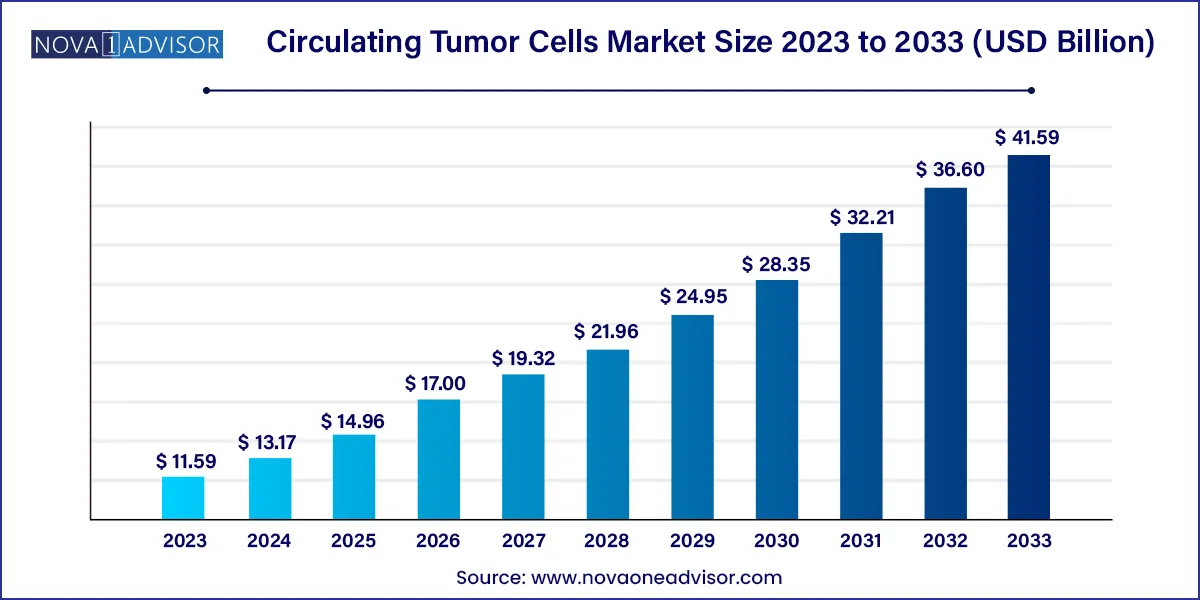

The global circulating tumor cells market size reached USD 11.59 billion in 2023 and is projected to hit around USD 41.59 billion by 2033, expanding at a CAGR of 13.63% during the forecast period from 2024 to 2033.

Key Takeaways:

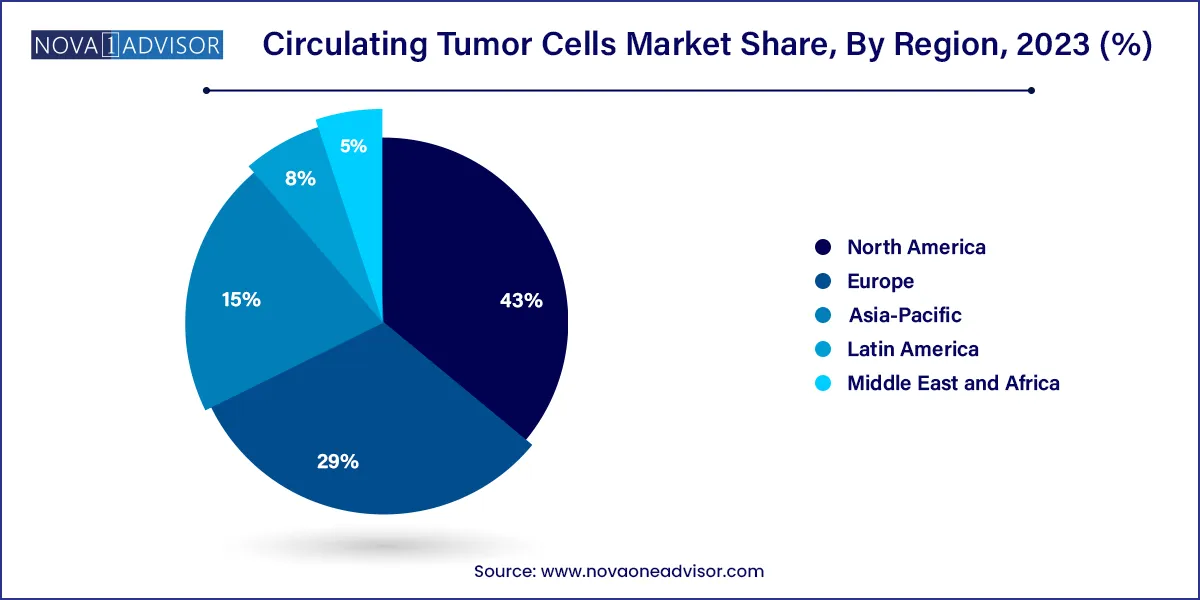

- North America captured the largest revenue share of 43% in 2023.

- Asia Pacific is projected to grow at a lucrative CAGR during the forecast period

- In 2023, the CTC detection and enrichment methods segment accounted for the largest revenue share of 66.29%.

- The CTC analysis segment is expected to register the fastest CAGR from 2024 to 2033.

- The research segment dominated the market and captured the largest revenue share in 2023.

- Clinical/ liquid biopsy is expected to register a significant CAGR from 2024 to 2033.

- The kits & reagents segment dominated the market and accounted for the largest revenue share of 2023.

- The devices or systems segment is expected to showcase significant CAGR during the forecast period.

- The research and academic institutes segment accounted for the largest revenue share of 2023.

- The diagnostic centers segment is expected to register a significant CAGR from 2024 to 2033.

- The blood specimen segment dominated the market and accounted for the largest revenue share in 2023.

- The bone marrow segment is expected to register a significant CAGR during the forecast period.

Circulating Tumor Cells Market Overview

The Circulating Tumor Cells (CTC) Market represents a transformative frontier in oncology, bridging the gap between traditional tissue biopsy and real-time, non-invasive cancer diagnostics. CTCs are cancer cells that detach from a primary tumor and circulate through the bloodstream, offering valuable insights into metastasis, disease progression, and treatment response. The ability to isolate and analyze these cells has opened up new avenues in early cancer detection, personalized medicine, and therapeutic monitoring.

The traditional reliance on invasive tissue biopsies is increasingly being supplemented or even replaced by CTC-based liquid biopsies. Liquid biopsies offer several advantages, including lower patient risk, real-time monitoring capabilities, and the potential to capture tumor heterogeneity more accurately. As oncology moves towards precision medicine, the demand for CTC detection, enrichment, and analysis technologies is growing rapidly.

Increasing cancer incidence globally, rising awareness of non-invasive diagnostic technologies, and technological advances in microfluidics, immunoassays, and imaging are propelling market expansion. Additionally, the surge in pharmaceutical research focusing on targeted therapies and cancer stem cell biology is driving demand for CTC platforms in academic and research settings. Industry players are investing heavily in developing automated, high-sensitivity, and multi-parameter CTC detection platforms to enhance diagnostic accuracy and clinical utility.

Major Trends in the Market

-

Shift Toward Liquid Biopsy-Based Oncology: Growing preference for non-invasive diagnostics and disease monitoring is fueling CTC-based liquid biopsy adoption.

-

Advancements in Microfluidic Technologies: Microfluidic chips are enabling higher sensitivity and specificity in CTC capture and enrichment.

-

Integration of AI and Machine Learning: Machine learning algorithms are increasingly applied to analyze CTC morphology, classification, and predictive analytics.

-

Emergence of Combined Detection Methods: Combining immunocapture, size-based, and density-based separation techniques is enhancing detection rates.

-

Focus on Rare CTC Subpopulations: Technologies targeting rare CTCs like circulating cancer stem cells (CSCs) are expanding research frontiers.

-

Personalized Therapy Monitoring: Real-time CTC analysis is being used to adjust targeted therapies and immunotherapies in individual patients.

-

Expansion of CTC Research Beyond Oncology: Interest is rising in using CTC technologies to study inflammation, fibrosis, and other pathologies.

-

Commercialization of Integrated Systems: Companies are launching turnkey systems that combine CTC isolation, imaging, and molecular analysis in one platform.

-

CTC-Based Clinical Trials: Pharmaceutical companies are incorporating CTC enumeration and characterization as endpoints in oncology trials.

-

Global Collaborations and Consortia: Public-private partnerships and academic consortia are driving technology validation and standardization efforts.

Circulating Tumor Cells Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 13.17 Billion |

| Market Size by 2033 |

USD 41.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 13.63% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

Technology, application, product, specimen, end-use, region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

QIAGEN; Bio-Techne Corp.; Precision for Medicine; AVIVA Biosciences; BIOCEPT, Inc.; BioCEP Ltd.; Fluxion Biosciences, Inc.; Greiner Bio-One International GmbH; Ikonisys, Inc.; Miltenyi Biotec; IVDiagnostics; BioFluidica; Canopus Bioscience Ltd.; Biolidics Limited; Creativ MicroTech, Inc.; LungLife AI, Inc.; Epic Sciences; Rarecells Diagnostics; ScreenCell; Menarini Silicon Biosystems; LineaRx, Inc. (Vitatex, Inc.); Sysmex Corporation; STEMCELL Technologies, Inc. |

Key Market Driver: Growing Demand for Non-Invasive Cancer Diagnostics

The major driver propelling the circulating tumor cells market is the escalating demand for non-invasive, real-time cancer diagnostics. Traditional biopsies are invasive, expensive, and often risky, particularly for deep-seated or metastatic tumors. In contrast, CTC analysis provides a minimally invasive alternative that can be performed repeatedly, offering dynamic insights into disease evolution.

Liquid biopsies based on CTCs enable early detection, monitoring of treatment response, and timely identification of drug resistance, thereby improving clinical outcomes. In aggressive cancers such as triple-negative breast cancer, non-small cell lung cancer, and prostate cancer, CTC detection offers a chance to intervene earlier and tailor therapy precisely. As patients and oncologists seek safer, faster, and more comprehensive diagnostic solutions, CTC technologies are being increasingly adopted both in clinical and research settings.

Key Market Restraint: Technical and Biological Challenges in CTC Detection

Despite significant advancements, the CTC market faces a critical restraint: technical and biological challenges associated with detecting rare and heterogeneous cells. CTCs are extremely rare, with as few as one CTC per billion blood cells, making enrichment and isolation technically demanding. Additionally, CTCs are highly heterogeneous, varying in size, morphology, surface marker expression, and genetic profile.

This heterogeneity complicates the design of universal detection methods. For instance, label-based immunocapture techniques often miss CTCs undergoing epithelial-mesenchymal transition (EMT), a process where cells lose their traditional markers. Moreover, isolating viable, intact CTCs suitable for downstream molecular analysis or culture is still a bottleneck. Such complexities can lead to false negatives, reducing clinical confidence in CTC-based assays and limiting their adoption in routine diagnostics.

Key Market Opportunity: Integration of CTCs into Personalized Therapy Regimens

An exciting opportunity in the CTC market lies in the integration of CTC analysis into personalized cancer treatment regimens. CTCs can provide a real-time, systemic view of the evolving tumor landscape, revealing emerging drug resistance mutations, tumor subtype shifts, and metastasis potential. By analyzing molecular features of CTCs, oncologists can tailor therapies, switch drugs proactively, and avoid ineffective treatments.

Several clinical studies have demonstrated that CTC counts and characteristics can predict prognosis and treatment response more accurately than traditional imaging or serum markers. As oncology care shifts toward adaptive, individualized treatment strategies, the clinical utility of CTCs in guiding therapy decisions will expand dramatically. Companies and research institutions investing in CTC-based companion diagnostics and therapy monitoring tools stand to unlock significant growth potential.

Segments Insights:

Technology Insights

CTC Detection & Enrichment Methods dominated the technology segment in 2024. Detection and enrichment are critical steps in CTC analysis, and a variety of methods—including immunocapture, size-based separation, and density-based techniques—are utilized to isolate these rare cells. Immunocapture methods, especially positive selection approaches targeting epithelial cell adhesion molecule (EpCAM) markers, are widely used. However, technological limitations associated with epithelial-mesenchymal transitioned CTCs are driving innovation in size-based and density-based separation techniques. Size-based membrane filtration and microfluidic-based systems are gaining popularity for their label-free, unbiased isolation capabilities, fueling the dominance of this segment.

CTC Analysis is expected to experience the fastest growth rate. As CTC enumeration moves beyond simple counts to in-depth molecular characterization, CTC analysis technologies such as single-cell genomics, transcriptomics, and proteomics are in high demand. Techniques like surface-enhanced Raman scattering (SERS) and advanced microscopy methods are opening up new diagnostic and prognostic applications. With oncology moving toward precision and targeted therapies, CTC analysis is set to become indispensable, especially in research and clinical decision-making frameworks.

Application Insights

Clinical/Liquid Biopsy applications accounted for the largest market share. The clinical utility of CTCs in risk assessment, early detection, screening, and monitoring treatment responses has driven their adoption in the liquid biopsy landscape. CTC counts are now integrated into prognostic models for breast, prostate, and colorectal cancers. Real-world clinical settings increasingly employ liquid biopsies for ongoing patient management, supporting the segment’s dominance.

Research applications are poised for the fastest growth. CTC-based research is burgeoning in fields like cancer stem cell biology, tumor microenvironment studies, and drug development. Pharmaceutical and biotech companies leverage CTC assays for patient stratification in clinical trials and evaluating drug efficacy. Growing interest in tumorogenesis mechanisms and metastasis biology further propels CTC research applications.

Product Insights

Devices or Systems dominated the product segment. Automated platforms integrating CTC isolation, enrichment, imaging, and molecular analysis are highly sought after in both clinical and research settings. Devices like the CellSearch® system, microfluidic chips, and imaging flow cytometers have become standard tools in CTC workflows.

Kits & Reagents are expected to grow at the fastest rate. As laboratories increasingly develop customized CTC workflows, demand for high-quality reagents, antibodies, and assay kits is rising sharply. Companies offering flexible, compatible kits that integrate with multiple platforms are expected to capture significant market share.

End-use Insights

Research and Academic Institutes dominated the end-use segment. Extensive academic research on CTC biology, metastasis, and drug development underpins the dominance of this segment. Major universities and cancer research institutes are investing heavily in CTC platforms for fundamental and translational research.

Hospitals and Clinics are anticipated to grow at the fastest rate. As CTC-based diagnostics gain regulatory approvals and clinical validation, hospitals and oncology clinics are adopting these technologies for patient care. Increasing integration of liquid biopsy panels into routine clinical workflows is supporting this shift.

Specimen Insights

Blood specimens dominated CTC sample collection in 2024. Peripheral blood remains the gold standard for CTC isolation due to its accessibility, minimal invasiveness, and repeatability. Blood-based CTC tests are easier to integrate into clinical workflows and patient monitoring protocols.

Other body fluids are witnessing the fastest growth. Emerging research on CTC detection in cerebrospinal fluid, pleural effusion, and urine is opening new diagnostic frontiers, particularly for cancers like glioblastoma and bladder cancer where blood-based detection may be insufficient.

Regional Insights

North America led the CTC market in 2024, primarily driven by strong healthcare infrastructure, high research activity, early adoption of liquid biopsy technologies, and the presence of major players like Menarini-Silicon Biosystems, Bio-Techne, and Thermo Fisher Scientific. The U.S. Food and Drug Administration (FDA) approval of CTC detection devices like CellSearch has further legitimized clinical CTC testing in the region. High cancer incidence rates, substantial R&D funding, and a favorable regulatory landscape position North America as the epicenter of CTC innovation and adoption.

Asia Pacific is expected to register the highest growth rate in the CTC market. Rising cancer burden, growing healthcare investments, expanding research capabilities, and increasing awareness about early diagnosis are propelling regional growth. Countries like China, Japan, South Korea, and India are rapidly embracing liquid biopsy technologies. Government-supported precision medicine initiatives, collaborations between local hospitals and global biotech firms, and the expansion of private diagnostic laboratories are creating fertile ground for CTC adoption.

Recent Developments

-

March 2025 – Menarini-Silicon Biosystems announced the launch of its new CELLSEARCH® CTC Pro System, offering enhanced sensitivity and modular workflows for clinical research.

-

January 2025 – Bio-Techne Corporation completed the acquisition of a microfluidics platform startup specializing in high-sensitivity CTC isolation for rare cancers.

-

November 2024 – RareCyte, Inc. expanded its CTC analysis platform to include multiplex immunofluorescence capabilities, enhancing downstream molecular profiling.

-

September 2024 – QIAGEN introduced a new CTC detection kit optimized for lung and breast cancer research, featuring improved sensitivity and minimal sample processing times.

-

July 2024 – Thermo Fisher Scientific launched a new liquid biopsy workflow integrating CTC enrichment and next-generation sequencing (NGS) for research applications.

Key Circulating Tumor Cells Companies:

The following are the leading companies in the circulating tumor cells market. These companies collectively hold the largest market share and dictate industry trends. Financials, strategy maps & products of these CTC companies are analyzed to map the supply network.

- QIAGEN

- Bio-Techne Corporation

- Precision for Medicine

- AVIVA Biosciences

- BIOCEPT, Inc.

- BioCEP Ltd.

- Fluxion Biosciences, Inc.

- Greiner Bio-One International GmbH

- Ikonisys, Inc.

- Miltenyi Biotec

- IVDiagnostics, Inc.

- BioFluidica

- Canopus Bioscience Ltd.

- Biolidics Limited

- Creativ MicroTech, Inc.

- LungLife AI, Inc.

- Epic Sciences

- Rarecells Diagnostics

- ScreenCell

- Menarini Silicon Biosystems

- LineaRx, Inc. (Vitatex, Inc.)

- Sysmex Corporation

- STEMCELL Technologies, Inc.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Circulating Tumor Cells market.

By Technology

- CTC Detection & Enrichment Methods

- Immunocapture (Label-based)

- Positive Selection

- Negative Selection

- Size-based Separation (Label-free)

- Membrane-based

- Microfluidic-based

- Density-based Separation (Label-free)

- Combined Methods

- CTC Direct Detection Methods

- CTC Analysis

By Application

- Clinical/ Liquid Biopsy

- Risk Assessment

- Screening and Monitoring

- Research

- Cancer Stem Cell & Tumorogenesis Research

- Drug/Therapy Development

By Product

- Kits & Reagents

- Blood Collection Tubes

- Devices or Systems

By Specimen

- Blood

- Bone Marrow

- Other Body Fluids

By End-use

- Research and Academic Institutes

- Hospital and Clinics

- Diagnostic Centers

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)