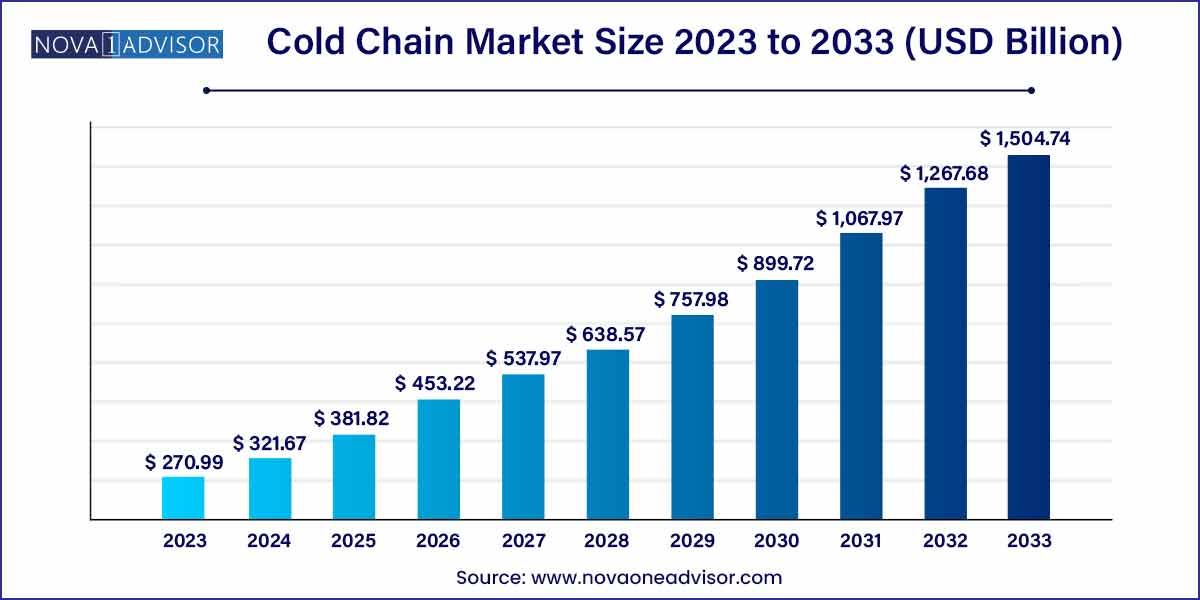

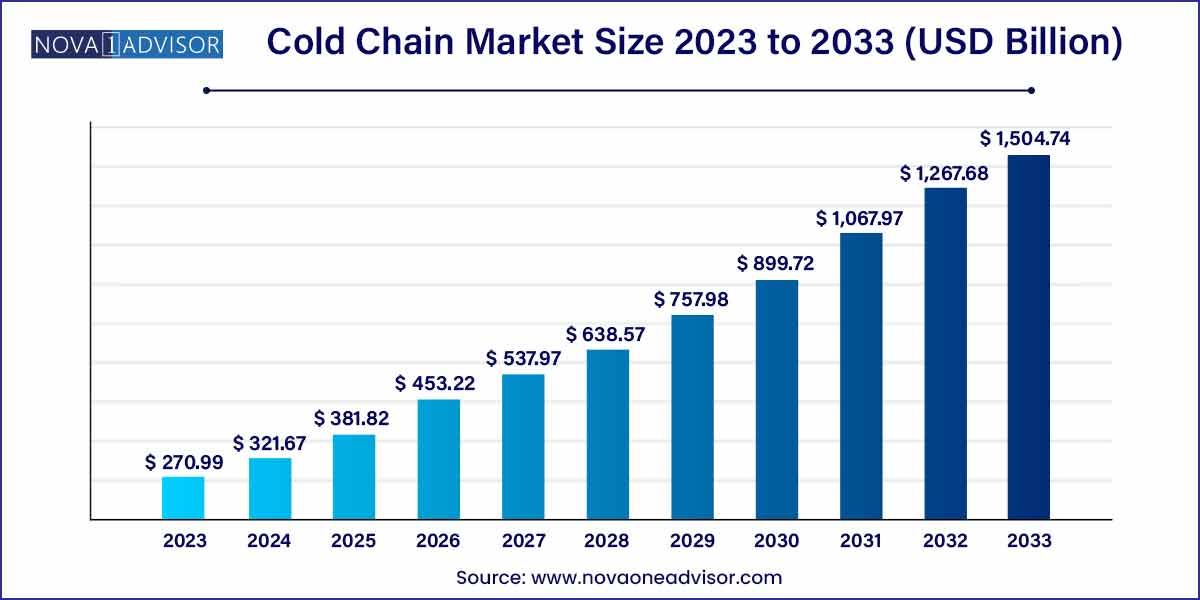

The global cold chain market size was exhibited at USD 270.99 billion in 2023 and is projected to hit around USD 1,504.74 billion by 2033, growing at a CAGR of 18.7% during the forecast period of 2024 to 2033.

Key Takeaways:

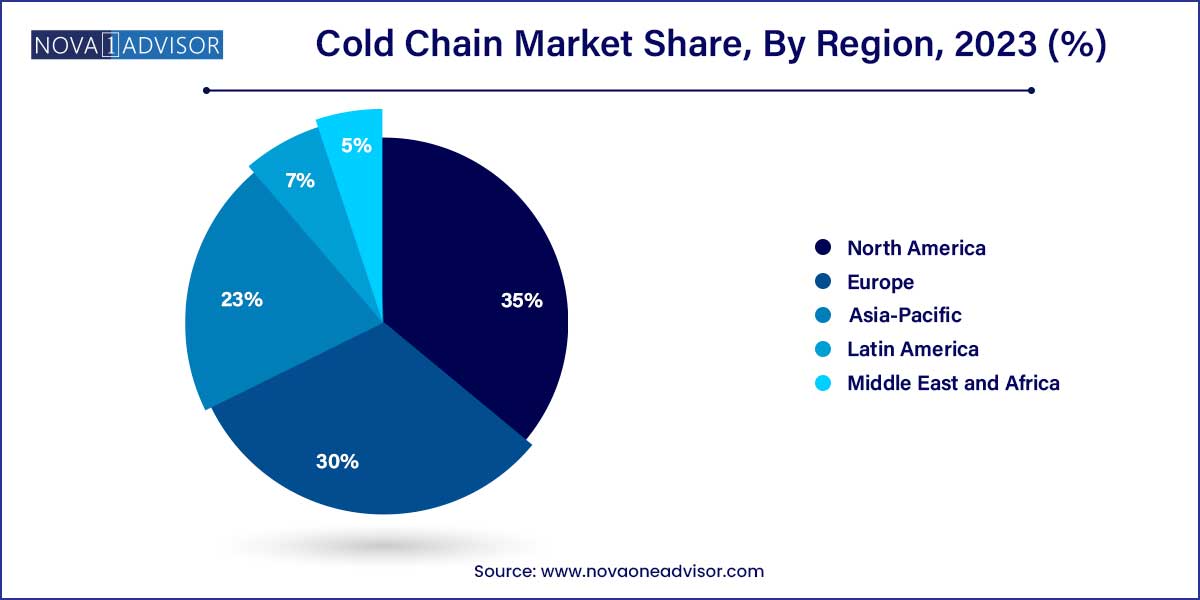

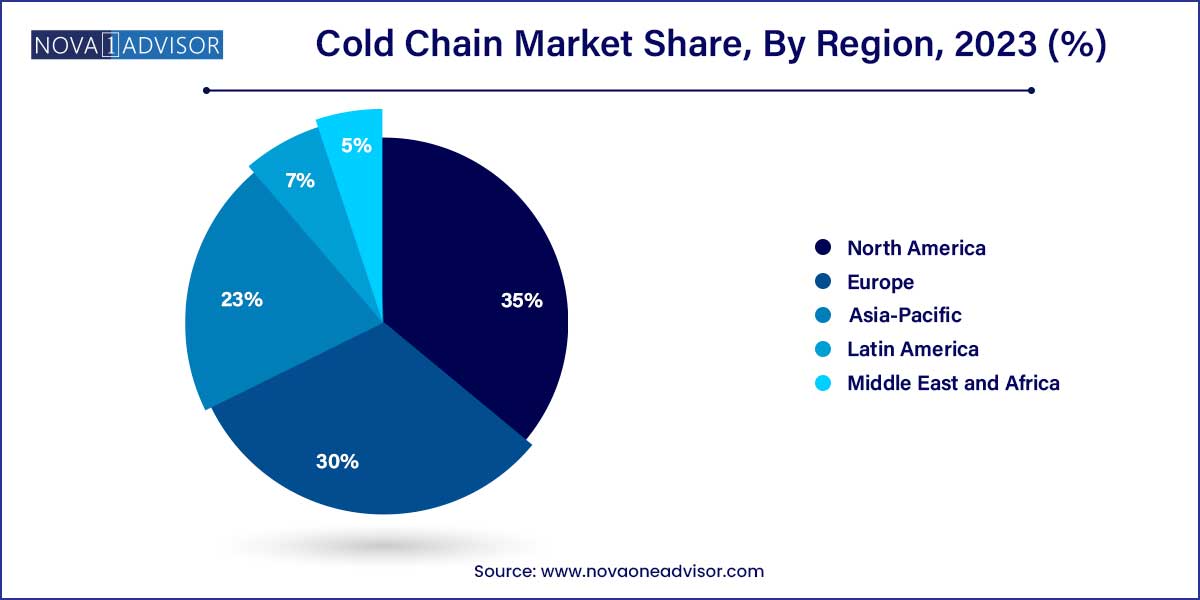

- North America held the largest revenue share of more than 35% in 2023.

- The storage segment dominated the overall cold chain industry, gaining a market share of more than 50.0% in 2023.

- The frozen (-18°C to -25°C) segment dominated the overall market, gaining a revenue share of more than 61.0% in 2023.

- The food & beverages segment dominated the overall cold chain industry, gaining a market share of more than 78.0% in 2023.

Cold Chain Market: Overview

The cold chain industry stands as a pivotal component within the global supply chain, facilitating the preservation and transportation of temperature-sensitive goods across various sectors, including pharmaceuticals, food, and beverages. This sector plays a crucial role in maintaining the integrity and quality of perishable products from production to consumption.

Cold Chain Market Growth

The cold chain market is experiencing robust growth driven by several key factors. Firstly, the rising demand for perishable goods, including food, pharmaceuticals, and chemicals, is fueling the expansion of cold chain networks globally. Additionally, stringent regulations mandating the maintenance of product integrity and safety during transportation and storage further underscore the importance of reliable cold chain infrastructure. Moreover, advancements in refrigeration technologies, coupled with the increasing adoption of IoT-enabled monitoring systems, are enhancing the efficiency and transparency of cold chain operations. Furthermore, globalization and expanding international trade are amplifying the need for sophisticated temperature-controlled logistics solutions, driving market growth. Overall, these factors collectively contribute to the sustained expansion of the cold chain market, presenting lucrative opportunities for stakeholders across the supply chain.

Cold Chain Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 270.99 Billion |

| Market Size by 2033 |

USD 1,504.74 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Temperature Range, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Americold Logistics, Inc.; LINEAGE LOGISTICS HOLDING, LLC; United States Cold Storage; Burris Logistics; Wabash National Corporation; NewCold; Sonoco ThermoSafe (Sonoco Products Company); United Parcel Service of America, Inc.; A.P. Moller - Maersk; NICHIREI CORPORATION; Tippmann Group. |

Cold Chain Market Dynamics

- Increasing Demand for Perishable Goods:

One of the primary dynamics shaping the cold chain market is the escalating demand for perishable goods worldwide. With growing consumer preferences for fresh and frozen foods, along with the expanding pharmaceutical industry, there is a heightened need for reliable temperature-controlled logistics solutions. This demand surge is further fueled by evolving dietary habits, urbanization, and the rise of e-commerce platforms offering perishable products. As a result, cold chain logistics providers are witnessing a surge in business opportunities, prompting investments in infrastructure, technology, and operational efficiency enhancements to meet the escalating demand while ensuring product integrity and safety.

- Advancements in Refrigeration Technologies:

The continuous evolution of refrigeration technologies stands as another significant dynamic driving the cold chain market forward. Innovations such as energy-efficient refrigeration systems, smart temperature monitoring devices, and sustainable refrigerants are revolutionizing cold chain operations, enhancing efficiency, and reducing environmental impact. These advancements enable precise temperature control, real-time monitoring, and predictive maintenance, thereby mitigating the risk of temperature excursions and product spoilage during transit. Moreover, the integration of IoT and blockchain technologies offers enhanced traceability and transparency, bolstering consumer confidence in the safety and quality of perishable goods.

Cold Chain Market Restraint

- High Initial Investment Costs:

One of the primary restraints hindering the growth of the cold chain market is the high initial investment required to establish and maintain temperature-controlled infrastructure and equipment. Building and operating cold storage facilities, refrigerated transport vehicles, and specialized packaging solutions entail significant capital expenditure, which can act as a barrier to entry for small and medium-sized enterprises (SMEs). Moreover, ongoing operational costs, including energy consumption, maintenance, and regulatory compliance, further contribute to the financial burden faced by cold chain logistics providers.

- Challenges in Rural and Remote Areas:

Another significant restraint confronting the cold chain market is the logistical challenges associated with serving rural and remote areas, where access to adequate infrastructure and transportation networks is limited. Delivering temperature-sensitive goods to remote regions often requires overcoming logistical hurdles such as poor road conditions, inadequate storage facilities, and unreliable power supply, which can compromise the integrity and safety of perishable products. Additionally, the lack of skilled personnel and cold chain infrastructure in rural areas further exacerbates the operational complexities faced by cold chain logistics providers.

Cold Chain Market Opportunity

- Rising Adoption of E-commerce Platforms:

The increasing adoption of e-commerce platforms presents a significant opportunity for the cold chain market. With the proliferation of online grocery shopping and the growing consumer demand for fresh and frozen foods delivered to their doorsteps, there is a surge in demand for efficient and reliable temperature-controlled logistics solutions. Cold chain logistics providers can capitalize on this trend by partnering with e-commerce companies to offer seamless and timely delivery of perishable goods while ensuring product integrity and safety throughout the supply chain. Moreover, the integration of advanced technologies such as route optimization, real-time temperature monitoring, and blockchain-based traceability enhances the efficiency and transparency of cold chain operations, further bolstering the attractiveness of cold chain services in the e-commerce sector.

- Expanding Pharmaceutical Industry:

The expanding pharmaceutical industry represents another lucrative opportunity for the cold chain market. With the growing demand for temperature-sensitive drugs, vaccines, and biologics, there is an increasing need for reliable cold chain logistics solutions to ensure the integrity and efficacy of these products throughout the distribution process. Cold chain logistics providers can leverage this opportunity by offering specialized services tailored to the unique requirements of pharmaceutical products, including stringent temperature control, regulatory compliance, and security measures. Furthermore, advancements in biopharmaceutical research and development, coupled with the emergence of personalized medicine and biotechnology innovations, are expected to drive further growth in the pharmaceutical cold chain segment.

Cold Chain Market Challenges

- Complex Regulatory Landscape:

One of the significant challenges confronting the cold chain market is the complex regulatory landscape governing temperature-controlled logistics. Regulations pertaining to food safety, pharmaceutical quality assurance, and environmental sustainability vary across regions and are subject to frequent updates, posing compliance challenges for cold chain logistics providers. Navigating this intricate regulatory environment requires substantial resources and expertise to ensure adherence to standards such as Good Distribution Practices (GDP), Hazard Analysis and Critical Control Points (HACCP), and the Food Safety Modernization Act (FSMA).

- Supply Chain Disruptions:

Another significant challenge facing the cold chain market is the risk of supply chain disruptions arising from various external factors, including natural disasters, geopolitical tensions, and global pandemics. Disruptions such as transportation delays, equipment failures, and inventory shortages can compromise the integrity and safety of perishable products, leading to financial losses and reputational damage for cold chain logistics providers. Moreover, the interconnected nature of the global supply chain exacerbates the impact of disruptions, as disruptions in one region can cascade through the entire supply chain, disrupting operations and creating bottlenecks.

Segments Insights:

Type Insights

Storage facilities dominated the cold chain market in 2024, driven by the rapid growth of refrigerated warehouses and cold rooms across major economies. Private and semi-private refrigerated warehouses account for a large share, primarily because of their customized services catering to specific industry needs. Leading food and pharmaceutical companies prefer private facilities to ensure better control over storage standards and to avoid dependency on third-party logistics providers. Additionally, cold rooms, particularly in hospitals, restaurants, and retail outlets, are witnessing steady demand as businesses increasingly prioritize on-site storage to guarantee freshness.

Simultaneously, transportation is the fastest-growing segment in the cold chain ecosystem. Transportation by road remains predominant, given its cost-effectiveness and extensive reach. However, transportation by air is gaining traction for high-value and time-sensitive shipments, especially in pharmaceuticals and fresh seafood. The refrigerated vehicles sub-segment is expanding rapidly due to the proliferation of temperature-sensitive e-commerce deliveries. Companies such as Lineage Logistics and Maersk are investing heavily in expanding their fleets of refrigerated containers and trucks to meet the burgeoning demand for prompt and reliable cold deliveries.

Temperature Range Insights

Chilled storage (0°C to 15°C) dominated the market because of its suitability for a wide range of products, including fruits, vegetables, dairy, and some pharmaceuticals. Most food products require chilled conditions, driving the segment's volume and revenue.

Meanwhile, deep-frozen storage (below -25°C) is the fastest-growing segment. Increasing demand for frozen meat, seafood, and certain biologics requiring ultra-low temperatures (like mRNA vaccines) is spurring investment in deep-freeze technologies. Companies are innovating specialized freezers that can maintain extreme low temperatures while optimizing energy consumption.

Application Insights

Food and beverages application led the cold chain market, driven by rising global consumption of dairy, processed foods, and bakery products. Growth in international trade of perishable foods and the popularity of online grocery platforms like FreshDirect and Instacart have accelerated the need for robust cold storage and transportation.

Pharmaceuticals are the fastest-growing application segment. Post-pandemic, awareness regarding the importance of cold storage in maintaining vaccine efficacy, blood banking, and biologic drug stability has intensified. Governments, healthcare institutions, and pharma giants are actively investing in cold chain infrastructure to prepare for future public health challenges.

Regional Insight

North America dominated the cold chain market in 2023, primarily due to well-established infrastructure, high demand for frozen foods, and a thriving biopharmaceutical industry. The United States, in particular, leads with sophisticated storage facilities, widespread refrigerated trucking networks, and robust regulations like the Food Safety Modernization Act (FSMA) that mandate strict cold chain practices. Major companies such as Americold Logistics and United States Cold Storage have expanded their capacities through mergers and acquisitions to meet increasing demand. Furthermore, the growing trend of meal kit delivery services such as HelloFresh and Blue Apron has significantly boosted cold storage requirements.

Asia-Pacific is the fastest-growing region in the cold chain market. Countries like China, India, and Southeast Asian nations are witnessing rapid urbanization, rising middle-class incomes, and changing food consumption habits, all of which drive cold chain investments. Government initiatives such as India's "National Centre for Cold-chain Development" and subsidies for cold chain projects are catalyzing market growth. The pharmaceutical sector's growth, especially vaccine manufacturing and exports, further amplifies the demand for advanced cold storage solutions in the region.

Recent Developments

-

March 2025: Lineage Logistics, a major player in cold storage, announced a $1 billion investment plan to expand its global network, focusing particularly on Latin America and Asia.

-

February 2025: Americold Realty Trust completed the acquisition of Vertical Cold Storage, adding over 50 million cubic feet of refrigerated warehousing to its capacity in the U.S.

-

January 2025: DB Schenker launched a fully sustainable cold chain transport service in Europe, using 100% electric refrigerated trucks for short-haul deliveries.

-

December 2024: Maersk unveiled its new cold storage facility in New Jersey, USA, aimed at serving pharmaceutical and perishable food industries with an emphasis on real-time monitoring.

-

November 2024: DHL Supply Chain announced the expansion of its cold chain logistics services in India with five new cold storage warehouses dedicated to pharmaceutical and food sectors.

Some of the prominent players in the Cold chain market include:

- Americold Logistics, Inc.

- LINEAGE LOGISTICS HOLDING, LLC

- United States Cold Storage

- Burris Logistics

- Wabash National Corporation

- NewCold

- Sonoco ThermoSafe (Sonoco Products Company)

- United Parcel Service of America, Inc.

- A.P. Moller - Maersk

- NICHIREI CORPORATION

- Tippmann Group

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cold chain market.

Type Outlook

-

-

-

- Private & Semi-Private

- Public

-

-

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

-

-

- Refrigerated vehicles

- Refrigerated containers

-

- Crates

- Insulated Containers & Boxes

-

-

- Large (32 to 66 liters)

- Medium (21 to 29 liters)

- Small (10 to 17 liters)

- X-small (3 to 8 liters)

- Petite (0.9 to 2.7 liters)

-

- Cold chain bags/Vaccine bags

- Ice packs

- Others

-

-

- Sensors

- RFID Devices

- Telematics

- Networking Devices

- Others

Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

Application

-

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

-

-

- Milk

- Butter

- Cheese

- Ice cream

- Others

-

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

-

- Vaccines

- Blood Banking

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)