Disinfection Cap Market Size and Research

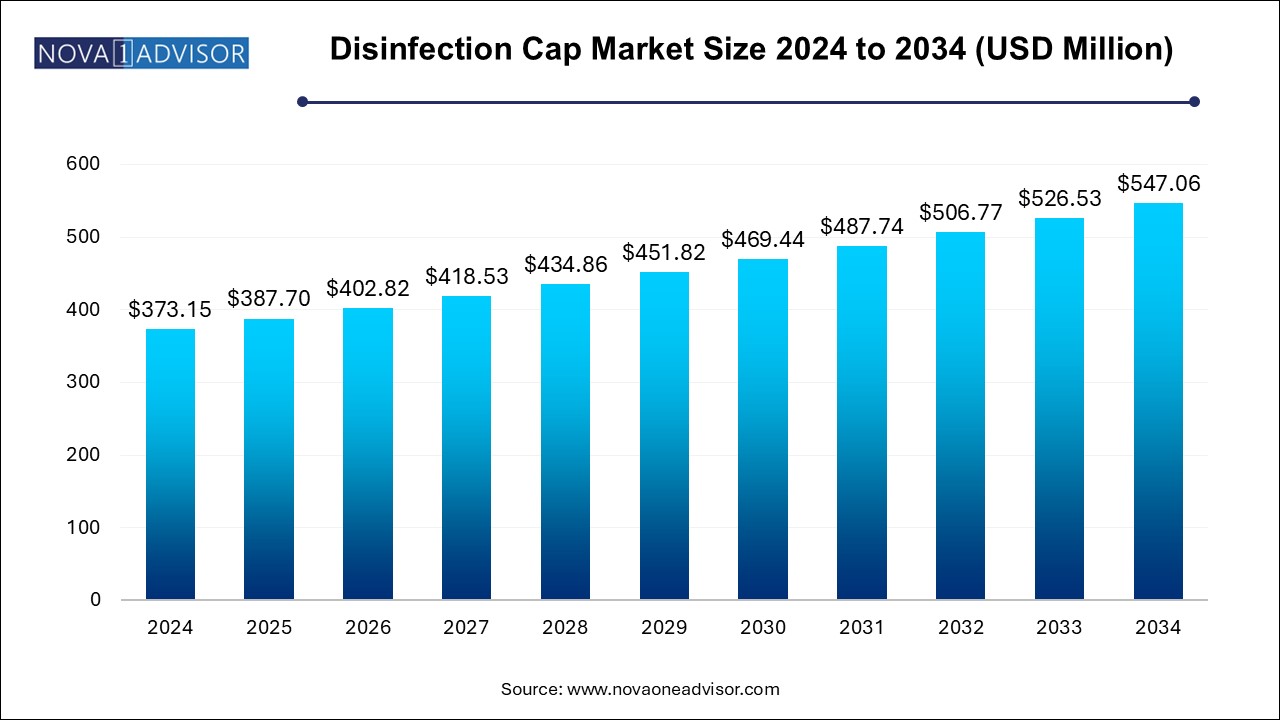

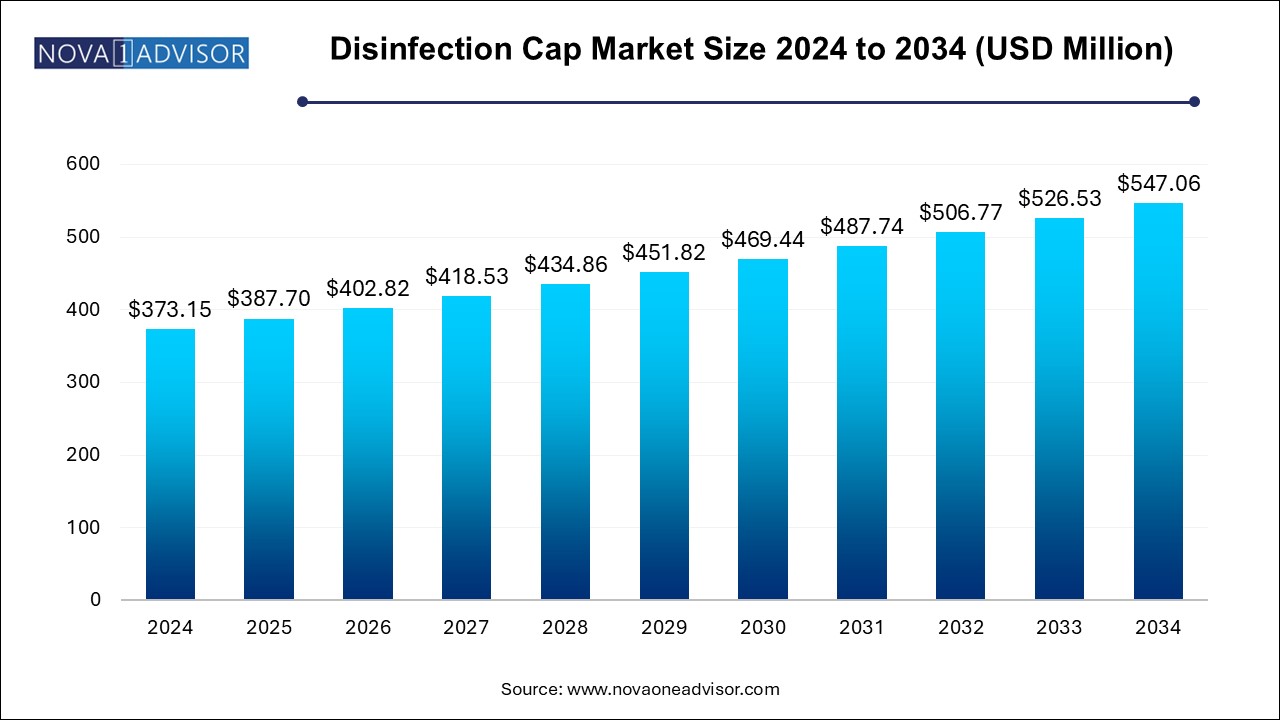

The disinfection cap market size was exhibited at USD 373.15 million in 2024 and is projected to hit around USD 547.06 million by 2034, growing at a CAGR of 3.9% during the forecast period 2024 to 2034.

Disinfection Cap Market Key Takeaways:

- The non-retail distributor segment dominated the industry in 2024 and accounted for the largest share of 69.8% of the overall revenue.

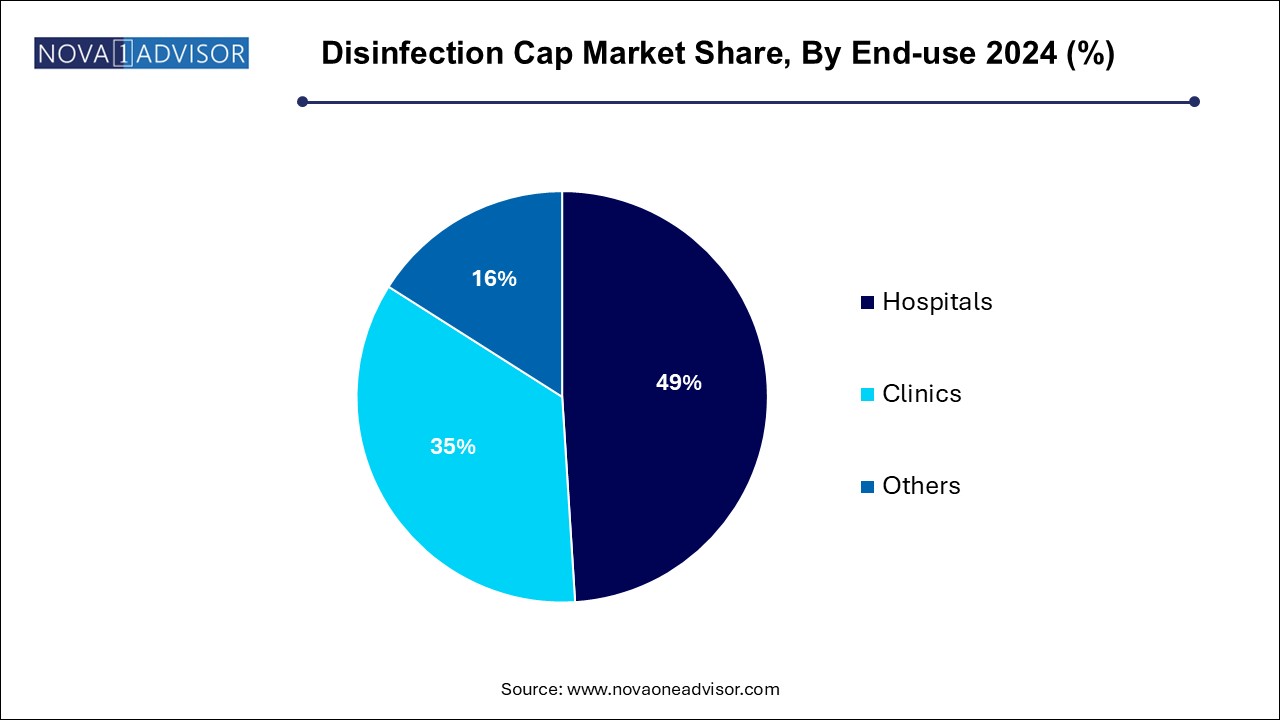

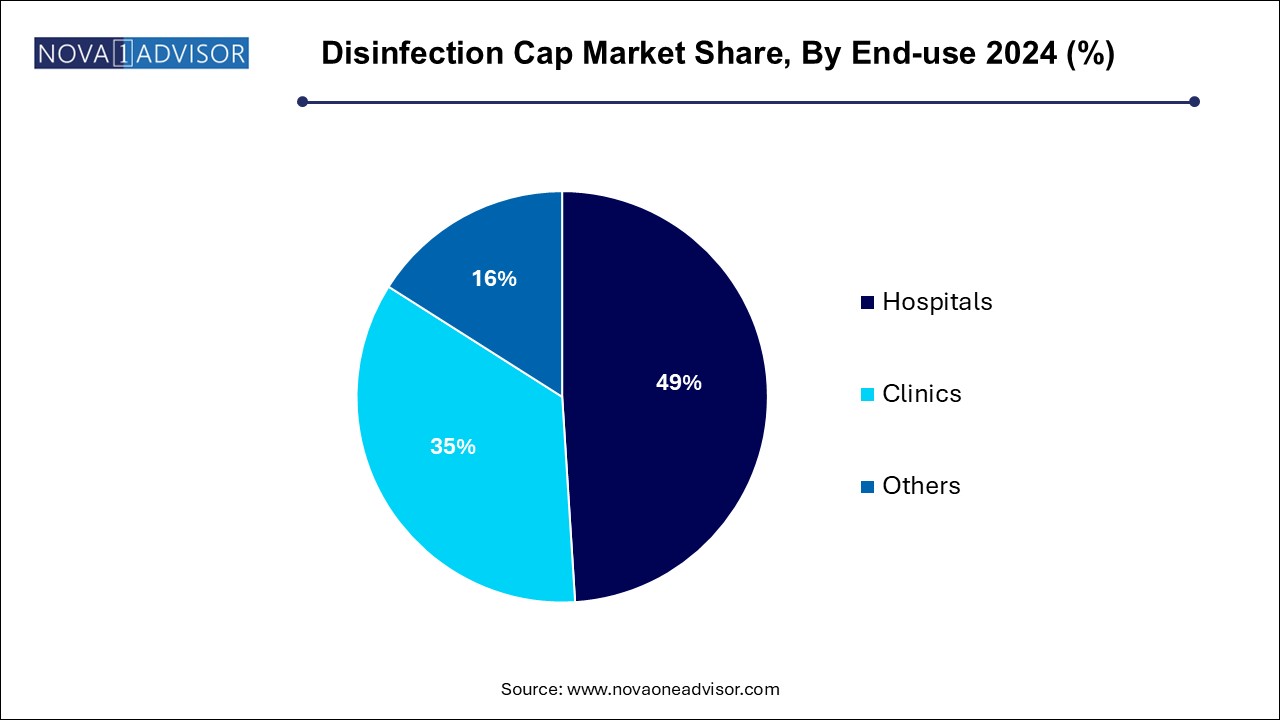

- The hospitals end-use segment dominated the global market in 2024 and accounted for the largest share of more than 49.0% of the overall revenue.

- North America dominated the global market and accounted for the largest share of 34.4% of the overall revenue.

- Asia Pacific is expected to register the fastest growth rate of 4.4% during the forecast period.

Market Overview

The Disinfection Cap Market has gained significant prominence within the global healthcare sector, particularly amid growing emphasis on infection control and hospital-acquired infection (HAI) prevention protocols. Disinfection caps are small, disposable caps containing an antiseptic agent—usually isopropyl alcohol—designed to cover and sanitize catheter hubs, IV connectors, or other access points, maintaining sterility and reducing contamination risks.

The market's growth is heavily fueled by rising awareness about bloodstream infections (BSIs), regulatory pressure on hospitals to lower HAI rates, and technological advancements in infection prevention solutions. Healthcare institutions, particularly in developed economies, are integrating disinfection caps into their standard protocols for central line-associated bloodstream infection (CLABSI) prevention.

According to the Centers for Disease Control and Prevention (CDC), CLABSIs account for thousands of deaths each year in the U.S. alone, making preventive measures an urgent healthcare priority. Disinfection caps offer a cost-effective, easy-to-use solution, leading to widespread adoption across hospitals, outpatient clinics, and even home healthcare settings. As healthcare providers strive to enhance patient safety, improve clinical outcomes, and minimize operational costs, the role of disinfection caps continues to expand globally.

Major Trends in the Market

-

Adoption of Bundled Infection Prevention Strategies: Disinfection caps are increasingly used as part of comprehensive HAI prevention bundles.

-

Growing Preference for Single-use, Disposable Caps: Disposable caps reduce cross-contamination risks, promoting their widespread adoption.

-

Technological Innovations in Cap Design: Advancements such as dual antiseptic mechanisms and tamper-evident caps are emerging.

-

Rising Integration in Home Healthcare Settings: Patients receiving outpatient infusion therapies are using disinfection caps at home to maintain sterility.

-

Expansion into Pediatric and Neonatal Care: Specialized small-sized disinfection caps are being developed for pediatric and NICU applications.

-

Increased Focus on Antimicrobial Resistance: Emphasis on preventing infections without over-reliance on systemic antibiotics is driving cap usage.

-

Color-coded Cap Systems: Color-coded caps based on antiseptic type or catheter compatibility enhance user compliance and safety.

-

Environmental Sustainability Initiatives: Development of biodegradable disinfection caps is an emerging trend to address healthcare waste concerns.

-

Growing Partnerships with Distributors: Manufacturers are collaborating with retail and non-retail distributors to expand global market reach.

-

Greater Regulatory Emphasis on CLABSI Reporting: Mandatory public reporting and hospital accreditation standards are boosting demand for infection control products, including disinfection caps.

Report Scope of Disinfection Cap Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 387.70 Million |

| Market Size by 2034 |

USD 547.06 Million |

| Growth Rate From 2024 to 2034 |

CAGR of 3.9% |

| Base Year |

2024 |

| Forecast Period |

2024-2034 |

| Segments Covered |

Distributor, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Covered |

North America, Europe, Asia Pacific, Latin America, MEA |

| Key Companies Profiled |

3M Company; Becton Dickinson and Company; ICU Medical Inc.; B. Braun Melsungen AG; Baxter International Inc. |

Key Market Driver: Increasing Incidence of Hospital-acquired Infections

One of the most powerful drivers of the disinfection cap market is the increasing incidence of hospital-acquired infections (HAIs), especially bloodstream infections. According to recent CDC data, bloodstream infections are among the most common and deadly HAIs, resulting in longer hospital stays, higher treatment costs, and increased patient morbidity and mortality.

Central venous catheters (CVCs) and peripheral intravenous lines present critical points of vulnerability for microbial contamination. Disinfection caps, when used consistently, create a physical and chemical barrier against pathogens, significantly lowering the risk of infection. Studies have shown that consistent use of disinfection caps can reduce CLABSI rates by up to 70%, making them a vital component of infection control strategies. As hospitals face mounting pressure from regulatory bodies like the Joint Commission and CMS to reduce HAIs, adoption of disinfection caps continues to grow steadily.

Key Market Restraint: Lack of Awareness and Compliance in Developing Regions

A major restraint on the global disinfection cap market is the limited awareness and low compliance with infection prevention protocols in certain developing regions. While leading hospitals in North America and Europe have incorporated disinfection caps into their standard operating procedures, healthcare facilities in parts of Asia, Africa, and Latin America often lack the necessary infrastructure, resources, or training to implement these technologies effectively.

Financial constraints and competing healthcare priorities often delay investment in relatively "small-ticket" yet crucial infection prevention solutions. Furthermore, in resource-limited settings, manual alcohol swabbing remains the standard practice, which is more prone to human error and variability. Without robust awareness campaigns, education, and supportive health policies, the full market potential of disinfection caps in emerging economies remains under-realized.

Key Market Opportunity: Expansion into Outpatient and Home Healthcare Markets

A promising opportunity for market growth lies in the expansion of disinfection caps into outpatient and home healthcare settings. With the shift toward value-based care and the emphasis on reducing hospital readmissions, many patients now receive infusion therapies, chemotherapy, or long-term parenteral nutrition outside the hospital environment.

These patients are at heightened risk for catheter-associated infections due to inconsistent aseptic technique in home settings. Disinfection caps offer a simple, foolproof solution for maintaining catheter hub sterility between clinical visits. As outpatient care and home infusion therapy markets grow, the demand for convenient, reliable infection prevention tools like disinfection caps is expected to rise sharply. Manufacturers focusing on patient-friendly, easy-to-apply cap designs tailored for non-clinical users can capitalize on this expanding market segment.

Disinfection Cap Market By Distributor Insights

Non-retail distribution channels dominated the disinfection cap market in 2024. Hospitals, clinics, and healthcare procurement groups primarily source disinfection caps through non-retail distributors specializing in medical supplies. These distributors offer bulk purchasing contracts, value-added services such as staff training, and integration into broader infection prevention product portfolios. Strategic partnerships with non-retail distributors enable manufacturers to penetrate institutional healthcare settings efficiently and ensure consistent product availability, which is critical for compliance with infection control protocols.

Retail distribution is anticipated to be the fastest-growing segment over the forecast period. With the rise of home healthcare services and outpatient infusion therapy, individual consumers and small healthcare providers are increasingly sourcing disinfection caps through retail outlets and e-commerce platforms. Online sales, pharmacy chains, and direct-to-patient programs are making it easier for home care patients to access high-quality infection prevention tools. Manufacturers expanding into retail channels through user-friendly packaging and branding stand to capture significant new demand.

Disinfection Cap Market By End-use Insights

Hospitals accounted for the largest share of disinfection cap usage in 2024. Hospitals remain the primary end-users of disinfection caps due to the high volume of invasive procedures, central line placements, and acute care settings where infection risk is elevated. Disinfection caps are systematically integrated into hospital protocols for CVC maintenance, and their usage is often mandated by internal infection control committees. The ability of hospitals to drive high-volume purchases and their focus on achieving accreditation and quality metrics solidify their dominant market share.

Clinics are expected to grow at the fastest rate among end-use categories. Specialized outpatient clinics, oncology centers, dialysis centers, and urgent care facilities are increasingly adopting disinfection caps as part of their infection control practices. These facilities perform a high volume of infusion procedures but often lack the inpatient capacity for extended monitoring, making robust preventive measures essential. Growing healthcare decentralization and patient preference for ambulatory services are supporting rapid adoption of disinfection caps in this segment.

Disinfection Cap Market By Regional Insights

North America led the global disinfection cap market in 2024, driven by strong regulatory frameworks, high healthcare spending, and heightened awareness about infection prevention. The U.S., in particular, benefits from initiatives such as the Centers for Medicare & Medicaid Services' (CMS) Hospital-Acquired Condition (HAC) Reduction Program, which financially penalizes hospitals with high HAI rates. Hospitals in North America are highly motivated to invest in proven infection control tools, making disinfection caps an integral part of central line bundles. Additionally, the presence of key industry players, advanced hospital networks, and a culture of early adoption of medical innovations further reinforce North America's dominant position.

Asia Pacific is expected to witness the highest growth rate in the disinfection cap market over the coming decade. Rapid healthcare infrastructure development, growing medical tourism, increasing awareness of HAIs, and government initiatives to improve hospital standards are key growth drivers. Countries like China, India, Japan, and Australia are investing heavily in healthcare quality improvements, leading to higher demand for infection prevention products. Furthermore, multinational healthcare providers establishing premium hospitals and specialty clinics in the region are standardizing the use of disinfection caps, creating new opportunities for market players.

Some of the prominent players in the disinfection cap market include:

- 3M Company

- Becton Dickinson and Company

- ICU Medical Inc.

- B. Braun Melsungen AG

- Baxter International Inc.

Recent Developments

-

February 2025 – ICU Medical, Inc. launched a new disinfection cap series with extended protection timeframes, designed for outpatient and home infusion settings.

-

December 2024 – Becton, Dickinson and Company (BD) introduced its latest generation of color-coded disinfection caps, allowing hospitals to customize caps based on clinical protocols.

-

September 2024 – 3M Company announced a collaboration with a major U.S. hospital network to pilot test its eco-friendly, biodegradable disinfection cap prototype.

-

July 2024 – Merit Medical Systems, Inc. expanded its disinfection cap product line in European markets, responding to rising demand for infection control solutions post-pandemic.

-

May 2024 – Excelsior Medical received CE mark approval for its next-gen alcohol-based disinfection cap system designed for pediatric use.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the disinfection cap market

Distributor

End-use

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)