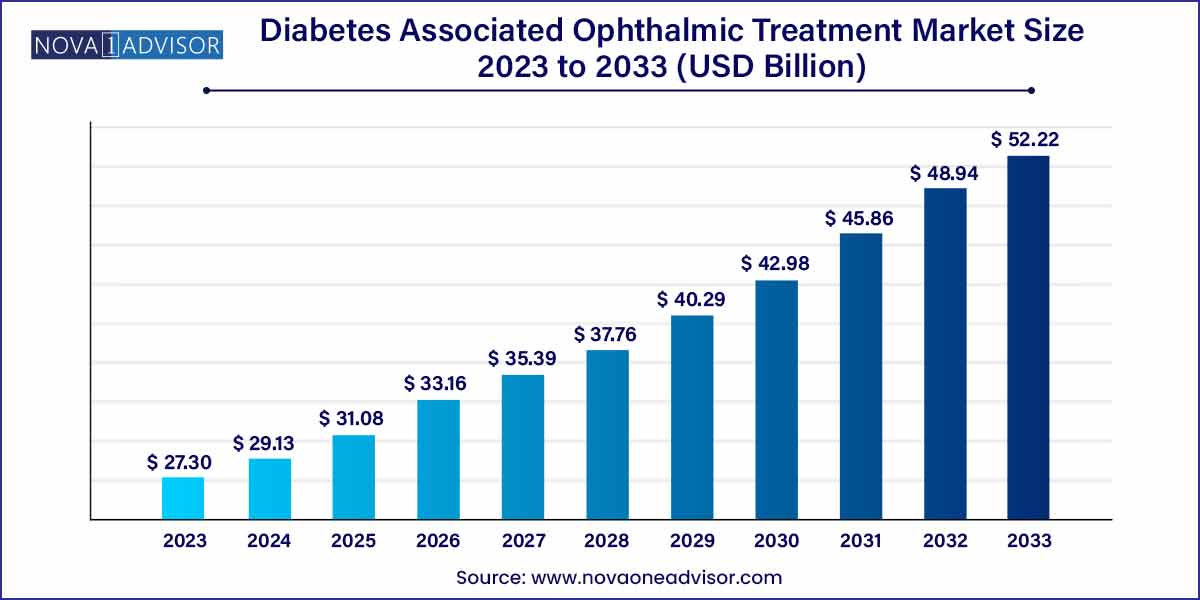

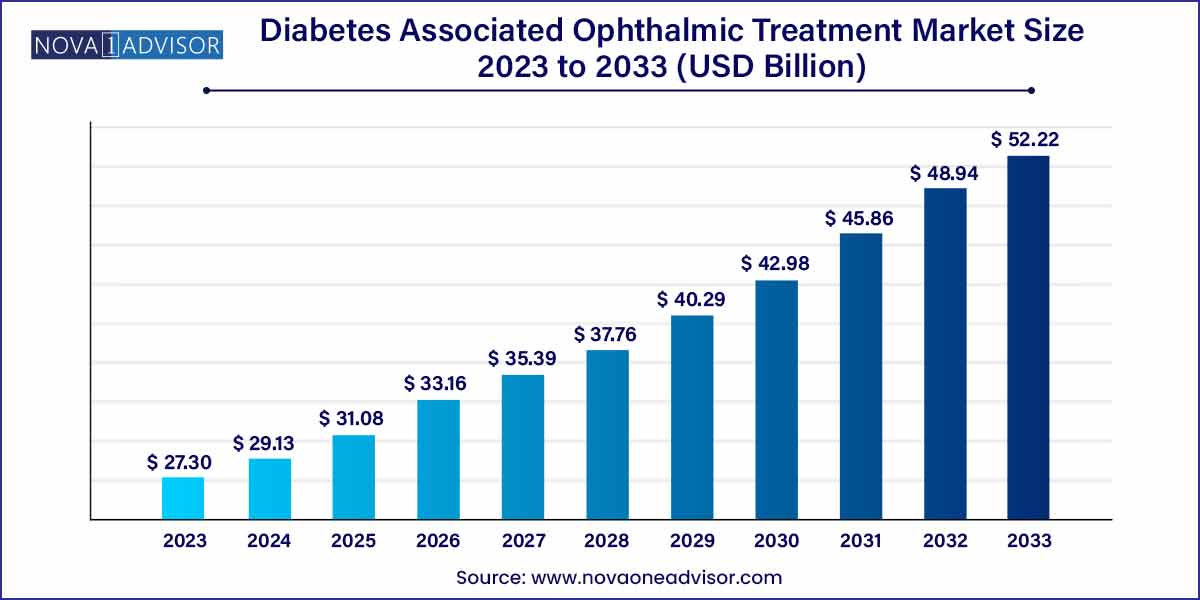

The global diabetes-associated ophthalmic treatment market was estimated at USD 27.30 billion in 2023, is expected to surpass around USD 52.22 billion by 2033, and is poised to grow at a compound annual growth rate (CAGR) of 6.7% during the forecast period of 2024–2033.

Key Takeaways:

- The drugs segment dominated the market for diabetes-associated ophthalmology and accounted for the largest revenue share of 57.6% in 2023.

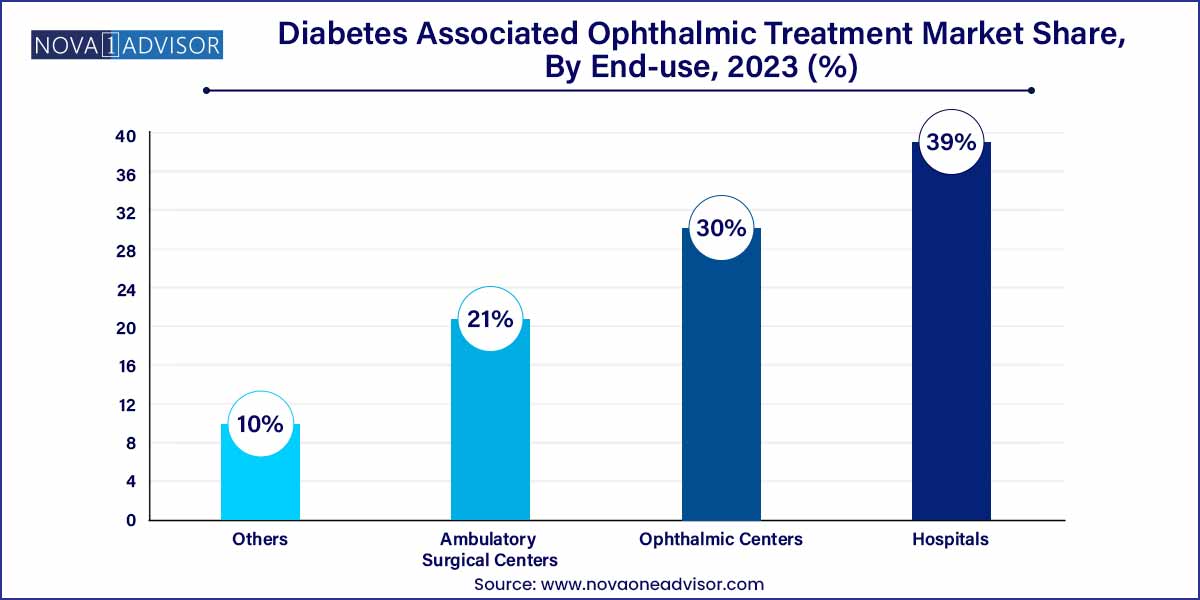

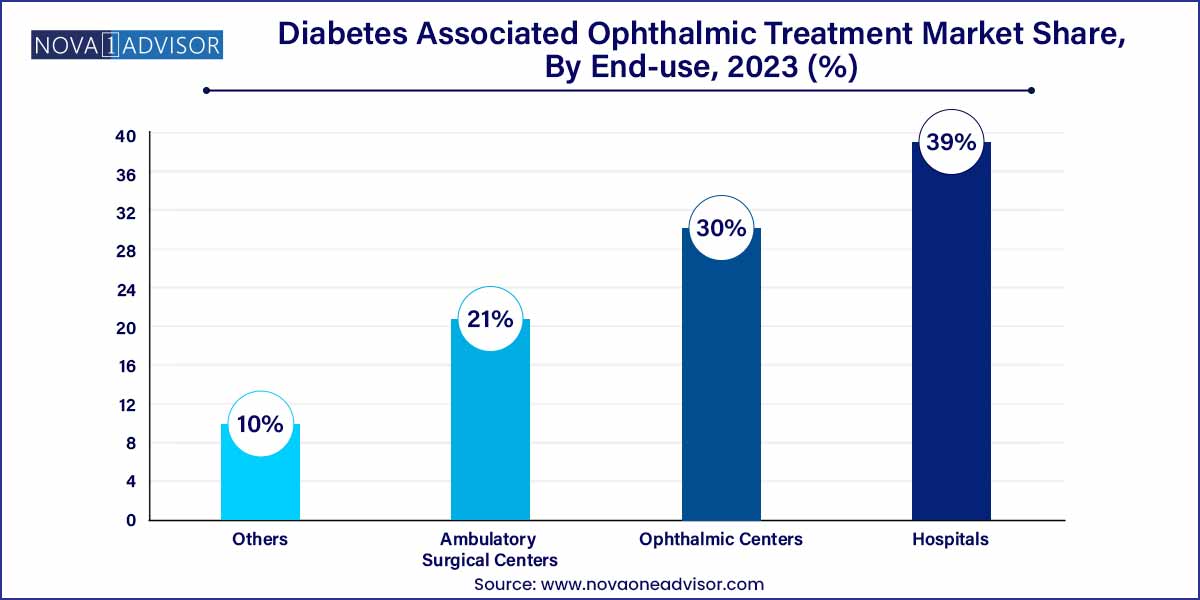

- The hospital segment dominated the market for diabetes-associated ophthalmic care and accounted for the largest revenue share of 39.0% in 2023.

- The diabetic retinopathy segment dominated the market for diabetes-associated ophthalmology and accounted for the largest revenue share of around 26.0% in 2023.

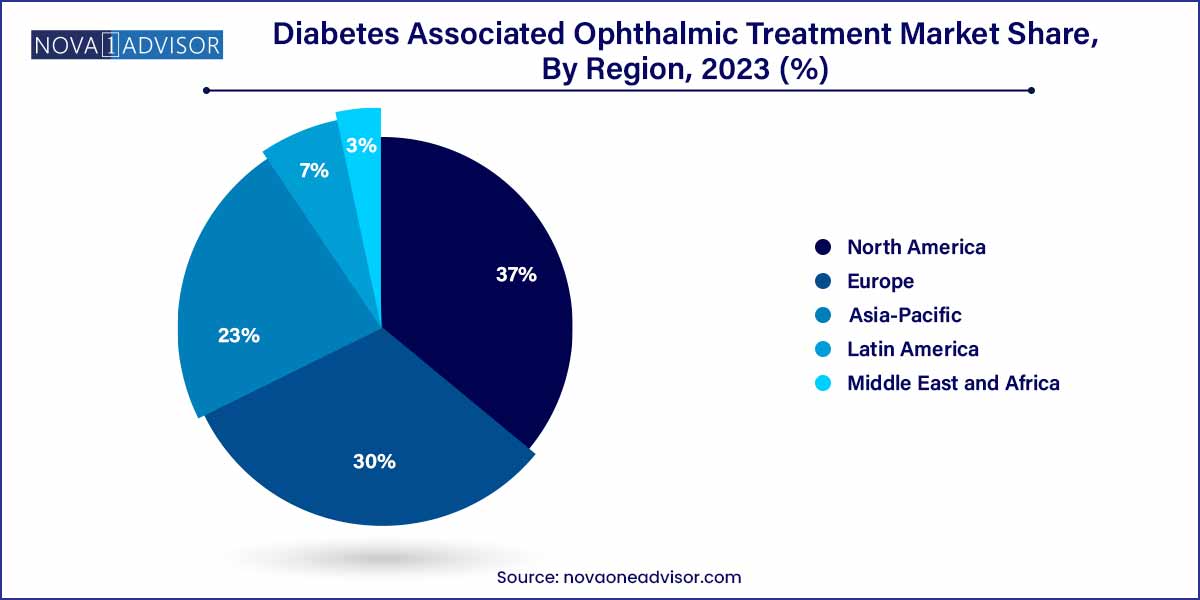

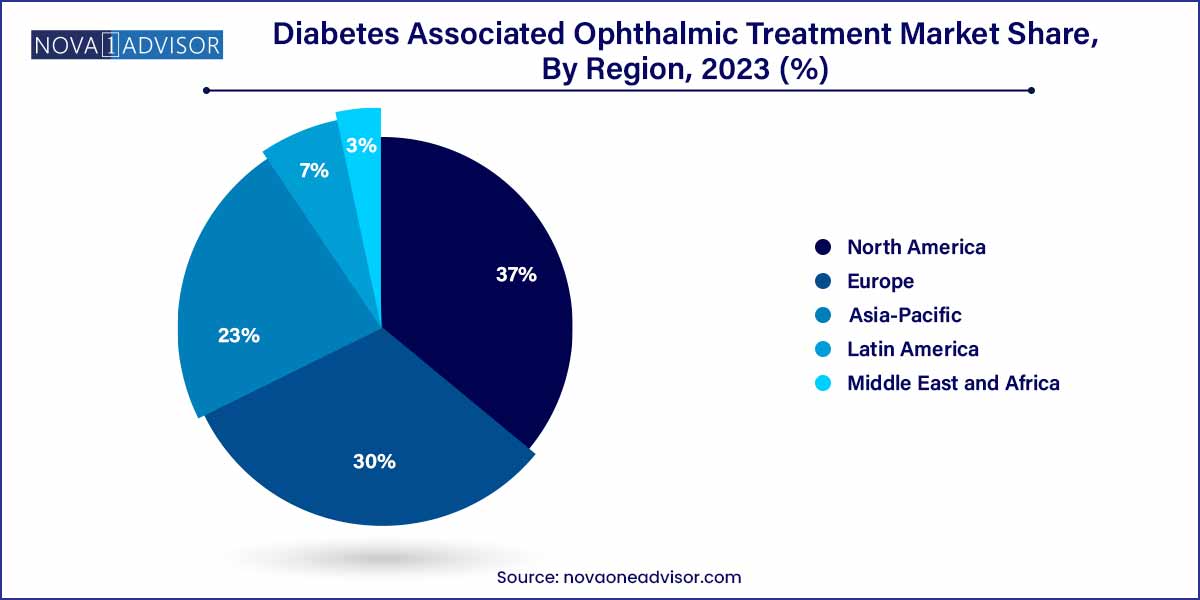

- North America dominated the diabetes-associated ophthalmic treatment market and held the largest revenue share of 37.0% in 2023.

Market Overview

The diabetes associated ophthalmic treatment market has emerged as a crucial healthcare segment due to the rising prevalence of diabetes worldwide and its direct impact on vision health. Diabetes is a chronic condition known to cause several ophthalmic complications, including diabetic retinopathy, diabetic macular edema, cataract formation, and glaucoma. The increasing patient pool suffering from these vision impairments has significantly escalated the demand for effective treatment solutions.

Medical advancements have led to innovative therapies, including anti-VEGF injections, corticosteroid implants, laser therapies, and surgical interventions, offering improved management of ophthalmic disorders associated with diabetes. Furthermore, early diagnosis through advanced ophthalmic devices has gained prominence, fostering the growth of preventive and therapeutic approaches. The market is driven by a collaborative healthcare ecosystem involving pharmaceutical giants, medical device companies, and specialized ophthalmology centers. With healthcare expenditures rising globally and awareness about diabetic complications increasing, the diabetes-associated ophthalmic treatment market is anticipated to witness robust growth over the coming decade.

Major Trends in the Market

-

Growing adoption of anti-VEGF therapies: Anti-vascular endothelial growth factor treatments have become the standard of care for diabetic macular edema and diabetic retinopathy.

-

Increasing focus on early detection and screening: Integration of AI-driven diagnostic tools and teleophthalmology platforms for remote diagnosis and monitoring is becoming prevalent.

-

Surge in minimally invasive surgeries: There is rising preference for minimally invasive laser surgeries and microincision vitrectomy techniques.

-

Expansion of biosimilars: The market is witnessing the entry of biosimilars for popular biologic drugs, enhancing affordability and accessibility.

-

Technological advancements in ophthalmic devices: Innovations such as OCT angiography and portable fundus cameras are transforming the diagnostic landscape.

-

Combination therapies gaining traction: Physicians are increasingly prescribing combination treatments involving anti-VEGF agents and corticosteroids to improve efficacy.

-

Growing investments in ophthalmic research: Pharmaceutical companies and research institutes are investing heavily in R&D for novel drug formulations and regenerative therapies.

Diabetes-Associated Ophthalmic Treatment Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 27.30 Billion |

| Market Size by 2033 |

USD 52.22 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 6.7% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Type, Application; End-Use; Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

Alcon; Johnson & Johnson Services, Inc.; Bausch Health; Allergan; Bayer AG; Santen Pharmaceutical Co. Ltd.; Novartis AG; Pfizer, Inc.; Genentech, Inc.; Carl Zeiss Meditec; Lumenis; Ellex Medical Lasers Ltd.; IRIDEX Corporation; Topcon Corporation; Abbott Medical Optics; Quantel. |

Type Insights

Drugs segment dominated the type segment in 2024. Pharmaceuticals, particularly anti-VEGF injections such as Eylea (aflibercept), Lucentis (ranibizumab), and emerging biosimilars, have been pivotal in treating diabetic-associated ophthalmic disorders. Drugs offer a non-invasive, effective, and often first-line treatment option for conditions such as diabetic retinopathy and diabetic macular edema. The dominance of the drug segment is reinforced by strong clinical efficacy, ongoing innovation in drug delivery systems, and the growing trend toward combination therapy approaches.

Devices segment is expected to be the fastest-growing. Ophthalmic devices such as optical coherence tomography (OCT) scanners, fundus cameras, and laser therapy equipment are witnessing rapid technological innovation. Portable and AI-enabled diagnostic tools have made early screening and monitoring more accessible, even in remote settings. Surgical devices for minimally invasive interventions are also gaining traction. The growing importance of timely and accurate diagnosis, along with the expansion of outpatient and ambulatory services, is propelling the devices segment at an accelerated pace.

End-use Insights

Hospitals dominated the end-use segment in 2024. Hospitals, with their integrated care facilities and access to multidisciplinary teams, continue to be the primary treatment centers for diabetes-associated ophthalmic conditions. They offer specialized ophthalmology departments equipped with advanced diagnostic and surgical capabilities. Moreover, hospitals remain the first point of care for severe and complicated cases requiring surgical interventions such as vitrectomy or retinal detachment repair.

Ophthalmic centers are anticipated to be the fastest-growing end-use segment. Specialized ophthalmic centers, including standalone eye hospitals and clinics, are expanding rapidly due to their focus on advanced diagnostics, personalized care, and shorter waiting times. These centers often offer outpatient services, day surgeries, and targeted screening programs for diabetic patients. The convenience and expertise provided by ophthalmic centers are increasingly attracting patients, particularly in urban and semi-urban regions, driving robust growth in this segment.

Application Insights

Diabetic Retinopathy dominated the application segment in 2024. Diabetic retinopathy, a progressive retinal disease caused by damage to blood vessels due to high blood sugar levels, remains the most prevalent ophthalmic complication among diabetic patients. It accounts for a significant proportion of cases requiring treatment interventions, including laser photocoagulation, anti-VEGF injections, and vitrectomy. Companies such as Genentech, Regeneron Pharmaceuticals, and Bayer have focused on developing specific therapeutics targeting diabetic retinopathy. The chronic nature of this condition and its potential to lead to complete vision loss without timely intervention make it a dominant application area in the market.

Diabetic Macular Edema is anticipated to be the fastest-growing application segment. Diabetic macular edema (DME) involves the accumulation of fluid in the macula, leading to blurred and distorted vision. It often coexists with diabetic retinopathy and has garnered significant attention with the advent of effective anti-VEGF therapies. DME treatments are expanding rapidly, especially with newer formulations showing better patient adherence and outcomes. As awareness increases and early detection improves through regular diabetic screenings, the treatment landscape for DME is expected to evolve dynamically, making it the fastest-growing application area.

Regional Insights

North America dominated the diabetes associated ophthalmic treatment market in 2024. The United States and Canada have a high prevalence of diabetes, supported by well-established healthcare infrastructure, favorable reimbursement policies, and a strong presence of leading pharmaceutical and medical device companies. North America has been at the forefront of adopting cutting-edge treatments such as anti-VEGF therapies, gene therapies, and AI-driven diagnostics. Additionally, proactive government initiatives, rising healthcare spending, and widespread awareness campaigns have accelerated the early diagnosis and treatment of diabetic eye diseases in the region.

Asia-Pacific is projected to be the fastest-growing region. Countries like China, India, and Japan are witnessing a diabetes epidemic due to changing lifestyles, aging populations, and urbanization. However, awareness about diabetic eye health is relatively low, creating a significant unmet need. With governments increasingly investing in healthcare infrastructure and multinational companies expanding their presence in the region, access to quality ophthalmic care is improving. Telemedicine initiatives and mobile screening programs are playing a critical role in enhancing early diagnosis rates, thereby stimulating the demand for diabetes-associated ophthalmic treatments across Asia-Pacific.

Some of the prominent players in the diabetes-associated ophthalmic treatment market include:

- Alcon

- Johnson & Johnson Services, Inc.

- Bausch Health

- F. Hoffmann-La Roche Ltd

- Allergan

- Bayer AG

- Santen Pharmaceutical Co. Ltd.

- Novartis AG

- Pfizer, Inc.

- Genentech, Inc.

- Carl Zeiss Meditec

- Lumenis

- Ellex Medical Lasers Ltd.

- IRIDEX Corp.

- Topcon Corp.

- Abbott Medical Optics

- Quantel

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global diabetes associated ophthalmic treatment market.

Application

- Dry Eye Syndrome

- Glaucoma

- Eye Allergy & Infection

- Diabetic Retinopathy

- Diabetic-associated Macular Degeneration

- Uveitis

- Cataract

- Diabetic Macular Edema

- Others

Type

End-use

- Hospitals

- Ophthalmic Centers

- Ambulatory Surgical Centers

- Others

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)