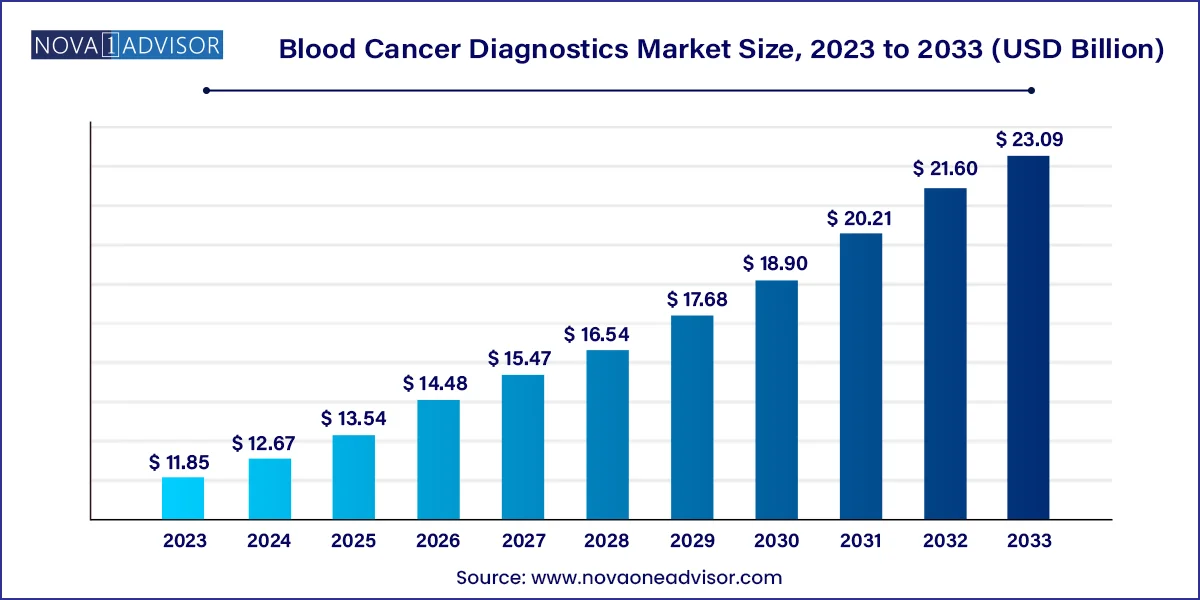

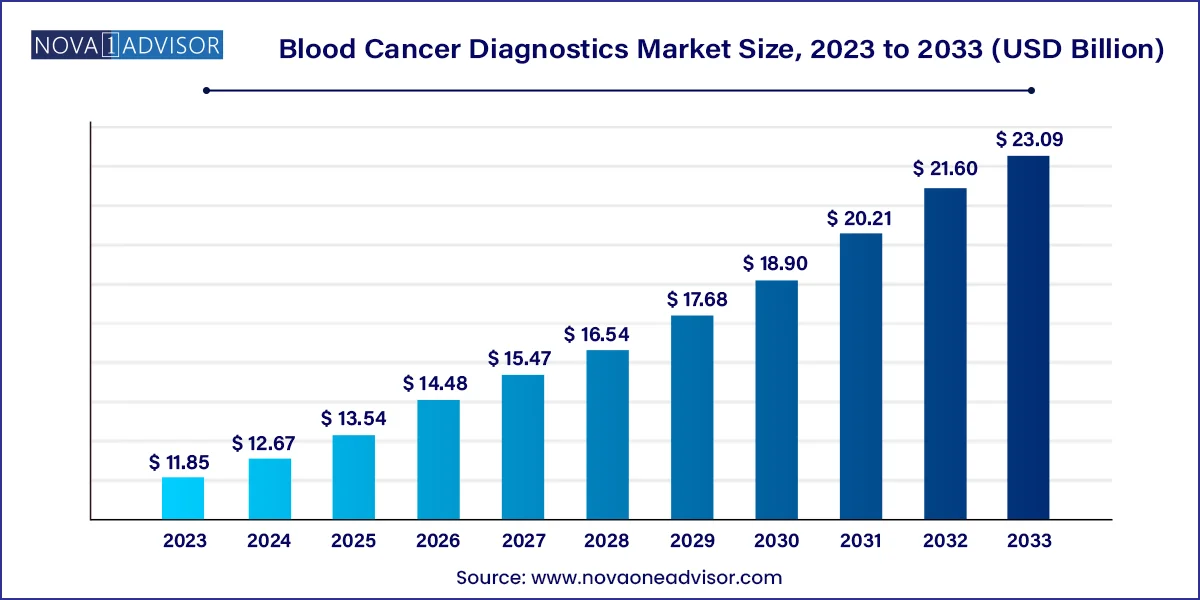

Blood Cancer Diagnostics Market Size and Growth

The global blood cancer diagnostics market size was valued at USD 11.85 billion in 2023 and is anticipated to reach around USD 23.09 billion by 2033, growing at a CAGR of 6.9% from 2024 to 2033.

Blood Cancer Diagnostics Market Key Takeaways

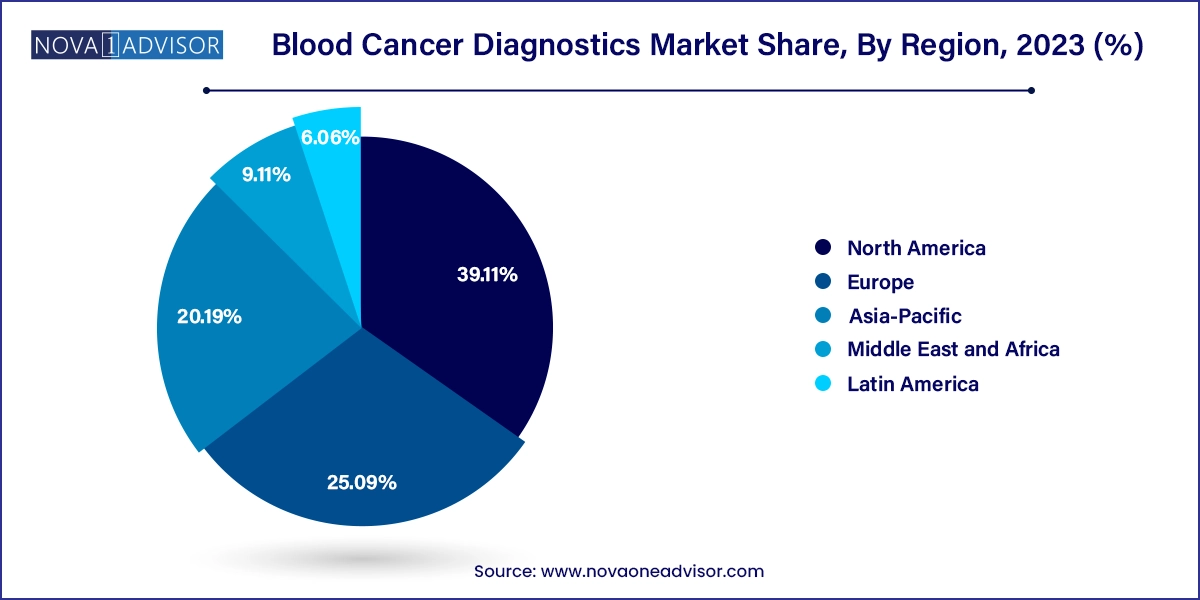

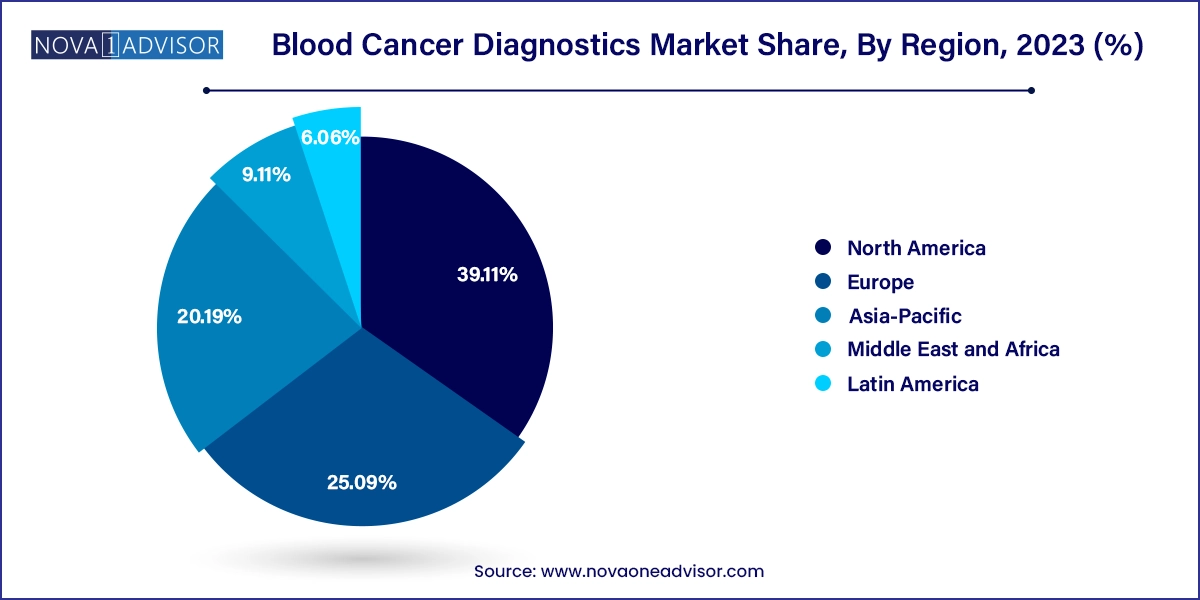

- North America blood cancer diagnostics market dominated the global industry and accounted for a 39.11% share in 2023

- The blood cancer diagnostics market in Asia Pacific is anticipated to witness the fastest growth over the forecast period.

- Assay kits and reagents accounted for the largest revenue share of 72.82% in 2023.

- The segment is also anticipated to grow at the fastest rate of 7.3% CAGR over the forecast period.

- Blood tests dominated the market and accounted for the largest share of 37.19% in 2023.

- The molecular tests segment is anticipated to grow at the fastest rate of 8.4% CAGR over the forecast period.

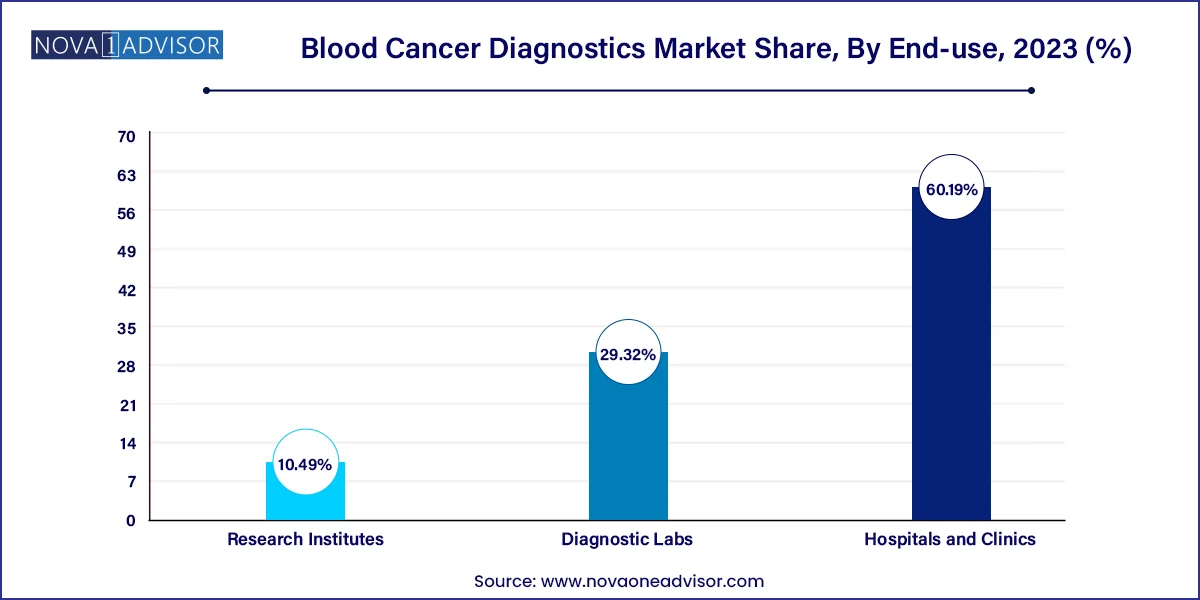

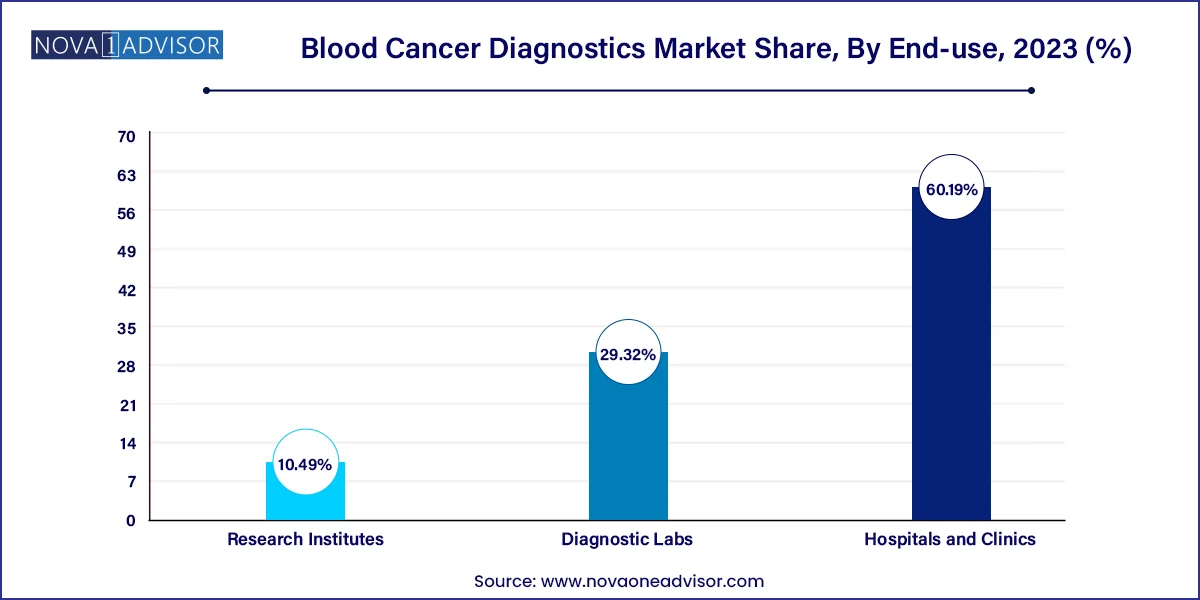

- Hospitals and clinics dominated the market with the largest share of 60.19% in 2023.

- The segment is also anticipated to grow at a fast pace over the forecast period.

Market Overview

Blood cancers, also known as hematologic malignancies, include a broad spectrum of diseases such as leukemia, lymphoma, and multiple myeloma. Unlike solid tumors, these cancers affect blood, bone marrow, and lymphatic systems, necessitating a different approach to diagnosis and management. Diagnostics play a central role not only in the initial detection of these conditions but also in determining the subtype, aggressiveness, and best course of treatment.

In the modern healthcare landscape, the evolution of diagnostics has revolutionized blood cancer detection. From conventional complete blood counts (CBCs) to cutting-edge molecular profiling and next-generation sequencing (NGS), the arsenal of tools available to hematologists and oncologists has expanded significantly. This market is not just about identifying disease—it’s about tailoring treatments and improving patient outcomes.

One of the major reasons for the rising attention on this segment is the growing incidence of blood cancers globally. This is partially due to better detection, aging populations, and environmental and lifestyle factors that contribute to cancer risk. Additionally, blood cancer diagnostics are becoming increasingly central to drug development, clinical trials, and personalized medicine initiatives. As a result, stakeholders from hospitals and labs to biotech startups—are investing heavily in diagnostic technologies that can offer rapid, accurate, and cost-effective insights.

Major Trends in the Market

-

Integration of Artificial Intelligence (AI): AI algorithms are being employed to analyze complex diagnostic data, improving accuracy and reducing diagnostic times.​

-

Rise of Liquid Biopsies: Non-invasive blood tests are gaining traction for detecting circulating tumor DNA, offering a less invasive alternative to traditional biopsies.​

-

Personalized Medicine: Diagnostics are increasingly tailored to individual genetic profiles, enabling targeted therapy decisions.​

-

Expansion of Point-of-Care Testing: Portable diagnostic devices are facilitating rapid testing in various healthcare settings, enhancing accessibility.​

-

Collaborative Research Initiatives: Public-private partnerships are fostering innovation in diagnostic technologies and expanding research capabilities.​

-

Regulatory Advancements: Streamlined approval processes are accelerating the introduction of new diagnostic tools to the market.​

-

Telemedicine Integration: Remote diagnostic consultations and monitoring are becoming more prevalent, especially in underserved regions.​

-

Emphasis on Early Detection: Screening programs are focusing on early identification of blood cancers to improve treatment outcomes.

Blood Cancer Diagnostics Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 12.67 Billion |

| Market Size by 2033 |

USD 23.09 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Product, test, end use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Illumina; InVivoScribe; Ipsogen (Qiagen); Asuragen(Bio-Techne); Danaher Corporation; Abbott; Sequenta (Adaptive biotechnologies); SkylineDx; Bio-Rad Laboratories; Alercell; Sophia Genetics. |

Market Driver: Rising Burden of Hematological Malignancies

A key force driving the blood cancer diagnostics market is the increase in hematological malignancies globally. Blood cancers are among the most commonly diagnosed cancers in both children and older adults. As life expectancy increases and chronic health conditions become more prevalent, more patients are falling into at-risk categories for cancers like chronic lymphocytic leukemia (CLL) or multiple myeloma.

Moreover, awareness of symptoms has improved, leading to more people undergoing diagnostic evaluations for unexplained fatigue, bruising, or infections—common early signs of blood cancers. Earlier detection not only saves lives but also reduces healthcare system costs. Diagnostics serve as the gateway to effective treatment planning, and healthcare systems are increasingly prioritizing early screening initiatives for this reason.

Market Restraint: Limited Access to High-End Diagnostic Technology

While the technologies enabling early and accurate diagnosis are evolving rapidly, a significant market restraint is the limited access to these tools in low-resource settings. Sophisticated diagnostics like NGS, digital cytometry, or biomarker testing require infrastructure, expensive machines, and highly trained staff. Many hospitals and labs—particularly in developing nations—struggle to implement or maintain these standards.

Moreover, even in developed countries, access disparities exist. Rural patients may not have easy access to centers with advanced diagnostic facilities, delaying diagnosis and treatment. Addressing this challenge involves not only technological innovation but also strategic distribution, training, and pricing models that allow more equitable access across regions and income groups.

Market Opportunity: Personalized Medicine and Diagnostic Innovation

A tremendous opportunity lies at the intersection of personalized cancer treatment and diagnostic innovation. With blood cancers increasingly being treated with drugs tailored to specific mutations or biomarkers (e.g., BCR-ABL for CML, FLT3 for AML), diagnostics have become the bedrock of treatment planning. Tests that can identify a patient’s unique genetic signature will become essential tools, not optional add-ons.

Companies that invest in multiplex panels, biomarker detection systems, or algorithms that suggest likely therapeutic outcomes based on diagnostic profiles are set to gain a strong market advantage. These diagnostics will also be essential in post-treatment monitoring, identifying relapse early, and assessing drug efficacy—creating long-term demand across the treatment continuum.

Blood Cancer Diagnostics Market By Product Insights

Assay Kits and Reagents dominate the product segment of the blood cancer diagnostics market. Their widespread usage across various testing platforms, from ELISA and PCR to flow cytometry and immunohistochemistry, ensures their centrality in diagnostic labs. These kits are often required not just for initial diagnosis but also for monitoring disease markers during treatment. Their consumable nature means labs must reorder them regularly, creating a strong revenue model.

Instruments, however, are the fastest-growing product category. While expensive upfront, automation, high-throughput capabilities, and the integration of machine learning into instruments are making them essential in modern diagnostics. Flow cytometers now come with real-time data interpretation modules. Advanced digital pathology tools can scan and analyze bone marrow biopsies far faster than traditional microscopes. As diagnostic centers upgrade, investment in sophisticated instruments is accelerating.

Blood Cancer Diagnostics Market By Test Insights

Blood tests are the backbone of hematological cancer diagnosis, making them the most dominant test category. CBC (Complete Blood Count), blood smears, and lactate dehydrogenase (LDH) levels are often the first steps when a doctor suspects leukemia or lymphoma. They are inexpensive, widely available, and fast. Moreover, blood tests are critical in tracking response to therapy and for long-term monitoring of remission patients.

Molecular tests, however, are growing at the fastest pace. Techniques like fluorescence in situ hybridization (FISH), RT-PCR, and gene panels offer in-depth insights into the genetic drivers of blood cancers. These tests can determine whether a patient is eligible for certain drugs (e.g., tyrosine kinase inhibitors), assess prognosis, and detect minute disease residues post-treatment. The surge in precision medicine has pushed these tests from specialized labs into mainstream use.

Blood Cancer Diagnostics Market By End Use Insights

Hospitals and clinics dominate the end-user market, largely because blood cancer diagnosis and treatment are closely tied to inpatient and specialized care settings. Hematologists typically operate from tertiary hospitals or cancer centers that are equipped with diagnostic labs, radiology, pathology, and pharmacy services. Inpatient admissions for chemotherapy or stem cell transplantation further centralize diagnostics in hospital settings.

Diagnostic labs are becoming the fastest-growing end-user category, thanks to decentralization of healthcare and the rise of independent diagnostic networks. As outpatient care models expand and labs compete on accuracy and turnaround time, their role in early screening and monitoring is becoming more prominent. Labs are also integrating telehealth platforms, allowing oncologists to access diagnostic reports remotely and make real-time decisions.

Blood Cancer Diagnostics Market By Regional Insights

North America holds a leading position in the blood cancer diagnostics market. The U.S. healthcare ecosystem is highly conducive to diagnostic innovation, supported by strong reimbursement structures, widespread access to specialists, and research funding. The presence of major cancer centers like Dana-Farber, MD Anderson, and Memorial Sloan Kettering ensures continual collaboration between diagnostics developers and clinicians. Moreover, the region has witnessed some of the earliest adoptions of AI, digital pathology, and molecular profiling in hematologic diagnostics.

The cultural emphasis on preventive care and cancer screening also contributes to high testing volumes. Patient awareness, coupled with government initiatives to support early cancer detection, continues to strengthen this region’s dominance.

Asia-Pacific is rapidly emerging as the fastest-growing market for blood cancer diagnostics. Countries like China, India, and South Korea are experiencing a surge in cancer incidence, largely due to aging populations and urban lifestyle shifts. In response, governments are investing in national screening programs and strengthening healthcare infrastructure.

Moreover, many diagnostic companies are partnering with local healthcare providers to deploy portable and affordable diagnostic kits suitable for high-volume screening. There is also a boom in clinical trials and genomic research in Asia-Pacific, which increases the demand for advanced molecular diagnostics and data-driven healthcare tools.

Blood Cancer Diagnostics Market Top Key Companies:

- Quest Diagnostics

- Illumina

- InVivoScribe

- Ipsogen (Qiagen)

- Asuragen(Bio-Techne)

- Danaher Corporation

- Abbott

- Sequenta (Adaptive biotechnologies)

- SkylineDx

- Bio-Rad Laboratories

- Alercell

- Sophia Genetics

Blood Cancer Diagnostics Market Recent Developments

-

March 2025 – Roche Diagnostics announced its latest digital pathology system, capable of detecting lymphoma subtypes with 92% accuracy through AI-enhanced image analysis. This launch aims to cut diagnostic times and standardize interpretation in busy clinical settings.

-

February 2025 – Thermo Fisher Scientific launched a new molecular panel for acute leukemia that enables simultaneous testing of over 25 gene mutations, facilitating rapid therapeutic alignment.

-

January 2025 – A biotech startup in California introduced a home-monitoring kit for chronic leukemia patients, allowing monthly at-home blood sample collection and AI-driven lab interpretation delivered through a mobile app.

-

December 2024 – A Japanese healthcare consortium partnered with a genomic research institute to roll out nationwide blood-based cancer screening, integrating genetic diagnostics into routine health check-ups for adults over 50.

Blood Cancer Diagnostics Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Blood Cancer Diagnostics market.

By Product

- Instruments

- Assay Kits and Reagents

By Test

- Blood Tests

- Imaging Tests

- Biopsy

- Molecular Test

By End Use

- Hospitals and Clinics

- Diagnostic Labs

- Research Institutes

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)