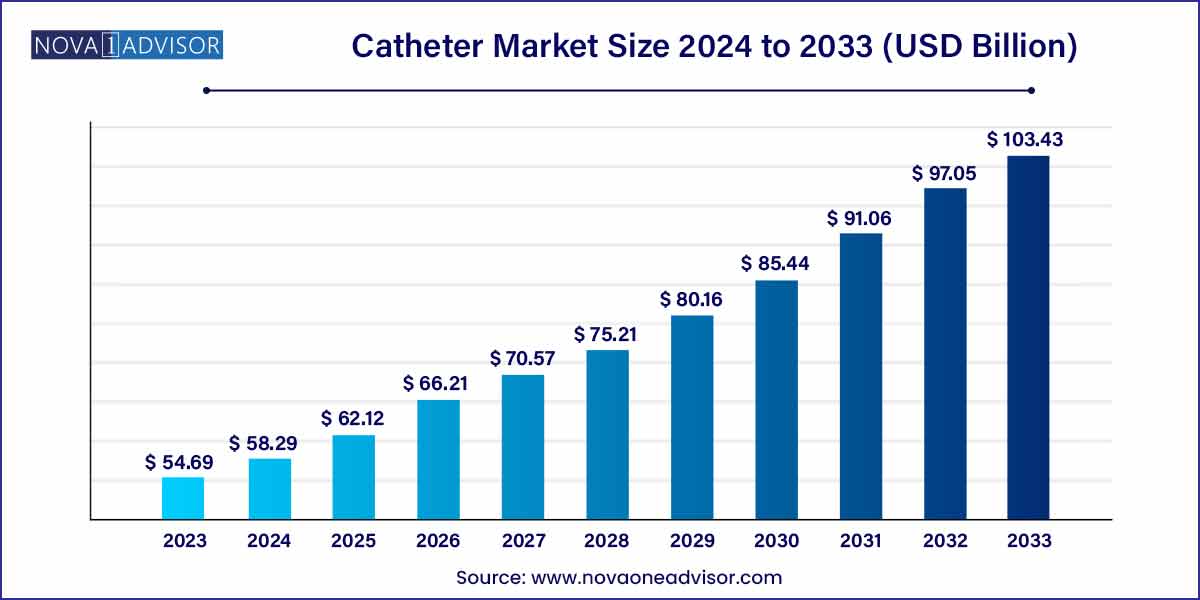

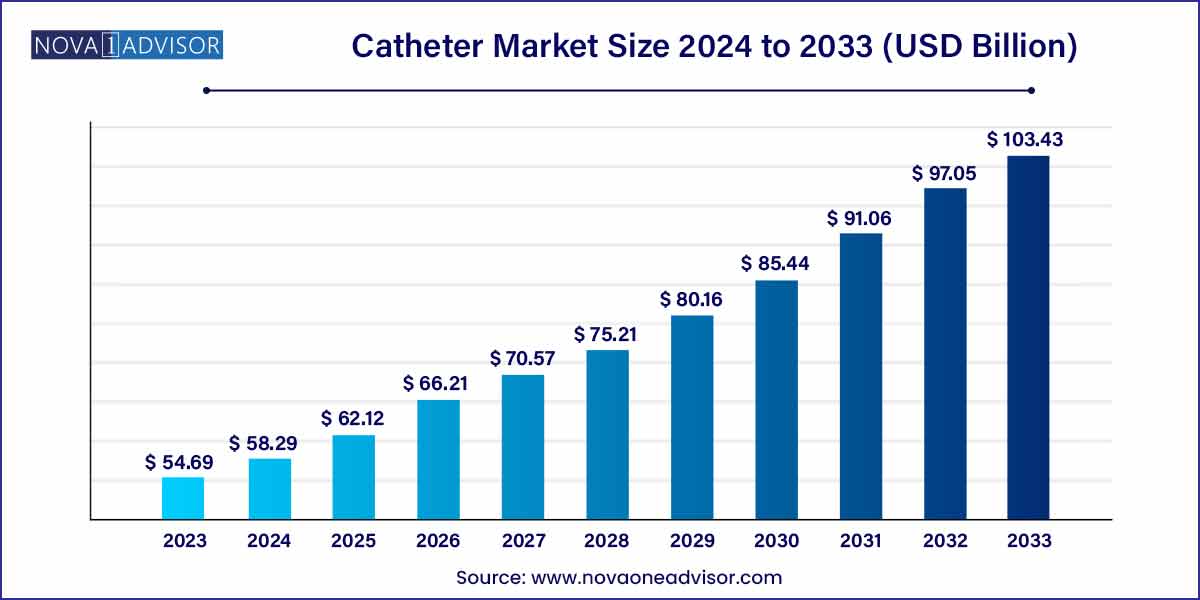

The global catheter market size was exhibited at USD 54.69 billion in 2023 and is projected to hit around USD 103.43 billion by 2033, growing at a CAGR of 6.58% during the forecast period of 2024 to 2033.

Key Takeaways:

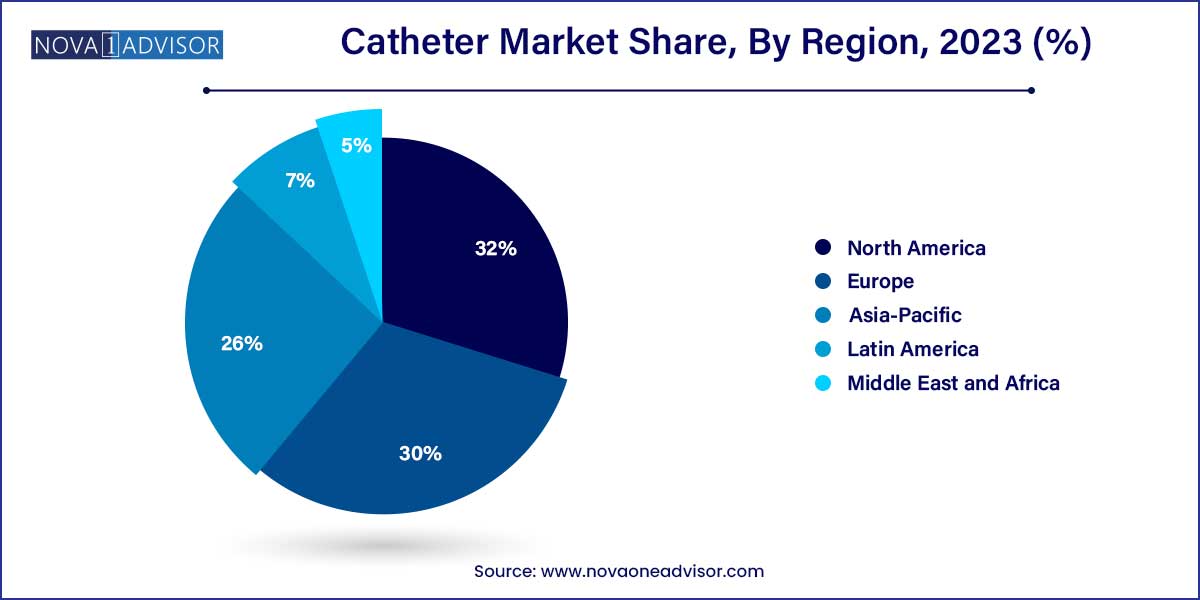

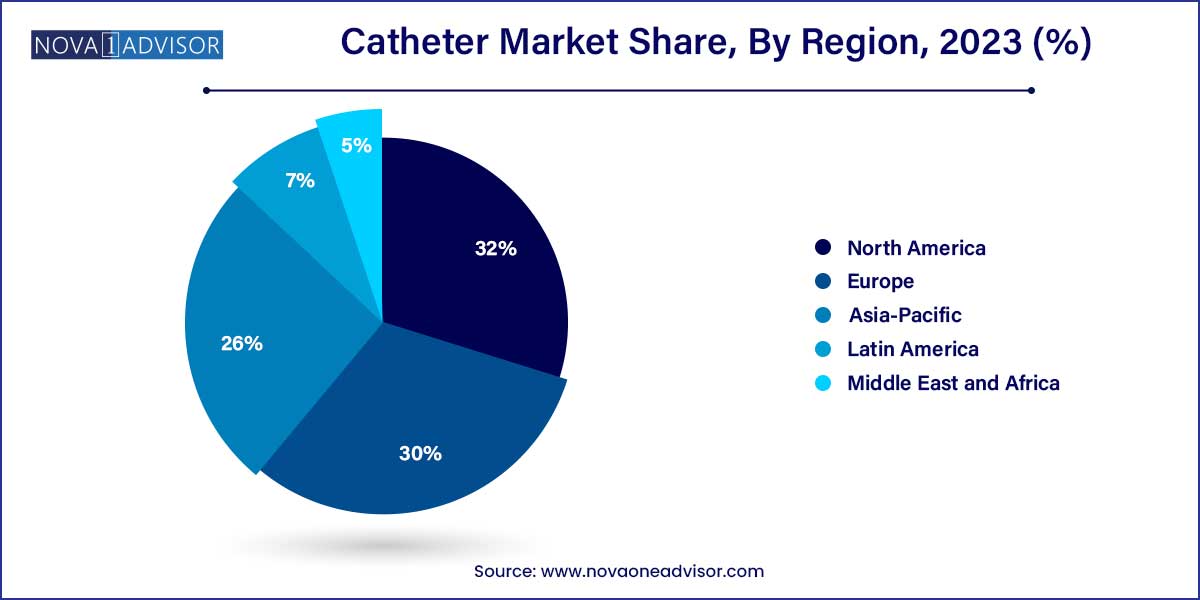

- North America accounted for 32.0% of the global market in 2023

- Cardiovascular catheter segment led the market and accounted for 27.99% of the total revenue share in 2023.

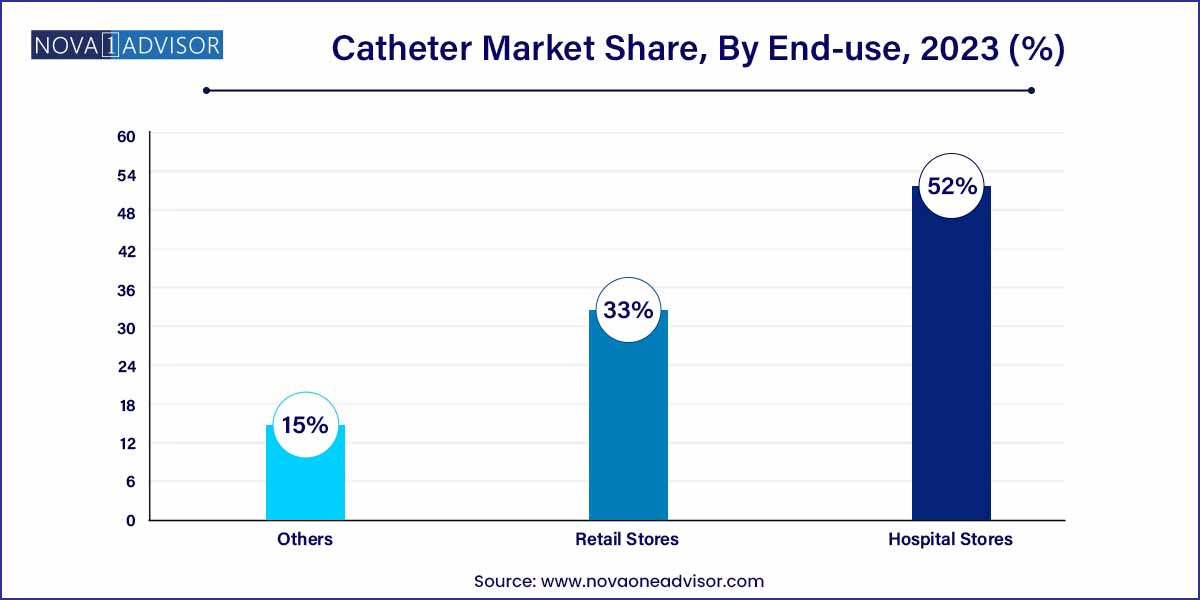

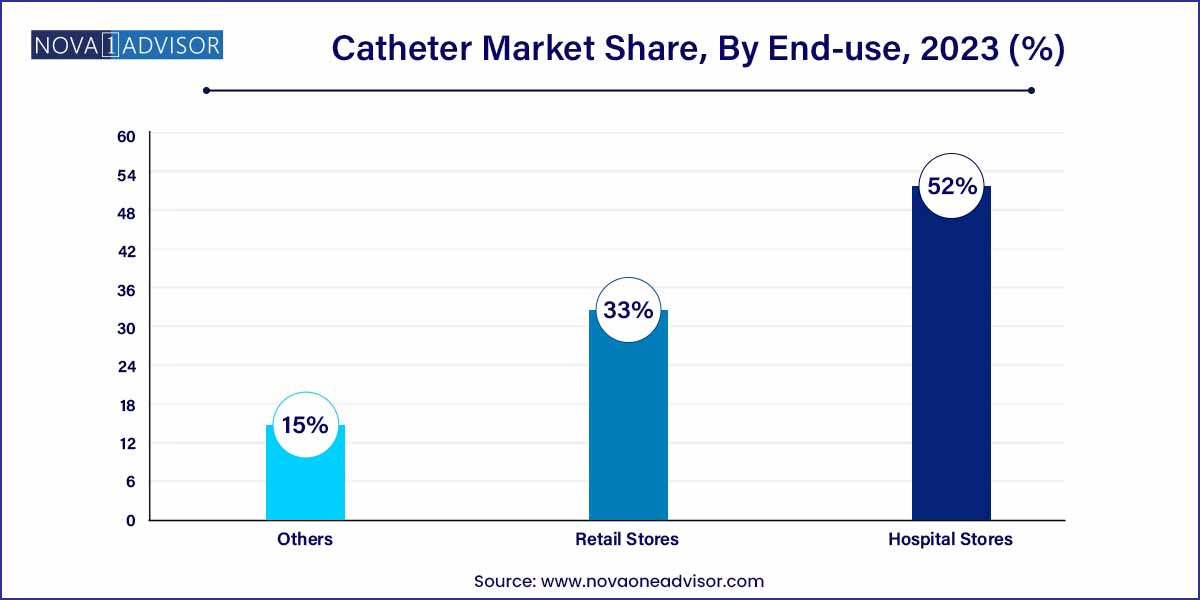

- Hospital stores segment dominated the market with the largest revenue share in 2023.

Market Overview

The global catheter market has evolved into one of the most dynamic segments of the medical device industry, driven by technological innovations, demographic shifts, and the increasing prevalence of chronic diseases. Catheters are flexible tubes inserted into the body for therapeutic or diagnostic purposes, serving critical roles in cardiovascular, urological, neurovascular, and intravenous procedures. From short-term interventions like angioplasty to long-term management such as dialysis and urinary incontinence, catheters enable life-sustaining care across hospital and home settings.

The market is benefiting from a surge in minimally invasive procedures, improved healthcare infrastructure in emerging markets, and rising surgical volumes globally. The COVID-19 pandemic accelerated investments in infection control, further elevating the importance of single-use catheters. Additionally, an aging global population has led to a higher incidence of conditions requiring catheterization, including heart disease, kidney failure, and urological disorders.

With increasing adoption of advanced materials, antimicrobial coatings, and integrated imaging technologies, catheters are becoming more sophisticated, safer, and patient-friendly. The competitive landscape is witnessing continuous product launches, strategic mergers, and geographic expansions, positioning the global catheter market for sustained long-term growth.

Major Trends in the Market

-

Rising Demand for Minimally Invasive Procedures: Catheters are at the core of interventional procedures that reduce surgical trauma and recovery time.

-

Growth of Home-based and Ambulatory Care: Patients are increasingly using catheters in home settings, especially for dialysis and urinary incontinence.

-

Adoption of Antimicrobial and Hydrophilic-coated Catheters: Coatings help reduce catheter-associated infections (CAUTIs), a major concern in healthcare.

-

Technological Integration with Imaging Systems: IVUS and EP catheters now offer real-time diagnostics through integrated ultrasound and electrical mapping.

-

Increased Use of Biocompatible and Sustainable Materials: Manufacturers are focusing on materials that reduce patient discomfort and environmental impact.

-

Shifting Preference Toward Disposable Catheters: Single-use designs are gaining popularity to minimize infection risks and meet regulatory compliance.

-

Regional Expansion of Key Players in Asia-Pacific and Latin America: Growth in these regions is encouraging global firms to localize manufacturing.

-

Robust Investments in Smart Catheters: Development of sensor-embedded catheters capable of monitoring pressure, oxygen levels, and flow dynamics.

-

Personalized and Size-specific Designs: Catheter designs are becoming more specialized for pediatric, geriatric, and niche anatomical needs.

-

AI and IoT in Catheter Management: Smart infusion and drainage catheters are being tested for automated monitoring and alert systems.

Catheter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 54.69 Billion |

| Market Size by 2033 |

USD 103.43 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.58% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Hollister Incorporated; Medtronic; Boston Scientific Corporation; Edward Lifesciences; Smith Medical Inc.; Teleflex Incorporated; ConvaTec Group Plc. |

Key Market Driver: Rising Prevalence of Chronic Diseases and Surgical Procedures

A key driver of the global catheter market is the rising burden of chronic diseases coupled with increasing surgical volumes worldwide. Cardiovascular diseases (CVDs) remain the leading cause of death globally, accounting for over 17 million deaths annually, with catheter-based interventions such as angioplasty and ablation procedures being frontline treatments.

Similarly, the global incidence of end-stage renal disease (ESRD) is climbing, requiring either hemodialysis or peritoneal dialysis both of which necessitate catheter placement. In the field of urology, aging populations are experiencing higher rates of urinary retention, incontinence, and prostate disorders that mandate long-term catheter use.

Moreover, the growing adoption of central venous catheters (CVCs) for chemotherapy, parenteral nutrition, and intensive care therapies has further amplified demand. As surgeries become more frequent and specialized, catheters are being employed as precision tools, not just conduits transforming them into indispensable medical devices across specialties.

Key Market Restraint: Risk of Catheter-associated Infections and Complications

Despite technological advancements, a major restraint remains the risk of catheter-associated complications, particularly infections such as catheter-associated urinary tract infections (CAUTIs), bloodstream infections, and thrombosis.

According to the CDC, CAUTIs account for over 30% of all hospital-acquired infections. Central line-associated bloodstream infections (CLABSIs) also contribute to increased hospital stays, morbidity, and healthcare costs. Improper insertion techniques, extended catheterization periods, and inadequate maintenance elevate these risks.

This has led to stringent regulatory scrutiny and clinical hesitancy regarding long-term catheter use, especially in high-risk patients. Although the development of coated and antimicrobial catheters has mitigated these issues to some extent, patient safety concerns and rising litigation costs continue to hinder unrestricted market expansion.

Key Market Opportunity: Expansion of Catheter Usage in Emerging Economies

An attractive opportunity for the global catheter market lies in the rapid expansion of healthcare infrastructure and procedural volumes in emerging markets. Countries such as India, China, Brazil, and those in Southeast Asia and Africa are witnessing a surge in non-communicable diseases due to urbanization, lifestyle changes, and aging populations.

Governments are investing heavily in tertiary care hospitals, dialysis centers, cardiac centers, and public health programs. These developments are increasing the availability of advanced medical procedures that rely on catheter-based access and delivery systems.

Moreover, local manufacturers are entering the market with affordable catheter products, making care more accessible to lower-income populations. Multinational companies forming strategic partnerships with domestic players for localized production and distribution stand to gain a significant competitive advantage in these high-potential regions.

Segments Insights:

Product Type Insights

Cardiovascular catheter segment led the market and accounted for 27.99% of the total revenue share in 2023. Rising prevalence of cardiovascular disorders and increasing demand for interventional cardiac procedures, coupled with growing adoption of cardiac catheters, are expected to boost the growth of the market for cardiovascular catheters during the forecast period. For instance, according to data released by the American College of Cardiology in July 2023, around 200 million individuals globally, and over 12 million people in the U.S., are dealing with peripheral artery disease (PAD). The increasing demand for these catheters can be attributed to the increasing incidence of cardiac conditions such as coronary artery disease, congenital heart problems, and cardiac arrhythmia. As the occurrence of these conditions rises, there is an increased need for diagnostic and interventional procedures, with cardiovascular catheters playing a pivotal role in performing minimal invasive procedures.

Specialty catheters segment is projected to witness the highest growth rate over the forecast period owing to the increasing demand for minimally invasive procedures, coupled with rising prevalence of target diseases, Moreover, increasing regulatory approvals are likely to contribute to segment growth. For instance, in February 2022, Teleflex Incorporated received U.S. FDA approval for its specialty catheters used for crossing Chronic Total Occlusion (CTO) that occur during Percutaneous Coronary Intervention (PCI). Specialty catheters are equipped with features such as smoother surfaces, reduced friction, and materials that minimize irritation. This customization enhances patient satisfaction and compliance, particularly in cases where long-term catheterization is necessary.

End-Use Insights

Hospital Stores led the end-use segment in 2023. Hospitals remain the largest purchasers and users of catheters, given their high patient volumes, emergency services, and surgical capabilities. From catheterizations in operating theaters to routine insertions in ICUs, the diversity of applications makes hospitals the primary revenue generators for catheter manufacturers. Centralized procurement, bulk purchasing, and adherence to standardized protocols further consolidate hospitals’ dominance.

Retail Stores are the fastest-growing channel. With the growth of chronic care at home especially for dialysis and urinary incontinence patients increasingly obtain catheters via retail pharmacies and e-commerce platforms. The aging global population and rise in self-administration of therapies like insulin and enteral nutrition are pushing catheter sales outside traditional hospital settings. Retailers offering discreet, user-friendly packaging and home delivery are experiencing notable growth in sales volume.

Regional Insights

North America remains the leading region in the global catheter market, driven by high healthcare expenditure, early adoption of advanced technologies, and strong regulatory frameworks. The United States, in particular, accounts for a significant portion of global catheter consumption due to its large patient base with chronic diseases, widespread insurance coverage, and advanced surgical infrastructure.

The region is also home to several key market players, including Boston Scientific, Becton Dickinson, and Abbott Laboratories. Investment in R&D, combined with favorable reimbursement policies, continues to foster innovation and market leadership in this region.

Fastest Growing Region: Asia Pacific

Asia Pacific is the fastest-growing region, with countries like China, India, and Japan witnessing rapid expansion in catheter usage. Key growth drivers include increasing disease prevalence, rising surgical volumes, greater government investment in healthcare infrastructure, and a burgeoning medical tourism industry.

In India, for example, the dialysis population is growing at over 15% annually, driving demand for urology catheters. Meanwhile, China’s aggressive rollout of advanced cardiology centers is fueling the uptake of cardiovascular and neurovascular catheters. As local companies begin to manufacture high-quality catheters, affordability and accessibility in the region are improving, accelerating growth.

Recent Developments

-

March 2025 – Boston Scientific announced FDA approval for its AGENT™ Drug-Coated Balloon Catheter, designed for treating coronary in-stent restenosis, enhancing its interventional cardiology portfolio.

-

January 2025 – Teleflex Incorporated launched its new Arrow® NextGen Hemodialysis Catheter in Europe, featuring enhanced flow rates and improved kink resistance.

-

November 2024 – B. Braun Melsungen AG expanded its manufacturing facility in Malaysia to increase production of intravenous catheters for Asia-Pacific markets.

-

September 2024 – Coloplast introduced a range of hydrophilic-coated intermittent catheters optimized for long-term self-catheterization patients, targeting the North American and Nordic regions.

-

July 2024 – Medtronic unveiled its Willow™ Neurovascular Aspiration Catheter, marking a significant advancement in minimally invasive stroke therapy devices.

Some of the prominent players in the catheter market include:

- Hollister Incorporated

- Medtronic

- Boston Scientific Corporation

- Edward Lifesciences

- Smith Medical Inc.

- Teleflex Incorporated

- ConvaTec Group Plc

- Cure Medical LLC

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global catheter market.

Product Type

-

- Electrophysiology Catheters

- PTCA Balloon Catheters

- IVUS Catheters

- PTA Balloon Catheters

-

- Hemodialysis Catheters

- Peritoneal Catheters

- Foley Catheters

- Intermittent Catheters

- External Catheters

-

- Peripheral Catheters

- Midline Peripheral Catheters

- Central Venous Catheters

- Neurovascular Catheters

- Specialty Catheters

-

- Wound/Surgical Catheters

- Oximetry Catheters

- Thermodilution Catheters

- IUI Catheters

End Use

- Hospital Stores

- Retail Stores

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)