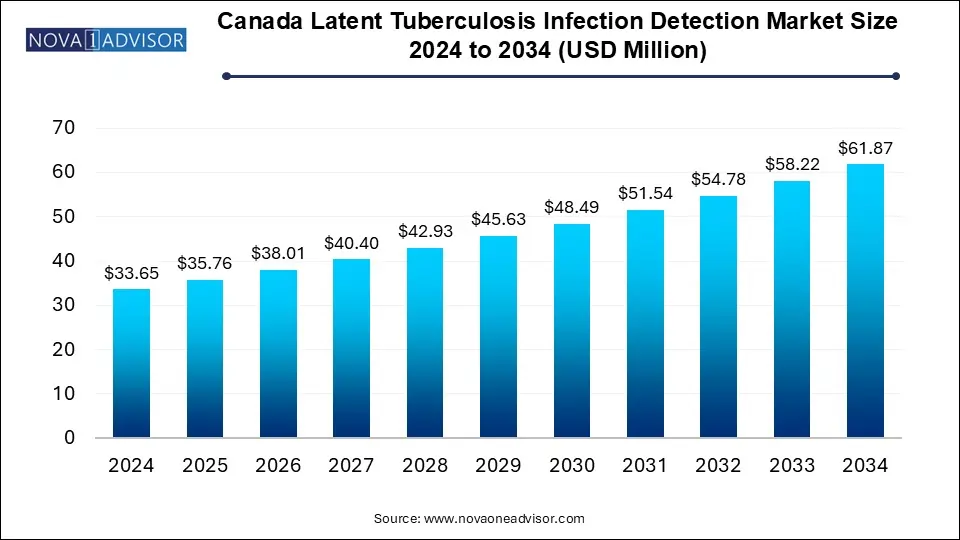

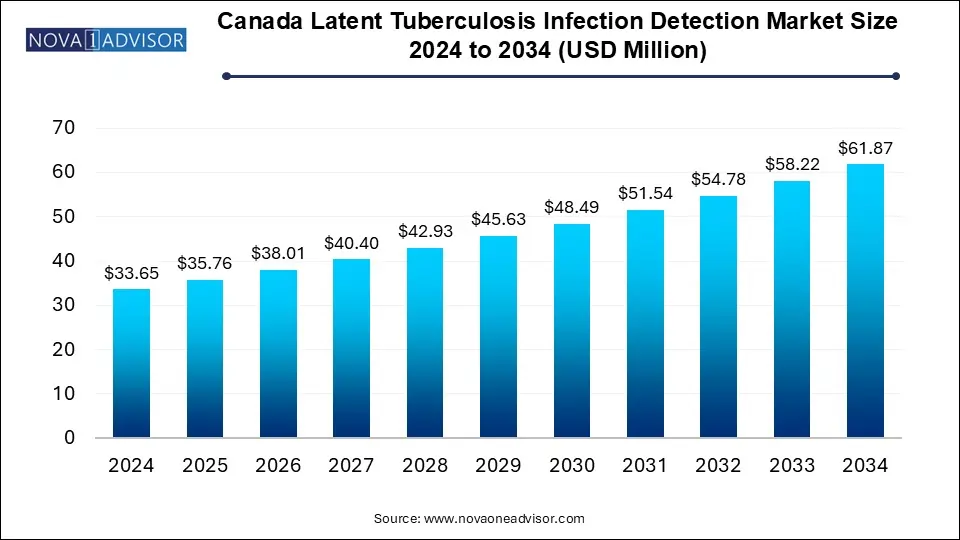

The Canada latent tuberculosis infection detection market size was estimated at USD 33.65 million in 2024 and is expected to hit around USD 61.87 million by 2034, poised to reach at a notable CAGR of 6.28% during the forecast period 2025 to 2034.

Key Takeaways:

- The interferon gamma release assays (IGRA) segment dominated the market with a revenue share of 55.42% in 2024

- The diagnostic laboratories segment dominated the Canada latent tuberculosis infection (LTBI) detection market, having 51.0% share

- Ontario province led the market with a market share of 17.99% in 2024

Market Overview

Latent Tuberculosis Infection (LTBI) is a non-contagious condition where individuals carry the Mycobacterium tuberculosis bacteria without manifesting active disease symptoms. However, they remain at risk of developing active tuberculosis (TB) later in life, especially if they are immunocompromised. Canada, though considered a low-incidence country for TB, still sees a persistent burden of LTBI particularly among immigrants, Indigenous populations, and people with comorbidities such as HIV and diabetes.

The LTBI detection market in Canada has gained strategic importance due to national TB elimination goals set by provincial and federal health authorities. It serves as a critical pillar of preventive health strategies. The market primarily consists of diagnostic tools like the Tuberculin Skin Test (TST) and Interferon Gamma Release Assays (IGRAs), both widely used in community screening, occupational health, immigration services, and outbreak management.

Factors such as rising immigration rates, health surveillance in correctional facilities, and public health mandates have led to an uptick in LTBI detection efforts. Moreover, advancements in IGRA technology, coupled with improved healthcare access and data integration, are creating a more conducive environment for robust screening programs.

Major Trends in the Market

-

Transition from TST to IGRA: Due to higher specificity, IGRAs are increasingly being adopted, especially in settings where BCG vaccination is common.

-

Indigenous Health Screening Programs: Provincial efforts targeting TB prevention in Indigenous communities are expanding LTBI detection services.

-

Immigration-Linked TB Screening: Canada’s immigration health assessment includes TB testing, creating a steady demand for LTBI detection.

-

Point-of-Care Diagnostic Innovations: Efforts to develop portable and rapid TB screening tools are ongoing to facilitate rural healthcare outreach.

-

Public Health and Academic Partnerships: Collaborations between universities, labs, and governments are driving LTBI research and pilot programs.

-

Health IT and Reporting Integration: Provinces are modernizing reporting systems to track LTBI cases, improving follow-up and treatment linkage.

-

Workplace Screening Programs: Employers in healthcare, correctional services, and long-term care are adopting routine LTBI screening for staff safety.

Report Scope of Canada Latent Tuberculosis Infection Detection Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 35.76 Million |

| Market Size by 2034 |

USD 61.87 Million |

| Growth Rate From 2025 to 2034 |

CAGR of 6.28% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Test Type, End-use, Province |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

Alberta, British Columbia, Manitoba, New Brunswick, Nova Scotia, Ontario, Prince Edward Island, Quebec, Saskatchewan, Northwest Territories, Nunavut, Yukon, Newfoundland & Labrador |

| Key Companies Profiled |

F. Hoffmann-La Roche Ltd, Abbott, QIAGEN, BD (Becton, Dickinson, and Company), bioMérieux SA., Oxford Immunotec USA, Inc., ARKRAY, Inc |

Market Driver: Government-Supported LTBI Elimination Programs

A strong driver in the Canadian LTBI detection market is the national and provincial government’s strategic commitment to TB elimination. Canada aims to reduce TB incidence to pre-elimination levels, and detecting latent infections is crucial to achieving this target. Programs such as the Pan-Canadian Framework for Action on TB Prevention and Control emphasize the need for proactive screening, especially in high-risk populations.

Public health initiatives like “Stop TB Canada” and provincial TB programs fund community testing drives, educational campaigns, and capacity building for labs and clinics. The integration of LTBI testing into immigration medical assessments further institutionalizes demand. Provincial health systems also subsidize or fully cover the cost of testing in priority populations, helping remove financial barriers to access. These coordinated efforts have made LTBI screening not just a diagnostic activity but a strategic national health priority.

Market Restraint: Limited Awareness and Access in Remote Areas

Despite government initiatives, a major restraint in Canada’s LTBI detection landscape is unequal awareness and access, particularly in remote, rural, and Indigenous communities. Many high-risk populations face systemic barriers to healthcare, such as transportation challenges, long wait times, or lack of culturally appropriate services. This often delays or prevents people from undergoing LTBI screening or follow-up treatment.

Additionally, awareness among general practitioners and non-specialist providers about current LTBI screening guidelines remains variable. This knowledge gap can result in under-testing or inappropriate selection of tests (e.g., reliance on TST where IGRA is preferred). Furthermore, the need for laboratory infrastructure and trained personnel for IGRA testing limits its scalability in under-resourced provinces and territories.

Market Opportunity: Integration of LTBI Testing with Primary Care and Digital Health

A notable market opportunity lies in integrating LTBI screening into routine primary care and digital health ecosystems. By embedding LTBI testing protocols into electronic health record (EHR) systems, clinicians can be automatically prompted to screen at-risk patients, including immigrants, the elderly, and individuals with immunosuppressive conditions.

Digital health tools can also streamline appointment scheduling, remote consultations, and result dissemination. For example, a patient flagged as at risk during a telemedicine appointment can be referred to a lab or mobile clinic for IGRA testing. Mobile health units equipped with rapid testing tools can expand coverage in underserved provinces and remote Indigenous communities. Investments in AI-powered decision support and population health analytics can further enhance screening effectiveness and treatment compliance.

Canada Latent Tuberculosis Infection Detection Market By Test Type Insights

The Tuberculin Skin Test (TST) continues to dominate Canada’s LTBI detection market, largely due to its widespread availability, low cost, and familiarity among healthcare professionals. Administered via an intradermal injection and assessed after 48–72 hours, TST has been the backbone of screening efforts for decades. It remains the preferred option in rural and remote settings, as it does not require specialized lab infrastructure. TST is also commonly used in occupational health protocols, immigration screening, and school health programs.

However, Interferon Gamma Release Assays (IGRAs) are the fastest-growing test type, especially in urban centers and hospital settings. IGRAs such as QuantiFERON-TB Gold and T-SPOT.TB offer higher specificity and do not produce false positives due to prior BCG vaccination an important factor for immigrants from high-TB-burden countries. These tests require only one patient visit and are often preferred in settings where follow-up for TST reading is unreliable. Laboratories in provinces like Ontario and British Columbia are increasingly adopting IGRA platforms for greater throughput and diagnostic accuracy.

Canada Latent Tuberculosis Infection Detection Market By End-use Insights

Hospitals and clinics represent the dominant end-use segment, as LTBI screening is often initiated in these settings, especially among patients undergoing pre-immunosuppressive therapy, surgery, or other risk-assessment evaluations. These institutions are typically integrated with provincial health systems, allowing direct access to government-funded screening programs and in-house testing capabilities. Large hospitals also participate in public health surveillance and clinical trials, making them major LTBI detection hubs.

Diagnostic laboratories are the fastest-growing end-use segment, driven by the decentralization of testing and increased outsourcing by healthcare providers. Labs like LifeLabs and Dynacare have expanded their presence in urban and suburban markets, offering both TST and IGRA testing. These labs also handle occupational health screening for corporations and long-term care facilities. Their role has become more prominent as telehealth providers partner with them to streamline patient referrals and follow-up workflows.

Country-Level Analysis – Canada

Canada's nationwide strategy for tuberculosis elimination has given a structured boost to the LTBI detection market. While the country reports a relatively low incidence of active TB—about 5 per 100,000 population—the prevalence of LTBI is estimated to be much higher, especially in key populations such as immigrants from high TB-endemic regions, Indigenous communities, healthcare workers, and immunocompromised individuals.

The provinces of Ontario, British Columbia, and Quebec lead the market in terms of test volumes and infrastructure. Ontario's health insurance program (OHIP) covers LTBI screening for most high-risk groups, and its network of public health labs supports widespread IGRA testing. British Columbia has invested in Indigenous health outreach programs, and its provincial TB strategy includes robust LTBI management protocols. Quebec maintains a strong surveillance system and is active in integrating LTBI screening with newcomer health assessments.

Smaller provinces like Manitoba, Saskatchewan, and Alberta are addressing TB prevalence in rural Indigenous communities, while territories such as Nunavut and Northwest Territories report some of the highest TB rates in the country, necessitating targeted LTBI detection efforts. Mobile testing units, nurse-led outreach, and tele-laboratory solutions are increasingly being deployed to overcome logistical barriers in these regions.

Key Companies & Market Share Insights

Key players are adopting strategies such as new product development, merger & acquisition, partnership, and awareness campaign to increase their market share in the country. For instance, in March 2023, QIAGEN actively embraced the theme of "The Stop TB Partnership" for World TB Day by organizing a 24-hour event dedicated to raising awareness about tuberculosis. Additionally, the company is consistently undertaking initiatives to enhance healthcare services for screening tuberculosis infections, thereby demonstrating their commitment to improving tuberculosis detection and management. Some prominent players in the Canada latent tuberculosis infection detection market include:

- Abbott

- QIAGEN

- F. Hoffmann-La Roche Ltd

- ARKRAY, Inc

- Oxford Immunotec USA, Inc.

- BD (Becton, Dickinson, and Company)

- BIOMÉRIEUX

Recent Developments

-

March 2025: Ontario’s Ministry of Health announced an expanded partnership with Dynacare and LifeLabs to implement IGRA-based LTBI screening across long-term care homes and shelters in Toronto and Ottawa.

-

January 2025: QuantiFERON-TB Gold Plus received Health Canada’s expanded approval for use in pediatric populations, enabling broader application in school health and immigration screening.

-

November 2024: The Canadian Institutes of Health Research (CIHR) awarded funding to a cross-provincial academic consortium to evaluate AI-based decision-support tools for LTBI screening in primary care.

-

September 2024: Public Health Agency of Canada (PHAC) published new national guidelines for TB prevention, emphasizing integration of IGRA into immigration medical exams and correctional facility screenings.

-

June 2024: Nunavut launched a community-wide LTBI screening initiative using mobile testing vans equipped with IGRA diagnostic platforms, in partnership with Indigenous Services Canada.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2018 to 2032. For this study, Nova one advisor, Inc. has segmented the Canada Latent Tuberculosis Infection Detection market.

By Test Type

- Tuberculin Skin Test

- Interferon Gamma Release Assays

By End-use

- Diagnostic Laboratories

- Hospitals/Clinics

- Academic and Research Institutions

By Province

- Alberta

- British Columbia

- Manitoba

- New Brunswick

- Nova Scotia

- Ontario

- Prince Edward Island

- Quebec

- Saskatchewan

- Northwest Territories

- Nunavut

- Yukon

- Newfoundland & Labrador