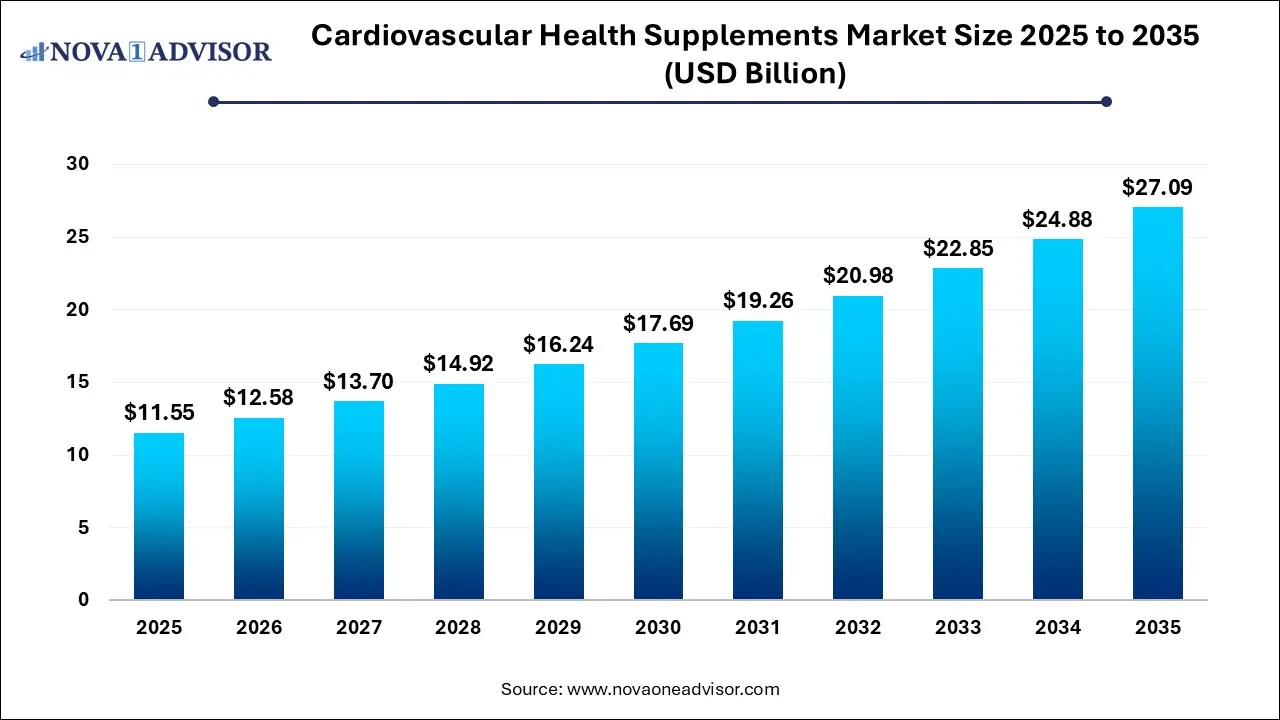

Cardiovascular Health Supplements Market Size and Growth

The cardiovascular health supplements market size was exhibited at USD 11.55 billion in 2025 and is projected to hit around USD 27.09 billion by 2035, growing at a CAGR of 8.9% during the forecast period 2026 to 2035.

U.S. Cardiovascular Health Supplements Market Size and Growth 2026 to 2035

The U.S. cardiovascular health supplements market size is evaluated at USD 2.26 billion in 2025 and is projected to be worth around USD 4.79 billion by 2035, growing at a CAGR of 7.8% from 2026 to 2035.

.webp)

North America led the cardiovascular health supplements market in 2025, fueled by high cardiovascular disease prevalence, an aging population, and advanced retail and regulatory infrastructure. The U.S., in particular, benefits from a mature nutraceuticals industry, strong clinical research backing, and widespread consumer awareness of heart-health supplements. Government campaigns and healthcare professional endorsements of omega-3s, CoQ10, and plant sterols further support market penetration.

Major players based in North America, such as Nature’s Bounty, NOW Foods, and GNC, have strong retail presence and invest heavily in clinical trials, clean-label innovation, and consumer outreach. The growing number of Americans turning to preventive health strategies, wearable health monitoring, and personalized nutrition tools is reinforcing demand across demographic groups.

Asia Pacific is projected to be the fastest-growing region, driven by economic development, urbanization, and a sharp increase in lifestyle-related diseases. Countries like China, India, and Japan are witnessing rising incidences of hypertension, diabetes, and obesity—major risk factors for cardiovascular disease. This is fostering greater awareness and demand for preventive solutions such as dietary supplements.

Cultural affinity for herbal and natural remedies also supports market adoption in this region. Additionally, e-commerce growth, supportive regulatory reforms, and increasing foreign direct investment in health and wellness products are propelling expansion. Local players are innovating with region-specific ingredients like red yeast rice, green tea extract, and garlic, tailored to the preferences of Asian consumers.

Market Overview

The cardiovascular health supplements market has emerged as a significant and rapidly expanding segment within the global nutraceuticals industry. Driven by rising awareness of heart health, aging populations, sedentary lifestyles, and increasing incidence of cardiovascular diseases (CVDs), consumers are actively seeking preventive solutions outside traditional pharmaceuticals. Cardiovascular health supplements offer a proactive approach to maintaining and improving heart function, cholesterol levels, blood pressure, and overall vascular health. These supplements include natural and synthetic compounds such as omega-3 fatty acids, Coenzyme Q10 (CoQ10), vitamins, minerals, and various herbal extracts that support heart function.

Globally, heart disease remains the leading cause of death, accounting for an estimated 17.9 million deaths each year, according to the World Health Organization (WHO). As healthcare systems shift from treatment to prevention, the demand for functional supplements that reduce cardiovascular risk is surging. Consumers, especially in developed and emerging economies, are becoming more health-conscious and self-reliant in managing chronic conditions. This paradigm shift has significantly boosted the market for heart-health supplements, particularly those with scientific backing, transparency in sourcing, and clean-label claims.

The cardiovascular health supplements market is supported by increasing availability across retail outlets, pharmacies, and e-commerce platforms. Key players are investing in product innovation, clinical research, and strategic partnerships to differentiate their offerings and expand their consumer base. Additionally, the influence of digital health tracking, personalized nutrition, and lifestyle-focused marketing is reshaping consumer engagement in this category. As regulatory frameworks become clearer and consumer education improves, the market is expected to experience steady and sustained growth across regions.

Major Trends in the Market

-

Shift Toward Preventive Healthcare: Consumers are prioritizing proactive heart care over reactive treatment, boosting supplement adoption.

-

Clean-Label and Natural Formulations: Growing demand for supplements derived from plant-based, organic, and non-GMO sources.

-

Omega-3 Resurgence: Clinical evidence supporting omega-3 fatty acids in cardiovascular protection continues to drive product development.

-

Rise in Personalized Nutrition: Genetic testing and personalized supplement programs are influencing purchasing decisions.

-

Digital Retail Expansion: Online platforms are becoming dominant channels for supplement sales, driven by convenience and product variety.

-

Senior Health Focus: Targeted supplements addressing age-related cardiovascular decline are gaining popularity among aging populations.

-

Clinical Validation and Transparency: Consumers and regulators demand greater clinical evidence and traceability of ingredients.

-

Combination Formulations: Multi-ingredient products that address various aspects of cardiovascular health (e.g., blood pressure and cholesterol) are increasingly common.

Report Scope of Cardiovascular Health Supplements Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 12.58 Billion |

| Market Size by 2035 |

USD 27.09 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 8.9% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Type, Ingredient, Form, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

NOW Foods; Bright, Lifecare Private Ltd (Truebasics.com); Natural Organics, Inc.; DaVinci Laboratories of Vermont; Nordic Naturals; Thorne, Inc.; Nestlé Health Science(Pure Encapsulations, LLC) ; Amway Corp.; InVite Health; GNC Holdings, LLC |

Market Driver: Increasing Prevalence of Cardiovascular Diseases

One of the most significant drivers of the cardiovascular health supplements market is the rising global prevalence of cardiovascular diseases, which continue to be the leading cause of death globally. Factors such as urbanization, poor dietary habits, physical inactivity, obesity, diabetes, and stress have contributed to a spike in heart-related conditions even in younger populations. With healthcare systems becoming increasingly burdened, there’s a growing emphasis on preventive strategies to reduce the incidence of CVDs.

Supplements such as omega-3 fatty acids, CoQ10, magnesium, and phytosterols are clinically proven to support cardiovascular function by reducing inflammation, improving lipid profiles, and supporting endothelial health. Consumers, especially those with a family history of heart disease or comorbidities like hypertension, are incorporating these supplements into their daily routines to mitigate long-term risks. This rising health consciousness is fueling both first-time buyers and repeat purchases, underpinning sustained market expansion.

Market Restraint: Regulatory and Product Quality Challenges

Despite strong growth, the cardiovascular health supplements market faces a significant restraint in the form of stringent regulatory scrutiny and quality inconsistencies. Unlike pharmaceutical drugs, supplements are not always subject to the same rigorous approval processes, which has led to a proliferation of unregulated products in some regions. This has, in turn, raised concerns regarding false claims, inconsistent dosages, and potential side effects from adulterated or mislabeled products.

Regulatory frameworks differ widely across countries, creating complexities for manufacturers aiming to expand globally. For instance, the U.S. FDA regulates supplements under the Dietary Supplement Health and Education Act (DSHEA), while the European Food Safety Authority (EFSA) has a different set of requirements for health claims and labeling. These regulatory discrepancies, coupled with increasing consumer demand for transparency, pose challenges for product development, branding, and cross-border marketing.

Market Opportunity: Growing Demand for Natural and Plant-Based Supplements

A major opportunity for manufacturers lies in the rising consumer preference for natural, plant-based, and clean-label cardiovascular supplements. As more consumers gravitate toward holistic wellness, the demand for supplements derived from botanicals such as garlic extract, turmeric (curcumin), green tea, hawthorn, and grape seed extract is increasing. These ingredients are traditionally associated with cardiovascular benefits and are being reformulated into modern supplements with standardized dosing and improved bioavailability.

The clean-label movement, which emphasizes transparency, sustainability, and minimal processing, is influencing purchasing decisions. Consumers are also seeking supplements free from artificial preservatives, allergens, and synthetic binders. Brands that cater to this trend by offering organic, non-GMO, vegan, or allergen-free options are gaining a competitive advantage. Furthermore, product innovation in delivery formats—such as gummies, effervescent tablets, or beverages—provides additional opportunities to attract younger, lifestyle-conscious consumers.

Cardiovascular Health Supplements Market By Type Insights

The Natural supplements dominated the cardiovascular health supplements market in 2025, owing to strong consumer preference for holistic and less processed health solutions. Products based on herbal and botanical ingredients, omega-3 sources, and naturally occurring antioxidants appeal to health-conscious consumers wary of synthetic additives. The increasing number of studies validating the effectiveness of natural ingredients in managing blood pressure, cholesterol, and arterial stiffness further boosts their market share. Natural supplements also benefit from alignment with wellness trends, clean-label demands, and compatibility with plant-based diets.

Synthetic supplements are projected to grow at the fastest pace, particularly in clinical settings and among populations seeking high-dose, standardized formulations. These supplements often include synthesized vitamins, minerals, and compounds like CoQ10 and L-carnitine that offer consistency and precision in dosing. They are favored in medical nutrition therapy and by practitioners recommending evidence-based interventions for managing cardiovascular risk. Additionally, technological advances in synthetic nutrient delivery systems such as nano-encapsulation are improving bioavailability and uptake.

Cardiovascular Health Supplements Market By Ingredient Insights

The Omega fatty acids, especially omega-3 (EPA and DHA), held the dominant market share, due to their proven cardiovascular benefits. These essential fatty acids help lower triglyceride levels, reduce inflammation, and improve endothelial function. They are widely recommended by cardiologists and are available in various forms including softgels, emulsions, and fortified foods. The re-emergence of algae-based omega-3 supplements has also attracted vegan and vegetarian consumers, broadening the category’s appeal.

Coenzyme Q10 (CoQ10) is among the fastest-growing ingredients, particularly as research supports its role in cellular energy production and heart muscle health. CoQ10 supplementation is increasingly recommended for patients on statin therapy, which depletes natural CoQ10 levels and may lead to muscle fatigue. As awareness of statin side effects grows, CoQ10’s popularity is rising. Innovations such as ubiquinol (a more bioavailable form of CoQ10) and time-release formulations are enhancing market adoption.

The Capsules remained the most dominant form, due to their convenience, precise dosing, longer shelf life, and wide availability. Capsules offer a non-intrusive way to combine multiple ingredients, including oils, powders, and herbal extracts, making them suitable for diverse product formulations. Consumers prefer them for their ease of swallowing and consistent dosage.

Liquid and softgel formats are the fastest-growing segments, driven by improved absorption and appeal to consumers with difficulty swallowing pills. Liquid forms are especially popular for omega-3 supplements and botanical extracts. The rise in flavored and sugar-free liquid supplements is encouraging adoption among younger consumers and those transitioning from traditional pills. Additionally, single-serve sachets and portable formats are gaining traction in convenience-driven markets.

Cardiovascular Health Supplements Market By Distribution Channel Insights

The Offline channels, including pharmacies, health food stores, and specialty retailers, dominated the market, due to trust in physical retail, pharmacist recommendations, and consumer preference for seeing products before purchase. Retail chains like GNC, CVS, and Boots have a strong foothold in North America and Europe and are pivotal for brand visibility and product sampling.

Online channels are witnessing the fastest growth, driven by increasing internet penetration, e-commerce convenience, subscription models, and influencer marketing. Consumers are leveraging online platforms for direct access to niche brands, global products, and personalized supplement regimens. Online marketplaces, brand-owned websites, and health-focused digital platforms provide detailed ingredient information, reviews, and loyalty programs that enhance consumer engagement and repeat purchases.

Some of the prominent players in the cardiovascular health supplements market include:

Cardiovascular Health Supplements Market Recent Developments

-

In March 2025, Amway introduced a new line of heart health supplements under its Nutrilite brand, featuring plant sterols, CoQ10, and grape seed extract, targeting middle-aged consumers in Asia and North America.

-

In January 2025, GNC partnered with a digital health startup to launch personalized cardiovascular supplement kits, integrating wearable health data with tailored product subscriptions.

-

In November 2024, Nestlé Health Science acquired a minority stake in a U.S.-based heart health nutraceutical company focusing on CoQ10 and omega-3 nanoemulsions.

-

In September 2024, Herbalife Nutrition expanded its HeartSmart product line with liquid omega-3 supplements in sugar-free, orange-flavored formulations designed for global rollout.

-

In August 2024, Nature’s Way announced the addition of cardio-support herbal capsules featuring hawthorn, olive leaf extract, and magnesium to its heart health range.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the cardiovascular health supplements market

By Type

- Natural Supplements

- Synthetic Supplements

By Ingredient

- Vitamins & Minerals

- Herbs & Botanicals

- Omega Fatty Acids

- Coenzyme Q10 (CoQ10)

- Others

By Form

- Liquid

- Tablet

- Capsules

- Softgels

- Powder

- Others

By Distribution Channel

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)

.webp)