Cell Analysis Market Size and Growth 2026 to 2035

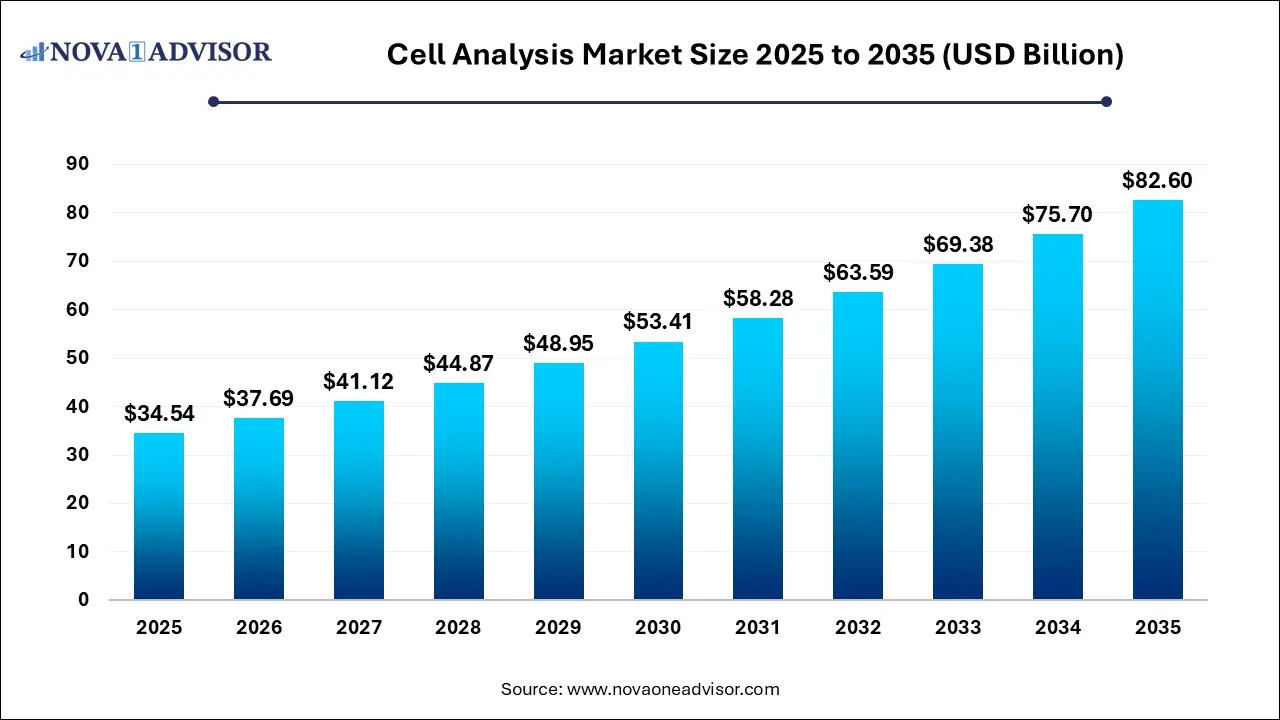

The global cell analysis market was valued at USD 34.54 billion in 2025 and is projected to hit around USD 82.6 billion by 2035, growing at a CAGR of 9.11% during the forecast period 2026 to 2035. The growth of the market is driven by the rising incidence of chronic diseases and increasing investments in cell-based research.

Cell Analysis Market Key Takeaways:

- North America dominated the cell analysis market in 2025.

- Asia Pacific is expected to expand at the highest CAGR between 2026 and 2035.

- By product & service, the reagents & consumables segment held the largest market share in 2025.

- By product & service, the services segment is expected to grow at the fastest rate during the projection period.

- By technique, the flow cytometry segment led the market in 2025.

- By technique, the high-content screening segment is expected to grow at a rapid face in the upcoming period.

- By process, the cell identification segment dominated the market in 2025.

- By process, the single-cell analysis segment is expected to expand at the fastest CAGR during the projection period.

- By end-use, the pharmaceutical and biotechnology companies segment contributed the largest market share in 2025.

- By end-use, the hospitals and clinical testing laboratories segment is expected to grow at the highest CAGR in the coming years.

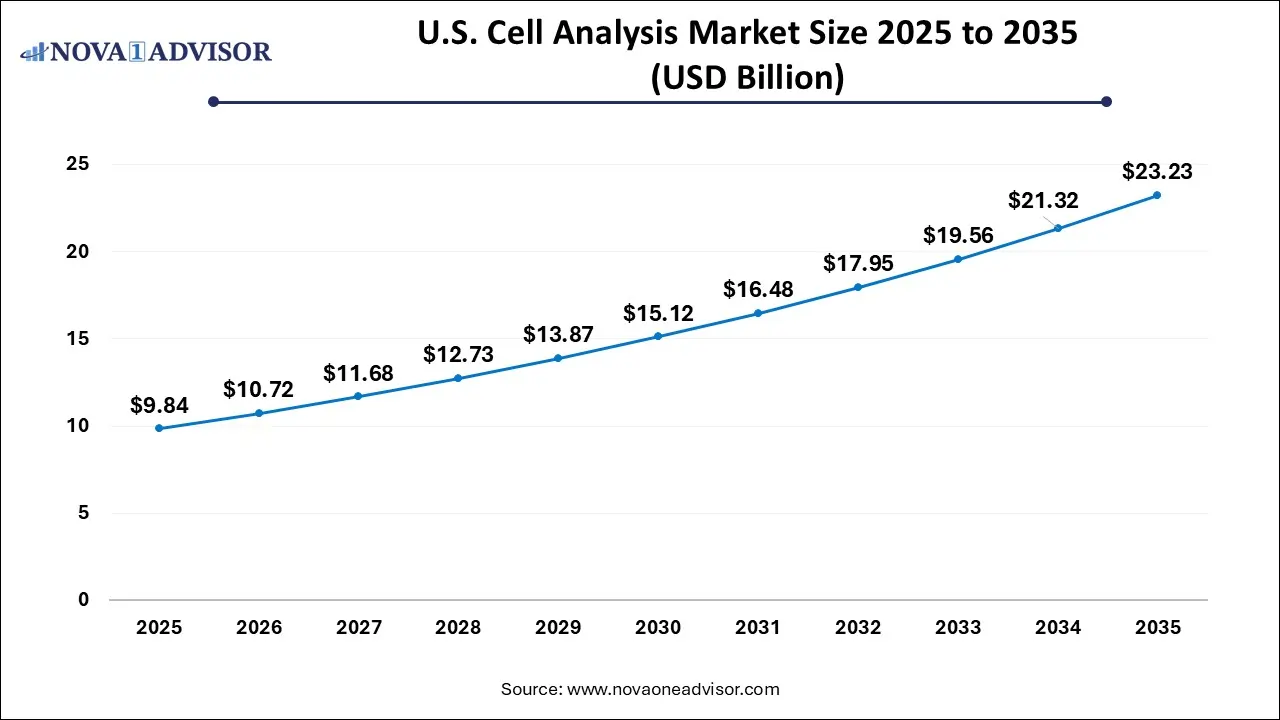

U.S. Cell Analysis Market Size and Growth 2026 to 2035

The U.S. cell analysis market size is evaluated at USD 9.84 billion in 2025 and is projected to be worth around USD 23.23 billion by 2034, growing at a CAGR of 8.97% from 2026 to 2035.

What Made North America the Dominant Region in the Cell Analysis Market?

North America dominated the cell analysis market while capturing the largest share in 2025. This is primarily due to its well-established biotechnology and pharmaceutical industries, which heavily invest in advanced cell analysis technologies for drug discovery, development, and personalized medicine. The region benefits from robust research infrastructure, significant government funding, and a strong presence of key market players such as Thermo Fisher Scientific, BD, and Danaher. Additionally, the high prevalence of chronic diseases and cancer has driven demand for precise diagnostic and therapeutic tools, further boosting the adoption of cell analysis solutions. The early adoption of cutting-edge technologies and strong regulatory support also contribute to North America's dominant market position.

The U.S. is a major contributor to the North American cell analysis market due to its strong biotechnology and pharmaceutical ecosystem, which heavily relies on advanced cell analysis for research, diagnostics, and drug development. The country is home to leading industry players, top research institutions, and well-funded academic centers that drive innovation and adoption of cutting-edge technologies like flow cytometry and single-cell analysis. Additionally, substantial government and private investments in life sciences, along with a high burden of chronic and infectious diseases, fuel continuous demand for precise and scalable cell-based solutions. The U.S. also benefits from a favorable regulatory environment and a skilled scientific workforce, further reinforcing its leadership in the market. Moreover, the rising approvals for cell and gene therapies supports market growth.

FDA-Approved Cell & Gene Therapies As of May 2025

| Manufacturers |

Product |

| Celgene Corporation |

ABECMA (idecabtagene vicleucel) |

| Iovance Biotherapeutics, Inc. |

AMTAGVI (lifileucel) |

| Pfizer, Inc. |

BEQVEZ (fidanacogene elaparvovec-dzkt) |

| Juno Therapeutics, Inc. |

BREYANZI (lisocabtagene maraleucel) |

| Janssen Biotech, Inc. |

CARVYKTI (ciltacabtagene autoleucel) |

| Vertex Pharmaceuticals Incorporated |

CASGEVY (exagamglogene autotemcel [exa-cel]) |

Why is Asia Pacific Experiencing Rapid Growth in the Cell Analysis Market?

Asia Pacific is expected to experience rapid growth in the market due to increasing investments in biotechnology and life sciences research across countries like China, India, Japan, and South Korea. Governments in the region are actively supporting healthcare innovation through funding, infrastructure development, and regulatory reforms to boost biotech and pharmaceutical sectors. The rising prevalence of chronic diseases, growing demand for personalized medicine, and expanding clinical research activities are also driving the need for advanced cell analysis technologies. Additionally, the presence of a large patient population and the growing number of contract research organizations (CROs) and academic institutions are accelerating adoption.

China is a leading player in the Asia Pacific cell analysis market due to its rapidly expanding biotechnology and pharmaceutical industries, backed by strong government support and funding initiatives. The country has made significant investments in life sciences infrastructure, research parks, and innovation hubs, encouraging both domestic and international companies to expand their presence. China's large patient population and growing demand for precision medicine have also driven adoption of advanced cell analysis technologies in diagnostics and therapeutic development. Additionally, the rise of contract research organizations (CROs) and favorable policies under initiatives like “Made in China 2025” have further strengthened its position in the regional market.

Impact of AI on the Cell Analysis Market

Artificial intelligence (AI) is significantly transforming the cell analysis market by enhancing the speed, accuracy, and depth of data interpretation. AI-driven tools enable automated image recognition, pattern detection, and predictive analytics, allowing researchers to extract meaningful insights from complex cellular datasets with minimal manual intervention. This is particularly beneficial in high-throughput screening, drug discovery, and single-cell analysis, where large volumes of data are generated. AI also improves reproducibility and reduces human error, making cell-based assays more reliable. As AI technologies continue to advance, they are expanding the capabilities of cell analysis platforms, driving innovation and accelerating biological research and clinical applications.

- In January 2025, ThinkCyte announced the pre-commercial launch of VisionCyte, its new AI-driven cell analysis platform, expanding beyond its flagship VisionSort system. VisionCyte combines high-resolution morphological profiling, high-throughput performance, and advanced AI to accelerate biomarker discovery and drug target identification. Full commercial rollout is planned for H2 2025.

Market Overview

The cell analysis market involves technologies and tools used to study the physical and chemical characteristics of cells, enabling detailed insights into cellular functions, structures, and interactions. It plays a crucial role in various applications such as drug discovery, cancer research, immunology, and clinical diagnostics by providing precise, high-throughput, and real-time data. Key benefits include improved accuracy in disease diagnosis, enhanced understanding of cellular processes, and accelerated development of therapeutics. The market is driven by factors like rising investments in biopharmaceutical research, advancements in cell analysis technologies, and increasing demand for personalized medicine. Growing adoption in emerging regions, expanding applications in regenerative medicine, and regulatory guidelines for cell-based research further fuel its growth.

- For instance, the International Society for Stem Cell Research (ISSCR) released updated guidelines to reinforce ethical, scientific, and regulatory standards for stem cell research and clinical translation, aiming to ensure safe therapies and prevent premature commercialization.

What are the Major Trends in the Cell Analysis Market?

- Rise of Single-Cell Analysis

Growing demand for understanding cellular heterogeneity is driving the adoption of single-cell technologies in research areas like oncology, immunology, and stem cell biology.

- Integration of Automation and High-Throughput Systems

Automated cell analysis platforms enable large-scale, efficient screening for drug discovery and diagnostics, improving reproducibility and laboratory productivity.

- Advancements in Imaging and Flow Cytometry

Innovations in real-time imaging, spectral flow cytometry, and label-free technologies are expanding the capabilities of researchers to study complex cellular behavior in greater detail.

- Expansion of Cell-Based Therapies

Increasing use of cell analysis in cell and gene therapy development is boosting demand for advanced tools to ensure quality control, potency, and safety of therapeutic products.

Report Scope of Cell Analysis Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 37.69 Billion |

| Market Size by 2035 |

USD 82.6 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 9.11% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Product & Service, Technique, Process, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Danaher; BD; Merck KGaA; Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Miltenyl Biotech; Revvity; New England Biolabs; Avantor, Inc. |

Market Dynamics

Drivers

Rising Demand for Cell and Gene Therapies

The rising demand for gene and cell therapies is a major driver of growth in the cell analysis market, as these advanced therapies require precise and detailed cellular characterization throughout development and manufacturing. Cell analysis tools are essential for assessing cell viability, purity, function, and genetic modifications to ensure the safety and efficacy of therapeutic products. As more gene and cell therapies enter clinical pipelines and receive regulatory approvals, the need for robust, high-throughput, and sensitive cell analysis solutions continues to grow. Additionally, regulatory agencies increasingly mandate comprehensive quality control, further fueling demand for sophisticated analytical technologies.

Increasing Cell-Based Research

The increasing focus on cell-based research is significantly driving the growth of the cell analysis market, as researchers seek deeper insights into cellular behavior, function, and interaction. Cell analysis tools are critical for applications such as cancer biology, immunology, neuroscience, and regenerative medicine, where understanding cellular mechanisms is key to scientific advancement. With rising investments from both public and private sectors in biomedical research, demand for advanced technologies like flow cytometry, high-content screening, and live-cell imaging has surged. These tools enable precise, real-time analysis of cellular responses to various stimuli, supporting drug development and disease modeling. As research becomes more complex and data-driven, the need for sophisticated cell analysis solutions continues to expand.

Restraints

High Costs of Instruments and Complexity of Data Analysis

The high cost of cell analysis instruments, such as flow cytometers and high-content imaging systems, poses a significant barrier for many research institutions and smaller biotech firms, especially in developing regions. These advanced systems often require substantial capital investment, along with ongoing maintenance and specialized consumables, limiting widespread adoption. Additionally, the complexity of data generated from cell analysis, especially in high-throughput and single-cell studies, requires advanced computational tools and skilled personnel to interpret results accurately. This adds to operational costs and can slow down research timelines.

Regulatory & Ethical Concerns and Standardization Issues

Regulatory and ethical concerns present significant hurdles in the growth of the cell analysis market. Strict regulatory frameworks and varying ethical standards across countries can delay product approvals and limit cross-border research collaborations. Additionally, the lack of standardized protocols for cell analysis methods, data interpretation, and quality control creates inconsistencies in results and complicates validation and reproducibility. These issues make it difficult for companies and researchers to scale up innovations or gain regulatory clearance efficiently.

Opportunities

Development of Portable and Cost-Effective Instruments

A major opportunity in the market lies in the development of portable and cost-effective cell analysis instruments. These compact and affordable devices allow smaller laboratories, academic institutions, and point-of-care settings to perform high-quality cellular analysis without the need for large infrastructure or high capital investment. This democratization of technology enables wider adoption in emerging markets and remote areas, where traditional, expensive systems are often out of reach. Moreover, portable solutions support field-based research, real-time diagnostics, and decentralized testing, aligning with the growing demand for flexible and rapid analysis. As innovation continues in miniaturization and affordability, these instruments are poised to drive market expansion across diverse applications.

Advancements in Cell Analysis Technologies

Advancements in cell analysis technologies, such as real-time imaging, high-throughput screening, spectral flow cytometry, and single-cell analysis, are unlocking new opportunities across research, diagnostics, and therapeutics. These innovations enable deeper insights into cellular behavior, enhanced sensitivity, and more precise data, accelerating discoveries in areas like cancer, immunology, and regenerative medicine. As technologies become more integrated with AI and automation, they offer improved scalability, reproducibility, and efficiency. This technological progress is not only expanding applications but also attracting investments and collaborations, fueling growth in the market.

Cell Analysis Market By Product & Service Insights

Why Did the Reagents & Consumables Segment Dominate the Cell Analysis Market in 2025?

The reagents & consumables segment dominated the market with a major share in 2025 due to their essential role in a wide range of cell-based assays and research applications. These products, including antibodies, dyes, buffers, and media, are critical for sample preparation, staining, detection, and analysis across both academic and commercial laboratories. As research in areas like cancer biology, immunology, and regenerative medicine continues to grow, the demand for high-quality, specialized reagents has surged. Additionally, advancements in single-cell technologies and flow cytometry have further increased the need for customizable and application-specific consumables.

The services segment is expected to grow at the fastest rate in the upcoming period due to the increasing demand for outsourced research, diagnostics, and data interpretation support. Many academic institutions, small biotech firms, and clinical labs are turning to specialized service providers for access to advanced technologies like flow cytometry, single-cell analysis, and high-content screening without the need for significant capital investment. Additionally, the complexity of cell analysis data requires expert bioinformatics and analytical services, further driving segmental growth. The rising trend of contract research and testing services is expected to sustain this momentum in the coming years.

Cell Analysis Market By Technique Insights

What Made Flow Cytometry the Dominant Technique in the Cell Analysis Market?

The flow cytometry segment dominated the market in 2025 due to its unmatched ability to rapidly analyze large populations of cells with high precision and detail. Widely used in immunology, cancer research, and clinical diagnostics, flow cytometry enables multiparametric analysis of physical and chemical characteristics of cells. Its applications in cell sorting, biomarker detection, and immune profiling have become essential, particularly with the rise of immunotherapies and personalized medicine. Technological advancements, such as high-throughput capabilities and integration with AI for data interpretation, have further expanded its utility across research and clinical settings. The combination of speed, scalability, and versatility solidified flow cytometry’s leading position in the market.

The high content screening segment is expected to expand at the fastest CAGR during the forecast period due to its ability to combine automated microscopy, image analysis, and multi-parameter data extraction. This technology is increasingly used in drug discovery, toxicity testing, and cell-based assays, allowing researchers to analyze complex cellular responses with high accuracy and throughput. As pharmaceutical and biotech companies demand more efficient tools for early-stage screening and phenotypic profiling, HCS offers a powerful solution. Its integration with AI and machine learning further enhances data analysis capabilities, making it a vital tool for next-generation cell research.

Cell Analysis Market By Process Insights

How Does the Cell Identification Segment Lead the Cell Analysis Market in 2025?

The cell identification segment led the market in 2025 due to its critical role in a wide range of biomedical applications, including disease diagnosis, immunophenotyping, and drug development. Accurately identifying and classifying specific cell types is essential for understanding disease mechanisms, monitoring immune responses, and developing targeted therapies. The increasing use of advanced technologies like flow cytometry, immunohistochemistry, and single-cell RNA sequencing has enhanced the precision and efficiency of cell identification.

Moreover, the rise of personalized medicine and cell-based therapies has further driven demand for robust cell identification tools. As research and clinical labs prioritize precise cell characterization, this segment has maintained a strong foothold in the market.

The single-cell analysis segment is expected to grow at a significant rate in the market over the projection period due to its crucial role in understanding cellular heterogeneity and uncovering rare cell populations. This technology enables high-resolution insights into gene expression, protein levels, and cell function at the individual cell level, which is critical for advancing personalized medicine, cancer research, and immunology. As research increasingly shifts toward precision diagnostics and targeted therapies, demand for single-cell technologies is rapidly expanding. Ongoing advancements in microfluidics, sequencing, and data analytics are also enhancing the accessibility and scalability of single-cell analysis, driving its adoption across both academic and clinical settings.

Cell Analysis Market By End-use Insights

How Does Pharmaceutical and Biotechnology Companies Contribute the Largest Market Share in 2025?

The pharmaceutical and biotechnology companies segment held the largest share of the cell analysis market in 2025 due to their extensive use of cell-based assays in drug discovery, development, and quality control. These companies rely heavily on cell analysis technologies to screen drug candidates, evaluate efficacy and toxicity, and understand disease mechanisms at the cellular level. The surge in biologics, cell and gene therapies, and personalized medicine further increased the need for advanced cell analysis tools. Additionally, the growing investment in R&D by biopharma companies and their partnerships with diagnostics and research organizations accelerated the adoption of high-throughput and high-precision cell analysis platforms.

The hospitals and clinical testing laboratories segment is expected to grow at the fastest rate in the coming years due to the increasing adoption of cell-based diagnostics for disease detection, monitoring, and personalized treatment planning. As precision medicine and immunotherapy become more integrated into clinical practice, hospitals are utilizing advanced cell analysis tools like flow cytometry and single-cell sequencing to guide therapeutic decisions. Additionally, the rise in chronic and infectious diseases has fueled demand for accurate, high-throughput diagnostic testing within clinical settings. Growing investments in healthcare infrastructure and diagnostic capabilities, particularly in emerging markets, are further accelerating this segment's growth.

Cell Analysis Market Value Chain Analysis

1. Raw Material Sourcing

This stage involves acquiring high-quality reagents, dyes, buffers, antibodies, and consumables essential for cell analysis workflows. The consistency and purity of these materials are critical for ensuring reliable experimental outcomes and data accuracy.

- Key Players: Merck KGaA, Thermo Fisher Scientific, Avantor, Bio-Rad Laboratories

2. Technology & Instrument Development

Manufacturers design and produce advanced instruments such as flow cytometers, imaging systems, high-content screening platforms, and single-cell analysis tools. These technologies are at the core of cell analysis, offering high throughput, sensitivity, and multiplexing capabilities for diverse applications like drug screening, immunology, and cancer research.

- Key Players: BD (Becton, Dickinson and Company), Danaher (Cytiva, Beckman Coulter), Agilent Technologies, Bio-Techne

3. Software & Data Analytics

Cell analysis generates vast amounts of complex biological data, requiring powerful software tools for visualization, quantification, and interpretation. AI and machine learning integration in analytical software is enhancing real-time analysis, automation, and predictive modeling.

- Key Players: Thermo Fisher Scientific, PerkinElmer (Revvity), Sartorius, Shimadzu Corporation

4. Manufacturing & Quality Control

This phase includes the mass production of reagents, kits, and instruments under stringent quality control standards such as Good Manufacturing Practices (GMP). Maintaining product consistency, sterility, and performance validation is crucial for clinical and research use.

- Key Players: Merck KGaA, Thermo Fisher Scientific, Lonza Group, FUJIFILM Irvine Scientific

5. End-User Applications

Cell analysis tools are widely used in pharmaceutical companies, biotechnology firms, academic institutions, and clinical labs for research, diagnostics, drug discovery, and personalized medicine. The end-user segment relies on integrated solutions combining instruments, software, and consumables.

- Key Users: Pfizer, Novartis, Roche, academic research centers, CROs like WuXi AppTec and Charles River

Competitive Landscape

1. Thermo Fisher Scientific

A global leader in life sciences, Thermo Fisher offers a comprehensive portfolio of cell analysis solutions, including flow cytometers, reagents, consumables, and software. The company’s robust R&D and acquisitions strategy support innovation in areas like single-cell analysis and precision diagnostics.

2. BD (Becton, Dickinson and Company)

BD is renowned for its advanced flow cytometry instruments and reagents used in clinical diagnostics, immunology, and cancer research. Its technologies enable high-throughput, multi-parametric analysis of cells and play a critical role in both research and clinical labs.

3. Danaher Corporation (via Cytiva & Beckman Coulter Life Sciences)

Danaher’s subsidiaries provide powerful tools for cell imaging, analysis, and single-cell genomics. Beckman Coulter’s cytometry systems and Cytiva’s bioprocessing platforms help streamline cell-based drug discovery and therapeutic development.

4. Merck KGaA (MilliporeSigma in the U.S.)

Merck delivers high-quality cell culture media, reagents, and cell analysis instruments. Its innovations support cell-based assays in biopharmaceutical development, stem cell research, and diagnostic workflows.

5. Agilent Technologies

Agilent contributes to the market with its advanced imaging and analytical instruments for live cell analysis and real-time monitoring. Its technologies are used in toxicology, cancer biology, and pharmacology studies.

6. Bio-Rad Laboratories

Bio-Rad offers flow cytometry systems, imaging tools, and reagents used extensively in immunology and clinical diagnostics. Its user-friendly platforms support small labs as well as large research institutions.

7. PerkinElmer (Revvity)

Known for its high-content screening (HCS) technologies, PerkinElmer helps researchers conduct multiparametric analysis of cells, particularly in drug discovery and toxicology studies.

8. Lonza Group

Lonza provides cell analysis services, cell culture media, and tools for cell therapy and bioproduction. Its offerings are crucial for the expansion of regenerative medicine and cell-based therapies.

Cell Analysis Market Recent Developments

- In May 2025, BD (Becton, Dickinson and Company) globally launched the BD FACSDiscover™ A8 Cell Analyzer, the world’s first cell analyzer to integrate spectral flow cytometry with real-time cell imaging. Featuring BD SpectralFX™ and BD CellView™ Image Technology, the device allows researchers to analyze 50+ cell characteristics and capture detailed spatial and morphological data, enhancing biomarker discovery and cellular analysis with greater depth, speed, and sensitivity.

- In March 2025, Cytek Biosciences unveiled the Cytek Muse Micro, a next-gen upgrade to its Guava Muse cell analyzer. Designed for simplicity and precision, the affordable system expands access to flow cytometry across applications like cell and gene therapy, drug discovery, and immune monitoring. Featuring an intuitive touchscreen, user-friendly software, and “Mix-and-Read” assays, Muse Micro makes advanced cell analysis more accessible and efficient.

- In June 2023, Agilent Technologies launched the enhanced xCELLigence RTCA Software Pro Version 2.8, designed to support GMP-regulated facilities with improved real-time cell analysis. The update includes data integrity controls compliant with FDA 21 CFR Part 11 and EU GMP Annex 11, meeting critical requirements for electronic records and signatures in pharmaceutical manufacturing.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the cell analysis market

By Product & Service

- Reagents & Consumables

- Instruments

- Accessories

- Software

- Service

By Technique

- Flow Cytometry

- PCR

- Cell Microarrays

- Microscopy

- Spectrophotometry

- High Content-Screening

- Other Techniques

By Process

- Cell Identification

- Cell Viability

- Cell Signaling Pathways

- Cell Proliferation

- Cell Counting

- Cell Interaction

- Cell Structure Study

- Single-cell Analysis

- Others

By End-use

- Pharmaceutical & Biotechnology Companies

- Hospitals & Clinical Testing Laboratories

- Academic & Research Institutes

- Other

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)