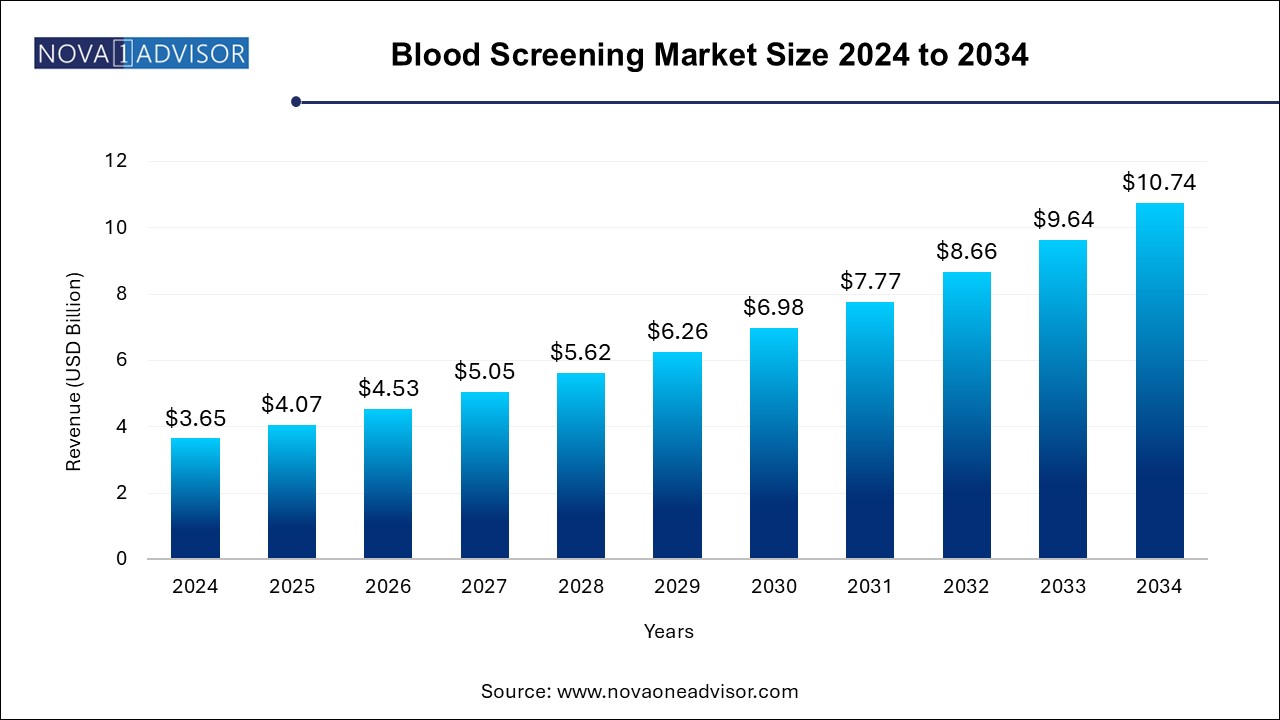

The blood screening market size was exhibited at USD 3.65 billion in 2024 and is projected to hit around USD 10.74 billion by 2034, growing at a CAGR of 11.4% during the forecast period 2024 to 2034.

The Blood Screening Market plays a vital role in global healthcare, serving as a first line of defense against the transmission of infectious diseases through blood transfusions. Blood screening refers to the process of testing donated blood for markers of infection such as HIV, hepatitis B and C, syphilis, malaria, and other pathogens before it is deemed safe for transfusion. As the demand for safe blood continues to grow due to the increasing number of surgical procedures, trauma cases, and hematological diseases, the importance of reliable and efficient blood screening technologies has become paramount.

Modern blood screening methodologies utilize highly sensitive and specific technologies such as nucleic acid amplification tests (NAT), enzyme-linked immunosorbent assay (ELISA), chemiluminescence immunoassay (CLIA), and next-generation sequencing (NGS) to ensure the highest levels of blood safety. The continuous emergence of new pathogens, such as Zika virus and SARS-CoV-2, has further emphasized the necessity for robust screening systems.

Rising healthcare expenditure, heightened awareness about transfusion-transmitted infections (TTIs), and favorable government initiatives to ensure blood safety are key factors propelling the growth of the blood screening market globally. Additionally, technological advancements and the adoption of automation in blood banks and laboratories are expanding market opportunities, making blood screening a critical and evolving segment within diagnostics.

Rising Adoption of NAT over Traditional Methods: Nucleic acid amplification tests are becoming the gold standard due to their superior sensitivity and ability to detect infections during the window period.

Integration of Automation and Robotics: Blood banks are adopting fully automated systems to enhance screening efficiency, reduce human error, and manage high sample volumes.

Growth in Pathogen Reduction Technologies (PRTs): Complementary techniques to blood screening, aiming to inactivate residual pathogens in blood products.

Expanding Application of Next-generation Sequencing (NGS): NGS is being increasingly applied for pathogen discovery, resistance detection, and rare infection diagnosis in blood screening.

Shift Toward Multiplex Testing: Platforms capable of simultaneously detecting multiple pathogens from a single blood sample are gaining popularity.

Emergence of Point-of-care (POC) Testing: Mobile and portable screening devices are expanding access to safe blood supplies in remote and resource-limited settings.

Focus on Screening for Emerging Infections: Blood screening panels are expanding to include new threats such as West Nile Virus, Zika, and COVID-19.

Growth of Public-private Partnerships: Governments collaborating with private players to upgrade blood safety infrastructure.

Increased Use of Chemiluminescence Immunoassay (CLIA): CLIA is preferred for its faster turnaround time, higher throughput, and better reproducibility.

Globalization of Blood Supply Chains: Growing international blood trade mandates stricter screening practices to meet global standards.

| Report Coverage | Details |

| Market Size in 2025 | USD 4.07 Billion |

| Market Size by 2034 | USD 10.74 Billion |

| Growth Rate From 2024 to 2034 | CAGR of 11.4% |

| Base Year | 2024 |

| Forecast Period | 2024-2033 |

| Segments Covered | Technology, Product, Region |

| Market Analysis (Terms Used) | Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope | North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled | Abbott; Danaher Corporation (Beckman Coulter); Becton Dickinson and Company; Bio-Rad Laboratories, Inc.; Hoffman-La Roche Ltd.; Grifols, S.A.; Ortho-Clinical Diagnostics, Inc.; Siemens Healthcare GmbH; Thermo Fisher Scientific, Inc.; SOFINA s.a (Biomerieux). |

One of the principal drivers fueling the blood screening market is the increasing global incidence of transfusion-transmitted infections (TTIs). Despite improvements in healthcare, millions of people worldwide remain at risk of receiving contaminated blood due to inadequate screening.

For instance, the World Health Organization (WHO) reports that over 5% of HIV infections in developing countries are attributable to unsafe blood transfusions. Hepatitis B and C infections also pose significant threats, with blood transmission being a major route. This growing awareness among healthcare providers and policymakers has led to stringent guidelines mandating mandatory screening for major pathogens.

Furthermore, emerging infectious threats like Zika and COVID-19 have heightened vigilance around blood safety, resulting in expanded screening requirements and the adoption of more sensitive technologies like NAT and NGS, thereby boosting market growth.

While innovation drives market expansion, a notable restraint is the high cost associated with implementing advanced blood screening technologies. NAT platforms, automated ELISA systems, and NGS require significant capital investment, along with the need for skilled personnel, maintenance, and consumables.

For many developing economies, the cost of upgrading blood banks to NAT-based screening can be prohibitive. Even in developed countries, budgetary constraints may limit the adoption of the most cutting-edge technologies to larger urban centers, leaving rural or under-resourced areas reliant on older, less sensitive methods.

Moreover, while multiplex assays and automation improve throughput and accuracy, they add additional layers of complexity and costs, posing challenges to widespread deployment and equitable access to safe blood globally.

A major opportunity for the blood screening market lies in the expansion of blood safety initiatives across emerging economies. Regions like Asia Pacific, Latin America, and parts of Africa are experiencing an increased demand for blood due to rising surgical volumes, road accidents, obstetric emergencies, and growing cancer and anemia burdens.

Governments in countries like India, China, and Brazil are investing heavily in healthcare infrastructure and launching national programs to ensure 100% voluntary blood donation and mandatory pathogen screening. International organizations like WHO and Red Cross are also supporting these efforts through funding and technical assistance.

Companies offering affordable, scalable, and easy-to-use blood screening platforms tailored to the needs of these regions can unlock significant growth potential over the coming decade.

Nucleic Acid Amplification Test (NAT) dominated the market in 2024. NAT is considered the most sensitive method available for early detection of viral pathogens, capable of identifying infections during the window period before antibody development. NAT-based systems such as the Roche cobas and Grifols Procleix platforms are now widely used in blood centers globally. Their ability to dramatically reduce the risk of transmitting HIV, HBV, and HCV has made NAT the benchmark for blood safety, particularly in North America, Europe, and parts of Asia.

Next Generation Sequencing (NGS) is projected to be the fastest-growing technology segment. Although still relatively new in clinical settings, NGS offers unparalleled accuracy and the ability to screen for multiple pathogens, including emerging or rare infections, from a single sample. NGS platforms are being piloted for blood screening in advanced research centers and are expected to revolutionize pathogen discovery, transfusion medicine, and personalized screening programs in the future.

Reagents dominated the blood screening market in 2024. Reagents, including test kits, buffer solutions, enzymes, and primers, are essential consumables used across all screening technologies. Since reagents must be replenished regularly for ongoing testing, they account for a larger cumulative market share compared to instruments. Companies like Abbott, Bio-Rad, and Roche Diagnostics have extensive reagent portfolios supporting blood screening needs.

Instruments are expected to grow at a faster rate. With rising blood donation volumes and an emphasis on automation, blood banks and diagnostic laboratories are investing heavily in automated NAT systems, chemiluminescence analyzers, and multiplex PCR instruments. Advanced instruments reduce human error, increase throughput, and enhance traceability—key factors driving their rising adoption.

North America dominated the global blood screening market in 2024. The U.S., with its highly developed healthcare infrastructure, rigorous regulatory oversight by bodies like the FDA, and high healthcare expenditure, leads in adopting advanced screening technologies. Organizations such as the American Red Cross and American Association of Blood Banks (AABB) mandate strict screening protocols that drive consistent demand for NAT and CLIA technologies.

High awareness levels regarding TTIs, the strong presence of leading diagnostics companies, and ongoing investment in blood safety initiatives consolidate North America's leadership in the market.

Fastest Growing Region: Asia Pacific

Asia Pacific is emerging as the fastest-growing region for the blood screening market. Countries like China, India, Japan, and South Korea are witnessing rapid improvements in healthcare access, blood donation rates, and regulatory frameworks for transfusion medicine.

China’s Healthy China 2030 initiative and India's National Blood Policy are examples of government programs promoting safe blood practices. The increasing incidence of chronic diseases, surgeries, trauma cases, and maternal care needs, combined with rising income levels and urbanization, is boosting demand for advanced blood screening technologies across the region.

March 2025 – Roche Diagnostics launched its next-generation cobas® 6800/8800 NAT platforms in Europe, offering faster turnaround times and enhanced pathogen panel expansion capabilities.

January 2025 – Grifols S.A. received U.S. FDA approval for its Procleix Panther® System's new multiplex assay panel, enabling simultaneous HIV, HBV, and HCV detection.

November 2024 – Abbott Laboratories introduced Alinity m NAT system in Asia Pacific, aiming to expand access to high-throughput blood screening technologies in emerging economies.

September 2024 – Bio-Rad Laboratories, Inc. announced strategic partnerships with African healthcare ministries to deploy affordable ELISA-based blood screening solutions across the continent.

July 2024 – Danaher Corporation (Beckman Coulter Diagnostics) unveiled its new fully automated CLIA platform optimized for rapid blood screening at large donation centers.

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the blood screening market

Technology

Product

Regional