Corneal Topographers Market Size and Trends

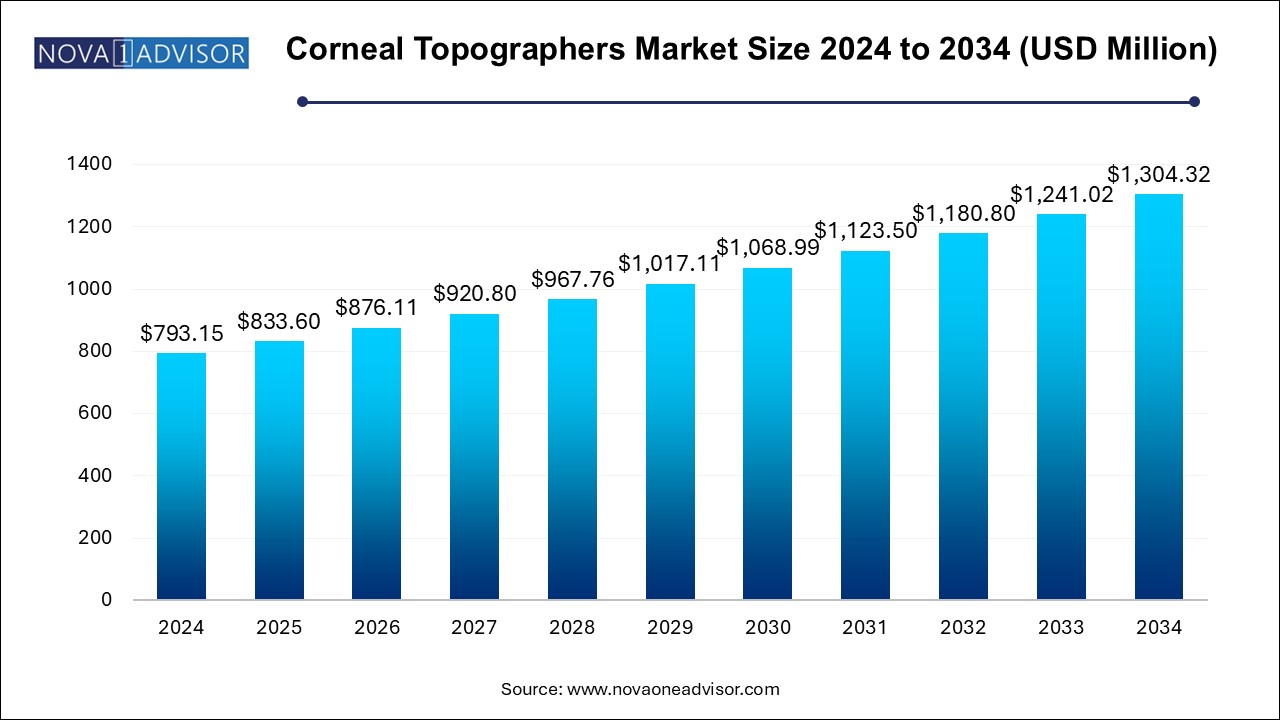

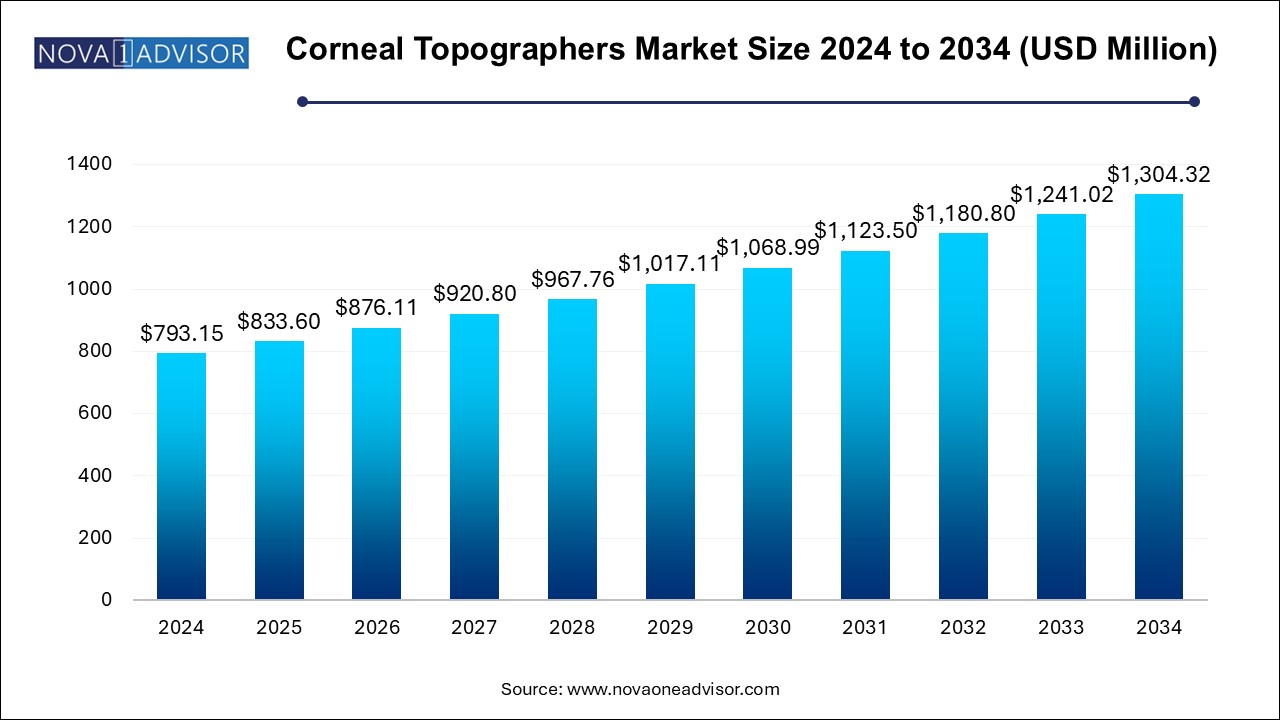

The corneal topographers market size was exhibited at USD 793.15 million in 2024 and is projected to hit around USD 1,304.32 million by 2034, growing at a CAGR of 5.1% during the forecast period 2024 to 2034.

Corneal Topographers Market By Key Takeaways:

- The placido disc system segment dominated the market, accounting for over 42.5% of the revenue share in 2024

- The scheimpflug systems segment is expected to exhibit the fastest CAGR during the forecast period.

- The refractive surgery evaluation segment dominated with a market share of around 33.0% in 2024.

- The cataract surgery evaluation segment is expected to grow at a lucrative CAGR during the forecast period.

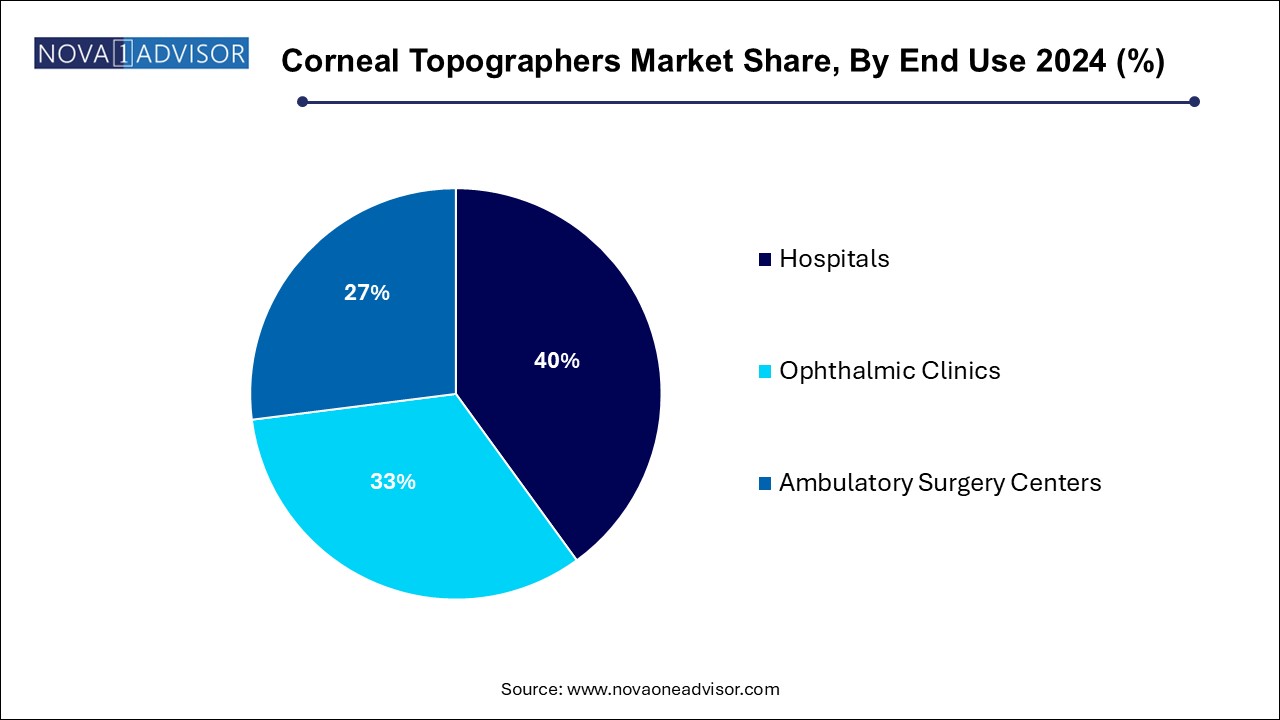

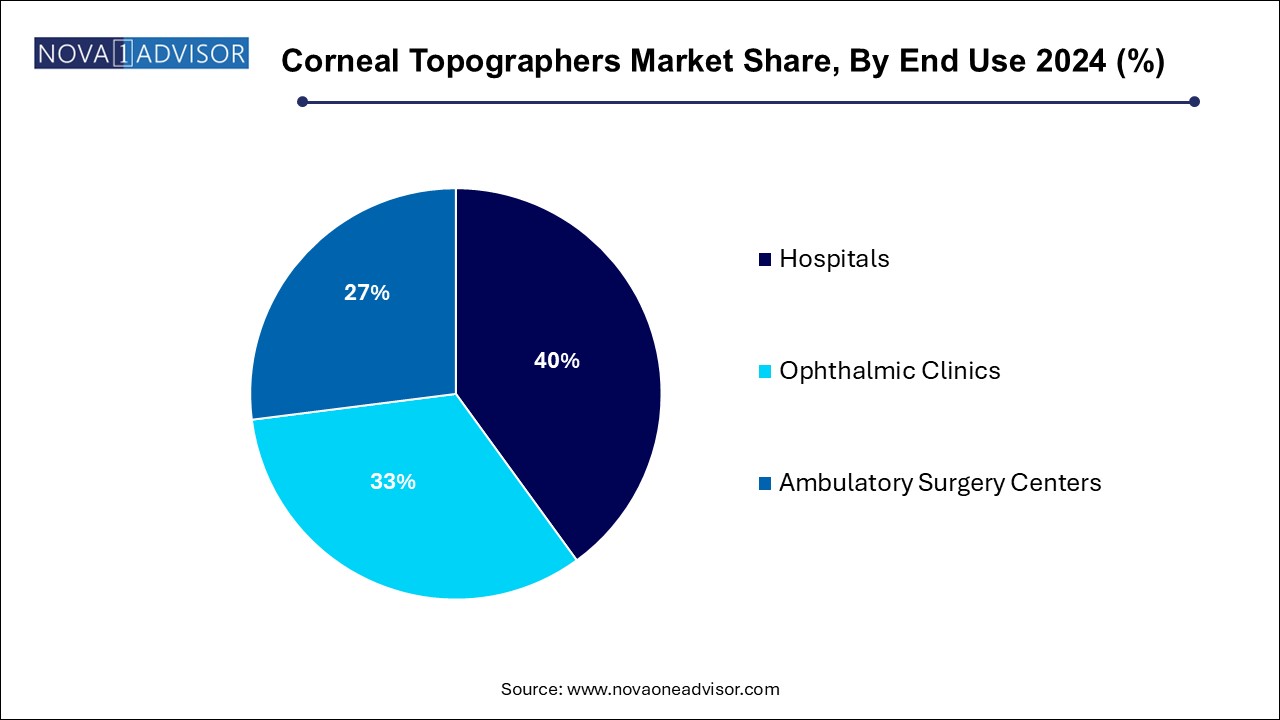

- The hospitals segment held the largest revenue share in 2024, accounting for more than 40.0% of the market share.

- The ambulatory surgical centers (ASC) segment is expected to be the fastest-growing segment during the forecast period.

- North America corneal topographers market dominated and accounted for 40.4% of revenue share in 2024.

Market Overview

The Corneal Topographers Market serves as a critical segment within the ophthalmology and optometry industries, offering indispensable tools for mapping the surface curvature of the cornea. Corneal topography is vital for diagnosing and managing various ocular conditions such as keratoconus, astigmatism, and irregular corneal shapes, as well as for pre-operative and post-operative evaluations for cataract and refractive surgeries.

Corneal topographers utilize advanced imaging techniques to provide detailed, three-dimensional maps of the cornea, allowing clinicians to detect abnormalities that traditional methods may miss. They have become essential in guiding surgical planning, monitoring disease progression, customizing contact lens fittings, and enhancing overall patient outcomes. Given the global rise in refractive errors, cataract surgeries, and corneal disorders, demand for sophisticated, accurate, and easy-to-use corneal topography systems is surging.

The integration of newer technologies such as Scheimpflug imaging, scanning slit techniques, and AI-based diagnostic algorithms into topographers has revolutionized their capabilities, enabling both structural and biomechanical assessments. As ophthalmologists increasingly shift towards personalized medicine and precision diagnostics, corneal topographers are expected to remain at the forefront of ophthalmic innovation.

Major Trends in the Market

-

Integration of AI and Machine Learning: Artificial intelligence is increasingly used to automate analysis and detect early-stage corneal disorders.

-

Rise in Customized Refractive Surgeries: Growing demand for customized LASIK and PRK procedures necessitates high-precision corneal mapping.

-

Portable and Handheld Devices: Technological miniaturization has led to the development of mobile topography systems for point-of-care usage.

-

Expansion into Emerging Economies: Rising disposable income and improved healthcare access are driving adoption in Asia Pacific and Latin America.

-

Multi-modal Diagnostic Platforms: Devices now combine corneal topography with pachymetry and anterior segment imaging for comprehensive evaluations.

-

Teleophthalmology Integration: Remote corneal assessments are being explored, particularly in rural healthcare initiatives.

-

Rising Popularity of Scleral and Specialty Contact Lenses: Complex lens fittings require highly detailed corneal maps, boosting device demand.

-

Scheimpflug Systems Gaining Prominence: Due to their ability to capture anterior and posterior corneal surfaces accurately.

-

Surge in Keratoconus Diagnosis and Management: Early detection strategies are enhancing the clinical value of topography devices.

-

Regulatory Support for Early Cataract and Glaucoma Screening: Pushing ophthalmic clinics to invest in advanced topography systems.

Report Scope of Corneal Topographers Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 833.60 Million |

| Market Size by 2034 |

USD 1,304.32 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 5.1% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product type, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Carl Zeiss AG; OCULUS Optikgeräte GmbH; Cassini Technologies; Nidek Co., Ltd; Tomey Corporation; EyeSys Vision; Tracey Technologies; Topcon Corporation |

Key Market Driver: Increasing Incidence of Refractive Errors and Corneal Disorders

A major market driver for corneal topographers is the rising global incidence of refractive errors and corneal disorders. According to the World Health Organization (WHO), over 2.2 billion people globally have a vision impairment, with a significant proportion attributed to uncorrected refractive errors such as myopia, hyperopia, and astigmatism.

Additionally, disorders like keratoconus, pellucid marginal degeneration, and corneal ectasia are becoming more commonly diagnosed due to enhanced awareness and better screening protocols. Corneal topographers provide precise, non-invasive measurements crucial for detecting early-stage ectatic diseases and planning appropriate interventions. The growing volume of refractive surgeries, particularly LASIK and PRK, further underscores the importance of accurate corneal mapping. As patients increasingly seek surgical vision correction, the reliance on detailed topographic evaluations continues to intensify.

Key Market Restraint: High Cost and Complex Training Requirements

Despite the growing demand, a key market restraint remains the high cost and technical complexity associated with corneal topography systems. Advanced devices with Scheimpflug imaging or scanning slit technologies represent significant capital investments, often ranging from tens to hundreds of thousands of dollars depending on capabilities.

Moreover, effective use of these systems demands specialized training to interpret complex topography maps accurately. Small clinics, optometrists in rural areas, and emerging markets often find the cost and training requirements prohibitive, limiting broader market penetration. Additionally, maintenance and calibration expenses further add to the total cost of ownership, slowing adoption among budget-constrained healthcare providers.

Key Market Opportunity: Expansion into Emerging Markets and Teleophthalmology

A significant market opportunity exists in expanding into emerging economies and integrating teleophthalmology solutions. As governments in Asia Pacific, Latin America, and parts of Africa invest in healthcare infrastructure, demand for advanced ophthalmic diagnostics, including corneal topographers, is rising.

At the same time, telemedicine initiatives are enabling remote screening and diagnostics, opening new pathways for topographers to be deployed in rural or underserved areas. Portable, cost-effective devices combined with cloud-based data sharing allow ophthalmologists to analyze corneal topography remotely. Companies that can develop affordable, user-friendly systems geared towards these markets potentially supported by remote reading centers stand to capture significant untapped potential.

Corneal Topographers Market By Product Type Insights

Placido Disc Systems dominated the market in 2024. Placido-based systems remain the gold standard for anterior surface corneal topography, widely used for initial screenings and contact lens fittings. These systems project a series of concentric rings onto the cornea, analyzing distortions to map curvature. They are cost-effective, relatively easy to operate, and suitable for a variety of clinical applications. Given their reliability and affordability, Placido disc systems enjoy extensive adoption among private ophthalmology practices and optical chains.

Scheimpflug Systems are projected to experience the fastest growth. Unlike Placido systems, Scheimpflug imaging captures both the anterior and posterior surfaces of the cornea, along with pachymetry maps (thickness measurements). This capability is critical for early detection of conditions like keratoconus and for accurate IOL (intraocular lens) calculations before cataract surgery. As precision diagnostics become standard in premium surgical practices, the adoption of Scheimpflug systems is accelerating, particularly in high-end clinics and academic hospitals.

Corneal Topographers Market By Application Insights

Refractive Surgery Evaluation accounted for the largest market share. Refractive surgeries such as LASIK, PRK, and SMILE require detailed corneal curvature and thickness data for surgical planning and eligibility screening. Corneal topographers play a pivotal role in identifying contraindications (e.g., early keratoconus) and ensuring optimal outcomes. Rising rates of myopia and growing consumer preference for surgical vision correction are driving strong demand from refractive surgery centers.

Corneal Disorder Diagnosis is expected to grow at the fastest pace. Increased awareness and improved screening for corneal diseases like keratoconus, post-LASIK ectasia, and Fuchs' dystrophy are fueling demand. Earlier diagnosis enabled by topography facilitates better management, including the use of collagen cross-linking to halt disease progression. As preventive ophthalmology gains traction, corneal topography's role in primary and secondary care is expanding rapidly.

Corneal Topographers Market By End Use Insights

Hospitals remained the leading end-user segment in 2024. Large hospitals and teaching institutions typically invest in comprehensive diagnostic platforms that integrate corneal topography with tomography, anterior segment OCT, and biomechanical analysis. Hospitals with refractive surgery programs, corneal transplant services, and specialty clinics rely heavily on advanced topography systems for both diagnosis and surgical planning, consolidating their dominant share.

Ambulatory Surgery Centers (ASCs) are set to register the fastest growth rate. As outpatient cataract and refractive surgeries grow, ASCs are increasingly investing in high-performance yet compact diagnostic solutions. The focus on faster patient throughput, cost-effective operations, and superior clinical outcomes makes ASCs a fertile ground for corneal topography system expansion.

Corneal Topographers Market By Regional Insights

North America continued to dominate the corneal topographers market in 2024. The region’s leadership stems from advanced healthcare infrastructure, high adoption of refractive and cataract surgeries, and widespread awareness of ocular diseases. Government initiatives promoting early diagnosis, strong insurance coverage for ophthalmic services, and the presence of key market players such as Carl Zeiss Meditec, Topcon Corporation, and Nidek Co., Ltd., further bolster market growth.

Additionally, North American consumers' strong inclination towards premium eye care services and elective vision correction procedures creates robust demand for state-of-the-art diagnostic equipment, including high-end corneal topographers with AI integration and combined anterior segment imaging.

Asia Pacific is poised to witness the fastest growth in the corneal topographers market. Factors such as the high prevalence of myopia (especially in East Asian countries like China, Japan, and South Korea), rising cataract surgery volumes, and improving healthcare access are propelling regional demand.

Emerging economies like India and China are investing heavily in expanding eye care infrastructure, both public and private, supported by aging populations and growing middle classes willing to pay for vision correction services. Furthermore, international manufacturers are increasingly establishing local distribution networks and partnerships, further enhancing market penetration.

Some of the prominent players in the corneal topographers market include:

- Carl Zeiss AG

- OCULUS Optikgeräte GmbH

- Cassini Technologies

- Nidek Co., Ltd

- Tomey Corporation

- EyeSys Vision

- Tracey Technologies

- Topcon Corporation

Corneal Topographers Market Recent Developments

-

March 2025 – Carl Zeiss Meditec introduced the ATLAS 9000 Corneal Topography System featuring AI-powered screening modules for keratoconus detection.

-

January 2025 – Topcon Corporation launched the new KR-1W Wavefront Analyzer integrated with Placido-based topography for enhanced refractive surgery planning.

-

November 2024 – NIDEK Co., Ltd. announced global expansion of its CEM-530 corneal topography system in Southeast Asian markets, aiming to tap into rapidly growing cataract and refractive surgery segments.

-

September 2024 – OCULUS Optikgeräte GmbH unveiled an updated version of its Pentacam AXL Wave, combining Scheimpflug tomography, wavefront aberrometry, and corneal topography in a single platform.

-

July 2024 – Optovue Inc. introduced a new anterior segment OCT-topography hybrid device targeted at high-end refractive and cataract surgery centers in North America and Europe.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the corneal topographers market

Product Type

- Placido Disc System

- Scheimpflug Systems

- Scanning Slit System

Application

- Cataract Surgery Evaluation

- Corneal Disorder Diagnosis

- Refractive Surgery Evaluation

- Contact Lens Fitting

- Others

End Use

- Hospitals

- Ophthalmic Clinics

- Ambulatory Surgery Centers

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)