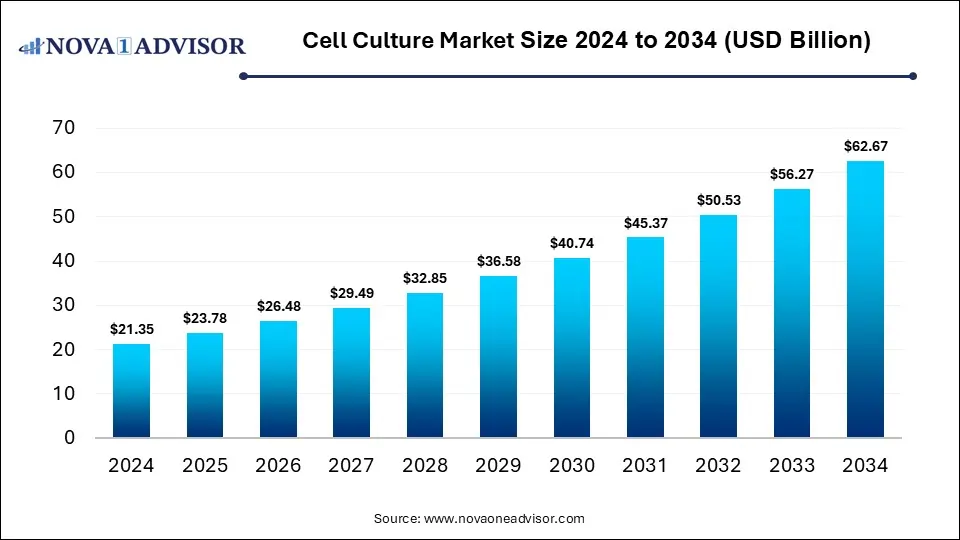

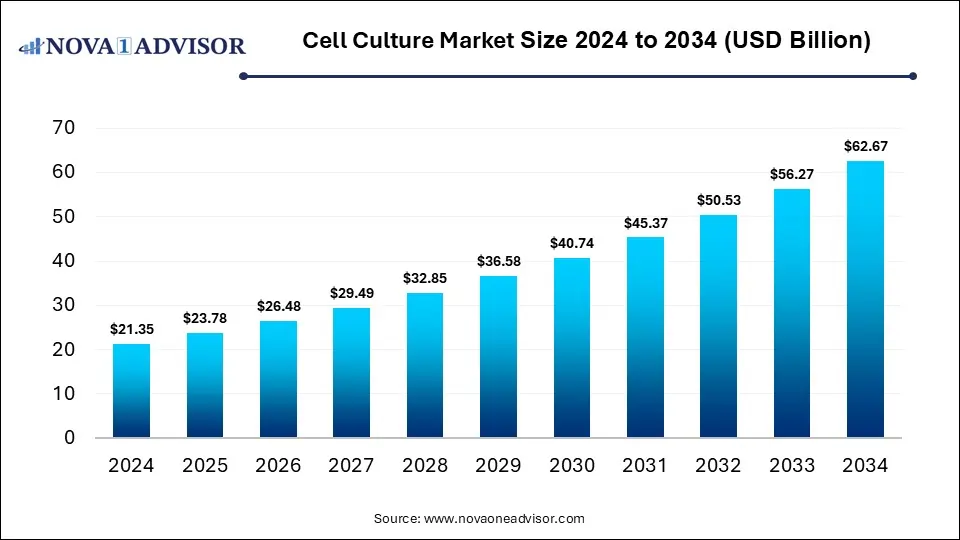

Cell Culture Market Size and Forecast 2025 to 2034

The global cell culture market size is calculated at USD 21.35 billion in 2024, grows to USD 23.78 billion in 2025, and is projected to reach around USD 62.67 billion by 2034, The market is expanding at a CAGR of 11.35% between 2025 and 2034. The market is growing due to rising demand for biopharmaceuticals, regenerative medicine, and advan7chnology.

Cell Culture Market Key Takeaways

- North America dominated the cell culture market with the revenue shares in 2024.

- Asia Pacific is expected to grow at the fastest CAGR in the market during the forecast period.

- By product, the consumables segment held the largest market share in 2024.

- By product, the stem cell culture segment is expected to grow at a notable rate in the market during the forecast period.

- By application, the biopharmaceutical production segment led the market with the largest revenue share in 2024.

- By application, the diagnostics segment is expected to grow at a notable rate in the market during the forecast period.

How is the Cell Culture Market Evolving?

Cell culture is the process of growing and maintaining cells outside their natural environment under controlled laboratory conditions. The cell culture is evolving as industries shift towards sustainable and ethical alternatives to animal testing, boosting demand for in-vitro models. Rising focus on food technology, including lab-grown meat and dairy substitutes, is also expanding its scope beyond healthcare. Emerging use in toxicity testing, precision agriculture, and environmental studies is broadening applications. Moreover, collaborations between research institutions and biotech firms alongside government funding are accelerating innovation, making cell culture a versatile and high-growth sector globally.

What are the Key trends in the Cell Culture Market in 2024?

- In September 2024, Terumo Blood and Cell Technologies partnered with Nova Biomedical to enhance automated cell culture monitoring. The partnership links Terumo’s Quantum Flex cell expansion system with Nova’s BioProfile FLEX2 analyzer, aiming to streamline and improve cell culture processes. (Source: https://www.terumobct.com/)

- In July 2024, Merck launched commercial operations of its first GMP-certified cell culture media production line in China, backed by a €6.6 million investment. This move aims to meet the rising demand for biopharmaceuticals, vaccines, and advanced therapeutics. (Source: https://www.sigmaaldrich.com/)

How Can AI Affect the Cell Culture Market?

AI is reshaping the market by advancing digital twins of cell systems, enabling virtual simulations before physical experiments. It supports smart supply chain management for media and reagents, ensuring timely availability and reducing wastage. AI-driven personalization allows tailoring culture protocols to specific cell types or therapeutic needs. Additionally, it aids in predictive maintenance of culture equipment and enhances regulatory compliance through automated documentation, making the overall workflow more reliable, transparent, and industry-ready.

Report Scope of Cell Culture Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 23.78 Billion |

| Market Size by 2034 |

USD 62.67 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 11.37% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

By Product, By Application, By Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Bio-Techne Corporation, Cell Biologics, Cell Culture Technologies, Danaher Corporation, GlaxoSmithKline, Hamilton, Merck, Nova Biomedical, Nucleus Biologics, Sartorius AG, StemBond Technologies, Ltd., STEMCELL Technologies, Thermo Fisher Scientific, Terumo Blood and Cell Technologies |

Market Dynamics

Driver

Rising Demand for Biopharmaceuticals

The growing demand for biopharmaceuticals drives the cell culture market as companies seek faster, more scalable, and cost-efficient production methods. Cell culture offers a flexible platform that supports continuous innovation in drug pipelines, including biosimilars and next-generation therapeutics. With healthcare systems prioritizing safer and more targeted treatment, reliance on cell culture intensifiers to meet regulatory quality standards and global supply needs. This trend fosters technological upgrades and infrastructure expansion, strengthening the role of cell culture in modern medicine.

- For Instance, In April 2024, Fujifilm Diosynth Biotechnologies announced a USD 1.2 billion investment to expand its North Carolina facility, increasing its cell culture production capacity to ~750,000 liters to serve growing biopharmaceutical demand.(Source: https://fujifilmbiotechnologies.fujifilm.com/)

Restraint

High Cost of Cell Culture Equipment, Media, and Maintenance

The high cost of cell culture equipment, media, and maintenance restricts the market because of affordability for scaling up production and delays wider commercialization of cell-based products. Expensive infrastructure often forces organizations to depend on outsourcing, creating dependency and slowing in-house innovation. In developing regions, limited funding and budget constraints make it harder to adopt advanced culture systems. This financial barrier not only restricts competition but also widens the gap between established players and smaller entrants.

Opportunity

Regenerative medicine

Regenerative medicine presents a future opportunity in the cell culture market as it encourages the development of novel platforms for growing complex tissues and organoids. These innovations allow researchers to better model human physiology, speeding up drug discovery and reducing reliance on animal testing. Advancements in 3D bioprinting and gene editing further expand possibilities for creating customized solutions. As healthcare shifts towards curative over symptomatic treatments, demand for such advanced culture-based technologies will continue to grow.

- For Instance, In August 2025, Hyderabad-based Tulsi Therapeutics developed Tulsi-28X, a stem cell and exosome therapy for chronic liver failure. After successful preclinical trials showing liver regeneration, the startup applied to India’s CDSCO to begin human clinical trials, highlighting regenerative medicine as a key growth opportunity in the cell culture market. (Source:https://herald.uohyd.ac.in/)

Segmental Insights

How does the Cell Culture Segment dominate the Cell Culture Market in 2024?

In 2024, the consumables segment dominated the market as they are essential for maintaining a standardized and contamination-free cell environment. Rising demand for customized reagents, specialized growth factors, and single-use products in advanced therapies and vaccine production contributed to their growth. Moreover, the shift towards automated and high-throughput systems increased the frequency and volume of consumable usage, reinforcing their critical role in sustaining research efficiency and ensuring reproducible results across laboratories and manufacturing facilities.

The cell culture segment is projected to grow significantly as it enables precise modelling of human tissues for toxicity testing, disease modelling, and therapeutic screening. Increased use in stem cell research, organoid development, and gene therapy applications is boosting demand. Additionally, the integration of smart sensors and AI-driven monitoring systems improves culture efficiency and reduces errors, making these platforms more attractive for both research labs and commercial biomanufacturing, driving strong growth during the forecast period.

Why Did the Biopharmaceutical Production Segment Dominate the Market in 2024?

In 2024, the biopharmaceutical production segment dominated the cell culture market as manufacturers increasingly focus on cost-effective, scalable, and flexible production platforms. Growing demand for next-generation therapies, including biosimilars and gene-and cell-based treatments, requires sophisticated culture systems for efficient protein expression and purification. Additionally, regulatory emphasis on quality and reproducibility encourages adoption of advanced cell culture technologies, making biopharmaceutical production the primary revenue-generating application within the market.

The diagnostics segment is projected to grow rapidly as well, as culture techniques are increasingly applied in developing point-of-care tests, organoid-based disease models, and in-vitro diagnostic kits. Growing focus on early detection, predictive testing, and outbreak monitoring fuels demand for reliable culture systems. Additionally, integration with automated imaging and AI analytics allows faster, more precise results, making diagnostics a key area for innovation. These factors collectively drive the segment's accelerated growth during the forecast period.

Regional Insights

How is North America contributing to the Expansion of the Cell Culture Market?

In 2024, North America led the market due to rapid technological adoption, including 3D cell culture, bioreactors, and AI-driven monitoring systems. The region’s strong focus on innovation in regenerative medicine, diagnostics, and vaccine development further boosted demand. Collaborative initiatives between biotech firms and academic institutions, along with availability of skilled workforce and advanced healthcare infrastructure, enhanced research efficiency. These factors collectively contributed to North America capturing the largest revenue share in the global cell culture market.

How is Asia-Pacific Accelerating the Cell Culture Market?

Asia-Pacific is projected to record the fastest CAGR as emerging economies focus on expanding their life sciences and healthcare sectors. The growing number of biotech startups, contract research organizations, and academic research centers is driving adoption of cell culture technologies. Increasing collaborations with global companies, rising awareness of advanced therapeutics, and a large patient population for clinical trials further accelerate market growth, making the region a rapidly expanding hub for cell culture applications during the forecast period.

Top Companies in the Cell Culture Market

- Bio-Techne Corporation

- Cell Biologics

- Cell Culture Technologies

- Danaher Corporation

- GlaxoSmithKline

- Hamilton

- Merck

- Nova Biomedical

- Nucleus Biologics

- Sartorius AG

- StemBond Technologies, Ltd.

- STEMCELL Technologies

- Thermo Fisher Scientific

- Terumo Blood and Cell Technologies

Recent Developments in the Cell Culture Market

- In October 2024, researchers at Osaka University introduced INSPCTOR, a compact incubator device for real-time cell growth monitoring. Utilizing lens-free imaging with thin-film transistors, it allows independent observation of six cultures, and multiple units can be operated simultaneously, enhancing efficiency and scalability in cell culture research. (Source: https://www.sanken.osaka-u.ac.jp/)

- In August 2024, Nucleus Biologics introduced QuickStart Media, a range of pre-optimized formulations that allow researchers to rapidly create custom cell culture media, streamlining experimental setup and saving development time. (Source: https://nucleusbiologics.com/)

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the cell culture market.

By Product

-

-

- Fetal Bovine Serum

- Others

-

-

-

- CHO Media

- HEK 293 Media

- BHK Medium

- Vero Medium

- Other Serum-Free Media

-

-

- Classical Media

- Stem Cell Culture Media

- Chemically Defined Media

- Specialty Media

- Other Cell Culture Media

- Instruments

-

- Culture Systems

- Incubators

- Centrifuges

- Cryostorage Equipment

- Biosafety Equipment

- Pipetting Instruments

By Application

- Biopharmaceutical Production

-

- Monoclonal Antibodies

- Vaccines Production

- Other Therapeutic Proteins

- Diagnostics

- Drug Development

- Tissue Culture & Engineering

- Cell & Gene Therapy

- Toxicity Testing

- Other Applications

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)