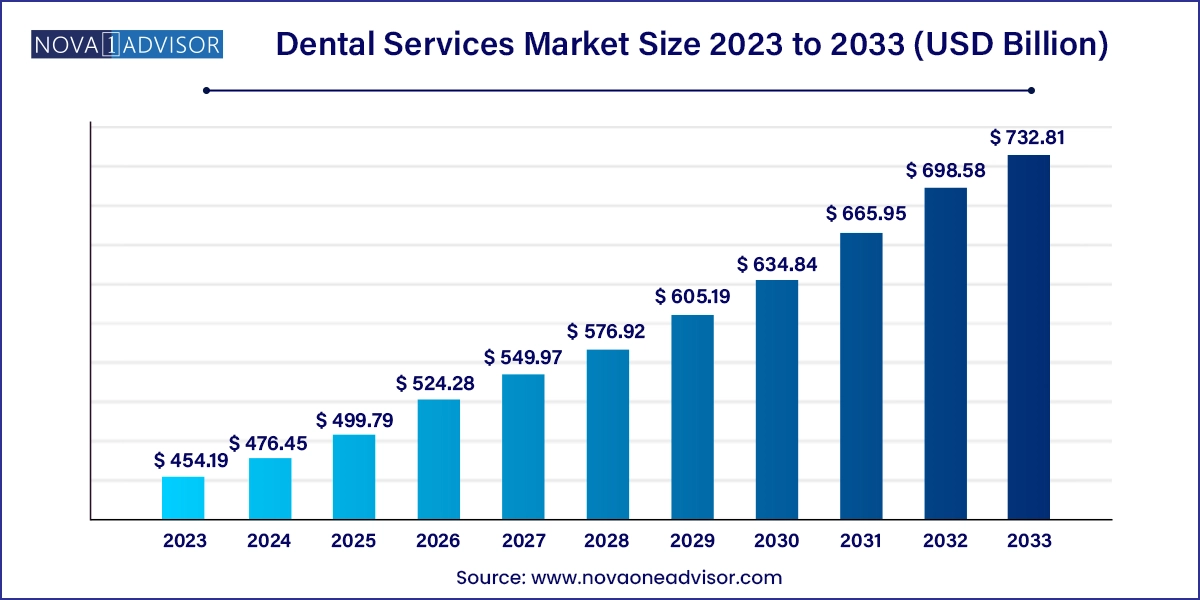

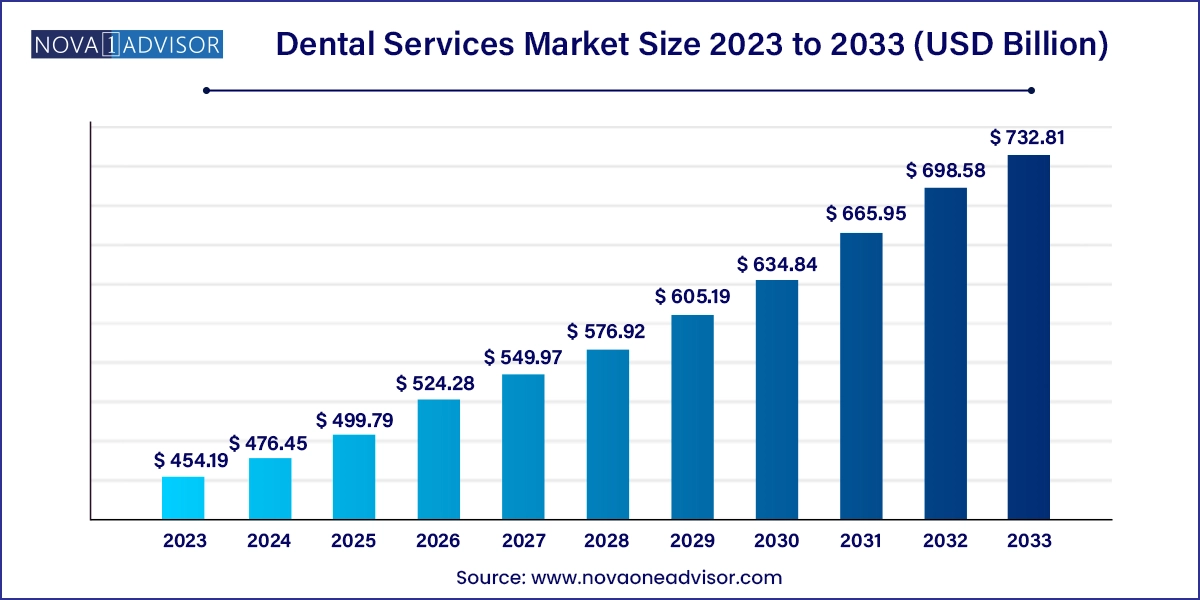

Dental Services Market Size and Growth

The global dental services market size was valued at USD 454.19 billion in 2023 and is anticipated to reach around USD 732.81 billion by 2033, growing at a CAGR of 4.9% from 2024 to 2033.

Market Overview

The Dental Services Market plays a pivotal role in the global healthcare ecosystem, encompassing a wide array of preventive, restorative, and cosmetic procedures aimed at maintaining oral health. With growing awareness of dental hygiene, the aging population, rising disposable incomes, and increased access to dental insurance, the market is witnessing robust growth across both developed and emerging regions.

From routine cleanings to advanced procedures such as dental implants, orthodontics, and full-mouth reconstruction, dental services have evolved considerably. Technology integration, particularly in diagnostics and treatment planning such as 3D imaging, computer-aided design and manufacturing (CAD/CAM), and laser-assisted surgery has revolutionized care delivery, improving precision and patient outcomes.

The market is also experiencing a shift in patient expectations. Oral health is no longer limited to functional restoration; aesthetic enhancement has become equally important. Cosmetic dentistry has seen unprecedented demand, fueled by the influence of social media, celebrity culture, and advancements in painless treatment methods. Furthermore, the growing trend of dental tourism where patients travel across borders to seek cost-effective and high-quality treatments is redefining competitive dynamics in the industry.

Despite being traditionally fragmented, the market is consolidating with the emergence of dental service organizations (DSOs), which offer corporate-backed, standardized care through networked dental chains. These entities are transforming dentistry from a solo-practitioner model to a scalable, technology-driven business.

Major Trends in the Market

-

Rising Popularity of Cosmetic Procedures: Teeth whitening, veneers, and smile makeovers are increasingly in demand due to rising aesthetic consciousness.

-

Growth of Digital Dentistry: CAD/CAM, intraoral scanners, and AI-driven diagnostics are enhancing speed and accuracy.

-

Expansion of Dental Service Organizations (DSOs): Corporate-backed clinics are expanding in the U.S., Europe, and increasingly in Asia-Pacific.

-

Increase in Dental Tourism: Countries like Hungary, Mexico, and India are becoming hubs for affordable, high-quality dental treatments.

-

Preventive Dentistry Awareness: Governments and healthcare providers are investing in early intervention and education programs.

-

Integration of Laser Dentistry: Minimally invasive and less painful, laser tools are becoming common in periodontal and cosmetic treatments.

-

Home Dental Services & Mobile Clinics: Especially in remote or elderly populations, mobile dentistry is emerging as a viable service model.

Dental Services Market Report Scope

| Report Attribute |

Details |

| Market Size in 2024 |

USD 476.45 Billion |

| Market Size by 2033 |

USD 732.81 Billion

|

| Growth Rate From 2024 to 2033 |

CAGR of 4.9% |

| Base Year |

2023 |

| Forecast Period |

2024 to 2033 |

| Segments Covered |

By Procedure Type, By Service Type, and By End User Type |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Report Coverage |

Revenue forecast, company ranking, competitive landscape, growth factors, and trends |

| Key Companies Profiled |

Smile 360, Pacific Dental Services, Dental Services Group, Axiss Dental, Q & M Dental Group, Apollo White Dental, Coast Dental, Gentle Dental of New England, Abano Healthcare Group, Healthway Medical Corporation. |

Market Driver: Growing Demand for Aesthetic and Cosmetic Dentistry

A primary driver behind the expansion of the dental services market is the surging demand for aesthetic enhancement, primarily through cosmetic dentistry. Aesthetic treatments, once considered luxury services, have entered the mainstream. Social media, online dating, and video conferencing (especially post-pandemic) have significantly heightened the importance of appearance and smile aesthetics.

Procedures such as veneers, bonding, whitening, and Invisalign clear aligners are gaining traction across age groups. For example, millennials and Gen Z patients are increasingly seeking smile makeovers before weddings or major life events. The accessibility of interest-free dental financing and the decreasing invasiveness of procedures have also contributed to the wider adoption of cosmetic treatments.

Dental practitioners are responding by incorporating modern materials (like zirconia and composite resins), 3D printing, and digital smile design tools to create personalized treatment plans with greater precision and predictability. The result is a growing intersection between oral healthcare and personal aesthetics, driving patient volumes and profitability.

Market Restraint: High Cost of Dental Treatments

Despite the growing awareness and demand, the high cost associated with dental procedures remains a key limiting factor, particularly in low-income and uninsured populations. Unlike general healthcare services, dental care is often inadequately covered under insurance plans in many countries, leaving patients to bear a significant out-of-pocket burden.

Advanced procedures like implants, full-mouth reconstruction, or orthodontics can cost thousands of dollars well beyond the reach of average households in many regions. Even preventive services like routine cleanings or cavity fillings are sometimes skipped due to affordability issues, especially in regions without robust public healthcare.

This cost barrier is exacerbated by disparities in rural versus urban access, where fewer providers operate in underserved communities. Consequently, while urban, affluent populations drive premium service uptake, large swaths of the population remain underserved posing a challenge to market inclusivity and universal oral health objectives.

Market Opportunity: Technological Integration and Tele-Dentistry

An emerging opportunity that is reshaping the dental services landscape is the integration of digital technology and tele-dentistry platforms. Digital workflows—from diagnostics to treatment planning are improving patient experiences, reducing treatment times, and minimizing human error. For instance, digital impressions using intraoral scanners eliminate the discomfort associated with traditional molding, while CAD/CAM systems allow same-day crown placement.

Moreover, tele-dentistry is extending access to oral care in remote and rural areas. Virtual consultations, especially for orthodontic evaluations and follow-ups, reduce the need for frequent in-person visits and enable dentists to triage patients more efficiently. The COVID-19 pandemic accelerated the use of virtual platforms, many of which have since been institutionalized within clinics and public health programs.

AI is also being embedded in radiographic analysis and clinical decision-making tools, enhancing diagnostic accuracy and helping practitioners prioritize care. These innovations not only improve efficiency and outcomes but also open the door for scalable, accessible, and inclusive dental care models worldwide.

By Procedure

Non-cosmetic dentistry holds the dominant share of the dental services market, largely due to its foundational role in preventive, diagnostic, and restorative care. Services under this category—like fillings, root canals, cleanings, and periodontal treatments—are essential for maintaining oral health. Government campaigns, school dental programs, and insurance-covered treatments continue to drive volume for non-cosmetic procedures. For instance, the NHS in the UK and Medicaid programs in the U.S. fund millions of basic dental treatments annually, reflecting their importance in public health infrastructure.

In contrast, cosmetic dentistry is the fastest-growing segment. Driven by the rise of aesthetic awareness, this category has seen a boom in elective procedures like veneers, teeth whitening, and smile design. Clear aligners (e.g., Invisalign), preferred for their discreet appearance, have especially gained momentum. Clinics offering subscription or EMI-based payment models have lowered the barrier for patients to opt for aesthetic enhancements. Celebrities and influencers openly sharing their smile transformation journeys have also added social validation, turning cosmetic dentistry into a lifestyle choice.

By Service

Dental implants dominate the services segment due to their effectiveness in addressing tooth loss, particularly among aging populations. The procedure has evolved significantly, with innovations like guided implant surgery, immediate loading, and advanced imaging improving success rates and patient comfort. With higher awareness and longer lifespans, older adults are increasingly opting for implants over traditional dentures for both functional and aesthetic reasons. Additionally, premium materials such as zirconium and titanium, along with improved techniques, are making implants more accessible.

Laser dentistry is emerging as the fastest-growing service segment. Offering reduced pain, faster healing, and greater precision, lasers are being used in a range of applications—from gingival reshaping and periodontal therapy to whitening and lesion removal. Pediatric and anxiety-prone patients benefit significantly from the minimally invasive nature of laser-based procedures. As more practitioners undergo specialized training and invest in laser units, the application of this technology is expected to expand across general and cosmetic practices.

By Gender

Female patients currently dominate the dental services market, particularly in cosmetic and preventive care. Surveys and clinic data consistently show that women are more proactive in seeking regular dental checkups and aesthetic enhancements. This demographic is also more responsive to marketing campaigns focused on smile aesthetics, personal grooming, and facial harmony.

However, the male segment is catching up, particularly in areas like orthodontics, implants, and preventive care. Increased focus on appearance, workplace confidence, and online dating trends have pushed more men to explore aesthetic dental options. Clinics are now targeting this segment with tailored services and marketing strategies, indicating potential for long-term growth.

By End User

Dental clinics are the leading end-user, primarily due to their accessibility, specialized services, and personalized care delivery. Independent practices and chain clinics alike offer a range of services—from basic cleanings to complex surgical interventions. The rise of corporate-backed chains (e.g., Aspen Dental, Pacific Dental Services) has brought scalability and consistent quality standards to clinic-based models. Additionally, dental tourism relies heavily on private clinics that cater to international patients seeking affordable, high-quality treatments.

Hospitals, while currently a smaller segment, are gaining traction in cases involving complex oral and maxillofacial surgeries, trauma care, and interdisciplinary procedures. Multispecialty hospitals, particularly in urban centers, now include dedicated dental departments equipped with advanced imaging, surgical suites, and multidisciplinary expertise. This segment is expected to expand further with rising cases of oral cancers, congenital anomalies, and trauma cases requiring coordinated medical and dental care.

Regional Analysis

North America leads the global dental services market due to its advanced healthcare infrastructure, high awareness, and large base of dental professionals. The U.S. and Canada collectively host thousands of dental practices offering advanced treatments and leveraging cutting-edge technologies. The presence of numerous DSOs, such as Heartland Dental and Aspen Dental, supports the industry’s growth through scalable operations, streamlined services, and aggressive expansion.

Insurance penetration, especially among employer-sponsored plans, encourages preventive and restorative care among insured populations. Furthermore, the U.S. is at the forefront of innovation in cosmetic and laser dentistry, with many clinics adopting AI-based diagnostics and chairside CAD/CAM workflows. Academic institutions and continuing education platforms also foster a culture of clinical excellence and technology adoption.

Asia-Pacific: Fastest Growing Region

Asia-Pacific is the fastest-growing region in the dental services market, fueled by rising disposable incomes, expanding middle-class populations, and improved access to care. Countries like India, China, Thailand, and South Korea are witnessing a surge in dental clinics, cosmetic procedures, and medical tourism. For example, Thailand is known globally for its affordable, high-quality dental care, attracting thousands of international patients annually.

Government initiatives such as India’s National Oral Health Program and China’s Healthy China 2030 campaign are also promoting dental awareness and accessibility. Private sector investments, especially in metro and tier-2 cities, are expanding dental service availability beyond urban elites. The proliferation of smartphone apps for appointment booking, tele-dentistry, and treatment financing is further accelerating market penetration across the region.

Dental Services Market Top Key Companies:

- Pacific Dental Services

- Dental Services Group

- Q & M Dental Group

- Apollo White Dental

- Coast Dental

- Axiss Dental

- Gentle Dental of New England

- Abano Healthcare Group

- Smile 360

- Healthway Medical Corporation

Recent Developments

-

February 2025: SmileDirectClub expanded its global footprint by launching clear aligner services in Brazil, aiming to tap into Latin America’s rising cosmetic dentistry demand.

-

November 2024: Pacific Dental Services announced a partnership with Straumann Group to enhance digital implant services across its U.S. clinics.

-

October 2024: Dentsply Sirona launched a new intraoral scanner with AI integration, allowing real-time diagnosis and improved chairside workflows.

-

August 2024: Clove Dental (India) opened its 500th clinic and announced plans to expand to tier-3 cities to boost affordable access to quality care.

-

June 2024: Heartland Dental introduced a new DSO-led continuing education program to train dental practitioners in digital and cosmetic dentistry techniques.

Dental Services Market Report Segmentation

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the Dental Services market.

By Procedure

- Cosmetic Dentistry

- Non-Cosmetic Dentistry

By Service

- Dental Implants

- Orthodontics

- Periodontics

- Root Canal - Endodontics

- Cosmetic Dentistry

- Laser Dentistry

- Dentures

- Oral and Maxillofacial Surgery

- Smile Makeover

- Others

By Gender

By End User

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)