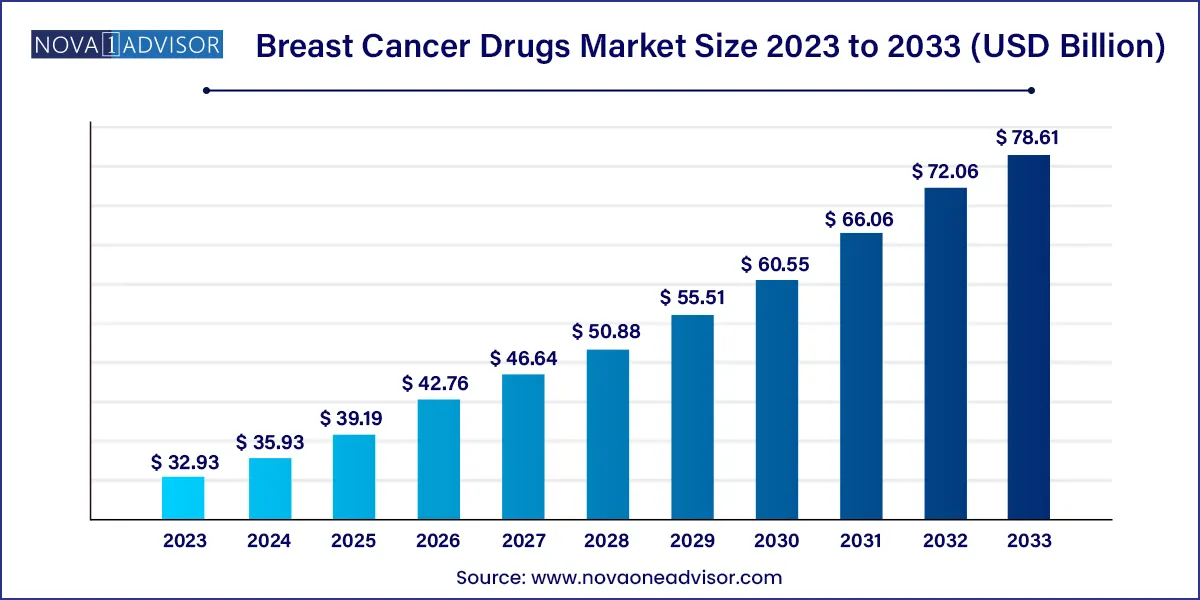

The global breast cancer drugs market size was estimated at USD 32.93 billion in 2023 and is projected to hit around USD 78.61 billion by 2033, growing at a CAGR of 9.09% during the forecast period from 2024 to 2033.

Key Takeaways:

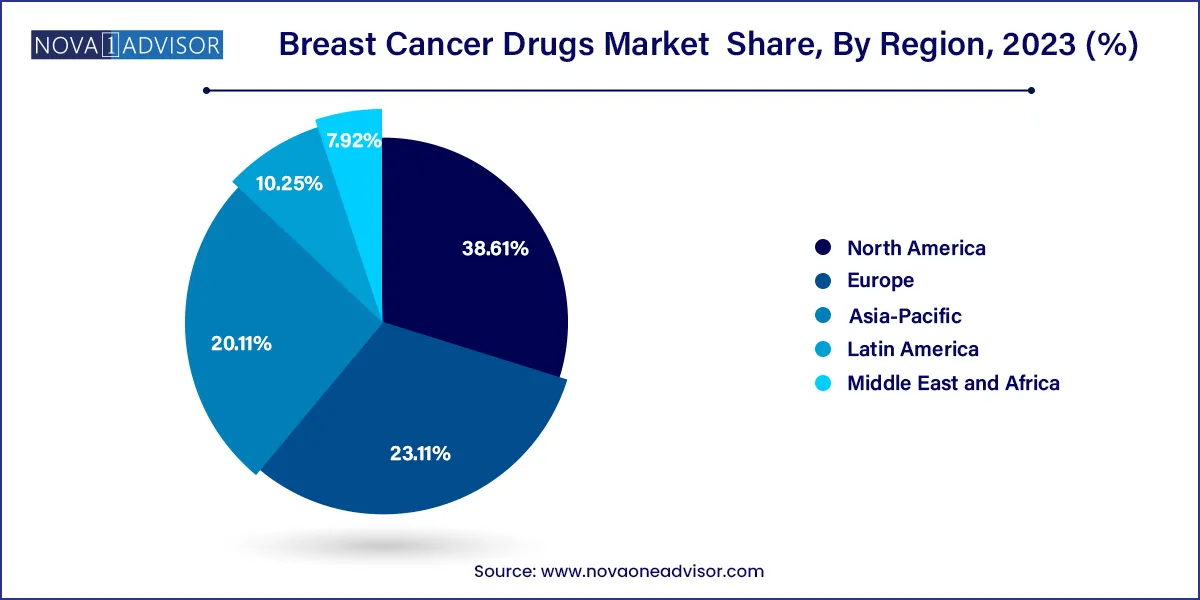

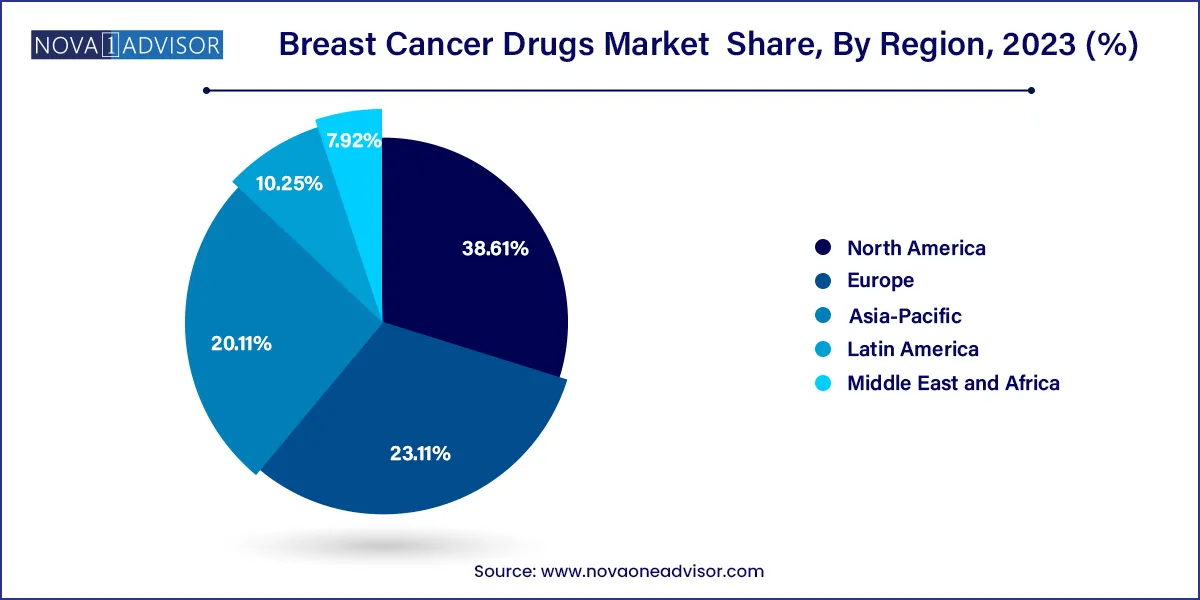

- North America was the dominant region in the market with a revenue share of 38.61% in 2023.

- The targeted therapy segment captured the largest share of 64.85% in 2023 and is expected to maintain dominance during the forecasted period.

- In 2023, the hormone receptor segment was a significant contributor to the global market. The segment accounted for the largest share of 66.97% in 2023.

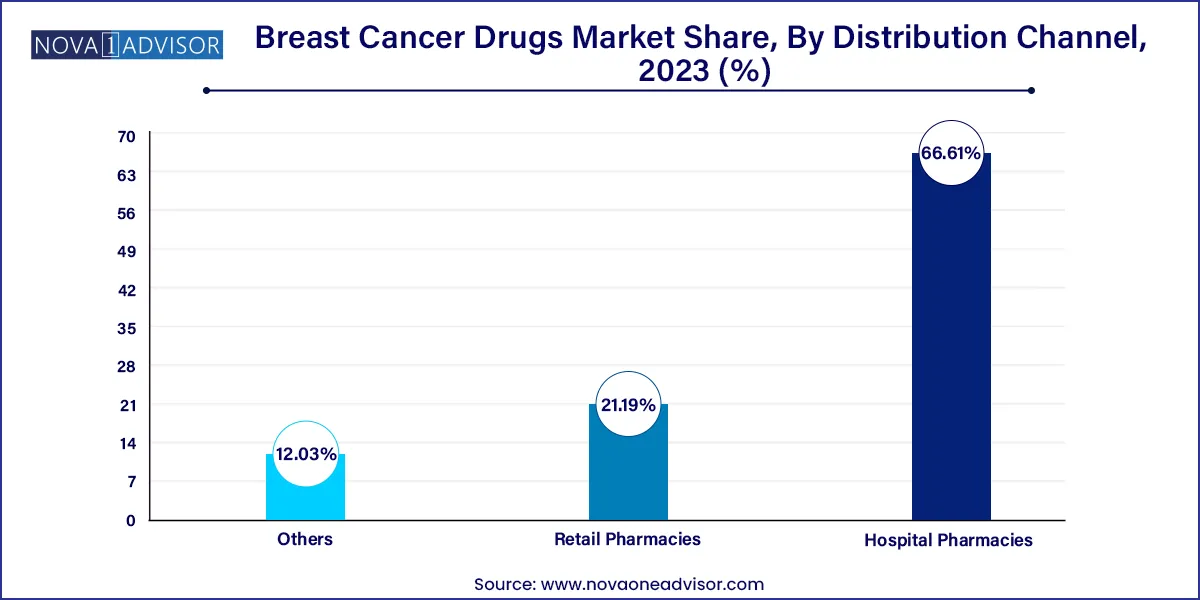

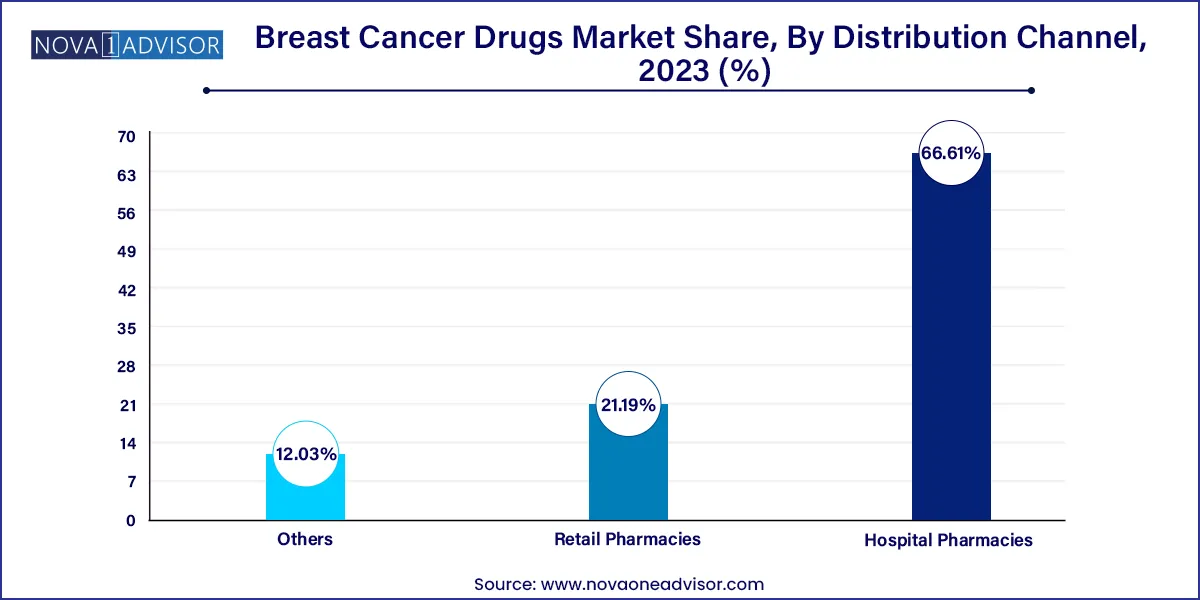

- The hospital pharmacies segment held a significant revenue share of 66.61% in 2023.

Market Overview

The global Breast Cancer Drugs Market is a dynamic and rapidly evolving segment within the broader oncology therapeutics landscape. Breast cancer is one of the most common cancers affecting women worldwide and a significant cause of cancer-related mortality. As of 2025, it accounts for over 2.3 million new diagnoses and approximately 685,000 deaths globally each year, according to the World Health Organization. With increasing awareness, early detection, and enhanced therapeutic options, survival rates have improved driving demand for more effective, personalized, and tolerable treatments.

The development of breast cancer therapeutics has advanced from generic chemotherapy to more targeted, biomarker-driven, and immunologically informed regimens. Today, treatment decisions are increasingly based on the molecular and receptor subtype of breast cancer, including hormone receptor-positive (HR+), HER2-positive, and triple-negative breast cancer (TNBC). Drugs like trastuzumab, palbociclib, and abemaciclib have changed the therapeutic landscape, offering patients better outcomes with fewer side effects.

Biopharmaceutical companies are investing heavily in clinical trials for next-generation drugs targeting resistance mechanisms, leveraging PARP inhibitors, antibody-drug conjugates (ADCs), CDK4/6 inhibitors, and checkpoint inhibitors. These investments, along with regulatory support and expanded clinical guidelines, have positioned breast cancer therapeutics as a top priority within oncology R&D portfolios. Moreover, the growing prevalence of breast cancer in both high-income and developing nations, along with increasing access to diagnostic and therapeutic resources, is expanding the market footprint globally.

Major Trends in the Market

-

Rise of Antibody-Drug Conjugates (ADCs): ADCs like trastuzumab deruxtecan (Enhertu) are gaining approval and market traction due to their targeted cytotoxic delivery with improved efficacy in HER2+ and HER2-low tumors.

-

Adoption of CDK4/6 Inhibitors in HR+ Patients: Drugs such as palbociclib (Ibrance), ribociclib (Kisqali), and abemaciclib (Verzenio) are now standard first-line therapies in metastatic HR+ breast cancer.

-

Expansion of Immunotherapy into Triple-Negative Breast Cancer: Immune checkpoint inhibitors like pembrolizumab (Keytruda) are approved for PD-L1-positive TNBC in combination with chemotherapy.

-

Personalized Therapy Based on Biomarkers: Biomarker-based patient stratification (BRCA mutations, PI3K pathway, HER2-low expression) is becoming a standard approach in clinical trials and therapy selection.

-

Oral Drug Development and At-Home Care: Hormonal therapies and CDK inhibitors are available in oral forms, supporting the shift toward home-based cancer treatment management.

-

Increased Use of Companion Diagnostics: Companion diagnostics guide drug selection based on gene expression or protein expression, improving precision and outcomes.

-

Patent Expirations and Biosimilar Entry: As key biologics face patent cliffs, biosimilar versions are emerging, offering cost-effective alternatives and altering market competition.

-

Global Regulatory Fast-Track Approvals: Agencies like the FDA and EMA are increasingly offering expedited pathways for innovative breast cancer therapies showing survival benefit in trials.

Breast Cancer Drugs Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 35.93 Billion |

| Market Size by 2033 |

USD 78.61 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.09% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Therapy, cancer type, distribution channel, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Novartis AG; Pfizer Inc.; Merck KgaA; Janssen Pharmaceuticals, Inc.; Celgene Corp., Inc.; Genzyme Corp.; F. Hoffmann-La Roche Ltd.; AstraZeneca; AbbVie Inc.; Bristol-Myers Squibb Company; Macrogenics, Inc.; Celldex Therapeutics; Onyx Pharmaceuticals Inc. |

Market Driver: Advancements in Targeted and Personalized Therapy

One of the most powerful drivers of the breast cancer drugs market is the proliferation of targeted and personalized therapy. Unlike traditional chemotherapy, which attacks rapidly dividing cells indiscriminately, targeted therapies interfere with specific molecular targets associated with cancer growth and survival. This has led to the approval and widespread adoption of agents such as trastuzumab (Herceptin), palbociclib (Ibrance), and olaparib (Lynparza), which are tailored to specific genetic and molecular cancer profiles.

For example, CDK4/6 inhibitors have dramatically improved progression-free survival in HR+/HER2– metastatic breast cancer when combined with hormonal therapy. In HER2-positive subtypes, the addition of pertuzumab and T-DM1 to trastuzumab has enhanced outcomes in both neoadjuvant and metastatic settings. These advancements, along with the integration of genomic testing into standard care, have enabled clinicians to design treatment regimens based on each patient’s tumor biology, improving efficacy while minimizing unnecessary toxicity.

Market Restraint: High Cost of Innovative Therapies

Despite promising clinical outcomes, one of the major restraints in the breast cancer drugs market is the high cost associated with targeted and novel therapeutics. Many of the latest breast cancer drugs, especially biologics and immunotherapies, are priced at several thousand dollars per month, posing a financial burden on healthcare systems and patients alike. For example, a year of therapy with trastuzumab can cost over $70,000 in the U.S., and newer ADCs or CDK inhibitors can be even more expensive.

This cost barrier limits access to life-saving treatments, particularly in low- and middle-income countries (LMICs) where public insurance coverage is limited. Even in high-income countries, copayments, prior authorization requirements, and lack of uniform coverage policies contribute to disparities in care. Although biosimilars and generics are beginning to alleviate some of this burden, the overall cost of cutting-edge breast cancer treatments remains a significant market challenge.

Market Opportunity: Growth of ADCs and HER2-Low Targeting Therapies

A major opportunity lies in the emergence of HER2-low breast cancer targeting and ADCs (antibody-drug conjugates). HER2-low is a recently defined subset of breast cancer that expresses low levels of HER2 protein but does not meet the traditional criteria for HER2 positivity. Historically, these patients were not eligible for anti-HER2 therapies. However, the development of next-generation ADCs such as trastuzumab deruxtecan (Enhertu) has changed this paradigm.

In August 2022, the FDA approved Enhertu for HER2-low metastatic breast cancer following results from the DESTINY-Breast04 trial, which showed a significant overall survival benefit. This approval opened a new patient population that accounts for up to 50% of all breast cancer cases. The development of novel ADCs that can deliver cytotoxic drugs directly to cancer cells with high specificity is creating a rapidly growing subsegment within the market. Pharmaceutical firms are investing in ADC pipelines across various tumor types, making this one of the most lucrative areas for innovation and market expansion.

By Therapy Insights

Targeted therapy dominated the therapy segment, supported by a steady stream of approvals and broad clinical adoption across multiple subtypes. CDK4/6 inhibitors, HER2-targeted drugs, and PARP inhibitors have become first-line treatments for metastatic HR+ and HER2+ disease. These drugs, including palbociclib, ribociclib, abemaciclib, trastuzumab, pertuzumab, and olaparib, work by interfering with specific molecular pathways, offering a more favorable side effect profile and better clinical outcomes compared to chemotherapy alone.

Immunotherapy is the fastest-growing therapy, especially in triple-negative breast cancer (TNBC). Immune checkpoint inhibitors like atezolizumab and pembrolizumab, in combination with chemotherapy, have shown promise in PD-L1-positive TNBC patients. Research into new immune targets and combination strategies is accelerating, with multiple ongoing trials evaluating bispecific antibodies, cancer vaccines, and immune modulators. The growth of this segment reflects the broader oncology trend toward harnessing the immune system to combat cancer.

By Cancer Type Insights

Hormone receptor-positive (HR+) breast cancer was the most prevalent, driving the dominance of this segment. HR+ cancers respond well to endocrine therapies and targeted treatments like CDK4/6 inhibitors. These therapies have been well-studied and approved for early and advanced-stage disease, making HR+ the most extensively treated and researched segment. Drugs such as tamoxifen, letrozole, and abemaciclib are standard in adjuvant and metastatic settings.

HER2+ breast cancer is the fastest-growing subtype, especially following the approval of newer HER2-directed agents like tucatinib, neratinib, and trastuzumab deruxtecan. The recognition of HER2-low disease and its eligibility for new drugs like Enhertu has expanded this market segment dramatically. Ongoing trials evaluating HER2-targeting in earlier stages and resistant disease further enhance its growth prospects.

By Distribution Channel Insights

Hospital pharmacies dominated the distribution channel segment, due to the complexity of breast cancer treatment regimens, the need for intravenous administration of many drugs, and the centralized management of oncology care. Hospitals play a key role in administering targeted therapies, ADCs, and chemotherapy under close supervision, particularly in the early stages of treatment.

Retail pharmacies are the fastest-growing distribution channel, as more breast cancer drugs become available in oral formulations, such as CDK4/6 inhibitors and hormonal therapies. Patients increasingly prefer the convenience of picking up medications locally, especially for long-term maintenance therapy. Additionally, the expansion of specialty pharmacy networks and home delivery options supports this growth.

By Regional Insights

North America leads the global breast cancer drugs market due to its advanced healthcare infrastructure, strong presence of leading pharmaceutical companies, and early adoption of novel therapies. The U.S. FDA provides expedited pathways for oncology drug approvals, encouraging innovation and timely market entry. Additionally, reimbursement policies in the U.S. and Canada support the use of advanced therapies, including genomic testing and companion diagnostics. High awareness and screening rates also contribute to earlier diagnosis and better treatment uptake.

Asia-Pacific is the fastest-growing region, propelled by increasing breast cancer incidence, urbanization, and improvements in healthcare infrastructure. Countries like China, India, and Japan are investing heavily in oncology care and clinical trials. The emergence of local biopharma companies, public health initiatives, and greater access to diagnostics is enhancing drug uptake. Moreover, regulatory reforms in China and partnerships between global pharmaceutical companies and Asian manufacturers are driving regional growth. Rising healthcare spending and adoption of western treatment protocols are transforming Asia-Pacific into a high-growth frontier for breast cancer therapeutics.

Some of the key players in the global breast cancer drugs market include:

- Novartis AG

- Pfizer Inc.

- Merck KGaA

- Janssen Pharmaceuticals, Inc.

- Celgene Corporation, Inc.

- Genzyme Corp.

- F. Hoffmann-La Roche Ltd.

- AstraZeneca

- AbbVie Inc.

- Bristol-Myers Squibb Company

- Macrogenics, Inc.

- Celldex Therapeutics

- Onyx Pharmaceuticals Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Breast Cancer Drugs market.

By Therapy

- Targeted Therapy

- Abemaciclib

- Ado-Trastuzumab Emtansine

- Everolimus

- Trastuzumab

- Ribociclib

- Palbociclib

- Pertuzumab

- Olaparib

- Others

- Hormonal Therapy

- Selective Estrogen Receptor Modulators (SERMs)

- Aromatase Inhibitors

- Estrogen Receptor Down regulators (ERDs)

- Chemotherapy

- Immunotherapy

By Cancer Type

By Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)