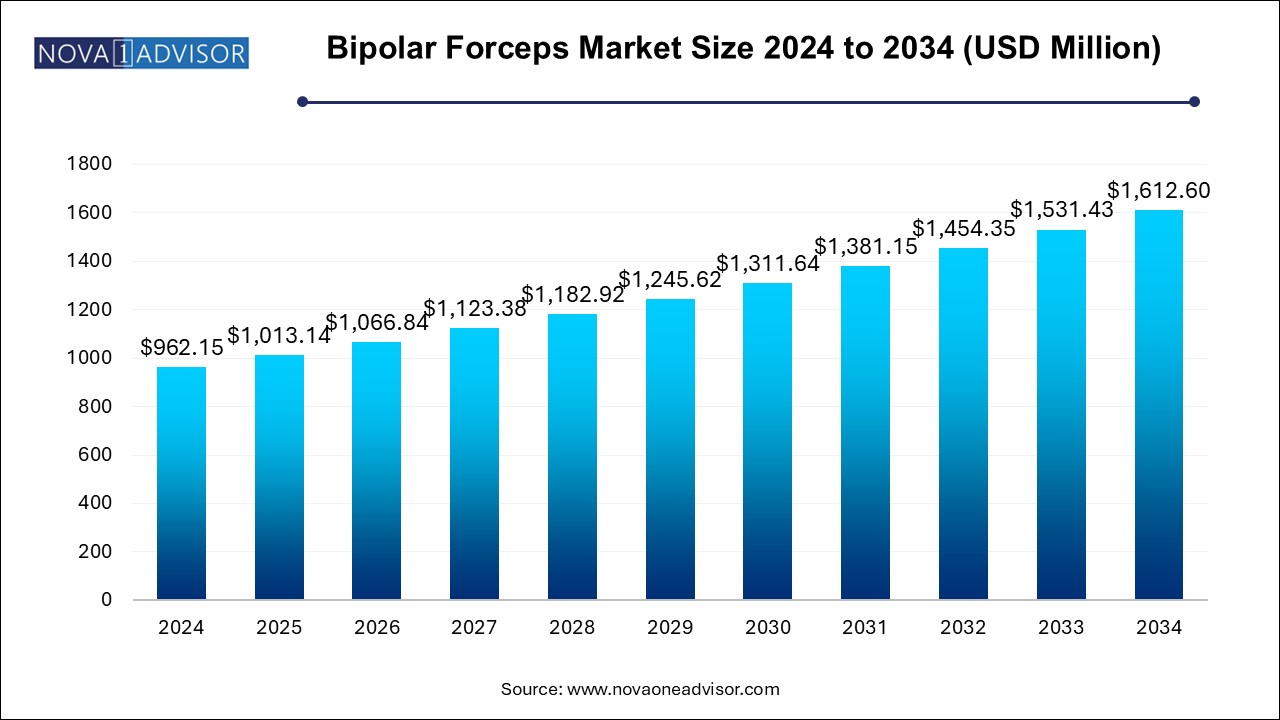

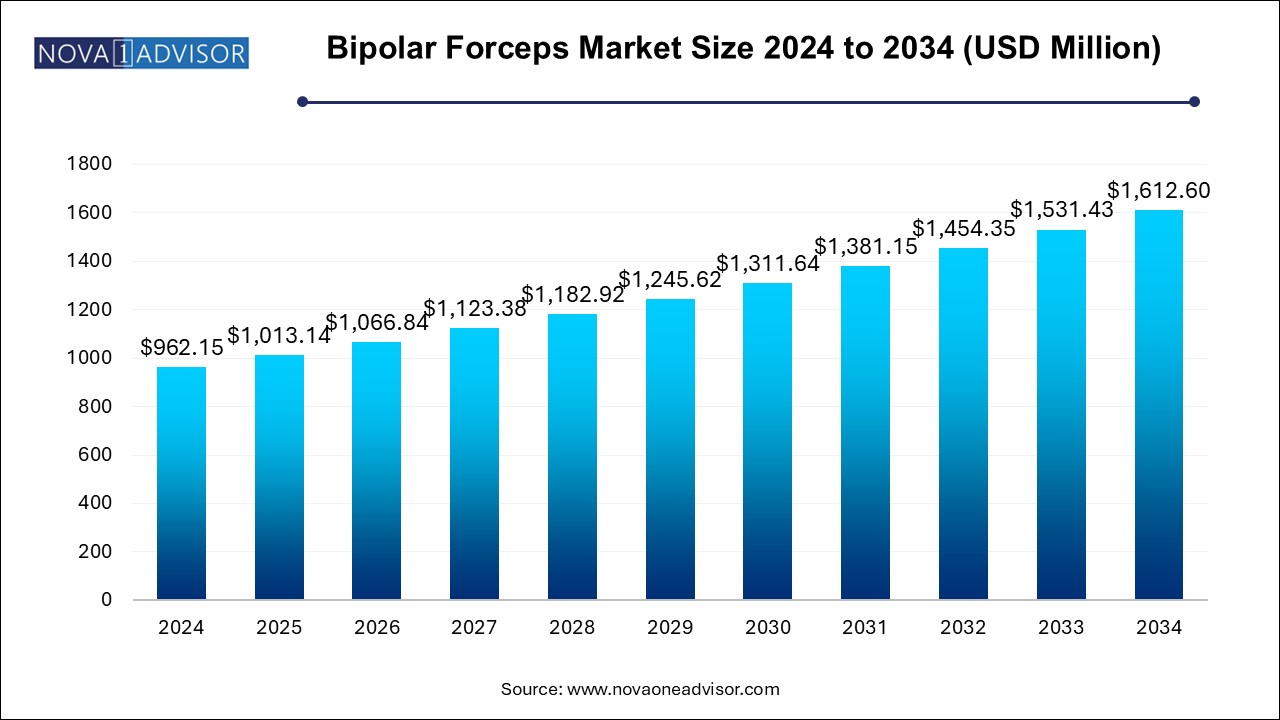

Bipolar Forceps Market Size and Growth

The bipolar forceps market size was exhibited at USD 962.15 million in 2024 and is projected to hit around USD 1,612.60 million by 2034, growing at a CAGR of 5.3% during the forecast period 2024 to 2034.

Bipolar Forceps Market Key Takeaways:

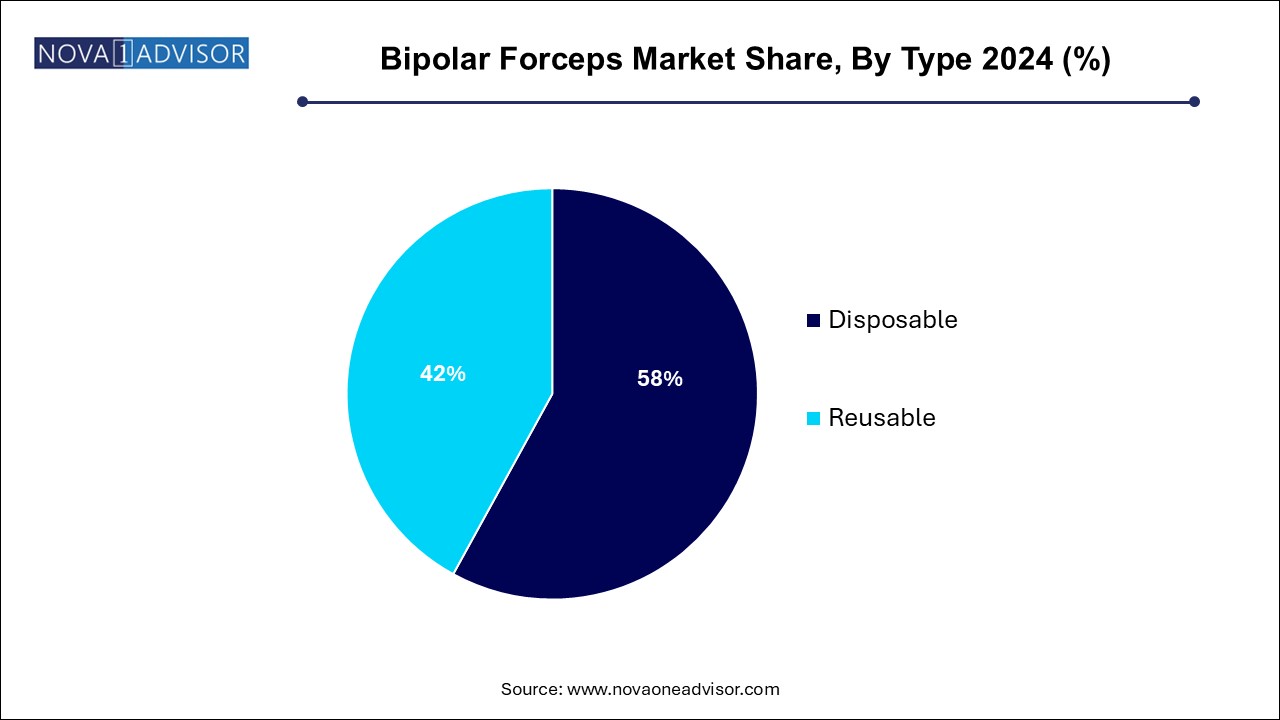

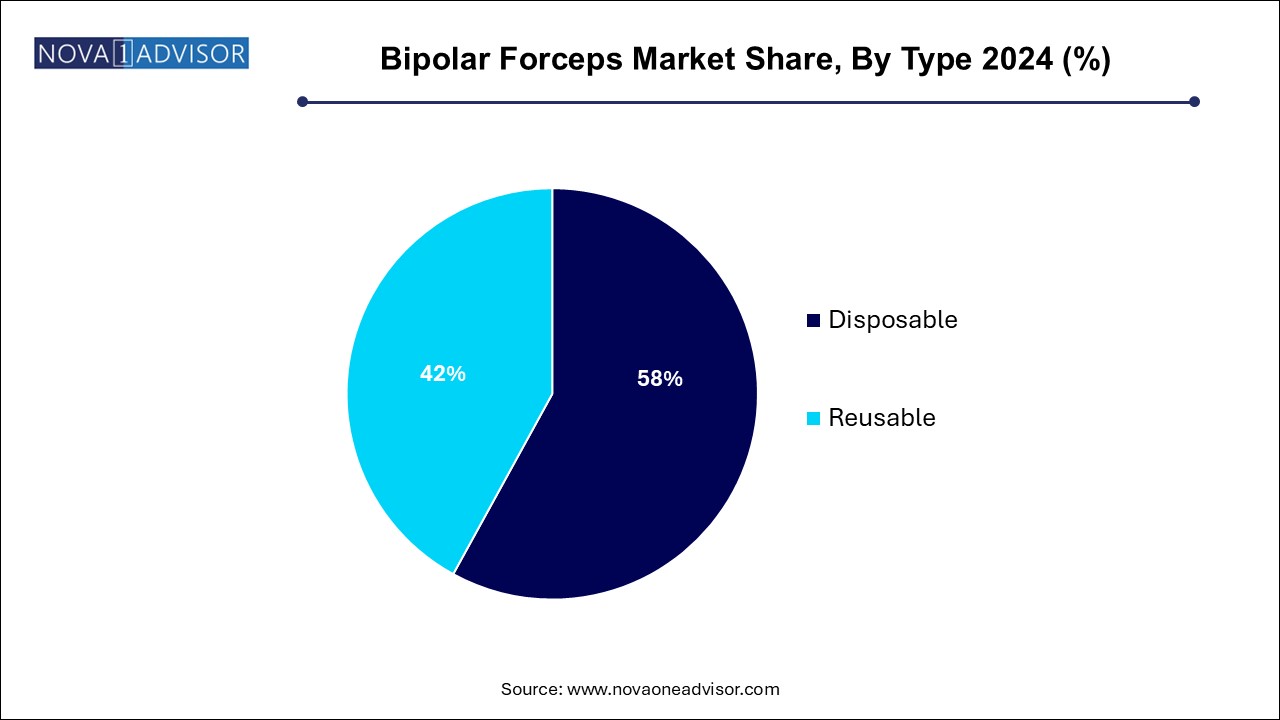

- The disposable segment dominated the market with a revenue share of 58.0% in 2024 and is projected to experience the fastest CAGR of 5.5% over the forecast period.

- The reusable bipolar forceps segment is projected to experience a significant CAGR over the forecast period

- The hospital segment dominated the market with the largest revenue share in 2024.

- The ambulatory surgical centers segment is projected to grow at a significant CAGR over the forecast period.

- The general surgery segment dominated the market with the largest revenue share in 2024.

- The gynecology segment is projected to grow at a significant CAGR over the forecast period.

- North America bipolar forceps market dominated the global market with a revenue share of 40.1% in 2024

Market Overview

The bipolar forceps market is a critical segment of the electrosurgical instruments industry, providing vital tools for precise tissue coagulation and dissection across a broad range of surgical disciplines. These forceps utilize a high-frequency electrical current that flows between two tips of the instrument, offering controlled coagulation with minimal lateral thermal spread. This unique mechanism ensures the safety of surrounding tissues during complex surgical procedures and significantly reduces intraoperative bleeding.

With the global rise in surgical interventions—particularly minimally invasive surgeries—the demand for precision instruments like bipolar forceps has surged. Aging populations, increasing prevalence of chronic conditions (e.g., cancer, neurological disorders, and gynecological conditions), and a growing inclination toward laparoscopic and robotic surgeries are further fueling the market. Hospitals and ambulatory surgical centers are upgrading their surgical toolkits to include advanced electrosurgical instruments, including both reusable and disposable bipolar forceps.

Bipolar forceps are indispensable in microsurgical applications such as neurosurgery, plastic and reconstructive procedures, and gynecological interventions. The instruments are used not only to cauterize blood vessels but also to manipulate delicate tissues without causing damage. This dual functionality makes them essential in surgeries where precision and hemostasis are of paramount importance. The market is witnessing rapid innovation in design ergonomics, insulation materials, and integration with digital and robotic platforms, expanding its clinical relevance.

Moreover, global healthcare modernization, particularly in developing nations, is increasing access to sophisticated surgical tools. Emerging markets like India, Brazil, and Southeast Asia are investing in hospital infrastructure and equipping facilities with advanced electrosurgical units. This, combined with rising government expenditure on healthcare systems and surgical training, bodes well for the growth of the bipolar forceps market globally.

Major Trends in the Market

-

Shift Toward Minimally Invasive and Robotic Surgeries: Surgeons are increasingly relying on bipolar forceps in minimally invasive procedures to reduce blood loss and recovery time.

-

Disposable Forceps Gaining Ground: Owing to rising infection control protocols and convenience, disposable bipolar forceps are rapidly replacing reusable models in certain settings.

-

Technological Advancements in Electrosurgery Units: Integration of bipolar forceps with advanced energy platforms enables real-time temperature control and automatic feedback mechanisms.

-

Growing Demand from Ambulatory Surgical Centers (ASCs): ASCs are expanding their use of bipolar electrosurgical tools due to lower procedural costs and shorter patient stays.

-

Ergonomic and Lightweight Designs: Manufacturers are focusing on user-friendly designs to reduce surgeon fatigue during prolonged procedures.

-

Increased Focus on Pediatric and Geriatric Surgeries: Tailored bipolar forceps for delicate tissues in these age groups are expanding the product scope.

-

Strategic Collaborations and Product Launches: Companies are entering partnerships with surgical institutions and R&D organizations to expand product lines.

Report Scope of Bipolar Forceps Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 1,013.14 Million |

| Market Size by 2034 |

USD 1,612.60 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 5.3% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Type, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

CONMED Corporation; Medtronic; KLS Martin Group; B. Braun SE; Stryker; BD; Johnson & Johnson Services, Inc.; Integra LifeSciences Corporation; Stingray Surgical Products, LLC; Surgical Holdings |

Key Market Driver

Rising Global Surgical Volume and Demand for Precision Instruments

One of the foremost drivers propelling the bipolar forceps market is the global surge in surgical procedures—both elective and emergency. From routine gynecological interventions to complex neurological surgeries, the demand for precise, reliable instruments has never been higher. According to the World Health Organization (WHO), approximately 313 million surgeries are performed globally each year, with that number expected to rise as populations age and chronic diseases become more prevalent.

Bipolar forceps are particularly favored for their ability to coagulate tissues without the need for grounding pads or dispersive electrodes, making them safer and more convenient. Their ability to reduce collateral tissue damage, especially in surgeries involving critical structures like the brain and spinal cord, has driven their widespread adoption. Furthermore, the adoption of advanced bipolar systems with integrated thermal sensors and energy modulation enhances procedural safety and efficiency, further boosting market demand.

Key Market Restraint

High Cost of Advanced Electrosurgical Systems

Despite the clinical advantages of bipolar forceps, their widespread adoption—particularly in low- and middle-income countries—is hindered by the high cost of electrosurgical generators and compatible forceps. High-quality reusable bipolar forceps, when coupled with modern energy platforms, can involve significant upfront investments. Additionally, maintenance costs, frequent sterilization requirements, and the need for trained personnel add to the economic burden on healthcare institutions.

Smaller hospitals, especially in rural regions, may continue to rely on traditional surgical tools or monopolar systems, which are less costly but carry a higher risk of tissue damage and bleeding. Even disposable bipolar forceps, while cost-effective in terms of infection control, often carry a price premium due to single-use design and stringent regulatory requirements. These financial constraints can slow market penetration in economically challenged areas.

Key Market Opportunity

Rising Adoption of Bipolar Forceps in Ambulatory Surgical Centers (ASCs)

Ambulatory Surgical Centers (ASCs) represent a significant growth opportunity for the bipolar forceps market. With the global healthcare landscape shifting toward outpatient care, ASCs have emerged as efficient alternatives to traditional hospitals for various surgical procedures. These centers prioritize cost efficiency, faster patient turnover, and minimal hospital stays—all of which align well with the use of bipolar electrosurgical instruments that reduce operative time and complications.

Manufacturers are now designing compact, ergonomic, and easy-to-use bipolar forceps tailored for ASC environments. The surge in cosmetic surgeries, minor gynecological procedures, and endoscopic interventions performed in ASCs is creating a fertile ground for market expansion. Additionally, as insurance providers incentivize outpatient surgeries due to their lower cost profiles, more investments are flowing into ASC setups, ensuring a steady demand for bipolar surgical instruments.

Bipolar Forceps Market By Type Insights

The disposable segment dominated the market with a revenue share of 58.0% in 2024 and is projected to experience the fastest CAGR of 5.5% over the forecast period, Disposable instruments eliminate the need for reprocessing, sterilization, and cross-contamination risks, especially in high-volume facilities. Hospitals, in particular, have increasingly adopted single-use bipolar forceps to streamline operating room logistics and comply with strict hygiene standards. These forceps are particularly useful in critical care surgeries and in low-resource settings where sterilization facilities may be limited.

Reusable bipolar forceps, while slightly trailing in dominance, are anticipated to witness steady growth, especially in surgical institutions with high caseloads and robust sterilization infrastructure. These forceps are constructed from high-grade stainless steel or titanium alloys and can withstand multiple sterilization cycles without compromising structural integrity. Their long-term cost-effectiveness makes them attractive for specialty hospitals and teaching institutions. Moreover, recent innovations in insulation materials and modular designs are enhancing the longevity and safety profile of reusable instruments.

Bipolar Forceps Market By End-use Insights

Hospitals dominate the end-use segment, benefiting from larger surgical volumes and access to comprehensive electrosurgical units. These institutions typically perform a wide variety of complex procedures, from cardiac and neuro to general and plastic surgeries, necessitating the use of advanced bipolar forceps. Hospitals also possess the infrastructure needed for sterilization, instrument maintenance, and specialized training. Furthermore, government and private hospital chains are upgrading their surgical suites with advanced tools, further boosting this segment’s demand.

Ambulatory surgical centers (ASCs) represent the fastest-growing end-use segment, as healthcare systems shift toward outpatient surgical care. Bipolar forceps, due to their efficiency and safety, are well-suited for the outpatient model where turnaround time and complication avoidance are critical. ASCs focus on high-efficiency, cost-sensitive operations, and manufacturers are responding with bipolar solutions that are compact, durable, and easy to operate without extensive setup. The growing preference for ASCs in procedures like laparoscopic cholecystectomy, hernia repairs, and cosmetic interventions is expected to sustain momentum in this segment.

Bipolar Forceps Market By Application Insights

Gynecology emerged as the largest application segment for bipolar forceps, attributed to the high frequency of procedures such as hysterectomies, myomectomies, endometriosis treatment, and tubal ligations. In gynecological surgery, the ability to control bleeding and preserve surrounding reproductive structures is crucial. Bipolar forceps enable surgeons to perform minimally invasive laparoscopic procedures with precision and minimal risk. With uterine fibroids and endometriosis affecting millions of women in the U.S. alone, gynecological interventions are among the most common surgical procedures globally.

Neurosurgery is the fastest-growing application, owing to its demanding precision requirements. Bipolar forceps are extensively used in cranial and spinal surgeries, where even minor tissue damage can have serious neurological consequences. These forceps help neurosurgeons achieve meticulous hemostasis in confined operative fields. The growing incidence of brain tumors, neurodegenerative conditions, and traumatic injuries—coupled with the rising adoption of image-guided and robotic-assisted neurosurgical procedures—has made bipolar instruments indispensable in this field.

Bipolar Forceps Market By Regional Insights

North America leads the global bipolar forceps market, owing to its sophisticated healthcare infrastructure, strong surgical volume, and robust adoption of advanced electrosurgical technologies. The U.S. in particular accounts for the largest market share, supported by a high concentration of tertiary care hospitals and ambulatory centers. Factors such as an aging population, favorable reimbursement policies for minimally invasive surgeries, and the presence of leading manufacturers like Medtronic, B. Braun, and Stryker contribute significantly to market leadership. Moreover, regulatory oversight by the FDA ensures high standards of product quality and innovation, further reinforcing the market’s maturity in this region.

Asia Pacific is witnessing the fastest growth, spurred by rising healthcare expenditures, surgical volumes, and hospital expansions. Countries like China, India, South Korea, and Thailand are investing heavily in modernizing their healthcare systems, establishing new multispecialty hospitals, and embracing medical tourism. These developments are increasing the demand for cost-effective and efficient surgical tools, including bipolar forceps. Moreover, regional players are entering collaborations with global manufacturers to localize production and reduce equipment costs. Awareness programs and surgical skill-building initiatives supported by governments and NGOs are also fostering the adoption of bipolar instruments in underserved areas.

Some of the prominent players in the bipolar forceps market include:

- CONMED Corporation

- Medtronic

- KLS Martin Group

- B. Braun SE

- Stryker

- BD

- Johnson & Johnson Services, Inc.

- Integra LifeSciences Corporation

- Stingray Surgical Products, LLC

- Surgical Holdings

Recent Developments

-

January 2025: Medtronic launched a next-generation line of insulated bipolar forceps designed for neurosurgical applications, integrating microfeedback temperature control to minimize thermal injury.

-

February 2025: B. Braun partnered with a major German university hospital to pilot AI-enabled electrosurgical units that enhance bipolar performance in complex surgeries.

-

March 2025: Stryker introduced a modular reusable bipolar forceps kit compatible with its latest SmartLife energy platform, aimed at general and gynecological surgeries.

-

April 2025: KLS Martin Group announced FDA clearance for its new ergonomic bipolar forceps designed specifically for outpatient procedures in ASCs.

-

April 2025: Olympus Corporation unveiled a collaboration with multiple Asian distributors to expand access to its electrosurgical range, including bipolar forceps, in emerging markets.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the bipolar forceps market

By Type

By Application

- Gynecology

- General Surgery

- Neurosurgery

- Plastic Surgery

- Others

By End-use

- Hospitals

- Specialty Clinics

- Ambulatory Surgical Centers

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)