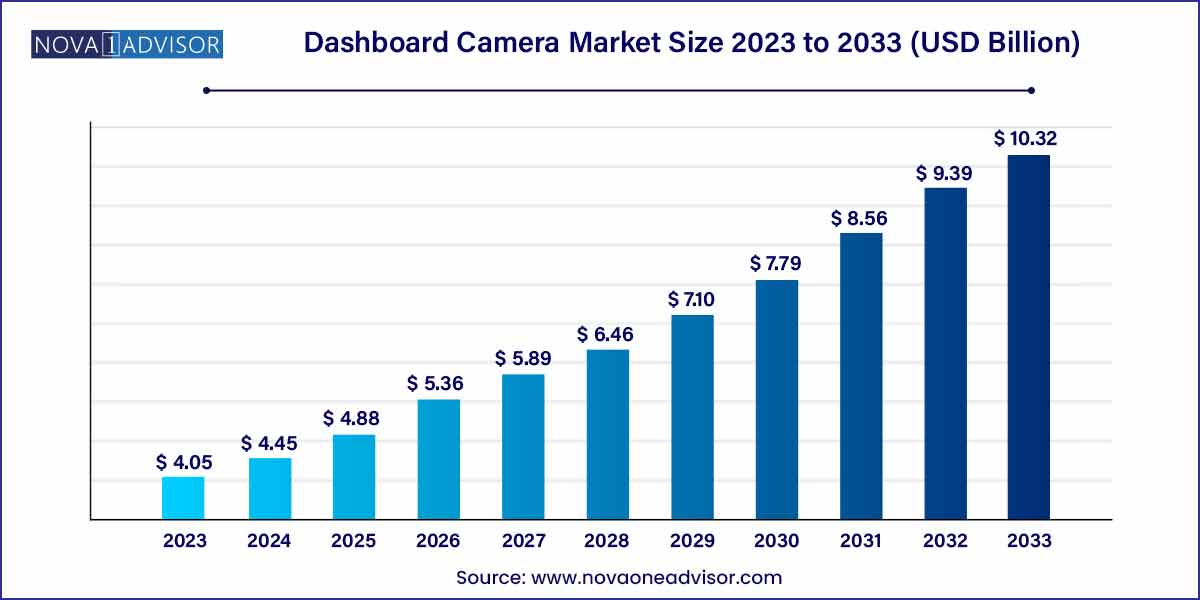

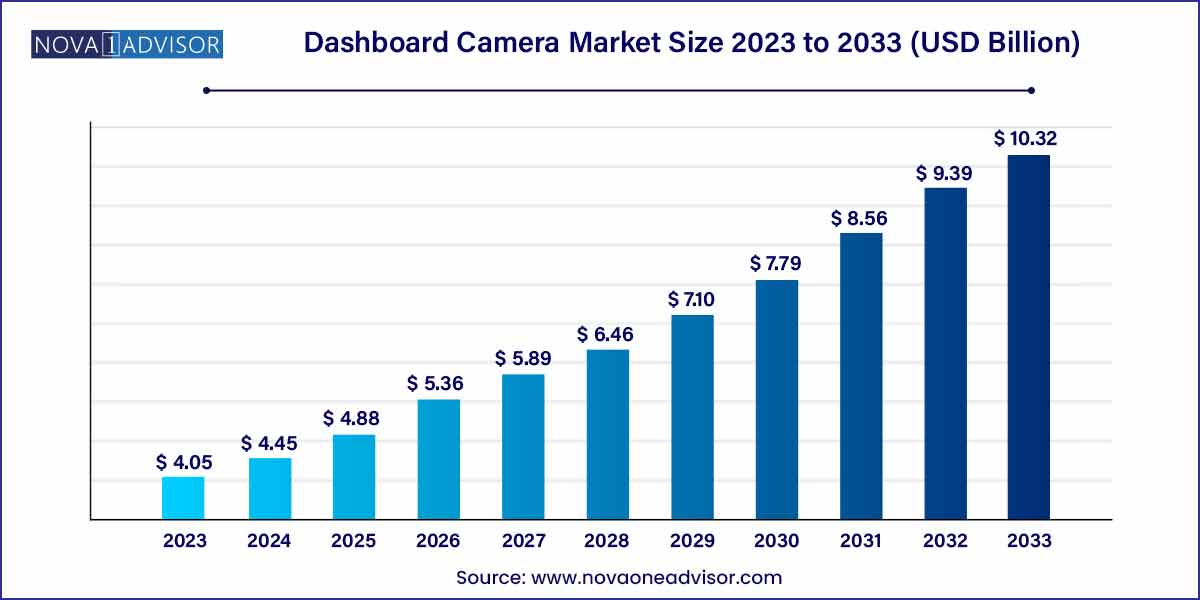

The global dashboard camera market size was exhibited at USD 4.05 billion in 2023 and is projected to hit around USD 10.32 billion by 2033, growing at a CAGR of 9.8% during the forecast period 2024 to 2033

Key Takeaways:

- Europe accounted for the largest market revenue share in 2023.

- The basic technology segment, based on technology, accounted for a dominant revenue share of the market in 2023.

- The 1-channel product segment is gaining market traction and will dominate the market by revenue in 2023.

- The SD & HD video quality segments dominated the global market and recorded the largest revenue share in 2023.

- The personal vehicle application segment dominated the global market and accounted for a dominant revenue share in 2023.

Dashboard Camera Market: Overview

In today's rapidly evolving automotive landscape, dashboard cameras have emerged as indispensable tools for vehicle owners, offering a myriad of benefits ranging from enhancing safety to providing crucial evidence in the event of accidents. This overview delves into the dynamics shaping the dashboard camera market, encompassing key trends, insights, and growth opportunities driving its expansion.

Dashboard Camera Market Growth

The growth of the dashboard camera market is propelled by several key factors. Firstly, increasing concerns regarding road safety have led to a higher demand for in-car surveillance systems, as consumers seek ways to enhance their safety and security while driving. Additionally, the rising incidence of accidents and the need for reliable evidence in insurance claims and legal proceedings have contributed to the market's expansion. Technological advancements, such as the integration of AI and high-definition video recording capabilities, have further augmented the appeal of dashboard cameras, offering users enhanced functionality and performance. Furthermore, the growing adoption of advanced driver assistance systems (ADAS) has spurred the demand for feature-rich dashcams that complement these systems, driving market growth. Lastly, regulatory mandates in various regions mandating the installation of safety devices in vehicles have also acted as a catalyst for market expansion, as manufacturers and consumers alike prioritize compliance and safety measures.

Dashboard Camera Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 4.05 Billion |

| Market Size by 2033 |

USD 10.32 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 9.8% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Technology, Product, Video Quality, Application, Distribution Channel, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

ABEO Technology CO., Ltd; Amcrest Technologies, LLC; CNSLink Ltd.; Cobra Electronics Corporation; DigiLife Technologies Co. Ltd; DOD Technologies, Inc; FINEDIGITAL INC.; Garmin Ltd.; PPL, incorporated association; Nexar; Panasonic Corporation; Pittasoft Co. Ltd.; Qubo; Shenzhen Zhixingsheng Electronic Co., Ltd.; STEELMATE COMPANY LIMITED; WatchGuard Technologies, Inc.; Waylens, Inc. |

Dashboard Camera Market Dynamics

- Technological Advancements:

The dashboard camera market is characterized by rapid technological advancements, which play a pivotal role in shaping consumer preferences and market dynamics. Manufacturers are continually innovating to incorporate advanced features such as GPS tracking, collision detection, lane departure warning, and night vision into dashboard cameras. These technological enhancements not only improve the functionality and usability of dashcams but also cater to evolving consumer needs for enhanced safety and convenience. Moreover, the integration of artificial intelligence (AI) and machine learning capabilities has enabled dashcams to offer predictive analytics, automatic event detection, and real-time alerts, further augmenting their utility and value proposition.

- Shift towards Dual-Channel Cameras:

A significant trend shaping the dashboard camera market is the increasing adoption of dual-channel cameras, also known as front and rear dashcams. These devices are equipped to record both the front and rear views of the vehicle simultaneously, providing comprehensive surveillance and protection. Dual-channel dashcams are particularly favored by consumers seeking enhanced coverage and documentation of road incidents, including accidents, vandalism, and theft attempts. The growing popularity of dual-channel dashcams can be attributed to the rising awareness of their benefits among consumers, coupled with advancements in technology that enable seamless integration and operation. Additionally, the commercial vehicle segment, including taxis, rideshare vehicles, and delivery fleets, has shown a keen interest in dual-channel dashcams to monitor driver behavior, enhance fleet management, and mitigate liability risks.

Dashboard Camera Market Restraint

- Privacy Concerns and Regulatory Hurdles:

A significant restraint hindering the widespread adoption of dashboard cameras revolves around privacy concerns and regulatory hurdles. While dashcams offer numerous benefits in terms of safety and security, they also raise questions regarding the collection, storage, and sharing of personal data, including video recordings of individuals and their surroundings. As such, there is a growing apprehension among consumers regarding the potential invasion of privacy and misuse of recorded footage. Moreover, varying regulations and legal frameworks governing the use of dashcams across different jurisdictions further complicate matters for manufacturers and users. Compliance with data protection laws, consent requirements, and restrictions on video recording in public spaces pose significant challenges for stakeholders in the dashboard camera market.

Another notable restraint impacting the dashboard camera market is the cost and affordability of dashcam products. While advancements in technology have led to the development of feature-rich dashcams with advanced functionalities, such as GPS tracking, Wi-Fi connectivity, and AI-powered capabilities, these innovations often come at a premium price point. As a result, cost-conscious consumers may perceive dashboard cameras as an additional expense rather than a necessary investment. Moreover, the upfront cost of purchasing dashcams may deter price-sensitive segments of the market, particularly in regions with lower disposable incomes or where dashcams are not deemed essential. Additionally, the cost of installation, maintenance, and potential subscription fees for cloud storage or premium features further add to the total cost of ownership, impacting affordability.

Dashboard Camera Market Opportunity

- Increasing Demand for Fleet Management Solutions:

One significant opportunity within the dashboard camera market lies in the increasing demand for fleet management solutions across various industries. As businesses strive to optimize operational efficiency, enhance driver safety, and mitigate risks associated with vehicle usage, there is a growing emphasis on the integration of dashboard cameras into fleet management systems. Dashcams offer valuable insights into driver behavior, vehicle performance, and incident documentation, enabling fleet operators to monitor and analyze real-time data to make informed decisions. Moreover, features such as GPS tracking, geo-fencing, and driver scorecards enhance route optimization, asset tracking, and compliance management. With the expansion of e-commerce, logistics, and transportation sectors, the demand for comprehensive fleet management solutions equipped with advanced dashboard camera technology is poised to escalate.

- Integration with Connected Car Ecosystem:

Another promising opportunity in the dashboard camera market revolves around the integration of dashcams with the connected car ecosystem. As vehicles become increasingly connected through IoT (Internet of Things) technologies, there is a growing trend towards leveraging in-car data and connectivity to enhance safety, convenience, and overall driving experience. Dashcams equipped with wireless connectivity options, such as Wi-Fi and Bluetooth, can seamlessly integrate with onboard infotainment systems, telematics platforms, and cloud-based services. This integration enables features such as remote monitoring, real-time video streaming, and automatic data synchronization with mobile devices and cloud storage. Furthermore, the integration of dashcams with vehicle-to-everything (V2X) communication systems holds immense potential for enabling advanced driver assistance, predictive analytics, and collaborative safety initiatives.

Dashboard Camera Market Challenges

- Legal and Regulatory Complexity:

One of the primary challenges confronting the dashboard camera market is navigating the complex landscape of legal and regulatory requirements across different jurisdictions. While dashboard cameras offer benefits such as enhanced safety, security, and accountability, their use raises legal and privacy concerns related to data protection, surveillance laws, and admissibility of recorded footage in legal proceedings. Regulations governing the use of dashcams vary widely from country to country and even within regions, leading to uncertainty and ambiguity for manufacturers, retailers, and consumers alike. Compliance with data privacy laws, consent requirements, and restrictions on video recording in public spaces presents a significant challenge for stakeholders in the dashboard camera market. Moreover, evolving regulatory frameworks and potential changes in legislation further add to the compliance burden and risk management considerations.

- Data Security and Cyber Threats:

Another pressing challenge facing the dashboard camera market is ensuring the security and integrity of data captured and stored by dashcams. As dashboard cameras increasingly incorporate advanced features such as Wi-Fi connectivity, cloud storage, and mobile app integration, they become susceptible to cybersecurity threats, including unauthorized access, data breaches, and malware attacks. The proliferation of connected car technologies and IoT (Internet of Things) ecosystems further amplifies the risk of data exposure and exploitation. Given that dashcams may capture sensitive information, including personal identifiable information (PII) and location data, protecting the confidentiality and integrity of recorded footage is paramount. Manufacturers must implement robust encryption protocols, secure authentication mechanisms, and regular software updates to mitigate cybersecurity risks and safeguard user data.

Segments Insights:

Technology Insights

Basic dashboard cameras dominated the market in 2024, primarily due to their affordability, simplicity, and widespread use among private vehicle owners. Basic dash cams typically offer straightforward loop recording, accident detection, and G-sensor features, catering to the needs of budget-conscious consumers. Brands like Yi Technology and Aukey have built significant market presence by offering reliable basic models at attractive price points.

However, smart dashboard cameras are the fastest-growing technology segment, fueled by rising consumer expectations for connected features, real-time monitoring, and AI-driven incident analysis. Smart dash cams offering Wi-Fi connectivity, smartphone apps, voice commands, and cloud storage are gaining traction, especially among tech-savvy younger consumers and commercial fleets aiming for proactive risk management.

Product Insights

1-channel dashboard cameras dominated the market, mainly because they offer a simple, cost-effective solution for front-view recording, which suffices for many personal vehicle owners. These cameras capture oncoming traffic, road conditions, and accidents from a forward-facing angle, which is often adequate for legal or insurance purposes.

Meanwhile, 2-channel dashboard cameras are the fastest-growing segment. Offering both front and rear-view recording capabilities, these systems provide enhanced security against rear-end collisions, parking lot accidents, and vandalism. Popular among rideshare drivers and commercial vehicle operators, dual-camera systems are increasingly being demanded for comprehensive coverage and peace of mind.

Video Quality Insights

SD and HD dashboard cameras held the dominant market share, especially in emerging economies where cost-sensitive consumers prioritize affordability over ultra-high video resolution. Basic models offering 720p to 1080p resolution meet the needs of drivers who require essential footage for insurance or evidence.

Nevertheless, Full HD and 4K dashboard cameras are the fastest-growing video quality segment, driven by the growing consumer preference for crystal-clear footage. High-definition recording is crucial for reading license plates, capturing minute accident details, and providing conclusive evidence. Brands like BlackVue and Thinkware are leading innovation in 4K dash cams, offering features such as night vision and HDR (high dynamic range) capabilities.

Application Insights

Personal vehicle application dominated the dashboard camera market, as private car owners seek to protect themselves from liability, theft, and accidents. The increasing affordability of dash cams and their availability through online and retail channels have made them a popular accessory for everyday drivers.

However, commercial vehicle applications are the fastest-growing segment. The logistics, delivery, taxi, and ride-hailing sectors increasingly equip their fleets with dash cams for driver monitoring, incident verification, and insurance management. Fleet telematics providers are integrating dash cam data with broader fleet management systems, enhancing operational safety and accountability.

Distribution Channel Insights

In-store retail channels dominated the dashboard camera market, particularly in regions where consumers prefer hands-on product evaluation before purchase. Electronics stores, automotive accessory outlets, and specialty retailers continue to play a major role in dash cam sales, offering installation services and post-purchase support.

Conversely, online sales channels are growing at the fastest pace, fueled by the convenience of e-commerce, extensive product variety, customer reviews, and competitive pricing. Online platforms like Amazon, Best Buy, and direct-to-consumer brand websites have expanded dash cam accessibility, especially during the pandemic-driven e-commerce surge.

Regional Insights

Asia-Pacific dominated the dashboard camera market in 2024, with countries like China, South Korea, and Japan leading adoption rates. Dash cams are almost a standard accessory in South Korea and Russia, where legal requirements and insurance policies have encouraged their widespread usage. Additionally, rapid urbanization, a large base of vehicle owners, and rising concerns over road safety drive robust demand across the region.

North America is the fastest-growing region, fueled by rising awareness about vehicle security, surging rideshare vehicle registrations, and favorable insurance discounts for dash cam users. U.S. consumers increasingly view dash cams as essential safety devices, while commercial fleet operators are integrating dash cams with broader telematics platforms. Legal acceptance of dash cam footage in accident disputes further accelerates market growth in the region.

Recent Development

-

March 2025: Garmin announced the launch of its "Garmin Dash Cam Live" featuring LTE connectivity, allowing users to view live footage remotely without relying on Wi-Fi networks.

-

February 2025: BlackVue unveiled its latest DR970X-2CH LTE model, integrating real-time GPS tracking, cloud connectivity, and 4K front + Full HD rear recording.

-

January 2025: Nextbase introduced a new lineup of Series 3 smart dash cams with built-in Alexa voice control, enhanced emergency SOS response features, and auto-sync to cloud storage.

-

December 2024: Thinkware partnered with Verizon Connect to integrate dash cam footage into fleet telematics dashboards, improving fleet safety and incident management for corporate clients.

-

November 2024: Vantrue released its Element 2 model, a 2-channel 2.5K dash cam system with upgraded parking mode surveillance and AI-powered motion detection.

Some of the prominent players in the dashboard camera market include:

- ABEO Technology CO., Ltd

- Amcrest Technologies, LLC

- CNSLink Ltd.

- Cobra Electronics Corporation

- DigiLife Technologies Co. Ltd

- DOD Technologies, Inc

- FINEDIGITAL INC.

- Garmin Ltd.

- Lukas Dashcam

- Nexar Inc.

- Panasonic Corporation

- Pittasoft Co. Ltd.

- Qubo (Hero Electronix)

- Shenzhen Zhixingsheng Electronic Co., Ltd.

- STEELMATE COMPANY LIMITED

- TourMate

- WatchGuard Technologies, Inc.

- Waylens, Inc.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global dashboard camera market.

Technology

Product

- 1-Channel

- 2-Channel

- Rear View

Video Quality

Application

- Commercial Vehicle

- Personal Vehicle

Distribution Channel

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)