Continuous Positive Airway Pressure Devices Market Size and Growth 2026 to 2035

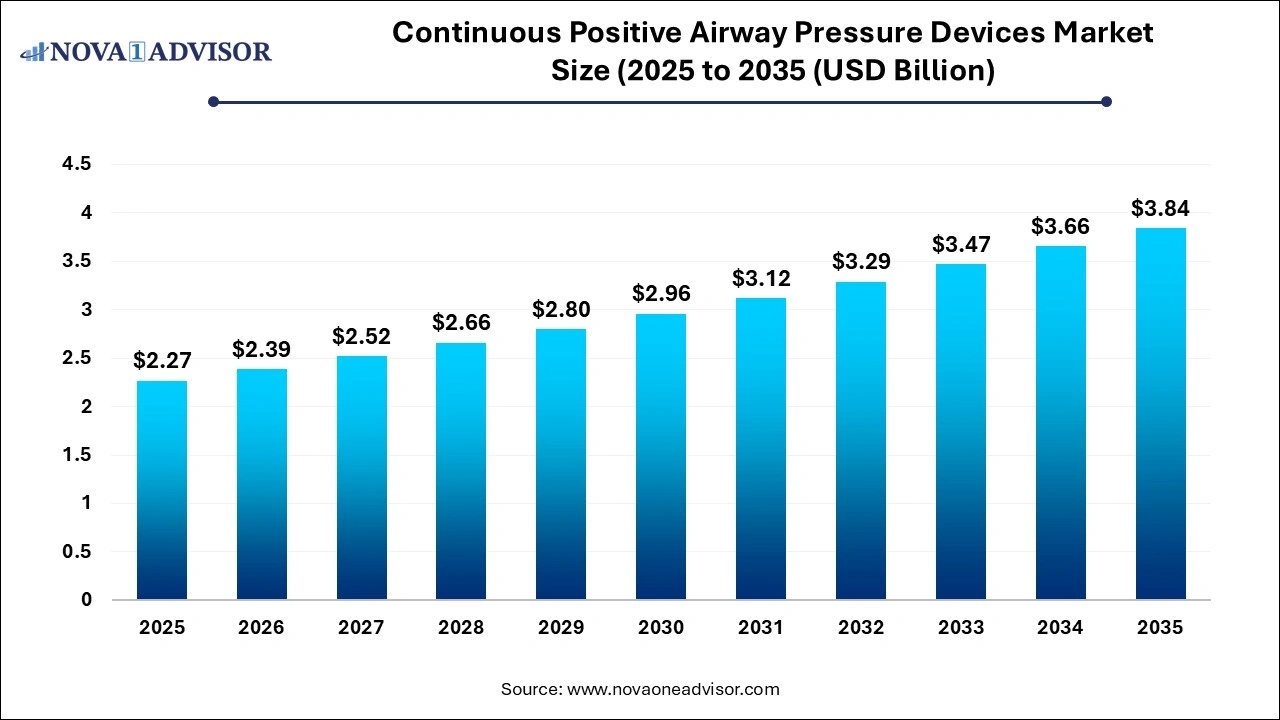

The continuous positive airway pressure devices market size was exhibited at USD 2.27 billion in 2025 and is projected to hit around USD 3.84 billion by 2035, growing at a CAGR of 5.4% during the forecast period 2026 to 2035. The continuous positive airway pressure devices market expansion is driven by globally rising incidences of sleep apnea and respiratory disorders, continuous advancements in CPAP technologies and increased healthcare expenditure.

Continuous Positive Airway Pressure (CPAP) Devices Market Key Takeaways:

- The connected CPAP devices segment held the largest revenue share of over 68.00% in 2025 and is anticipated to grow at the fastest growth rate over the forecast year.

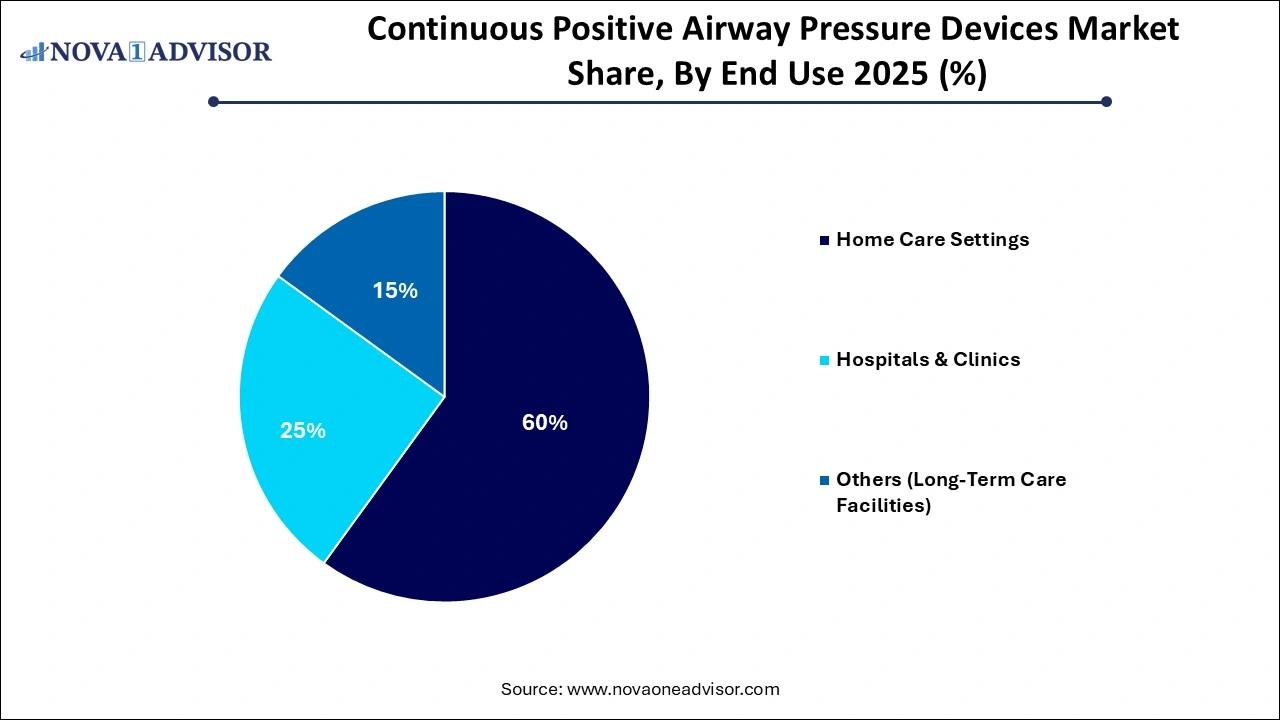

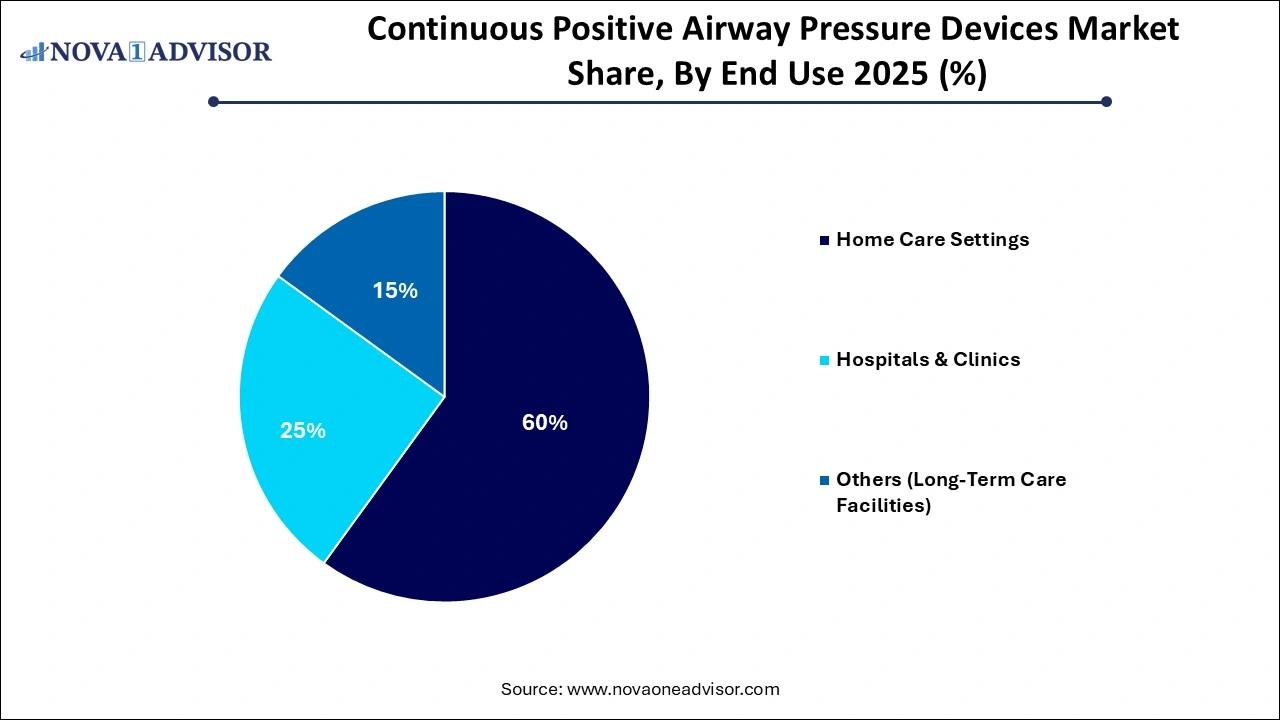

- The home care settings segment held the largest revenue share of over 60.00% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period.

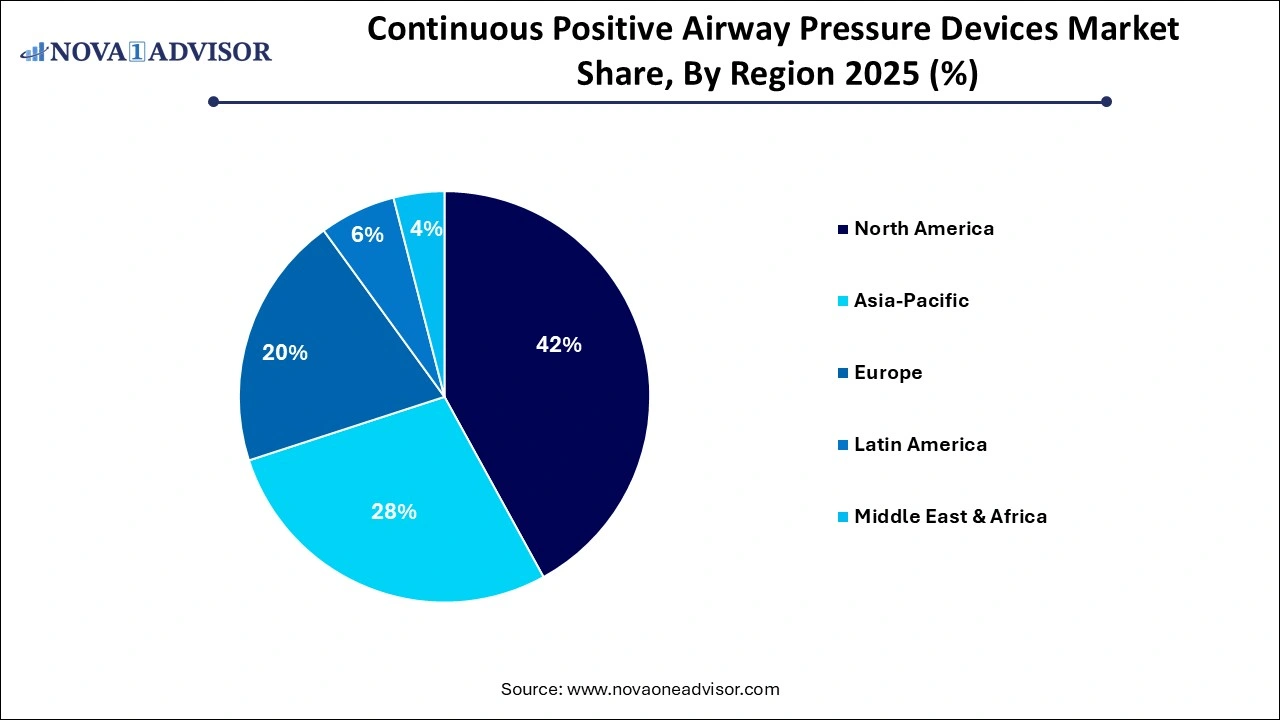

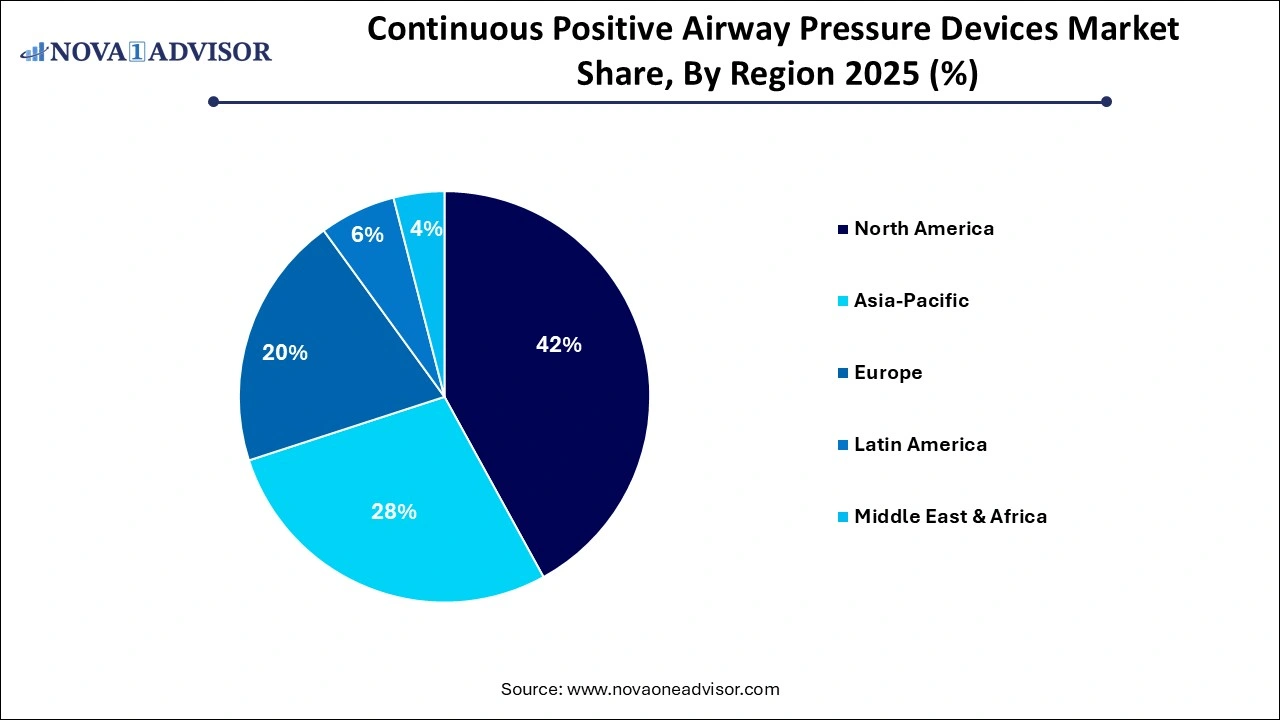

- North America held the largest revenue share of 42% in 2025.

Continuous Positive Airway Pressure Devices Market Overview

The continuous positive airway Pressure (CPAP) devices market has emerged as a cornerstone of the respiratory care industry, particularly in the management of sleep-related breathing disorders such as obstructive sleep apnea (OSA). CPAP devices function by delivering a steady stream of pressurized air through a mask, preventing airway collapse during sleep and thereby maintaining proper airflow. With increasing awareness, improved diagnostics, and rising disease prevalence, CPAP therapy has become the gold standard for non-invasive treatment of OSA.

Globally, millions remain undiagnosed or untreated for sleep apnea—a condition that significantly raises the risk of cardiovascular disease, stroke, hypertension, and type 2 diabetes. In the U.S. alone, the American Sleep Apnea Association estimates that over 22 million Americans suffer from sleep apnea, with 80% of moderate to severe cases remaining undiagnosed. As diagnostic tools improve and awareness grows, the demand for CPAP devices is experiencing consistent growth across home and clinical care settings.

The COVID-19 pandemic also served as a pivotal moment for the CPAP devices market. During peak periods, several CPAP devices were repurposed or modified as non-invasive ventilatory support tools in overwhelmed hospital ICUs, demonstrating their utility beyond sleep medicine. Furthermore, the pandemic accelerated the adoption of remote health monitoring and telemedicine—facilitating the expansion of connected CPAP devices capable of wirelessly transmitting sleep data to providers for evaluation and therapy adjustment.

Major players in the market are increasingly focused on developing compact, travel-friendly, and smart CPAP machines with Bluetooth and Wi-Fi connectivity. These innovations not only enhance patient adherence but also support long-term health monitoring and engagement. With the convergence of respiratory health, digital health technologies, and growing health consciousness, the CPAP market is poised for substantial expansion.

Major Trends in the Continuous Positive Airway Pressure Devices Market

-

Increased Adoption of Connected CPAP Devices: Integration of wireless connectivity, mobile apps, and cloud platforms is enhancing therapy monitoring and patient compliance.

-

Miniaturization and Portability: Development of lightweight, travel-friendly CPAP devices is helping users maintain therapy adherence during travel.

-

Home-Based Sleep Diagnostics: Rise in home sleep testing kits is increasing CPAP therapy initiation outside traditional clinical settings.

-

Hybrid Connectivity Solutions: Devices offering both Bluetooth and Wi-Fi/cellular connections provide flexible options for patients and providers.

-

Artificial Intelligence Integration: AI-enabled CPAP devices are helping automate pressure adjustments and detect anomalies in sleep patterns.

-

Reimbursement Policy Expansion: Favorable insurance support in several developed economies is making therapy more accessible.

-

Eco-Conscious Designs and Reusability: Manufacturers are designing more sustainable and recyclable CPAP components to reduce environmental impact.

-

Collaborative Digital Health Platforms: Partnerships between device makers and health IT companies are fostering end-to-end sleep disorder management ecosystems.

Artificial intelligence algorithms are being applied for analyzing patient data such as breathing patterns and usage statistics to provide tailored CPAP therapy settings based on individual needs, further enhancing efficacy and comfort of treatment. Remote monitoring of patients through AI-powered CPAP devices is enabling remote tracking of therapy progress and real-time data sharing to healthcare providers reducing the need for in-person visits. Furthermore, AI can be applied for predicting patient needs and detection potential challenges in treatment which can potentially improve patient outcomes by allowing proactive adjustments in therapy settings.

Report Scope of Continuous Positive Airway Pressure (CPAP) Devices Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 2.39 Billion |

| Market Size by 2035 |

USD 3.84 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 5.4% |

| Base Year |

2025 |

| Forecast Period |

2026 to 2035 |

| Segments Covered |

By Connectivity, By End use |

| Market Analysis (Terms Used) |

Value (USD Million/Billion) or (Volume/Units) |

| Regional Covered |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

ResMed; Koninklijke Philips N.V.; Fisher & Paykel Healthcare Limited; Medical Depot, Inc. dba Drive DeVilbiss Healthcare; React Health (3B Medical); Transcend Inc. (Somnetics International, Inc.); Wellell Inc. (Apex Medical); BMC |

Continuous Positive Airway Pressure Devices Market Dynamics

Driver

Rising Prevalence of Obstructive Sleep Apnea and Related Comorbidities

One of the most significant drivers of the CPAP devices market is the escalating incidence of obstructive sleep apnea (OSA) across all age groups, particularly among the aging population and individuals with obesity. As per the National Sleep Foundation, OSA is now recognized as a public health issue that extends beyond sleep quality to impact cardiovascular and metabolic health. Patients with untreated sleep apnea face a higher risk of heart attacks, strokes, atrial fibrillation, and poor glycemic control in diabetes.

The increasing burden of lifestyle-induced disorders, coupled with more accurate and accessible diagnostic tools like polysomnography and home sleep testing kits, is pushing more individuals toward treatment. CPAP therapy is not only clinically validated as an effective first-line intervention but also cost-effective over time. Its ability to improve daytime alertness, reduce accident risk, and enhance quality of life is further prompting adoption. Health systems, insurers, and clinicians are now aligning to recommend early diagnosis and CPAP adherence, contributing to sustained demand.

Restraint

Therapy Non-Adherence and Patient Discomfort

Despite its clinical efficacy, CPAP therapy is often plagued by poor patient adherence, which remains a significant restraint to market expansion. Discomfort caused by the mask, claustrophobia, dry nose or mouth, noise from the device, and the need for consistent nightly use are common barriers to sustained use. Studies suggest that up to 30–50% of patients prescribed CPAP therapy fail to adhere to it beyond the first year.

Non-compliance diminishes the therapy’s effectiveness and can lead to costly readmissions, worsening health outcomes, and increased healthcare expenditure. While manufacturers are introducing noise-reduction technologies, humidification features, and better mask designs, the issue of long-term adherence remains a clinical and commercial challenge. Addressing behavioral and psychological aspects of therapy will require a more holistic approach involving patient education, counseling, and customized device options.

Opportunity

Surge in Demand for Home-Based Sleep Care and Remote Monitoring

The growing preference for home-based healthcare represents a substantial opportunity for CPAP device manufacturers and service providers. As telemedicine gains ground and healthcare systems shift toward decentralized care, patients are increasingly being diagnosed and treated for sleep disorders from the comfort of their homes. CPAP devices with remote monitoring capabilities—integrated with apps and cloud-based platforms—allow physicians to track patient usage, compliance, and therapeutic efficacy in real time.

This model not only improves access to therapy for patients in rural or underserved areas but also reduces the burden on hospitals and sleep centers. Companies offering connected CPAP systems that integrate with digital health platforms can build recurring revenue models through data services, subscription maintenance, and personalized therapy plans. The opportunity to offer CPAP-as-a-Service is gaining momentum in both public and private healthcare systems, aligning with trends toward value-based care.

Continuous Positive Airway Pressure (CPAP) Devices Market

By Connectivity Insights

Connected CPAP devices dominated the market and are projected to maintain leadership due to the increasing importance of data-driven respiratory care. Within this category, Wi-Fi and cellular-connected devices are widely adopted by hospitals and sleep centers due to their seamless cloud integration, allowing for real-time data transmission and proactive interventions. Bluetooth-connected CPAPs are particularly popular among home users, as they provide quick pairing with mobile apps for instant feedback. Hybrid-connected CPAPs, combining multiple connectivity options, are gaining traction for their flexibility across different care settings and travel scenarios.

Non-connected CPAP devices are the fastest-growing segment in certain emerging markets where affordability and internet infrastructure pose challenges. These devices offer a simplified, cost-effective alternative for patients who require CPAP therapy but do not need or cannot access advanced digital features. Many hospitals in developing countries still rely on non-connected CPAPs for inpatient respiratory support. As manufacturers develop budget-friendly, durable, and battery-operated models for such contexts, non-connected devices will see consistent uptake, particularly in resource-constrained environments.

By End Use Insights

The home care settings segment held the largest revenue share of over 60% in 2025 and is anticipated to grow at the fastest CAGR over the forecast period. The comfort and privacy of home treatment, combined with technological advances that enable self-monitoring, have made CPAP therapy more accessible and user-friendly. Patients with chronic sleep apnea often prefer to manage their condition at home, especially when supported by digital applications and regular teleconsultations. The convenience and reduced costs of avoiding repeated clinical visits are further encouraging adoption.

Hospitals and clinics represent the fastest-growing end-use segment, particularly in cases involving acute respiratory distress or sleep apnea diagnosis. CPAP therapy is often initiated in hospitals for patients undergoing post-operative recovery or non-invasive respiratory support. Moreover, in the context of infectious diseases like COVID-19, hospitals used CPAP machines as temporary ventilatory support devices. This dual application is expanding their utility in hospital respiratory care departments. Specialty sleep clinics also play a crucial role in prescribing and fine-tuning therapy, ensuring patients are correctly diagnosed and fitted for CPAP use.

Continuous Positive Airway Pressure (CPAP) Devices Market By Regional Insights

North America leads the global CPAP devices market, accounting for the highest revenue share due to its advanced healthcare infrastructure, high awareness levels, and favorable reimbursement landscape. The United States, in particular, has a well-established network of sleep centers, diagnostic laboratories, and insurance systems that cover CPAP therapy for diagnosed sleep apnea. Leading manufacturers such as ResMed, Philips Respironics, and Fisher & Paykel Healthcare have their operational hubs and R&D centers located in North America, reinforcing product availability and innovation.

Further, the prevalence of obesity, a major risk factor for sleep apnea, is higher in the U.S. compared to many other nations, contributing to higher diagnosis rates. The strong presence of digital health platforms and early adoption of connected CPAP devices also position North America as a technological leader. Numerous companies have introduced AI-powered sleep analytics and cloud-enabled monitoring solutions that have revolutionized how therapy is delivered and tracked.

U.S. is a major contributor to the market in North America. Increased awareness and diagnosis rates of sleep apnea disorders, advanced healthcare infrastructure, continuous technological advancements and innovations, favourable regulatory environment, shift towards home-based care, rise of telehealth platforms and favourable reimbursement policies are the factors driving the market growth.

- For instance, in August 2024, Inspire Medical Systems secured the Food and Drug Administration’s approval for its innovative Inspire V obstructive sleep apnea (OSA) neurostimulator therapy.

Asia Pacific is the fastest-growing region in the CPAP devices market, driven by rising urbanization, increasing healthcare expenditure, and growing public awareness about sleep-related disorders. Countries like China, India, Japan, and South Korea are witnessing significant demand for respiratory care devices as their populations age and lifestyles become increasingly sedentary. Government initiatives aimed at expanding healthcare access and insurance penetration are playing a crucial role in the market’s expansion.

Moreover, the region has seen a boom in private healthcare infrastructure, including the establishment of sleep labs and specialized respiratory clinics in major cities. Local manufacturers are emerging with cost-effective CPAP solutions tailored to the specific needs and purchasing capacities of the population. Partnerships between global giants and regional distributors are also increasing product accessibility, particularly in rural and semi-urban areas. The adoption of portable and non-connected CPAP devices is growing in Asia Pacific due to economic and infrastructural limitations, but connected devices are gradually making inroads in urban centers.

China is anticipated to show the fastest growth in the Asia Pacific market. A huge population suffering from obstructive sleep apnea (OSA) driven by factors such as lifestyle changes, rapid urbanization, increased obesity rates, shifts in dietary habits and aging population creating the demand for CPAP devices. Furthermore, increased awareness among individuals, continuous advancements like development of portable and smart CPAP machines, government initiatives and growing consumer preference for home-based non-invasive ventilation therapy with remote monitoring capabilities are boosting the market growth.

What is Fuelling the Growth of CPAP Devices Market in India?

India is considered as a rapidly expanding regional market in the Asia Pacific. The market growth can be linked to factors such as increasing prevalence of sleep apnea and respiratory disorders, expansion of diagnosis efforts such as home sleep apnea testing (HSAT), and availability of CPAP devices with IoT integration and cloud-based connectivity improving patient comfort. Organizations like the INdian initiative on Obstructive Sleep Apnea (INOSA) develops guidelines for the diagnosis and treatment of Obstructive sleep apnoea (OSA) and obstructive sleep apnoea syndrome (OSAS). Government initiatives like the Digital Health ID (DHID) which is a part of the Ayushman Bharat Digital Mission is paving the way for advanced telehealth and telemedicine platforms which will potentially improve access to sleep apnea care.

For instance, in January 2025, ResMed introduced its next-generation CPAP device, AirSense 11 in India for individuals with Obstructiev Sleep Apnea (OSA). The new device provides access to myAir (ResMed’s patient engagement app) and AirView (ResMed’s remote monitoring platform for clinicians) leading to enhanced patient adherence

Some of the prominent players in the continuous positive airway pressure devices market include:

Continuous Positive Airway Pressure (CPAP) Devices Market Recent Developments

- In May 2025, the Ministry of Health and Social Protection of the Population of the Republic of Tajikistan received over 227 Continuous Positive Airway Pressure (CPAP) machines and 300 oxygen concentrators as well as essential accessories and consumables from UNICEF Tajikistan for improving neonatal care across 73 healthcare facilities in both urban and rural areas of Tajikistan.

- In September 2024, ResMed, a globally leading healthcare technology company, launched AirTouch N30i which is a fabric-wrapped frame featuring a soft, breathable, and moisture-wicking design for optimal comfort in a tube-up design. The new product is first-of-a-kind CPAP (continuous positive airway pressure) mask innovation by ResMed.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2026 to 2035. For this study, Nova one advisor, Inc. has segmented the continuous positive airway pressure devices market

By Connectivity

- Connected

- Bluetooth-Connected CPAP

- Wi-Fi & Cellular Connected CPAP

- Hybrid-Connected

- Non-Connected

By End Use

- Home Care Settings

- Hospitals & Clinics

- Others (Long-Term Care Facilities, etc.)

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)