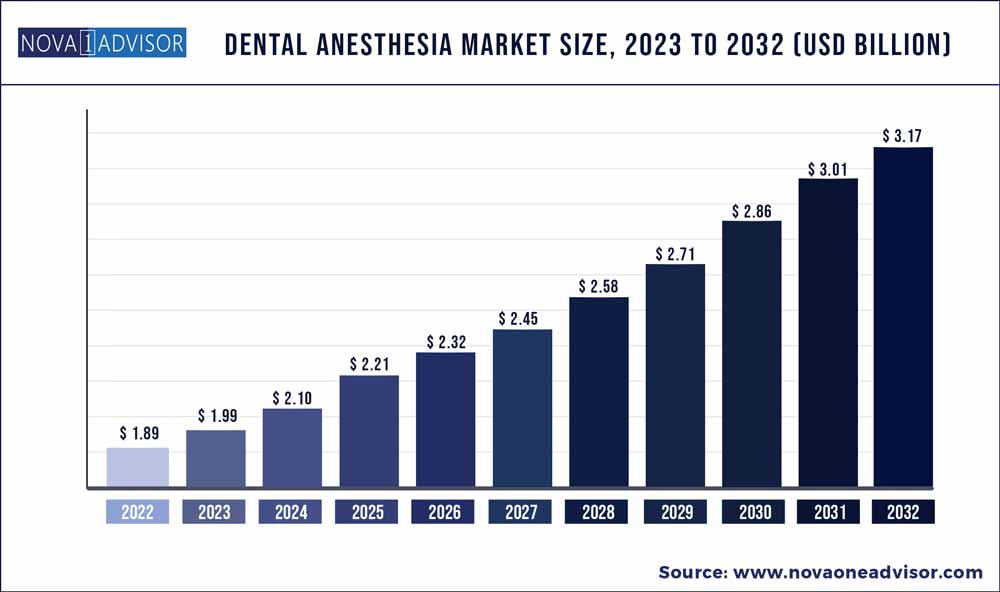

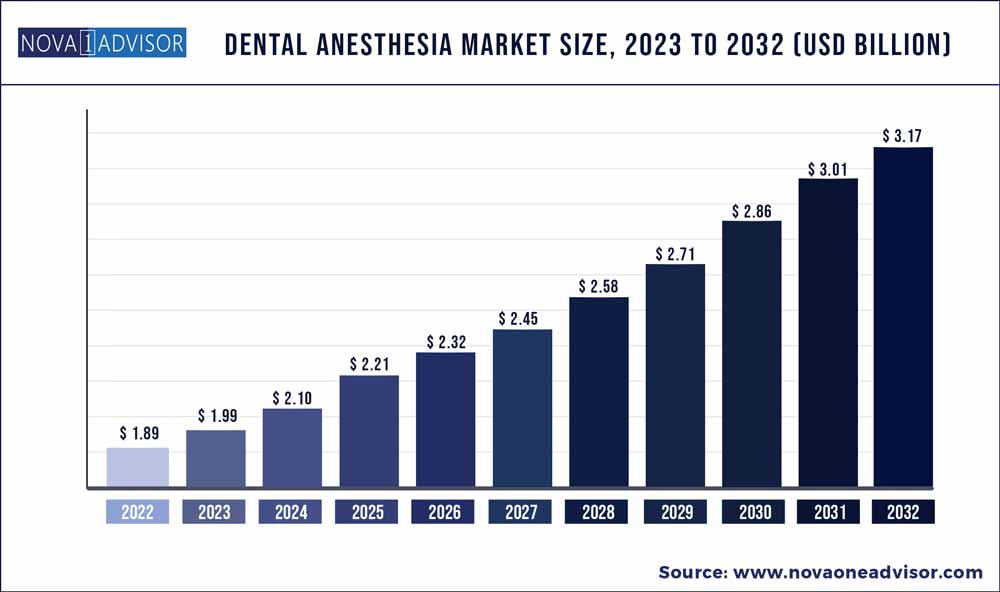

The global dental anesthesia market size was estimated at USD 1.89 billion in 2022 and is expected to surpass around USD 3.17 billion by 2032 and poised to grow at a compound annual growth rate (CAGR) of 5.3% during the forecast period 2023 to 2032. Anesthetics are drugs that can induce reversible sensation loss. They are typically given to help with the surgery. The two vasoconstrictors used in the US are epinephrine and levonordefrin. Dental anesthetics that contain epinephrine include prilocaine, bupivacaine, lidocaine, and articaine. Before performing any dental surgery, dental anesthetics are administered to the inner cheek or gum.

Key Takeaways:

- Local dental anesthesia is expected to dominate the dental anesthesia market in terms of revenue with a market share of 52.8% in 2022.

- The dental clinic end-use segment accounted for the largest share 53.7% in 2022.

- Asia Pacific dominated the dental anesthesia market capturing a 38.6% market share in 2022 and is expected to showcase a significant CAGR in the forecast period.

Dental Anesthesia Market Report Scope

| Report Coverage |

Details |

| Market Size in 2023 |

USD 1.89 Billion |

| Market Size by 2032 |

USD 3.17 Billion |

| Growth Rate From 2023 to 2032 |

CAGR of 5.3% |

| Base Year |

2022 |

| Forecast Period |

2023-2032 |

| Segments Covered |

Type, End-Use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Denstply Sirona; Laboratorios Inibsa; Pierre Pharma; Septodont; Laboratorios Normon; Primex Pharmaceuticals; Aspen Group; Dentalhitec; Zeyco |

The rising cases of dental problems are likely to drive the dental anesthesia market. The market for dental anesthetics will expand dramatically over the next years as a result of rising disposable incomes and rising oral awareness. Dental anesthetic is anticipated to increase in popularity in growing nations like China, India, and Brazil over the next few years because of their rising income levels and relatively high DMFT indices (decayed, missing, and filled teeth index).

Global demand for dental anesthetics is predicted to rise as a result of the rising incidence rate of cancer, periodontitis, and gingivitis. Additionally, it is projected that cigarette and tobacco usage will increase, and dietary habits will change, leading to an increase in maxillofacial and oral dental problems. The market for dental anesthesia is anticipated to develop as a result of the increasing frequency of dental caries and tooth decay around the world, rising public awareness of the value of oral health, and government efforts to improve access to dental care.

COVID-19 has affected all the markets including the dental industry as there was a complete lockdown imposed by the government as a precautionary measure. The supply chain for dental anesthesia was also affected. The pandemic has caused a huge disruption in the supply chain of the overall medical device industry. Due to international constraints, there was a reduction in dental procedures in 2020 and 2022, which had a negative effect on the market due to the coronavirus outbreak. The demand for dental anesthetics is anticipated to rise during the projected period due to rising dental care awareness and shifting demographics.

Type Insights

Based on the type segment, the dental anesthesia market is segmented into local, general, and sedation. Local dental anesthesia is expected to dominate the dental anesthesia market in terms of revenue with a market share of 52.8% in 2022. The most popular kind of anesthesia is a local anesthetic. Simpler treatments, such as filling a cavity, that take less time to complete and are typically less difficult, are treated with a local anesthetic.

In most situations, it is the safest choice and also has few negative effects, hence is preferred the most. Since the eighteenth century, clinical dentists have employed local anesthetics to reduce or eliminate the discomfort associated with invasive procedures. Additionally, oral and maxillofacial surgery commonly makes use of local anesthetics. Dental professionals most frequently utilize local anesthetics (LAs). They are safer medications. More than 40% of dental emergencies result in discomfort that requires an injection of LA.

End-use Insights

Based on end use, the dental anesthesia market is segmented into dental hospitals, dental clinics, and others. The dental clinic end-use segment accounted for the largest share 53.7% in 2022. The growing number of dental offices worldwide and the widespread usage of advanced dentistry by both large and small dental practices are the primary drivers fuelling the growth of the dental clinics segment. It is also projected that the increasing number of dental clinics, especially in developed countries, will accelerate the expansion of the market. Depending on the area, public healthcare provides dentists in industrialized nations with adequate compensation for their treatments and services.

Given the rising popularity of the dental franchise model, there may also be an opportunity for dental clinics to flourish. A dental franchise model offers advantages including increased negotiating power and cost savings through economies of scale. For example, the Indian dental practice chain Clove Dental spent INR 171 crore ($25 million) in September 2018 to grow its franchise network to 600 clinics in India over the following five years. This franchise model aids in lowering treatment and service costs overall, which will increase the number of patients using dental services and propel the market for dental clinics.

Regional Insights

Asia Pacific dominated the dental anesthesia market capturing a 38.6% market share in 2022 and is expected to showcase a significant CAGR in the forecast period. This is due to the increasing number of dental problems among children and adult population and increasing awareness for oral health.

APAC is expected to witness the highest CAGR of 5.7% during the forecast period owing to a favorable government initiative, large population, and availability of developed healthcare facilities in these countries. Dentists in densely populated nations like China and India frequently recommend dental implants to replace missing natural teeth, which are increasing in popularity. These nations also suffer from a significant load of dental and oral disorders, which is leading to increased demand for regular dental visits and checkups. In addition, China and India are currently the greatest producers and consumers of tobacco with the lowest awareness levels about smoking hazards. These are the elements that are anticipated to fuel the market for dental anesthesia in the area.

Some of the prominent players in the Dental anesthesia Market include:

- Dentsply Sirona

- Laboratorios Inibsa

- Pierre Pharma

- Septodont

- Laboratorios Normon

- Primex Pharmaceuticals

- Aspen Group

- Dentalhitec

- Zeyco

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2020 to 2032. For this study, Nova one advisor, Inc. has segmented the global Dental anesthesia market.

Type Outlook

End-use Type

- Hospitals

- Dental Clinics

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)