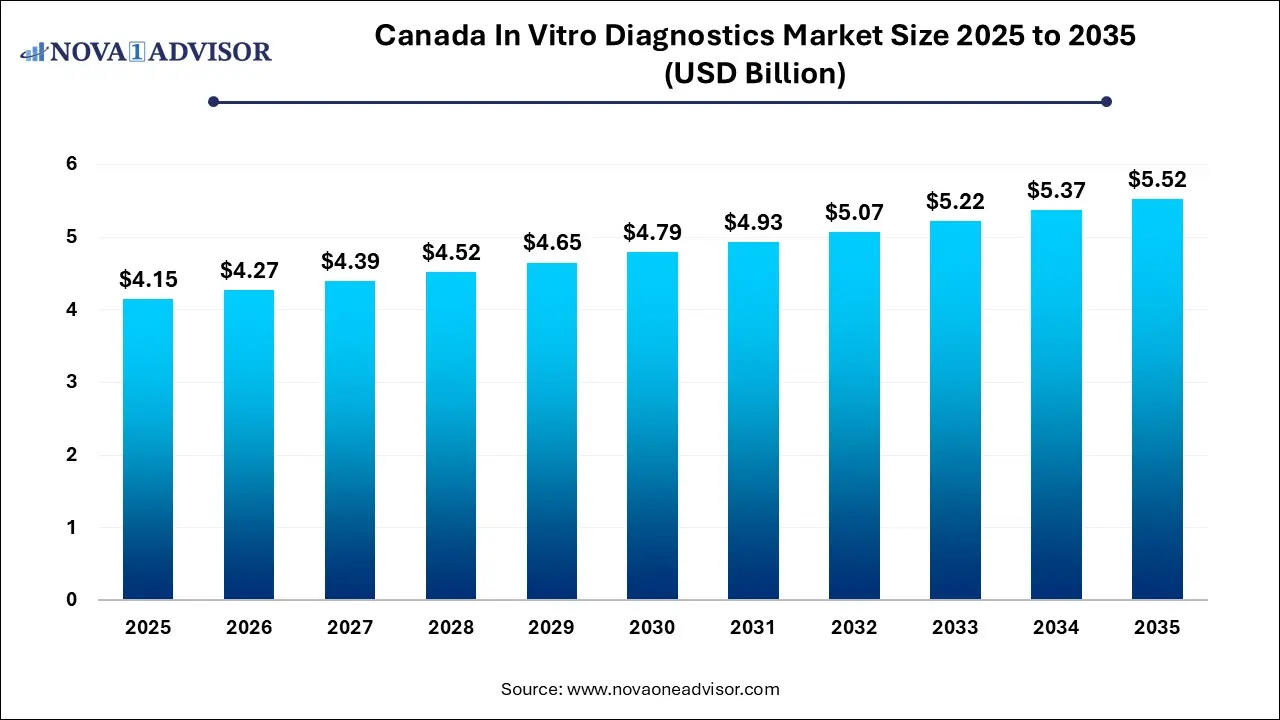

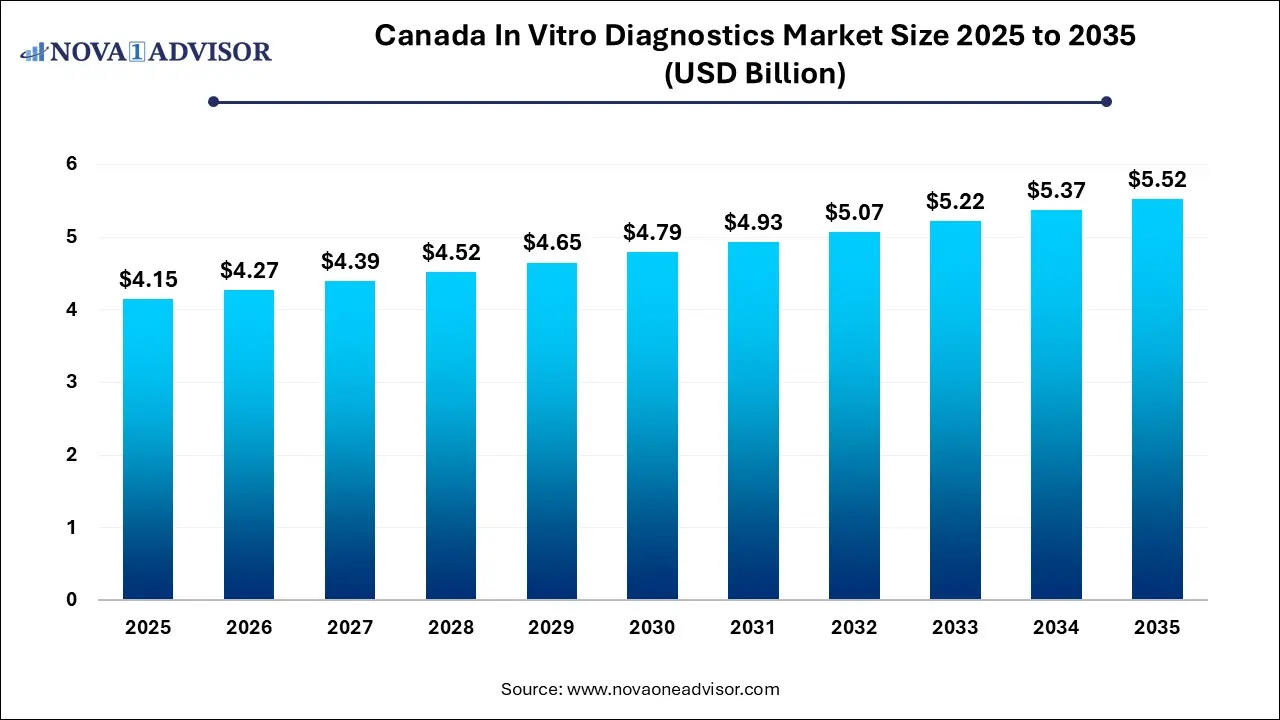

Canada In Vitro Diagnostics Market Size and Growth

The Canada in vitro diagnostics market size was exhibited at USD 4.15 billion in 2025 and is projected to hit around USD 5.52 billion by 2035, growing at a CAGR of 2.9% during the forecast period 2026 to 2035.

Canada In Vitro Diagnostics Market Key Takeaways:

- Based on product, the reagents segment dominated the Canada IVD market with a revenue share of 63.07% in 2025

- The instruments segment held the second largest share in 2025.

- The molecular diagnostics segment held the largest market share of 26.39% in 2025.

- The coagulation segment is expected to witness the fastest CAGR over the forecast period.

- In 2025, the infectious disease segment held the largest market share of 58.37%.

- The oncology segment is expected to experience the fastest growth during the forecast period.

- Laboratories held the largest share of 58.69% of the Canada IVD market in 2025.

- The home care segment, on the other hand, is expected to experience the fastest growth rate during the forecast period.

- The hospitals segment held the largest market share of 35.0% in 2025

- The home-care segment is expected to witness a robust growth rate during the forecast period.

- The Ontario province dominated the Canada IVD market with a revenue share of 31.39% in 2025.

- East Canada is expected to register the fastest growth rate during the forecast period.

Market Overview

The Canada In Vitro Diagnostics (IVD) Market has become a cornerstone of the country’s healthcare landscape, driven by the increasing emphasis on early disease detection, chronic disease management, and precision medicine. IVDs are non-invasive tests performed on biological samples such as blood, urine, or tissues to detect diseases, monitor conditions, and assess overall health. They range from basic laboratory tests to sophisticated molecular diagnostics used in oncology and infectious disease detection.

Canada, with its publicly funded healthcare system and emphasis on preventive healthcare, has fostered a growing demand for IVD solutions. The Canadian healthcare system places a high premium on evidence-based decision-making, and diagnostic tools play a central role in this model. Post-COVID-19, the importance of diagnostics has been underscored, with rapid testing, molecular diagnostics, and decentralized testing gaining traction. Furthermore, the adoption of digital tools, AI-based diagnostics, and automated laboratory systems is elevating efficiency and clinical outcomes across Canadian provinces.

The market is well-supported by Health Canada’s regulatory oversight, ensuring test safety and efficacy. Provincial health authorities and private diagnostic providers collectively contribute to test accessibility across urban and rural populations. Rising health awareness, aging demographics, and a strong innovation ecosystem make Canada an attractive ground for IVD investments and advancements.

Major Trends in the Market

-

Decentralization of Diagnostics: Shift from centralized labs to point-of-care and home testing, especially for chronic disease monitoring and infectious diseases.

-

Digital and AI Integration: Use of machine learning and AI in diagnostics for image analysis, data interpretation, and predictive diagnostics.

-

Rising Use of Molecular Diagnostics: Increasing use of PCR, RT-PCR, and NGS in infectious disease testing, cancer screening, and genetic disorders.

-

Lab Automation: Automation in clinical chemistry, hematology, and immunoassay labs is reducing turnaround times and improving throughput.

-

Personalized Diagnostics: Rise of companion diagnostics and pharmacogenomics supporting individualized treatment plans.

-

Regulatory Reforms: Health Canada’s alignment with global regulatory frameworks (like FDA and EMA) is streamlining test approvals.

-

Expansion of Home Testing Kits: Growth in consumer-oriented test kits for glucose, cholesterol, STIs, and COVID-19 has increased self-care adoption.

Report Scope of Canada In Vitro Diagnostics Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 4.27 Billion |

| Market Size by 2035 |

USD 5.52 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 2.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

By Product, By Technology, By Application, By End-use, By Test Location, By Province |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Key Companies Profiled |

Abbott, Bio-Rad Laboratories, Inc, F. Hoffmann-La Roche Ltd, BD, and bioMérieux SA among others |

Canada In Vitro Diagnostics Market By Product Insights

Reagents dominated the Canadian IVD market, accounting for the largest share due to their recurring use in routine diagnostic processes. They are essential for executing tests in immunoassays, molecular diagnostics, hematology, and microbiology. Reagents offer high margins for manufacturers and represent a stable source of revenue due to repeat demand from laboratories and hospitals. With increasing test volumes, particularly in diabetes and infectious disease management, reagent consumption continues to rise steadily.

Services are the fastest-growing segment, particularly those involving diagnostic interpretation, test management, and data integration. With the expansion of laboratory informatics and AI-enabled diagnostic tools, service providers now offer packaged solutions beyond raw test execution ranging from digital pathology to predictive analytics. These services appeal to both urban hospitals and remote health centers seeking diagnostic insights without on-site expertise.

Canada In Vitro Diagnostics Market By Technology Insights

Immunoassays dominate the technology segment, widely used for detecting infectious diseases, hormone levels, cardiac markers, and cancer antigens. ELISA and chemiluminescence assays are routinely performed in both public and private labs across Canada. Their sensitivity, specificity, and automation compatibility have made them the workhorse of diagnostic labs.

Molecular diagnostics are the fastest-growing, driven by the demand for precision diagnostics in cancer, genetic diseases, and infectious outbreaks. Techniques like PCR and next-generation sequencing are now commonplace in advanced labs, and COVID-19 greatly expanded their adoption across Canada. Moreover, public health labs in provinces like Ontario and Quebec are investing in molecular infrastructure for syndromic panels and multiplex pathogen detection.

Canada In Vitro Diagnostics Market By Application Insights

Infectious disease testing remains the dominant application, given ongoing surveillance for pathogens such as HIV, hepatitis, tuberculosis, influenza, and COVID-19 variants. The widespread adoption of rapid antigen and molecular tests during the pandemic has carried over into broader respiratory and sexually transmitted infection screening protocols.

Oncology is the fastest-growing application, reflecting the expansion of cancer screening programs and the integration of molecular diagnostics into treatment decision-making. Liquid biopsy and biomarker-driven cancer detection platforms are being piloted in Canada, especially in urban tertiary care centers. Genomic profiling of tumors is increasingly used to guide therapy, requiring precise, high-sensitivity diagnostic tools.

Canada In Vitro Diagnostics Market By Test Location Insights

Laboratories remain the primary test location, handling centralized, high-throughput processing for a variety of conditions. Canada has a robust network of hospital labs, private labs (e.g., LifeLabs), and reference labs that manage complex diagnostic workflows.

Point-of-care (POC) testing is the fastest-growing, especially in clinics, pharmacies, and emergency settings. The need for rapid diagnostics in managing chronic conditions and acute infections is driving adoption of POC devices. Provinces like British Columbia and Alberta have integrated POC devices in primary care to reduce patient wait times and hospital admissions.

Canada In Vitro Diagnostics Market By End-use Insights

Hospitals dominate in terms of test volumes, with centralized labs processing a wide range of diagnostics for inpatients and outpatients. These facilities typically house advanced analyzers for immunology, hematology, and molecular diagnostics, and are fully integrated into Canada’s public healthcare model.

Home care is the fastest-growing end-use segment, bolstered by the availability of self-testing kits and telehealth support. Blood glucose monitors, ovulation predictors, cholesterol test kits, and COVID-19 rapid antigen tests are widely used by consumers. The trend is supported by pharmacy chains and digital health platforms that enable remote patient monitoring and test fulfillment.

Country-Level Analysis

Canada’s IVD market is shaped by a combination of federal oversight and provincial healthcare delivery. Health Canada regulates the approval of diagnostic tests through its Medical Devices Bureau, ensuring safety and performance. At the provincial level, Ministries of Health fund diagnostic services based on clinical need and cost-effectiveness.

Ontario and Quebec lead in test volume and infrastructure, supported by academic research centers and large hospital networks. Western Canada, especially Alberta and British Columbia, is actively integrating digital health tools, AI diagnostics, and remote testing services. Eastern Canada, though smaller in population, is seeing growth in outreach diagnostics and telehealth-linked services to serve remote communities. Investments in genomics (e.g., Genome Quebec, BC Cancer Agency) and public-private collaborations are fostering innovation across provinces.

Some of the prominent players in the Canada in vitro diagnostics market include:

- Abbott

- bioMérieux SA

- Bio-Rad Laboratories, Inc

- Siemens Healthcare GmbH

- QIAGEN

- Quidel Corporation

- F. Hoffmann-La Roche Ltd

- BD

- Danaher

- Agilent Technologies, Inc

Recent Developments

-

In March 2025, LifeLabs expanded its molecular diagnostics service offering in Ontario with a new multiplex PCR respiratory panel for RSV, COVID-19, and influenza.

-

BioSyent Inc., a Canadian healthcare company, launched a digital platform in April 2025 to distribute at-home diagnostic kits for cholesterol and fertility testing nationwide.

-

In February 2025, Roche Diagnostics Canada received Health Canada approval for its AI-integrated immunohistochemistry system for breast cancer biomarker analysis.

-

Dynacare, a leading Canadian lab services provider, introduced a remote sample collection service in January 2025 to support rural and mobility-challenged patients in Saskatchewan and Manitoba.

-

In May 2025, Abbott Canada began local manufacturing of rapid antigen tests in collaboration with a Montreal-based partner to enhance supply chain resilience.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Canada in vitro diagnostics market

By Product

- Instruments

- Reagents

- Services

By Technology

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

-

- Instruments

- Reagents

- Services

By Application

- Infectious Diseases

- Diabetes

- Oncology

- Cardiology

- Nephrology

- Autoimmune Diseases

- Drug Testing

- Others

By End-use

- Hospitals

- Primary Care

- Laboratories

- Home Care

- Others

By Test Location

- Point of Care (POC)

- Home Care

- Laboratories

By Province

- Quebec

- Ontario

- West Canada

-

- Alberta

- Saskatchewan

- Manitoba

- British Columbia

-

- Nova Scotia

- Prince Edward Island

- New Brunswick

- Newfoundland and Labrador