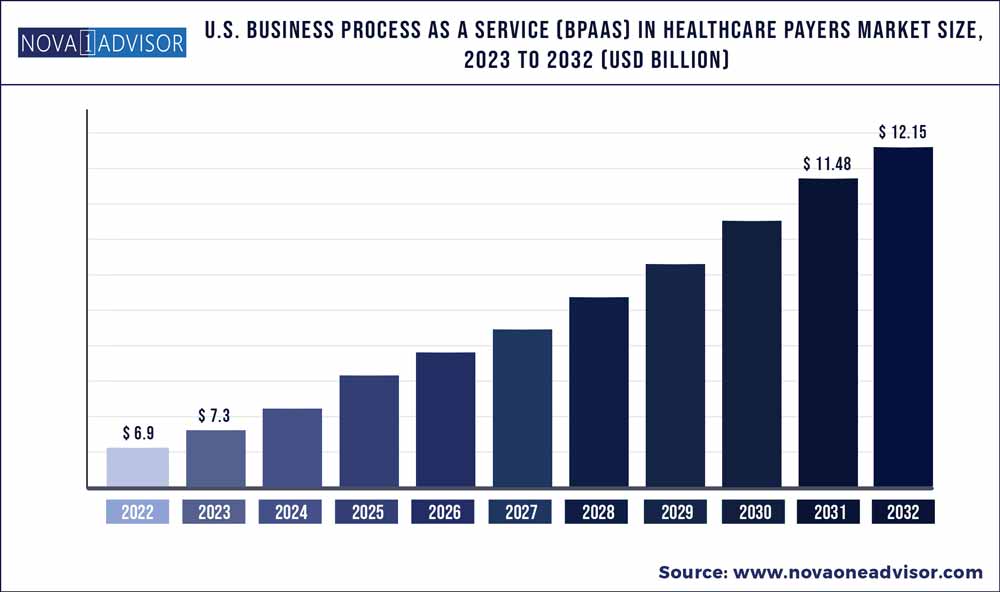

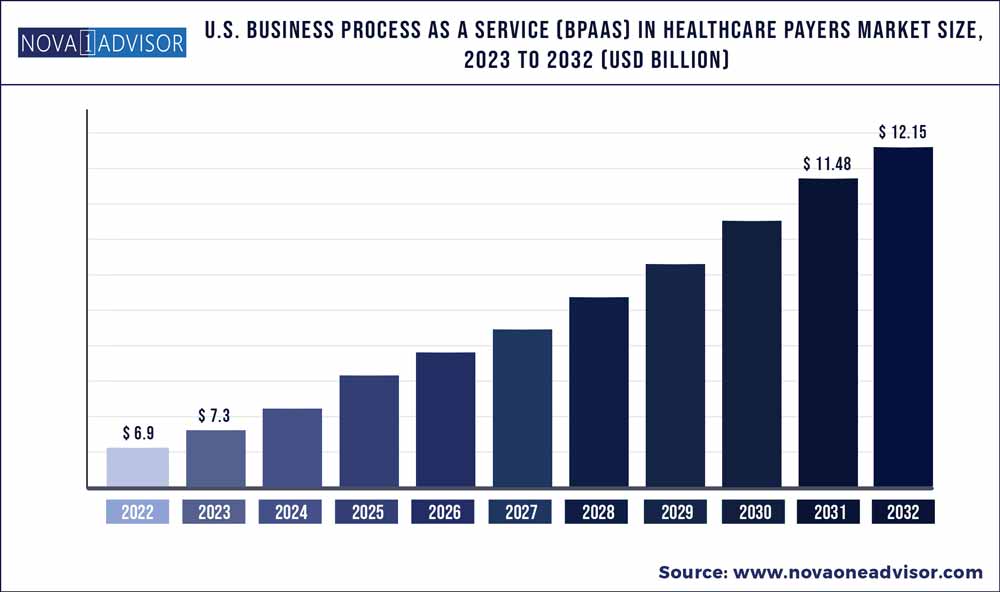

The U.S. business process as a service (BPaaS) in healthcare payers market size was exhibited at USD 6.9 billion in 2022 and is projected to hit around USD 12.15 billion by 2032, growing at a CAGR of 5.82% during the forecast period 2023 to 2032.

Market Overview

The U.S. Business Process as a Service (BPaaS) in healthcare payers market has witnessed transformative evolution over the past decade, propelled by technological innovation, regulatory shifts, and increasing pressure to reduce administrative costs while improving operational efficiency. BPaaS is a delivery model for outsourcing business processes through a cloud-based platform, combining services with automation and analytics. In the healthcare payer landscape, BPaaS addresses critical back-end and front-end functions, including claims management, member engagement, and care coordination.

Healthcare payers in the U.S., ranging from government programs like Medicare and Medicaid to commercial insurers and employer-sponsored plans, face growing complexities in managing large volumes of data, ensuring compliance with government mandates, and providing high-quality service to members. Traditional IT outsourcing is no longer sufficient; instead, healthcare payers are rapidly embracing cloud-first solutions that integrate intelligent automation, analytics, and secure cloud infrastructure.

The shift toward BPaaS is not just about outsourcing but a strategic realignment to drive business agility, scalability, and innovation. Organizations leveraging BPaaS report benefits such as faster claims processing, reduced fraud, improved member satisfaction, and better insights for decision-making. With major players investing in new platforms and partnerships, and with government support for value-based care, the BPaaS model is poised for exponential growth across all payer segments.

Major Trends in the Market

-

Increased adoption of AI-driven automation in claims processing and fraud detection.

-

Rising demand for end-to-end BPaaS platforms that streamline multiple functions simultaneously.

-

Shift toward consumer-centric care driving investments in enhanced member engagement platforms.

-

Growing participation of large health tech firms in delivering tailored BPaaS solutions to smaller and mid-sized payers.

-

Expansion of hybrid BPaaS models integrating on-premise legacy systems with cloud platforms.

-

Use of predictive analytics in care management processes to improve health outcomes.

-

Compliance-focused BPaaS solutions gaining traction amidst evolving CMS regulations.

-

Integration of robotic process automation (RPA) with BPaaS to minimize human intervention in repetitive tasks.

U.S. Business Process As A Service (BPaaS) In Healthcare Payers Market Report Scope

| Report Attribute |

Details |

| Market Size in 2023 |

USD 7.3 Billion |

| Market Size by 2032 |

USD 12.15 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.82% |

| Base Year |

2022 |

| Forecast Period |

2023 to 2032 |

| Segments Covered |

Solution coverage, Buyer Size, Buyer type, Value chain processes |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Accenture; Cognizant; HCL Technologies Limited; IBM; Infosys; NTT DATA Corporation; Optum; TATA Consultancy Services Limited; UST; Wipro; EXL; Softheon Inc.; Genpact; Change Healthcare; Firstsource; Celegence; Highmark Health |

A significant driver for the BPaaS in healthcare payers market is the ongoing digital transformation across payer organizations. Healthcare payers are under immense pressure to modernize legacy systems to keep up with regulatory demands, enhance customer experience, and reduce operational inefficiencies. BPaaS enables them to achieve these goals by offering a unified platform that incorporates advanced technologies like AI, big data analytics, and machine learning. For instance, companies like Cognizant and Accenture provide BPaaS solutions that automate manual tasks such as eligibility verification, premium billing, and claim adjudication. The transition to digital platforms through BPaaS has proven to reduce administrative costs by up to 30%, while improving process accuracy and compliance, making digital transformation a key enabler of market growth.

Market Restraint: Data Privacy and Security Concerns

Despite its advantages, data privacy and security remain a critical restraint in the widespread adoption of BPaaS among U.S. healthcare payers. The healthcare sector deals with vast amounts of sensitive personal health information (PHI), and outsourcing processes to third-party BPaaS vendors raises concerns over data breaches, unauthorized access, and non-compliance with HIPAA (Health Insurance Portability and Accountability Act). Although most providers offer secure cloud environments with encryption and access control, incidents like the 2023 ransomware attack on a major insurance firm highlight the risks. These apprehensions, especially among smaller and mid-sized payers with limited cybersecurity infrastructure, may delay the shift to cloud-based BPaaS models.

Market Opportunity: Value-Based Care and Outcome-Driven Models

An emerging opportunity for BPaaS lies in supporting the transition to value-based care (VBC). With CMS and private insurers promoting reimbursement models that reward improved health outcomes rather than service volume, payers are compelled to redesign their operational frameworks. BPaaS solutions can facilitate this transition by offering robust care management tools, integrated population health analytics, and real-time member engagement systems. For instance, BPaaS platforms that track chronic condition management and alert care teams about at-risk patients can significantly reduce readmission rates and enhance member outcomes. This shift toward outcome-driven care creates fertile ground for specialized BPaaS vendors to offer differentiated, value-aligned services.

Segmental Analysis

By Solution Coverage

End-to-end Traditional BPaaS dominated the market owing to its holistic approach to handling core business functions across the value chain. These solutions provide seamless integration of multiple payer functions such as claims management, member eligibility, provider data validation, and payment processing into a single platform. Companies opting for end-to-end BPaaS benefit from enhanced workflow efficiency, uniform compliance monitoring, and reduced redundancy. Major insurers like UnitedHealth and Humana have invested in end-to-end solutions to streamline their operations across states and product lines.

However, End-to-end Best-of-breed BPaaS is emerging as the fastest-growing segment as payers look for customization and modularity. Unlike traditional models, best-of-breed platforms allow integration of specialized third-party tools tailored for specific tasks—such as AI-based fraud detection or telehealth coordination—offering more flexibility. Smaller payers and startups particularly prefer this model for its scalability, while larger organizations adopt it to experiment with innovation without overhauling entire systems.

By Buyer Type

Commercial Buyers held the largest market share due to their volume of enrollees and broad portfolio of insurance products ranging from HMOs to PPOs. These organizations are investing heavily in BPaaS platforms to reduce claim handling time, improve customer satisfaction, and manage operational scalability. For instance, companies like Anthem and Cigna have partnered with IT service providers to build BPaaS-powered ecosystems capable of handling millions of transactions monthly.

In contrast, Medicare Advantage is witnessing the fastest growth. With rising senior populations and favorable CMS incentives, many payers are expanding their Medicare Advantage offerings. These plans are complex, requiring rigorous care coordination, risk adjustment, and quality reporting. BPaaS solutions tailored for Medicare Advantage, especially those integrating clinical data with claims, are becoming essential for providers aiming to improve STAR ratings and receive performance bonuses.

By Value Chain Processes

Claims Management continued to dominate the segment, accounting for a significant share of the BPaaS deployments. Claims processing is a resource-intensive function prone to delays, errors, and fraud. Through BPaaS, healthcare payers can automate claim adjudication, detect duplicate billing, and ensure timely payments. Leading firms like Cognizant and Infosys offer BPaaS platforms that handle end-to-end claims workflows with audit trails and compliance dashboards, reducing claim cycle time and boosting member trust.

Meanwhile, Member Engagement is the fastest-growing value chain process, driven by the industry's shift toward patient-centric care. BPaaS platforms equipped with omnichannel communication tools, personalized health content, and real-time feedback collection are helping payers build deeper relationships with members. For example, a BPaaS solution used by Blue Shield of California leverages data to send reminders for preventive screenings and manage chronic conditions—contributing to both better health outcomes and higher retention.

By Buyer Size

Large Buyers dominate the market due to their substantial processing volumes and capital reserves to invest in enterprise-grade BPaaS platforms. These buyers often face complex regulatory requirements and require robust, customizable platforms that can scale with their needs. For example, Aetna and Centene have adopted large-scale BPaaS platforms to manage multi-state operations while aligning with federal and state regulations.

Midsized Buyers are growing fastest, spurred by their need to stay competitive against larger insurers while managing tighter operational budgets. Midsized players increasingly turn to BPaaS for its cost-saving benefits, particularly for care management and member engagement, where in-house solutions are resource-intensive. The rise of modular BPaaS offerings tailored for midsized organizations ensures that these buyers can adopt digital tools incrementally without committing to full-suite replacements.

Country-Level Analysis: United States

In the United States, the healthcare payer landscape is diverse, comprising government agencies, large private insurers, and smaller regional payers. The U.S. market is uniquely driven by stringent regulatory frameworks like HIPAA, ACA provisions, and CMS mandates. BPaaS adoption has been most prominent among commercial payers due to operational scale, but federal and state health programs are also integrating BPaaS into Medicaid and Medicare Advantage.

Healthcare payer organizations in California, Texas, Florida, and New York are leading adopters of BPaaS platforms, owing to high insurance enrollment numbers and regional innovation hubs. Additionally, the U.S. Department of Health and Human Services has advocated for greater interoperability and digital efficiency in claims and care coordination, further catalyzing BPaaS investments. With a clear push toward cloud-based digital health ecosystems, the U.S. remains the most lucrative market for BPaaS in the healthcare payer sector.

Key Companies & Market Share Insights

- Accenture

- Cognizant

- HCL Technologies Limited

- IBM

- Infosys Limited

- NTT DATA Corporation

- Optum

- TATA Consultancy Services Limited

- UST

- Wipro

- EXL

- Softheon, Inc.

- Genpact

- Change Healthcare

- Firstsource

- Celegence

- Highmark Health

Recent Developments

-

March 2025: Cognizant announced the launch of its new BPaaS-based "CuraPayer Suite" designed to streamline value-based reimbursement processing for Medicare Advantage plans. This marks a strategic push toward integrating care quality metrics into claims workflows.

-

January 2025: Accenture entered a partnership with GuideWell to deploy a BPaaS solution focused on end-to-end claims and provider data management for Florida Blue, targeting over 5 million members.

-

November 2024: Optum introduced a predictive analytics BPaaS module to support care management in chronic disease programs, enhancing member outreach and adherence tracking.

-

September 2024: EXL Service expanded its U.S. BPaaS operations by acquiring a healthcare analytics startup specializing in payer workflows and regulatory compliance automation.

-

June 2024: Wipro launched a HIPAA-compliant BPaaS platform tailored for midsized commercial payers in the U.S., featuring AI-led fraud detection and real-time member service tools.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the U.S. Business Process As A Service (BPaaS) In Healthcare Payers market.

By Solution Coverage

- Traditional BPaaS

- End-to-end Traditional BPaaS

- Process-specific Traditional BPaaS

- Best-of-breed BPaaS

- End-to-end Best-of-breed BPaaS

- Process-specific Best-of-breed BPaaS

By Buyer Type

- Government Buyers

- Medicare Advantage

- Managed Medicaid

- Commercial Buyers

- Individual Health Plan

- Employer-sponsored Health Plan

By Value Chain Processes

- Claims Management

- Member Engagement

- Care Management

- Others

By Buyer Size

- Small Buyers

- Midsized Buyers

- Large Buyers