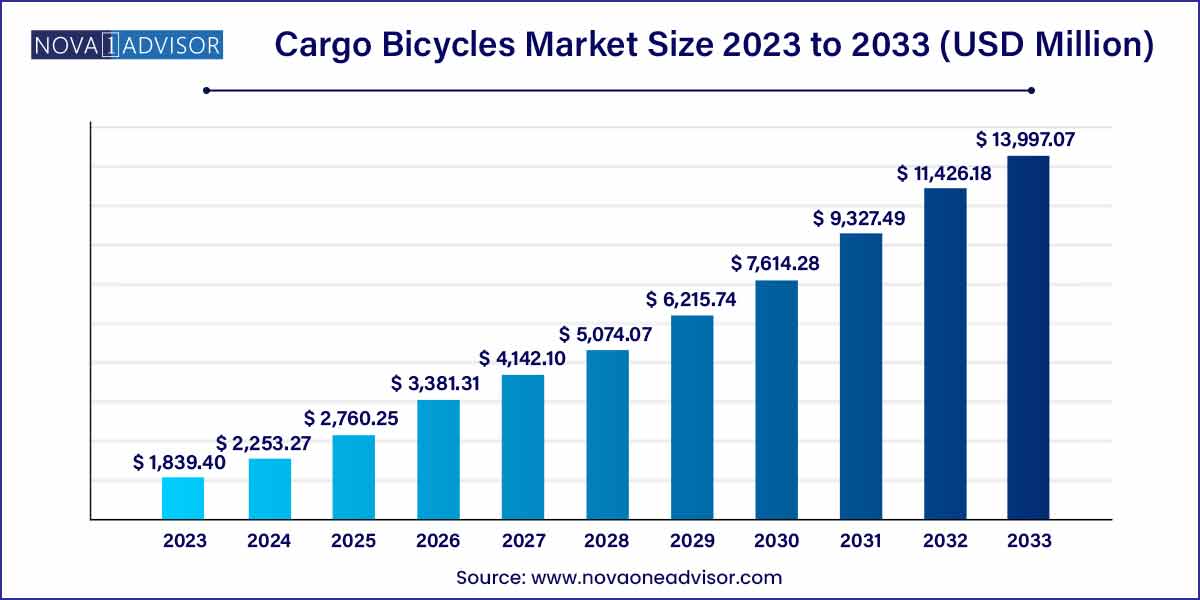

The global cargo bicycles market size was exhibited at USD 1,839.40 million in 2023 and is projected to hit around USD 13,997.07 million by 2033, growing at a CAGR of 22.5% during the forecast period of 2024 to 2033.

Key Takeaways:

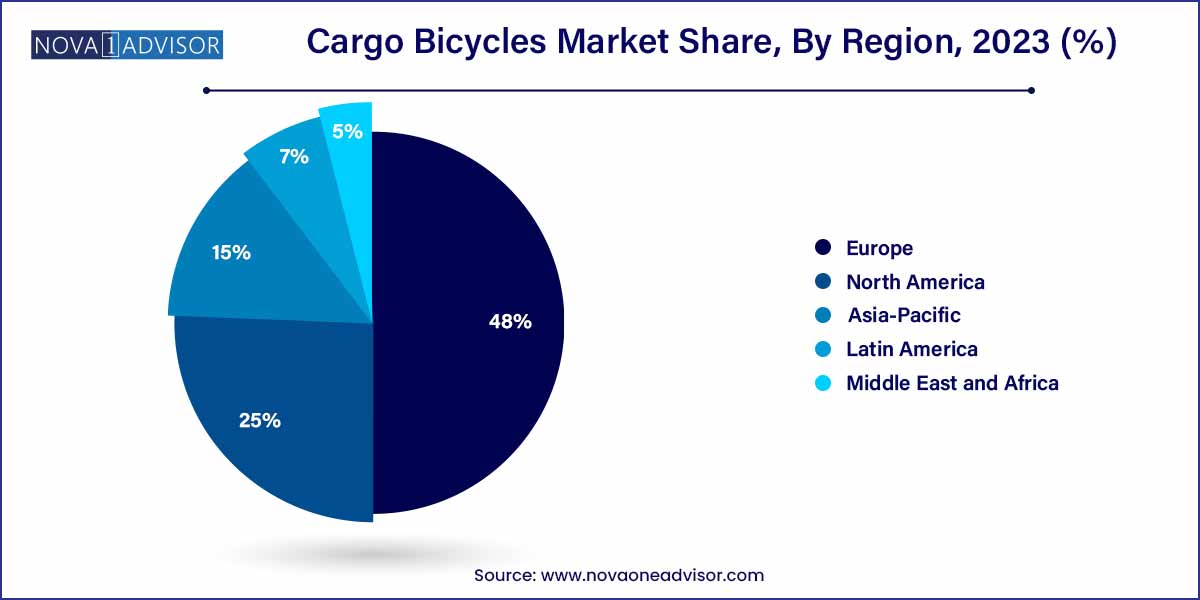

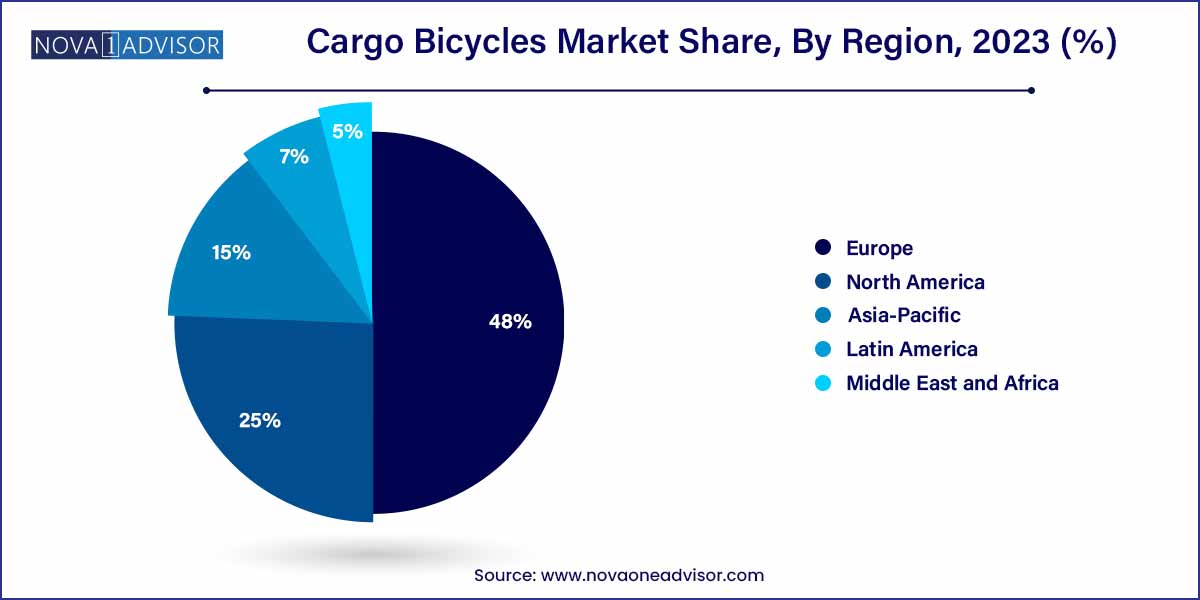

- Europe dominated the overall market, gaining a market share of 48.0% in 2023.

- The two-wheeled cargo bicycles segment is expected to dominate the market through 2030, gaining a market share of 49.3% in 2023.

- Electric cargo bicycles are anticipated to witness a CAGR of approximately 25% during the forecast period.

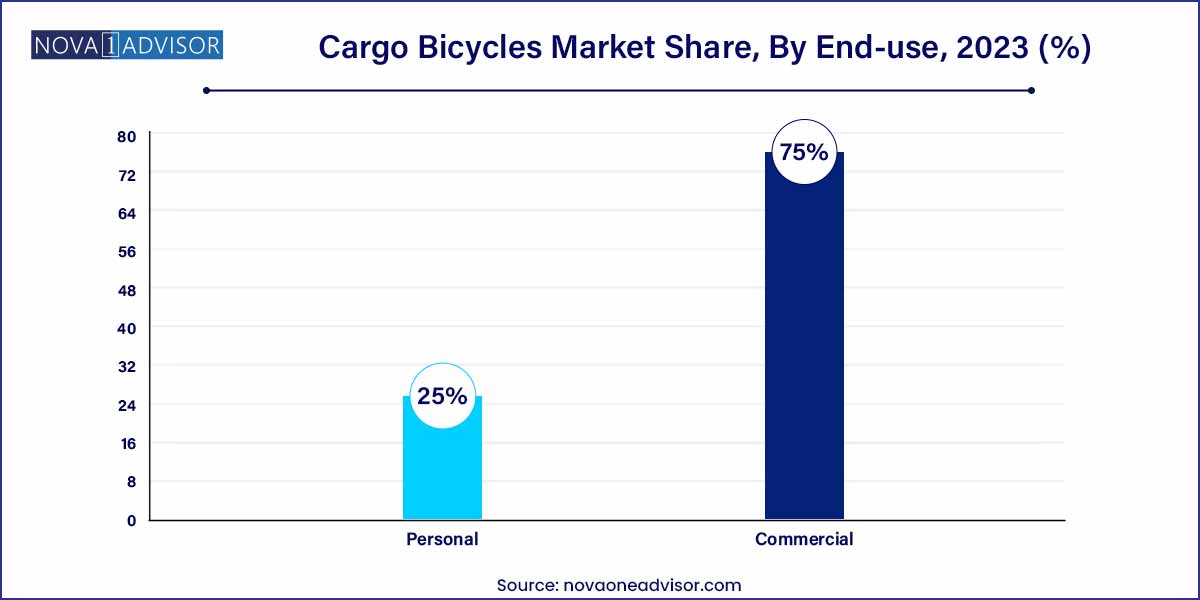

- The personal application segment is expected to advance at a faster CAGR of 25.0% during the forecast period.

Market Overview

The cargo bicycles market has emerged as a pivotal solution in the global shift towards sustainable urban transportation and last-mile logistics. Traditionally used in parts of Europe and Asia for delivering goods, cargo bicycles—also known as freight or utility bikes—have evolved into high-performance, load-bearing vehicles suited for both personal and commercial use. As urban congestion, environmental concerns, and e-commerce demands escalate, cargo bicycles are gaining popularity for their cost-efficiency, maneuverability, and zero-emission operations.

Cargo bicycles are designed to carry heavier loads than standard bikes, with configurations that include two-wheeled, three-wheeled, and even four-wheeled structures. They come in electric and non-electric versions and are often customized for specific use cases such as parcel delivery, food distribution, garbage collection, or family commuting. Governments across the globe are recognizing the role of cargo bikes in urban mobility plans, offering subsidies, tax incentives, and infrastructure developments like cargo lanes and secure parking.

Cities such as Amsterdam, Copenhagen, Paris, Portland, and Berlin are witnessing a rapid increase in cargo bike adoption among small businesses, municipalities, and households. In dense urban areas, cargo bikes often outperform vans by navigating traffic and accessing restricted zones, significantly reducing delivery time and emissions. The rise of gig economy services, growing demand for green logistics, and technological innovations in electric drivetrains are poised to propel the cargo bicycles market into a new growth era.

Major Trends in the Market

-

Electrification of Cargo Bikes: Battery-assisted cargo bicycles are becoming mainstream, enabling users to carry heavier loads over longer distances.

-

Urban Delivery Transformation: Cargo bikes are replacing diesel vans for last-mile delivery, especially in low-emission zones.

-

Growth in Family and Personal Use Models: Parents are opting for cargo bikes as alternatives to cars for school runs and errands.

-

Municipal and Government Use: Cities are integrating cargo bikes into sanitation, maintenance, and fleet services.

-

Rising Demand for Subscription and Rental Models: Commercial fleets and startups are adopting cargo bikes through flexible financing and leasing programs.

-

Regulatory Incentives: Government subsidies and e-bike funding programs are driving consumer and business adoption.

-

Design and Safety Innovations: New models include smart braking, advanced suspension, weatherproof covers, and modular cargo areas.

Cargo Bicycles Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 1,839.40 Million |

| Market Size by 2033 |

USD 13,997.07 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 22.5% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, Type, Wheel Size, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Smart Urban Mobility B.V.; Xtracycle; Tern; Rad Power Bicycles; Worksman Cycles; Yuba Bicycles LLC; Cycles Maximus Ltd.; Triobicycle A/S; Elian Cycles; Surly Bicycles. |

By Product Insights

Two-wheeled cargo bicycles dominate the market, largely due to their maneuverability, affordability, and familiarity among users. These bicycles often feature a front- or rear-mounted cargo box or platform and are widely used by families and small businesses for personal errands, child transport, and urban deliveries. Lightweight construction, ease of parking, and compatibility with existing cycling infrastructure make them a popular choice in both developing and developed urban settings.

Conversely, four-wheeled cargo bicycles are growing at the fastest rate, especially in high-volume commercial and municipal applications. These models offer superior load capacity and stability, making them ideal for parcel delivery, waste collection, mobile vending, and facility maintenance. Equipped with electric drivetrains, regenerative braking, and modular cargo containers, four-wheeled cargo bikes are increasingly viewed as van substitutes. Companies like Citkar, ONO, and Vowag are pioneering this space with electric cargo quadricycles designed for urban logistics.

By Type Insights

Electric cargo bikes lead the market, thanks to their superior utility, reduced physical strain, and extended range. Battery-powered pedal-assist systems enable riders to carry heavier loads over longer distances and on hilly terrain, making them especially valuable for commercial deliveries. The surge in e-commerce, coupled with government incentives for electric mobility, is propelling the growth of e-cargo bikes across both private and public sectors.

In contrast, non-electric cargo bicycles are declining in growth rate, as businesses and individuals opt for electric variants that offer better efficiency and flexibility. While manual cargo bikes remain popular in low-cost markets or short-range applications, the expanding reach of affordable lithium-ion battery technology and improvements in e-bike regulation are reducing the appeal of traditional cargo models.

By Wheel Size Insights

The 20"-24" wheel size segment dominates the cargo bicycle market, offering the optimal balance between load stability, maneuverability, and rider control. These mid-sized wheels are commonly used in both personal and commercial cargo bikes, providing sufficient ground clearance while maintaining a low center of gravity for cargo balance. The compact size also facilitates easier navigation in tight urban environments and compatibility with standard cycling paths.

Meanwhile, cargo bikes with wheel sizes above 28" are growing fastest, particularly in high-capacity and high-speed commercial models. Larger wheels offer improved rolling efficiency, shock absorption, and enhanced visibility on the road. These bikes are especially suited for long-haul urban deliveries or utility applications where robustness and rider comfort are paramount. As manufacturers design new chassis to accommodate larger wheelbases and electric assistance, this segment is gaining momentum in premium commercial deployments.

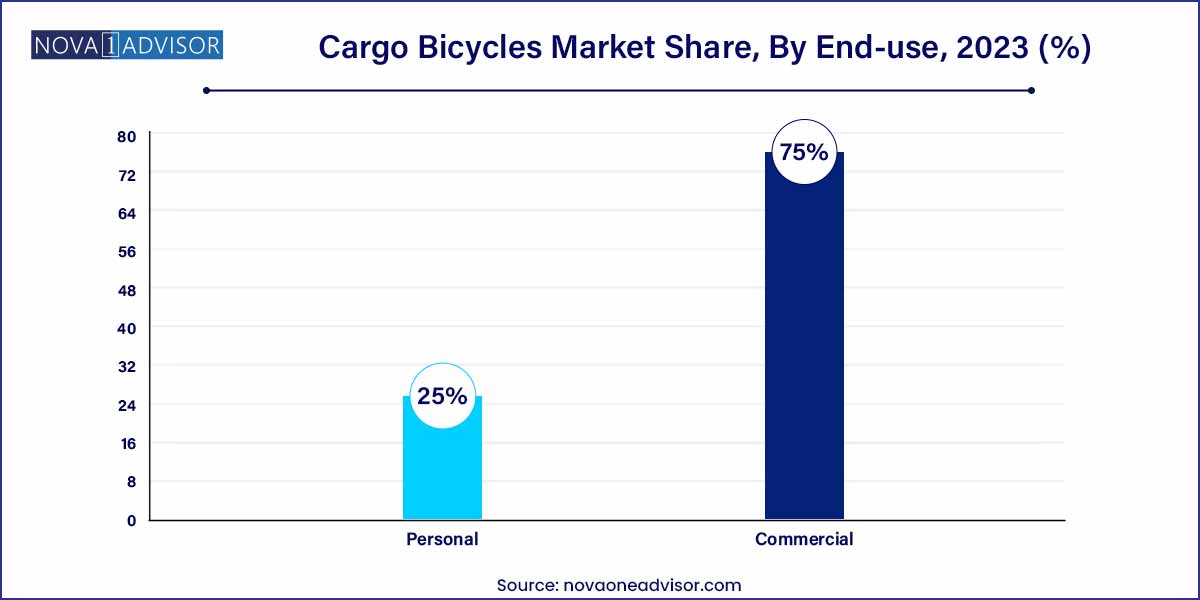

By Application Insights

Commercial applications dominate the cargo bicycles market, particularly in sub-segments like courier & parcel services, rental/custom fleets, and municipal services. Large logistics providers, last-mile startups, and local businesses are integrating cargo bikes into their delivery networks to cut emissions, reduce operational costs, and access low-emission urban zones. Municipalities are also deploying cargo bikes for waste collection, park maintenance, and infrastructure services.

However, the personal use segment is growing rapidly, driven by a shift in urban mobility preferences. Families are adopting cargo bikes as car alternatives for school drop-offs, shopping, and leisure activities. The rise in compact, user-friendly, and family-focused models with features like child seats, weatherproof covers, and intuitive electric assistance is expanding the consumer base. Public awareness campaigns and financial subsidies further encourage adoption among environmentally conscious individuals.

By Regional Insights

Europe dominates the global cargo bicycles market, driven by strong cycling cultures, dense urban populations, and progressive environmental policies. Countries like Germany, the Netherlands, Denmark, France, and the UK have pioneered cargo bike infrastructure, subsidies, and awareness programs. Major cities have introduced low-emission zones, congestion charges, and delivery regulations that incentivize cargo bike usage.

European logistics providers like DHL and UPS operate large-scale cargo bike fleets, and cities like Amsterdam and Copenhagen have integrated cargo bikes into their public mobility networks. Government subsidies in countries like Germany can cover up to 40% of the cost of an e-cargo bike, significantly boosting adoption.

Asia-Pacific is the fastest-growing market, particularly in China, India, Japan, and Southeast Asia. In these regions, cargo bicycles have long been used for informal logistics and vending. Now, with the rise of organized last-mile delivery and shared mobility platforms, there's renewed investment in modern electric cargo bike fleets.

China, in particular, is leading in terms of manufacturing and exporting e-cargo bikes, while Japan is witnessing growing adoption among seniors and families. India’s e-commerce boom and smart city initiatives are driving cargo bike usage in tier-1 cities, particularly for food delivery and waste management. As urbanization accelerates and emission regulations tighten, the APAC region is expected to account for a significant share of future growth.

Some of the prominent players in the cargo bicycles market include:

- Smart Urban Mobility B.V.

- Xtracycle

- Tern

- Rad Power Bikes

- Worksman Cycles

- Yuba Bicycles LLC

- Cycles Maximus Ltd.

- Triobike A/S

- Elian Cycles

- Surly Bikes

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cargo bicycles market.

Product

- Two-Wheeled

- Three-Wheeled

- Four-Wheeled

Type

Wheel Size

- Below 20"

- 20"-24"

- 25"-28"

- Above 28"

Application

-

- Courier & Parcel Service

- Rental/Custom Fleets

- Facility Maintenance

- Waste, Municipal Services

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)