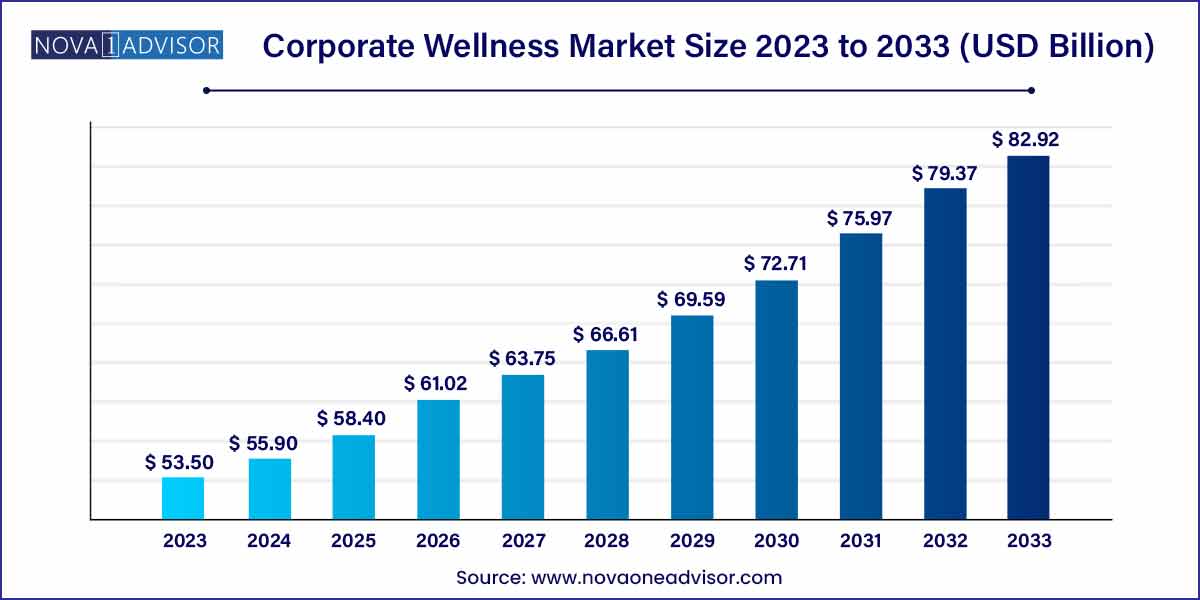

The global corporate wellness market was estimated at USD 53.50 billion in 2023, is expected to surpass around USD 82.92 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 4.48% during the forecast period of 2024–2033.

Key Takeaways:

- The health risk assessment segment dominated the market in 2023 with a revenue share of 21.0%.

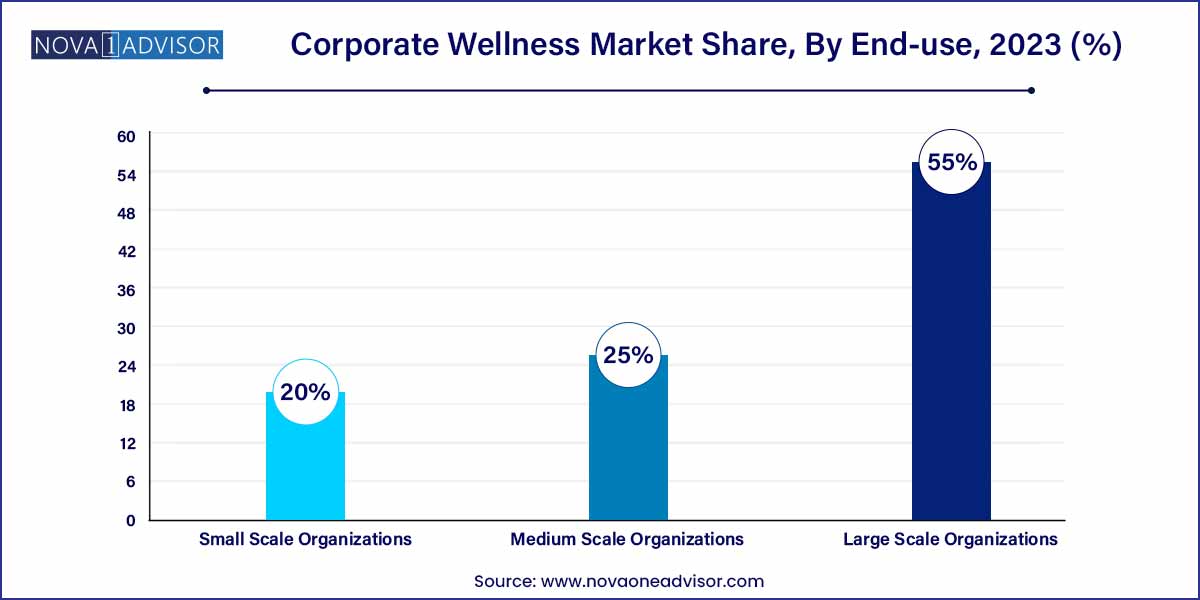

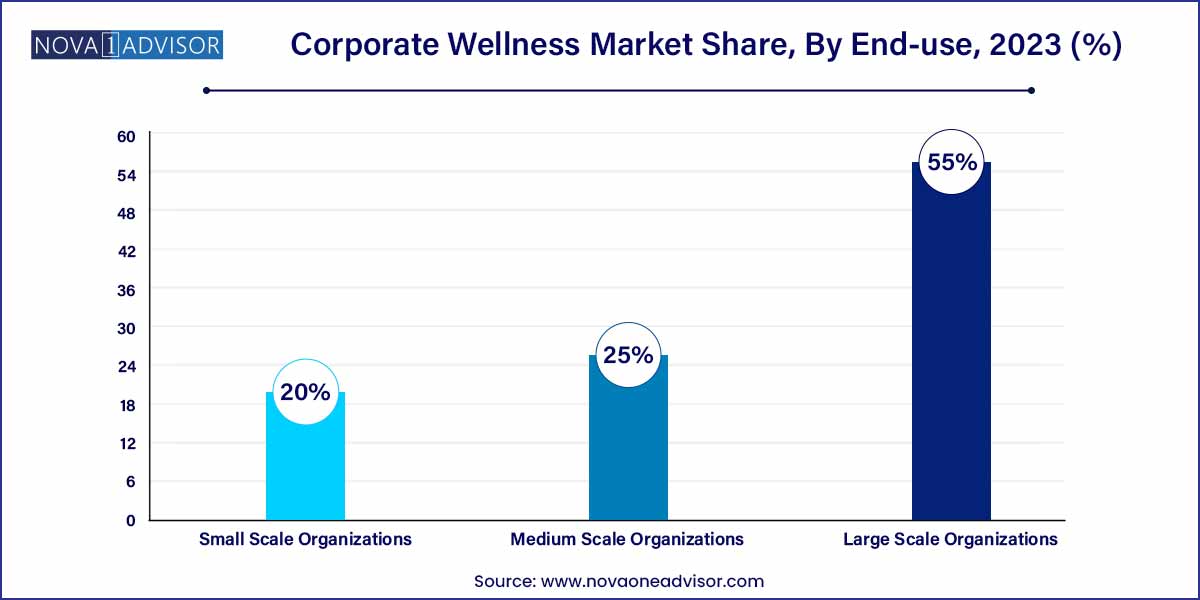

- The large-scale organizations with a share of 55.0% dominated the market in 2023.

- The organizations/ employers segment with 50.0% in 2023 accounted for the maximum portion of the market.

- The onsite segment held the maximum market share of 56.4% in 2023.

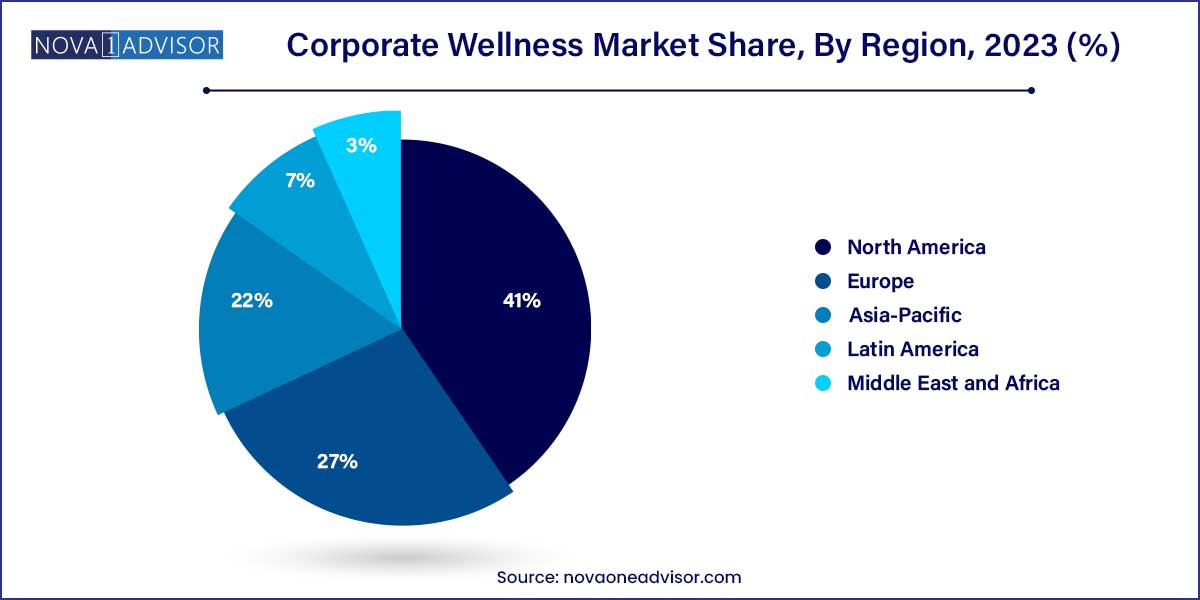

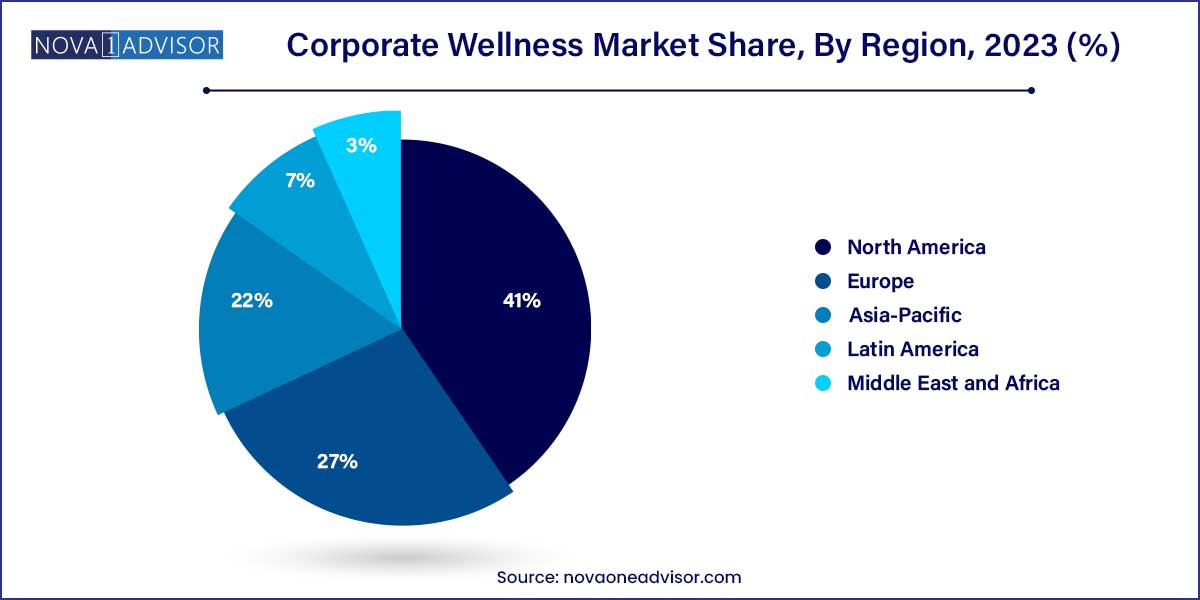

- North America dominated the corporate wellness market and accounted for the largest revenue share of 41.0% in 2023.

Market Overview

The corporate wellness market has steadily transitioned from being a "nice-to-have" to a "strategic necessity" for organizations aiming to foster employee well-being, enhance productivity, and reduce healthcare costs. As companies worldwide recognize the tangible link between employee health and organizational performance, wellness programs are increasingly being integrated into corporate cultures. From fitness programs and smoking cessation initiatives to stress management workshops and nutrition counseling, corporate wellness solutions are designed to promote holistic employee health.

Rising healthcare expenses, an increase in lifestyle-related diseases, and a growing focus on mental health have fueled the adoption of wellness initiatives across organizations of all sizes. The COVID-19 pandemic further highlighted the critical importance of employee health, pushing companies to adopt virtual wellness programs, mental health resources, and flexible work arrangements.

Today, corporate wellness is no longer limited to gym memberships or annual health screenings. Innovative companies are leveraging technology platforms, wearable devices, and personalized programs to offer comprehensive, accessible, and measurable wellness solutions. As corporate leadership increasingly prioritizes Diversity, Equity, and Inclusion (DEI), wellness programs are also evolving to address a wide range of employee needs, contributing to a more supportive work environment.

Major Trends in the Market

-

Rise of Virtual Wellness Programs: Remote work has accelerated the demand for digital fitness classes, mental health apps, and virtual counseling sessions.

-

Focus on Mental Health and Emotional Well-being: Stress management, resilience building, and access to psychological therapy have become core components of wellness programs.

-

Personalized Wellness Solutions: Programs are being tailored to individual employee health profiles, preferences, and risk factors.

-

Increased Adoption of Wearable Devices: Companies are using fitness trackers and smartwatches to incentivize physical activity and monitor employee health metrics.

-

Emphasis on Preventive Healthcare: Preventive screenings, vaccination drives, and early risk detection initiatives are becoming mainstream.

-

Integration of Financial Wellness: Programs addressing financial literacy, debt management, and retirement planning are gaining traction as part of holistic wellness strategies.

-

Expansion of Wellness into SMEs: While traditionally large corporations led the way, small and medium-sized enterprises are increasingly adopting tailored wellness initiatives.

-

Regulatory Support and Incentives: Governments in many regions are encouraging corporate wellness adoption through tax benefits and regulatory frameworks.

Corporate Wellness Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 53.50 Bilion |

| Market Size by 2033 |

USD 82.92 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 4.48% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Service, End-use, Category, Delivery Model, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ComPsych; Wellness Corporate Solutions; Virgin Pulse; EXOS; Marino Wellness; Privia Health; Vitality; Wellsource, Inc.; Central Corporate Wellness; Truworth Wellness; SOL Wellness. |

Driver: Increasing Prevalence of Chronic Diseases

One of the most significant drivers of the corporate wellness market is the rising prevalence of chronic diseases among the working population. Conditions like obesity, hypertension, diabetes, and cardiovascular diseases are on the rise due to sedentary lifestyles, poor dietary habits, and high-stress levels.

Employers bear a substantial portion of healthcare costs associated with treating these chronic conditions. According to the Centers for Disease Control and Prevention (CDC), chronic diseases account for approximately 90% of the $4.1 trillion annual healthcare expenditures in the U.S. Recognizing this, companies are investing in preventive care through wellness initiatives, aiming to detect health risks early and promote healthier behaviors. Successful examples include Johnson & Johnson's wellness program, which reportedly saved the company $250 million on healthcare costs over a decade.

Restraint: Low Employee Engagement in Wellness Programs

Despite offering wellness programs, many organizations struggle with low employee participation rates. A key challenge is designing initiatives that are relevant, accessible, and engaging for a diverse workforce. Generic or poorly communicated programs often fail to resonate with employees, leading to underutilization.

Additionally, some employees may perceive wellness programs as intrusive, especially those involving health assessments or biometric screenings. Others may be reluctant to participate due to time constraints or skepticism about the program’s impact. Without strategic communication, leadership endorsement, incentives, and personalization, even the most well-funded programs risk low engagement, thereby limiting their effectiveness and ROI.

Opportunity: Integration of AI and Data Analytics for Personalized Wellness

An emerging opportunity in the corporate wellness market lies in the integration of artificial intelligence (AI) and data analytics to create highly personalized wellness journeys. By leveraging health data collected from wearables, surveys, and EHRs, AI can offer tailored recommendations on exercise, nutrition, stress management, and chronic disease prevention.

For instance, AI-driven platforms can alert employees when their stress levels are elevated based on heart rate variability data, suggesting timely interventions like meditation sessions. Companies like Virgin Pulse are already pioneering data-driven corporate wellness programs that adapt to individual needs in real time. As personalization becomes a key differentiator, AI-powered wellness platforms present vast opportunities for enhancing engagement and measurable outcomes.

Service Insights

Health risk assessment dominated the corporate wellness market in 2024, primarily because organizations are increasingly emphasizing early identification of health risks to guide preventive interventions. Comprehensive assessments involving biometric screenings, lifestyle questionnaires, and personalized feedback reports allow employers to identify at-risk employees and tailor wellness programs accordingly. Companies are partnering with third-party providers to conduct annual or semi-annual health risk assessments as part of broader occupational health strategies.

However, the fitness segment is anticipated to be the fastest-growing segment during the forecast period. With the global emphasis on combating sedentary lifestyles, employers are promoting physical activity through onsite fitness centers, gym membership reimbursements, virtual fitness classes, and corporate challenges like step competitions. Corporate partnerships with fitness brands like Peloton and ClassPass highlight the expanding scope of corporate fitness offerings, targeting both in-office and remote employees.

End-Use Insights

Large scale organizations dominated the corporate wellness market in 2023. These enterprises have the financial resources and human capital to implement comprehensive, multi-faceted wellness programs covering physical health, mental well-being, financial literacy, and more. Global giants like Google and Microsoft have long invested in onsite wellness centers, meditation spaces, and full-time wellness coaches, setting benchmarks for others to follow.

Meanwhile, small-scale organizations are projected to witness the fastest growth. Increased awareness of employee well-being, coupled with accessible and affordable digital wellness platforms, is enabling SMEs to offer effective wellness initiatives without substantial capital investment. Providers now offer customizable packages that allow small firms to implement mental health days, tele-counseling services, and flexible fitness programs, creating a more inclusive wellness landscape.

Category Insights

Organizations/Employers were the largest contributors to the corporate wellness market in 2023. As the primary initiators and funders of wellness programs, employers have a vested interest in improving employee health to reduce absenteeism, boost morale, and enhance productivity. Initiatives like Amazon’s "WorkingWell" program, which combines physical, mental, and ergonomic support for employees, illustrate how employers are taking a proactive stance.

Psychological therapists are expected to be the fastest-growing category within the market. Rising awareness of mental health, burnout, and emotional well-being post-pandemic has driven demand for professional psychological support services. Employers are increasingly offering access to licensed therapists, either onsite or through Employee Assistance Programs (EAPs), reflecting the shift towards holistic well-being.

Delivery Model Insights

Onsite delivery models dominated the market in 2024, with many large corporations offering onsite fitness centers, wellness seminars, vaccination drives, and ergonomic interventions. Face-to-face engagement allows for higher participation rates and fosters a culture of health and community within the workplace.

However, the offsite delivery model is poised to experience the fastest growth, particularly driven by hybrid and remote work trends. Offsite services, including digital platforms, mobile health apps, tele-counseling, and virtual fitness sessions, enable companies to reach geographically dispersed employees. Flexibility, convenience, and scalability are the key factors making offsite wellness delivery models increasingly attractive.

Regional Insights

North America led the corporate wellness market in 2024, accounting for the highest revenue share. Factors such as the high incidence of lifestyle diseases, rising healthcare costs, corporate culture emphasizing employee welfare, and strong penetration of wellness service providers contribute to the region’s dominance.

The U.S. has been at the forefront, with major corporations integrating wellness into their value propositions to attract and retain talent. Programs are increasingly focusing on mental health, diversity and inclusion, and preventive care. Tax benefits for employers offering wellness programs under the Affordable Care Act (ACA) have also incentivized adoption.

Asia-Pacific is forecasted to exhibit the fastest growth over the forecast period. The rising burden of chronic diseases, rapid urbanization, growing workforce stress, and increased awareness about employee well-being are key growth drivers.

Countries like India, China, and Japan are witnessing surging demand for corporate wellness solutions. In India, the corporate sector is partnering with wellness providers like HealthifyMe and Truworth Wellness to deliver fitness challenges, yoga sessions, and tele-counseling services. Government initiatives promoting occupational health and wellness, such as Japan’s "Premium Friday" campaign to improve work-life balance, further support regional growth.

Some of the prominent players in corporate wellness include:

- ComPsych

- Wellness Corporate Solutions

- Virgin Pulse

- EXOS

- Marino Wellness

- Privia Health

- Vitality

- Wellsource, Inc.

- Central Corporate Wellness

- Truworth Wellness

- SOL Wellness

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global corporate wellness.

Service

- Health Risk Assessment

- Fitness

- Smoking Cessation

- Health Screening

- Nutrition & Weight Management

- Stress Management

- Others

End-Use

- Small Scale Organizations

- Medium Scale Organizations

- Large Scale Organizations

Category

- Fitness & Nutrition Consultants

- Psychological Therapists

- Organizations/Employers

Delivery Model

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)