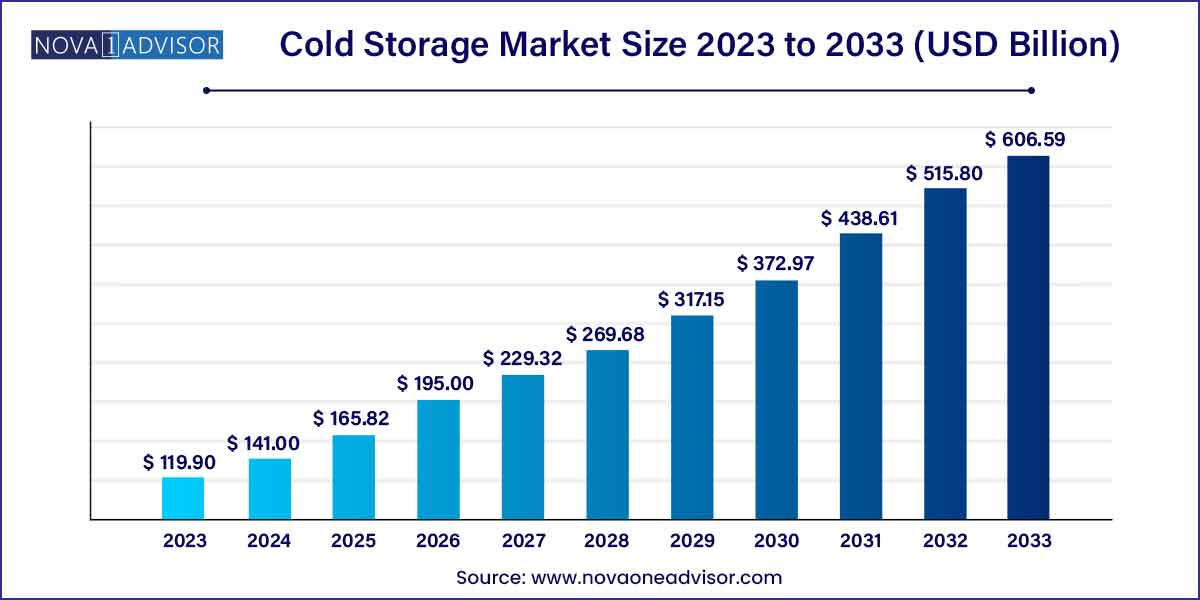

The global cold storage market size was exhibited at USD 119.90 billion in 2023 and is projected to hit around USD 606.59 billion by 2033, growing at a CAGR of 17.6% during the forecast period of 2024 to 2033.

Key Takeaways:

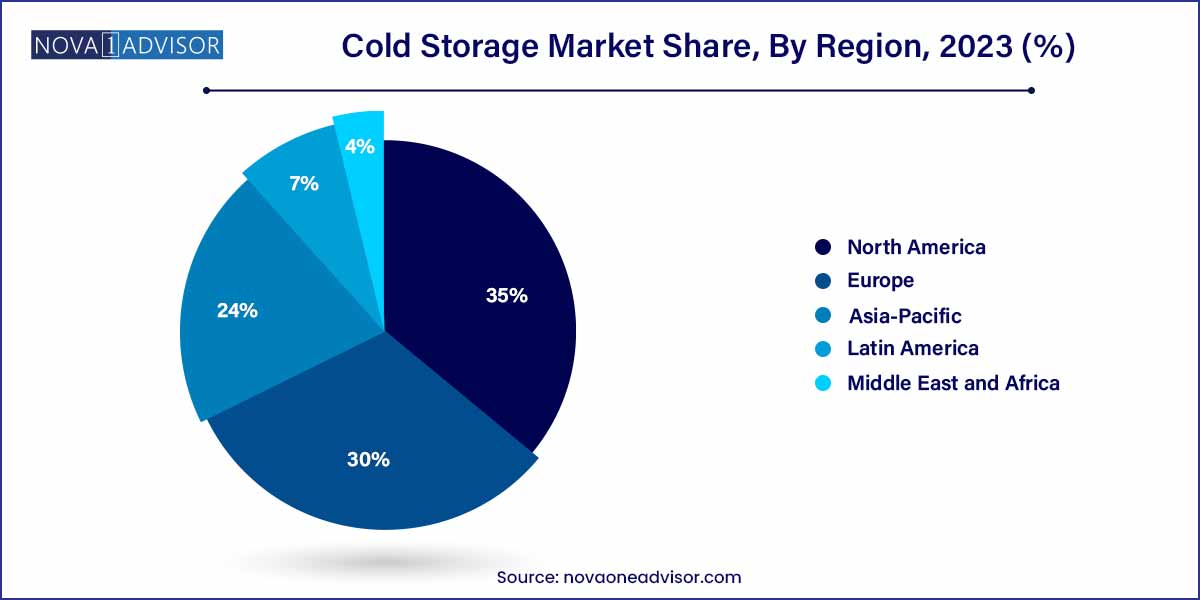

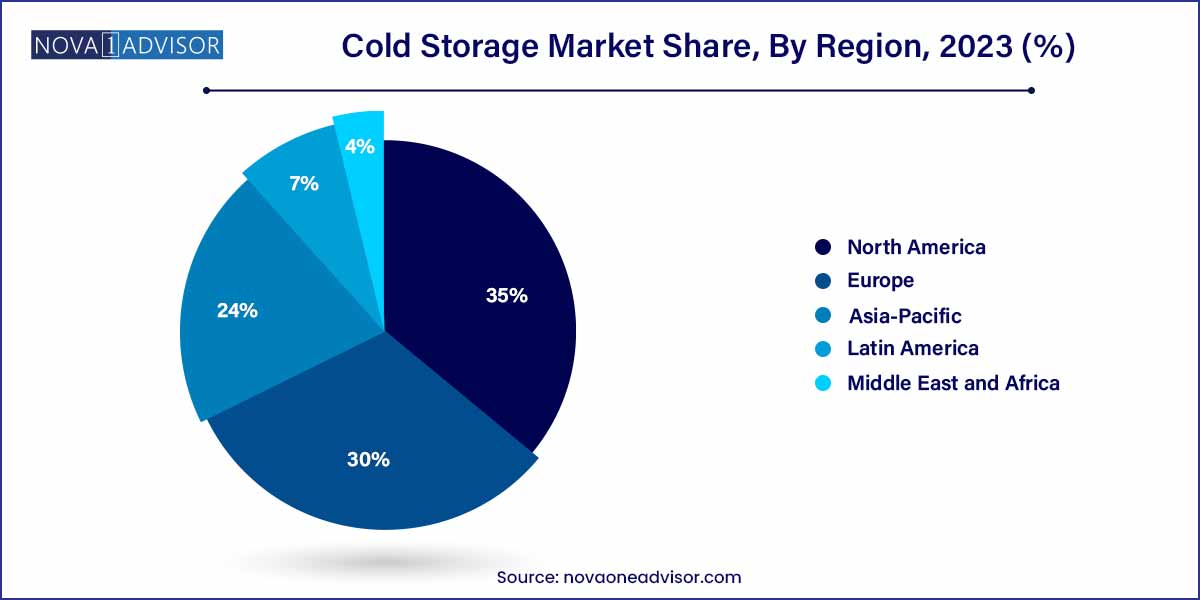

- The North America region led the market with a 35.0% revenue share globally in 2023.

- The facilities and services segment dominated the overall market, gaining a revenue share of 89.8% in 2023.

- The frozen (-18°C to -25°C) segment dominated the overall market, gaining a revenue share of more than 61% in 2023.

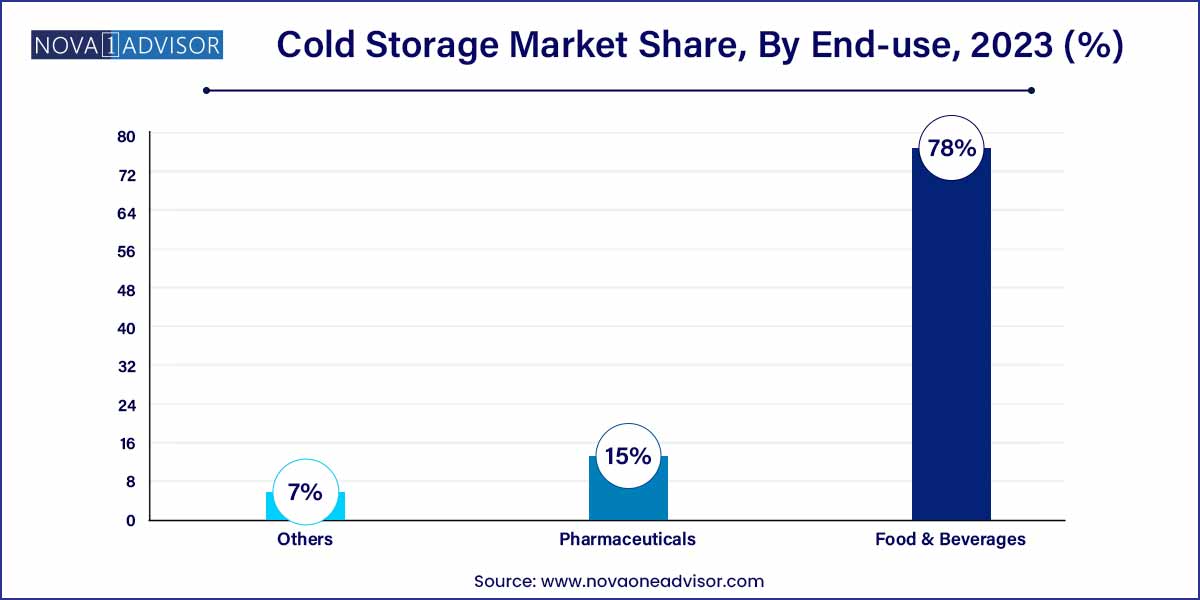

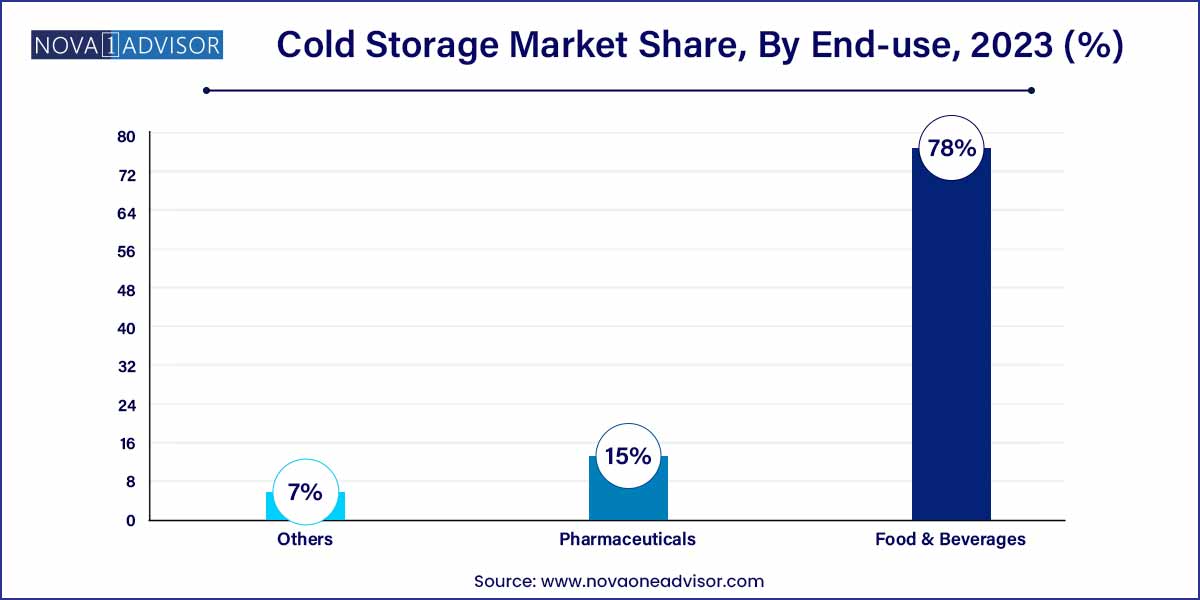

- The food & beverage segment dominated the overall cold storage industry, gaining a revenue share of more than 78% in 2023.

Cold Storage Market: Overview

The cold storage market is a cornerstone of the global logistics and supply chain ecosystem, playing a critical role in the preservation and transportation of temperature-sensitive goods. These facilities and equipment are essential for industries like food and beverages, pharmaceuticals, and chemicals, ensuring product integrity, quality, and safety from production to consumption. As globalization of the food trade expands and pharmaceutical distribution becomes more complex, the demand for reliable cold storage infrastructure continues to accelerate.

Modern cold storage operations are no longer limited to simple refrigeration rooms. Today’s market incorporates highly automated, digitally managed refrigerated warehouses, blast freezers, and advanced cold room technologies. These systems cater to varied temperature needs, from chilled conditions to deep freezing, allowing precise storage of perishable products such as vaccines, dairy, meat, seafood, and produce. The proliferation of online grocery and frozen food deliveries has further intensified the requirement for strategically placed cold storage units near urban centers.

Environmental concerns, energy efficiency mandates, and rising global health standards have also influenced cold storage design. Players in this market are investing in greener technologies, low-GWP refrigerants, and AI-powered monitoring solutions to ensure regulatory compliance while improving performance. The cold storage market is thus evolving as a convergence point for infrastructure development, technological innovation, and supply chain modernization.

Cold Storage Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 119.90 Billion |

| Market Size by 2033 |

USD 606.59 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 17.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Storage Type, Temperature Range, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Americold Logistics, Inc., Al Rai Logistica K.S.C, Agro Merchants Group, Burris Logistics, Barloworld Limited, Cloverleaf Cold Storage, Gulf Drug LLC, Henningsen Cold Storage Company, Kloosterboer, LINEAGE LOGISTICS HOLDING, LLC, Nordic Logistics, Oxford Logistics Group, Oceana Group Limited, Preferred Freezer, RSA Logistics, Swire Group, VersaCold Logistics Services, United States Cold Storage, Wared Logistics. |

Cold Storage Market Dynamics

- Technological Advancements Driving Efficiency:

The cold storage market dynamics are strongly influenced by ongoing technological advancements. Innovations in refrigeration technologies, such as precision cooling and the integration of IoT and sensor technologies, are enhancing the efficiency of cold storage facilities. Real-time monitoring and control capabilities contribute to the optimization of temperature conditions, ensuring the preservation of perishable goods.

- Globalization and E-commerce Reshaping Supply Chains:

The globalization of the food supply chain, coupled with the rise of e-commerce, significantly impacts the dynamics of the cold storage market. As consumer preferences shift towards diverse and seasonal food products, the demand for cold storage solutions has surged to facilitate the seamless distribution of temperature-sensitive goods across borders. E-commerce platforms, with their increasing focus on last-mile delivery, have further intensified the need for strategically located cold storage warehouses.

Cold Storage Market Restraint

- High Initial Investment and Operating Costs:

A prominent restraint in the cold storage market is the high initial investment and ongoing operating costs associated with establishing and maintaining temperature-controlled facilities. The need for specialized infrastructure, advanced refrigeration systems, and energy-efficient technologies significantly elevates the upfront capital required for entering the cold storage business. Additionally, the continuous energy consumption to maintain precise temperature conditions imposes ongoing operational expenses.

- Regulatory Compliance Challenges:

Regulatory compliance poses a considerable restraint in the cold storage market, particularly due to the stringent standards and guidelines governing the storage and transportation of perishable goods. Meeting and adhering to these regulations require significant investments in monitoring systems, documentation processes, and staff training to ensure that products are stored and transported within specified temperature ranges. Non-compliance not only risks product integrity but also subjects companies to potential legal consequences.

Cold Storage Market Opportunity

- Rising Demand for Pharmaceutical Cold Chain Logistics:

A significant opportunity within the cold storage market lies in the expanding demand for pharmaceutical cold chain logistics. The pharmaceutical industry, with its increasing emphasis on biopharmaceuticals and specialty drugs, relies heavily on temperature-sensitive storage and transportation. As the global pharmaceutical supply chain becomes more intricate, the need for reliable cold storage facilities to maintain the integrity of vaccines, biologics, and other temperature-sensitive medications presents a substantial growth avenue.

- Growing Popularity of E-Commerce and Online Grocery Shopping:

The growing popularity of e-commerce and online grocery shopping represents a significant opportunity in the cold storage market. As consumers increasingly turn to online platforms for their food and grocery needs, the demand for efficient and reliable cold storage solutions has surged. Cold storage warehouses strategically located to support last-mile delivery services for perishable goods have become integral to the success of e-commerce ventures.

Cold Storage Market Challenges

- Energy Consumption and Environmental Impact:

An inherent challenge in the cold storage market revolves around the substantial energy consumption required to maintain precise temperature conditions. The constant need for refrigeration and environmental control contributes to elevated operational costs and a significant carbon footprint. As sustainability becomes a key focus across industries, finding eco-friendly refrigeration solutions and implementing energy-efficient practices poses a considerable challenge.

- Complexity in Regulatory Compliance:

The cold storage market faces a complex challenge in navigating and adhering to the stringent regulatory requirements governing the storage and transportation of perishable goods. Regulations vary across regions and are subject to frequent updates, adding a layer of complexity to compliance efforts. Ensuring that facilities meet and maintain compliance standards demands continuous investments in monitoring systems, staff training, and documentation processes.

Segments Insights:

By Storage Type Insights

Refrigerated warehouses dominate the cold storage market, serving as centralized facilities for bulk storage of frozen and chilled products. These include both public warehouses, which cater to multiple clients, and private or semi-private facilities owned by large food producers or logistics companies. Public refrigerated warehouses offer flexible space and scalability, making them highly attractive to seasonal or small-scale users.

Cold rooms are among the fastest-growing storage types, especially for urban distribution and specialized applications like hospitality, retail, and local pharmaceuticals. These rooms offer compact, temperature-specific storage ideal for on-site operations or mobile installations. Their modular design, ease of installation, and compatibility with small-scale logistics networks make them a popular choice for rapid cold chain deployment in urban food service, vaccine centers, and grocery delivery.

By Temperature Range Insights

Frozen storage (-18°C to -25°C) dominates the market, particularly in the food and beverage segment. Frozen conditions are essential for preserving seafood, meat, processed meals, and frozen desserts over extended periods. Frozen storage is the backbone of international food exports and long-haul transportation where shelf-life extension is critical.

Deep-frozen storage (below -25°C) is the fastest-growing category, driven largely by pharmaceutical applications and high-end food products like specialty seafood and dairy. Deep freezing is crucial for preserving biological samples, vaccines, and high-value perishables that cannot tolerate temperature deviations. This segment has seen major infrastructure upgrades in response to global health emergencies and emerging medical therapies.

By Application Insight

Food and beverages lead the cold storage application market, particularly in the subcategories of meat, seafood, and dairy products. Demand is supported by globalization of food trade, rising consumer preference for convenience foods, and the rapid growth of online grocery services. Cold storage ensures food safety, traceability, and quality control in an increasingly complex supply chain.

Pharmaceuticals represent the fastest-growing application, as the sector expands its cold chain requirements for vaccines, biologics, blood products, and clinical samples. Strict regulatory requirements for temperature-controlled transportation and storage have prompted pharmaceutical companies to build or lease high-specification cold storage infrastructure. In particular, the global vaccine rollout and rise in chronic illness treatments have created unprecedented demand for secure, monitored cold facilities.

By Regional Insight

North America dominates the global cold storage market, led by the United States, which has a well-established network of refrigerated warehouses, food distributors, and pharmaceutical logistics providers. The region benefits from strong regulatory oversight, advanced technology adoption, and a highly organized food retail sector. Cold storage demand is further fueled by the rising penetration of e-commerce grocery services like Walmart, Amazon Fresh, and Instacart.

Asia-Pacific is the fastest-growing region, spurred by rising food demand, rapid urbanization, and increased exports of perishable goods. Countries such as China, India, and Indonesia are aggressively expanding cold chain infrastructure to meet domestic consumption needs and tap into global agri-food markets. Regional governments are investing in rural cold storage, subsidizing refrigerated transport, and incentivizing private sector partnerships to build smart, sustainable cold warehouses.

Recent Developments

- Lineage Logistics (March 2025): Announced the opening of a next-generation automated cold storage facility in Texas with over 100,000 pallet positions and AI-powered inventory management.

-

Americold Realty Trust (February 2025): Expanded its footprint in Europe by acquiring a leading temperature-controlled logistics provider in France.

-

Snowman Logistics (January 2025): Partnered with a pharmaceutical major in India to establish a dedicated ULT warehouse for vaccine distribution.

-

NewCold (December 2024): Began construction of a solar-powered automated cold storage facility in Australia, aligning with net-zero sustainability goals.

-

Agro Merchants Group (November 2024): Launched a cloud-based cold chain monitoring system to enhance transparency

and traceability across global operations.

Some of the prominent players in the cold storage market include:

- Americold Logistics, Inc.

- Al Rai Logistica K.S.C

- Agro Merchants Group

- Burris Logistics

- Barloworld Limited

- Cloverleaf Cold Storage

- Gulf Drug LLC

- Henningsen Cold Storage Company

- Kloosterboer

- LINEAGE LOGISTICS HOLDING, LLC

- Nordic Logistics

- Oxford Logistics Group

- Oceana Group Limited

- Preferred Freezer

- RSA Logistics

- Swire Group

- VersaCold Logistics Services

- United States Cold Storage

- Wared Logistics

- Wabash National Corporation

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global cold storage market.

Storage Type

-

-

- Private & Semi-Private

- Public

-

- Blast freezer

- Walk-in Cooler and Freezer

- Deep Freezer

- Others

Temperature Range

- Chilled (0°C to 15°C)

- Frozen (-18°C to -25°C)

- Deep-frozen (Below -25°C)

Application

-

- Fruits & Vegetables

- Fruit Pulp & Concentrates

- Dairy Products

-

-

- Milk

- Butter

- Cheese

- Ice cream

- Others

-

- Fish, Meat, and Seafood

- Processed Food

- Bakery & Confectionary

- Others

-

- Vaccines

- Blood Banking

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)