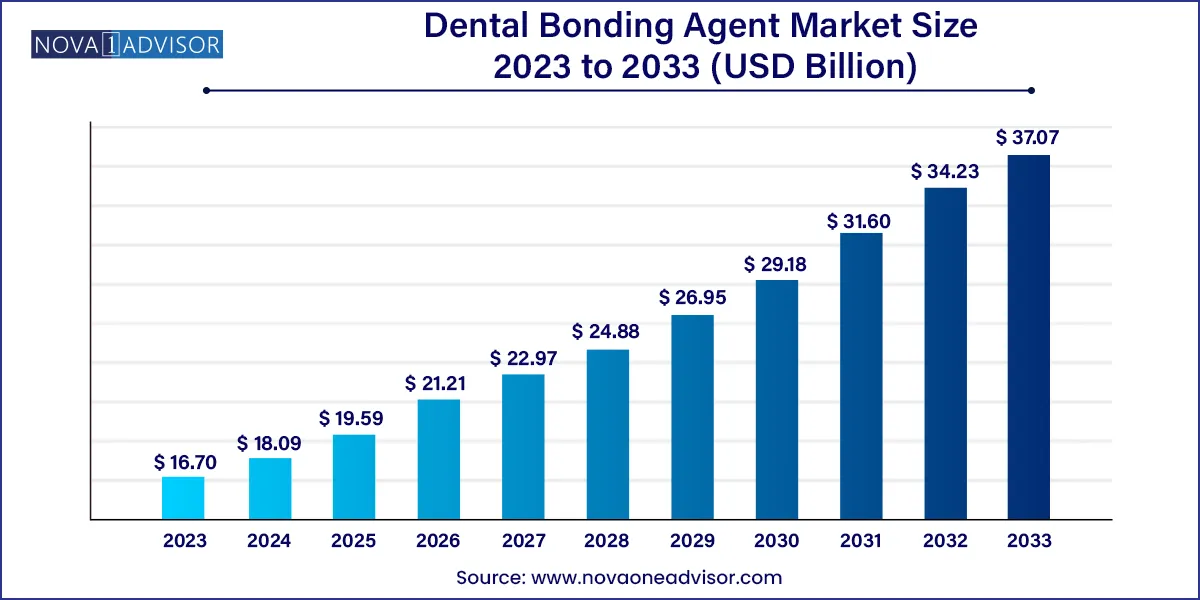

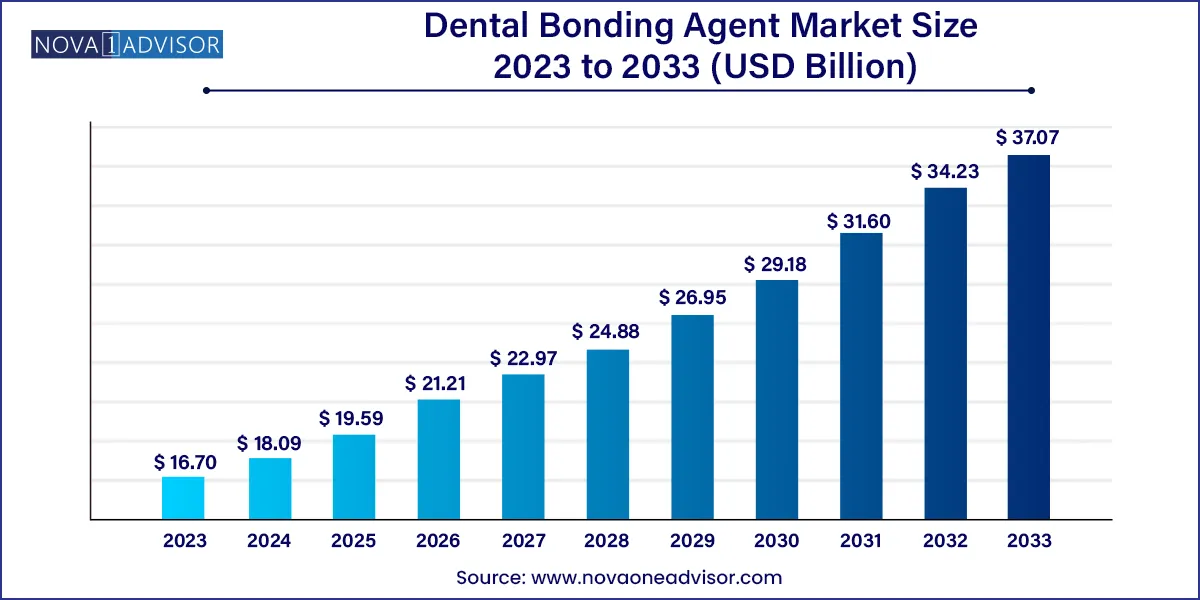

The global dental bonding agent market size was exhibited at USD 16.70 billion in 2023 and is projected to hit around USD 37.07 billion by 2033, growing at a CAGR of 8.3% during the forecast period 2024 to 2033.

Key Takeaways:

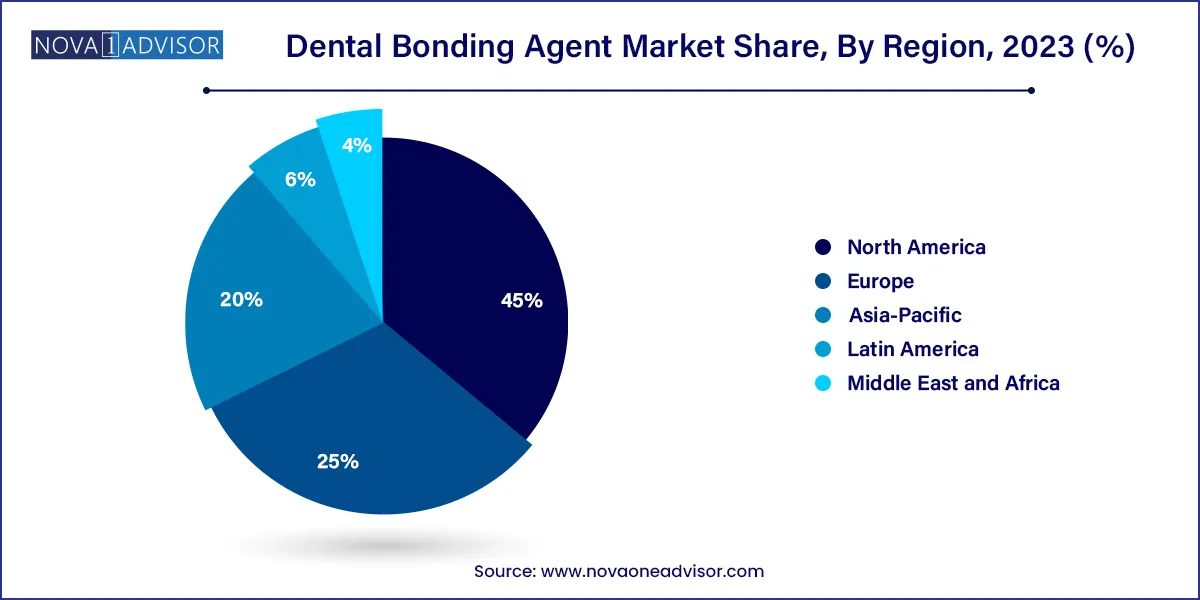

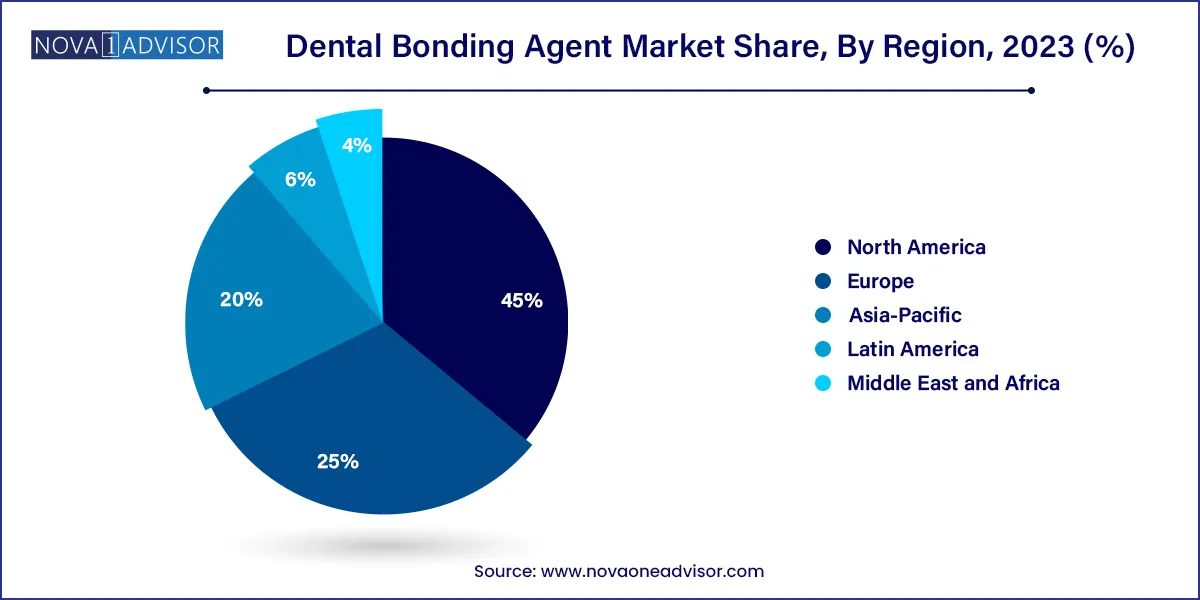

- North America accounted for the largest revenue share of nearly 45.0% in 2023

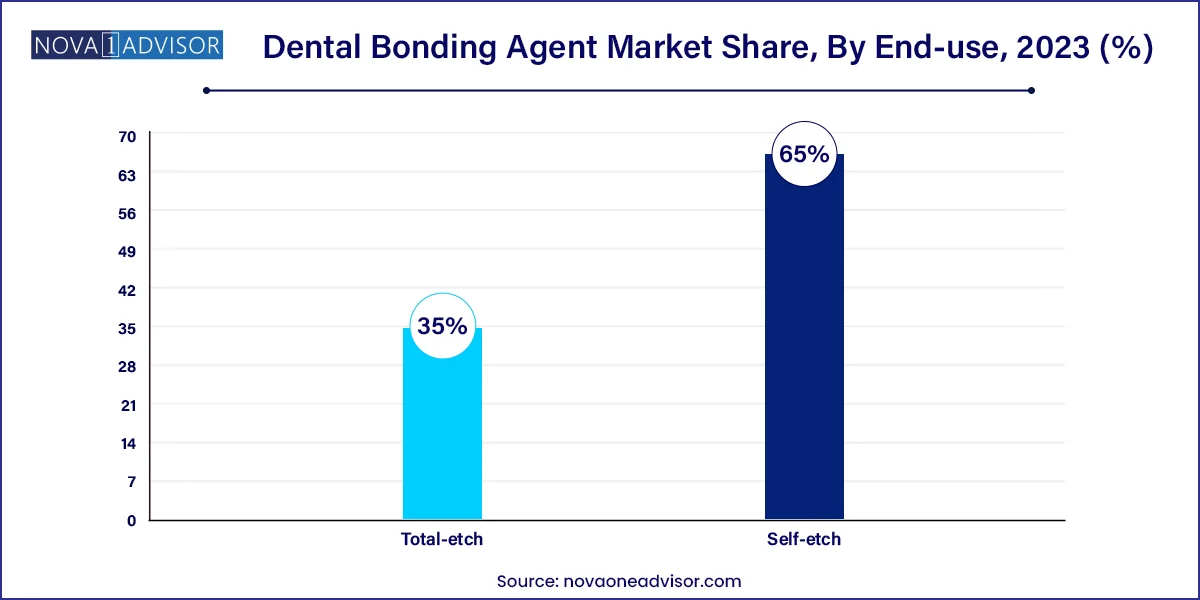

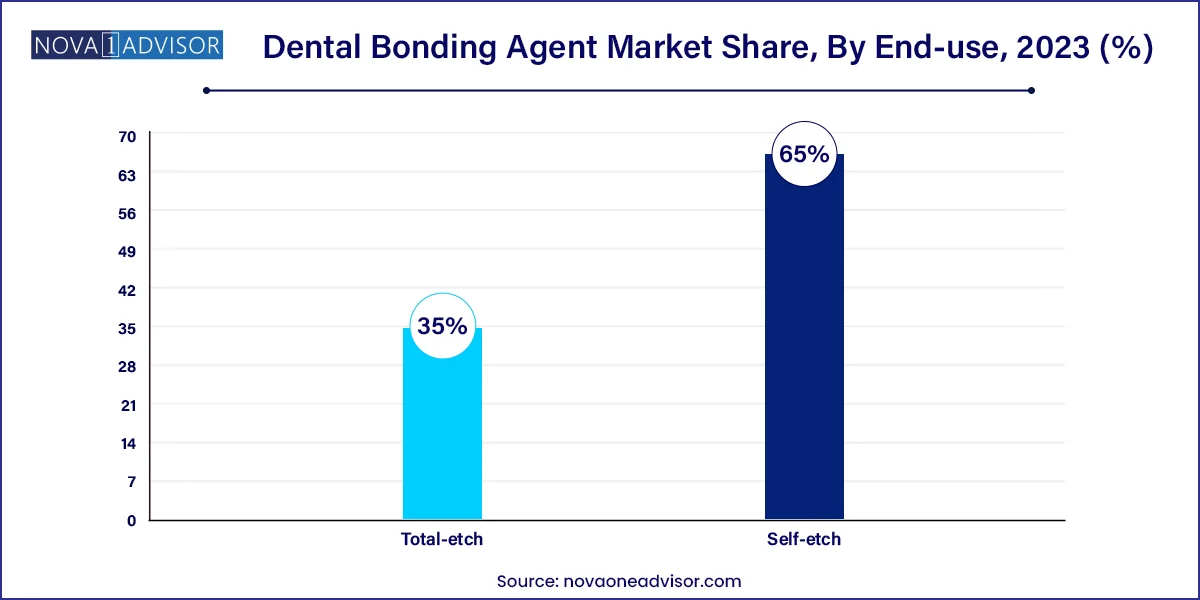

- The self-etch segment accounted for the largest market share of 65.0% in 2023.

- Based on the end-use, the dental clinics segment dominated the market with a revenue share of 63.7%.

Market Overview

The Dental Bonding Agent Market represents a vital and expanding segment within the broader dental materials industry, supporting a wide array of restorative and cosmetic dental procedures. Dental bonding agents—also referred to as adhesives—are used to create a strong, durable bond between dental restoratives such as composites and the tooth’s enamel or dentin. These agents are essential in procedures such as composite fillings, veneers, crowns, orthodontic bracket placements, and cosmetic reshaping.

Driven by the rising global prevalence of dental caries, increased demand for cosmetic dentistry, and advances in adhesive technology, the market is witnessing robust growth. According to the World Health Organization, nearly 3.5 billion people suffer from oral diseases globally, and dental caries in permanent teeth is the most common condition worldwide. As a result, the demand for efficient, minimally invasive, and long-lasting dental restorative procedures is increasing rapidly.

The dental bonding market is characterized by continued innovations with manufacturers focusing on simplifying application techniques, improving adhesion to both enamel and dentin, enhancing bond strength, and reducing post-operative sensitivity. The development of universal adhesives and the integration of nanotechnology and biocompatible compounds into bonding systems are shaping the next generation of products.

The market’s expansion is also fueled by increasing investments in dental infrastructure, especially in emerging economies, along with supportive insurance coverage for dental procedures in many countries. Dental professionals, private clinics, and academic institutions are continuously updating their materials and practices to meet patient expectations for both functional and aesthetic outcomes, thereby driving demand for superior bonding agents.

Major Trends in the Market

-

Emergence of Universal Bonding Agents: Products compatible with both self-etch and total-etch techniques are gaining popularity for their versatility and simplified workflow.

-

Shift Toward Minimally Invasive Dentistry: Demand is rising for bonding agents that support procedures preserving natural tooth structure.

-

Increased Preference for Nanotechnology-based Bonding Systems: Nano-sized fillers improve bond strength and penetration into dental substrates.

-

Growth of Cosmetic Dentistry: Rising consumer demand for aesthetic procedures is accelerating the use of bonding agents in veneers, tooth whitening, and reshaping.

-

Automation and CAD/CAM Integration: Bonding agents compatible with digital dentistry systems are being developed for streamlined indirect restorations.

-

Educational Expansion and Dental Tourism: Growth in dental schools and international dental tourism is contributing to product adoption in developing regions.

-

Environmental and Biocompatibility Concerns: Non-toxic, BPA-free, and biocompatible bonding agents are in demand, particularly in pediatric and preventive dentistry.

Dental Bonding Agent Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 18.09 Billion |

| Market Size by 2033 |

USD 37.07 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 8.3% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Ivoclar Vivadent AG; VOCO America Inc.; DMG America GC America; Danaher Corporation; BISCO Dental Products; Shofu Dental; 3M Company; Pentron Clinical; Dentsply |

Market Driver: Increasing Demand for Aesthetic and Restorative Dentistry

A primary driver of the dental bonding agent market is the growing global emphasis on dental aesthetics and restorative health. In both developed and emerging markets, the focus on achieving a “perfect smile” is increasing, driven by the influence of social media, consumer awareness, and technological advancements in cosmetic dentistry.

Dental bonding agents are integral to procedures such as composite restorations, diastema closures, reshaping of teeth, veneer applications, and crown placements, all of which have become more accessible to the general public. Moreover, the shift from metal-based restorations to tooth-colored, adhesive-based techniques further enhances the relevance of bonding systems in modern dental practice.

As the patient pool seeking restorative care continues to expand particularly among the aging population the need for high-performance bonding materials that offer reliable adhesion to both dentin and enamel is expected to grow significantly.

Market Restraint: Technique Sensitivity and Material Compatibility Challenges

Despite innovations, a notable restraint in the dental bonding agent market is the technique sensitivity of the materials, which may lead to inconsistent clinical outcomes. Dental adhesives, particularly multi-step total-etch systems, require precise moisture control, careful timing, and layered application, all of which demand advanced practitioner skills.

Incorrect application or contamination during the bonding process can compromise the strength and longevity of the restoration. Additionally, compatibility issues between different adhesives and restorative materials (especially resin composites) can reduce effectiveness or even lead to restoration failure.

This complexity can limit adoption in some practices especially in resource-limited settings or among general practitioners prompting a preference for simpler, all-in-one systems, albeit sometimes at the cost of optimal performance. Addressing these challenges through formulation enhancements and better user education remains key to unlocking full market potential.

Market Opportunity: Advancements in Self-Adhesive and Bioactive Bonding Agents

An emerging opportunity lies in the development of self-adhesive and bioactive bonding systems that simplify workflows and improve patient outcomes. Self-etch bonding agents, which require fewer clinical steps and are less technique-sensitive, are gaining momentum for their user-friendliness and time-saving benefits.

Moreover, the introduction of bioactive adhesives those that promote dentin remineralization, release fluoride, or form chemical bonds with tooth structure is revolutionizing how clinicians think about dental adhesion. These systems not only bond restorative materials but also contribute to tooth health, especially in pediatric and geriatric patients with high risk of secondary caries.

As dental science moves toward preventive and regenerative solutions, bonding agents that enhance both clinical performance and biological outcomes are expected to be at the forefront of innovation, offering a distinct value proposition to dental professionals.

Segments Insights:

By Type

Self-etch bonding agents dominate the market due to their simplified clinical protocol and reduced post-operative sensitivity. These adhesives eliminate the need for separate etching and rinsing steps, streamlining the bonding process and minimizing the risk of over-drying or over-etching dentin. As a result, self-etch systems are widely used in general dentistry and favored in pediatric applications where patient cooperation is limited. Their consistent performance in daily practice, along with improved formulations that bond well to enamel and dentin, reinforces their dominant position.

Meanwhile, total-etch bonding agents are the fastest-growing type, particularly in cosmetic and high-strength restorative procedures. These systems are known for superior bond strength, especially to enamel, making them preferred for anterior restorations, veneer bonding, and indirect restorations. As dental professionals gain confidence in adhesive protocols and adopt combination techniques (etch-and-rinse followed by self-etch), the use of total-etch agents is increasing in specialized clinics. Continuous product enhancements, such as dual-cure compatibility and universal application protocols, are expanding this segment's growth.

By End-use

Dental clinics dominate the end-use segment, accounting for the majority of bonding agent consumption. These facilities handle a broad spectrum of dental procedures, from routine fillings and sealants to complex esthetic restorations, making them the largest consumer of adhesive materials. The growing number of private dental clinics globally—particularly in urban centers—and the shift toward private-pay cosmetic procedures further bolster this segment.

However, ambulatory surgical centers are emerging as the fastest-growing end-use category, reflecting the rise in outpatient dental surgeries, particularly implant-supported prosthetics and complex restorations. These centers often adopt advanced adhesive technologies to ensure strong, long-term performance of restorations performed under sedation or in one-day procedures. As the dental ecosystem expands beyond traditional office settings, this segment is expected to contribute increasingly to bonding agent demand.

By Regional Insights

North America currently dominates the global dental bonding agent market, driven by high levels of dental awareness, advanced dental infrastructure, and a strong focus on cosmetic dentistry. The United States, in particular, has a large number of private dental practices offering esthetic procedures where dental bonding agents are used routinely. Reimbursement for restorative care, availability of universal bonding systems, and the presence of leading manufacturers like Dentsply Sirona, 3M, and Ivoclar Vivadent further strengthen the region’s leadership.

Asia-Pacific is the fastest-growing regional market, reflecting rapid urbanization, growing middle-class populations, and increasing expenditure on oral healthcare. Countries such as China, India, South Korea, and Japan are witnessing a surge in dental tourism, digital dentistry adoption, and government-backed dental health initiatives. The expansion of dental schools and training centers in this region also plays a pivotal role in increasing the use of modern bonding materials. As affordability improves and awareness spreads, Asia-Pacific is expected to significantly influence global market dynamics over the next decade.

Some of the prominent players in the Dental bonding agent market include:

- Ivoclar Vivadent AG

- VOCO America Inc.

- DMG America GC America

- Danaher Corporation

- BISCO Dental Products

- Shofu Dental

- 3M Company

- Pentron Clinical

- Dentsply

Recent Developments

-

March 2025 – Dentsply Sirona launched a new version of its Prime&Bond Universal™ adhesive, integrating nanotechnology to enhance bond strength across various substrates.

-

January 2025 – 3M Oral Care announced its next-generation Scotchbond™ Universal Plus adhesive, featuring BPA-free formulation and verified pulp safety, aimed at pediatric and conservative dentistry markets.

-

October 2024 – GC Corporation introduced G-Premio BOND Universal, a multi-purpose bonding agent compatible with both direct and indirect restorations, across European and Asian markets.

-

September 2024 – Kuraray Noritake Dental began U.S. trials for a bioactive dental adhesive system designed to promote dentin regeneration in minimally invasive restorations.

-

August 2024 – Ivoclar Vivadent expanded its Adhese® Universal portfolio with a new dual-cure activator for bulk-fill composite workflows in North America and Europe.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2023 to 2033. For this study, Nova one advisor, Inc. has segmented the global dental bonding agent market.

Type

End-use

- Hospitals

- Dental Clinics

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)