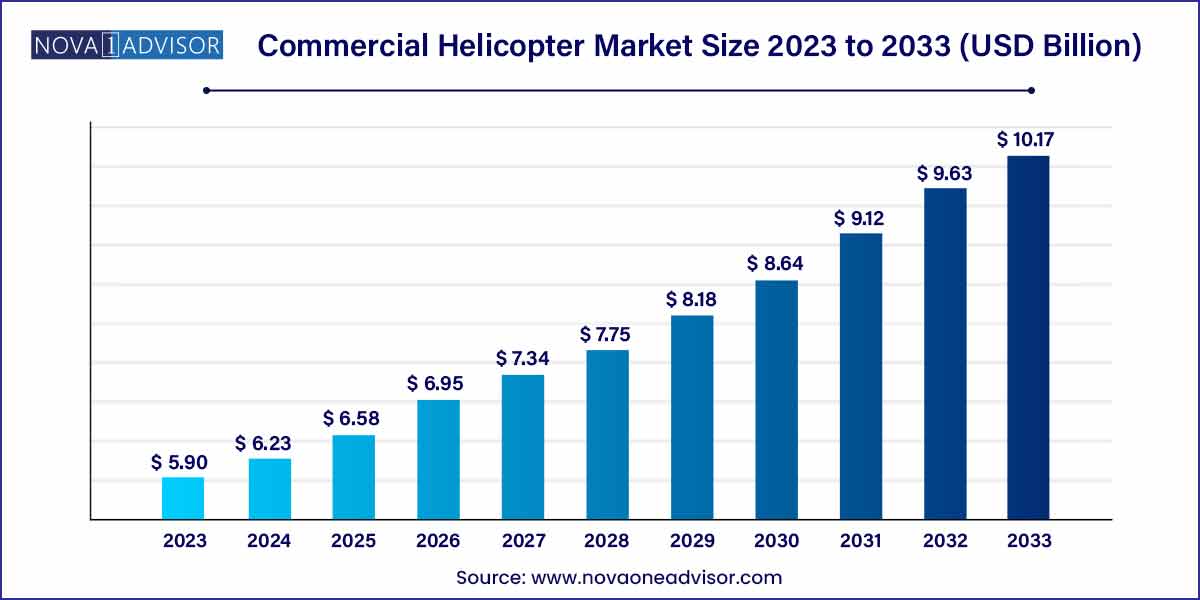

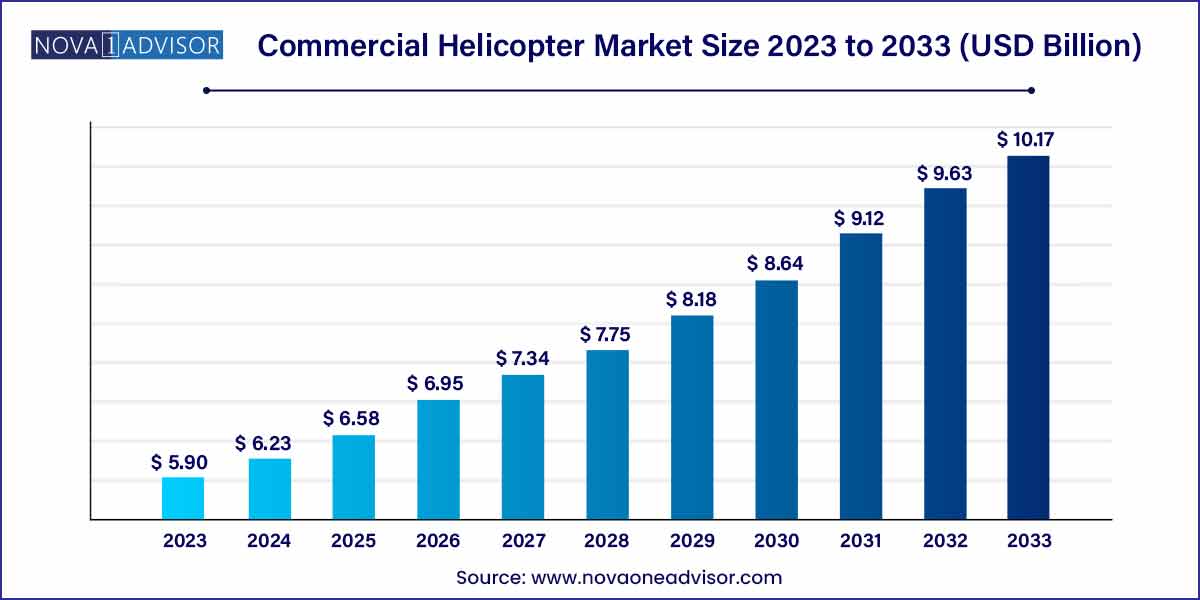

The global commercial helicopter market was exhibited at USD 5.90 billion in 2023 and is projected to hit around USD 10.17 billion by 2033, growing at a CAGR of 5.6% during the forecast period of 2024 to 2033.

Key Takeaways:

- The law enforcement segment captured the largest market share of 31.4% in 2023.

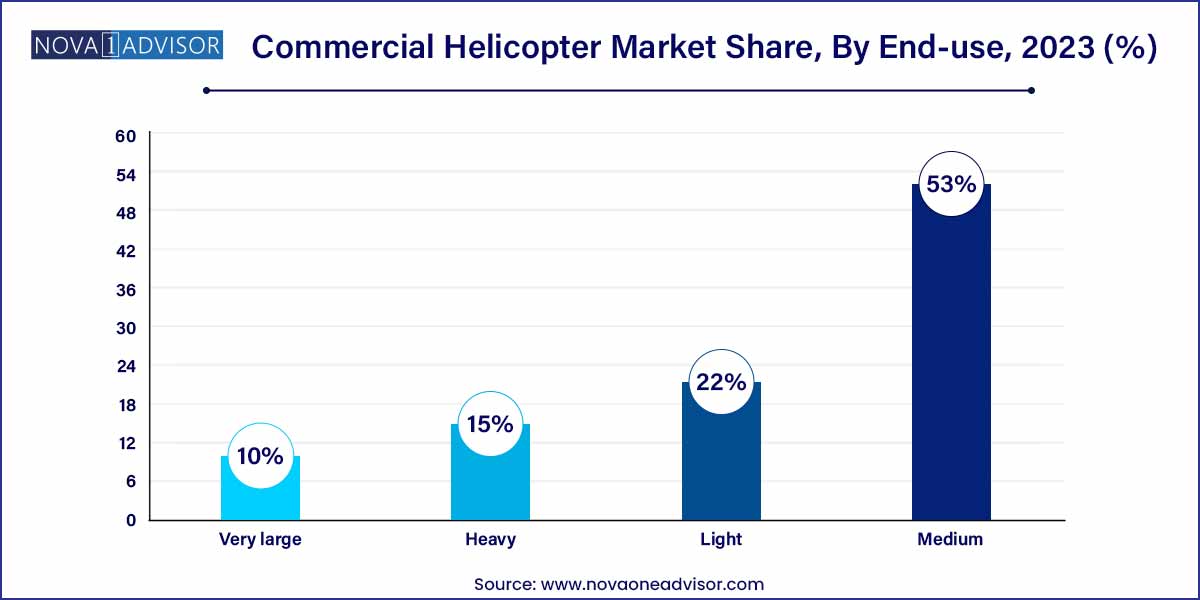

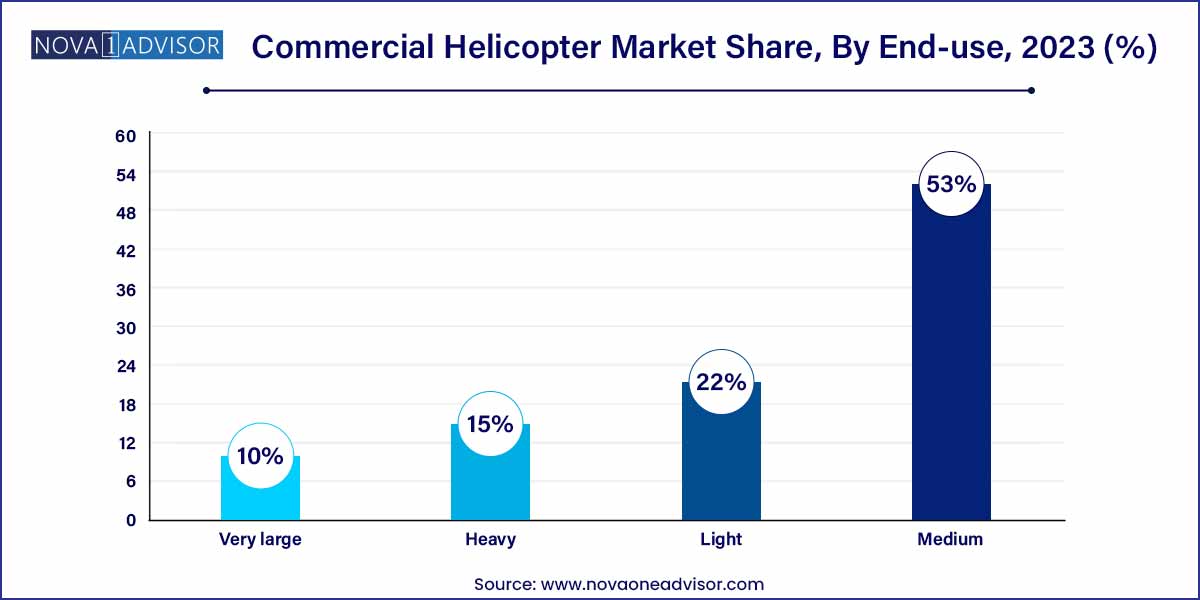

- The medium-type segment captured the largest revenue share of 53.0% in 2023.

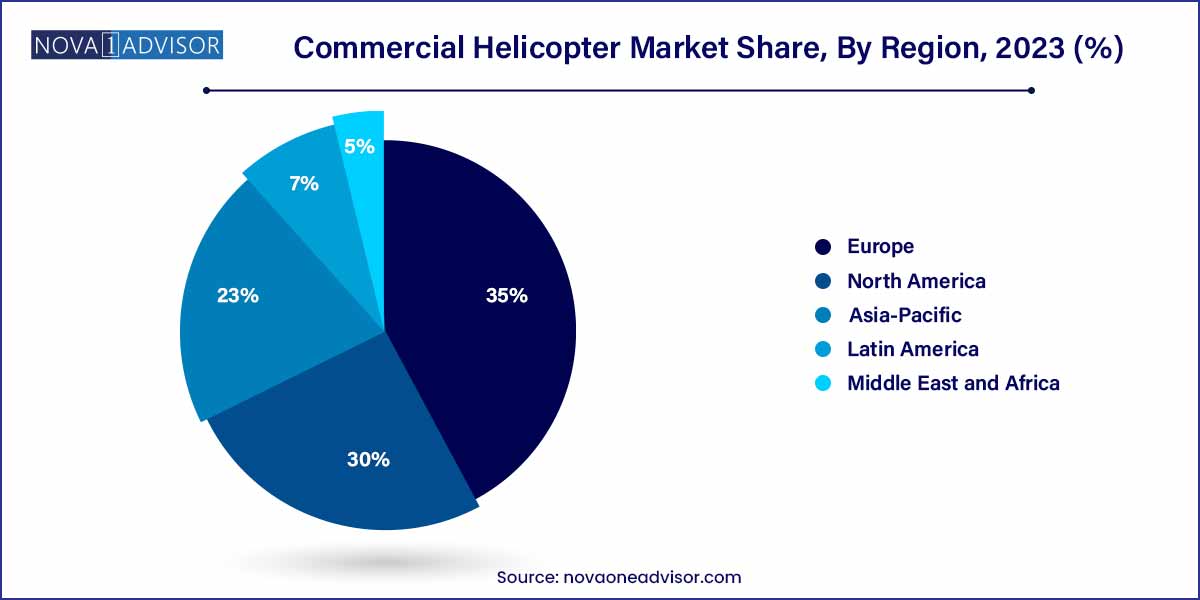

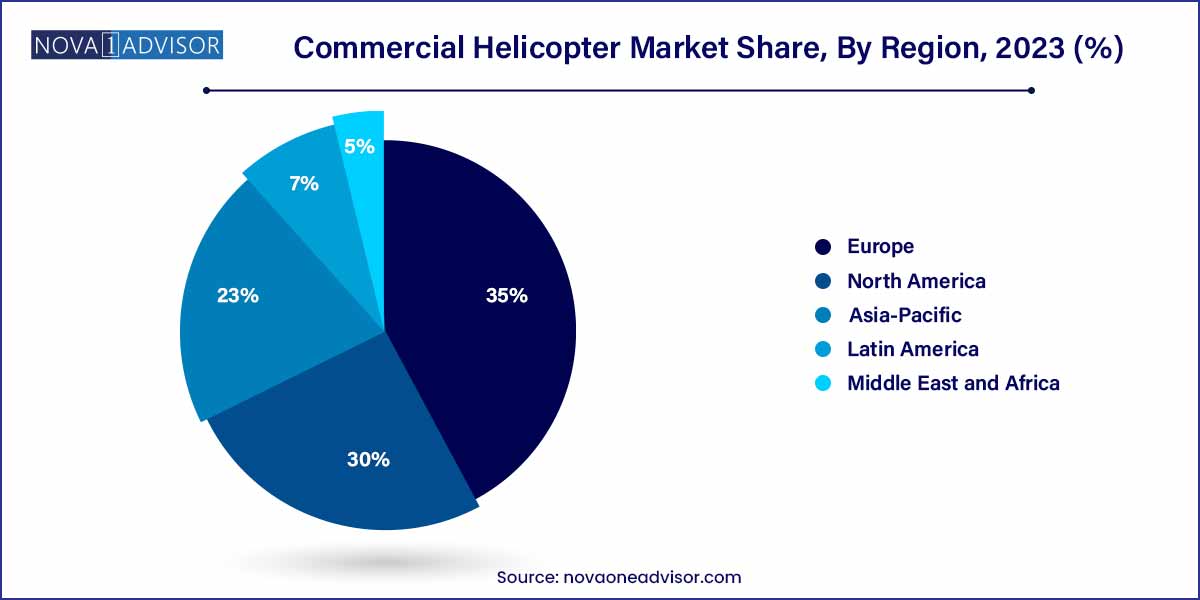

- The European market accounted for the largest revenue share of 35.0% in 2023 and is expected to witness significant growth over the forecast period.

Commercial Helicopter Market: Overview

The commercial helicopter market plays an indispensable role in modern aviation, serving diverse applications such as oil and gas transport, emergency medical services, search and rescue operations, law enforcement, and public safety. Helicopters offer unique advantages including vertical takeoff and landing (VTOL) capabilities, access to remote or constrained areas, and operational flexibility, making them critical assets in urban, industrial, and rugged environments.

As economies develop and urban centers expand, the need for rapid, reliable, and specialized transportation grows, bolstering demand for helicopters across sectors. Technological innovations such as hybrid-electric propulsion, autonomous flight systems, and advanced avionics are reshaping the market landscape, offering improved safety, efficiency, and environmental performance. Governments and private operators alike are investing heavily in upgrading fleets, modernizing helicopter infrastructure, and expanding aerial services.

Amid a backdrop of global economic recovery and rising energy exploration, the commercial helicopter sector is poised for robust expansion. Players across the ecosystem are adapting to evolving customer expectations around safety, speed, cost, and sustainability, leading to a dynamic and competitive market environment.

Commercial Helicopter Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.90 Billion |

| Market Size by 2033 |

USD 10.70 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 5.6% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application, and Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Airbus S.A.S.; Bell Helicopter Textron Inc.; Enstrom Helicopter Corp.; Hindustan Aeronautics Limited; Korea Aerospace Industries, Ltd.; Leonardo S.P.A.; Lockheed Martin Corporation; MD Helicopters, Inc.; Robinson Helicopter Company; Russian Helicopters, JSC. |

Commercial Helicopter Market Dynamics

- Technological Advancements Driving Innovation:

The commercial helicopter market is experiencing dynamic shifts propelled by rapid technological advancements. Ongoing innovations in helicopter design, avionics, and propulsion systems are fundamentally reshaping the industry. Manufacturers are investing significantly in research and development to introduce cutting-edge technologies that enhance overall performance, fuel efficiency, and safety. The integration of state-of-the-art avionics and materials is not only improving the reliability of commercial helicopters but also contributing to a more sustainable and cost-effective operational landscape.

- Environmental Considerations and Sustainable Solutions:

An increasingly influential dynamic in the commercial helicopter market is the industry's commitment to addressing environmental concerns. With a growing emphasis on sustainability, manufacturers are actively exploring and implementing eco-friendly solutions. The emergence of electric and hybrid propulsion technologies is a testament to this commitment, aiming to reduce the ecological footprint of helicopter operations. As regulatory bodies worldwide tighten environmental standards, the adoption of cleaner and more fuel-efficient technologies becomes imperative.

Commercial Helicopter Market Restraint

- High Operational Costs and Ownership Expenses:

One significant restraint impacting the commercial helicopter market is the substantial operational costs associated with ownership. Helicopter operators face considerable expenses related to maintenance, fuel consumption, and pilot training. The complexity of helicopter systems and the need for specialized expertise contribute to higher maintenance costs, posing a financial challenge for both operators and potential buyers. Additionally, the overall cost of ownership, including acquisition expenses and ongoing operational outlays, presents a barrier for entry and may limit the market's growth potential.

- Economic Uncertainty and Global Geopolitical Factors:

The commercial helicopter market is susceptible to economic fluctuations and global geopolitical tensions, representing a significant restraint on its growth. Economic uncertainties can impact key industries that heavily rely on helicopter services, such as tourism, corporate travel, and offshore operations. Changes in government policies, trade relations, and geopolitical events can influence market dynamics, affecting both demand and supply. The industry's resilience in navigating through such uncertainties becomes paramount, requiring strategic planning and adaptability to ensure continued growth.

Commercial Helicopter Market Opportunity

- Expanding Applications in Urban Air Mobility (UAM):

A significant opportunity within the commercial helicopter market lies in the expanding applications of helicopters in the emerging field of urban air mobility (UAM). The increasing urbanization and congestion in major cities have led to a growing interest in air transportation solutions. Helicopters, with their vertical take-off and landing capabilities, are well-positioned to play a pivotal role in UAM, offering a faster and more flexible alternative for intra-city travel.

- Rising Demand for Emergency Medical Services (EMS):

Another notable opportunity in the commercial helicopter market is the rising demand for helicopters in Emergency Medical Services (EMS). Helicopters play a crucial role in providing swift and efficient transportation for medical emergencies, particularly in hard-to-reach or remote areas. The demand for air ambulances equipped with advanced medical facilities is growing, driven by the need for rapid medical evacuation and lifesaving interventions.

Commercial Helicopter Market Challenges

- Operational Costs and Affordability Challenges:

The commercial helicopter market faces a significant challenge in the form of high operational costs, encompassing maintenance, fuel, and pilot training expenses. The complexity of helicopter systems and the need for specialized skills contribute to elevated maintenance costs, making ownership and operation financially demanding. Affordability remains a key concern for both operators and potential buyers, limiting the market's accessibility and growth potential.

- Environmental and noise concerns:

The commercial helicopter market encounters challenges associated with environmental and noise considerations. Helicopter operations, especially in urban and densely populated areas, are under increasing scrutiny due to noise pollution concerns. As environmental regulations become more stringent, manufacturers are compelled to develop and adopt technologies that reduce the ecological footprint of helicopter flights. Striking a balance between operational efficiency and environmental impact poses a challenge, requiring the industry to invest in quieter and more environmentally friendly propulsion systems.

Segments Insights:

Application Insights

Oil & Gas segment leads the market, driven by the critical role helicopters play in supporting offshore drilling operations. Helicopters transport personnel, critical equipment, and emergency responders to and from remote oil platforms, often under extreme environmental conditions. Long-range endurance, high payload capacities, and maritime safety equipment are essential features propelling demand in this segment.

Medical services are the fastest-growing application, fueled by increasing awareness of the "golden hour" in trauma care, government funding for air ambulance services, and the integration of helicopter emergency medical services (HEMS) into national healthcare systems. Helicopters equipped with advanced medical equipment and trained personnel are reducing response times and improving patient survival rates in critical emergencies.

Type Insights

Light helicopters dominate the commercial helicopter market, accounting for a substantial share of global deliveries. Their affordability, operational flexibility, lower maintenance requirements, and suitability for short-range missions make them ideal for applications like law enforcement, tourism, medical evacuations, and private charters. Manufacturers continually innovate light helicopters with enhanced safety features, compact designs, and digital cockpit systems, ensuring their sustained dominance.

Medium helicopters are the fastest-growing type, particularly favored in sectors like offshore oil and gas, search and rescue (SAR), and corporate transport. They offer an optimal balance between payload capacity, range, and cost-effectiveness. The ability of medium helicopters to undertake both civil and parapublic missions has made them highly attractive for fleet operators seeking multi-role versatility.

Regional Insights

North America dominates the commercial helicopter market, underpinned by a mature aviation infrastructure, high disposable income, strong demand for corporate and emergency services, and robust oil and gas operations, especially in the Gulf of Mexico. The U.S., being a hub for innovation in aerospace technologies and home to major OEMs, consistently leads global helicopter sales and fleet modernization initiatives.

Asia-Pacific is the fastest-growing region, driven by rapid urbanization, infrastructure development, and rising defense and civil aviation investments. Countries like China, India, Japan, and Australia are expanding their helicopter fleets for applications ranging from disaster management to offshore energy support. Additionally, the region's geographic diversity from islands to mountainous terrains makes helicopters indispensable for transportation and logistics.

Recent Developments

-

Airbus Helicopters (March 2025): Launched the new H160M "Guépard" variant for both commercial and military applications, featuring advanced avionics and reduced maintenance requirements.

-

Bell Textron Inc. (February 2025): Announced a collaboration with NASA to develop autonomous flight systems for next-generation commercial helicopters.

-

Leonardo S.p.A. (January 2025): Expanded its production facilities in the U.S. to meet rising demand for AW139 medium helicopters for corporate and EMS markets.

-

Sikorsky, a Lockheed Martin Company (December 2024): Introduced its "Urban Hawk" program focusing on hybrid-electric helicopters for urban air mobility (UAM) solutions.

-

MD Helicopters, LLC (November 2024): Secured a large order from a Southeast Asian operator for its light utility helicopters tailored for law enforcement and border patrol missions.

Some of the prominent players in the commercial helicopter market include:

- Airbus S.A.S.

- Bell Helicopter Textron Inc.

- Enstrom Helicopter Corp.

- Hindustan Aeronautics Limited,

- Leonardo S.P.A.

- Lockheed Martin Corporation

- MD Helicopters, Inc.

- Robinson Helicopter Company

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global commercial helicopter market.

Type

- Light

- Medium

- Heavy

- Very large

Application

- Oil & Gas

- Medical Services

- Transport

- Law Enforcement & Public Safety

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)