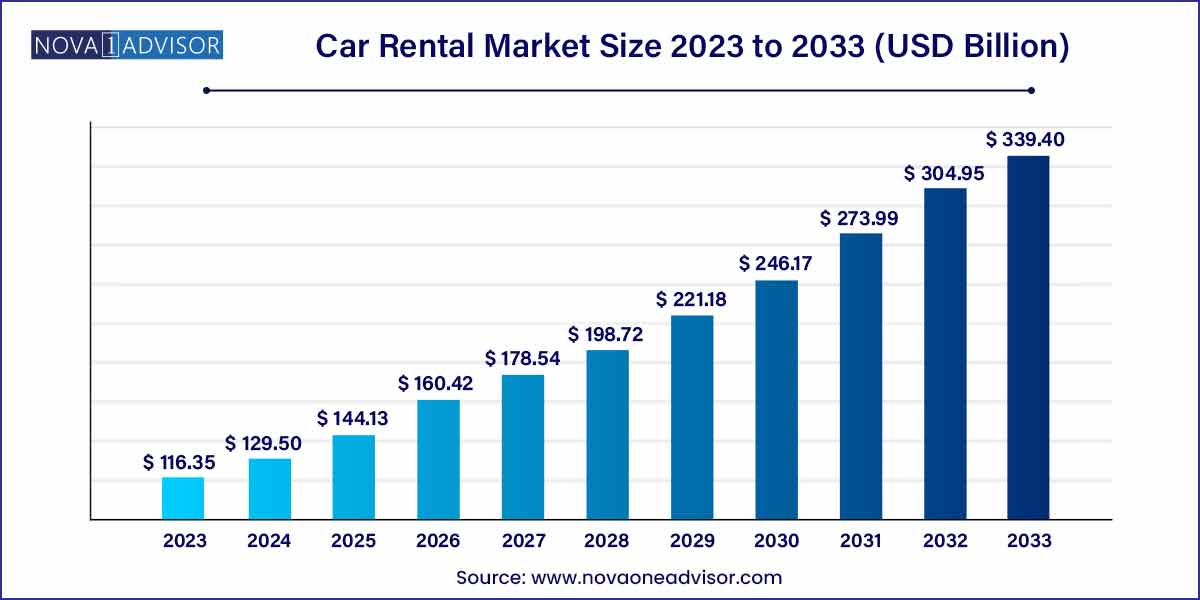

The global car rental market size was estimated at USD 116.35 billion in 2023 and is expected to surpass around USD 339.40 billion by 2033 and poised to grow at a compound annual growth rate (CAGR) of 11.3% during the forecast period of 2024 to 2033.

Key Takeaways:

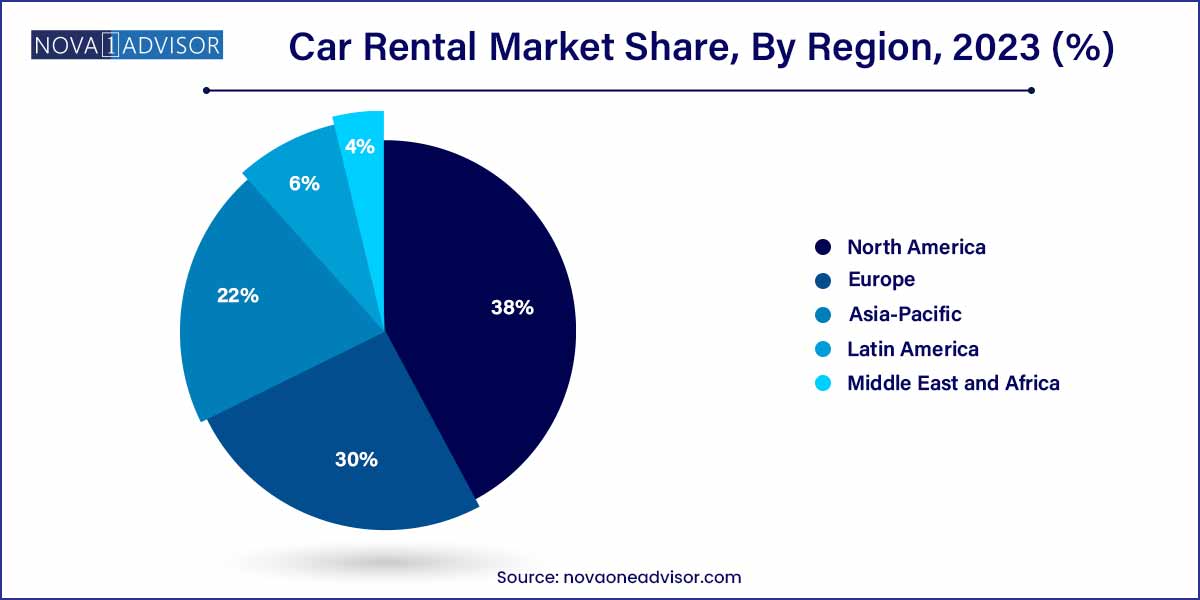

- North America dominated the market and accounted for the largest revenue share of 38.0% in 2023.

- The economy cars segment accounted for the largest revenue share of 33.1% in 2023.

- The airport transport segment held the largest revenue share of 40.0% in 2023.

Car Rental Market: Overview

The car rental industry serves as a vital component of the transportation sector, offering convenience, flexibility, and mobility to a diverse range of customers worldwide. This overview delves into key aspects shaping the car rental market, including market size, trends, challenges, and opportunities.

Car Rental Market Growth

The growth of the car rental market is fueled by several key factors. Firstly, the increasing preference for convenient and flexible transportation options, especially among travelers and urban dwellers, drives demand for rental vehicles. Secondly, the expansion of the travel and tourism industry, coupled with rising disposable incomes, contributes to higher rental volumes. Additionally, the advent of digital technologies has transformed the rental experience, making it more accessible and efficient for customers to book vehicles online or through mobile apps. Moreover, the growing awareness of environmental sustainability has led many rental companies to incorporate electric and eco-friendly vehicles into their fleets, attracting environmentally conscious consumers. Furthermore, the emergence of peer-to-peer rental platforms and the diversification of rental offerings present opportunities for market expansion. Overall, these factors converge to support the continued growth and evolution of the car rental industry globally.

Car Rental Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 116.35 Billion |

| Market Size by 2033 |

USD 339.40 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 11.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Vehicle Type, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

AVR Qatar, Inc.; Avis Budget Group, Inc.; Carzonrent India Pvt. Ltd.; Eco Rent A Car; Enterprise Holdings, Inc.; Europcar; Localiza; The Hertz Corporation; SIXT. |

Car Rental Market Dynamics

The car rental industry is undergoing a significant digital transformation, driven by technological advancements and changing consumer preferences. Online booking platforms, mobile apps, and self-service kiosks have become integral components of the rental process, offering customers greater convenience and flexibility. Digitalization streamlines reservation procedures, facilitates contactless transactions, and enables real-time fleet management, enhancing operational efficiency for rental companies. Moreover, data analytics and artificial intelligence enable personalized recommendations, pricing optimization, and predictive maintenance, improving the overall customer experience and driving business growth.

- Shift towards Sustainable Mobility:

Environmental sustainability has emerged as a significant driver shaping the car rental market dynamics. With growing concerns about carbon emissions and air quality, there is increasing demand for eco-friendly transportation options. Many car rental companies are responding to this trend by integrating electric, hybrid, and fuel-efficient vehicles into their fleets. By offering sustainable mobility solutions, rental companies appeal to environmentally conscious consumers and align with regulatory initiatives promoting clean transportation. Additionally, partnerships with renewable energy providers and carbon offset programs further enhance the sustainability credentials of rental services.

Car Rental Market Restraint

- Regulatory Compliance Challenges:

The car rental industry is subject to a complex web of regulations and licensing requirements across different jurisdictions, presenting significant challenges for rental companies. Compliance with local, regional, and national regulations pertaining to vehicle registration, insurance, taxation, and safety standards can be time-consuming and costly. Additionally, regulatory changes and updates further compound the compliance burden, requiring rental companies to continuously monitor and adapt their operations to ensure legal adherence. Failure to comply with regulatory requirements can result in fines, penalties, and reputational damage, posing a considerable risk to rental businesses.

- Intense Competitive Landscape:

The car rental market is characterized by intense competition among both traditional rental companies and emerging players, including ride-hailing services and peer-to-peer rental platforms. Price competition, aggressive marketing strategies, and innovative service offerings contribute to market saturation and margin pressure for rental companies. Moreover, the rise of shared mobility solutions and integrated transportation platforms poses a threat to traditional rental models, as consumers increasingly opt for on-demand and multi-modal transportation options. In response to heightened competition, rental companies may engage in price wars, sacrificing profitability to maintain market share.

Car Rental Market Opportunity

- Emerging Market Expansion:

Expanding into emerging markets presents a lucrative opportunity for car rental companies to tap into growing demand for transportation services. Rapid urbanization, rising disposable incomes, and increasing travel and tourism activities in emerging economies create a fertile ground for rental business expansion. By establishing a presence in emerging markets, rental companies can capitalize on untapped market potential and diversify their revenue streams. Strategic partnerships with local stakeholders, such as airlines, hotels, and travel agencies, can facilitate market entry and enhance brand visibility. Moreover, leveraging digital technologies and innovative business models tailored to the needs of emerging markets can drive customer acquisition and retention.

- Technology Integration and Innovation:

Embracing technology integration and innovation presents a compelling opportunity for car rental companies to enhance operational efficiency, improve customer experience, and unlock new revenue streams. Leveraging advanced technologies such as artificial intelligence, machine learning, and Internet of Things (IoT), rental companies can optimize fleet management, predictive maintenance, and demand forecasting. Implementing digital solutions, such as mobile apps, self-service kiosks, and contactless transactions, streamlines the rental process and enhances convenience for customers. Furthermore, exploring emerging trends such as autonomous vehicles and mobility-as-a-service (MaaS) platforms opens up possibilities for diversifying rental offerings and exploring new business models.

Car Rental Market Challenges

- Regulatory Compliance Complexity:

The car rental industry operates within a complex regulatory landscape, with regulations varying significantly across different jurisdictions. Compliance with local, regional, and national laws related to vehicle registration, insurance, taxation, and safety standards presents a formidable challenge for rental companies. Navigating the intricacies of regulatory requirements requires substantial resources, time, and expertise, particularly for multinational rental operators. Additionally, regulatory changes and updates further compound the compliance burden, necessitating continuous monitoring and adaptation of policies and procedures. Non-compliance with regulatory mandates can result in fines, penalties, and legal consequences, posing a significant risk to rental businesses.

- Intensifying Competitive Landscape:

The car rental market is characterized by intense competition among traditional rental companies, as well as emerging players such as ride-hailing services and peer-to-peer rental platforms. Price competition, aggressive marketing tactics, and innovative service offerings contribute to market saturation and margin pressure for rental companies. Moreover, the rise of shared mobility solutions and integrated transportation platforms presents a threat to traditional rental models, as consumers increasingly embrace on-demand and multi-modal transportation options. In response to heightened competition, rental companies may engage in price wars, sacrificing profitability to maintain market share. Additionally, differentiation becomes crucial for rental companies to stand out amidst competition, necessitating investments in customer experience enhancements, brand positioning, and value-added services.

Segments Insights:

Vehicle Type Insights

Economy cars dominated the vehicle type segment, capturing the largest market share due to their affordability, fuel efficiency, and versatility. Travelers, especially leisure tourists and small families, prefer economy cars for their value proposition—offering reliable transport at reasonable prices.

Economy models like the Toyota Corolla, Hyundai Accent, and Ford Focus are mainstays of rental fleets worldwide. Rental agencies prioritize economy cars to cater to price-sensitive customers, particularly at airports and tourist hotspots. Moreover, lower operational costs and easier maintenance enhance profitability for rental firms managing large economy fleets.

Meanwhile, Luxury Cars are emerging as the fastest-growing segment. Increasing disposable incomes, lifestyle changes, and the rising preference for premium experiences are driving demand for luxury car rentals among high-net-worth individuals and business executives. Brands like BMW, Mercedes-Benz, and Audi dominate luxury rental fleets, offering models for weddings, business travel, and special occasions. Companies like Sixt, Hertz Prestige Collection, and Enterprise Exotic Car Collection are expanding luxury offerings to capitalize on this growing niche.

Application Insights

Airport transport accounted for the largest application share, fueled by the massive influx of domestic and international travelers seeking convenient mobility immediately upon arrival. Car rental counters at major airports like Los Angeles International, Heathrow, and Dubai International are critical revenue centers for rental companies.

Airport-based rentals offer the advantage of integrated travel solutions, often bundled with flight and hotel bookings. Tourists and business travelers value the ability to immediately access vehicles without relying on taxis or public transport, especially in regions with dispersed urban layouts.

Simultaneously, Local Usage is the fastest-growing application segment. Intra-city travelers, daily commuters, and residents increasingly use car rental services for personal errands, weekend getaways, and temporary needs. The trend is supported by growing availability of mobile apps offering instant booking and flexible rental durations (hourly or daily), creating new revenue streams for rental operators.

Regional Insights

North America emerged as the leading region in the car rental market, driven by mature tourism, a high rate of personal and business travel, strong airport infrastructure, and a developed car rental ecosystem. The United States alone accounts for a significant portion of global rental revenues, with brands like Enterprise, Hertz, and Avis maintaining extensive national fleets.

Post-pandemic recovery in domestic tourism, growth of suburban mobility needs, and innovations in EV rental offerings are propelling market expansion. Furthermore, the U.S. Department of Transportation’s emphasis on infrastructure modernization is expected to further stimulate regional market opportunities.

Additionally, high car ownership costs in urban centers like New York and San Francisco are making short-term car rentals a preferred option for occasional use.

Asia-Pacific is witnessing the fastest growth, buoyed by rapid urbanization, burgeoning middle classes, expanding air travel networks, and rising smartphone penetration. Countries like China, India, Japan, and Australia are leading growth trajectories.

India’s car rental market is undergoing a digital transformation with platforms like Zoomcar and Revv promoting self-drive rentals among tech-savvy millennials. In China, Didi Chuxing’s rental services cater to both leisure and business travelers, integrating ride-hailing with long-term rental solutions.

The Asia-Pacific region’s young, mobile population, growing domestic tourism sectors, and government initiatives promoting electric mobility (especially in China and Singapore) are creating enormous opportunities for both international and domestic car rental companies.

Recent Developments

-

April 2025 – Enterprise Holdings expanded its EV rental program across the U.S. and Europe, adding thousands of new electric vehicles to its fleet, including Tesla and Polestar models.

-

March 2025 – Hertz Global Holdings partnered with Uber to provide EV rentals to ride-hailing drivers, boosting its fleet of Tesla Model 3 and Model Y vehicles.

-

February 2025 – Avis Budget Group introduced its "Avis Now" mobile platform upgrade, offering contactless rental experience, digital vehicle selection, and curbside pickup.

-

January 2025 – Sixt SE announced its expansion into Australia and New Zealand markets, aiming to capture the growing tourism and business travel sectors with a premium fleet offering.

-

December 2024 – Europcar Mobility Group completed its merger with Green Mobility, strengthening its urban electric rental network across major European cities.

Some of the prominent players in the Car rental market include:

- AVR Qatar, Inc.

- Avis Budget Group, Inc.

- Carzonrent India Pvt. Ltd.

- Eco Rent A Car

- Enterprise Holdings, Inc.

- Europcar

- Localiza

- The Hertz Corporation

- SIXT

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global car rental market.

Vehicle Type

- Luxury cars

- Executive cars

- Economy cars

- SUVs

- MUVs

Application

- Local usage

- Airport transport

- Outstation

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)