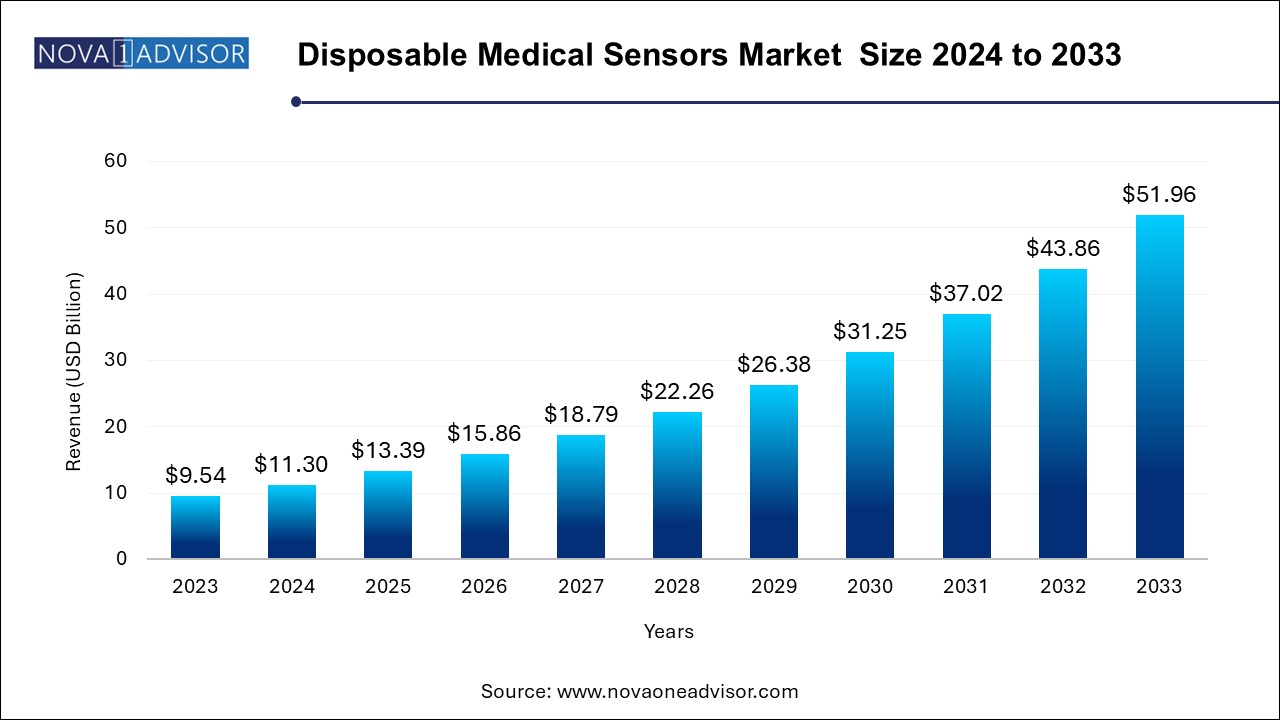

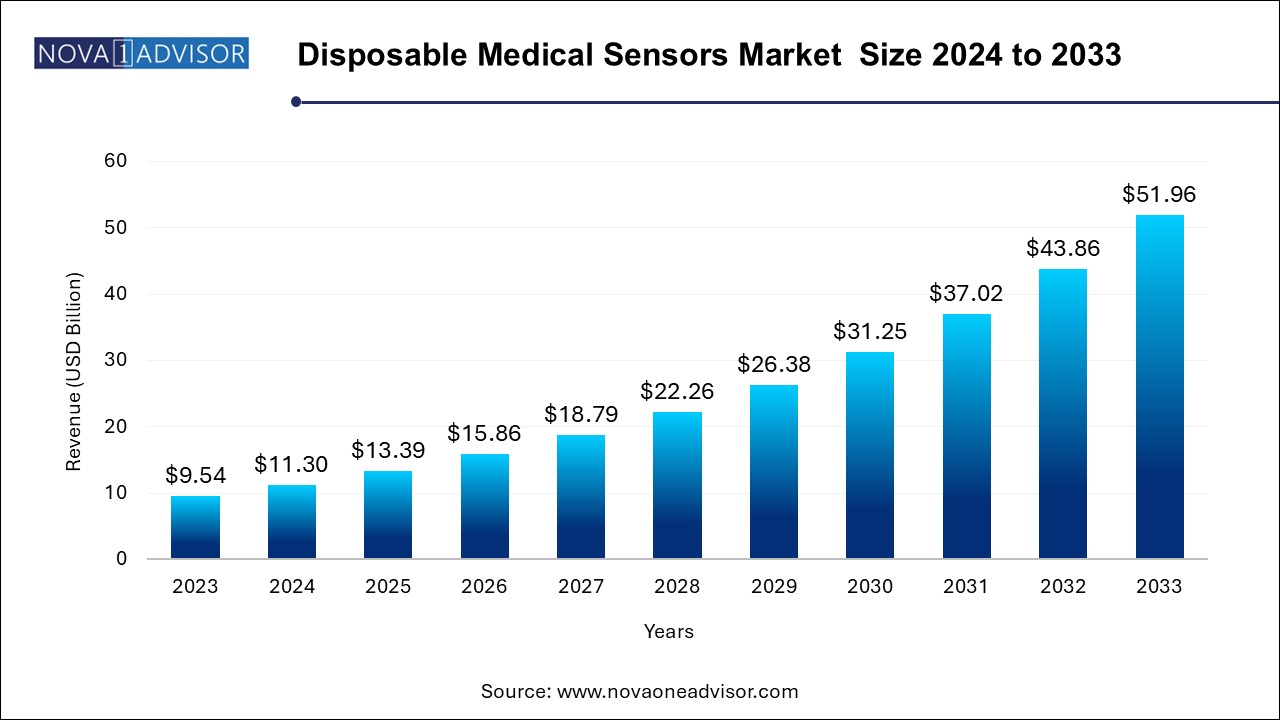

The global disposable medical sensors market size was exhibited at USD 9.54 billion in 2023 and is projected to hit around USD 51.96 billion by 2033, growing at a CAGR of 18.47% during the forecast period of 2024 to 2033.

Key Takeaways:

- North America dominated the market with the largest revenue share of over 43.0% in 2023.

- The diagnostic led the market and accounted for more than 41.0% share of the global revenue in 2023.

- In 2023, the biosensors segment dominated the market with a share of over 49.70%.

- In 2023, the strip sensors segment dominated the market with a share of over 38.76%.

Market Overview

The disposable medical sensors market is rapidly evolving as a vital component of modern healthcare, driven by the convergence of miniaturization, digital health technologies, and infection control needs. These sensors are designed for one-time or short-term use to monitor, diagnose, and support the treatment of patients, minimizing cross-contamination risks and reducing the burden of sterilization. Ranging from biosensors embedded in test strips to ingestible and implantable sensors, these devices are used across hospitals, clinics, homecare, and remote monitoring settings.

The growing emphasis on patient-centric care, especially in chronic disease management and post-acute monitoring, has accelerated demand for disposable sensor technologies. From glucose monitoring in diabetes patients to pressure sensors in catheters and accelerometers in rehabilitation therapy, these solutions offer real-time insights while being cost-effective and hygienic. Moreover, the COVID-19 pandemic has spotlighted the importance of disposables in minimizing infection risks, thereby catalyzing investments and innovation in sensor-based diagnostics and remote patient monitoring.

Technological advancements have made sensors more accurate, smaller, and compatible with wireless networks, cloud platforms, and mobile applications. As a result, disposable medical sensors are increasingly used in point-of-care testing, wearable health tech, and biosensor-enabled drug delivery systems. The market is witnessing strong support from both public and private sectors, with governments funding diagnostic tools and startups developing integrated biosensing platforms. With expanding use cases and increased integration into electronic health record (EHR) systems, the disposable sensor ecosystem is becoming more dynamic, scalable, and essential to future healthcare delivery.

Major Trends in the Market

-

Integration of Disposable Sensors in Wearable Health Devices: Companies are embedding single-use biosensors into fitness bands and health monitors for real-time health tracking and diagnostics.

-

Rapid Growth of Remote Patient Monitoring: Post-pandemic healthcare systems are leveraging disposable sensors for home-based monitoring of heart rate, respiration, glucose, and other vitals.

-

Rise of Ingestible and Implantable Sensors: These next-gen devices offer internal diagnostics with minimal invasiveness, providing unprecedented visibility into patient physiology.

-

Expansion in Point-of-Care Diagnostics: Disposable sensors are central to portable testing kits used in primary care, emergency settings, and low-resource environments.

-

Adoption of Printed Electronics and Flexible Substrates: These enable low-cost mass production of sensors with high customization potential for specific medical conditions.

-

Environmentally-Friendly Innovations: Sustainable and biodegradable materials are being explored to reduce the ecological footprint of single-use sensors.

-

Partnerships between Medtech and Software Providers: Integration with cloud platforms, AI, and mobile apps enhances the data utility and scalability of sensor-based diagnostics.

Disposable Medical Sensors Market Report Scope

| Report Coverage |

Details |

| Market Size in 2024 |

USD 9.54 Billion |

| Market Size by 2033 |

USD 51.96 Billion |

| Growth Rate From 2024 to 2033 |

CAGR of 18.47% |

| Base Year |

2023 |

| Forecast Period |

2024-2033 |

| Segments Covered |

Application, Type, Product, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional Scope |

North America; Europe; Asia Pacific; Central and South America; the Middle East and Africa |

| Key Companies Profiled |

SSI Electronics; ACE Medical Devices; Sensirion AG Switzerland; Smiths Medical; Koninklijke Philips N.V.; GE Healthcare; Analog Devices Inc.; Honeywell International Inc, TE Connectivity; Medtronic; NXP Semiconductor. |

Market Driver: Increasing Demand for Infection Control and Hygiene in Clinical Settings

A significant driver of the disposable medical sensors market is the heightened emphasis on infection prevention and control across healthcare environments. Infections acquired in hospitals and clinics (HAIs) are a leading cause of morbidity and additional healthcare costs globally. Disposable medical sensors, which eliminate the need for sterilization and reduce the risk of cross-contamination, offer an effective solution to this persistent challenge.

The COVID-19 pandemic intensified global awareness about hygiene, personal protective equipment (PPE), and the role of disposables in limiting viral transmission. Sensors used for temperature monitoring, respiratory rate tracking, and oxygen saturation were deployed extensively during the crisis. Hospitals and governments prioritized procurement of disposable devices, which could be used and discarded without additional decontamination procedures. This behavioral and regulatory shift is expected to have a lasting impact, with disposables becoming a standard in infection-sensitive clinical workflows.

Market Restraint: Environmental and Waste Management Concerns

Despite the benefits, the widespread use of disposable medical sensors raises environmental and waste management challenges, especially concerning non-biodegradable materials. The increased use of plastic, silicon, and other non-recyclable materials in disposable devices contributes significantly to medical waste, which requires specialized handling and disposal to avoid environmental contamination and biohazard risks.

In many developing countries, inadequate waste segregation infrastructure exacerbates this issue, creating potential public health hazards. While incineration and advanced waste treatment technologies can mitigate the problem, they are costly and not universally accessible. Regulatory pressure is mounting on healthcare providers and manufacturers to develop sustainable alternatives. This has led to innovation in biodegradable electronics and recyclable sensor components, but widespread adoption remains limited due to cost and scalability barriers.

Market Opportunity: Growth in Home Healthcare and Chronic Disease Monitoring

A major opportunity in the disposable medical sensors market is the surging demand for home-based healthcare solutions, particularly for the monitoring of chronic diseases such as diabetes, cardiovascular disorders, and respiratory illnesses. As populations age and healthcare costs escalate, more patients are being treated outside hospitals either in homecare settings or through digital health platforms that enable continuous monitoring and remote consultations.

Disposable biosensors and wearable patches capable of measuring glucose levels, cardiac rhythms, or pulmonary function empower patients to track their health with minimal clinical intervention. These devices also reduce the burden on healthcare infrastructure by preventing unnecessary hospital visits and enabling early intervention. For example, disposable ECG patches used for atrial fibrillation detection can be worn at home and transmit data to cardiologists in real-time. Companies that can deliver user-friendly, reliable, and interoperable disposable sensors for remote care are well-positioned to lead this next phase of healthcare evolution.

Segmental Analysis

By Application

Patient monitoring applications dominate the disposable medical sensors market, accounting for a significant share due to the rise in chronic diseases, aging populations, and the need for post-operative surveillance. Sensors in this category include single-use ECG patches, respiration monitors, and blood pressure sensors, which are used across hospitals, outpatient settings, and homecare environments. Their appeal lies in their ability to provide continuous real-time data, enhancing care decisions while reducing manual check-ups and hospital stays.

Therapeutic applications are the fastest-growing, as the industry explores ways to deliver treatment through sensor-enabled systems. For instance, closed-loop insulin delivery systems that incorporate disposable glucose sensors and automated pumps represent a breakthrough in diabetes care. Similarly, temperature sensors embedded in wound dressings help manage infections and promote healing. The integration of diagnostic and therapeutic functionalities (theranostics) in a single disposable sensor is creating new value propositions and accelerating market adoption.

By Product

Biosensors currently dominate the market, driven by their versatility in detecting biochemical markers related to diseases, metabolic activity, or medication adherence. These sensors are used extensively in glucose monitors, pregnancy test kits, and infectious disease diagnostics. As they can be integrated into strip-based tests, wearables, and ingestible formats, biosensors have become ubiquitous in point-of-care testing and consumer health applications.

Image sensors are the fastest-growing segment, supported by advances in endoscopic procedures, capsule imaging, and digital pathology. Disposable image sensors are now embedded in low-cost, single-use endoscopes and pill-sized devices that capture high-resolution internal images. These technologies are revolutionizing gastrointestinal diagnostics and cancer screening by providing clinicians with real-time visuals without invasive surgeries or complex sterilization protocols.

By Type

Strip sensors dominate the market, particularly due to their low cost, simplicity, and widespread use in at-home diagnostic applications such as glucose and ketone monitoring. They are often used in conjunction with handheld devices or smartphone-integrated readers, providing accessible healthcare tools for millions of patients globally.

Wearable sensors represent the fastest-growing type, as they align with the global trend of personalized, real-time health monitoring. These sensors are typically embedded in patches, wristbands, or clothing, and are used for tracking vitals like ECG, oxygen saturation, and movement. Startups and tech giants alike are investing in flexible, skin-compatible sensor technologies that can be worn for extended periods and disposed of without clinical intervention. Wearables have seen rapid uptake in both consumer wellness and regulated clinical care, especially for post-acute monitoring.

Regional Analysis

North America leads the global disposable medical sensors market, driven by a high prevalence of chronic diseases, strong healthcare infrastructure, and supportive regulatory frameworks. The U.S. is home to key market players, advanced R&D ecosystems, and a reimbursement environment that supports innovation. The region also benefits from widespread adoption of digital health technologies and increasing government focus on infection control and value-based care models. The FDA’s streamlined approval pathways for biosensors and diagnostic devices have further accelerated innovation and market growth.

Asia-Pacific is the fastest-growing region, fueled by rapid healthcare digitization, rising middle-class incomes, and increasing government investments in public health. Countries like China, India, Japan, and South Korea are witnessing a surge in non-communicable diseases, creating demand for affordable and scalable diagnostic and monitoring solutions. Disposable sensors, particularly those embedded in mobile-connected diagnostics, are ideal for remote and rural healthcare delivery. Furthermore, manufacturing cost advantages and local tech innovation make APAC a strategic hub for global expansion in disposable medtech products.

Some of the prominent players in the disposable medical sensors market include:

- SSI Electronics

- ACE Medical Devices

- Sensirion AG Switzerland

- Smith’s Medical

- Koninklijke Philips N.V.

- GE Healthcare

- Analog Devices, Inc.

- Honeywell International Inc

- TE Connectivity

- Medtronic

- NXP Semiconductor

Recent Developments

-

Medtronic (March 2025): Announced the launch of a next-generation disposable CGM sensor with 14-day wear and AI-enhanced glucose trend prediction, aimed at Type 1 and Type 2 diabetes management.

-

Philips Healthcare (February 2025): Introduced a new line of disposable wearable biosensors for in-hospital and home monitoring of respiratory and cardiac metrics.

-

Cardiomo (January 2025): A health tech startup received FDA breakthrough designation for its patch-based disposable ECG monitoring system, which provides 5-day continuous cardiac insights for remote patients.

-

Smiths Medical (December 2024): Expanded its disposable temperature and pressure sensor line to include pediatric-compatible variants for use in neonatal intensive care units (NICUs).

-

Dexcom (November 2024): Partnered with Samsung Health to integrate its disposable glucose sensor data into connected wearable platforms for real-time alerts and trend tracking.

Segments Covered in the Report

This report forecasts revenue growth at global, regional, and country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2033. For this study, Nova one advisor, Inc. has segmented the global disposable medical sensors market.

Application

- Diagnostic

- Therapeutic

- Patient Monitoring

Product

- Biosensors

- Pressure Sensors

- Accelerometers

- Temperature Sensors

- Image Sensors

- Others

Type

- Strip Sensors

- Wearable Sensors

- Implantable Sensors

- Invasive Sensors

- Ingestible Sensors

By Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East & Africa (MEA)