Consumer IoT Market Size and Research

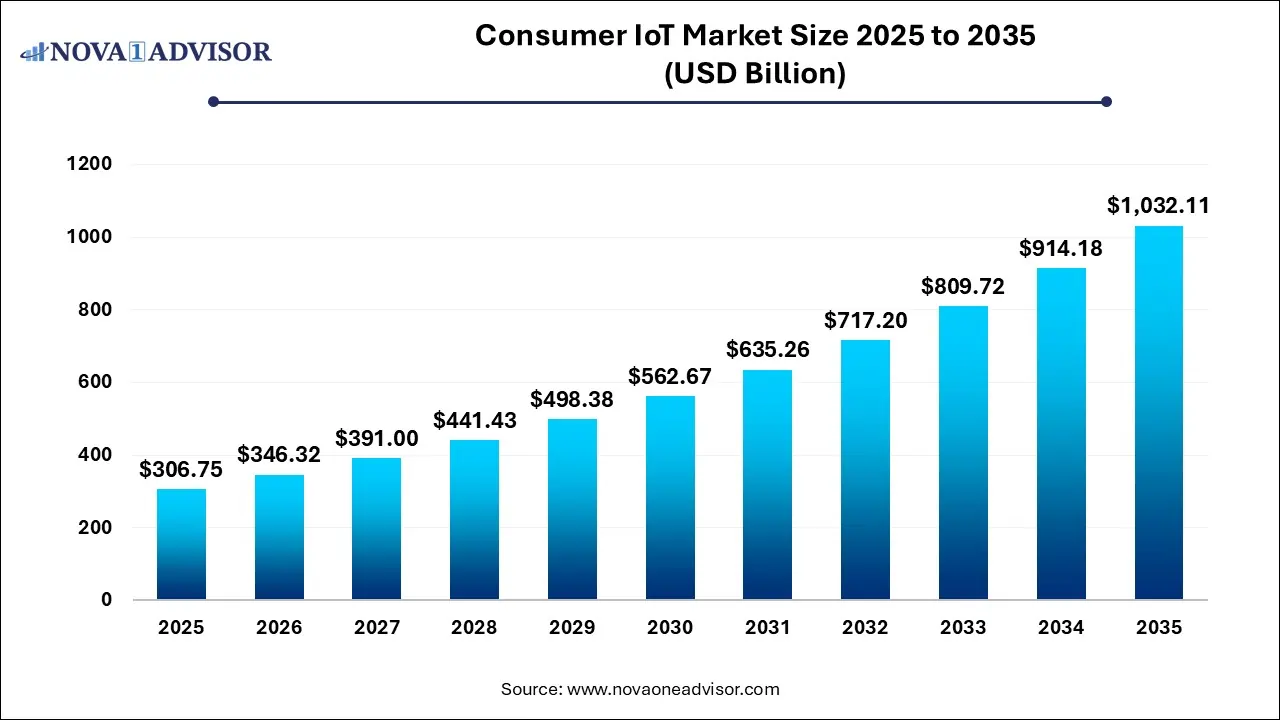

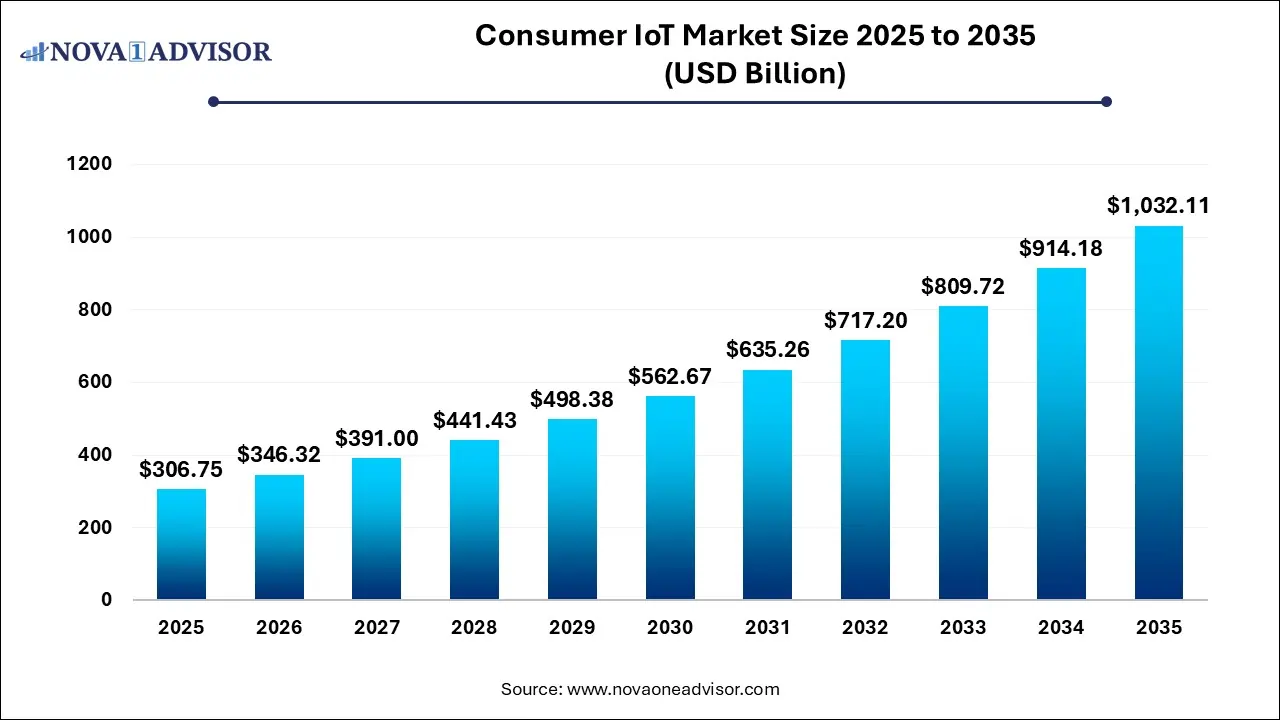

The consumer IoT market size was exhibited at USD 306.75 billion in 2025 and is projected to hit around USD 1,032.11 billion by 2035, growing at a CAGR of 12.9% during the forecast period 2026 to 2035.

Consumer IoT Market Key Takeaways:

- The hardware component segment accounted for the maximum revenue share of more than 38.85% in 2025.

- The services component segment is expected to record the fastest growth rate from 2026 to 2035.

- The wireless connectivity technology segment is expected to record the fastest growth rate of more than 13.60% from 2026 to 2035.

- The consumer electronics segment accounted for the largest share of more than 39.0% of the overall revenue in 2025

- The wearable segment is estimated to register the fastest CAGR from 2026 to 2035.

- North America accounted for the largest share of more than 24.0% of the overall revenue in 2025.

Market Overview

The Consumer Internet of Things (IoT) Market represents one of the most transformative trends in modern technology. It refers to the growing ecosystem of interconnected smart devices used by individual consumers for personal, home, healthcare, and transportation purposes. These devices use embedded sensors, processors, and connectivity modules to collect and exchange data with minimal human intervention, enhancing convenience, efficiency, and lifestyle quality.

From smartwatches that monitor health to voice-controlled assistants that manage daily schedules and lighting systems that adapt to user preferences, the consumer IoT landscape is becoming increasingly ubiquitous. The market is being fueled by the convergence of multiple technologies wireless communication, low-power microelectronics, edge computing, and artificial intelligence. Additionally, falling hardware costs and widespread smartphone penetration have democratized access to these technologies.

Consumer IoT devices now span a wide array of applications, including wearables, smart home systems, fitness trackers, connected cars, and remote health monitoring tools. As digital lifestyles become the norm, consumers demand greater interoperability, personalization, and security in their connected environments. Global investment in 5G and the growth of smart city infrastructure further strengthen the foundation for robust Consumer IoT expansion.

Major Trends in the Market

-

Proliferation of Smart Wearables: Smartwatches, fitness bands, and AI-powered hearing aids continue to dominate personal IoT applications.

-

Edge AI Integration: AI models are increasingly deployed on-device, enabling faster responses and improved privacy for IoT applications.

-

Expansion of Smart Home Ecosystems: Interoperable devices like smart thermostats, lighting, and security systems are growing in household adoption.

-

Healthcare IoT Momentum: Remote patient monitoring and fitness tracking are driving consumer healthcare IoT demand post-pandemic.

-

5G and Wi-Fi 6 Enablement: High-speed wireless connectivity is unlocking real-time consumer applications such as streaming and automotive safety.

-

Sustainability and Energy Efficiency: Eco-conscious designs and power-efficient hardware are becoming a major product differentiation strategy.

-

Increased Focus on Data Security: Growing concerns over consumer privacy have led to advanced encryption, multi-factor authentication, and on-device processing.

Report Scope of Consumer IoT Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 346.32 Billion |

| Market Size by 2035 |

USD 1,032.11 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 12.8% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Component, Connectivity Technology, Application, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Alphabet Inc.; Amazon.com, Inc.; Apple Inc.; AT&T, Cisco Systems, Inc.; Honeywell International Inc.; IBM Corp.; Intel Corp.; LG Corp.; Microsoft; Samsung; Schneider Electric; Sony Corp.; Texas Instruments; TE Connectivity |

Market Driver: Accelerated Adoption of Smart Home Devices

A powerful driver of the Consumer IoT market is the accelerated adoption of smart home technologies. As consumers seek convenience, energy efficiency, and home security, demand for IoT-enabled thermostats, smart lighting, video doorbells, and home assistants like Amazon Alexa and Google Nest has soared. The COVID-19 pandemic also shifted consumer preferences toward contactless, voice-activated, and remotely controllable home appliances.

With prices becoming more accessible and ecosystems like Apple HomeKit, Samsung SmartThings, and Zigbee improving device compatibility, mass adoption is underway. For example, Philips Hue lights and Ring doorbells integrate seamlessly with voice assistants, allowing users to control their environments using simple voice commands or mobile apps. Such frictionless experiences are at the heart of the Consumer IoT boom.

Market Restraint: Growing Privacy and Cybersecurity Concerns

A significant restraint on market growth is increasing concerns over consumer data privacy and cybersecurity vulnerabilities. Many IoT devices collect sensitive user data ranging from location and health statistics to behavior and voice recordings. Weak security protocols or outdated firmware can make these devices prime targets for cyberattacks, as demonstrated by major breaches involving smart baby monitors, home security cameras, and connected door locks.

Additionally, inconsistent regulatory frameworks across regions complicate compliance for manufacturers and reduce consumer trust. While initiatives like GDPR and the U.S. IoT Cybersecurity Improvement Act are steps forward, fragmented standards leave many gray areas. Without rigorous security mechanisms such as encrypted communications, secure boot processes, and continuous updates, user adoption could slow due to fear of misuse or surveillance.

Market Opportunity: Expansion of Consumer Healthcare IoT

An immense opportunity lies in the expansion of Consumer IoT within healthcare and wellness sectors. With populations aging and chronic diseases on the rise, remote monitoring devices that track vital signs, sleep, glucose levels, or activity are gaining mainstream traction. The pandemic catalyzed the trend, pushing wearable oximeters, smart thermometers, and blood pressure monitors into regular use.

Companies like Fitbit, Apple, and Withings are investing in FDA-cleared devices that double as clinical-grade monitoring tools. Future growth is anticipated in smart pill dispensers, wearable ECG monitors, and even AI-based fall detectors for elder care. As insurers and healthcare providers begin reimbursing for IoT-based remote monitoring, the healthcare vertical could become a core driver for Consumer IoT growth.

Consumer IoT Market By Component Insights

Hardware dominates the Consumer IoT market, as it forms the physical backbone of IoT ecosystems. Processors, sensors, memory units, and camera modules are embedded in smartwatches, appliances, cars, and medical devices. Among sensors, accelerometers and light sensors are widely deployed in wearables and smartphones to detect motion and ambient conditions. Inertial Measurement Units (IMUs) are critical in VR/AR systems and fitness trackers, while pressure and humidity sensors are key in connected home systems like HVAC.

Software is the fastest-growing component, especially data management, network monitoring, and security software. With the number of connected devices exploding, managing data flow, automating firmware updates, and ensuring secure interoperability are critical tasks. Remote monitoring software for appliances and health devices is also gaining traction, allowing users to control and analyze device behavior via mobile dashboards.

Consumer IoT Market By Connectivity Technology Insights

Wireless connectivity is the leading segment, with Wi-Fi, Bluetooth, Zigbee, and cellular networks powering the majority of consumer IoT applications. Bluetooth is integral to wearable devices like earbuds and fitness trackers. Wi-Fi is dominant in home appliances, surveillance, and streaming devices. Zigbee and Z-Wave are popular in smart lighting and HVAC systems due to their mesh networking advantages.

Wireless technologies like BLE (Bluetooth Low Energy) and NFC are the fastest-growing, particularly in fitness bands, contactless payment devices, and health monitors. With 5G and Wi-Fi 6 rollouts accelerating, new real-time use cases in AR/VR and connected vehicles are emerging, offering ultra-low latency and high-speed data transmission that significantly enhance user experiences.

Consumer IoT Market By Application Insights

Consumer electronics is the largest application area, covering devices like TVs, ovens, washing machines, lighting systems, and audio equipment. Companies like LG, Samsung, and Sony are launching AI-enhanced appliances that communicate with each other and can be controlled via voice or smartphone. Smart fridges now track inventory, while ovens are equipped with AI-based cooking assistants.

Wearables and healthcare are the fastest-growing applications, driven by increasing health awareness, remote diagnostics, and fitness tracking. Smartwatches like the Apple Watch and Samsung Galaxy Watch now include ECG monitoring, blood oxygen sensors, and sleep analysis. Body-worn cameras and smart glasses are emerging in personal safety and entertainment, while IoT-powered glucose meters and pulse oximeters are becoming part of preventive health regimens.

Consumer IoT Market By Regional Insights

North America leads the global Consumer IoT market, owing to high consumer purchasing power, early technology adoption, and the presence of leading tech companies such as Google, Apple, Amazon, and Fitbit. The region also benefits from robust home internet infrastructure, a thriving startup ecosystem, and strong investor interest in IoT innovations.

U.S. households increasingly adopt smart speakers, security cameras, and thermostats. Furthermore, consumer-focused 5G initiatives and incentives for telehealth solutions are accelerating healthcare IoT growth. Regulatory support for connected device safety and a digitally aware population ensure sustained market dominance.

Asia Pacific is the fastest-growing Consumer IoT market, driven by rapid urbanization, growing smartphone penetration, and expanding middle-class consumption in countries like China, India, and Southeast Asia. China’s smart home adoption is booming, with local players like Xiaomi and Huawei offering feature-rich devices at competitive prices. India’s surge in fitness awareness has also led to a rise in smart band sales.

Smart city projects in Singapore, Tokyo, and Seoul are fostering infrastructure to support connected homes and vehicles. Government-backed initiatives promoting digital transformation and local manufacturing of electronics are further amplifying growth prospects across the region.

Some of the prominent players in the consumer IoT market include:

Recent Developments

-

March 2025: Apple announced new AI features in the Apple Watch Series 10, enabling advanced blood glucose monitoring and fall detection using on-device neural processing.

-

February 2025: Samsung Electronics launched its SmartThings Hub 3.0 with support for Matter, a universal IoT standard designed for cross-platform device compatibility.

-

January 2025: Amazon introduced a major Alexa update enabling emotion detection through voice cues, enhancing user interactions in Echo smart speakers.

-

December 2024: Xiaomi unveiled a new line of IoT-enabled smart kitchen appliances for the Indian and Southeast Asian markets under its “Mi Smart Life” initiative.

-

November 2024: Fitbit (Google) received FDA clearance for a new wearable ECG monitor integrated with Fitbit Premium, enhancing its positioning in healthcare IoT.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the consumer IoT market

By Component

-

-

- Temperature

- Pressure

- ECG

- Accelerometers

- Inertial Measurement Unit

- Humidity

- Light

- Camera Modules

- Others (Magnetic, Motion & Position, etc.)

-

- Memory Devices

- Logic Devices

-

- Data Management

- Security

- Real-time Streaming Management

- Remote Monitoring

- Network Management

- Others (Application Management, Device Management)

-

-

- Consulting Services

- Implementation Services

- Support & Maintenance

By Connectivity Technology

-

- Bluetooth

- Zigbee

- Wi-Fi

- NFC

- ANT+

- Others (BLE, WLAN, GNSS)

By Application

-

- Lighting

- Washing Machine

- Dishwasher

- TV

- Others (Dryer, Oven, Cooktop, Kettle, etc.)

-

- Blood Pressure Monitor

- Fitness & Heartrate Monitor

- Pulse Oximeter

- Blood Glucose Meter

- Others (Programmable Syringe Pump, Fall Detector, etc.)

-

- Smart Watch

- Smart Glasses

- Body-worn Cameras

- Fitness Tracker

- Others (AI Hearing Aids, VR Headsets, etc.)

-

- Connected Cars

- In-car Infotainment

- Traffic Management

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)