Cancer Immunotherapy Market Size and Trends 2026 to 2035

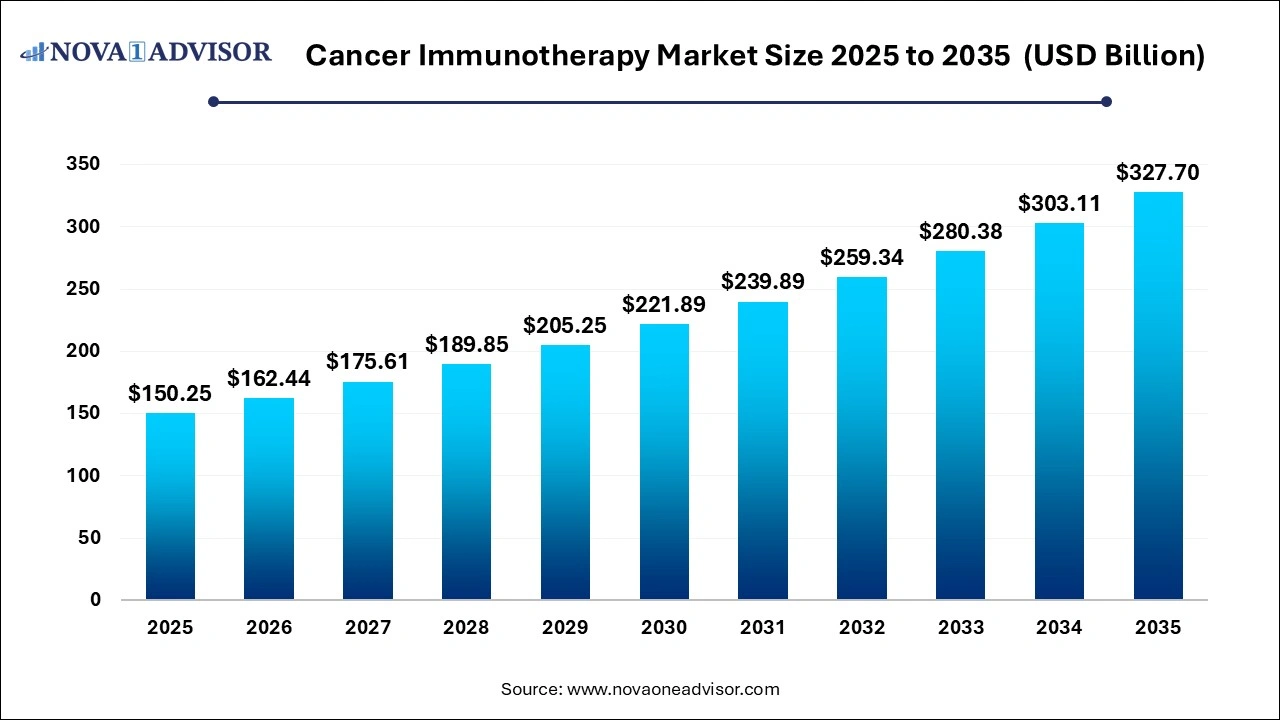

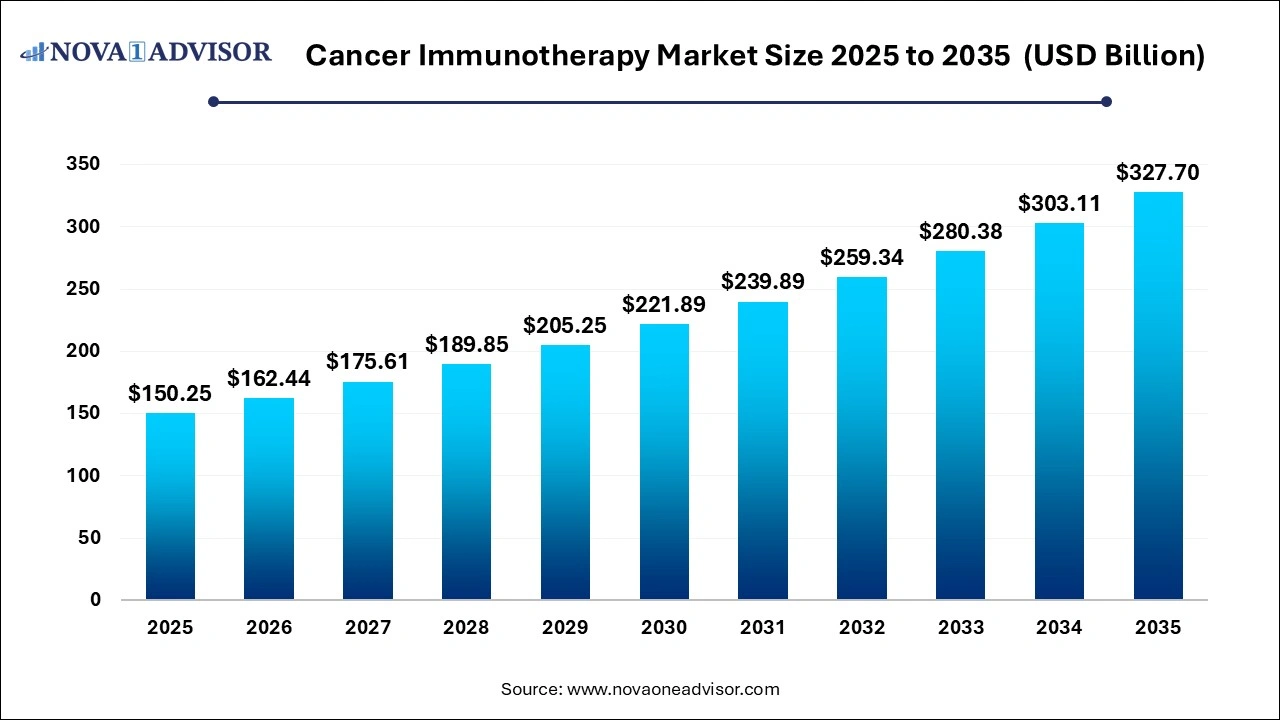

The global cancer immunotherapy market size was valued at USD 150.25 billion in 2025 and is projected to surpass around USD 327.7 billion by 2035, registering a CAGR of 8.11% over the forecast period of 2026 to 2035.

Cancer Immunotherapy Market Key Takeaways

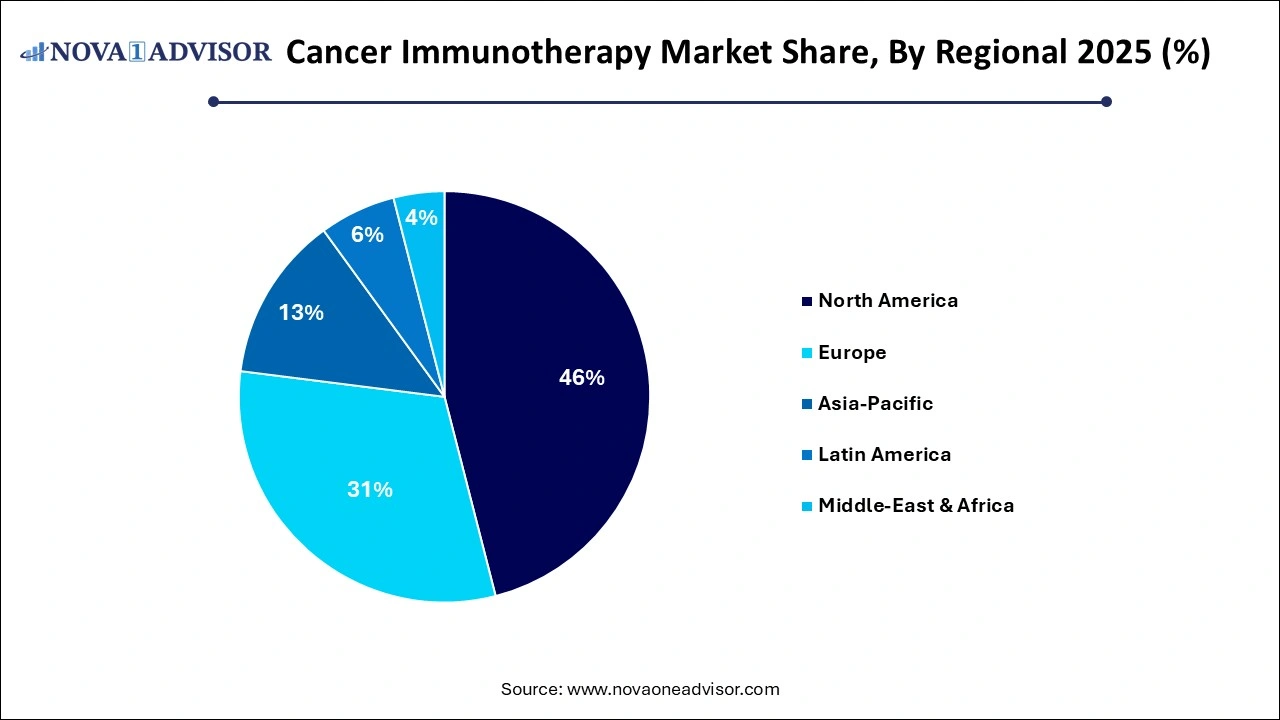

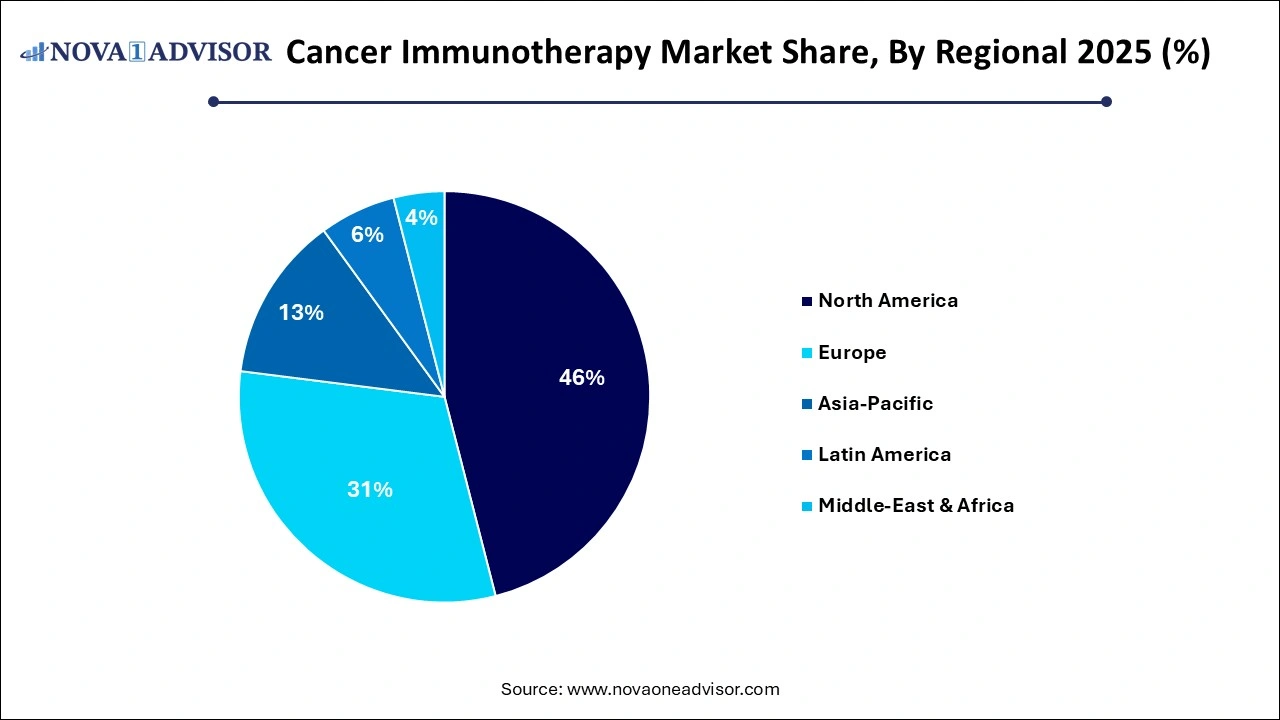

- North America dominated the market and accounted for 45.11% share in 2025.

- Asia Pacific is anticipated to witness the fastest CAGR in the global market

- Hospital Pharmacy segment dominated the market in 2025.

- Online pharmacy segment is estimated to register a significant CAGR over the forecast period.

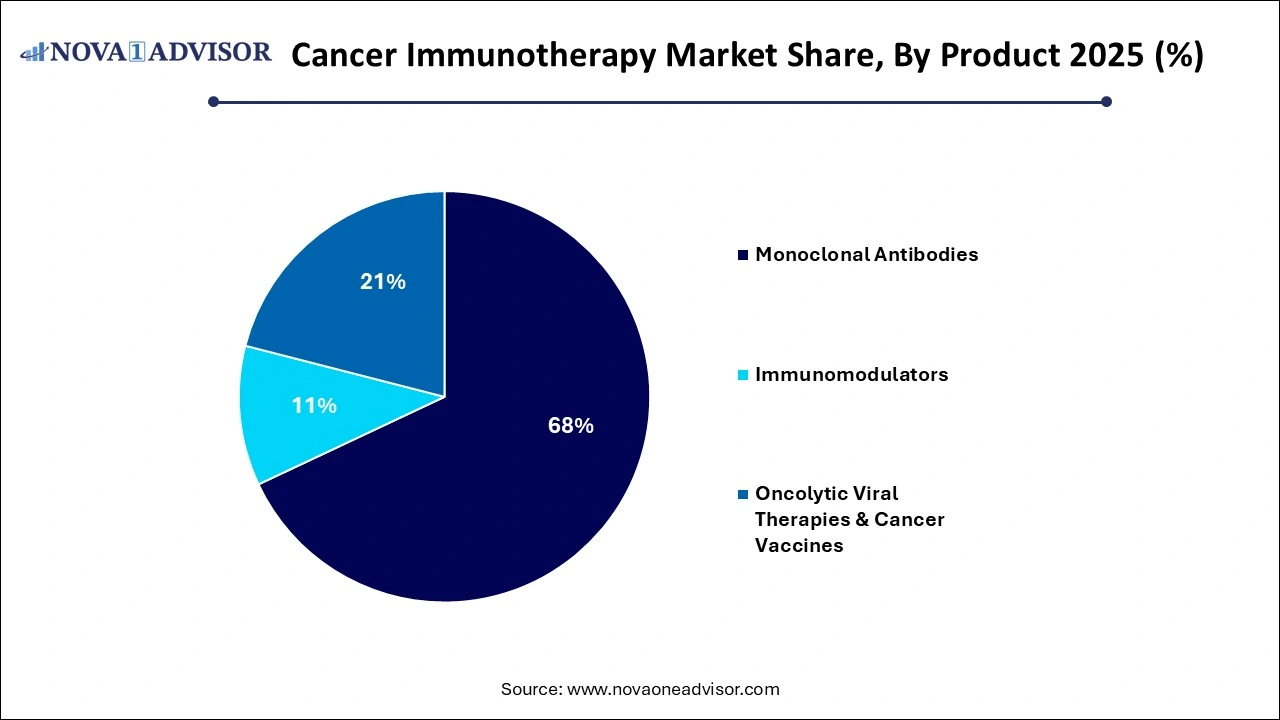

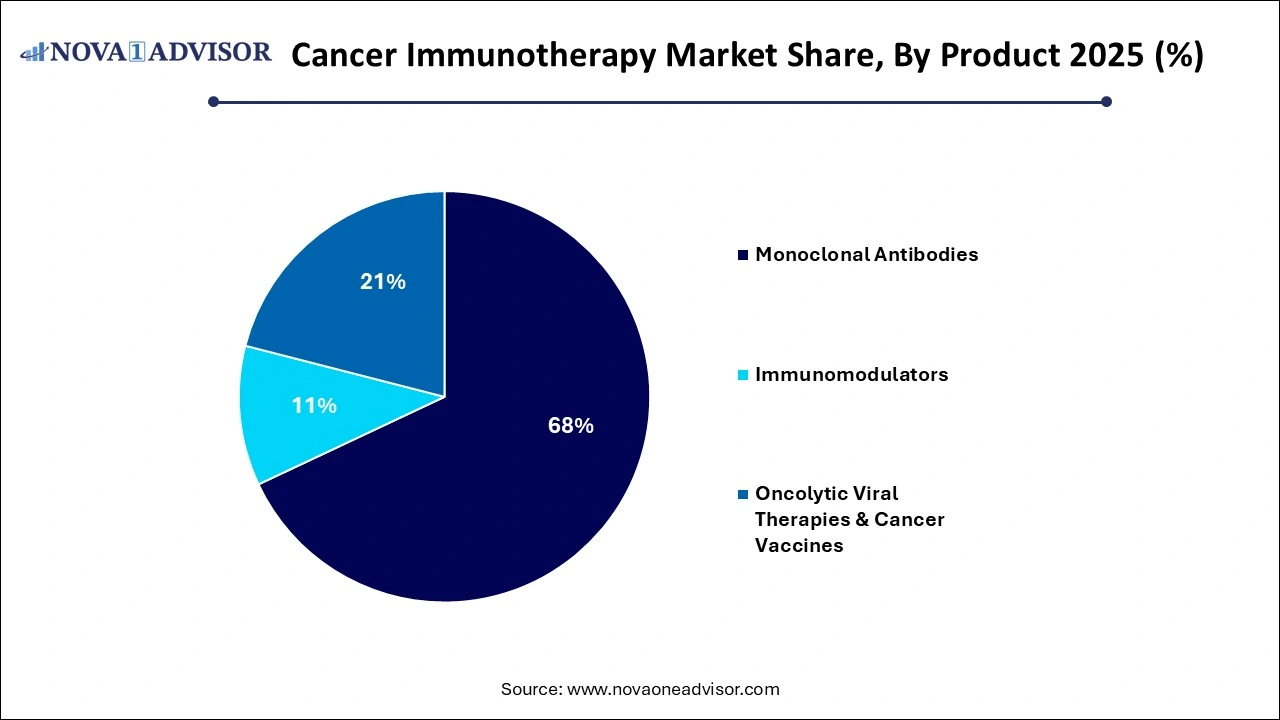

- Monoclonal Antibodies segment led the market and accounted for the largest revenue share of 67.11% in 2025.

- Oncolytic Viral Therapies and Cancer Vaccines is anticipated to witness a significant market growth over the forecast period.

- Lung Cancer segment accounted for the largest revenue share in 2025.

- Breast Cancer segment is estimated to register a significant CAGR over the forecast period.

- Hospitals & Clinics segment accounted for the largest revenue share in 2025.

- Cancer Research Centers segment is estimated to register a significant CAGR over the forecast period.

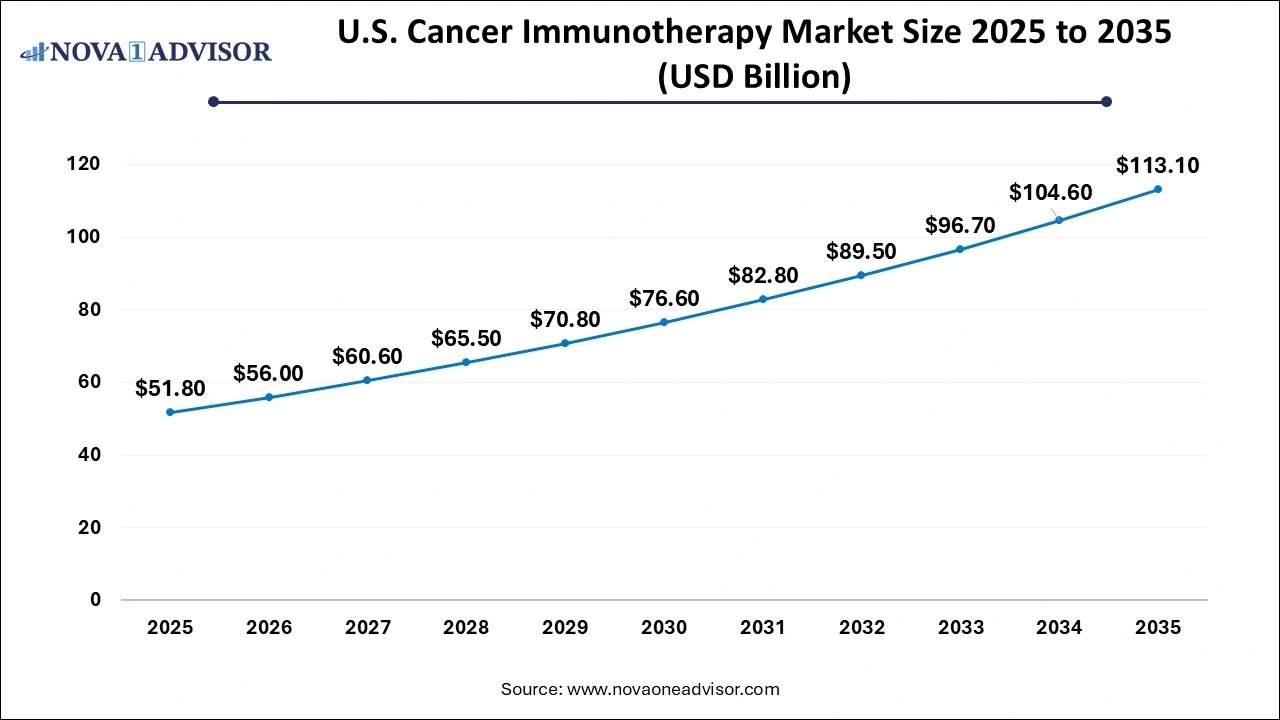

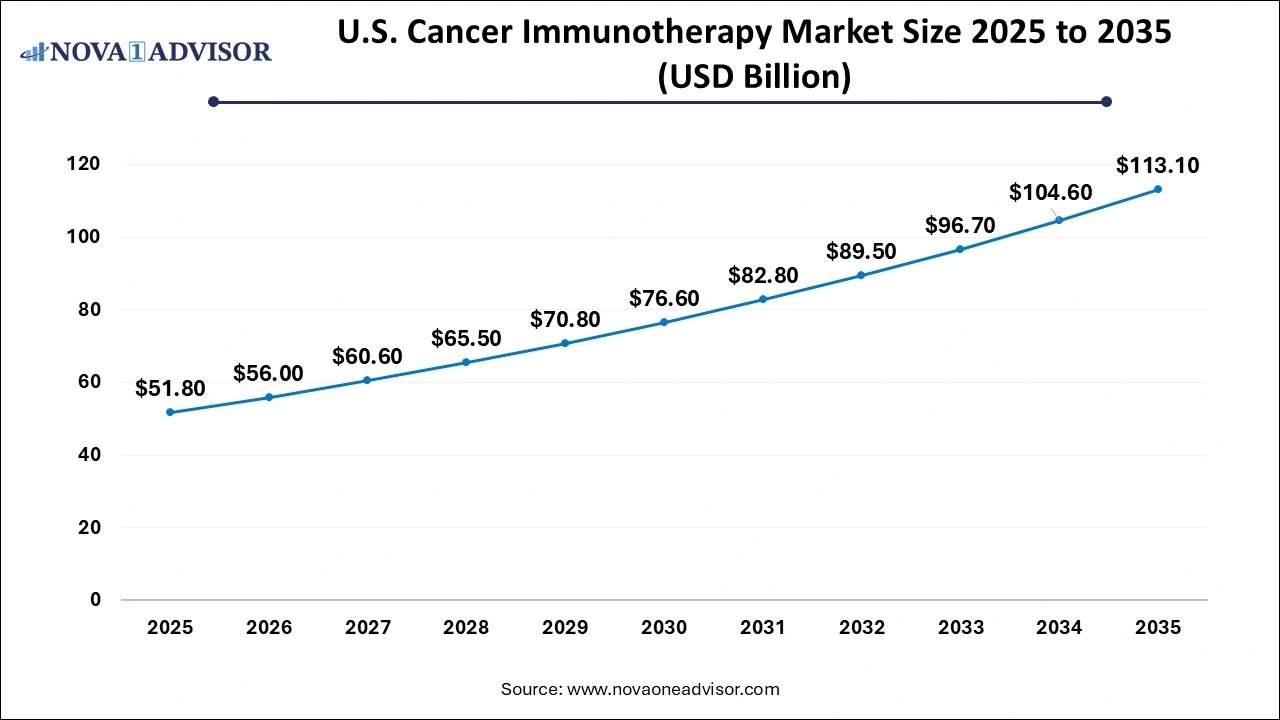

U.S. Cancer Immunotherapy Market Size and Growth 2026 to 2035

The U.S. Cancer Immunotherapy market size was valued at USD 51.8 billion in 2025 and is anticipated to reach around USD 113.1 billion by 2035, growing at a CAGR of 7.36% from 2026 to 2035.

North America leads the cancer immunotherapy market, owing to its advanced healthcare infrastructure, high cancer incidence, favorable reimbursement policies, and strong R&D ecosystem. The United States is home to several key players including Merck, Bristol-Myers Squibb, and Amgen, and hosts a large proportion of global oncology clinical trials. The FDA’s expedited approval pathways and support for orphan drug designations have accelerated the availability of immunotherapies.

In Canada, increasing awareness, supportive provincial healthcare programs, and early access to biosimilars are boosting uptake. The widespread availability of companion diagnostics and genomic profiling tools further strengthens North America’s dominance.

Asia-Pacific is the fastest-growing region, driven by rising cancer incidence, improving healthcare access, and government support for innovation. Countries like China, Japan, South Korea, and India are investing heavily in local drug development and clinical infrastructure. For instance, China’s regulatory reforms have streamlined oncology drug approvals, leading to a surge in domestic and multinational clinical trials.

Additionally, local biopharma companies are developing their own immunotherapy pipelines, such as Innovent Biologics, BeiGene, and Hengrui. The rising use of combination therapies, increasing insurance coverage, and adoption of digital health tools are contributing to the region’s rapid growth.

Cancer Immunotherapy Market Overview

The Cancer Immunotherapy Market represents a paradigm shift in oncology, where treatment is designed not merely to kill cancer cells directly, but to empower the patient’s own immune system to fight malignancies more effectively and durably. This market is evolving rapidly due to technological advancements, deepening biological insights, and growing investments in personalized medicine.

Cancer immunotherapy encompasses a broad spectrum of treatments including monoclonal antibodies, checkpoint inhibitors, cancer vaccines, oncolytic viral therapies, and immunomodulators. Unlike traditional chemotherapy and radiation, which indiscriminately target dividing cells, immunotherapy offers the promise of selective, targeted, and often long-lasting responses, even in advanced cancers. Success stories such as immune checkpoint inhibitors for melanoma, NSCLC (non-small cell lung cancer), and renal cell carcinoma have set new standards of care and opened the door to broader clinical adoption.

The global burden of cancer continues to rise, with over 19 million new cases and nearly 10 million deaths reported in 2023, according to the World Health Organization. This creates a massive demand for novel, effective treatment approaches. Immunotherapy is increasingly integrated into first-line and adjuvant treatment regimens across various tumor types. Additionally, next-generation immunotherapies such as CAR-T cell therapies and bispecific T-cell engagers are entering clinical practice and accelerating market growth.

The competitive landscape is dynamic and driven by leading pharmaceutical giants (e.g., Bristol-Myers Squibb, Merck, Roche, Novartis) as well as innovative biotech startups focusing on tumor microenvironment modulation, T-cell engineering, and personalized neoantigen vaccines. Regulatory support, favorable reimbursement frameworks in developed markets, and increased research funding are fueling R&D pipelines and facilitating rapid commercialization.

Major Trends in the Cancer Immunotherapy Market

-

Rise of Checkpoint Inhibitors: Anti-PD-1, PD-L1, and CTLA-4 therapies have become standard treatments for several cancers and are expanding to new indications.

-

Combination Therapy Dominance: Immunotherapy is increasingly used in combination with chemotherapy, targeted therapies, and radiation to enhance efficacy and overcome resistance.

-

Emergence of Personalized Immunotherapy: Neoantigen vaccines, tumor-infiltrating lymphocyte (TIL) therapies, and adoptive cell transfer are enabling tailored treatments.

-

CAR-T and Cell Therapy Expansion: Originally approved for hematologic malignancies, CAR-T therapies are being developed for solid tumors with next-gen platforms.

-

Development of Cancer Vaccines and Oncolytic Viruses: Therapeutic vaccines (e.g., for prostate, melanoma) and viral vectors are being researched as adjunct or standalone treatments.

-

Biomarker-Driven Patient Selection: Use of PD-L1, TMB (tumor mutational burden), and MSI (microsatellite instability) as predictive biomarkers is guiding treatment decisions.

-

Digital and AI-Driven Drug Discovery: AI platforms are being deployed for immunotherapy target identification, patient stratification, and trial design optimization.

-

Global Clinical Trials Expansion: Growth of multi-regional trials in Asia-Pacific and Latin America is accelerating immunotherapy availability in emerging markets.

Cancer Immunotherapy Market Report Scope

| Report Attribute |

Details |

| Market Size in 2026 |

USD 162.44 Billion |

| Market Size by 2035 |

USD 327.7 Billion |

| Growth Rate From 2024 to 203 |

CAGR of 8.11% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

Product, application, distribution, end-use, region |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Pfizer Inc.; AstraZeneca; Merck & Co. Inc; F. Hoffmann-La Roche Ltd; Bristol-Myers Squibb Company; Novartis AG; Lilly; Johnson & Johnson Services, Inc; Immunocore, Ltd |

Market Driver: Increasing Cancer Incidence and Need for Durable Therapeutic Outcomes

A key driver for the cancer immunotherapy market is the rising global burden of cancer and the need for effective, durable, and less toxic treatments. Traditional cancer treatments often yield temporary responses and significant adverse effects. Immunotherapies, by contrast, offer the potential for long-term remission and improved quality of life.

For example, checkpoint inhibitors like nivolumab (Opdivo) and pembrolizumab (Keytruda) have demonstrated significant survival benefits in cancers like melanoma, lung, and renal carcinoma. These therapies have now become part of standard clinical protocols globally. Furthermore, the success of CAR-T therapies like Yescarta and Kymriah in treating refractory blood cancers illustrates the transformative potential of immune-based treatments, which are now being explored for solid tumors as well.

As patient awareness, access to diagnostics, and availability of immunotherapies increase, the demand for such novel treatments will continue to rise, driving market expansion globally.

Market Restraint: High Treatment Costs and Accessibility Barriers

Despite its promise, a significant restraint in the cancer immunotherapy market is the high cost of treatment, which limits accessibility, particularly in low- and middle-income countries. Leading checkpoint inhibitors and CAR-T therapies can cost $100,000–$500,000 per treatment course, not including diagnostic tests and supportive care.

Furthermore, these therapies often require specialized infrastructure and trained personnel, especially for cell-based treatments like CAR-T, which are currently limited to select academic and high-tier hospitals. Variability in reimbursement policies, especially for off-label uses or combination therapies, also hampers market penetration.

Efforts are underway to reduce manufacturing costs through automation, allogeneic cell platforms, and biosimilar development. However, cost-related challenges continue to constrain equitable access and limit the full potential of immunotherapy on a global scale.

Market Opportunity: Advancements in Tumor-Agnostic and Next-Generation Immunotherapies

A transformative opportunity in the cancer immunotherapy market lies in the development of tumor-agnostic therapies and next-gen immuno-oncology platforms. The approval of pembrolizumab for MSI-H and TMB-high tumors regardless of anatomical origin marked a new era of genomics-driven, tissue-agnostic cancer therapy.

Future opportunities are concentrated in next-gen approaches such as:

-

Personalized cancer vaccines (targeting tumor-specific neoantigens)

-

Bispecific antibodies (redirecting T cells to cancer cells)

-

Allogeneic (“off-the-shelf”) CAR-T cells

-

RNA-based cancer vaccines and immunomodulators

These platforms can significantly broaden the addressable patient pool, reduce manufacturing times, and enable tailored therapies based on tumor biology rather than location. As precision medicine and biomarker discovery evolve, these next-generation technologies will unlock new revenue streams and change the future of oncology.

Segmental Insights

By Distribution Insights

Hospital pharmacies dominate the distribution landscape, as most immunotherapies are administered in controlled clinical settings, especially for infusions and cell-based treatments. These centers ensure appropriate monitoring, handling, and reimbursement processes.

Online pharmacies and specialty distributors are growing, particularly for oral and subcutaneous immunotherapies that allow at-home administration. As more oral formulations (e.g., immunomodulatory agents) enter the market and digital health platforms expand, e-distribution is poised to capture a larger share, especially in developed regions.

By Product Insights

Monoclonal antibodies dominate the cancer immunotherapy market, owing to their widespread use, proven efficacy, and continued innovation in antibody engineering. These include immune checkpoint inhibitors (e.g., PD-1, PD-L1, CTLA-4) and targeted monoclonal antibodies that induce antibody-dependent cellular cytotoxicity (ADCC) or block tumor-promoting pathways. Drugs such as Keytruda, Opdivo, Tecentriq, and Imfinzi have become essential components in cancer treatment regimens and are approved for multiple indications globally.

Oncolytic viral therapies and cancer vaccines are the fastest-growing segments, driven by increasing investments in novel mechanisms and successful clinical trials. Products like T-VEC (Imlygic), an FDA-approved oncolytic herpes virus for melanoma, represent the early success of this approach. Several therapeutic vaccines (e.g., for prostate, pancreatic, and HPV-related cancers) are progressing through clinical pipelines. The promise of immune system training with fewer systemic side effects is fueling research interest in these innovative therapies.

By Application Insights

Lung Cancer segment accounted for the largest revenue share in 2023, the increasing prevalence of lung malignancies, growing awareness programs, increasing adoption of immunotherapy, and presence of a robust pipeline of investigational candidates are some of the key factors expected to drive the segment's growth. Furthermore, rising product approval and product launches are fueling the demand forward.For instance, in November 2023, the US Food and Drug Administration (FDA) granted marketing authorizations to Augtyro (Bristol, Inc.) for the treatment of locally refractory or metastatic Non-Small Cell Lung Cancer (NSCLC) with Repotrectinib.

Breast Cancer segment is estimated to register a significant CAGR over the forecast period. The high prevalence of the disease, ongoing research and development activities, and growing investments by leading players to develop novel therapeutics for breast malignancies are expected to accelerate segment expansion. For instance, in November 2023, AstraZeneca got FDA approval for their breast cancer drug capivasertib with fulvestrant.

By End Use Insights

Hospitals and clinics remain the primary end users, especially for administering high-complexity therapies and managing adverse effects. Oncology centers, academic hospitals, and cancer clinics are leading adopters of immunotherapy due to the availability of infrastructure and expert care teams.

Cancer research centers are the fastest-growing end-use segment, fueled by the surge in clinical trials, translational research, and personalized therapy development. These institutions are not only testing novel immunotherapies but also partnering with pharma companies for early-phase trials and biomarker development, thereby playing a central role in pipeline innovation.

Global Cancer Immunotherapy Market Recent Developments

-

March 2025: Bristol-Myers Squibb announced positive Phase III trial results for its combination of nivolumab and relatlimab in advanced melanoma, showing improved PFS over nivolumab monotherapy.

-

January 2025: Gilead Sciences and Arcus Biosciences reported clinical success in their anti-TIGIT antibody program, expanding checkpoint blockade strategies beyond PD-1.

-

November 2024: AstraZeneca received expanded FDA approval for Imfinzi in combination with chemotherapy for biliary tract cancers, marking its first use in gastrointestinal oncology.

-

September 2024: BioNTech initiated Phase II trials for its mRNA-based personalized cancer vaccine in colorectal and pancreatic cancer, signaling a shift in cancer vaccine development.

-

July 2024: Novartis launched a multi-center trial for its next-gen CAR-T therapy targeting HER2+ solid tumors, using an allogeneic platform to reduce production time.

Key Companies & Market Share Insights

- Pfizer Inc., AstraZeneca, and Merck & Co., Inc. are some of the dominant players operating in the global market.

- Pfizer, Inc. is engaged in discovery, development, manufacture, sales, and distribution of medical products across the world. Pfizer’s products range includes medicines, vaccines, and consumer goods

- Merck & Co., Inc. is a healthcare solutions provider that operates majorly operates in four segments: pharmaceutical, healthcare services, animal health, and alliances. It offers therapeutic products for asthma, hepatitis C, diabetes, cardiovascular diseases, HIV infections, fungal & intra-abdominal infections, osteoporosis, hypertension, and fertility issues

- Bristol-Myers Squibb Company, Novartis AG, and Immunocore, Ltd are some of the emerging market players functioning in the market.

- Novartis AG is a Swiss-based multinational company catering to pharmaceutical market. It is also involved in the R&D, manufacturing, and marketing of healthcare products

- Bristol-Myers Squibb (BMS) is a pharmaceutical company that manufactures and sells biopharmaceutical products across the globe. It manufactures products in several therapeutic areas, such as psychiatric disorders, cardiovascular disease, diabetes, HIV/AIDS, hepatitis, cancer, and rheumatoid arthritis and is headquartered in New York

Cancer Immunotherapy Market Top Key Companies:

Cancer Immunotherapy Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Cancer Immunotherapy market.

By Product

- Monoclonal Antibodies

- Immunomodulators

- Oncolytic Viral Therapies & Cancer Vaccines

By Application

- Lung Cancer

- Breast Cancer

- Colorectal Cancer

- Melanoma

- Prostate Cancer

- Head & Neck Cancer

- Ovarian Cancer

- Pancreatic Cancer

- Others

By Distribution Channel

- Hospital Pharmacy

- Retail Pharmacy

- Online Pharmacy

By End Use

- Hospitals & Clinics

- Cancer Research Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)