Celiac Disease Treatment Market Size and Trends

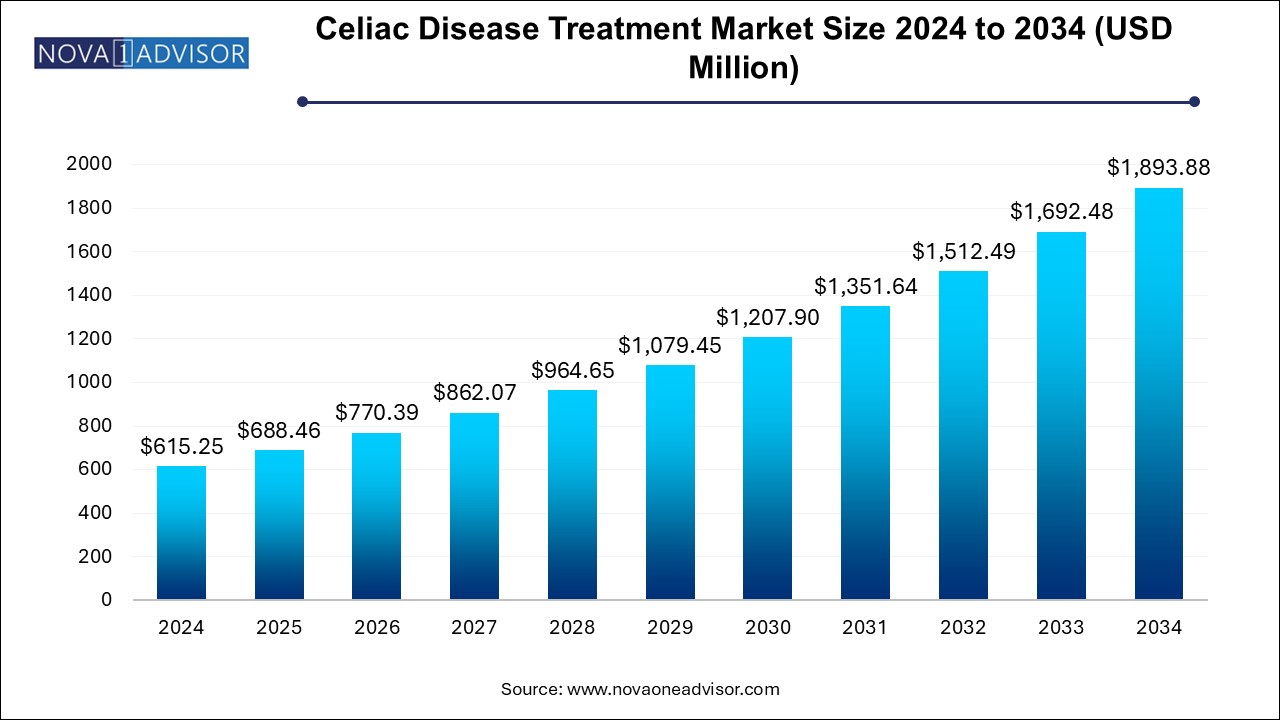

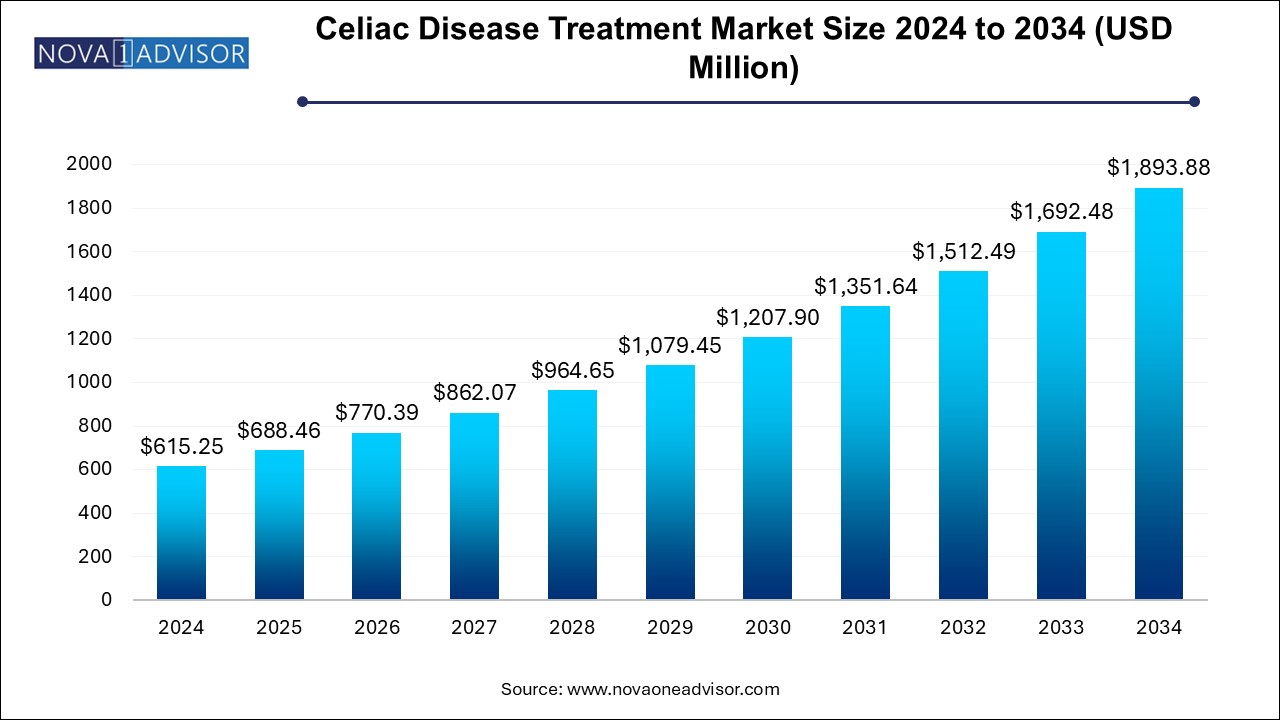

The celiac disease treatment market size was exhibited at USD 615.25 million in 2024 and is projected to hit around USD 1893.88 million by 2034, growing at a CAGR of 11.9% during the forecast period 2024 to 2034.

Celiac Disease Treatment Market Key Takeaways:

- Vitamins and minerals dominated the market and accounted for the largest revenue share of 50.2% in 2024.

- Gluten-free diets are projected to grow at a CAGR of 10.8% over the forecast period.

- The oral route of administration led the market and accounted for the largest revenue share of 62.7% in 2024.

- The parenteral route of administration is expected to grow at a CAGR of 10.4% over the forecast period.

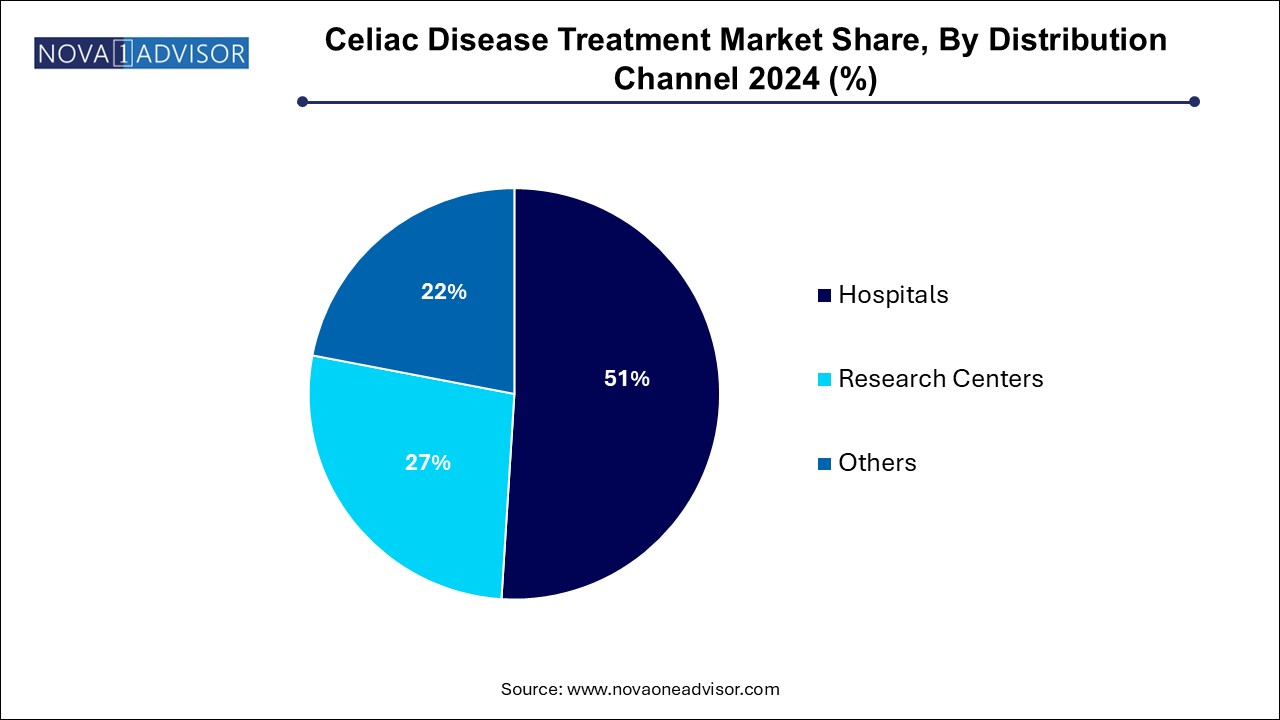

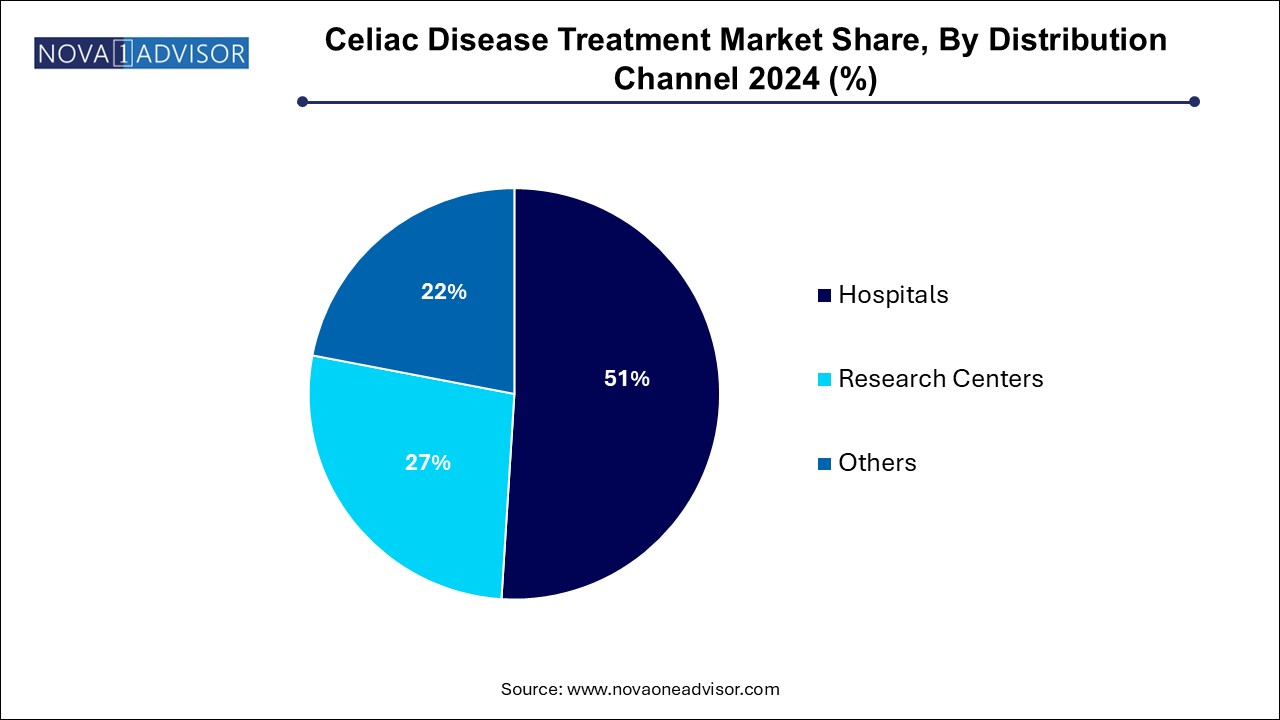

- The hospitals dominated the market and held the largest revenue share of 51.0% in 2024.

- Research centers are expected to grow at a CAGR of 9.6% over the forecast period.

- North America celiac disease treatment market dominated the global market and accounted for the largest revenue share of 41.8% in 2024.

Market Overview

The celiac disease treatment market is an evolving segment within the broader gastrointestinal therapeutics landscape, focused on addressing an autoimmune disorder triggered by the ingestion of gluten, a protein found in wheat, barley, and rye. Celiac disease affects the small intestine, leading to malabsorption of nutrients, gastrointestinal distress, and a range of systemic complications, including osteoporosis, infertility, neurological disorders, and an elevated risk of certain cancers.

For decades, the primary and only effective treatment has been a strict lifelong gluten-free diet (GFD). However, adherence to a GFD is challenging, given the widespread use of gluten in processed foods and the risk of cross-contamination. Moreover, even patients strictly following a GFD may experience persistent symptoms or intestinal damage due to inadvertent gluten exposure.

The growing understanding of celiac disease’s pathophysiology, combined with advances in immunology and biotechnology, has fueled a surge in research into adjunctive and alternative therapies. Medical therapies aimed at improving intestinal barrier function, modulating immune responses, or directly neutralizing gluten are under active investigation, creating new opportunities within the market.

As awareness of celiac disease increases, diagnosis rates improve, and therapeutic innovation accelerates, the celiac disease treatment market is poised for significant transformation in the coming decade.

Major Trends in the Market

-

Development of Novel Therapeutic Agents: Focus on drugs like larazotide acetate and enzyme therapies to complement or replace a gluten-free diet.

-

Expansion of Diagnostic and Screening Programs: Early detection boosting treatment demand globally.

-

Emergence of Personalized Medicine Approaches: Tailoring therapies based on genetic, immunologic, and microbiome profiles.

-

Integration of Digital Health Tools: Apps and platforms supporting dietary adherence and symptom tracking.

-

Increased Research into Microbiome-targeted Therapies: Exploring gut microbiota modulation as a treatment avenue.

-

Rising Demand for Gluten Detection Technologies: Tools for real-time detection of gluten in food promoting safer consumption.

-

Growing Investment in Biologics: Targeting inflammatory pathways and autoimmune responses.

-

Collaborations Between Pharma Companies and Research Institutes: Accelerating drug discovery and clinical development.

Report Scope of Celiac Disease Treatment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 688.46 Million |

| Market Size by 2034 |

USD 1893.88 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 11.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Treatment, Route of Administration, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Teva Pharmaceutical Industries Ltd.; Amgen Inc.; Amneal Pharmaceuticals LLC.; Glenmark Life Sciences Limited; Takeda Pharmaceutical Company Limited.; Hikma Pharmaceuticals PLC; Viatris Inc.; Zydus Pharmaceuticals, Inc.; Novartis AG; BioLineRx Ltd. |

Key Market Driver: Rising Prevalence of Celiac Disease Globally

The primary driver propelling the celiac disease treatment market is the rising prevalence and improved diagnosis of celiac disease worldwide. Historically underdiagnosed, celiac disease is now recognized to affect about 1% of the global population, with rates even higher in some regions.

Factors such as better serological screening tools (e.g., tissue transglutaminase antibody tests), increased healthcare provider awareness, and growing patient education initiatives have led to earlier and more frequent diagnoses. The emergence of non-classical and asymptomatic presentations has further broadened the diagnostic spectrum, revealing a much larger affected population than previously estimated.

As more individuals are diagnosed, the need for comprehensive treatment solutions beyond dietary management becomes increasingly urgent, driving demand for both pharmaceutical interventions and supportive care products.

Key Market Restraint: High Dependence on Gluten-Free Diet and Limited Approved Drug Options

Despite growing R&D activity, the market's current heavy reliance on gluten-free diets (GFD) and the limited number of approved pharmacological treatments act as significant restraints. At present, no drug has gained global regulatory approval specifically for the primary treatment of celiac disease, making GFD the default management strategy.

While strict adherence to a GFD can be effective, maintaining it is difficult due to gluten’s ubiquity in processed foods, restaurants, and even non-food products like medications and cosmetics. Furthermore, gluten contamination can occur even with best efforts, leading to continued symptoms and intestinal damage in a substantial minority of patients.

The slow pace of drug development and regulatory hurdles for demonstrating therapeutic efficacy in an autoimmune setting add complexity, prolonging the timeline for new treatment launches and limiting current options for patients and providers.

Key Market Opportunity: Advancements in Immunomodulatory Therapies

A major opportunity in the celiac disease treatment market lies in the development of immunomodulatory therapies aimed at altering the disease’s underlying immune response rather than just avoiding gluten exposure.

Research into agents like larazotide acetate (which modulates intestinal tight junctions), therapeutic vaccines, anti-inflammatory monoclonal antibodies, and gluten-degrading enzymes presents new hope for patients. These therapies seek either to reduce gluten-induced immune activation or promote immune tolerance to gluten, offering a potential cure or, at minimum, a safer and more flexible dietary regimen.

Companies that succeed in bringing the first FDA- or EMA-approved immunotherapy to market are expected to achieve blockbuster status, creating unprecedented growth opportunities.

Celiac Disease Treatment Market By Treatment Insights

Gluten-free diet (GFD) dominates the treatment segment, forming the mainstay of celiac disease management since the condition’s first clinical descriptions in the 20th century. GFD effectively prevents disease symptoms and complications when strictly adhered to, explaining its entrenched position. Gluten-free foods, supplements, and dietary support services constitute a significant associated economy, with major supermarkets and food companies expanding their gluten-free product lines.

Medical therapies are growing fastest, driven by the surge in pharmaceutical R&D aimed at creating adjunctive or alternative treatments. Agents like larazotide acetate, budesonide for refractory celiac disease, and novel biologics targeting T-cell activation are gaining traction. Although most are still in clinical trial stages, their future market potential is substantial, especially for patients struggling with GFD adherence or experiencing refractory symptoms.

Celiac Disease Treatment Market By Route of Administration Insights

Oral administration dominates the market, largely due to the convenience, compliance, and preference among patients managing a chronic condition. Vitamins, minerals, enzyme therapies, and most investigational drugs under development, including larazotide acetate, are designed for oral consumption, aligning with outpatient and home-based care models.

Parenteral administration is expanding rapidly, particularly for biologics and monoclonal antibodies in development that cannot yet be effectively delivered orally. Injectable formulations are being explored to modulate immune responses or directly impact inflammatory pathways, especially for severe or refractory celiac disease cases. As pipeline products mature, the share of parenteral therapies is expected to grow steadily.

Celiac Disease Treatment Market By Distribution Channel Insights

Hospitals dominate the distribution channel segment, serving as the primary sites for initial diagnosis, serological testing, endoscopy, and management of complex celiac disease cases, including refractory disease requiring immunosuppressive therapies.

Research centers are growing fastest, reflecting the surge in clinical trial activity around new therapeutic candidates. Academic institutions and specialized research hospitals are at the forefront of conducting pivotal Phase II and Phase III trials for investigational therapies, facilitating patient enrollment, protocol management, and regulatory submissions.

Celiac Disease Treatment Market By Regional Insights

North America leads the global celiac disease treatment market, driven by high disease prevalence, strong awareness initiatives, advanced diagnostic infrastructures, and proactive regulatory frameworks. The U.S. alone accounts for a substantial share, with organizations like Beyond Celiac and the Celiac Disease Foundation actively promoting education, research funding, and patient advocacy.

The region also boasts a robust pipeline of investigational drugs, with several biotech startups and pharmaceutical giants headquartered in North America. Insurance reimbursement for celiac-related diagnostic tests and consultations further supports early diagnosis and market growth.

Asia-Pacific is the fastest-growing region, propelled by increasing diagnosis rates, improving healthcare infrastructure, and changing dietary patterns that expose genetically susceptible populations to higher gluten consumption. Countries like Japan, China, India, and Australia are experiencing rising celiac awareness through physician education programs and consumer advocacy campaigns.

Although historically underdiagnosed, improvements in serological screening, urbanization, and access to specialty care are accelerating market expansion. Additionally, the growing middle-class population’s willingness to invest in specialty foods and medical care supports future growth in both gluten-free diets and emerging pharmaceutical therapies.

Some of the prominent players in the celiac disease treatment market include:

- Teva Pharmaceutical Industries Ltd.

- Amgen Inc.

- Amneal Pharmaceuticals LLC.

- Glenmark Life Sciences Limited

- Takeda Pharmaceutical Company Limited.

- Hikma Pharmaceuticals PLC

- Viatris Inc.

- Zydus Pharmaceuticals, Inc.

- Novartis AG

- BioLineRx Ltd.

Celiac Disease Treatment Market Recent Developments

-

March 2025: 9 Meters Biopharma reported positive Phase II results for larazotide acetate, showing reduced gastrointestinal symptoms in celiac patients on a gluten-free diet.

-

February 2025: Takeda Pharmaceuticals announced the launch of a new clinical trial exploring a monoclonal antibody targeting interleukin pathways in refractory celiac disease.

-

January 2025: Cour Pharmaceuticals received FDA Fast Track designation for its nanoparticle-based therapeutic vaccine for inducing gluten tolerance.

-

December 2024: ImmunogenX completed enrollment for its Phase III trial of latiglutenase, an oral glutenase enzyme therapy designed to degrade gluten in the digestive tract.

-

November 2024: BioLineRx partnered with a major North American research institute to explore microbiome-targeted interventions for celiac disease management.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the celiac disease treatment market

Treatment

- Vitamins & Minerals

- Gluten-free Diet

- Medical Therapies

-

- Infliximab

- Larazotide Acetate

- Azathioprine

- Budesonide

- Others

By Route of Administration

By Distribution Channel

- Hospitals

- Research Centers

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)