Cell Reprogramming Market Size and Research

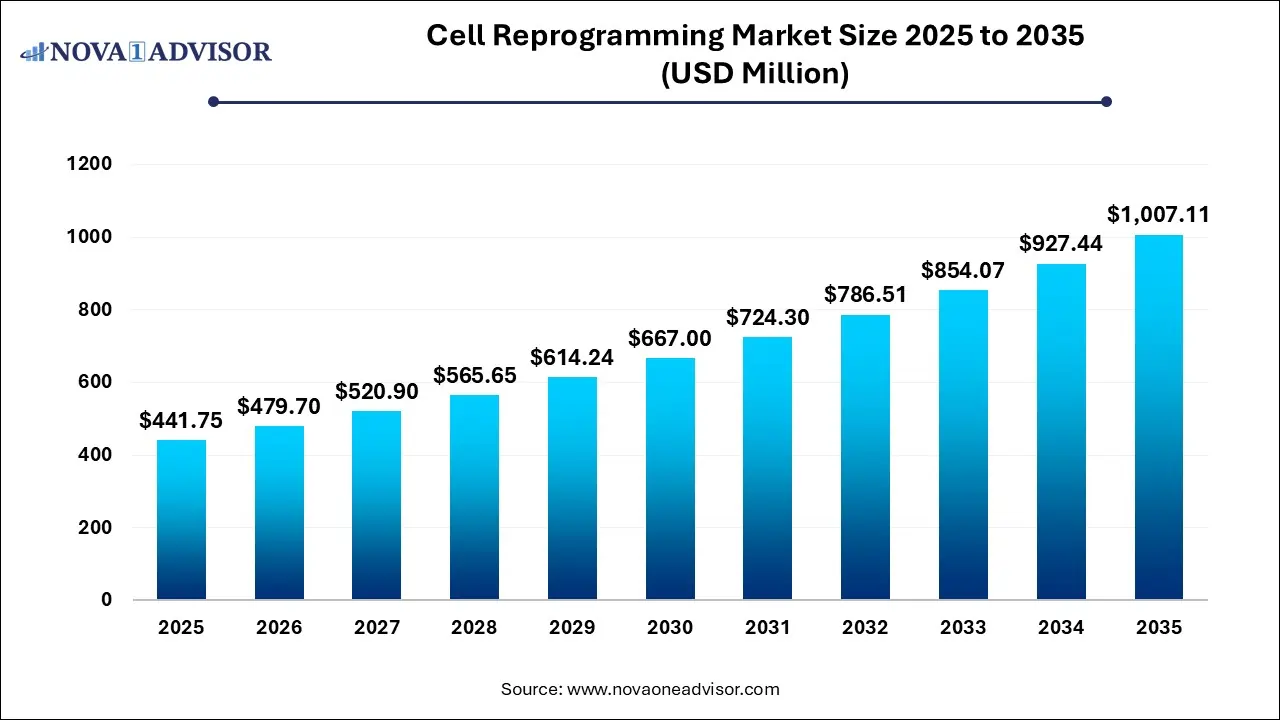

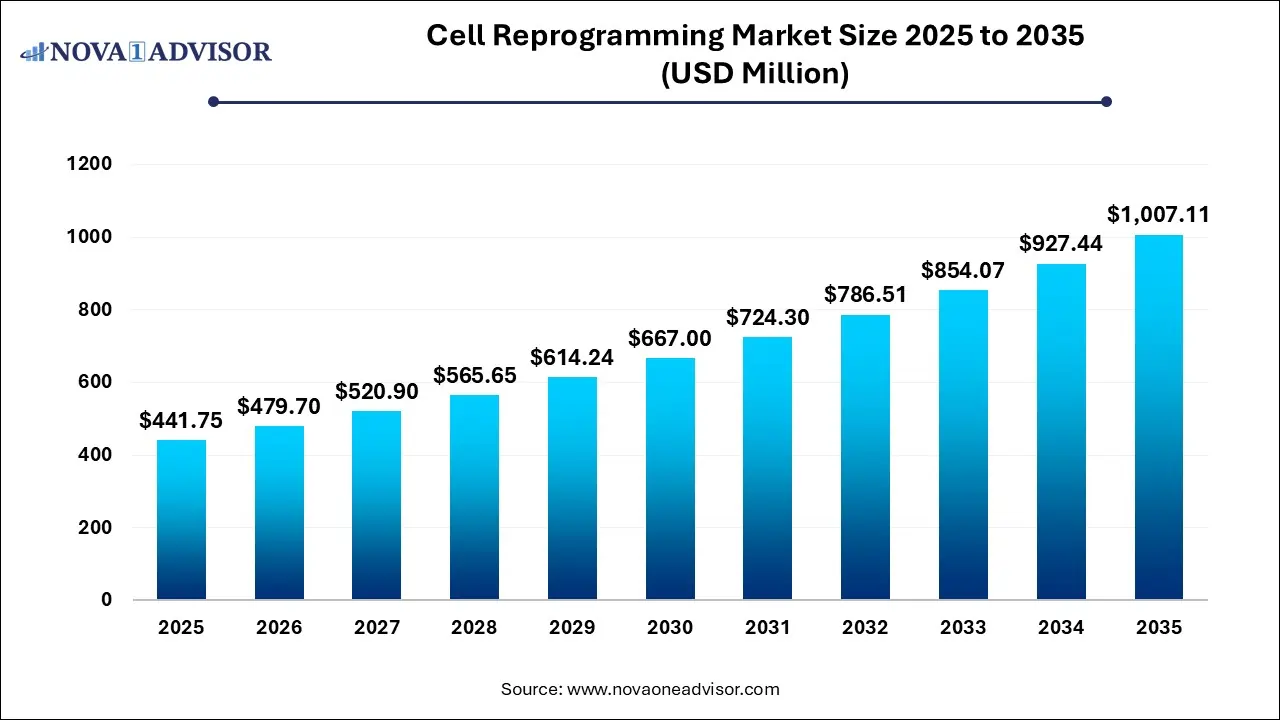

The Cell Reprogramming Market size was exhibited at USD 441.75 million in 2025 and is projected to hit around USD 1,007.11 million by 2035, growing at a CAGR of 8.59% during the forecast period 2026 to 2035.

Key Takeaways:

- The mRNA reprogramming segment dominated the market in 2025, accounting for the largest share of 33%.

- The research segment dominated the market, with the largest share of 68% in 2025.

- The research & academic institutes segment captured the largest market share of 69% in 2025.

- North America cell reprogramming market dominated the global industry with a share of 40% in 2025.

Market Overview

The cell reprogramming market is a transformative domain within regenerative medicine and biotechnology, focused on converting differentiated somatic cells into pluripotent or different lineage-specific cells. This technique, made famous by the introduction of induced pluripotent stem cells (iPSCs) by Shinya Yamanaka in 2006, holds revolutionary potential in areas like disease modeling, personalized medicine, tissue regeneration, and drug discovery.

Cell reprogramming facilitates the conversion of adult cells, such as fibroblasts, into cells with embryonic-like pluripotency or into directly reprogrammed functional cells like neurons or cardiomyocytes. The potential to regenerate damaged tissues without the ethical concerns surrounding embryonic stem cells has sparked interest from academic, clinical, and commercial entities. Moreover, with the advent of newer vectors like Sendai virus and non-integrative techniques like episomal vectors or mRNA, reprogramming has become safer and more efficient.

The global market for cell reprogramming is experiencing exponential growth due to increasing investments in stem cell research, advancements in gene-editing technologies such as CRISPR-Cas9, and a rise in chronic and degenerative diseases. Additionally, pharmaceutical and biotechnology companies are increasingly adopting reprogramming tools for drug screening, regenerative therapies, and cell-based assays.

Major Trends in the Market

-

Surge in iPSC-based disease modeling: Pharmaceutical companies are increasingly using induced pluripotent stem cells to develop accurate human disease models for drug testing.

-

Non-integrative reprogramming gaining traction: Techniques like mRNA and episomal vector-based reprogramming are preferred due to reduced risk of genomic instability.

-

AI and machine learning in reprogramming protocols: Algorithms are now used to optimize the cocktail of transcription factors, reducing time and cost.

-

Increasing public-private partnerships: Government bodies are funding academic institutes and startups to accelerate translational research.

-

Expansion in Asia-Pacific R&D infrastructure: Countries like China, Japan, and South Korea are investing in advanced regenerative medicine centers.

-

Use of reprogrammed cells in personalized medicine: Personalized treatments based on patient-derived iPSCs are emerging as a major trend in neurology and cardiology.

-

Clinical trials pipeline expansion: The number of clinical trials involving iPSCs and reprogrammed cells is increasing, particularly in the U.S., Japan, and Germany.

-

Automated reprogramming platforms: Companies are launching robotic systems to handle the high-throughput reprogramming process for scalability.

Report Scope of Cell Reprogramming Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 479.7 Million |

| Market Size by 2035 |

USD 1007.11 Million |

| Growth Rate From 2026 to 2035 |

CAGR of 8.59% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific Inc.; Allele Biotechnology and Pharmaceuticals Inc.; ALSTEM; STEMCELL Technologies; Merck KGaA; Bio-Techne; REPROCELL Inc.; Lonza; FUJIFILM Corporation (Fujifilm Cellular Dynamics); Mogrify Limited |

Market Driver: Rising Prevalence of Chronic and Degenerative Diseases

A major driver propelling the cell reprogramming market is the growing burden of chronic and degenerative diseases such as Parkinson’s, Alzheimer’s, heart failure, and type 1 diabetes. These conditions require regenerative solutions that go beyond traditional drug therapies. Reprogrammed cells, particularly iPSCs, are being explored as a means to regenerate damaged tissues or model diseases for novel drug development.

For instance, in Parkinson’s disease, dopaminergic neurons derived from iPSCs are being tested in clinical trials to replace dysfunctional cells. Similarly, in cardiac conditions, reprogrammed cardiomyocytes offer promise for myocardial repair. This growing medical need, combined with increased research funding and supportive regulatory frameworks, is accelerating both innovation and commercialization of reprogramming technologies.

Market Restraint: High Cost and Technical Complexity

Despite its promise, the high cost and technical intricacies involved in reprogramming cells pose a significant challenge. Generating high-quality iPSCs or lineage-specific cells requires sophisticated infrastructure, costly reagents, and expert handling. Moreover, reprogramming protocols must balance efficiency, reproducibility, and genomic integrity, which adds further layers of complexity.

Manufacturing under Good Manufacturing Practices (GMP) for therapeutic applications demands rigorous quality control, increasing overall expenses. This limits widespread adoption, particularly in resource-constrained settings. Additionally, low reprogramming efficiencies and variability between donor cells can hamper scalability for clinical applications.

Market Opportunity: Expansion of Personalized Medicine

The growing focus on personalized medicine provides a massive opportunity for the cell reprogramming market. Patient-derived iPSCs are being used to tailor treatments to individual genetic backgrounds, especially in rare diseases and cancer. For example, in oncology, patient-specific iPSCs can be differentiated into tumor-relevant cells for high-throughput drug screening, enhancing treatment precision.

Moreover, the integration of genomic profiling, AI, and organoid technology allows researchers to build personalized disease models. This convergence opens the door for cell reprogramming to become a staple in preclinical drug development, offering safer and more targeted therapeutic avenues.

Segmental Analysis

By Technology Outlook

Sendai virus-based reprogramming has emerged as the most dominant technology segment owing to its high efficiency and non-integrative nature. This method uses a non-integrating RNA virus to deliver reprogramming factors, thereby reducing the risk of insertional mutagenesis and making it safer for clinical applications. It is particularly favored in regenerative medicine and clinical-grade iPSC generation, where genomic integrity is paramount. Several research labs and commercial vendors now offer Sendai virus kits due to their robust performance and regulatory friendliness.

On the other hand, mRNA reprogramming is the fastest-growing segment, thanks to its transgene-free and non-immunogenic properties. This method leverages synthetic modified mRNA to transiently express reprogramming factors. Unlike viral methods, it leaves no genetic footprint and shows promise for clinical scalability. Recent improvements in mRNA stabilization and delivery have boosted reprogramming efficiency and reproducibility. Biotech firms focused on cell therapy and gene editing are actively investing in mRNA-based approaches for both in vitro modeling and therapeutic purposes.

By Application Outlook

The research segment holds the largest share in the application outlook due to the widespread use of reprogramming technologies in basic and translational research. Academic institutions, biotech companies, and pharmaceutical firms utilize iPSCs and other reprogrammed cells to study disease mechanisms, identify drug targets, and validate lead compounds. The advent of CRISPR genome editing combined with iPSCs has enabled sophisticated studies in oncology, neurology, and cardiology, further propelling the dominance of the research segment.

Conversely, therapeutic applications are the fastest-growing due to the increasing number of iPSC-derived cellular therapies entering preclinical and clinical pipelines. These include treatments for retinal diseases, spinal cord injuries, and heart failure. For instance, Kyoto University’s Center for iPS Cell Research and Application (CiRA) has initiated trials using iPSC-derived retinal cells to treat macular degeneration. As regulatory pathways become clearer and patient demand for regenerative solutions rises, therapeutic use of reprogrammed cells is expected to skyrocket.

By End-use Outlook

Research and academic institutions dominate the end-use segment, primarily due to their pioneering role in cell reprogramming technology development and innovation. Universities and research centers like Harvard, Stanford, and Kyoto University have significantly contributed to the development and refinement of iPSC technology. These institutes receive substantial funding from governments and private entities, enabling them to undertake high-risk, high-reward projects that private companies often avoid.

Meanwhile, biotechnology and pharmaceutical companies are the fastest-growing end-users, driven by a surge in commercialization efforts. Pharma firms are adopting iPSCs for patient-specific drug screening and toxicity testing, while biotech startups are launching reprogrammed cell-based therapeutics and personalized medicine platforms. This shift from academia to industry marks a crucial transition in the value chain, signaling increased revenue potential and investment interest.

By Regional Analysis

North America Dominated the Cell Reprogramming Market

North America, particularly the United States, remains the global leader in the cell reprogramming market due to a robust research ecosystem, significant funding, and early adoption of advanced biotechnologies. The region is home to major institutions like the NIH, Harvard Stem Cell Institute, and numerous biotech startups focusing on regenerative medicine. Regulatory support, such as the FDA’s expedited review pathways for cell-based therapies, further enhances the commercial viability of reprogramming technologies.

Major industry players such as Thermo Fisher Scientific, Fate Therapeutics, and FUJIFILM Cellular Dynamics operate out of North America, leveraging its advanced clinical infrastructure and intellectual property landscape. Additionally, patient advocacy and funding organizations contribute to accelerating translational research, creating a conducive environment for innovation and market growth.

Asia Pacific is the Fastest Growing Region

Asia Pacific is the fastest-growing region in the cell reprogramming market, driven by strategic government initiatives, expanding biotechnology sectors, and increasing clinical trials. Japan has been a pioneer in iPSC technology, with Nobel laureate Shinya Yamanaka spearheading global initiatives from Kyoto University. The Japanese government actively supports regenerative medicine through its favorable regulatory frameworks.

China and South Korea are rapidly catching up, investing billions in regenerative medicine research. The rise of stem cell biobanks, growing collaborations with Western institutions, and increasing adoption of AI in cellular reprogramming protocols position Asia Pacific as a high-growth region. Additionally, the region’s large patient pool and cost-effective manufacturing offer a competitive advantage for commercial applications.

Some of The Prominent Players in The Cell Reprogramming Market Include:

Recent Developments

-

January 2025 – Thermo Fisher Scientific launched a next-gen episomal vector kit designed for higher reprogramming efficiency with reduced cytotoxicity, aimed at academic and pharma researchers working on iPSC generation.

-

November 2024 – FUJIFILM Cellular Dynamics, Inc. announced the initiation of a Phase I clinical trial using iPSC-derived retinal cells for treating retinitis pigmentosa in Japan, furthering its clinical portfolio in regenerative ophthalmology.

-

August 2024 – Fate Therapeutics entered into a strategic partnership with Janssen Biotech to co-develop reprogrammed immune cell therapies for cancer, with a deal value exceeding $1.2 billion in milestones and royalties.

-

June 2024 – BlueRock Therapeutics (a Bayer company) received FDA approval for its IND (Investigational New Drug) application for iPSC-derived dopaminergic neurons aimed at treating Parkinson’s disease, a major milestone in cell reprogramming therapeutics.

-

March 2024 – StemCell Technologies unveiled an automated high-throughput cell reprogramming platform integrated with AI to standardize iPSC production and characterization, reducing variability and enhancing reproducibility.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the Cell Reprogramming Market

By Technology

- Sendai Virus-based Reprogramming

- mRNA Reprogramming

- Episomal Reprogramming

- Others

By Application

By End-use

- Research & Academic Institutes

- Biotechnology & Pharmaceutical Companies

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)