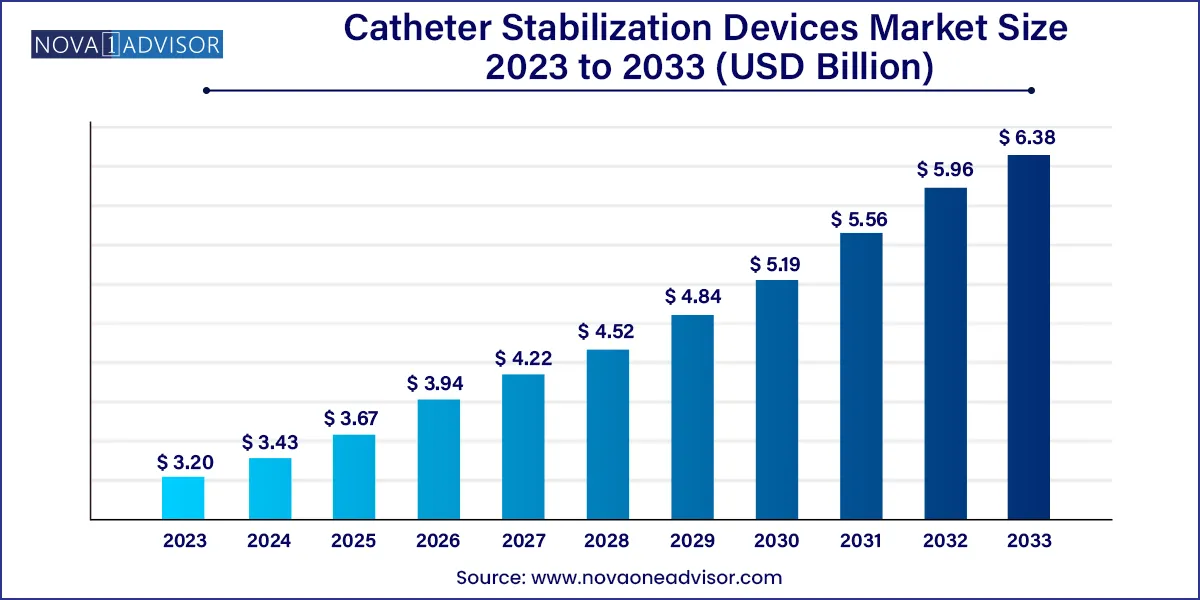

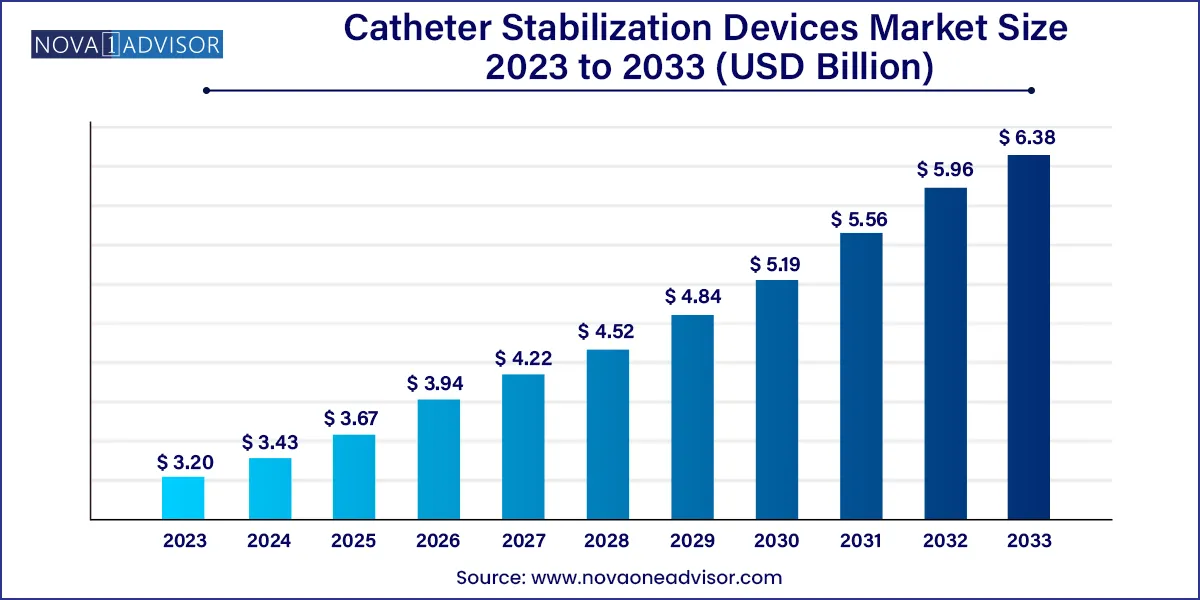

The global catheter stabilization devices market size was exhibited at USD 3.20 billion in 2023 and is projected to hit around USD 6.38 billion by 2033, growing at a CAGR of 7.15% during the forecast period 2024 to 2033.

Key Takeaways:

- North America dominated the catheter securement devices market in 2023 with the highest revenue share.

- In 2023, the arterial securement devices segment held the largest share in the market.

- The CVC securement devices segment is expected to grow at the fastest rate with a CAGR of 8.1% during the forecast period.

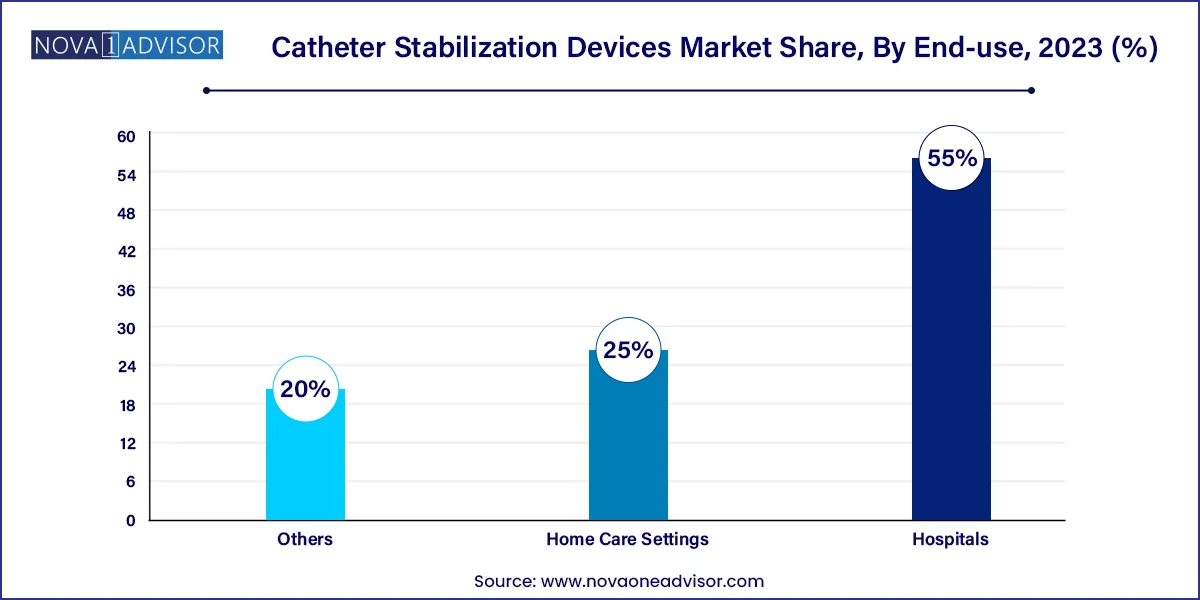

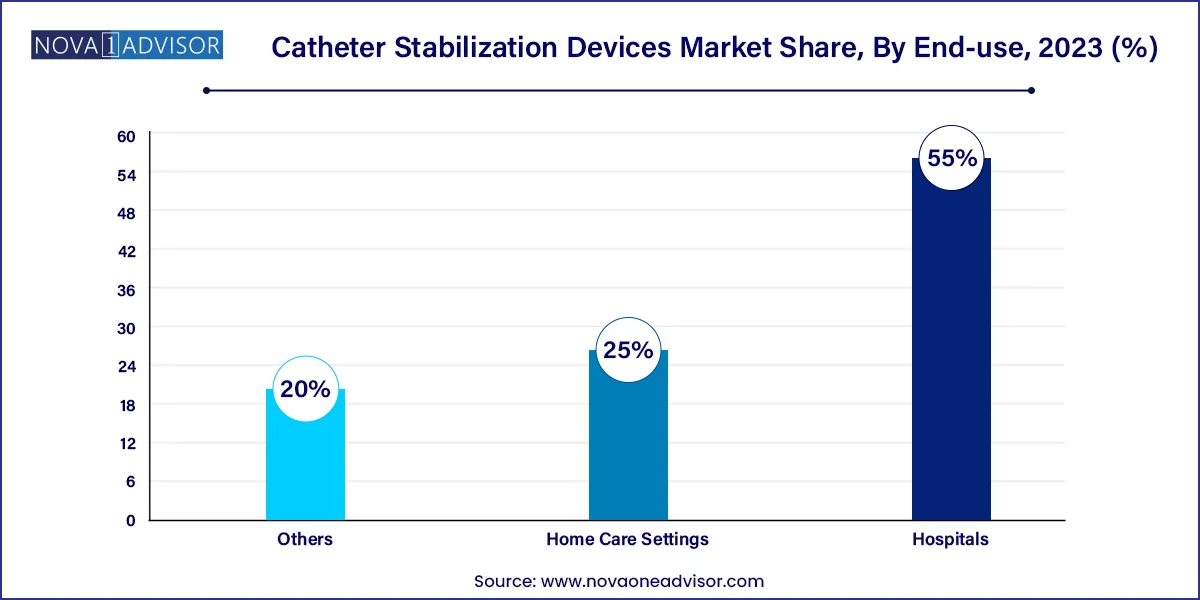

- In 2023, the hospital segment held most of the share.

Market Overview

The catheter stabilization devices market is an integral component of the broader medical devices industry, addressing the need for safe, efficient, and long-term catheter placement. These devices are designed to secure catheters in place, minimizing movement that could lead to complications such as phlebitis, dislodgement, infections, or occlusions. With catheter use prevalent in critical care, surgery, dialysis, and long-term treatment, the demand for advanced stabilization methods continues to surge.

The evolution of catheter stabilization technologies reflects a paradigm shift from traditional adhesive tapes to engineered devices that enhance patient safety and comfort. These modern systems reduce skin trauma, ensure proper catheter positioning, and prevent costly complications like catheter-associated bloodstream infections (CABSI). In both acute care and outpatient settings, their utility is increasingly recognized as a clinical necessity rather than an optional add-on.

According to recent healthcare usage trends, over 70% of hospitalized patients receive some form of catheterization during their stay. As procedures involving central venous catheters (CVCs), peripherally inserted central catheters (PICCs), arterial lines, and urinary catheters become routine, catheter securement devices have transitioned from niche products to standard care accessories. This evolution is supported by clinical guidelines such as those from the Centers for Disease Control and Prevention (CDC) and the Infusion Nurses Society (INS), which recommend the use of securement devices to mitigate infection risk and improve outcomes.

Major Trends in the Market

-

Adoption of Integrated Securement Devices: Combination products with built-in securement and dressing functionalities are gaining popularity.

-

Expansion of Home-Based Healthcare: Increased use of long-term catheterization in home care drives demand for user-friendly, non-invasive securement systems.

-

Rising Preference for Non-Adhesive Technologies: Silicone-based and hydrocolloid alternatives are replacing aggressive adhesives to prevent skin breakdown.

-

Technological Integration: Smart securement systems integrated with sensors to monitor pressure or movement are emerging in clinical trials.

-

Biocompatible and Hypoallergenic Materials: Manufacturers focus on hypoallergenic, latex-free materials to accommodate sensitive patients.

-

Emphasis on Pediatric and Geriatric Care: Specially designed stabilization devices cater to fragile patient populations.

-

Sustainability in Design: Reusable and recyclable securement devices are gaining traction in environmentally conscious healthcare systems.

-

Increased Use in Oncology Settings: Long-term catheter use in chemotherapy elevates demand for secure, low-irritation devices.

-

Miniaturization and Discreet Designs: More discrete and patient-comfort-oriented designs are being introduced to reduce stigma and visibility.

-

Global Supply Chain Localization: Regional manufacturing expansion to meet regulatory needs and reduce shipping lead times.

Catheter Stabilization Devices Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 3.43 Billion |

| Market Size by 2033 |

USD 6.38 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.15% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Product, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

C.R. Bard, Inc.; Baxter; 3M; Centurion Medical Products; B Braun Melsungen AG; Merit Medical Systems, Inc.; ConvaTec, Inc.; TIDI Products, LLC; Smiths Medical |

Key Market Driver: Rising Incidence of Catheter-Associated Complications

One of the primary drivers of the catheter stabilization devices market is the surging awareness and incidence of catheter-related complications, notably bloodstream infections. Central line-associated bloodstream infections (CLABSIs), in particular, pose severe risks to patient safety and incur high treatment costs. According to the CDC, CLABSIs can increase hospital stays by up to 10 days and cost more than $45,000 per episode.

Proper catheter securement drastically reduces these risks by stabilizing the line, minimizing micromotion, and lowering the chances of bacterial entry at the insertion site. As hospitals strive to meet zero-infection targets, particularly under value-based care models where reimbursements are tied to patient outcomes, the role of catheter stabilization becomes more pronounced. This regulatory and cost-saving imperative is pushing healthcare providers to adopt securement devices as standard practice across ICU, OR, and oncology departments.

Key Market Restraint: High Cost and Limited Reimbursement in Developing Nations

Despite clinical benefits, the high cost and lack of reimbursement support for catheter stabilization devices in many developing nations remain a significant barrier. Compared to traditional medical tapes or sutures, these specialized devices entail higher upfront costs, which can deter procurement in resource-limited hospitals. In countries with underfunded healthcare systems or limited insurance coverage, especially across Latin America, Sub-Saharan Africa, and parts of Southeast Asia, securement devices are often excluded from essential supplies.

Moreover, healthcare professionals may be inadequately trained in the use of advanced securement devices, contributing to underutilization. This restraint underscores the need for greater clinical education, more affordable solutions tailored for low-income settings, and broader healthcare policy reform to include catheter-related products in insurance reimbursement schemes.

Key Market Opportunity: Growth of Home-Based Care and Self-Catheterization

A notable opportunity for market expansion lies in the growth of home-based care, driven by rising elderly populations, post-acute care transitions, and outpatient procedures. Patients requiring long-term catheterization such as those undergoing chemotherapy, dialysis, or parenteral nutrition are increasingly managed at home, necessitating devices that are safe, easy to use, and maintain catheter stability for extended periods.

Manufacturers are responding with patient-friendly securement options designed for self-application, including intuitive fastening systems and skin-friendly adhesives. Furthermore, digital health integration, such as Bluetooth-enabled tracking or educational apps, is being explored to support caregivers and enhance adherence to catheter care protocols. This expansion into the homecare sector presents a significant, untapped market for catheter stabilization devices.

Segments Insights:

By Product Insights

Central venous catheter (CVC) securement devices dominated the market, owing to the critical importance of stabilizing high-risk central lines in ICU and oncology settings. CVCs are vital for administering medications, fluids, and parenteral nutrition, and their improper fixation is linked with severe complications. As such, hospitals are increasingly investing in securement devices that ensure long-term stability without sutures. Major players are also innovating integrated dressing-securement systems for CVCs that maintain sterility and reduce dressing changes.

Urinary catheter securement devices are the fastest-growing segment, reflecting the rising prevalence of urinary incontinence and post-operative bladder drainage across aging populations. These devices are particularly valuable in long-term care facilities and home settings, where skin irritation and dislodgement risk are high. The shift toward silicone-based, adhesive-free securement systems that offer gentle but effective fixation is fueling rapid adoption, especially in markets like Japan and the U.S. with growing geriatric populations.

By End-use Insights

Hospitals are the leading end users, leveraging catheter stabilization devices to meet infection control benchmarks and enhance patient safety. Large hospitals often perform complex procedures involving multiple catheter types arterial lines, drainage tubes, PICCs requiring a wide array of stabilization products. Institutional protocols and risk-based audits have increasingly made securement devices a core requirement in patient care pathways. Additionally, hospitals benefit from economies of scale in procurement and training.

Home care settings are the fastest-growing end-use segment, buoyed by the global push for healthcare decentralization and patient preference for at-home recovery. With increasing self-care of chronic diseases, including bladder dysfunction, oncology, and diabetes, the need for secure and comfortable catheter stabilization tools is rising. Product lines targeting caregivers and non-clinical users are focusing on ease-of-use, skin compatibility, and integration with mobile health applications.

By Regional Insights

North America dominates the global catheter stabilization devices market, driven by its mature healthcare infrastructure, high adoption of evidence-based practices, and the presence of leading manufacturers. The U.S., in particular, has implemented stringent hospital-acquired infection (HAI) policies, prompting widespread use of catheter securement devices in both inpatient and outpatient settings. Favorable reimbursement schemes, increased spending on advanced medical consumables, and integrated care systems further support market growth.

Additionally, the rise of ambulatory surgical centers (ASCs) and telehealth services across the U.S. and Canada is promoting the use of stabilization devices in decentralized care environments. According to the American Hospital Association (AHA), nearly 65% of U.S. hospitals have integrated catheter-related HAI prevention protocols, many of which include securement as a standard of care.

Asia-Pacific is the fastest-growing market, propelled by rapid healthcare modernization, expanding insurance coverage, and increasing surgical volumes. Countries like China, India, and Indonesia are witnessing a surge in demand for intravenous therapies, dialysis, and urology care each reliant on effective catheter management. As healthcare providers in the region upgrade clinical practices and pursue international quality certifications, the importance of catheter securement is gaining recognition.

In India, government initiatives such as the Ayushman Bharat scheme have broadened access to tertiary care, boosting demand for advanced medical devices. Meanwhile, local manufacturers in China are launching cost-effective securement devices, catering to the price-sensitive yet rapidly expanding middle-class healthcare segment. This momentum is supported by increasing training programs and partnerships with global players to ensure product quality and compliance.

Some of the prominent players in the Catheter stabilization devices market include:

- C.R. Bard, Inc.

- Baxter

- 3M

- Centurion Medical Products

- B Braun Melsungen AG

- Merit Medical

- Systems, Inc.

- ConvaTec, Inc.

- TIDI Products LLC

- Smith’s Medical

Recent Developments

-

3M Health Care (February 2025) launched the SecureEase+ Stabilization System, integrating antimicrobial dressing with securement for central lines, designed for high-acuity ICU environments.

-

Smiths Medical (January 2025) announced a pilot program with telehealth providers to distribute home-use securement kits for urinary catheters in the U.S.

-

B. Braun (December 2024) opened a new production facility in Malaysia to localize manufacturing of securement devices for the Asia-Pacific market.

-

Centurion Medical Products (October 2024) introduced a pediatric-specific PICC securement device with enhanced skin adhesion and repositioning capabilities.

-

TIDI Products (September 2024) completed the acquisition of a startup focused on eco-friendly catheter fixation systems, expanding its sustainable product line.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global catheter stabilization devices market.

Products

- Arterial Securement Devices

- Central Venous Catheter Securement Devices

- Peripheral Securement Devices

- Urinary Catheter Securement Devices

- Chest Drainage Tube Securement Devices

- Others

End-use

- Hospitals

- Home Care Settings

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)