Brain Computer Interface Market Size and Research

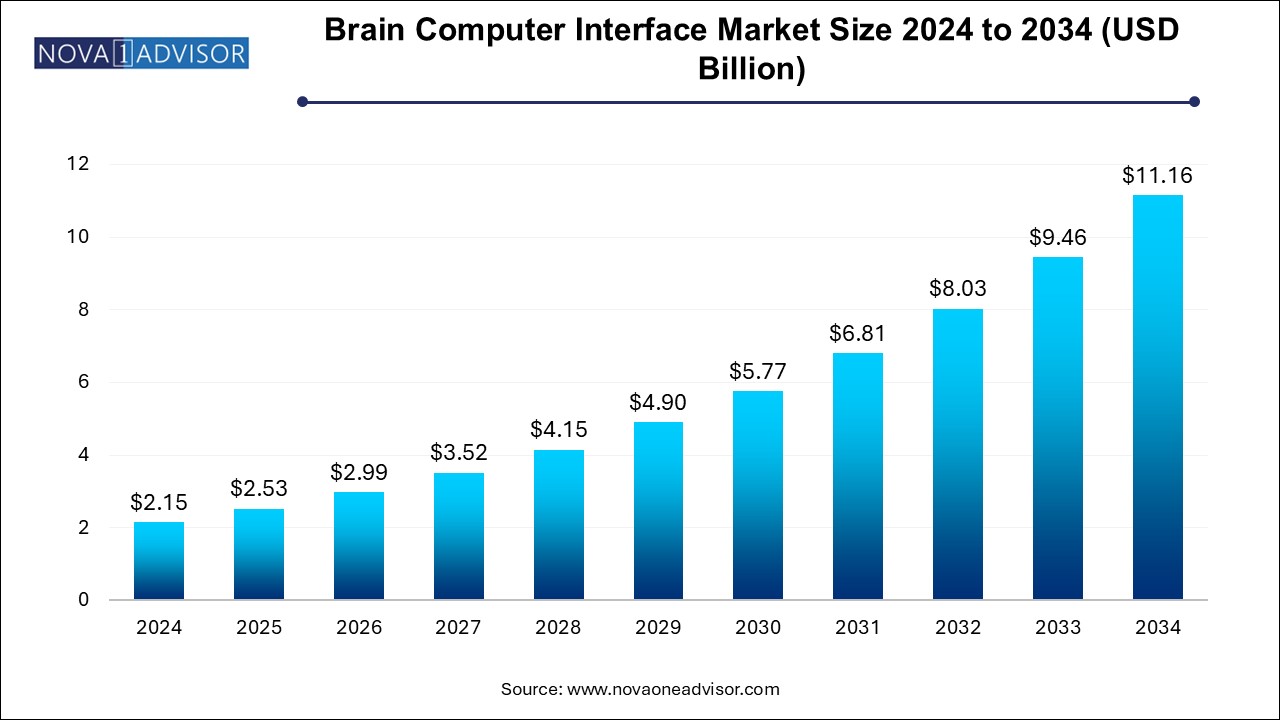

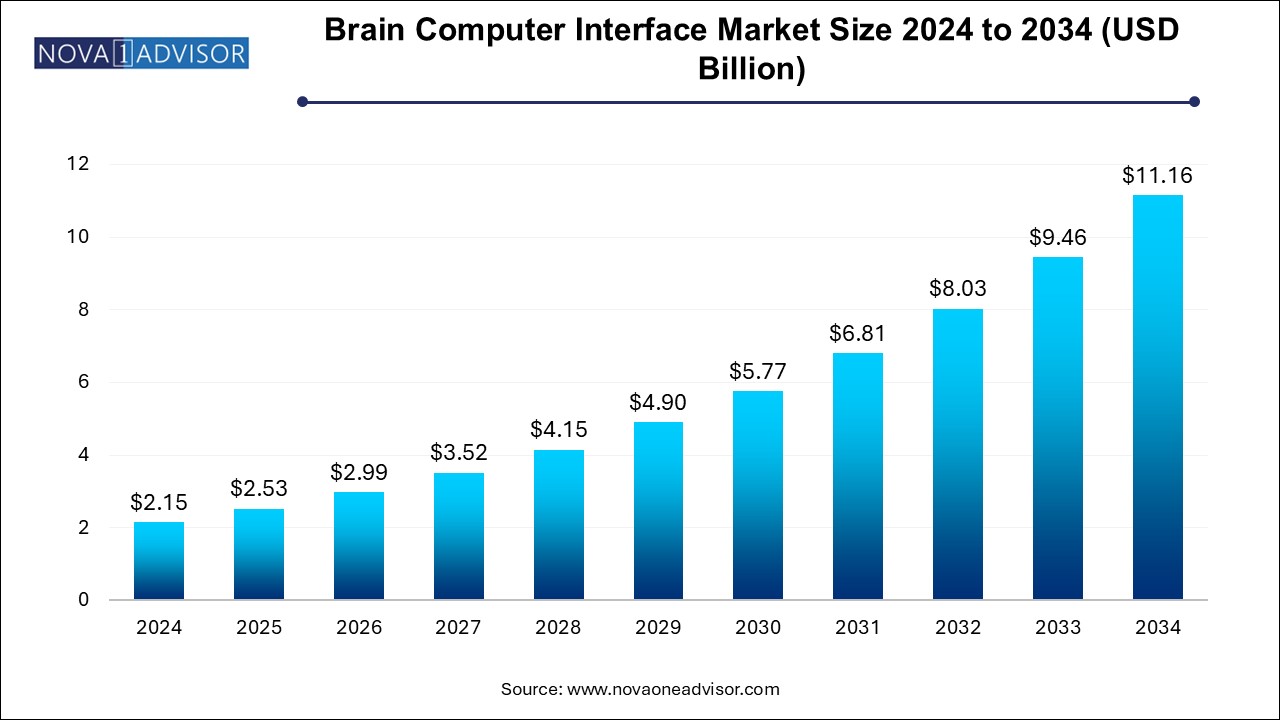

The brain computer interface market size was exhibited at USD 2.15 billion in 2024 and is projected to hit around USD 11.16 billion by 2034, growing at a CAGR of 17.9% during the forecast period 2024 to 2034.

Brain Computer Interface Market Key Takeaways:

- The non-invasive BCI segment dominated the market with the largest revenue share of 85.94% in 2024.

- The invasive segment is expected to witness lucrative growth over the forecast period.

- The healthcare segment held the highest market share in 2024.

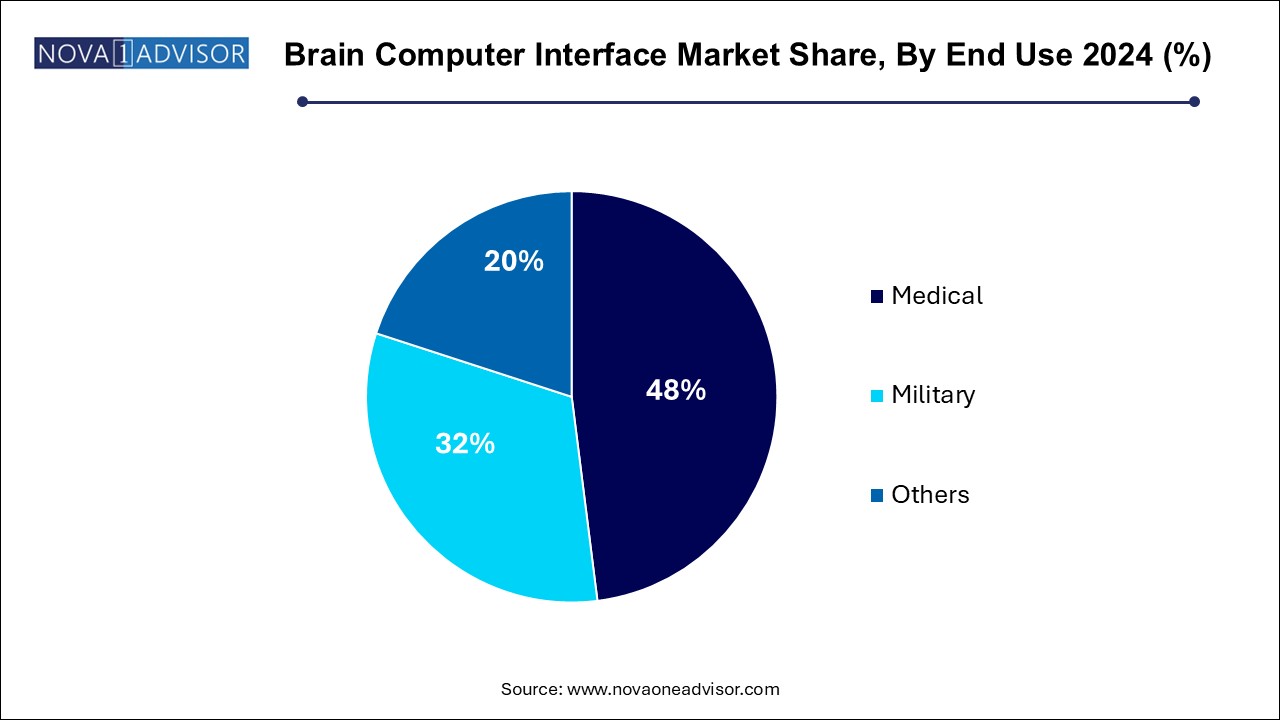

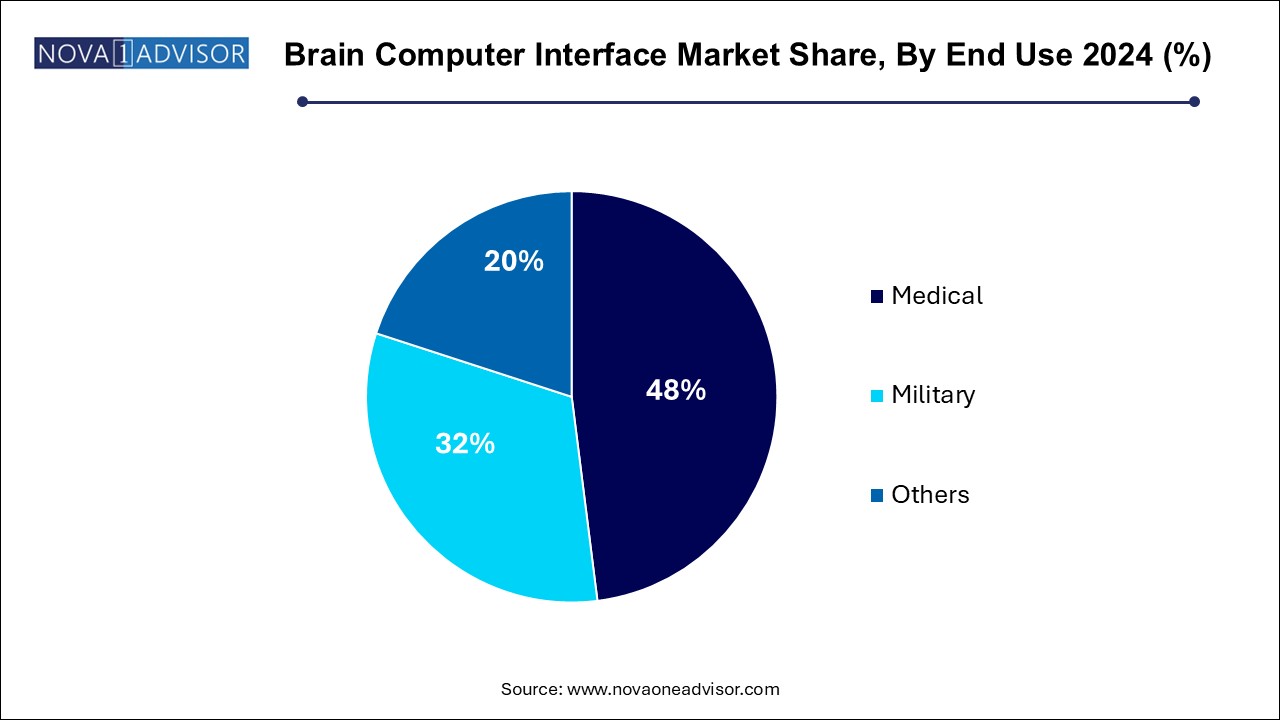

- The medical segment dominated the market with the largest revenue share of 48.0% in 2024.

- North America brain computer interface market dominated the global market with the largest revenue share of 39.4% in 2024.

Market Overview

The brain-computer interface (BCI) market represents one of the most transformative and futuristic segments within the global healthcare and technology industries. BCIs create a direct communication link between the human brain and external devices, bypassing conventional neuromuscular pathways. By interpreting brain signals, BCIs allow users to control prosthetics, communicate without speech, and even interact with computers or smart environments using only their thoughts.

Initially developed for assisting individuals with severe physical disabilities, BCI technology has rapidly expanded into a broader range of applications, including healthcare rehabilitation, military operations, gaming, entertainment, and smart home control. Advancements in neural decoding, machine learning, signal acquisition hardware, and non-invasive neuroimaging are propelling the BCI market into new frontiers.

The potential for BCIs extends beyond therapy into enhancing human capabilities, leading to increasing interest from companies like Neuralink, Facebook Reality Labs, and major academic research institutions. The synergy between neuroscience, artificial intelligence (AI), and wearable technology continues to create new business models and growth avenues for BCI solutions.

Despite facing technical, ethical, and regulatory challenges, the brain-computer interface market is set for profound expansion as developments bring mind-controlled communication, immersive entertainment, and brain-driven smart home interaction closer to everyday reality.

Major Trends in the Market

-

Advancement of Non-invasive BCI Technologies: Use of EEG and fNIRS (functional near-infrared spectroscopy) for safer, user-friendly interfaces.

-

Rise of Brain-controlled Smart Home Devices: Expanding BCI applications into environmental control and automation.

-

Integration with Artificial Intelligence and Machine Learning: Enhancing signal interpretation accuracy and real-time responsiveness.

-

Expansion into Gaming and Virtual Reality (VR): Creation of immersive, thought-driven entertainment experiences.

-

Military and Defense Applications: Use of BCI for battlefield communication, drone control, and cognitive enhancement.

-

Miniaturization and Wearable BCIs: Development of lightweight, portable brain-computer interfaces.

-

Focus on Neurorehabilitation: BCIs facilitating stroke recovery, mobility restoration, and prosthetic control.

-

Emergence of Ethical and Regulatory Frameworks: Discussions around data privacy, human enhancement, and cognitive security.

Report Scope of Brain Computer Interface Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 2.53 Billion |

| Market Size by 2034 |

USD 11.16 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 17.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Medtronic; g.tec medical engineering GmbH; Natus Medical Incorporated; Compumedics Neuroscan; Brain Products GmbH; Integra LifeSciences Corporation; Advanced Brain Monitoring, Inc.; EMOTIV; NeuroSky; ANT Neuro; NIRx Medical Technologies, LLC; Ripple Neuro.; Neuroelectrics; OpenBCI; COGNIONICS, INC. (CGX); Blackrock Neurotech |

Key Market Driver: Growing Applications in Healthcare and Neurorehabilitation

The primary driver accelerating the brain-computer interface market is the expanding application of BCIs in healthcare and neurorehabilitation. Neurological disorders such as stroke, amyotrophic lateral sclerosis (ALS), spinal cord injuries, and traumatic brain injuries often leave patients with significant motor impairments.

BCIs provide a pathway for restoring communication, controlling assistive devices, and even re-training neural circuits for functional recovery. For instance, BCI-controlled robotic exoskeletons enable paralyzed individuals to regain mobility, and communication BCIs allow "locked-in" patients to convey thoughts through computer text or synthesized speech.

As the global burden of neurological disabilities increases, and as healthcare systems seek cost-effective rehabilitation solutions, the adoption of BCI technologies within clinical settings is set to rise steadily.

Key Market Restraint: Technological Complexity and Signal Reliability Issues

Despite its promise, the brain-computer interface market faces a significant restraint: technological complexity and signal reliability challenges.

Brain signals, particularly those acquired non-invasively, are extremely weak, noisy, and susceptible to artifacts from muscle movements or external electromagnetic interference. Decoding these signals accurately in real-time to drive external devices demands sophisticated algorithms, extensive calibration, and high-fidelity hardware.

Moreover, invasive BCI systems, while offering superior signal quality, require risky neurosurgical implantation, limiting their widespread acceptance. Developing systems that are safe, user-friendly, affordable, and capable of operating reliably across diverse real-world environments remains a major hurdle for BCI commercialization.

Key Market Opportunity: Expansion into Entertainment, Gaming, and Smart Home Control

A transformative opportunity for the BCI market lies in its expansion into the entertainment, gaming, and smart home sectors.

Brain-controlled games, VR environments, and immersive entertainment experiences offer consumers a novel form of interaction, merging mental engagement with digital environments. Companies are actively developing EEG-based headsets that allow gamers to move characters, control environments, or influence narratives based purely on brain activity.

In smart homes, BCI-driven systems allow users to control lighting, adjust thermostats, or operate appliances through thought commands, creating more accessible and personalized living spaces, especially for people with disabilities. As consumer comfort with wearable tech grows, and as brain signal decoding becomes faster and more reliable, these non-medical applications will become major growth engines for the BCI market.

Brain Computer Interface Market By Product Insights

Non-invasive BCIs dominate the product segment, capturing the largest market share due to their safety, ease of use, and growing adoption in healthcare, gaming, and research applications. Non-invasive BCIs rely on technologies like EEG, MEG, and fNIRS to record brain signals without surgical implantation, minimizing risks and broadening potential user bases.

Invasive BCIs are expanding rapidly, particularly driven by developments in clinical research and commercial initiatives like Elon Musk’s Neuralink. Invasive systems, while requiring surgical intervention, offer much higher signal fidelity and faster response times, making them ideal for applications like prosthetic limb control, spinal cord injury rehabilitation, and restoring vision.

Brain Computer Interface Market By Application Insights

Healthcare dominates the application segment, primarily due to the critical role BCIs play in neurorehabilitation, communication for paralyzed individuals, pain management, and mental health therapy. Hospitals, rehabilitation centers, and research institutions are major users of healthcare-focused BCIs, supported by strong clinical evidence and increasing insurance reimbursement pathways in developed markets.

Entertainment and gaming are growing fastest, fueled by the increasing integration of BCIs into VR headsets, brain-controlled games, and immersive entertainment experiences. Consumer interest in mind-driven control and deeper interaction with digital worlds is pushing startups and tech giants alike to develop affordable, easy-to-use BCI-enabled entertainment systems.

Brain Computer Interface Market By End Use Insights

Medical end-use dominates the market, encompassing hospitals, research institutes, and rehabilitation centers. The use of BCIs to restore lost function, support stroke recovery, and improve the quality of life for patients with neurological impairments drives consistent demand in the medical sector.

Military applications are growing fastest, with governments investing in cognitive enhancement programs, brainwave-based communication systems, and thought-controlled drone piloting. Defense organizations recognize the potential of BCIs to offer strategic advantages in operational environments where speed, stealth, and reduced physical movement are critical.

Brain Computer Interface Market By Regional Insights

North America leads the global BCI market, underpinned by a strong innovation ecosystem, robust funding for neuroscience research, leading technology firms, and favorable regulatory frameworks.

The United States, in particular, boasts an impressive concentration of BCI-related academic research (e.g., Stanford University, University of Washington) and commercial initiatives (e.g., Neuralink, Kernel, Blackrock Neurotech). Government agencies like DARPA (Defense Advanced Research Projects Agency) are significant funders of BCI projects for defense and healthcare applications.

The growing acceptance of assistive technologies, rising healthcare expenditures, and an innovation-friendly environment ensure that North America will continue to lead BCI commercialization.

Asia-Pacific is the fastest-growing region, propelled by massive investments in healthcare technology, a growing elderly population, and increased emphasis on digitalization.

Countries like China, Japan, and South Korea are making strategic investments in neurotechnology through public and private sector initiatives. China’s "Brain Science and Brain-like Intelligence Technology" initiative, for example, is a major national project aimed at advancing neuroscience and brain-computer interface development.

The expansion of the gaming and VR sectors in Asia-Pacific, coupled with rising public awareness of assistive technologies, further fuels regional demand for BCIs.

Some of the prominent players in the brain computer interface market include:

- Medtronic

- g.tec medical engineering GmbH

- Natus Medical Incorporated

- Compumedics Neuroscan

- Brain Products GmbH

- Integra LifeSciences Corporation

- Advanced Brain Monitoring, Inc.

- EMOTIV

- NeuroSky

- ANT Neuro

- NIRx Medical Technologies, LLC

- Ripple Neuro.

- Neuroelectrics

- OpenBCI

- COGNIONICS, INC. (CGX)

- Blackrock Neurotech

Brain Computer Interface Market Recent Developments

-

March 2025: Neuralink announced successful human trials for its fully implantable brain-computer interface chip, aimed initially at helping individuals with quadriplegia.

-

February 2025: NextMind (acquired by Snap Inc.) launched an advanced non-invasive EEG BCI for integration into augmented reality glasses.

-

January 2025: Synchron received FDA breakthrough designation for its minimally invasive Stentrode BCI device, designed for communication restoration in ALS patients.

-

December 2024: Emotiv launched its Insight 2.0 wearable EEG headset targeting consumer wellness and brain-training applications.

-

November 2024: Blackrock Neurotech announced new partnerships with rehabilitation centers to expand its brain-controlled prosthetic limb trials across North America.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the brain computer interface market

By Product

- Invasive BCI

- Partially Invasive BCI

- Non Invasive BCI

By Application

- Healthcare

- Smart Home Control

- Communication and control

- Entertainment & Gaming

By End Use

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)