Canada Pharmaceutical Market Size and Research

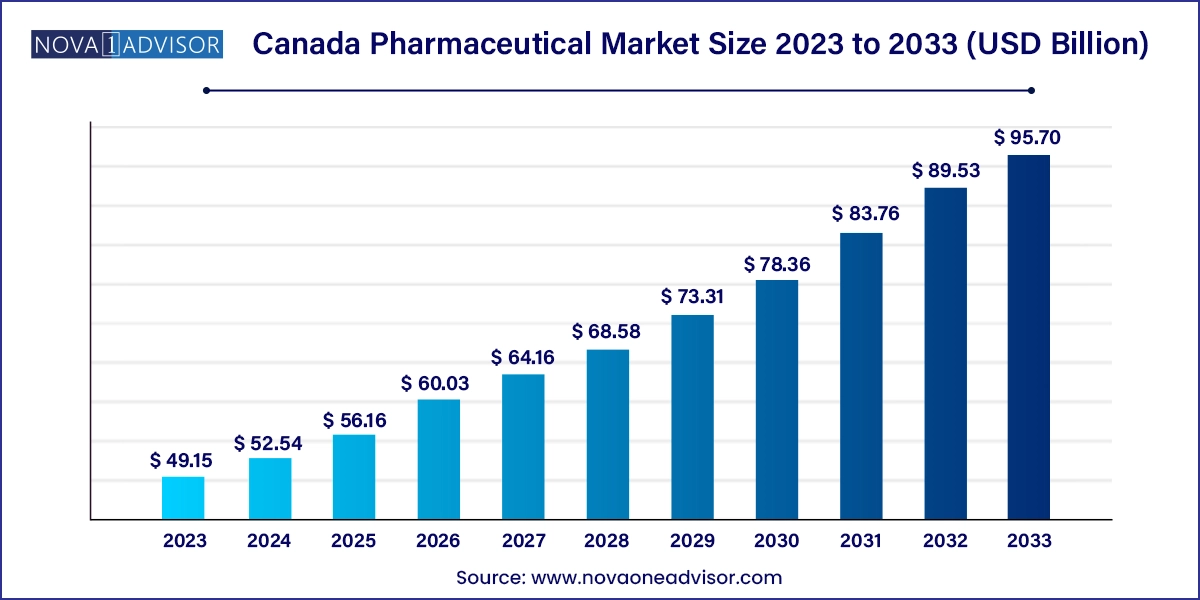

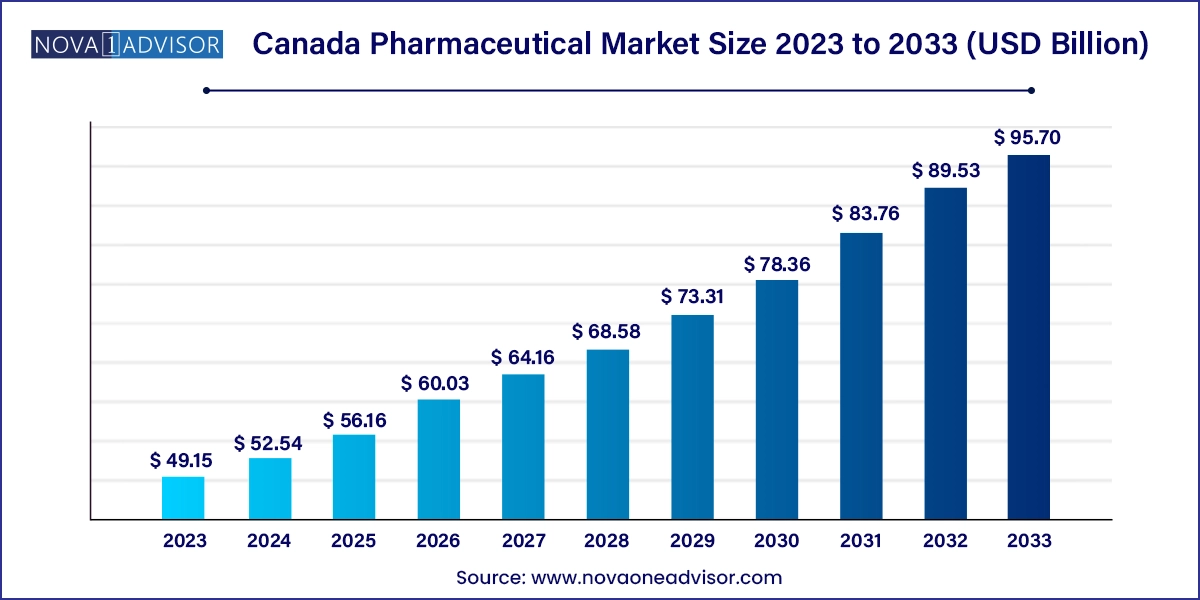

The Canada Pharmaceutical market size was exhibited at USD 49.15 billion in 2023 and is projected to hit around USD 95.70 billion by 2033, growing at a CAGR of 6.89% during the forecast period 2024 to 2033.

Canada Pharmaceutical Market Key Takeaways:

- On the basis of drug type, the conventional drugs (small molecules) segment accounted for the largest market share of 55.21% in 2023.

- Based on the product, the branded segment held the largest market share of 68.18% in 2023

- The prescription segment dominated the pharmaceutical market in Canada in terms of revenue in 2023

- Based on disease, the cancer segment dominated the market in terms of revenue in 2023

- The oral route of administration dominated the market in terms of revenue in 2023.

- Based on formulation, the tablet segment dominated the market in terms of revenue in 2023.

- Based on age group, the geriatric segment dominated the market in 2023.

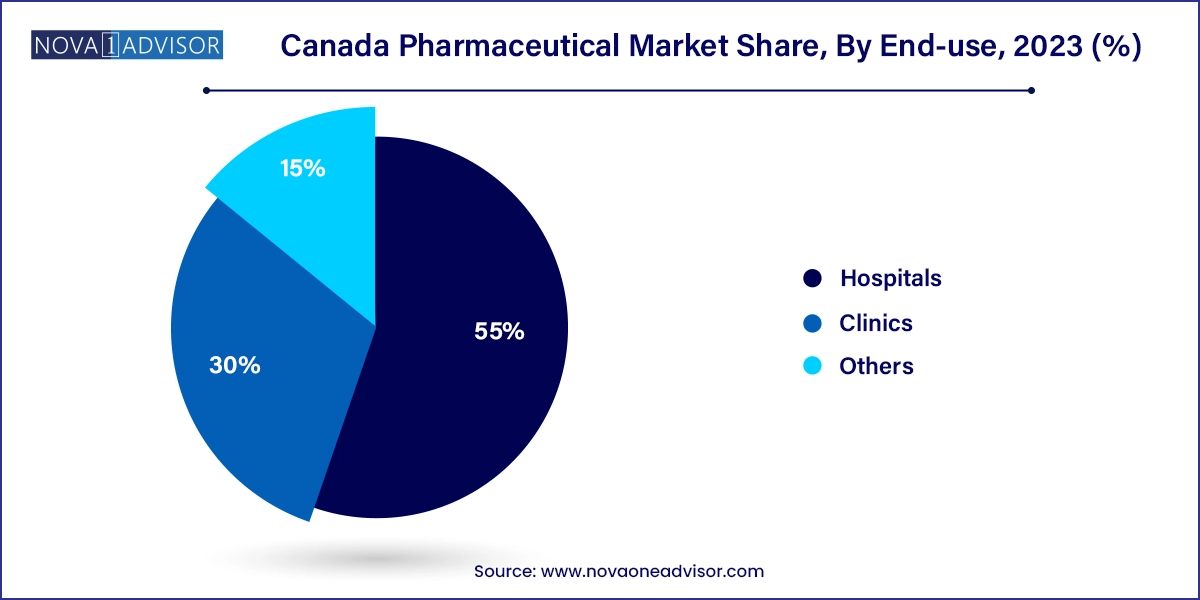

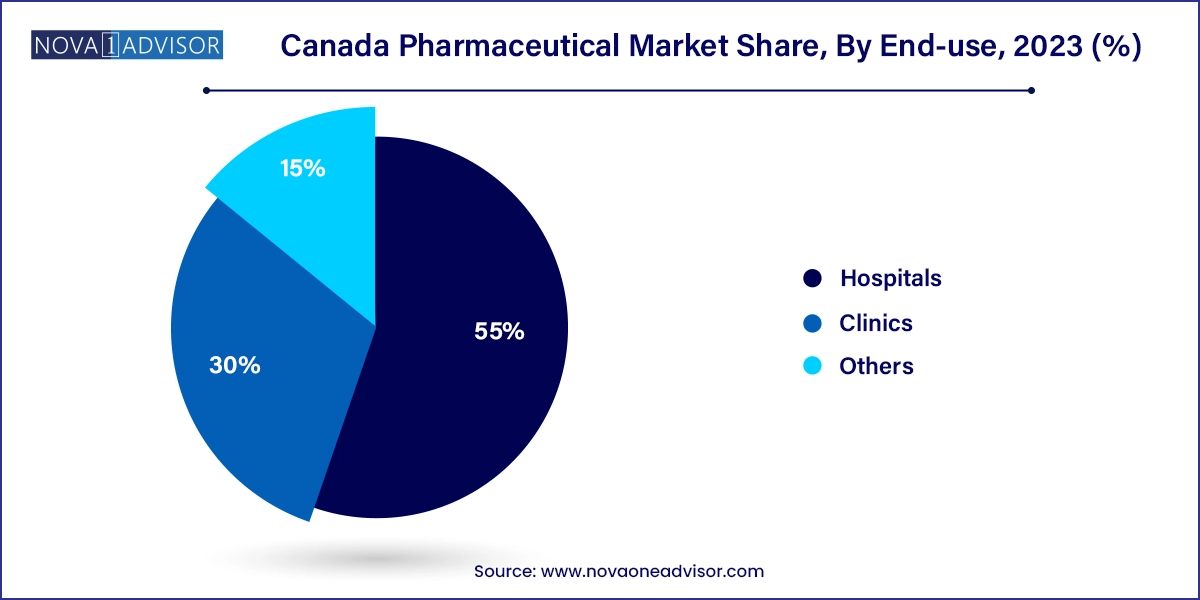

- Based on end-use, the hospital segment dominated the market share of 55.0% in 2023.

Market Overview

The Canada pharmaceutical market stands as one of the most robust and highly regulated healthcare markets globally, driven by a sophisticated healthcare system, high per capita health expenditure, and significant public-private sector collaboration. With a steadily aging population, increasing prevalence of chronic diseases, and ongoing investments in biopharmaceutical research, Canada continues to expand its pharmaceutical footprint. According to the Canadian Institute for Health Information (CIHI), prescription drug spending alone accounted for over 15% of the country’s total healthcare expenditure in recent years, highlighting its strategic significance.

Canada’s pharmaceutical market benefits from universal healthcare coverage, yet drug access is shared between federal and provincial jurisdictions, leading to unique dynamics in pricing, reimbursement, and policy-making. While brand-name pharmaceutical companies dominate high-value segments, generic drug manufacturers have gained substantial ground due to strong support from provincial drug plans and cost-containment efforts. The country also serves as a critical hub for clinical trials, biotech innovation, and cross-border collaborations with the U.S., positioning itself at the frontier of global drug development.

As the healthcare sector undergoes a digital transformation, Canada’s pharmaceutical industry is increasingly incorporating AI-driven drug discovery, personalized medicine, and real-world evidence (RWE) platforms. With strong institutions like the Canadian Institutes of Health Research (CIHR) and a growing biotech startup ecosystem in provinces like Ontario, Quebec, and British Columbia, the pharmaceutical market in Canada is poised for continued expansion, innovation, and global competitiveness.

Major Trends in the Market

-

Shift towards biologics and biosimilars, especially monoclonal antibodies and cell therapies for oncology and autoimmune diseases.

-

Growing preference for personalized and precision medicine, driven by genomic research and digital health tools.

-

Increased adoption of AI and machine learning in drug discovery, trial optimization, and post-market surveillance.

-

Expansion of virtual healthcare and e-prescriptions, improving access and delivery of medications.

-

Surge in demand for mental health and neuropharmaceutical drugs, especially post-COVID-19.

-

Strong emphasis on price regulation and cost-effectiveness analysis through bodies like CADTH and PMPRB.

-

Rise in generic drug penetration, especially in provincial drug plans due to cost-saving policies.

-

Strategic partnerships between Canadian and international pharma companies, fostering R&D and commercialization.

Report Scope of Canada Pharmaceutical Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 52.54 Billion |

| Market Size by 2033 |

USD 95.70 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.89% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Drug type, Product, type, Disease, Route of Administration, Formulation, Age group, End-use |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Country scope |

Canada |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd.; Novartis AG; GlaxoSmithKline plc; Pfizer, Inc.; Merck & Co., Inc.; AstraZeneca; Johnson & Johnson Services, Inc.; Sanofi; Eli Lilly and Company; AbbVie, Inc. |

Market Driver: Aging Population and Rise in Chronic Diseases

A fundamental driver of the Canada pharmaceutical market is the growing aging population coupled with the increasing burden of chronic diseases such as cardiovascular disorders, diabetes, arthritis, and cancer. According to Statistics Canada, nearly 20% of the Canadian population is aged 65 and older a demographic that utilizes healthcare services, including pharmaceuticals, at a significantly higher rate.

This demographic trend has led to sustained demand for prescription medications, particularly for conditions that require long-term pharmacological management. Cardiovascular and metabolic disorders, prevalent in older populations, are often managed with drug regimens spanning decades. Furthermore, the incidence of neurodegenerative diseases like Alzheimer’s and Parkinson’s is also on the rise, spurring pharmaceutical innovation in neurological and geriatric medicine. As healthcare shifts toward preventative and personalized care models, the need for advanced, targeted therapies across age groups continues to increase, reinforcing the importance of the pharmaceutical sector in Canada.

Market Restraint: Complex Pricing Regulations and Policy Uncertainty

One of the most significant restraints in the Canadian pharmaceutical market is the complex and evolving regulatory framework surrounding drug pricing and market access. The federal Patented Medicine Prices Review Board (PMPRB) plays a central role in controlling drug prices, which, although aimed at affordability, creates uncertainty for pharmaceutical manufacturers. Recent attempts to revise PMPRB guidelines to lower the ceiling price for patented drugs faced pushback from the industry and were partially suspended after legal challenges in 2022 and 2023.

Additionally, Canada's fragmented healthcare system, with each province maintaining its own drug reimbursement and formulary policies, makes market access complex and inconsistent. Pharmaceutical companies often face delays in getting product listings across all provincial plans, limiting timely access for patients. This regulatory burden and policy ambiguity can deter investment in innovation and slow down the launch of new therapies, particularly in specialty and orphan drug segments.

Market Opportunity: Growth in Biologics and Biosimilars Market

An exciting opportunity lies in the rapidly expanding biologics and biosimilars segment. Biologics especially monoclonal antibodies and gene therapies are at the forefront of treatment for oncology, autoimmune diseases, and rare genetic disorders. Canada has seen a significant increase in the number of biologic therapies approved, with Health Canada actively fostering innovation in this domain.

Moreover, with numerous blockbuster biologics nearing patent expiration, the biosimilar market is gaining momentum. Biosimilars offer significant cost savings to the public system while maintaining comparable safety and efficacy. The Canadian Generic Pharmaceutical Association (CGPA) estimates that increased biosimilar uptake could save the healthcare system billions over the next decade. The recent approval of biosimilars for adalimumab, rituximab, and trastuzumab has opened new doors for market competition. Government-led initiatives to promote biosimilar substitution at the provincial level, particularly in British Columbia and Alberta, have further catalyzed their adoption—presenting a high-growth opportunity for manufacturers.

Canada Pharmaceutical Market By Drug Type Insights

Conventional drugs (small molecules) continue to dominate the Canada pharmaceutical market due to their widespread application in treating acute and chronic conditions. These drugs are easier to manufacture, generally cost less, and are heavily represented in the generics space. Conditions such as hypertension, infections, mental health disorders, and diabetes are predominantly treated using conventional drugs. The long history of successful use, robust manufacturing infrastructure, and cost-effective production methods keep small molecules a major pillar in Canada’s pharma landscape.

Biologics and biosimilars are the fastest-growing drug types, especially in oncology, immunology, and rare diseases. Monoclonal antibodies have become the cornerstone of modern therapies for rheumatoid arthritis, breast cancer, and lymphoma. Canada has also been supportive of cell and gene therapy innovation, with the federal government investing in regenerative medicine hubs like Ontario’s CCRM. The emergence of homegrown biopharma companies such as AbCellera and Notch Therapeutics underscores this momentum, with partnerships and licensing deals accelerating product development in this segment.

Canada Pharmaceutical Market By Product Insights

Branded drugs dominate the pharmaceutical product segment, driven by their extensive use in innovative therapies and patented treatments. Brand-name pharmaceuticals hold considerable value in oncology, autoimmune diseases, and rare disorders. These therapies are often first-in-class or offer superior clinical outcomes. Despite cost pressures, physicians and specialists often prefer branded drugs for complex cases where biosimilars or generics may not yet have market presence or proven equivalency.

Generics are witnessing faster growth, bolstered by cost-containment policies across provincial drug plans. Government programs such as the pan-Canadian Pharmaceutical Alliance (pCPA) have been instrumental in negotiating lower prices for generic drugs, thereby increasing their accessibility. Generic drugs are commonly prescribed for cardiovascular, gastrointestinal, and respiratory conditions, where therapeutic consistency has been well established. The market is also seeing increased local manufacturing activity in generics to ensure supply chain resilience post-COVID-19.

Canada Pharmaceutical Market By Type Insights

Prescription drugs dominate the Canadian pharmaceutical market, as the majority of complex, chronic, and high-burden diseases require physician oversight and specialist treatment protocols. Prescription drugs also dominate provincial formularies and are subject to reimbursement schemes, further consolidating their market share. These include treatments for cancer, diabetes, autoimmune disorders, and mental health conditions.

Over-the-counter (OTC) drugs are growing faster, particularly in areas like digestive health, allergies, and minor pain relief. Increasing consumer awareness and the trend of self-care have expanded the scope of OTC offerings. The COVID-19 pandemic also accelerated interest in immunity boosters, vitamins, and respiratory relief products many of which are available OTC. Pharmacies and retailers are responding by expanding OTC shelves and investing in digital pharmacy models.

Canada Pharmaceutical Market By Disease Insights

Cancer remains the dominant therapeutic area, consuming a significant portion of pharmaceutical R&D and public drug funding. Oncology drugs—particularly immunotherapies, targeted therapies, and biosimilars—have transformed cancer care in Canada. Innovative therapies like PD-1 inhibitors and CAR-T cell therapies are now available through provincial health plans, reflecting high unmet need and demand for clinical innovation.

Mental health and neurological disorders are among the fastest-growing segments, especially as post-pandemic awareness, diagnosis rates, and treatment-seeking behavior increase. Depression, anxiety, ADHD, and neurodegenerative disorders such as Alzheimer’s are driving pharmaceutical demand. Health Canada’s support for mental health infrastructure and increased private sector investment in neuropharma startups is further amplifying growth.

Canada Pharmaceutical Market By Route of Administration Insights

Oral drugs dominate the market, owing to their convenience, cost-effectiveness, and patient adherence. Most chronic disease medications, antibiotics, and mental health therapies are administered orally, making this route the preferred choice across all age groups.

Parenteral drugs are the fastest-growing, particularly intravenous biologics and vaccines. Oncology, autoimmune disorders, and critical care medications often require IV or IM administration. Additionally, the expansion of outpatient infusion centers and home-based injectable therapies is making parenteral delivery more accessible.

Tablets remain the most dominant formulation, thanks to their stability, ease of administration, and lower cost of production. They are used in a wide range of diseases, including diabetes, cardiovascular disorders, and mental health.

Injectables are growing rapidly, especially with the rise of biologics, vaccines, and emergency care drugs. Advanced injectables—such as auto-injectors and depot formulations—are enhancing patient convenience and adherence. Moreover, innovations in subcutaneous injection technology are further driving this trend.

Canada Pharmaceutical Market By Age Group Insights

Adults represent the largest age group consuming pharmaceutical products. From lifestyle-related chronic conditions like hypertension to mental health therapies, adult patients form the bulk of prescription and OTC drug users.

The geriatric population is growing fastest, driven by demographic shifts. Polypharmacy, age-related degenerative conditions, and multiple comorbidities are increasing the need for complex medication regimens. This is boosting demand for safer formulations, adherence aids, and tailored therapies.

Canada Pharmaceutical Market By End-use Insights

Hospitals dominate the pharmaceutical end-use segment, due to the high volume of inpatient care, surgical procedures, and specialized treatments requiring drug support. Hospital formularies cover a broad spectrum of injectables, oncology drugs, and critical care medications.

Clinics are the fastest-growing end-use category, particularly specialty and outpatient clinics. These facilities administer infusion therapies, vaccinations, and manage chronic diseases in ambulatory settings. The shift from inpatient to outpatient care is reshaping drug distribution models across Canada.

Country-Level Analysis

Canada’s pharmaceutical ecosystem is deeply influenced by its single-payer healthcare system and strong regulatory oversight by Health Canada. Despite challenges around drug affordability and approval timelines, the market remains highly attractive due to its stability, transparency, and innovation culture. Provinces like Ontario, Quebec, and British Columbia dominate pharmaceutical sales and R&D activities, hosting global pharma firms, CROs, and biotech clusters.

Montreal and Toronto are Canada’s leading life sciences hubs, while Vancouver is gaining traction with a growing biotech startup scene. Government funding, tax credits for R&D, and partnerships with academic institutions like the University of Toronto and McGill University continue to drive research output. Canada's alignment with global regulatory standards also makes it a prime candidate for clinical trials, serving as a critical part of global launch strategies for pharma companies.

Some of the prominent players in the Canada Pharmaceutical market include:

- F. Hoffmann-La Roche Ltd.

- Novartis AG

- GlaxoSmithKline plc.

- Pfizer, Inc.

- Merck & Co., Inc.

- AstraZeneca

- Johnson & Johnson Services, Inc.

- Sanofi

- Eli Lilly and Company

- AbbVie, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Canada Pharmaceutical market

Drug type

- Biologics & Biosimilars (Large Molecules)

-

- Monoclonal Antibodies

- Vaccines

- Cell & Gene Therapy

- Others

- Conventional Drugs (Small Molecules)

Product

Type

Disease

- Cardiovascular diseases

- Cancer

- Diabetes

- Infectious diseases

- Neurological disorders

- Respiratory diseases

- Autoimmune diseases

- Mental health disorders

- Gastrointestinal disorders

- Women’s Health Diseases

- Genetic and Rare genetic diseases

- Dermatological conditions

- Obesity

- Renal diseases

- Liver conditions

- Hematological disorders

- Eye conditions

- Infertility conditions

- Endocrine disorders

- Allergies

- Others

Route of Administration

-

- Intravenous

- Intramuscular

- Inhalations

- Other Routes of Administration

Formulation

- Tablets

- Capsules

- Injectable

- Sprays

- Suspensions

- Pozders

- Other Formulations

Age Group

- Children & Adolescents

- Adults

- Geriatric

End-use