Dental Fluoride Treatment Market Size and Trends

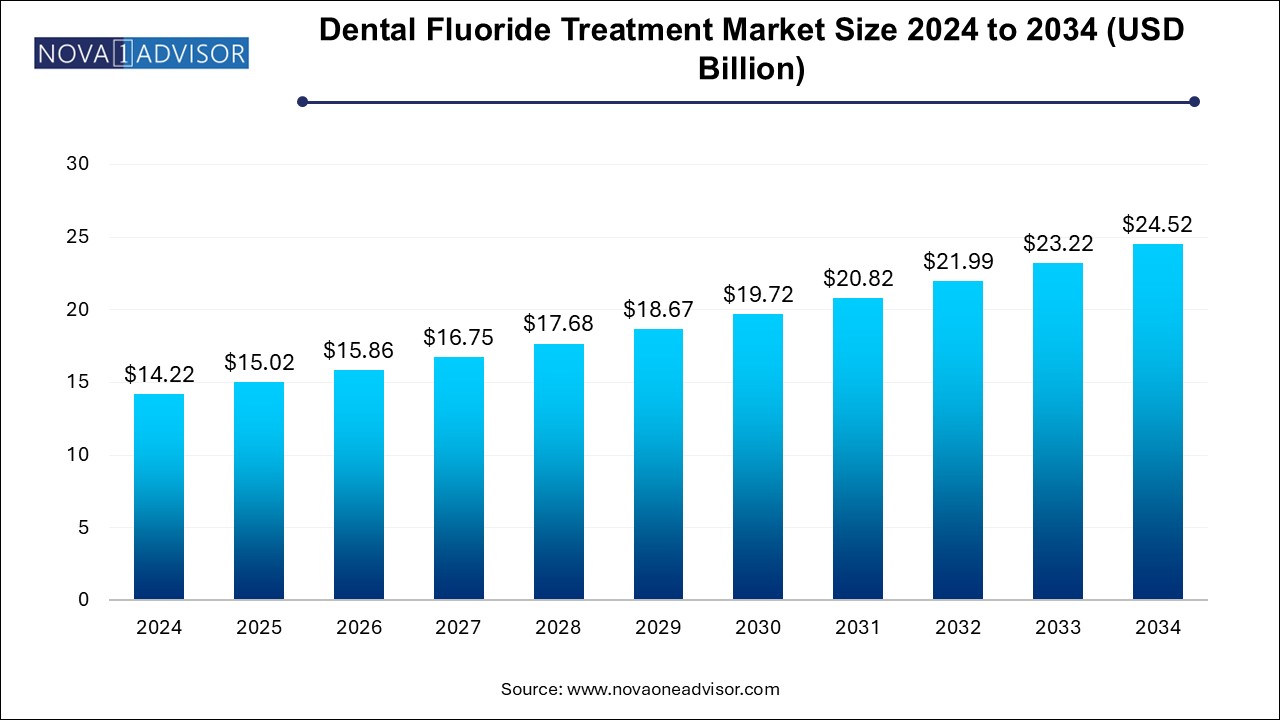

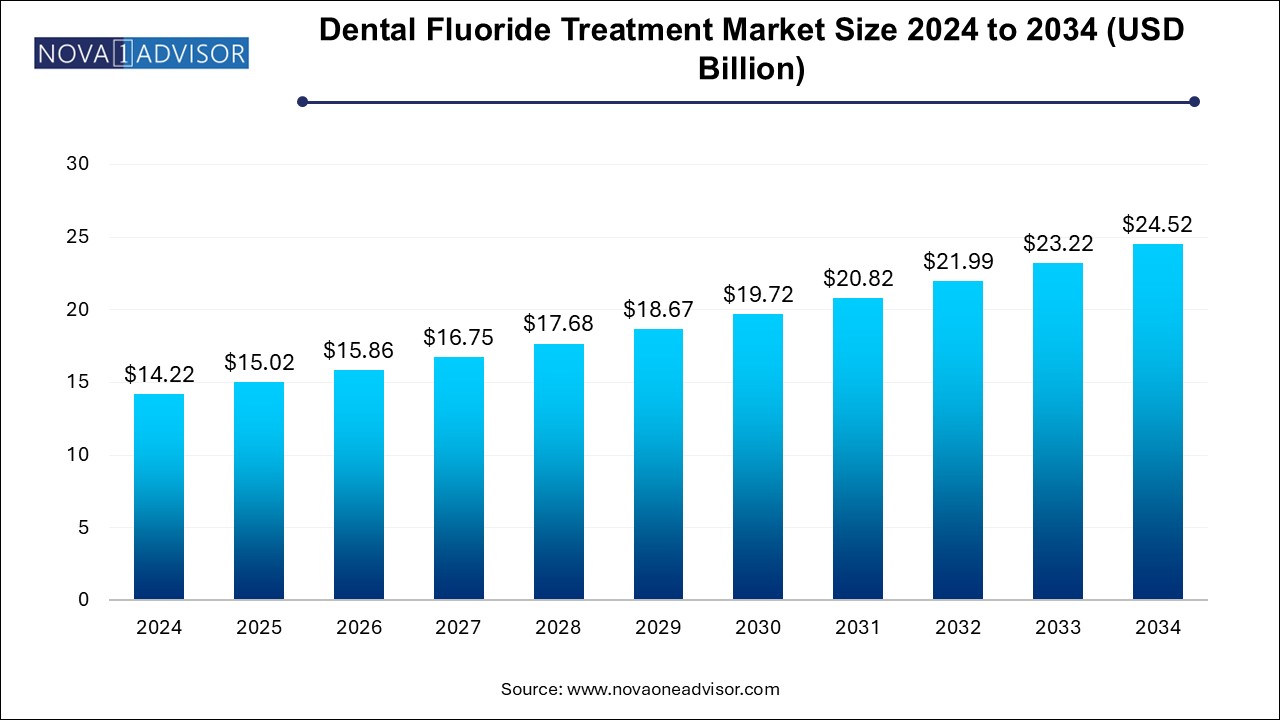

The dental fluoride treatment market size was exhibited at USD 14.22 billion in 2024 and is projected to hit around USD 24.52 billion by 2034, growing at a CAGR of 5.6% during the forecast period 2024 to 2034.

Market Overview

The Dental Fluoride Treatment Market is experiencing robust expansion, driven by the growing global awareness of oral hygiene and the widespread prevalence of dental caries. Fluoride-based products, ranging from daily-use toothpaste to professionally applied varnishes, are foundational tools in the prevention of tooth decay and the remineralization of enamel. With fluoride proven to reduce cavities by as much as 25% in both children and adults, its role in dental care is both preventive and restorative.

Fluoride treatment has evolved from a basic mineral additive in toothpaste to a diverse therapeutic segment encompassing gels, varnishes, rinses, and dietary supplements. These products are recommended not just by dentists but also by health organizations like the American Dental Association (ADA) and the World Health Organization (WHO) as essential public health interventions. The expansion of dental insurance in both developed and emerging markets, coupled with government-supported fluoridation programs, is creating favorable conditions for industry growth.

Changing dietary patterns, increased sugar consumption, and aging populations are contributing to a higher incidence of dental issues, necessitating the use of fluoride treatments across various age groups. Moreover, advancements in delivery formats, such as slow-release fluoride varnishes and dual-action rinses, are improving consumer compliance and product effectiveness. With innovation and accessibility at the core of industry growth, the market continues to gain traction among both consumers and dental professionals globally.

Major Trends in the Market

-

Rising Adoption of Preventive Dentistry: Increasing emphasis on preventive care rather than curative interventions is boosting demand for fluoride-based prophylactic products.

-

Increased Demand for Pediatric Dental Care: Growing awareness among parents about early-age oral hygiene is accelerating the use of fluoride gels and varnishes for children.

-

Expansion of In-office Fluoride Therapies: Dental clinics and hospitals are expanding their treatment portfolios to include more intensive fluoride applications like high-concentration varnishes.

-

Clean-label and Natural Fluoride Products: Consumer demand for fluoride sourced from natural minerals is giving rise to organic, eco-certified variants.

-

Technological Integration in Dental Practices: Smart dispensers and application systems are being used in clinical settings for accurate dosing and enhanced patient safety.

-

Personalized Oral Care Solutions: AI-powered tools and at-home diagnostics are encouraging customization of fluoride treatment based on individual dental risk assessments.

-

Regulatory Support for Water Fluoridation: Government initiatives promoting water fluoridation in public supply systems continue to validate the use of fluoride in oral health.

-

Growth of E-commerce Distribution Channels: Online sales of dental fluoride products, especially in emerging markets, are surging due to accessibility and variety.

-

Focus on Sustainable Packaging: Eco-friendly packaging for toothpaste and mouth rinses is gaining popularity in line with global sustainability goals.

-

Integration of Probiotics in Fluoride Products: Innovative formulations combining fluoride with probiotics aim to balance oral microbiota while strengthening enamel.

Report Scope of Dental Fluoride Treatment Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 15.02 Billion |

| Market Size by 2034 |

USD 24.52 Billion |

| Growth Rate From 2024 to 2034 |

CAGR of 5.6% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

Colgate-Palmolive; Philips N.V.; Dentsply Sirona; VOCO; DÜRRDENTAL; Young Dental; Ivoclar Vivadent; Ultradent Products; DMG Dental; Church & Dwight |

One of the most significant drivers of the dental fluoride treatment market is the high global prevalence of dental caries (tooth decay), which remains a public health concern even in high-income countries. According to the Global Burden of Disease Study, nearly 2.5 billion people suffer from untreated dental caries in permanent teeth. In children, dental cavities are one of the most common non-communicable diseases, impacting nutrition, self-esteem, and academic performance.

Fluoride's role in combating demineralization and enhancing enamel resistance is well documented. Consequently, regular fluoride treatments are considered essential across all age groups, particularly for high-risk individuals. From fluoridated toothpaste used daily to professionally administered fluoride varnishes for those with severe enamel erosion, the increasing incidence of dental caries has led to a surge in demand for fluoride-based solutions. This demand is further amplified by dental professionals’ recommendations and preventive dental care guidelines set forth by leading health authorities.

Key Market Restraint: Fluoride Overexposure and Public Skepticism

Despite its proven benefits, the potential health risks associated with excessive fluoride exposure serve as a key market restraint. Long-term overexposure, particularly in areas with naturally high levels of fluoride in water, can lead to dental and skeletal fluorosis. While mild dental fluorosis is mostly aesthetic and non-threatening, severe cases can result in brown stains and pitting of the enamel.

Moreover, the internet and social media have amplified skepticism about fluoride safety. Anti-fluoride movements in some parts of the U.S. and Europe advocate against water fluoridation and excessive use of fluoride-containing products, claiming links to neurological issues and other systemic effects. Although these claims often lack scientific consensus, they influence consumer behavior and policy decisions. Regulatory scrutiny and a push for “fluoride-free” alternatives among niche consumer segments may limit the potential adoption of fluoride treatments, particularly among young adults and pregnant women.

Key Market Opportunity: Integration of Fluoride into Cosmetic Dental Treatments

The growing consumer interest in aesthetic dentistry presents a major opportunity for integrating fluoride treatments into cosmetic dental services. As procedures like teeth whitening, veneers, and orthodontic alignments become increasingly mainstream, there is rising awareness of the potential damage these treatments can cause to tooth enamel.

Many dental practices are now offering post-treatment fluoride therapies to protect enamel from sensitivity and erosion following cosmetic procedures. For example, after a bleaching session, dentists may apply a fluoride varnish to reinforce enamel and reduce post-procedure discomfort. This crossover between cosmetic enhancement and preventive treatment opens up a new revenue stream for fluoride-based products, particularly in urban clinics and high-income markets. The convergence of beauty and oral health thus represents a powerful growth lever for manufacturers and service providers alike.

Dental Fluoride Treatment Market By Product Insights

Toothpaste continues to dominate the dental fluoride treatment market owing to its widespread usage, affordability, and easy availability. As the most common form of fluoride delivery, toothpaste reaches a massive demographic, from children to seniors. It plays a foundational role in daily oral hygiene routines and is often the first point of fluoride contact for most individuals. The inclusion of fluoride in nearly all commercially available toothpaste brands has contributed to significant reductions in dental caries worldwide. Moreover, specialized variants such as anti-sensitivity, whitening, and cavity-protection formulations cater to diverse consumer needs, reinforcing this segment’s leadership.

Varnishes are emerging as the fastest-growing product segment, largely due to their increasing adoption in clinical settings. Fluoride varnishes, typically applied by dental professionals, offer high-concentration fluoride delivery and are especially useful for patients at high risk of caries or enamel demineralization. Their long-lasting effect—sticking to the enamel for several hours—makes them highly effective, particularly in pediatric dentistry. Recent innovations such as flavored varnishes and rapid-set formulas have improved patient compliance and comfort. Additionally, public health programs in schools are increasingly using varnish applications to reduce childhood caries, further propelling the growth of this segment.

Dental Fluoride Treatment Market By Regional Insights

North America maintains its dominance in the dental fluoride treatment market due to the integration of fluoride therapy in standard dental practice and public health policy. The U.S., in particular, has implemented fluoride addition in public water supplies since the mid-20th century, benefiting millions. According to the CDC, nearly 73% of the U.S. population had access to fluoridated water as of 2022. Dental offices in the U.S. and Canada regularly use fluoride varnishes and gels as part of standard cleanings, especially for children, teenagers, and the elderly. Coupled with a well-established dental insurance ecosystem and high per capita dental expenditure, the region continues to be the global hub for fluoride innovation and application.

Asia Pacific is witnessing rapid transformation in oral health awareness and access. Governments in countries such as India, Thailand, and Indonesia are promoting fluoride-based interventions through school dental health programs and public campaigns. For instance, Japan, despite already having one of the lowest caries rates globally, has increased investment in fluoride mouth rinsing programs for schoolchildren. The combination of traditional oral care practices with modern fluoride-based therapies is gaining traction. Rising disposable income, urban migration, and the presence of global dental brands are enabling more consumers to access advanced fluoride products. Additionally, domestic companies are developing low-cost fluoride toothpaste and gels, making them affordable for a broader population.

Some of the prominent players in the dental fluoride treatment market include:

- Colgate-Palmolive

- Philips N.V.

- Dentsply Sirona

- VOCO

- DÜRRDENTAL

- Young Dental

- Ivoclar Vivadent

- Ultradent Products

- DMG Dental

- Church & Dwight

Recent Developments

-

March 2025 – Colgate-Palmolive launched a new fluoride toothpaste line in India called "Total Defense," with dual-action antibacterial and fluoride protection targeting enamel erosion caused by urban pollution and acidic diets.

-

January 2025 – GC Corporation, a leading Japanese dental company, introduced a new fluoride varnish called “MI Varnish Plus” across European markets, which includes bioavailable calcium and phosphate for enhanced remineralization.

-

November 2024 – 3M Oral Care announced the expansion of its fluoride varnish production facility in the U.S. to meet growing demand from pediatric and geriatric dental segments, particularly in community dental clinics.

-

September 2024 – Dentsply Sirona partnered with dental universities in Latin America to roll out a fluoride rinse awareness program aimed at reducing early childhood cavities.

-

June 2024 – Procter & Gamble reformulated its Oral-B toothpaste range with stannous fluoride for enhanced antimicrobial protection, launching in North America and select European countries.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the dental fluoride treatment market

Product

- Toothpaste

- Varnish

- Gel

- Mouth Rinse

- Supplements

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)