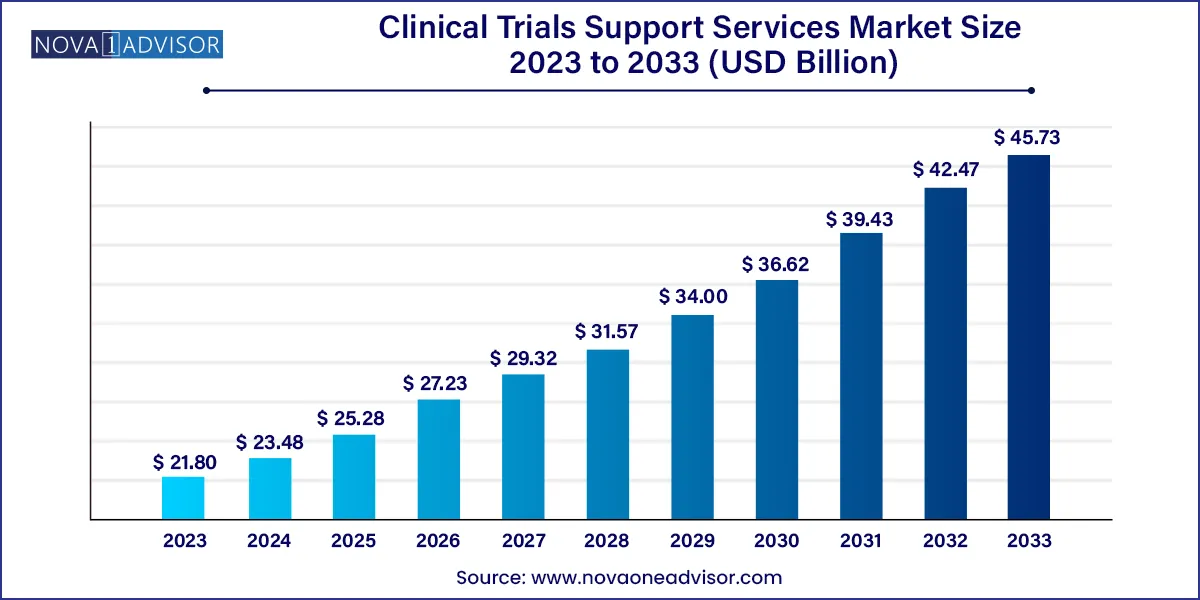

The global clinical trials support services market size was exhibited at USD 21.80 billion in 2023 and is projected to hit around USD 45.73 billion by 2033, growing at a CAGR of 7.69% during the forecast period 2024 to 2033.

Key Takeaways:

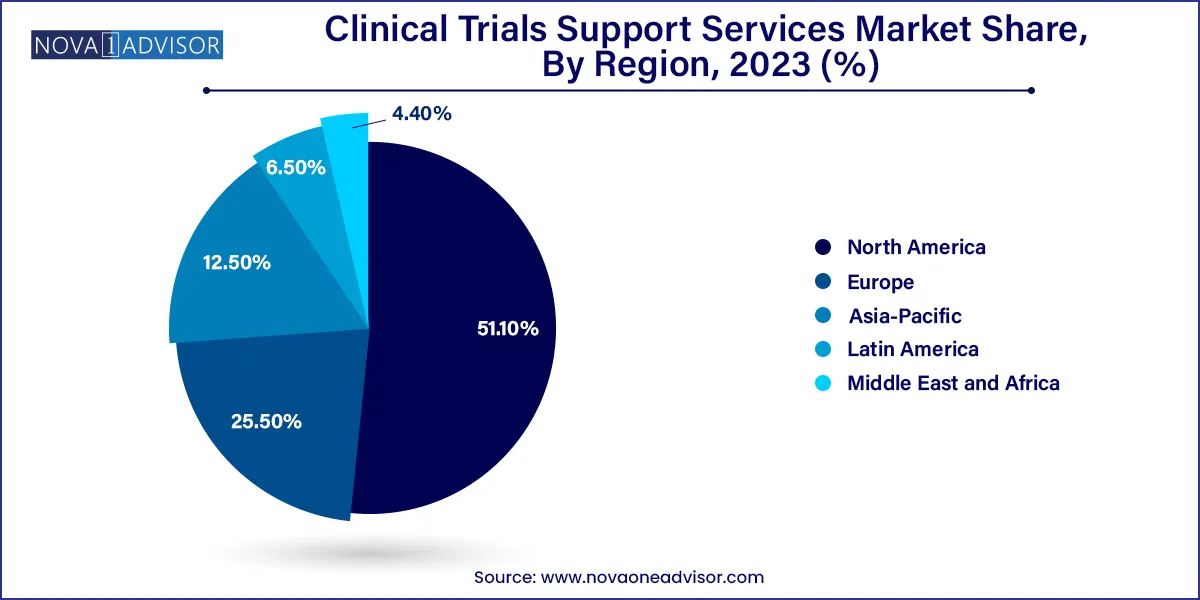

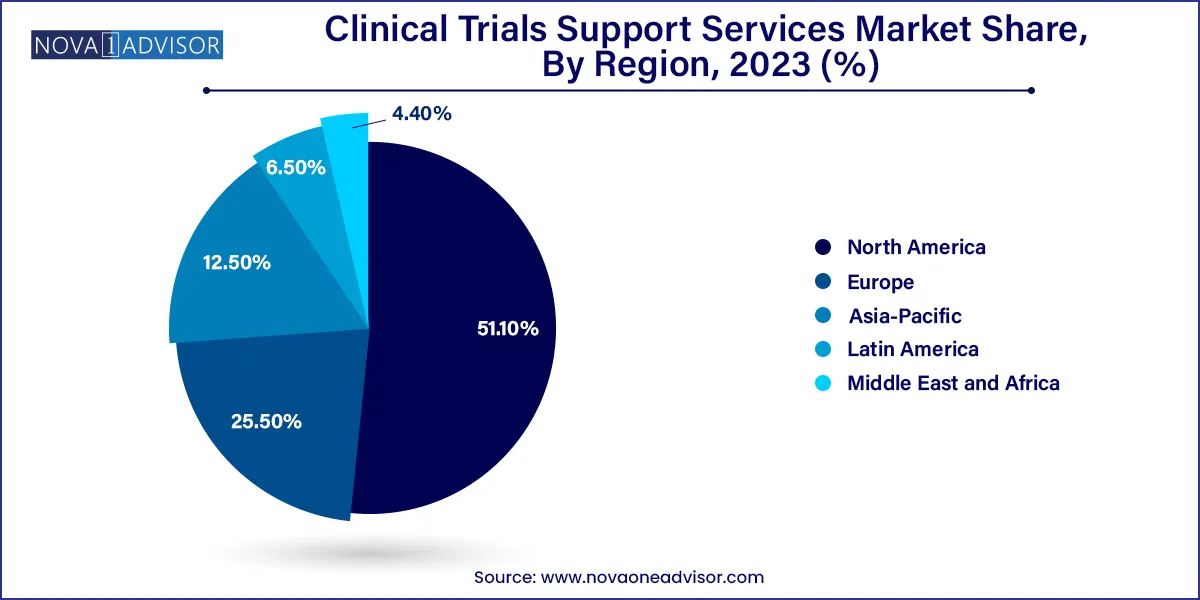

- North America dominated the global market in 2023 with the largest share of 51.1%

- Asia Pacific is anticipated to be the fastest-growing at CAGR 8.5% regional market during the forecast period.

- Clinical trial site management includes site recruitment, retention, and monitoring. It accounted for the largest market share of 44.5% in 2023 and CAGR at 8.9%.

- The phase III segment dominated the market with the largest share of 54.1% in 2023.

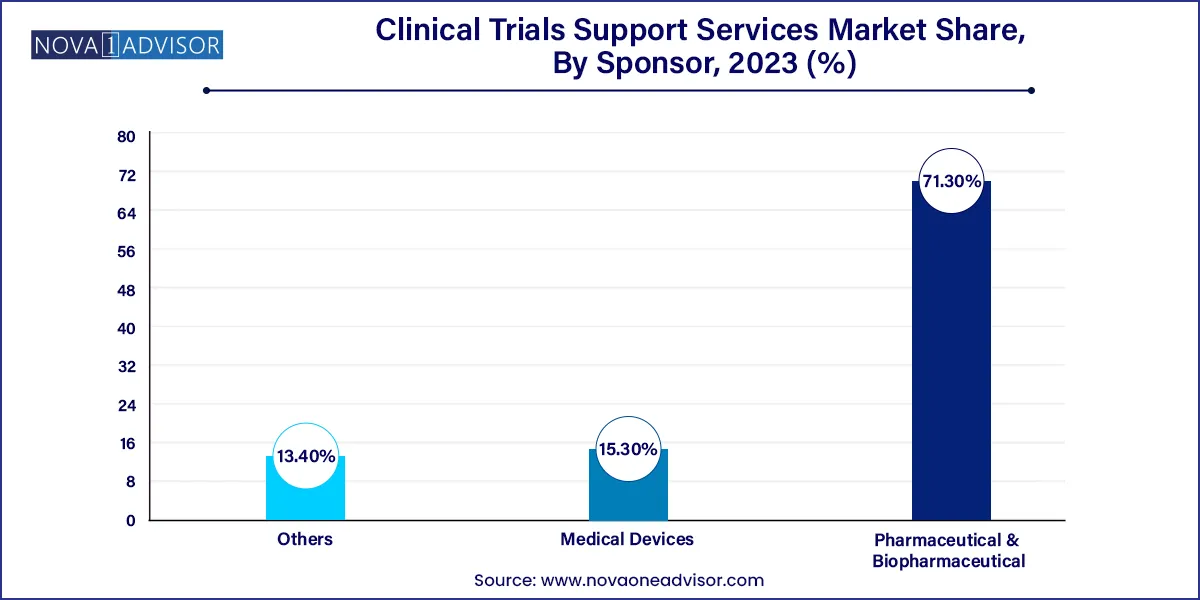

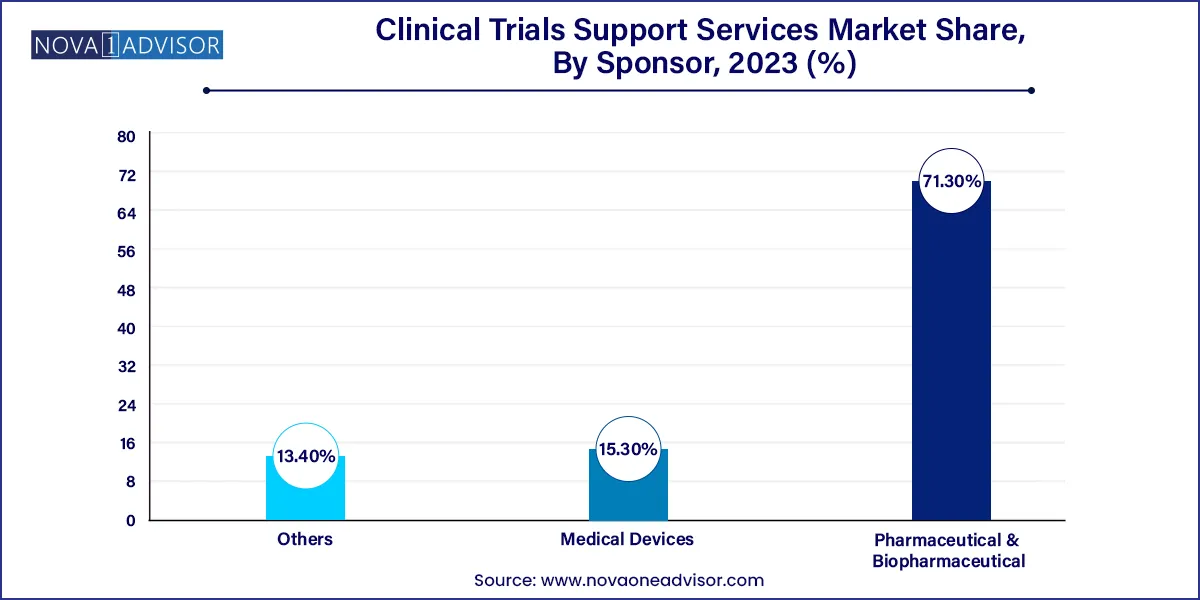

- The pharmaceutical & biopharmaceutical companies' sponsor segment dominated the market with the largest revenue share of over 71.3% in 2023.

- The medical device companies segment is anticipated to show lucrative growth CAGR 6.8% during the forecast period.

Market Overview

The Clinical Trials Support Services Market has become an essential backbone for the efficient execution and management of clinical trials, playing a crucial role in the development and commercialization of new therapeutic solutions. As drug development becomes increasingly complex and competitive, the demand for specialized support services such as site management, data coordination, regulatory affairs, patient recruitment, and institutional review board (IRB) management has grown substantially. These services are vital for ensuring that clinical trials are not only scientifically valid but also ethically compliant, timely, and cost-effective.

With the global drug development pipeline expanding rapidly particularly in oncology, immunotherapy, and gene therapies the role of support services has moved from ancillary to strategic. Biopharmaceutical and medical device companies increasingly rely on contract research organizations (CROs) and specialized service providers to handle operational, logistical, and regulatory hurdles. The shift towards decentralized clinical trials (DCTs), real-world evidence integration, and digital platforms has added further layers of complexity that demand expert management.

This market is also being shaped by the ongoing evolution of healthcare delivery and research protocols, especially in response to COVID-19's long-tail impact. The pandemic redefined trial execution, introducing a permanent shift toward hybrid and remote models. As a result, clinical trial support services have had to expand their capabilities both technologically and operationally to meet new expectations for agility, patient-centricity, and data accuracy.

Major Trends in the Market

-

Adoption of Decentralized Clinical Trial Models: Support services are increasingly adapting to remote operations, including virtual site visits, eConsent, and remote patient monitoring, demanding new IT and operational frameworks.

-

AI and Automation in Data Management: AI-driven analytics and automated data cleaning are becoming the norm, especially in large, multi-site trials that generate massive data volumes.

-

Specialization in Patient-Centric Services: There’s an increased focus on services like patient retention, home healthcare coordination, and multilingual communication to improve adherence and engagement.

-

Strategic Outsourcing by Mid-size Biotech Firms: Smaller and mid-tier biopharma firms are turning to specialized support providers to manage trial execution, allowing them to focus on R&D.

-

Consolidation Among Service Providers: Mergers and acquisitions among CROs and niche support service providers are reshaping the market landscape, driven by a need to offer end-to-end solutions.

-

Expansion into Emerging Markets: Asia-Pacific and Latin America are becoming hotbeds for trial activity, prompting service expansion and localization strategies.

-

Integration with EHR and Real-World Data Systems: To improve trial design and post-market analysis, support services are beginning to leverage real-world evidence from EHRs and registries.

Report Scope of the Clinical Trials Support Services Market

| Report Coverage |

Details |

| Market Size in 2024 |

USD 23.48 Billion |

| Market Size by 2033 |

USD 45.73 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 7.69% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, Phase, Sponsor, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Charles River Laboratories International, Inc.; Wuxi Apptec, Inc; Iqvia Holdings, Inc; Syneos Health, Inc.; Eurofins Scientific; Ppd, Inc. (Pharmaceutical Product Development); Icon Plc; Laboratory Corporation Of America Holdings (Labcorp); Alcura; Parexel International Corporation |

Key Market Driver: Increasing Complexity of Clinical Trials

One of the primary growth drivers in the Clinical Trials Support Services Market is the rising complexity of clinical trial protocols and requirements. Over the last decade, the average clinical trial has grown in terms of endpoints, data points, and participant criteria. As a result, trials now require greater coordination across multiple functions, geographies, and compliance regimes.

For example, a Phase III oncology trial might involve dozens of international sites, multiple biomarkers, and adaptive statistical designs. Managing such trials internally becomes untenable for most sponsors, thereby creating a high demand for external expertise in site coordination, data management, patient engagement, and protocol adherence. Additionally, regulatory bodies now demand extensive safety and efficacy documentation, which can only be managed efficiently through advanced data analytics and support platforms.

Key Market Restraint: Regulatory Fragmentation and Compliance Risk

Despite the upward momentum, regulatory fragmentation across geographies remains a major restraint. Clinical trial support services must navigate a complex web of ethical, legal, and operational requirements, which can vary widely between countries and regions. This lack of harmonization results in delays, additional costs, and heightened legal risk.

For instance, patient data protection regulations such as Europe's GDPR or California's CCPA impose stringent guidelines on consent, data storage, and sharing all of which impact data management services. Similarly, IRB protocols and trial site approvals vary by region, necessitating in-depth local knowledge and custom strategies. Smaller support service providers may struggle to scale operations without incurring compliance pitfalls.

Key Market Opportunity: Growing Demand for Patient Recruitment and Retention Services

A powerful opportunity area within the market lies in patient recruitment and retention management. Nearly 80% of clinical trials fail to meet enrollment deadlines, and approximately 30% of enrolled participants drop out before completion. These statistics highlight a massive opportunity for support service providers to develop innovative solutions in outreach, screening, onboarding, and continuous engagement.

Digital technologies, such as AI-based patient matching algorithms and targeted advertising via social media, are transforming how patients are identified and recruited. Services like multilingual communication portals, transportation coordination, and home nursing are being used to boost retention, particularly in decentralized or rare disease trials. Providers that can build scalable, patient-centric engagement models will find themselves at the forefront of this growing segment.

Segments

Clinical Trials Support Services Market By Service Insights

Clinical trial site management dominates the service segment due to its indispensable role in operationalizing trial protocols at ground level. This service encompasses site selection, initiation, monitoring, and closure all of which are fundamental to the trial's success. Site management ensures that the selected locations meet patient population needs, infrastructure readiness, and compliance standards. Given the increasing number of multi-center, global trials, demand for centralized site coordination continues to rise. Providers offering integrated site management services, such as Parexel and ICON, are particularly well-positioned.

Patient recruitment management is the fastest-growing segment as sponsors grapple with lengthy recruitment timelines and high dropout rates. Sub-segments like patient retention and patient registries are gaining traction. In rare diseases and pediatric trials, these services are especially critical. The use of digital platforms, mobile apps, and telemedicine in patient engagement is becoming standard practice. Recruitment strategies are increasingly being designed with patient behavior and preferences in mind, emphasizing convenience and trust-building.

Clinical Trials Support Services Market By Phase Insights

Phase III support services dominate the market as this stage involves large patient cohorts, multiple trial sites, and extensive regulatory documentation. The sheer volume of data and the operational complexity in Phase III necessitate comprehensive support in site monitoring, data management, safety reporting, and compliance auditing. It’s not uncommon for these trials to extend across 20+ countries, making logistical coordination crucial.

Phase I services are emerging as the fastest-growing segment, particularly with the rise of early-stage biotech firms and personalized therapies. These trials require specialized recruitment (often involving healthy volunteers), intensive data analysis, and safety oversight. Companies are also exploring human micro-dosing and pharmacokinetic modeling at this stage, increasing demand for advanced support solutions.

Pharmaceutical and biopharmaceutical companies are the leading sponsor segment, owing to their vast pipelines and consistent outsourcing strategies. These companies prefer to partner with support providers who can offer regulatory expertise, digital infrastructure, and global reach. Large pharma firms such as Pfizer and Novartis often engage multiple support vendors to cover distinct geographies and therapeutic areas.

Medical device sponsors are showing the fastest growth, driven by the increasing complexity of device-related trials and regulatory expectations. With a rising number of wearable devices and digital health tools entering the clinical research domain, service providers must now adapt their models to accommodate engineering, software validation, and usability testing all critical aspects for device trials.

Clinical Trials Support Services Market By Regional Insights

North America, particularly the United States, leads the global Clinical Trials Support Services Market. The region benefits from a mature regulatory framework, high research investment, a large pool of academic medical centers, and a proactive CRO ecosystem. The U.S. FDA’s support for decentralized and hybrid trials has further catalyzed market growth. Companies like Medpace and Labcorp Drug Development have expanded their support capabilities, offering full-spectrum services across trial phases.

Asia-Pacific is the fastest-growing region, with countries like China, India, and South Korea at the forefront. The region’s appeal lies in its vast patient pool, competitive trial costs, and expanding clinical infrastructure. Governments are increasingly investing in research hubs and easing regulations to attract foreign sponsors. For example, China's NMPA reforms and India’s Clinical Trial Rules have made it easier to conduct multi-site trials, leading to a surge in demand for localized support services. Multilingual recruitment, local IRB management, and cross-border data compliance are areas of significant activity.

Some of the prominent players in the Clinical trials support services market include:

- Charles River Laboratories International, Inc.

- Wuxi Apptec, Inc

- Iqvia Holdings, Inc

- Syneos Health, Inc.

- Eurofins Scientific

- Ppd, Inc. (Pharmaceutical Product Development)

- Icon Plc

- Laboratory Corporation Of America Holdings (Labcorp)

- Alcura

- Parexel International Corporation

Recent Developments

-

April 2025 – ICON plc launched a new AI-enabled platform for patient recruitment in oncology trials, offering predictive analytics to identify eligible participants based on real-world data.

-

February 2025 – Parexel and Jeeva Informatics announced a collaboration to enhance decentralized trial support services with integrated eConsent and remote data capture capabilities.

-

January 2025 – Medpace expanded its workforce by 800 staff globally, signaling growing demand for clinical site management and data services, particularly in Europe and Asia.

-

December 2024 – Labcorp Drug Development introduced a blockchain-based data validation module for Phase I studies, aimed at improving auditability and transparency.

-

October 2024 – Syneos Health acquired a niche patient engagement firm to bolster its retention capabilities across global CNS and rare disease trials.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global clinical trials support services market.

Service

- Clinical Trial Site Management

- Patient Recruitment Management

-

- Patient recruitment & registry services

- Patient retention

- Others

- Data Management

- Administrative staff

- IRB

- Others

Phase

- Phase I

- Phase II

- Phase III

- Phase IV

Sponsor

- Pharmaceutical & Biopharmaceutical

- Medical Devices

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)