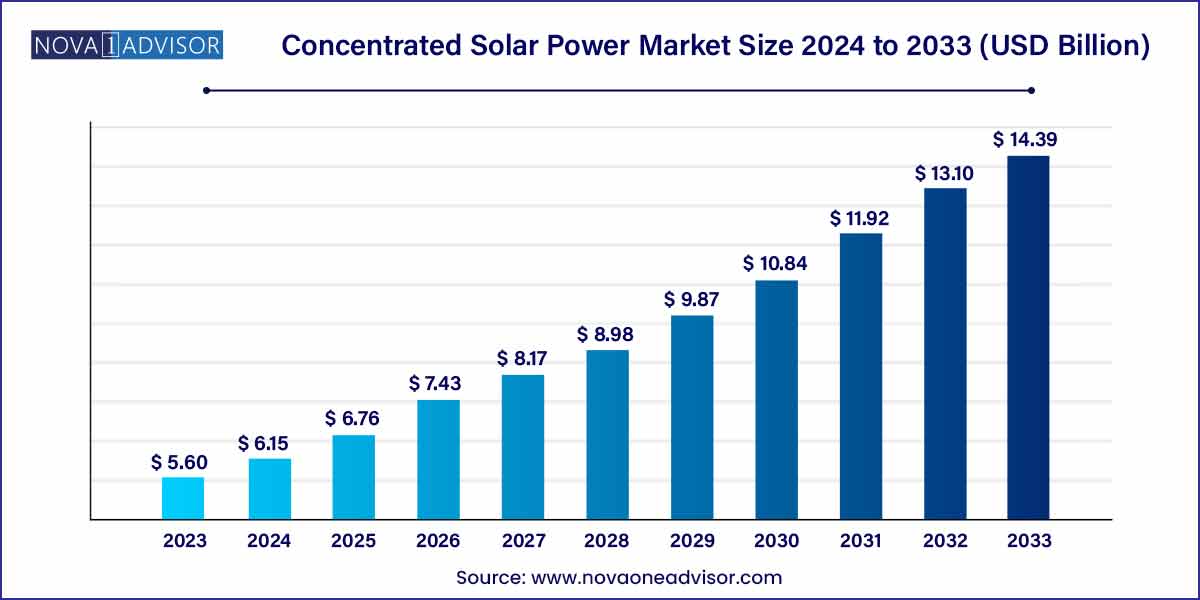

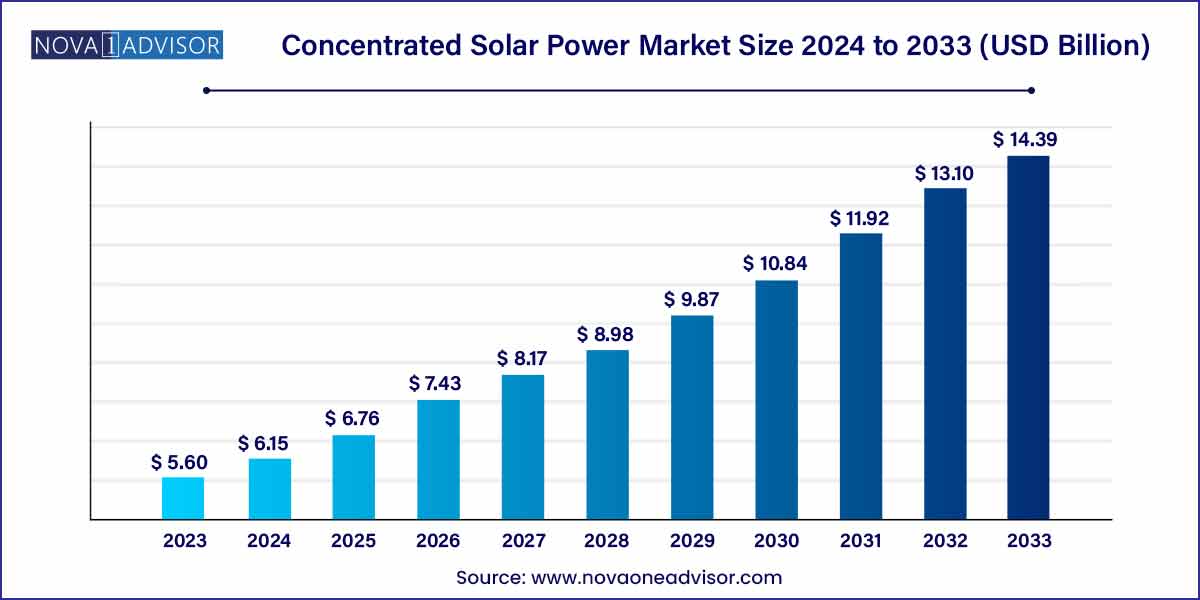

The global concentrated solar power market size was exhibited at USD 5.60 billion in 2023 and is projected to hit around USD 14.39 billion by 2033, growing at a CAGR of 9.9% during the forecast period of 2024 to 2033.

Key Takeaways:

- Asia Pacific dominated the CSP market in 2023 with a revenue share of 45.0%, owing to the upsurge in installations of concentrated solar power plants.

- The utility application segment accounted for the largest revenue share of 63.9% in 2023.

- The parabolic trough technology segment accounted for the largest revenue share of 85.0% in 2023

Concentrated Solar Power Market by Overview

Concentrated Solar Power (CSP) is a renewable energy technology that uses mirrors or lenses to concentrate a large area of sunlight onto a small area to generate heat, which is then used to produce electricity. Unlike photovoltaic (PV) solar panels, which convert sunlight directly into electricity, CSP systems leverage thermal energy to drive conventional steam turbines or engines. This fundamental distinction allows CSP to offer advantages such as thermal energy storage (TES), enabling power generation even when the sun is not shining.

In recent years, the global demand for CSP has surged, driven by the need for sustainable, dispatchable energy solutions that can complement intermittent renewables like wind and PV solar. Countries with high solar irradiance, such as Spain, Morocco, South Africa, the UAE, and Australia, have been at the forefront of CSP deployment. The technology not only aids in reducing carbon footprints but also supports grid stability—an increasingly critical requirement as renewable energy penetration rises.

Moreover, advances in thermal storage, particularly molten salt technologies, have significantly enhanced the reliability and competitiveness of CSP plants. Iconic projects like Noor Ouarzazate Solar Complex in Morocco and Ivanpah Solar Electric Generating System in the United States serve as testament to CSP’s viability at utility scale. As global energy policies increasingly favor carbon neutrality and sustainable development, the CSP market is poised for robust growth across the next decade.

Concentrated Solar Power Market Growth

The growth of the concentrated solar power (CSP) market is underpinned by several key factors driving its expansion. Firstly, the increasing global emphasis on renewable energy as a sustainable alternative to fossil fuels fuels the demand for CSP technology. With growing concerns over climate change and environmental sustainability, CSP offers a clean and abundant source of power generation, attracting investments and driving market growth. Moreover, advancements in CSP technology, including improvements in efficiency, cost reduction, and energy storage capabilities, enhance the competitiveness of CSP plants compared to traditional energy sources. Additionally, supportive government policies, incentives, and renewable energy targets incentivize the deployment of CSP projects, further stimulating market growth. The scalability and flexibility of CSP systems, along with their ability to provide dispatchable power, make them attractive options for addressing energy needs across various sectors and regions. Overall, these factors collectively contribute to the robust growth of the concentrated Solar Power market, positioning it as a vital component of the global renewable energy transition.

Concentrated Solar Power Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 5.60 Billion |

| Market Size by 2033 |

USD 14.39 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.9% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Technology, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Abengoa; BrightSource Energy, Inc.; Siemens Energy; Acciona; Aalborg CSP; TSK Fl; ACWA POWER; INITEC Energía; Torresol Energy; Enel Spa. |

Concentrated Solar Power Market Dynamics

- Technological Advancements:

The CSP market is characterized by ongoing technological advancements aimed at enhancing the efficiency, reliability, and cost-effectiveness of CSP systems. Innovations in receiver design, heat transfer fluids, thermal storage, and solar collector materials have led to significant improvements in the performance of CSP plants. Additionally, advancements in molten salt storage, power block components, and control systems enable CSP plants to operate more efficiently and provide grid stability through dispatchable power generation. Furthermore, research and development efforts focused on next-generation CSP technologies, such as hybrid systems integrating photovoltaic and CSP technologies, further expand the potential applications and market opportunities for CSP.

- Market Expansion and Global Deployment:

The CSP market is experiencing rapid expansion and deployment globally, driven by increasing energy demand, renewable energy targets, and climate change mitigation efforts. While historically concentrated in regions with abundant solar resources, such as the Middle East, North Africa, and the southwestern United States, CSP deployment is now expanding to new markets worldwide. Emerging economies in Asia, Latin America, and Africa are increasingly investing in CSP projects to meet their growing energy needs and reduce dependence on fossil fuels. Moreover, supportive government policies, incentives, and procurement programs, coupled with declining technology costs, are accelerating CSP deployment in both developed and developing markets. Additionally, advancements in CSP technology and project financing models enable innovative deployment approaches, such as hybridization with other renewable energy technologies and integration with industrial processes.

Concentrated Solar Power Market Restraint

- High Initial Capital Costs:

One of the primary restraints hindering the widespread adoption of Concentrated Solar Power is the high initial capital costs associated with CSP projects. CSP plants require significant upfront investment for construction, including the installation of specialized equipment such as solar collectors, thermal storage systems, and power block components. Additionally, the complexity of CSP technology and the need for specialized infrastructure further contribute to the high capital costs. As a result, the upfront investment required for CSP projects can be prohibitively expensive compared to other renewable energy technologies, such as solar photovoltaic (PV) and wind power. High capital costs pose challenges for project developers in securing financing and achieving acceptable returns on investment, particularly in markets with limited access to capital or where electricity prices are low.

- Land and Water Requirements:

Another significant restraint impacting the CSP market is the land and water requirements associated with CSP projects. CSP plants typically require large land areas for solar field deployment, as well as access to water for cleaning solar collectors, cooling systems, and thermal storage operations. In regions with limited available land or water resources, securing suitable sites for CSP development can be challenging and may face opposition from local communities or environmental concerns. Additionally, water scarcity and competition for water resources pose risks to the sustainability of CSP projects, particularly in arid or water-stressed regions where CSP deployment is most favorable. Addressing land and water constraints through site selection optimization, water conservation measures, and alternative cooling technologies will be crucial for mitigating environmental impacts and ensuring the long-term viability of CSP projects.

Concentrated Solar Power Market Opportunity

- Energy Storage Integration:

One of the most promising opportunities in the CSP market lies in the integration of energy storage technologies. CSP plants equipped with thermal energy storage (TES) systems have the unique ability to store excess heat energy generated during the day and utilize it to generate electricity during periods of low solar irradiance or at night. This capability enables CSP plants to provide dispatchable and reliable power, addressing the intermittency challenges associated with solar energy generation. As energy storage technologies continue to advance and costs decline, the integration of TES with CSP plants presents significant opportunities for enhancing grid stability, supporting renewable energy integration, and meeting peak demand. Additionally, the flexibility offered by energy storage enables CSP plants to participate in ancillary services markets, providing additional revenue streams and improving the economic viability of CSP projects.

- Hybridization and Co-Located Projects:

Another promising opportunity in the CSP market is the development of hybrid and co-located projects that integrate CSP with other renewable energy technologies or industrial processes. Hybridization allows CSP plants to complement their solar thermal generation with other renewable energy sources, such as photovoltaic (PV) solar or wind power, to optimize energy output and enhance grid reliability. Co-located projects, such as solar-wind hybrids or CSP-biomass hybrids, leverage synergies between different energy sources to maximize resource utilization, reduce costs, and minimize environmental impact. Furthermore, integrating CSP with industrial processes, such as desalination, mineral processing, or hydrogen production, creates additional revenue streams and enhances the economic viability of CSP projects. Hybridization and co-location offer opportunities for CSP developers to diversify their project portfolios, mitigate risks, and leverage existing infrastructure and resources to maximize project value.

Concentrated Solar Power Market Challenges

- Intermittency and Variability:

One of the primary challenges hindering the widespread adoption of Concentrated Solar Power is the inherent intermittency and variability of solar energy. Unlike traditional power plants fueled by fossil fuels or nuclear energy, CSP plants rely on direct sunlight for electricity generation, making them susceptible to fluctuations in weather conditions, seasonal variations, and diurnal cycles. Cloud cover, dust storms, and atmospheric conditions can significantly reduce solar irradiance levels, leading to fluctuations in power output and affecting the reliability and predictability of CSP plants. Moreover, the mismatch between peak solar generation and peak electricity demand poses challenges for grid integration and system stability.

- Competition from Other Renewable Energy Sources:

Another significant challenge facing the CSP market is the increasing competition from other renewable energy sources, particularly solar photovoltaic (PV) and wind power. Solar PV and wind power technologies have experienced rapid growth and significant cost reductions in recent years, making them increasingly competitive with CSP in terms of capital costs, levelized cost of electricity (LCOE), and project economics. Additionally, solar PV and wind power offer advantages such as scalability, simplicity, and faster deployment compared to CSP, which relies on complex thermal energy conversion processes and specialized equipment. As a result, CSP faces challenges in attracting investment and securing market share, particularly in regions where solar PV and wind power dominate the renewable energy landscape.

Segments Insights:

By Application

Utility applications dominated the Concentrated Solar Power market in 2023.

Utility-scale CSP projects, often in the range of 100 MW and above, have been the primary growth engine for the market. These large projects feed renewable energy directly into national grids, contributing toward government-mandated renewable energy targets. The Noor Ouarzazate project in Morocco, Shams 1 in the UAE, and Crescent Dunes in the U.S. exemplify how CSP serves national grid needs by delivering dispatchable, sustainable energy. Utility projects often benefit from government backing, concessional financing, and long-term power purchase agreements (PPAs), ensuring financial viability over multi-decade timelines.

Meanwhile, the Desalination segment is projected to be the fastest growing application area during the forecast period.

Water scarcity, particularly in arid regions like the Middle East and North Africa, is prompting significant investments in desalination technologies. CSP-powered desalination offers an attractive alternative to energy-intensive reverse osmosis plants. CSP plants can supply the thermal energy needed for processes such as multi-effect distillation without relying heavily on electricity grids. Initiatives like Saudi Arabia’s NEOM project, which emphasizes renewable desalination, signal a broader trend toward integrating CSP into water infrastructure strategies. As freshwater demand soars globally, CSP’s role in sustainable desalination is expected to accelerate significantly.

By Technology

Parabolic Trough technology dominated the CSP market in 2023.

Parabolic trough systems are the most commercially mature and widely deployed CSP technology. Their relatively straightforward design, proven track record, and operational efficiency have made them the preferred choice for utility-scale projects worldwide. Iconic installations like the Solnova Complex in Spain and the SEGS plants in California validate the commercial success of parabolic trough systems. These plants can achieve substantial efficiency levels, especially when integrated with molten salt storage, providing reliable, dispatchable power at utility scale.

Conversely, Power Tower technology is projected to witness the fastest growth over the coming decade.

Power tower (or central receiver) systems are gaining traction due to their superior thermal efficiency and scalability. By concentrating sunlight onto a central receiver atop a tower, these systems can achieve temperatures exceeding 550°C, enabling higher steam cycle efficiencies and more cost-effective thermal storage. Projects like Noor III and Ivanpah have demonstrated the feasibility and potential of this technology. Additionally, ongoing R&D efforts aim to further reduce costs and enhance reliability, setting the stage for widespread deployment of next-generation power towers, particularly in high-irradiance regions.

Regional Analysis

Europe remained the dominant region in the global Concentrated Solar Power market in 2023.

Europe, particularly Spain, has been a pioneer in CSP development, hosting some of the world’s earliest and largest installations. The Andalusia region boasts several CSP complexes like Andasol and Gemasolar, which integrate advanced thermal storage capabilities. The European Union’s commitment to achieving net-zero emissions by 2050, coupled with supportive policy frameworks like feed-in tariffs and renewable auctions, has fostered CSP investment. Moreover, European companies like Abengoa, SENER, and BrightSource Energy have emerged as technological leaders, exporting expertise and solutions worldwide.

The Middle East and Africa (MEA) region is anticipated to experience the fastest growth during the forecast period.

With abundant solar resources and growing energy demand, countries across MEA are aggressively investing in CSP technology. The Noor Energy 1 project in Dubai—a 700 MW hybrid CSP-PV plant—is a case in point, aiming to deliver round-the-clock renewable energy. Similarly, South Africa’s REIPPPP (Renewable Energy Independent Power Producer Procurement Programme) has included CSP projects as part of its clean energy drive. The region’s unique combination of high solar irradiance, supportive policies, and water scarcity challenges (boosting CSP desalination) makes it the most promising frontier for future CSP market expansion.

Some of the prominent players in the concentrated solar power market include:

- Abengoa

- BrightSource Energy, Inc.

- Siemens Energy

- Acciona

- Aalborg CSP

- TSK Fl

- ACWA POWER

- INITEC Energía

- Torresol Energy

- Enel Spa

- Trivelli Energia srl

- Grün leben GmbH

Recent Developments

-

Abengoa S.A. (January 2025): Announced successful completion of the Xina Solar One project in South Africa, featuring parabolic trough technology with five hours of molten salt storage, supplying power to 95,000 homes.

-

ACWA Power (February 2025): Secured financing for the Redstone CSP project in South Africa, a 100 MW power tower facility featuring 12 hours of thermal storage, reinforcing its presence in the African renewable sector.

-

BrightSource Energy (December 2024): Entered a partnership with a Saudi Arabian developer to pilot a CSP-powered industrial heat project aimed at decarbonizing cement manufacturing.

-

GlassPoint Solar (March 2025): Restarted plans to develop solar steam EOR projects in Oman, leveraging CSP technologies to support sustainable oil recovery operations.

-

ENGIE (November 2024): Announced plans to explore hybrid CSP-PV projects in Morocco, focusing on supplying continuous power to local industrial parks under a private PPA model.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global concentrated solar power market.

Application

- Utility

- EOR

- Desalination

- Others

Technology

- Parabolic Trough

- Linear Fresnel

- Dish

- Power Tower

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)