CRISPR And Cas Genes Market Size and Growth

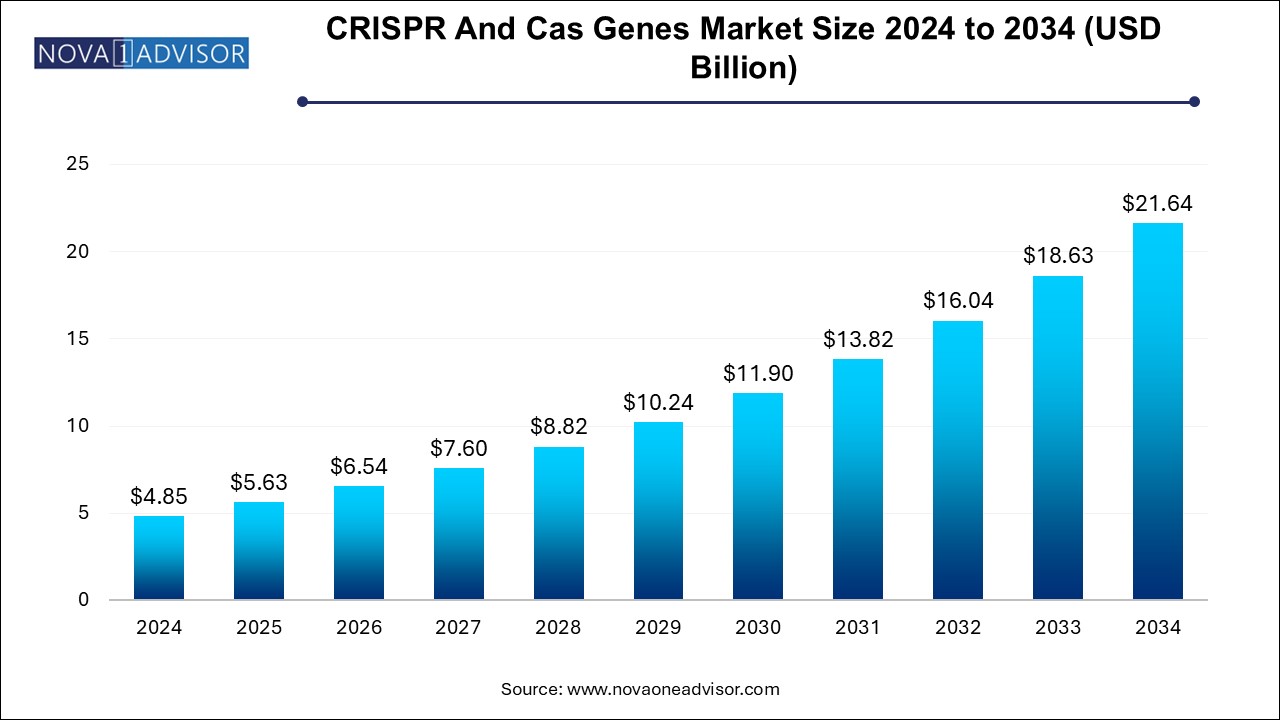

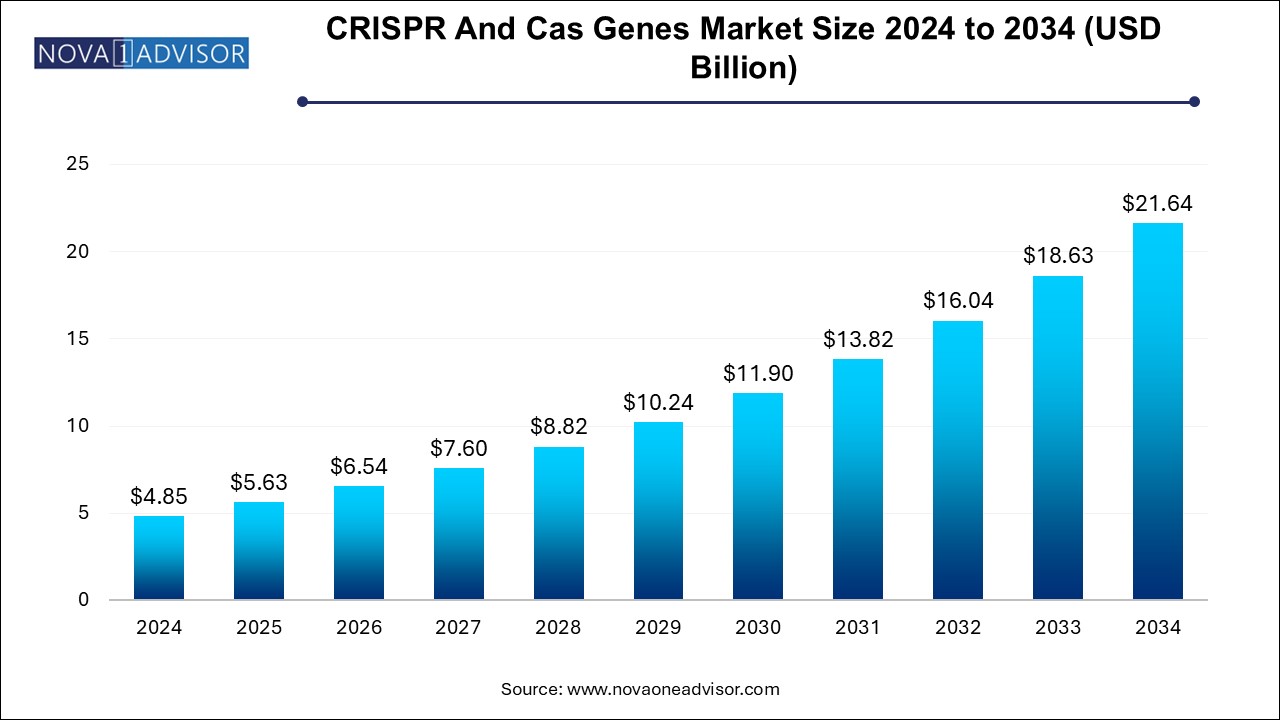

The CRISPR and Cas genes market size was exhibited at USD 4.85 billion in 2024 and is projected to hit around USD 21.64 billion by 2034, growing at a CAGR of 16.13% during the forecast period 2024 to 2034.

CRISPR And Cas Genes Market Key Takeaways:

- The product segment dominated the market in 2024 and accounted for the largest market share.

- The service segment is expected to grow at the fastest CAGR of 17.21% from 2024 to 2034.

- The biomedical applications segment dominated the market in 2024.

- The biomedical applications segment dominated the market in 2024.

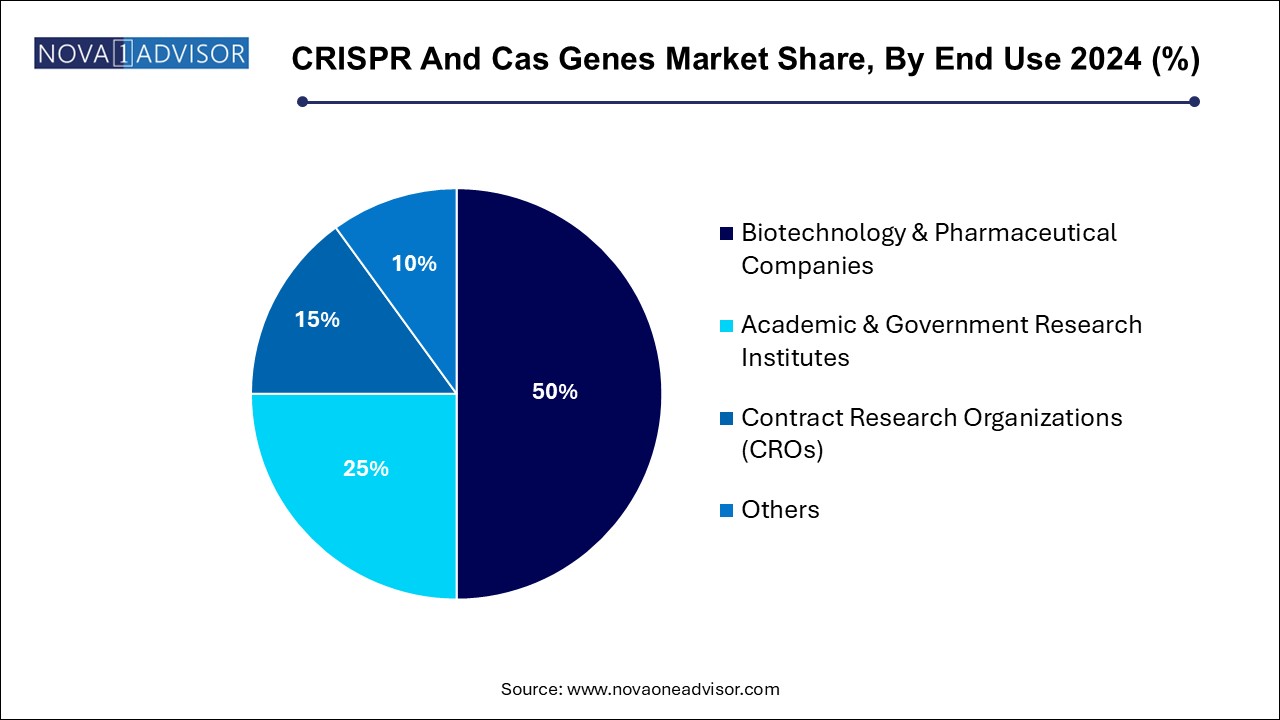

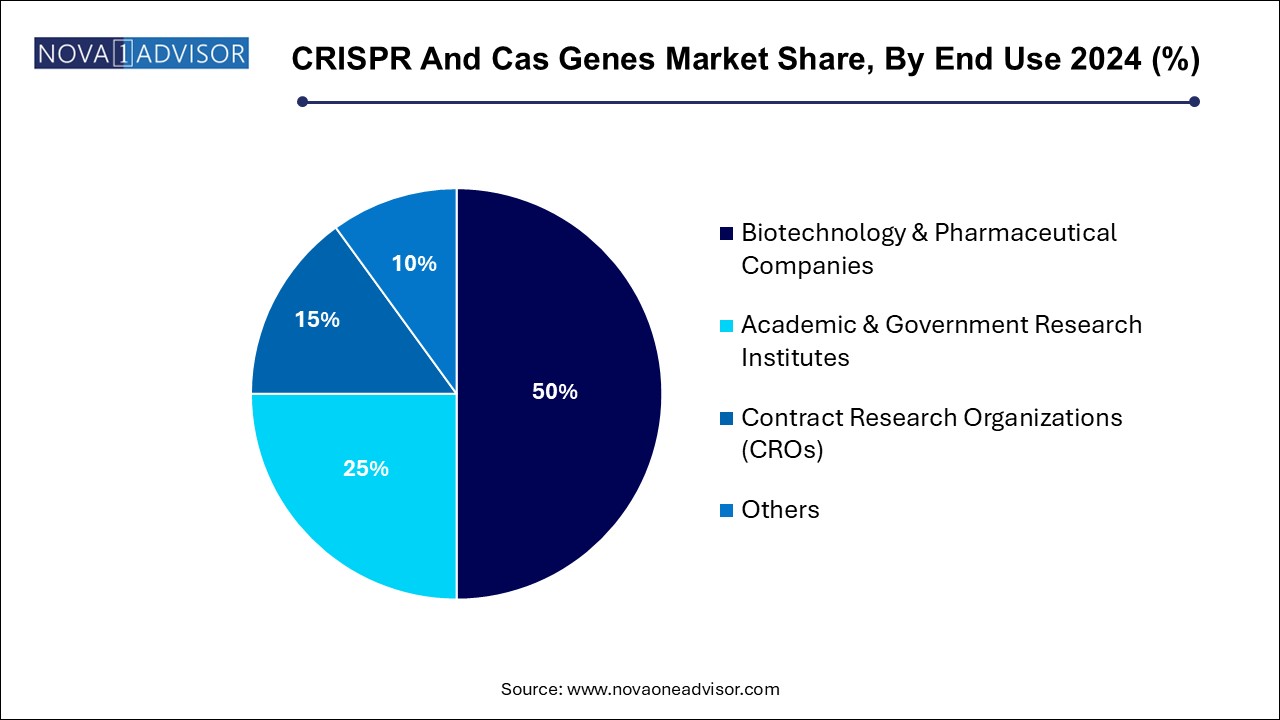

- The biotechnology and pharmaceutical companies dominated the market in 2024, accounting for 50.0% of overall revenue share.

- The Contract Research Organizations (CROs) segment is expected to grow at the fastest CAGR of 17.89% from 2024 to 2034.

- North America CRISPR and CAS genes market accounted for the largest market share globally of 41.36% in 2024.

Market Overview

The CRISPR and Cas genes market has emerged as a transformative force in the life sciences and biotechnology sectors, enabling precise gene editing with applications ranging from disease treatment to agricultural enhancements. Clustered Regularly Interspaced Short Palindromic Repeats (CRISPR), along with associated Cas proteins (particularly Cas9 and Cas12), provide a powerful toolkit for manipulating the genome in a highly specific and efficient manner. This technology has evolved from basic research into a robust commercial industry with promising implications for healthcare, agriculture, pharmaceuticals, and synthetic biology.

Over the past decade, CRISPR has transitioned from the research bench to clinical trials, with companies and academic institutions accelerating the development of gene therapies for rare diseases, cancer immunotherapy, and even viral infections. The appeal of CRISPR lies in its relative ease of use, cost-effectiveness, and the ability to edit genes in vivo or ex vivo. Unlike earlier gene-editing tools such as zinc-finger nucleases (ZFNs) or TALENs, CRISPR is simpler to program and more versatile, making it a popular choice across diverse scientific disciplines.

In agriculture, CRISPR is being harnessed to create crops with improved resistance to diseases, enhanced nutritional content, and better yield under challenging climatic conditions. Startups and multinational agribiotech firms are actively investing in CRISPR technologies to address food security and sustainability challenges. Meanwhile, the growth of CRISPR-related services—including cell line engineering and guide RNA synthesis—has contributed significantly to the overall market expansion.

Moreover, the pandemic catalyzed the demand for CRISPR-based diagnostics and research tools, bringing attention to its potential in infectious disease detection. The future outlook remains promising, bolstered by continuous investments in research, expanding intellectual property portfolios, and increasing regulatory endorsements for clinical use.

Major Trends in the Market

-

Proliferation of CRISPR-based Therapeutics: Multiple biotech firms are advancing CRISPR gene therapies into Phase I/II clinical trials for conditions like sickle cell anemia and beta-thalassemia.

-

Emergence of CRISPR Diagnostics: New tools like CRISPR-Cas12/13 systems are being developed for rapid pathogen detection, as seen during the COVID-19 pandemic.

-

Rise of Base Editing and Prime Editing Technologies: Innovations improving CRISPR precision without double-strand breaks are gaining traction.

-

Commercialization of CRISPR Crops: Regulatory flexibility in countries like the U.S. is paving the way for commercial launch of gene-edited crops such as non-browning mushrooms and drought-tolerant maize.

-

Growth of Outsourced CRISPR Services: CROs offering design, screening, and cell line engineering services are attracting academic and commercial clients.

-

Ethical and Regulatory Dialogues: As CRISPR applications grow, global debates continue on the ethical boundaries, especially concerning germline editing.

-

Strategic Partnerships and Licensing Agreements: Companies are increasingly entering collaborations to leverage each other’s IP and research capabilities.

Report Scope of CRISPR And Cas Genes Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 5.63 Billion |

| Market Size by 2034 |

USD 21.64 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 16.13% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product & Service, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Thermo Fisher Scientific; Illumina, Inc; Agilent Technologies; Synthego; Danaher; Origene Technologies; GenScript; Lonza; Revvity, Inc.; Merck KGaA |

Market Driver: Expansion of CRISPR-based Therapeutic Pipelines

A major growth driver for the CRISPR and Cas genes market is the expansion of therapeutic pipelines utilizing CRISPR-Cas systems. With the first human trials of CRISPR-edited cells beginning in the mid-2010s, there has been an accelerating push toward clinical validation. Companies like CRISPR Therapeutics and Vertex Pharmaceuticals have reported promising interim results in clinical trials targeting genetic blood disorders such as sickle cell disease and beta-thalassemia using ex vivo CRISPR-edited hematopoietic stem cells.

Furthermore, the ability to engineer T-cells for immunotherapy applications has spurred activity in oncology, particularly for CAR-T therapies. The precision and efficiency of CRISPR editing are enhancing the safety profiles of these therapies while reducing manufacturing timelines. Regulatory support from agencies like the U.S. FDA and European Medicines Agency (EMA) is further encouraging investment in CRISPR-based clinical programs.

Market Restraint: Off-target Effects and Safety Concerns

Despite its groundbreaking potential, off-target effects and long-term safety remain key restraints in the CRISPR and Cas genes market. While advances in guide RNA design and novel Cas variants have reduced unintended edits, the risk of gene disruptions or insertions at non-target sites still poses a challenge particularly in clinical applications where precision is paramount.

These risks are magnified when CRISPR is used in vivo, where delivery systems such as viral vectors or lipid nanoparticles must also be tightly regulated. The ethical considerations around editing the human germline and concerns regarding mosaicism further complicate widespread adoption. As a result, regulatory bodies require extensive safety data, which can delay product development and increase costs for innovators.

Market Opportunity: Integration of CRISPR with AI and Big Data in Functional Genomics

The integration of CRISPR technologies with AI and big data analytics presents a significant opportunity in functional genomics. Genome-wide CRISPR screens generate vast datasets that can unravel gene functions, identify drug targets, and elucidate disease pathways. AI and machine learning algorithms can accelerate analysis by predicting off-target effects, optimizing gRNA design, and modeling CRISPR efficacy in different cell types.

Several companies and academic labs are now using AI to simulate CRISPR edits before executing them, reducing lab time and improving accuracy. This convergence not only enhances the efficiency of research but also opens up commercial opportunities in drug discovery, synthetic biology, and precision agriculture, where predictive insights can drastically shorten R&D cycles.

CRISPR And Cas Genes Market By Product & Service Insights

Kits and reagents dominated the market due to their indispensable role in CRISPR workflows.

The product segment—especially kits and reagents—is the cornerstone of the CRISPR market. Kits offer a comprehensive package that includes Cas proteins, guide RNAs, and reaction buffers tailored for applications like genome editing or diagnostics. These are widely used in research institutes, biotech companies, and CROs. Cas proteins, especially Cas9, represent a major revenue-generating subcategory due to their universal application in genome editing experiments. The increasing adoption of novel enzymes like Cas12 and Cas13 is expected to further drive this segment’s growth.

CRISPR-related services are the fastest growing segment, led by cell line engineering and screening services.

As companies seek to expedite preclinical studies, the demand for outsourced services has surged. Cell line engineering using CRISPR is essential in oncology, immunology, and metabolic disease research. CROs are leveraging automation and high-throughput tools to offer genome-wide screens and functional validation services. This allows smaller biotech firms and academic labs to access state-of-the-art CRISPR tools without investing in expensive infrastructure. Guide RNA design and synthesis services are also in demand as researchers aim for high specificity and minimal off-target activity.

CRISPR And Cas Genes Market By Application Insights

Biomedical applications held the largest share, fueled by investments in gene therapies and disease models.

Within biomedical applications, genome engineering leads the field due to its critical role in developing gene therapies and studying genetic diseases. Functional genomics, another important sub-segment, helps decipher gene behavior across various diseases, enabling targeted drug development. CRISPR’s utility in epigenetics and disease modeling further strengthens this segment's dominance. Academic institutions, pharmaceutical firms, and government agencies are pouring resources into these applications to uncover the genetic basis of diseases and create precise treatment strategies.

Agricultural applications are growing rapidly as CRISPR gains ground in crop improvement and pest resistance.

The agricultural segment, though smaller in size, is experiencing the fastest growth. CRISPR is enabling precision breeding editing traits like drought resistance, faster growth, or longer shelf life without introducing foreign DNA. For instance, Calyxt and Pairwise are working on CRISPR-edited soybeans and leafy greens, respectively. The relative regulatory ease for non-transgenic CRISPR crops in the U.S. further accelerates adoption. With climate change impacting crop yields, gene-edited agriculture presents a sustainable solution for future food security.

CRISPR And Cas Genes Market By End Use Insights

Biotechnology and pharmaceutical companies dominated the end-use segment due to drug development and therapeutic research.

These companies utilize CRISPR tools extensively for target validation, high-throughput screening, and development of next-gen gene therapies. The ability to create knockout and knock-in models using CRISPR streamlines the drug discovery process. Large firms such as Editas Medicine and Intellia Therapeutics are driving clinical programs, while others are investing in CRISPR to design novel immunotherapies and antivirals. The ongoing push toward precision medicine makes this segment a core driver of the overall market.

Contract research organizations (CROs) are the fastest growing end-users, driven by demand for outsourced research solutions.

CROs have become pivotal players, providing cost-effective CRISPR research services including gRNA synthesis, functional genomics screening, and custom cell line development. These services cater to both academic labs and startups with limited internal capabilities. As drug pipelines grow more complex, outsourcing CRISPR services allows flexibility and scalability, especially for preclinical projects. The trend is expected to continue as CRISPR workflows become more standardized and widely adopted across diverse research areas.

CRISPR And Cas Genes Market Regional Insights

North America dominated the CRISPR and Cas genes market, led by strong research infrastructure and biotech investments.

The U.S. and Canada form the hub of CRISPR innovation, backed by major research institutions such as MIT, Harvard, and the Broad Institute. North America hosts numerous CRISPR-focused startups and clinical-stage biotech firms, many of which have secured substantial funding. For example, in 2024, Vertex Pharmaceuticals and CRISPR Therapeutics jointly announced expanded investment into gene-editing trials for sickle cell disease. The region benefits from a well-developed regulatory framework and intellectual property protections that foster innovation.

Asia Pacific is the fastest growing region due to rising genomics research and government support.

Countries like China, Japan, and South Korea are rapidly increasing investments in gene-editing technologies. China, in particular, has emerged as a major player with its large-scale agricultural CRISPR programs and ambitious plans for clinical applications. The country is also home to numerous publications and patents on CRISPR-related discoveries. In India, government-backed biotech incubators are supporting startups working on CRISPR diagnostics. The combination of growing research talent, reduced development costs, and supportive policies is driving exponential growth in this region.

Some of the prominent players in the CRISPR and Cas genes market include:

CRISPR And Cas Genes Market Recent Developments

-

In March 2025, Intellia Therapeutics announced positive interim results from its CRISPR-based gene therapy trial targeting hereditary angioedema, demonstrating substantial reduction in attack frequency after a single infusion.

-

In February 2025, CRISPR Therapeutics and Vertex Pharmaceuticals submitted regulatory filings in the U.S. and EU for their gene-editing therapy exa-cel (exagamglogene autotemcel), aimed at treating beta-thalassemia and sickle cell disease.

-

In January 2025, Editas Medicine revealed its new in vivo editing program using Cas12a to target retinal diseases, advancing its ophthalmology pipeline.

-

In December 2024, Pairwise launched its first CRISPR-edited leafy greens in U.S. retail, marking a milestone in consumer acceptance of gene-edited crops.

-

In November 2024, Synthego, a leading CRISPR tool provider, unveiled an AI-driven CRISPR design platform, aimed at improving guide RNA targeting and reducing experimental failure rates.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the CRISPR and Cas genes market

By Product & Service

-

-

- Cas Proteins & Enzymes

- Guide RNA

- Others

-

- Libraries

- Design Tool

- Antibodies

- Others

-

- Cell Line Engineering

- gRNA Design & Synthesis & Synthesis

- Screening Services

- Others

By Application

-

- Genome Engineering

- Disease Model Studies

- Functional Genomics

- Epigenetics

- Others

By End Use

- Biotechnology & Pharmaceutical Companies

- Academic & Government Research Institutes

- Contract Research Organizations (CROs)

- Others

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)