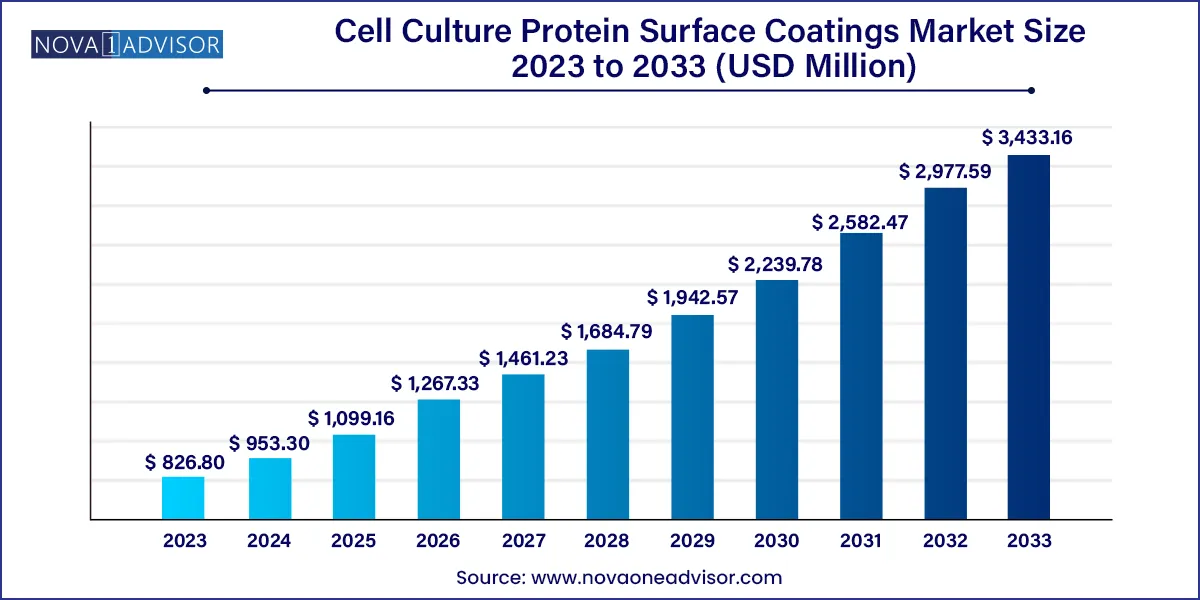

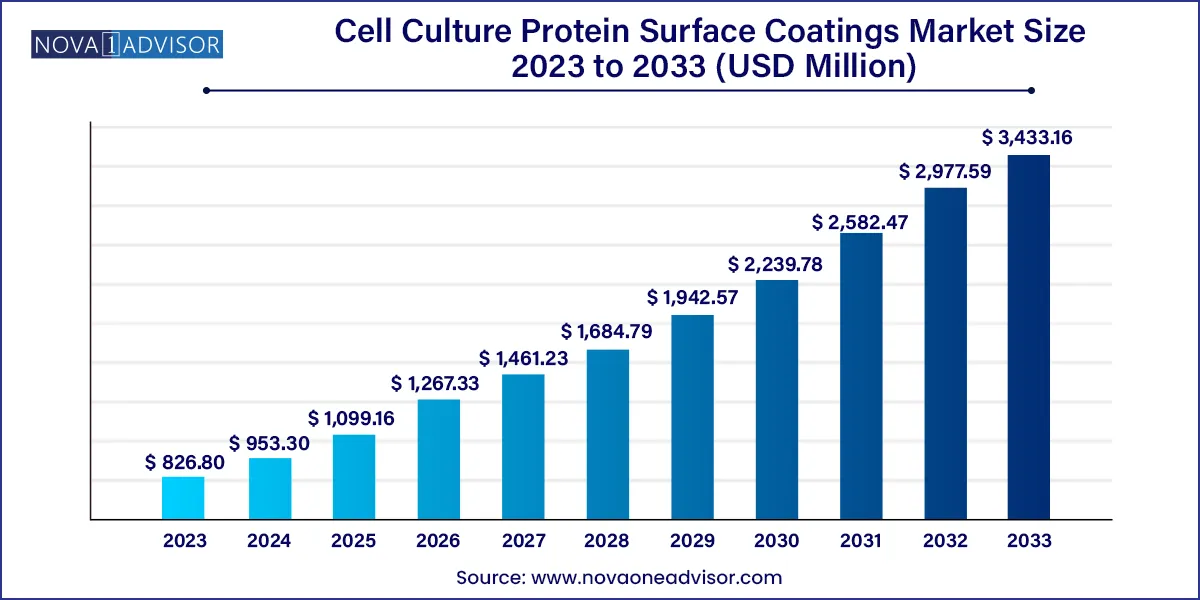

The global cell culture protein surface coatings market size was exhibited at USD 826.80 million in 2023 and is projected to hit around USD 3,433.16 million by 2033, growing at a CAGR of 15.30% during the forecast period of 2024 to 2033.

Key Takeaways:

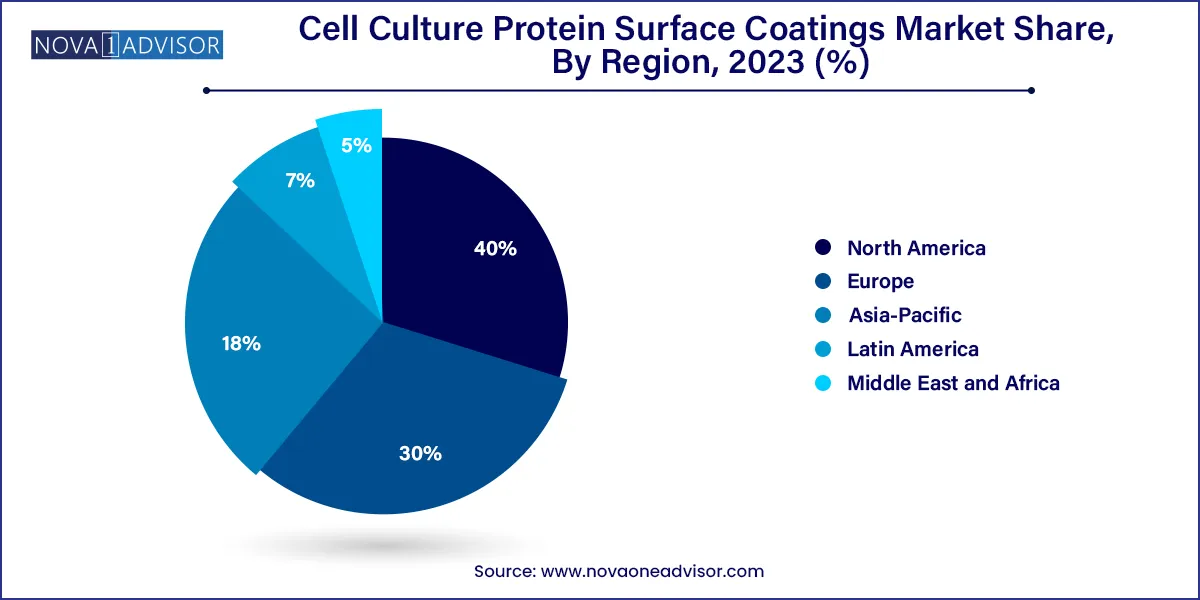

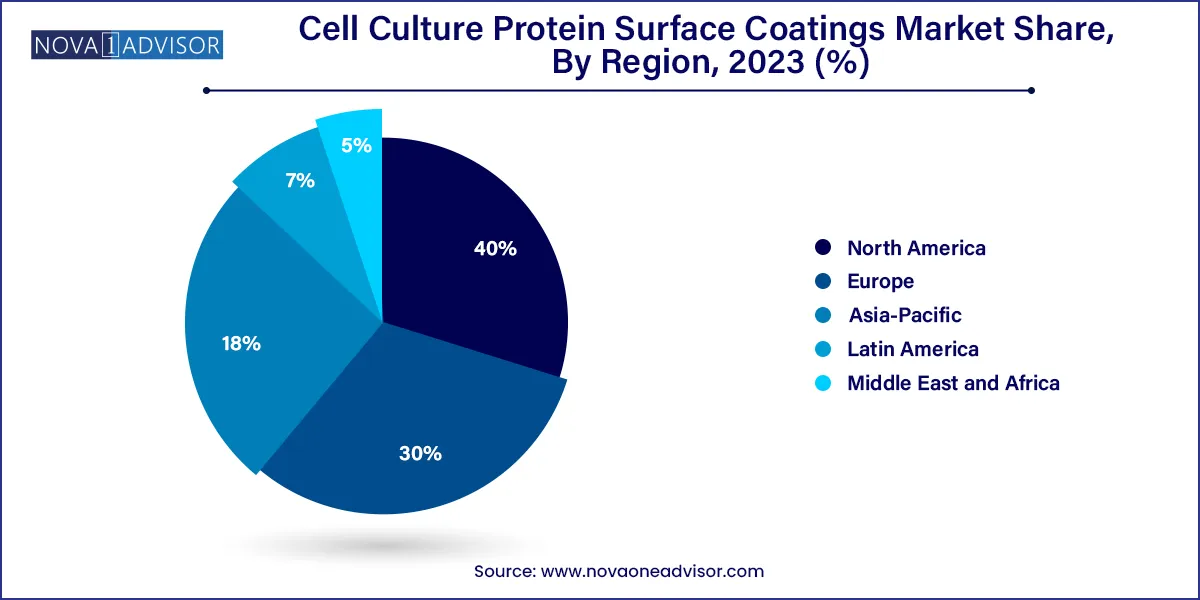

- North America dominated the overall industry and accounted for the largest share of 40.0% in 2023.

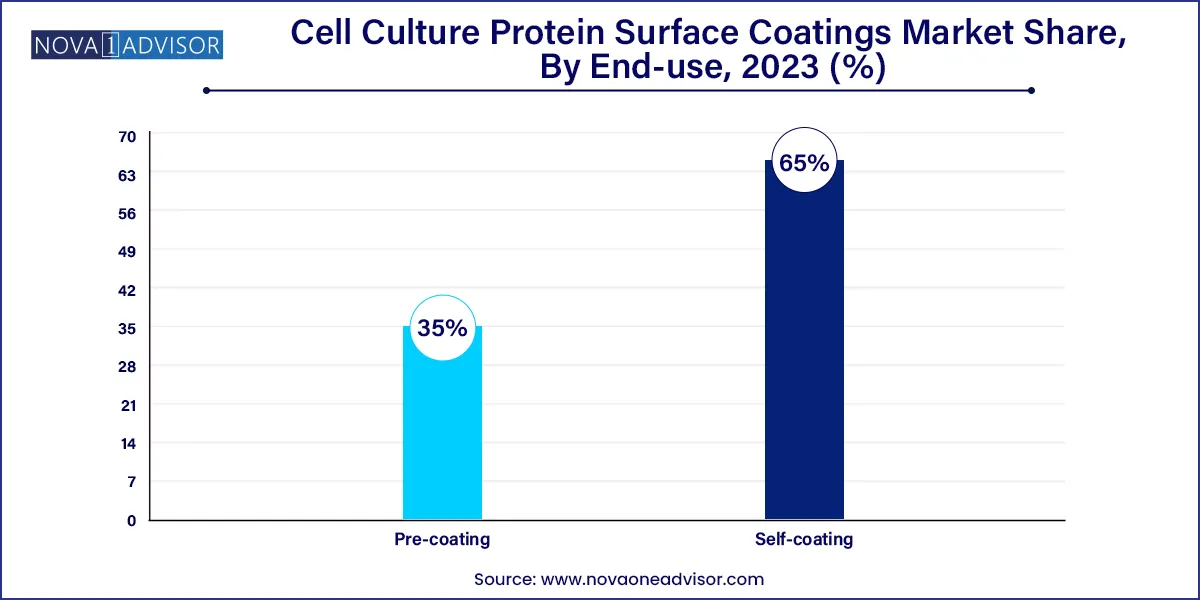

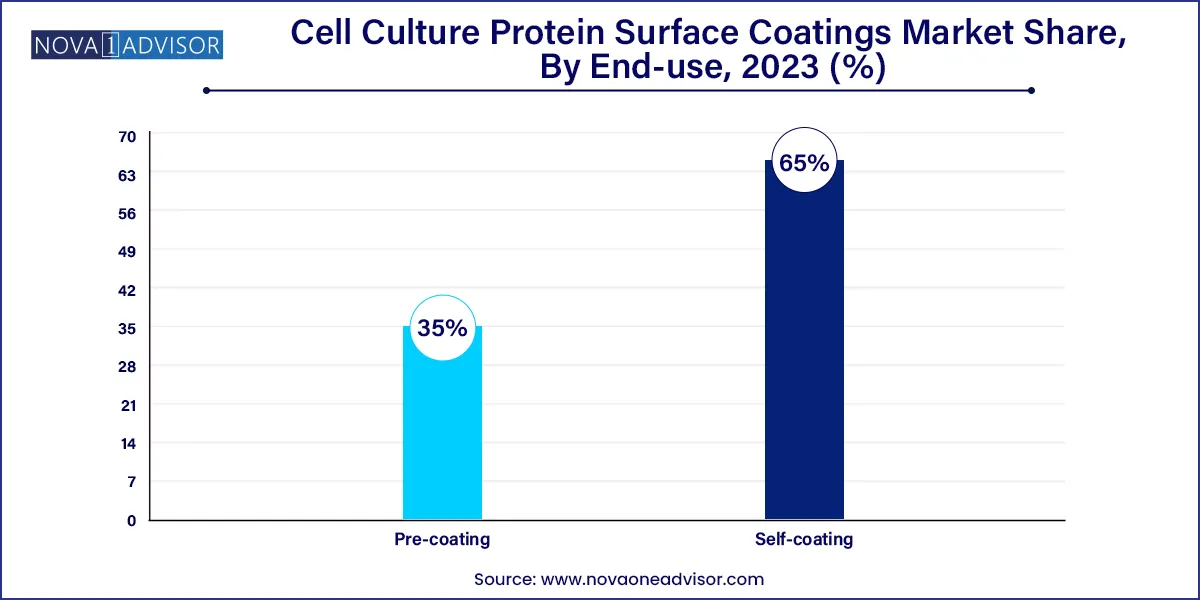

- The self-coating segment dominated the global industry and accounted for the highest share of around 65.0% of the overall revenue.

- The animal-derived material segment dominated the global industry in 2023 and accounted for the highest share (40.16%) of the overall revenue.

Market Overview

The Cell Culture Protein Surface Coating Market forms a critical infrastructure component within the broader life sciences ecosystem, supporting the expansion of cellular biology, regenerative medicine, vaccine development, and pharmaceutical R&D. These surface coatings are used to improve cell attachment, growth, and differentiation on culture substrates such as flasks, plates, and coverslips. As research increasingly demands precise cell behavior mimicking in vivo environments, the demand for customized surface coatings has accelerated rapidly.

Cell culture protein surface coatings include naturally derived or synthetic biomolecules that facilitate the adhesion of anchorage-dependent cells by mimicking the extracellular matrix (ECM). These coatings are essential for the successful propagation of stem cells, neuronal cells, hepatocytes, and epithelial cells, many of which are used in advanced drug discovery, cancer research, tissue engineering, and diagnostics. Commonly used proteins include collagen, fibronectin, laminin, vitronectin, and various synthetic peptide-based coatings.

The market's growth is underpinned by the rise in stem cell research, 3D cell culture models, organ-on-a-chip technologies, and the increasing commercialization of cell therapy products. Additionally, stringent regulatory demands for reproducibility and Good Manufacturing Practice (GMP) compliance in cell therapy production have elevated the need for quality-assured coating materials.

From academic institutions and clinical laboratories to commercial biomanufacturers, the application of cell culture coatings continues to evolve, driven by a mix of biological necessity and technological innovation.

Major Trends in the Market

-

Increasing adoption of pre-coated cultureware to minimize contamination risks and standardize experimental results.

-

Rising demand for xeno-free and chemically defined coatings in clinical and GMP-grade applications.

-

Emergence of synthetic biomimetic coatings that offer enhanced control over cellular behavior.

-

Surging utilization of ECM protein combinations for culturing difficult-to-grow cells such as neurons and primary stem cells.

-

Expansion of 3D cell culture systems and scaffold technologies requiring specialized surface coatings for spheroid and organoid development.

-

Integration of protein coatings in organ-on-chip and microfluidic platforms, enabling better simulation of human tissue environments.

-

Shifting focus towards animal-free, human-derived, or plant-based coatings to align with ethical standards and reduce batch variability.

-

Increased partnerships between coating providers and cultureware manufacturers to deliver turnkey pre-coated solutions.

Cell Culture Protein Surface Coatings Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 953.30 Million |

| Market Size by 2033 |

USD 3,433.16 Million |

| Growth Rate From 2024 to 2033 |

CAGR of 15.30% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Coating Type, Protein Source, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc.; Corning Incorporated; Merck KGaA; Eppendorf SE; Sartorius AG; Greiner Bio-One International GmbH; PerkinElmer, Inc.; ZenBio, Inc.; Kollodis BioSciences, Inc.; Viogene |

Key Market Driver: Growth of Stem Cell and Regenerative Medicine Research

A fundamental driver of the cell culture protein surface coating market is the accelerating investment in stem cell and regenerative medicine research, which demands high-quality cell culture environments. Stem cells, particularly human pluripotent stem cells (hPSCs), are notoriously sensitive to microenvironmental cues, making the surface substrate a pivotal factor in maintaining their viability and pluripotency.

Protein coatings such as laminin-521, vitronectin, and collagen I are widely used to facilitate the propagation and differentiation of stem cells. Researchers rely on these coatings to mimic ECM structures and ensure lineage-specific development in cardiac, neural, hepatic, and musculoskeletal tissue engineering. Furthermore, the commercialization of cell-based therapies and stem-cell-derived products necessitates scalable, defined, and xeno-free coatings that are compliant with regulatory expectations. As a result, manufacturers are innovating surface chemistries to meet the stringent demands of regenerative medicine, directly propelling market growth.

Key Market Restraint: High Cost and Batch Variability of Protein Coatings

Despite its indispensable role, the market faces a significant restraint in the form of high costs associated with protein coatings, especially those derived from human or animal sources. ECM proteins are often purified from complex biological materials, requiring extensive processing, quality control, and storage considerations. This makes premium-grade coatings particularly expensive, limiting accessibility for smaller research labs or institutions in low- and middle-income countries.

Additionally, batch-to-batch variability of natural protein coatings presents challenges in maintaining experimental consistency and reproducibility critical factors in both basic research and regulated biomanufacturing environments. Variability in biological origin, extraction protocols, and storage conditions can alter coating efficacy, impacting cell behavior and downstream outcomes. These challenges have prompted a growing interest in synthetic alternatives, but the transition is not without its hurdles due to performance gaps.

Key Market Opportunity: Shift Toward Synthetic and Plant-Derived Coatings

The emergence of synthetic and plant-derived protein coatings represents a transformative opportunity for the market. These coatings are designed to replicate the structural and functional characteristics of ECM proteins while overcoming issues related to cost, variability, and ethical sourcing. Synthetic peptides and recombinant proteins, often designed to include RGD (Arg-Gly-Asp) motifs, are increasingly used to support the adhesion and differentiation of various cell types.

Plant-derived coatings, such as recombinant human collagen produced in transgenic plants or yeast, offer a sustainable and scalable alternative with minimal risk of zoonotic contamination. These innovations are particularly valuable in clinical applications, where xeno-free conditions are required. As regulatory bodies favor chemically defined and animal-free inputs for therapeutic manufacturing, the demand for synthetic coatings is expected to skyrocket, creating new avenues for product innovation and commercialization.

Segments Insights:

By Coating Type

Pre-coating dominated the coating type segment, largely due to its convenience, time-saving attributes, and enhanced consistency across experimental runs. Pre-coated products ranging from microwell plates to flasks and petri dishes eliminate the need for in-lab coating procedures, which are prone to variability and contamination. Labs engaged in high-throughput screening, stem cell culture, or regulated manufacturing environments prefer pre-coated solutions for their reproducibility and compliance. Multiwell and microwell plates, in particular, are integral to pharmaceutical screening and are often customized with specific protein blends.

On the other hand, self-coating is experiencing robust growth, especially in research-focused institutions and custom assay development labs. This approach allows users to tailor the coating concentration, composition, and pattern based on specific cellular or experimental needs. Self-coating is widely used in exploratory research, mechanistic studies, and when dealing with rare or novel cell types. Though it demands a higher level of expertise and laboratory infrastructure, it offers unparalleled flexibility in designing cell culture platforms, thus driving its adoption.

By Protein Source

Animal-derived protein coatings hold the dominant share, owing to their historical prevalence and established performance in facilitating cell adhesion. Collagen types I and IV, fibronectin, and gelatin derived from bovine or porcine sources are widely used in academia and industrial research. Their availability and proven efficacy across a wide range of cell lines from fibroblasts to epithelial and stem cells make them a mainstay in standard protocols.

However, synthetic protein coatings are emerging as the fastest-growing segment, driven by their reproducibility, regulatory alignment, and scalability. Recombinant protein fragments and peptide-based coatings are particularly popular in applications requiring xeno-free conditions, such as clinical-grade stem cell expansion and vaccine production. Additionally, innovations in surface engineering and bioinspired peptide synthesis have enabled the development of highly functionalized synthetic coatings with tailored mechanical and biochemical properties.

By Regional Insights

North America remains the largest market for cell culture protein surface coatings, supported by a mature biomedical ecosystem, strong academic funding, and a robust pipeline of regenerative medicine initiatives. The U.S., in particular, is home to numerous top-tier universities, research hospitals, and biotechnology hubs that demand high-quality cell culture infrastructure. Government bodies like the NIH and private investors continue to pour billions into stem cell and tissue engineering projects, creating consistent demand for pre-coated cultureware and defined coating solutions.

Leading suppliers in the region, such as Thermo Fisher Scientific and Corning Inc., have established a wide network of partnerships and product portfolios to cater to both research and clinical markets. Furthermore, the presence of GMP-certified facilities for commercial bioproduction supports large-scale consumption of high-grade protein coatings.

Some of the prominent players in the Cell culture protein surface coatings market include:

- Thermo Fisher Scientific, Inc.

- Corning Incorporated

- Merck KGaA

- Eppendorf SE

- Sartorius AG

- Greiner Bio-One International GmbH

- PerkinElmer, Inc.

- ZenBio, Inc.

- Kollodis BioSciences, Inc.

- Viogene

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cell culture protein surface coatings market.

Coating Type

-

- Multiwall/microwell plates

- Petri dishes

- Flasks

- Slides

- Cover slips

Protein Source

- Animal-derived

- Human-derived

- Synthetic

- Plant-derived

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)