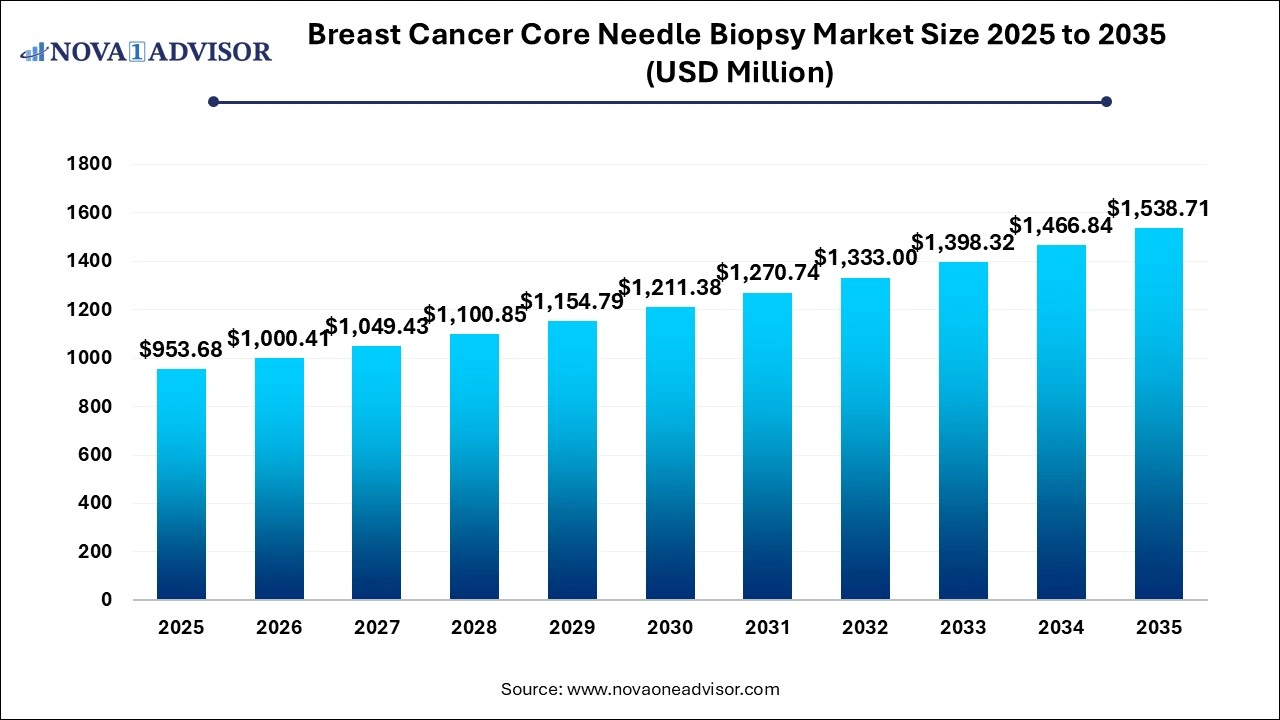

Breast Cancer Core Needle Biopsy Market Size and Growth

The breast cancer core needle biopsy market size was exhibited at USD 953.68 million in 2025 and is projected to hit around USD 1,538.71 million by 2035, growing at a CAGR of 4.9% during the forecast period 2026 to 2035.

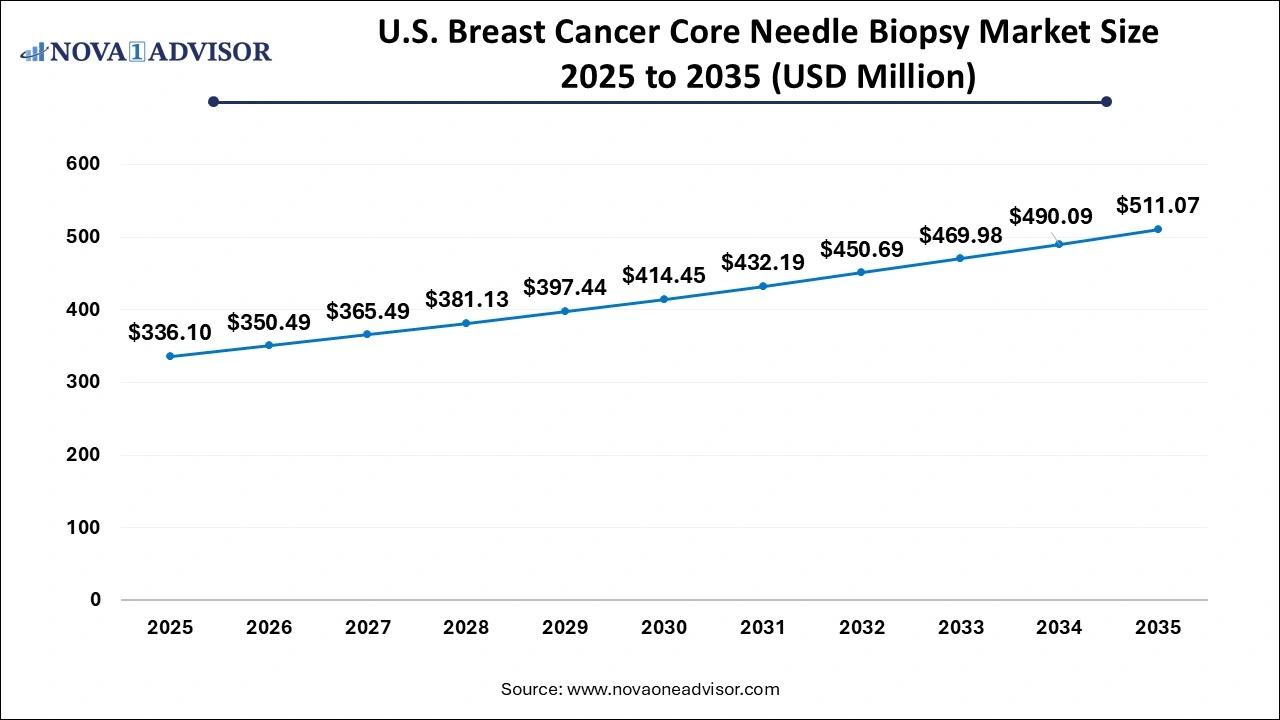

U.S. Breast Cancer Core Needle Biopsy Market Size and Growth 2026 to 2035

The U.S. breast cancer core needle biopsy market size is evaluated at USD 336.1 million in 2025 and is projected to be worth around USD 511.07 million by 2035, growing at a CAGR of 4.28% from 2026 to 2035.

North America, particularly the United States, leads the global breast cancer CNB market in terms of both procedure volume and technological innovation. The region boasts a well-established screening ecosystem, with widespread access to mammography, ultrasound, and MRI services. National programs like the American Cancer Society’s breast cancer awareness campaigns and the U.S. Preventive Services Task Force guidelines promote routine screening, resulting in early detection and higher biopsy uptake. Additionally, reimbursement policies under Medicare and private insurance schemes cover CNB procedures, ensuring affordability and accessibility.

The presence of major players such as Hologic, BD (Becton Dickinson), and Danaher Corporation has also driven innovation in biopsy devices, imaging integration, and robotic-assisted systems. North America’s high R&D investment, skilled healthcare workforce, and established clinical trial infrastructure further reinforce its leadership in this market.

Asia Pacific is emerging as the fastest-growing regional market, driven by rising breast cancer incidence, increasing healthcare spending, and improving diagnostic infrastructure. Countries like China, India, and South Korea are witnessing significant investments in oncology services, including breast imaging and biopsy capabilities. The expansion of urban healthcare networks, combined with government-led cancer control initiatives, has improved early detection rates, leading to higher biopsy volumes.

In China, for example, the "Healthy China 2030" blueprint prioritizes cancer prevention and early diagnosis. This has led to rapid deployment of mobile mammography units, diagnostic laboratories, and biopsy services in urban and semi-urban areas. Additionally, international collaborations and local manufacturing of biopsy systems are making these technologies more affordable. With increasing public awareness and expanding health insurance coverage, Asia Pacific is expected to continue its upward trajectory in the coming decade.

Market Overview

The breast cancer core needle biopsy market is a vital component of the global diagnostic landscape, supporting early and accurate detection of breast malignancies. Core needle biopsy (CNB) is a minimally invasive procedure that involves extracting a small sample of breast tissue using a hollow needle for histopathological evaluation. This method has become a preferred diagnostic tool due to its precision, lower patient discomfort, and reduced risk compared to traditional surgical biopsies. As breast cancer continues to be the most commonly diagnosed cancer among women globally, the demand for advanced, reliable, and image-guided biopsy technologies has risen significantly.

With increasing awareness of breast cancer screening and the expansion of national cancer control programs, particularly in developed economies, CNB procedures are being widely adopted in hospitals, diagnostic centers, and specialized oncology clinics. Additionally, technological advancements in imaging modalities such as MRI, ultrasound, and stereotactic mammography have facilitated highly targeted biopsies, minimizing the chances of false negatives or inconclusive results. The integration of AI-assisted imaging, real-time feedback systems, and portable biopsy devices is further streamlining workflow and enhancing diagnostic yield.

The market's growth trajectory is also being influenced by rising healthcare expenditure, the aging population, and an increase in routine breast screening initiatives. For instance, countries like the United States, the United Kingdom, and Australia have made breast cancer screening a cornerstone of public health policies, which directly drives biopsy volumes. Meanwhile, developing regions are catching up, fueled by government partnerships, private diagnostic chain expansions, and mobile screening units. As a result, the global breast cancer CNB market is expected to exhibit steady growth through 2034, propelled by both technological progress and expanding clinical applications.

Major Trends in the Market

-

Integration of AI and CAD Systems in Imaging-Guided Biopsies: Machine learning algorithms are now being used to improve lesion detection and biopsy accuracy.

-

Increasing Preference for Ultrasound-Guided Biopsies: Due to their real-time imaging capability and absence of ionizing radiation, ultrasound-guided procedures are gaining popularity.

-

Rising Adoption of Vacuum-Assisted Core Needle Biopsies (VABs): These offer larger tissue samples and reduce the need for repeat procedures.

-

Growth in Ambulatory and Outpatient Biopsy Services: Diagnostic services are shifting to outpatient settings due to cost-effectiveness and convenience.

-

Expanding Use of MRI-Guided Biopsies in Dense Breast Tissue Cases: MRI is proving invaluable for diagnosing lesions not visible in mammography or ultrasound.

-

Shift Toward Minimally Invasive, Image-Guided Diagnostics: Patients and clinicians prefer non-surgical diagnostic options with lower risk profiles.

-

Portable Biopsy Device Development for Point-of-Care Use: Innovations are enabling CNB in rural or resource-limited settings, improving accessibility.

Report Scope of Breast Cancer Core Needle Biopsy Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 1,000.41 Million |

| Market Size by 2035 |

USD 1,538.71 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 4.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Intact Medical Corporation; Ethicon Surgical Technologies; Gallini SRL; Leica Biosystems Nussloch GmbH; Hologic, Inc.; Argon Medical Devices; Encapsule Medical Devices LLC.; Cook Medical Incorporated; Becton, Dickinson and Company; C.R. Bard, Inc. |

Key Market Driver: Rising Global Burden of Breast Cancer

The most significant driver for the breast cancer CNB market is the increasing global incidence of breast cancer, especially among women aged 40 and above. According to the World Health Organization (WHO), breast cancer accounts for approximately 2.3 million new cases each year and remains the leading cause of cancer-related deaths among women. With early detection being the most effective strategy for reducing mortality, healthcare systems worldwide are emphasizing diagnostic accuracy and accessibility.

Core needle biopsy has become a critical component of early diagnosis strategies, allowing for precise characterization of suspicious breast lesions. Compared to fine needle aspiration, CNB offers more comprehensive histological data, enabling oncologists to determine hormone receptor status and plan personalized treatment protocols. Countries such as the U.S. have established routine mammography screening for women over 40, often followed by CNB for abnormal findings, thus making biopsy an essential diagnostic standard.

Key Market Restraint: Limited Access in Low-Resource Settings

Despite technological advancements and improved procedural outcomes, the breast cancer CNB market is constrained by limited access in low- and middle-income countries. Many regions in sub-Saharan Africa, South Asia, and parts of Latin America lack the infrastructure and trained personnel to perform image-guided CNB procedures. The high cost of imaging equipment such as MRI and stereotactic mammography machines also limits deployment in rural hospitals.

Additionally, cultural stigma, lack of awareness, and delayed diagnosis continue to pose challenges. In several developing nations, breast cancer is still diagnosed at advanced stages due to the unavailability of proper diagnostic tools or financial barriers that prevent women from seeking early screening. Unless addressed through targeted investments and policy initiatives, this disparity will hinder equitable growth of the CNB market globally.

Key Market Opportunity: Expansion of AI and Robotic-Assisted Biopsy Technologies

A promising opportunity in the breast cancer core needle biopsy market lies in the integration of artificial intelligence (AI) and robotic-assisted biopsy systems. These technologies offer the potential to reduce operator dependency, minimize variability, and improve diagnostic precision. AI algorithms can assist in real-time lesion localization, image interpretation, and needle trajectory prediction—particularly in dense breast tissues or complex anatomical locations.

Several healthcare technology companies are working on robotic biopsy systems that automate needle insertion and sample extraction with millimeter-level accuracy. For example, robotic arms guided by AI-enhanced imaging can ensure safer and faster procedures, thereby reducing patient discomfort and improving throughput in high-volume diagnostic centers. Such technologies, while currently in the developmental or early commercialization phases, are expected to gain traction over the next decade, especially in developed healthcare systems and academic institutions.

Breast Cancer Core Needle Biopsy Market By Technology insights

The Ultrasound-based breast biopsies dominate the market, owing to their real-time imaging capability, cost-effectiveness, and absence of radiation. Ultrasound-guided CNB is widely preferred for evaluating palpable and non-palpable breast masses, especially in younger women with denser breast tissue. These procedures can be performed quickly, require no contrast agents, and are well-suited for outpatient settings. The portability of ultrasound equipment also allows for broader access in community clinics and mobile screening units. With the proliferation of compact and handheld ultrasound systems, adoption rates for this technology are expected to remain high across all healthcare tiers.

In contrast, MRI-based breast biopsies are the fastest-growing segment due to their exceptional sensitivity in detecting lesions not visible through mammography or ultrasound. MRI-guided CNB is particularly beneficial for high-risk patients, such as those with BRCA gene mutations or dense breast composition. While these procedures are more resource-intensive, they offer unparalleled diagnostic accuracy. Healthcare institutions are increasingly investing in MRI-compatible biopsy equipment to expand services for complex cases. Additionally, improvements in gadolinium contrast agents and reduced scan times are making MRI-guided procedures more patient-friendly and cost-effective, accelerating their uptake.

Breast Cancer Core Needle Biopsy Market By End-use Insights

The Hospitals and diagnostic laboratories remain the dominant end-users, driven by their comprehensive infrastructure, availability of imaging modalities, and skilled personnel. These institutions typically serve as the primary sites for biopsy referrals following abnormal mammogram or ultrasound results. Hospitals often integrate biopsy procedures within breast cancer screening or oncology departments, allowing for seamless coordination of care, including pathology analysis, patient counseling, and treatment planning. Diagnostic labs affiliated with hospitals also conduct high-throughput histopathological analysis, reducing turnaround times and facilitating faster treatment initiation.

Meanwhile, academic and research institutes are the fastest-growing end-user segment, particularly in technologically advanced regions. These institutions are at the forefront of clinical research and pilot testing of new biopsy devices, imaging algorithms, and AI-guided workflows. With increasing government and private research funding, academic centers are undertaking multi-center clinical trials to evaluate biopsy efficacy, optimize protocols, and assess patient outcomes. Furthermore, the emphasis on personalized medicine and biomarker discovery has led to increased biopsy volumes in research settings, positioning this segment for substantial growth.

Some of the prominent players in the breast cancer core needle biopsy market include:

Breast Cancer Core Needle Biopsy Market Recent Developments

-

March 2025: Hologic Inc. announced the launch of its new 3D ultrasound-guided biopsy system, designed to offer improved accuracy and patient comfort. The product received FDA clearance for clinical use in the U.S.

-

February 2025: BD (Becton Dickinson) partnered with a leading Chinese oncology chain to supply core needle biopsy devices and training support, aiming to expand biopsy access across Tier 2 cities.

-

January 2025: Siemens Healthineers introduced an AI-enhanced MRI biopsy module integrated with real-time lesion mapping and automatic needle guidance.

-

November 2024: Danaher Corporation (through its Leica Biosystems unit) unveiled a digital pathology integration for core needle biopsy samples, enabling remote review and AI-powered histopathology.

-

August 2024: Fujifilm Holdings expanded its diagnostic imaging footprint in Southeast Asia, launching a portable ultrasound device tailored for breast biopsy procedures in rural health centers.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the breast cancer core needle biopsy market

By Technology

- MRI-based Breast Biopsy

- Ultrasound-based Breast Biopsy

- Mammography-based (Stereotactic) Breast Biopsy

- CT-based Breast Biopsy

- Other Image Based Breast Biopsy

By End-use

- Hospitals & Diagnostic Laboratories

- Pharmaceutical & Biotechnology Companies

- Academic & Research Institutes

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)