Blockchain Technology Market Size and Research

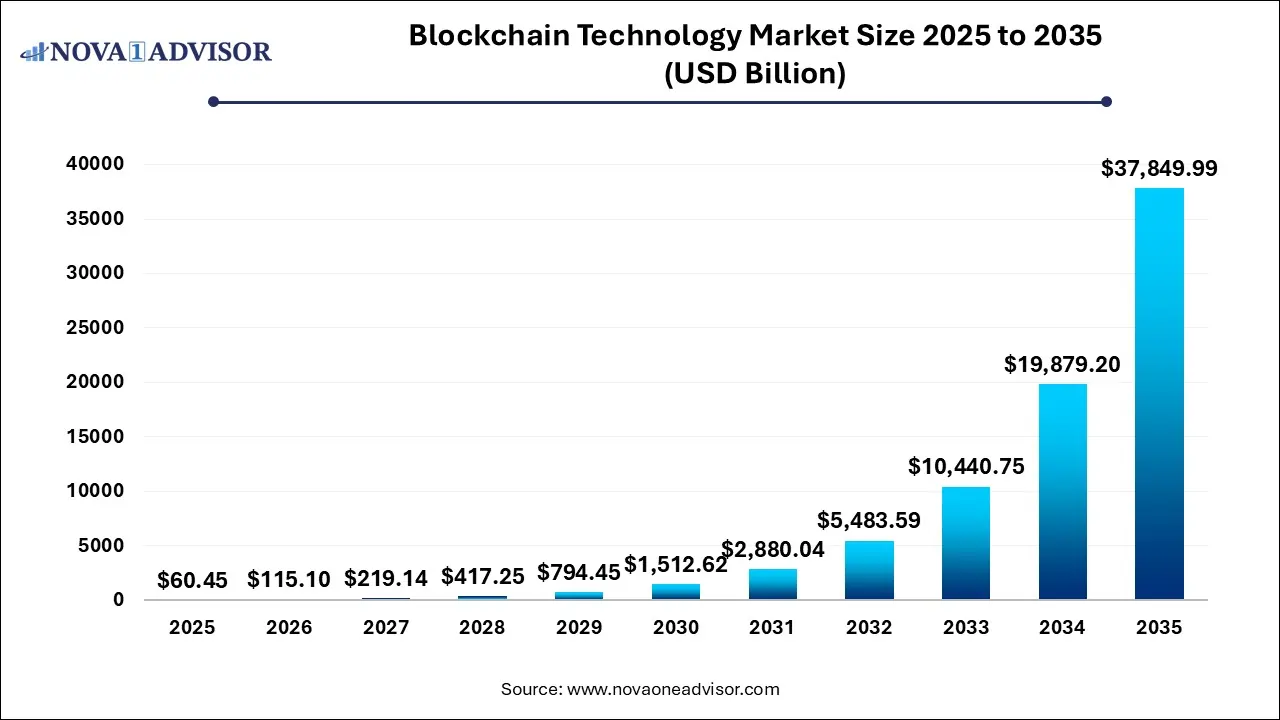

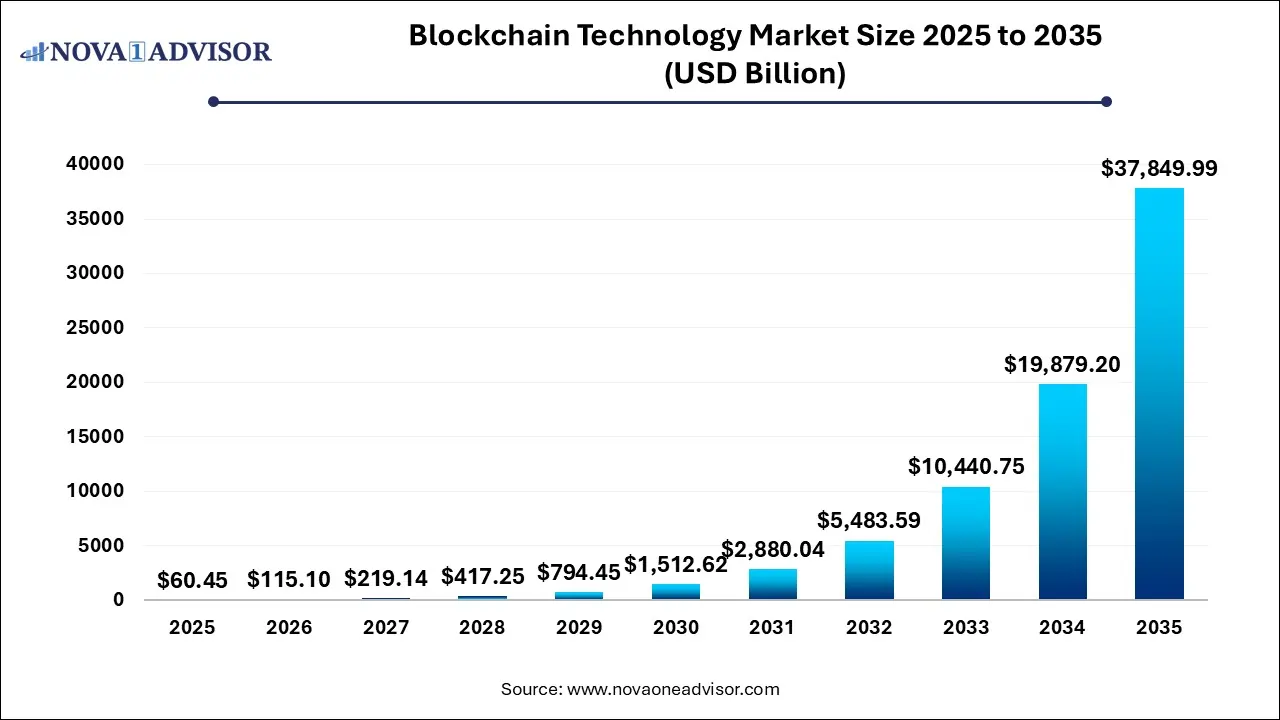

The blockchain technology market size was exhibited at USD 60.45 billion in 2025 and is projected to hit around USD 37,849.99 billion by 2035, growing at a CAGR of 90.4% during the forecast period 2026 to 2035.

Blockchain Technology Market Key Takeaways:

- The public cloud segment dominated the market in 2025 and accounted for a 63.0% share of the global revenue.

- The private cloud segment is anticipated to witness significant growth over the forecast period.

- The infrastructure & protocols segment dominated the market in 2025.

- The middleware segment is expected to witness significant growth over the forecast period.

- The platform segment dominated the market in 2025.

- The services segment is expected to witness significant growth over the forecast period.

- The payments segment dominated the market in 2025.

- The digital identity segment is anticipated to grow at the fastest CAGR over the forecast period.

- The large enterprises segment dominated the market in 2025.

- The small & medium enterprise segment is anticipated to grow at the fastest CAGR over the forecast period.

- The financial services segment dominated the market in 2025.

- The healthcare segment is anticipated to grow at the fastest CAGR over the forecast period.

- North America blockchain technology market dominated globally in 2025 and accounted for 38.0% share of the global revenue.

- The blockchain technology market in U.S. is expected to grow at a significant CAGR from 2026 to 2035.

Market Overview

The Blockchain Technology Market is witnessing unprecedented expansion as businesses, governments, and consumers embrace decentralized and immutable data infrastructures. Blockchain a distributed ledger technology that records transactions across multiple nodes in a secure, transparent, and tamper-resistant manner is no longer confined to the realm of cryptocurrencies. It is now revolutionizing sectors such as banking, healthcare, logistics, manufacturing, energy, and even public governance.

Blockchain’s core strengths transparency, security, decentralization, and auditability address critical challenges in trust-based ecosystems. These attributes are especially valuable in environments that involve multi-party data exchanges, supply chains, financial settlements, identity management, and contract enforcement. Blockchain also supports the rise of Web3, decentralized finance (DeFi), tokenized assets, and smart contracts, opening up entirely new digital business models.

The shift toward digital-first economies, coupled with the need for resilient, real-time systems, has prompted both large enterprises and startups to integrate blockchain platforms into their operational stack. Moreover, regulatory clarity and interoperability standards are gradually improving, reducing entry barriers and boosting enterprise adoption.

Major Trends in the Market

-

Rise of Permissioned (Private) Blockchains: Enterprises are preferring private and hybrid blockchains for greater control, scalability, and compliance readiness.

-

Integration with IoT and AI: Blockchain is being paired with AI and IoT for traceability, predictive analytics, and real-time automation in sectors like logistics and manufacturing.

-

Growing Popularity of Smart Contracts: Automated execution of agreements via smart contracts is streamlining processes in insurance, real estate, and procurement.

-

Blockchain for Sustainability and ESG: Companies are using blockchain to track carbon credits, verify sustainability claims, and ensure ethical sourcing.

-

Emergence of Central Bank Digital Currencies (CBDCs): Governments are piloting national digital currencies powered by blockchain infrastructure.

-

Interoperability Protocols Maturing: Technologies like Polkadot, Cosmos, and Chainlink are facilitating cross-chain communication, enabling multichain ecosystems.

-

Tokenization of Real-World Assets: Real estate, artworks, and commodities are being tokenized for fractional ownership and secondary trading.

Report Scope of Blockchain Technology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 115.10 Billion |

| Market Size by 2035 |

USD 37,849.99 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 90.4% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Component, Offering, Application, Enterprise Size, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

IBM Corporation; Microsoft Corporation; The Linux Foundation; Blockchain Tech LTD; Chain; Circle Internet Financial, LLC; Deloitte Touche Tohmatsu Limited; Digital Asset Holdings, LLC; Global Arena Holding, Inc. (GAHC); Monax Labs; Ripple |

Key Market Driver: Increasing Demand for Transparency and Trust in Data Transactions

A central driver of the blockchain technology market is the growing demand for transparency, auditability, and trust in digital interactions. In an era where data integrity, traceability, and verification are paramount, blockchain offers a distributed system where records are immutable and visible to authorized participants. This feature is particularly important in sectors with complex supply chains, such as pharmaceuticals and agriculture, where verifying product origin and journey is crucial.

Moreover, in financial services, blockchain reduces fraud, accelerates settlements, and minimizes reconciliation errors by providing a single source of truth accessible to all stakeholders. Similarly, government applications such as land registries, voting systems, and welfare distribution benefit from blockchain’s tamper-proof record-keeping. As digital trust becomes a key competitive differentiator, organizations across the globe are leveraging blockchain to build verifiable systems and reduce reliance on intermediaries.

Key Market Restraint: Scalability and Interoperability Challenges

Despite its advantages, scalability and interoperability limitations pose significant challenges to blockchain adoption. Public blockchains like Bitcoin and Ethereum, in their original form, suffer from slow transaction processing speeds and high energy consumption. For enterprise use, these performance issues hinder large-scale implementation, particularly in high-frequency industries like finance and telecom.

Interoperability is another major barrier, as many blockchains operate in silos without standardized protocols for cross-chain data exchange. This fragmentation limits seamless integration into existing IT systems and slows ecosystem growth. While solutions like layer-2 protocols and interoperable platforms (e.g., Cosmos, Polkadot) are under development, widespread deployment and consensus are still evolving. Enterprises must weigh these constraints against blockchain’s benefits, and vendor solutions must evolve to address these limitations.

Key Market Opportunity: Expanding Use of Blockchain in Supply Chain Management

One of the most promising opportunities in the blockchain technology market is its expanding application in supply chain management. Supply chains often involve multiple participants across geographies, making data accuracy and traceability difficult. Blockchain offers an immutable ledger to track products from origin to end-consumer, ensuring authenticity, compliance, and visibility.

For example, IBM’s Food Trust blockchain has been adopted by Walmart and Nestlé to track food from farms to shelves. Similarly, Maersk uses blockchain to digitize shipping documentation, reducing fraud and transit delays. In the post-pandemic world, supply chain resilience is a top priority, and blockchain’s ability to provide real-time insights and automated compliance can unlock significant efficiency and trust gains.

Blockchain Technology Market By Type Insights

Private cloud-based blockchains dominate the market, especially in enterprise and government deployments. These permissioned networks offer better control, faster processing, and customized governance structures. Financial institutions, logistics companies, and healthcare providers prefer private blockchain systems for regulatory compliance, internal transparency, and transaction efficiency.

Hybrid cloud blockchains are the fastest-growing segment, combining the benefits of both public and private systems. Hybrid blockchains allow sensitive data to remain private while enabling public verification or inter-organizational collaboration. They are gaining popularity in sectors like eCommerce, energy, and media, where both transparency and data privacy are essential.

Blockchain Technology Market By Component Insights

Application & solution layers hold the largest market share, encompassing business-focused blockchain solutions like supply chain monitoring, asset tokenization platforms, digital identity frameworks, and payment gateways. These applications are built on top of blockchain protocols and tailored to industry-specific needs.

Infrastructure & protocols are the fastest-growing, as new blockchain platforms compete to offer better scalability, security, and interoperability. Innovations in consensus mechanisms (e.g., proof-of-stake, DAG, and zero-knowledge proofs) and the rise of enterprise-grade protocols such as Hyperledger, Corda, and Avalanche are driving this segment’s momentum.

Blockchain Technology Market By Offering Insights

Platform offerings lead the market, as companies build and deploy applications using foundational blockchain frameworks. These platforms provide APIs, SDKs, and cloud-hosted environments to accelerate development. Leaders like Ethereum, IBM Blockchain, and Azure Blockchain dominate here.

Services are growing rapidly, especially in consulting, integration, maintenance, and training. As blockchain matures, organizations are turning to third-party vendors to design blockchain architecture, manage node hosting, and ensure regulatory compliance. Managed services for blockchain hosting are especially gaining traction among SMEs.

Blockchain Technology Market By Application Insights

Payments remain the largest application, driven by cryptocurrency transactions, remittances, and cross-border transfers. Blockchain reduces fees, improves transparency, and enables near-instant settlements, making it highly attractive in fintech and remittance-heavy economies.

Smart contracts are the fastest-growing application, automating execution of agreements in insurance, supply chain, and decentralized finance (DeFi). For instance, decentralized lending platforms and peer-to-peer insurance pools use smart contracts to enforce rules and process transactions without intermediaries.

Blockchain Technology Market By Enterprise Size Insights

Large enterprises dominate blockchain adoption, due to their ability to invest in experimental technologies, meet compliance requirements, and manage ecosystem partnerships. Banks, multinational logistics firms, and major retailers lead this trend.

SMEs are adopting blockchain rapidly, especially for traceability, digital payments, and simplified cross-border trade. Cloud-hosted blockchain services and SaaS models have lowered the cost and complexity of blockchain integration, making it more accessible to smaller firms.

Blockchain Technology Market By End-use Insights

Banking & Financial Services lead the market, given blockchain’s natural fit for payments, trade finance, clearing, KYC, and fraud prevention. Major banks have piloted or deployed blockchain for real-time settlements and digital identity verification.

Retail & eCommerce is the fastest-growing end-use, using blockchain for tracking product provenance, combating counterfeit goods, and enabling loyalty programs. Blockchain also supports decentralized marketplaces and secure payment systems, addressing both consumer trust and operational efficiency.

Blockchain Technology Market By Regional Insights

North America dominates the blockchain market, led by the U.S., which is home to key technology providers, financial innovators, and regulatory experimentation. Major companies like IBM, Microsoft, Coinbase, ConsenSys, and Ripple are headquartered in the region. The U.S. SEC and CFTC are increasingly defining crypto and blockchain policies, shaping the regulatory landscape.

Adoption is also robust in Canada, which has embraced blockchain in land registry, healthcare, and identity verification projects. North America’s venture capital ecosystem and academic research institutions further contribute to the region’s leadership in blockchain innovation.

Asia Pacific is the fastest-growing region, driven by rapid digital transformation, high mobile penetration, and progressive government support. China, despite banning cryptocurrencies, is developing blockchain for cross-border payments, trade documentation, and smart city projects under its Blockchain Service Network (BSN).

Singapore, South Korea, and Japan are highly active, launching blockchain initiatives in finance, logistics, and public services. India has also entered the fray with pilot projects in agricultural traceability, voting systems, and digital health records. The diverse and digitally savvy population, combined with regulatory evolution, makes Asia Pacific a dynamic and promising region for blockchain growth.

Some of the prominent players in the blockchain technology market include:

Blockchain Technology Market Recent Developments

-

April 2025: ConsenSys launched MetaMask Institutional, a wallet solution for enterprises engaging in DeFi, integrating compliance and custody features.

-

March 2025: IBM expanded its Food Trust blockchain platform into Latin America to support traceability for perishable exports.

-

February 2025: Ripple announced the launch of a CBDC platform to support central banks in deploying and managing national digital currencies.

-

January 2025: Polygon Labs partnered with Adobe to launch blockchain-based provenance tracking tools for digital art and NFTs.

-

November 2024: Alibaba Cloud introduced a hybrid blockchain infrastructure-as-a-service (BaaS) offering for Chinese enterprises under regulatory compliance.

-

October 2024: JPMorgan expanded its JPM Coin blockchain-based payment network to include programmable payment features for B2B clients.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the blockchain technology market

By Type

- Public Cloud

- Private Cloud

- Hybrid Cloud

By Component

- Application & Solution

- Infrastructure & Protocols

- Middleware

By Offering

By Application

- Digital Identity

- Exchanges

- Payments

- Smart Contracts

- Supply Chain Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By End-use

- Banking & Financial Services

- Government

- Healthcare

- Media & Entertainment

- Retail & eCommerce

- Transportation & Logistics

- Travel

- Manufacturing

- IT & Telecom

- Real Estate & Construction

- Energy & Utilities

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)