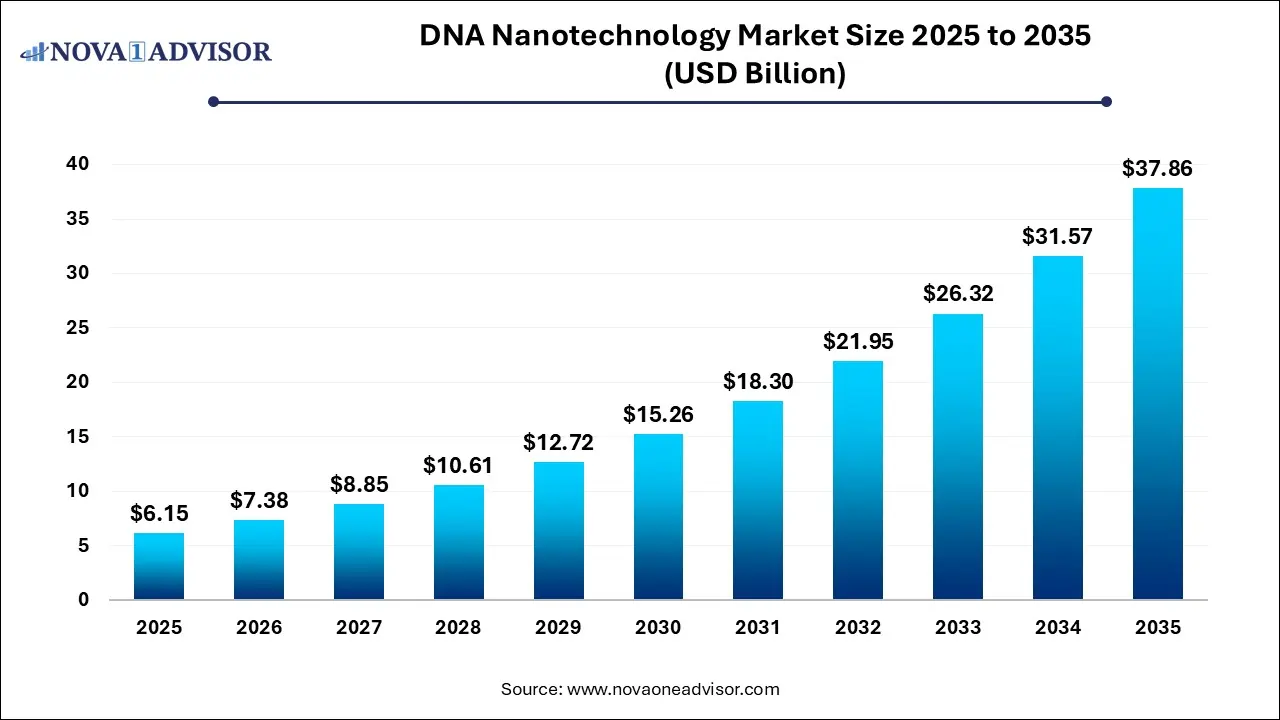

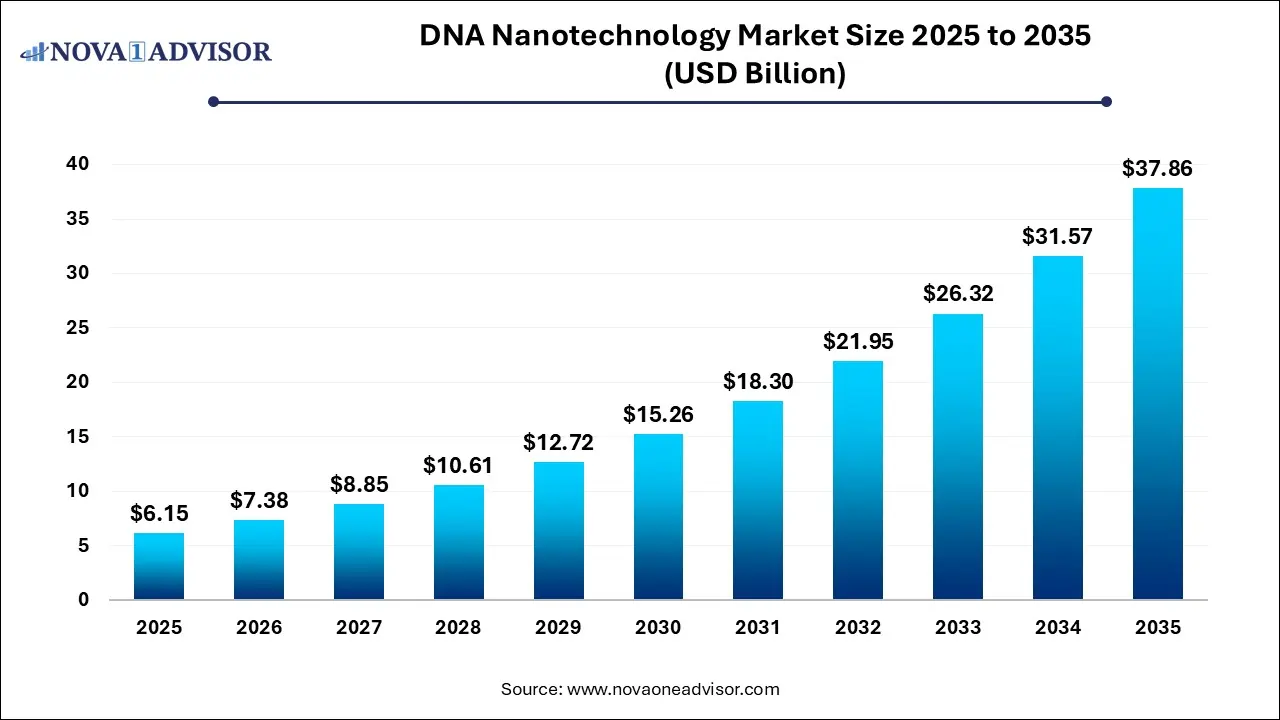

DNA Nanotechnology Market Size and Growth

The DNA nanotechnology market size was exhibited at USD 6.15 billion in 2025 and is projected to hit around USD 37.86 billion by 2035, growing at a CAGR of 19.93% during the forecast period 2026 to 2035.

Key Takeaways:

- The structural DNA nanotechnology segment dominated the market in 2025.

- The drug delivery systems segment dominated the market with the largest revenue share of 43% in 2025.

- The academic & research institutions segment dominated the market with the largest revenue share of 54% in 2025.

- North America DNA nanotechnology industry dominated globally with a revenue share of 59% in 2025.

Market Overview

The DNA Nanotechnology Market is rapidly evolving into a dynamic frontier at the intersection of biotechnology, material science, and nanomedicine. Leveraging the structural and chemical properties of DNA, this field utilizes nucleic acids not as carriers of genetic information, but as programmable building blocks for constructing nanoscale devices, structures, and machines. With the ability to control matter at the molecular level, DNA nanotechnology offers vast potential in drug delivery, biosensing, diagnostics, material design, and computing.

DNA molecules possess a unique capability to self-assemble based on base-pairing rules, making them ideal for creating complex and customizable nanostructures. These structures range from 2D lattices and 3D polyhedra to dynamic switches, walkers, and nanoscale containers. Researchers have demonstrated DNA-based robots capable of performing logical operations, biosensors with ultra-sensitive detection, and drug delivery vehicles that release payloads in response to molecular cues. As a result, DNA nanotechnology is no longer confined to academic curiosity it is becoming a viable commercial technology.

While still in its early stages compared to established nanotech or biotech industries, the market is witnessing increasing investment from biotech firms, material science innovators, and research institutions. Startups and university spinouts are partnering with pharmaceutical companies to translate laboratory prototypes into clinical applications. Additionally, advancements in synthetic biology, CRISPR technologies, and microfluidics are enhancing the integration and functionality of DNA-based nanodevices. As applications transition from proof-of-concept to pilot testing and commercialization, the global DNA nanotechnology market is poised for exponential growth through 2034.

Major Trends in the Market

-

Convergence of DNA Nanotechnology and Synthetic Biology

Researchers are integrating synthetic circuits and gene editing tools with DNA nanostructures to create programmable bio-hybrid systems.

-

Rise of DNA Origami for Precision Nanoassembly

The use of DNA origami techniques to fold long DNA strands into predetermined shapes is gaining traction in drug delivery and nanoelectronic fabrication.

-

Expansion of Smart Drug Delivery Systems

DNA-based carriers that respond to specific biomarkers or environmental stimuli are being developed for targeted therapeutics in cancer and chronic diseases.

-

Growing Use in Biosensing and Environmental Monitoring

DNA nanostructures are being used to build highly specific and sensitive biosensors for detecting pathogens, toxins, and biomolecules.

-

Application in Nanorobotics and Molecular Computing

Dynamic DNA nanostructures capable of computation, logic gate function, and movement are forming the basis of molecular robots.

-

Integration with CRISPR and Gene Therapy Platforms

DNA nanodevices are being adapted to improve gene editing efficiency and deliver CRISPR-Cas9 components with higher precision.

Report Scope of DNA Nanotechnology Market

| Report Coverage |

Details |

| Market Size in 2026 |

USD 7.38 Billion |

| Market Size by 2035 |

USD 37.86 Billion |

| Growth Rate From 2026 to 2035 |

CAGR of 19.91% |

| Base Year |

2025 |

| Forecast Period |

2026-2035 |

| Segments Covered |

Technology, Application, End use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Gattaquant; Nanobio Designs; Tilibit; Helixworks; SomaLogic; EnaChip; Ginkgo Bioworks; Nanolab Technologies; Nanogami; DNA Nanobots, LLC |

Market Driver: Rising Demand for Precision Drug Delivery

A primary driver fueling the DNA nanotechnology market is the increasing demand for precision drug delivery systems that can improve therapeutic efficacy while minimizing side effects. Traditional drug delivery faces several challenges, including non-specific distribution, systemic toxicity, and premature degradation. DNA nanostructures provide a solution by offering programmable, biocompatible, and biodegradable delivery vehicles capable of encapsulating drugs and targeting them to specific cells or tissues.

For instance, DNA tetrahedrons have been developed to transport chemotherapeutic agents directly into tumor cells, where they release their cargo in response to pH or enzyme triggers. These smart nanocarriers can be engineered to bypass the immune system, extend circulation time, and reduce off-target effects. As personalized medicine becomes a clinical priority, DNA-based nanocarriers offer customizable solutions tailored to individual molecular profiles. This has made them highly attractive for use in cancer therapy, neurology, and infectious disease treatment, accelerating adoption and investment in the market.

Market Restraint: Scalability and Manufacturing Challenges

Despite its promising outlook, a significant restraint is the limited scalability and high production costs associated with DNA nanostructure fabrication. While self-assembly offers design flexibility and precision, producing DNA nanodevices at industrial scale remains a technical and economic hurdle. Synthesizing long DNA strands with high fidelity, purifying large volumes of nanostructures, and maintaining structural integrity during storage and application pose ongoing challenges.

Moreover, most assembly techniques require controlled lab environments and expensive reagents such as high-purity DNA oligonucleotides, increasing the cost per unit. While enzymatic amplification and automated synthesis are improving yields, the production bottleneck has so far hindered large-scale commercial deployment. Bridging the gap between lab-scale innovation and clinical-grade manufacturing will be crucial for unlocking the full market potential.

Market Opportunity: Expanding Role in Biosensing and Diagnostics

An emerging opportunity lies in the rapidly growing use of DNA nanotechnology in biosensing and diagnostics, especially in point-of-care and real-time detection systems. DNA-based biosensors offer unmatched specificity, sensitivity, and programmability. Their ability to undergo conformational changes in response to target molecules makes them ideal for detecting nucleic acids, proteins, and small molecules in complex biological samples.

For example, DNA aptamer-based sensors have been designed to detect cancer biomarkers, viral RNA (including SARS-CoV-2), and environmental toxins with high accuracy. Some DNA nanodevices can also function as molecular switches or circuits that amplify detection signals. Integration with microfluidic chips and smartphones is creating user-friendly diagnostic platforms for field and home use. As rapid diagnostics become integral to healthcare and public health, especially post-pandemic, DNA nanotech-based biosensors are poised to capture a significant share of the diagnostics innovation space.

Segmental Analysis

By Technology Outlook

Structural DNA Nanotechnology dominated the market in 2025, as the foundation of most DNA-based applications lies in the creation of stable, programmable structures. This includes discrete geometries like tetrahedrons, cages, and polyhedra, as well as complex lattices for molecular scaffolding. Applications range from drug delivery and tissue engineering to nanoelectronics. Tools such as DNA origami, scaffolded assembly, and tile-based approaches are increasingly being adopted by research labs and pharmaceutical companies.

Dynamic DNA Nanotechnology is projected to grow at the fastest rate, thanks to its capability to perform logical operations, respond to stimuli, and mimic biological processes. Techniques like strand displacement cascades and nanomechanical devices are enabling the construction of responsive systems such as nanorobots and autonomous molecular walkers. These are being tested in advanced drug release platforms and synthetic biology circuits, indicating strong future demand in both therapeutic and computing applications.

By Application Outlook

Drug delivery systems led the application segment, reflecting the high clinical and commercial interest in DNA nanostructures for therapeutic use. The ability to create carriers that can cross biological barriers, release drugs on-demand, and evade immune detection is revolutionizing how treatments are designed. DNA-based platforms have been used in preclinical trials for targeted cancer therapies and are being explored for neurodegenerative disorders, gene therapy, and vaccine delivery.

Diagnostics and biosensing development is the fastest growing segment, driven by global demand for rapid, accurate, and low-cost diagnostics. DNA nanodevices like DNAzymes, aptamers, and logic-gated biosensors are being used for early disease detection, infection surveillance, and personalized diagnostics. Startups and research consortia are actively developing plug-and-play biosensor platforms capable of detecting multiple targets simultaneously with high specificity, often within minutes.

By End Use Outlook

Academic and research institutions dominated the end-use landscape, accounting for the majority of market engagement in 2025. Universities, government labs, and public-private consortia are the primary drivers of innovation in this field, supported by grants and research funding from organizations such as NIH, NSF, Horizon Europe, and China's National Natural Science Foundation. These institutions lead in developing proof-of-concept systems, publishing research, and spinning out startups.

Biotechnology and pharmaceutical companies are the fastest growing end-use sector, fueled by interest in commercializing DNA-based therapeutics and diagnostics. From early-stage drug delivery startups to big pharma companies incorporating DNA nanotech into their precision medicine pipelines, the private sector is scaling up both investment and infrastructure. Companies are partnering with academic labs and licensing technologies for clinical trials and product development, marking a shift from exploration to industrial application.

By Regional Analysis

North America remains the dominant region in the DNA nanotechnology market, driven by its robust research ecosystem, deep-pocketed investors, and early adoption of advanced technologies. The U.S. in particular hosts many of the world’s leading academic labs, biotech startups, and funding agencies engaged in DNA nanotech innovation. Institutions like MIT, Caltech, and Harvard have pioneered DNA origami and molecular robotics research. Government initiatives such as the National Nanotechnology Initiative and increased NIH funding for advanced diagnostics have further strengthened regional leadership.

Asia Pacific is the fastest growing region, owing to large-scale investments in nanotechnology research, favorable government policies, and a growing life sciences manufacturing base. Countries such as China, Japan, and South Korea are actively funding DNA nanotech research in areas like drug delivery and biosensing. China, in particular, is integrating DNA nanotech into its precision medicine strategy, while Japanese research groups are making breakthroughs in DNA computing and molecular electronics. The region’s expanding pharmaceutical sector and increasing collaboration with Western biotech firms are accelerating market development.

Some of The Prominent Players in The DNA nanotechnology market Include:

Recent Developments

-

March 2025 – Ginkgo Bioworks announced a partnership with a university consortium to develop DNA-based nanorobots for targeted intracellular drug delivery in oncology, with pilot testing planned by late 2025.

-

February 2025 – DNA Script received a $12 million grant from the European Commission to scale its DNA synthesis platform for use in DNA nanostructure fabrication and rapid prototyping.

-

December 2024 – Tilibit Nanosystems launched a new modular DNA origami kit for academic and commercial research, enabling rapid design and folding of user-defined 2D and 3D structures.

-

October 2024 – Nanosurf AG introduced an advanced AFM imaging solution optimized for DNA nanostructure visualization, enhancing structural analysis in nanomedicine research labs.

-

August 2024 – Harvard’s Wyss Institute published results of a DNA nanodevice capable of logic-gated therapeutic release in tumor models, opening new possibilities in smart drug delivery.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2035. For this study, Nova one advisor, Inc. has segmented the DNA nanotechnology market

Technology

- Dynamic DNA Nanotechnology

-

- Extended Lattices

- Discrete Structures

- Template Assembly

- Others

- Structural DNA Nanotechnology

-

- Nanomechanical Devices

- Strand Displacement Cascades

- Others

Application

- Drug Delivery Systems

- Diagnostics and Biosensing Development

- Material Science and Nanoassembly

- Others

End Use

- Academic & Research Institutions

- Biotechnology and Pharmaceuticals

- Others

Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)