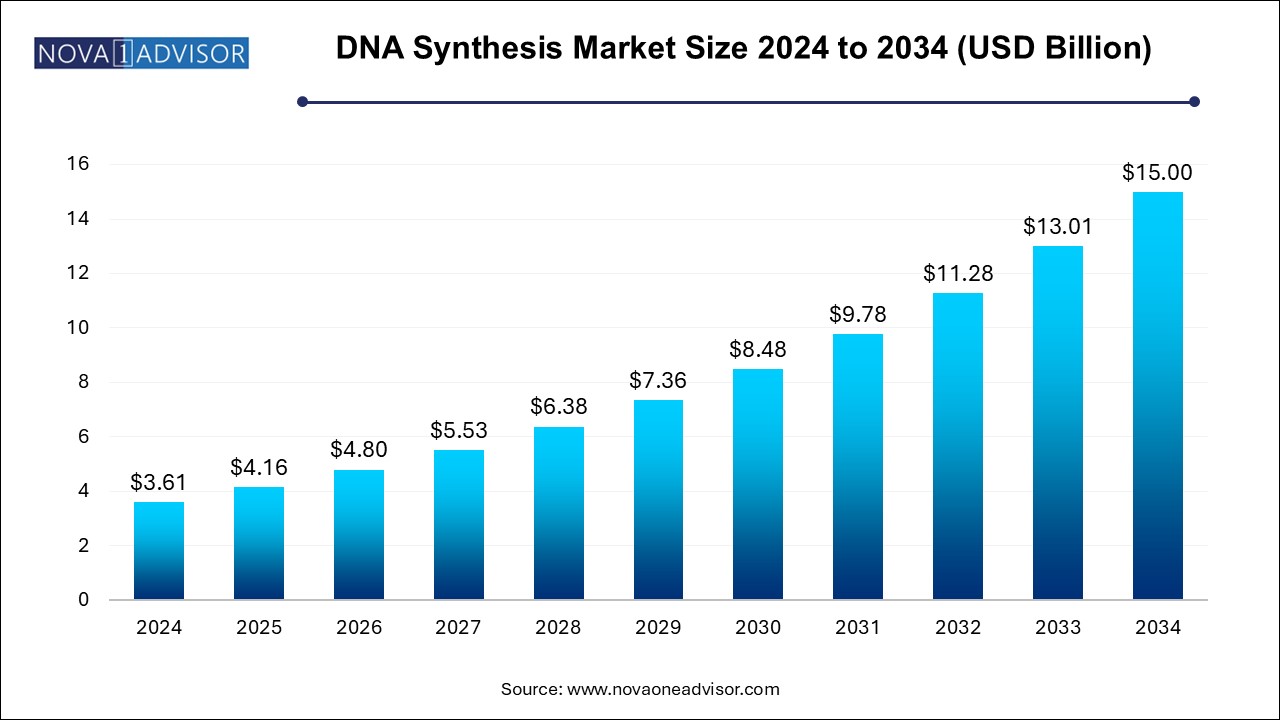

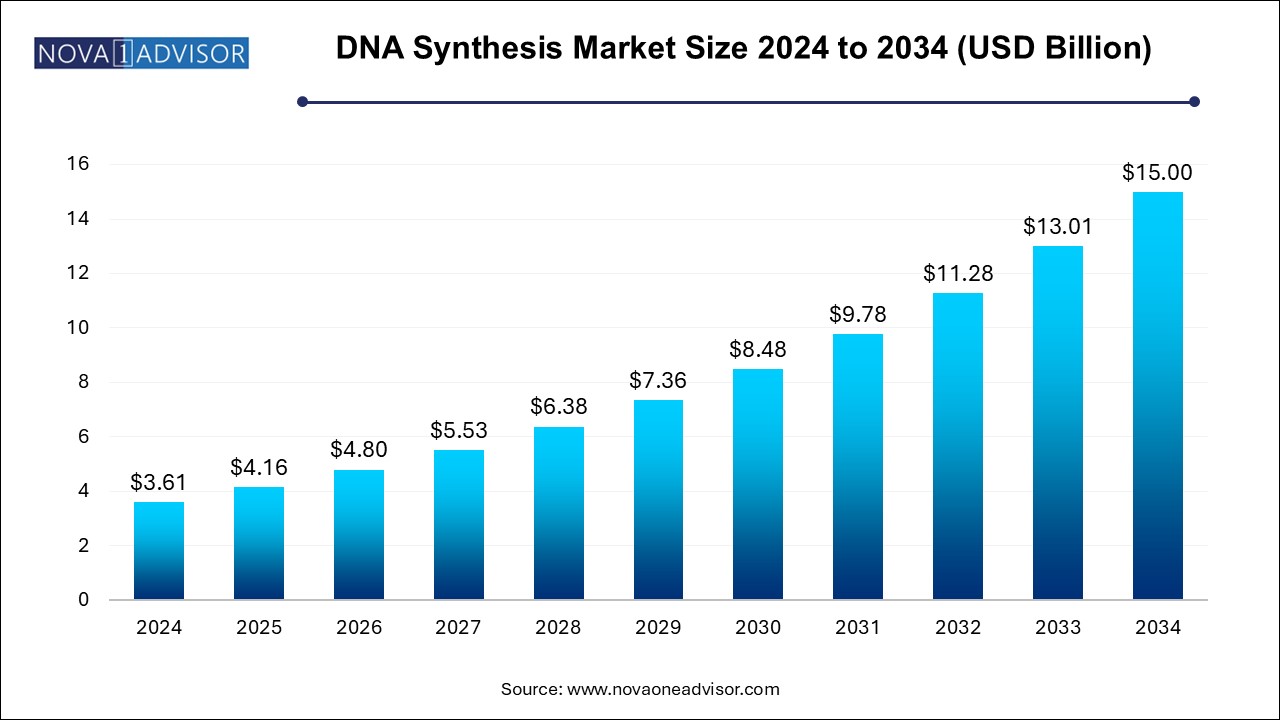

DNA Synthesis Market Size and Trends

The DNA synthesis market size was exhibited at USD 3.61 billion in 2024 and is projected to hit around USD 15.0 billion by 2034, growing at a CAGR of 15.31% during the forecast period 2025 to 2034.

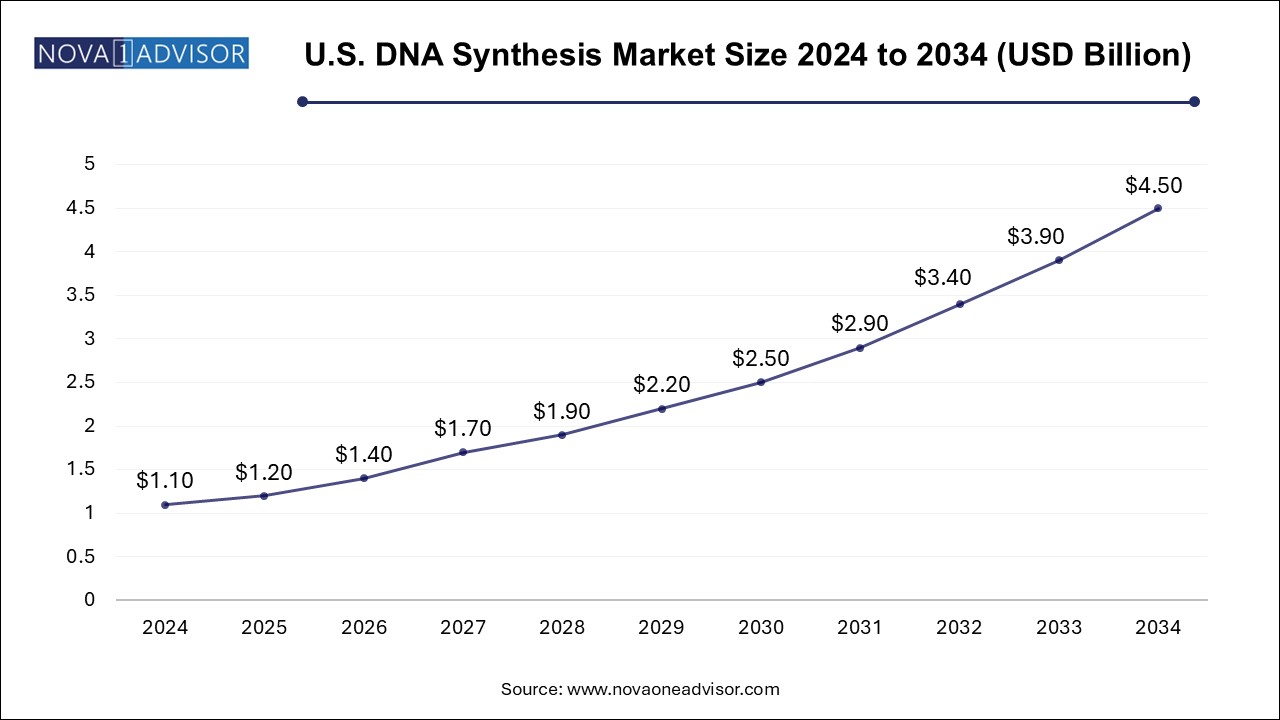

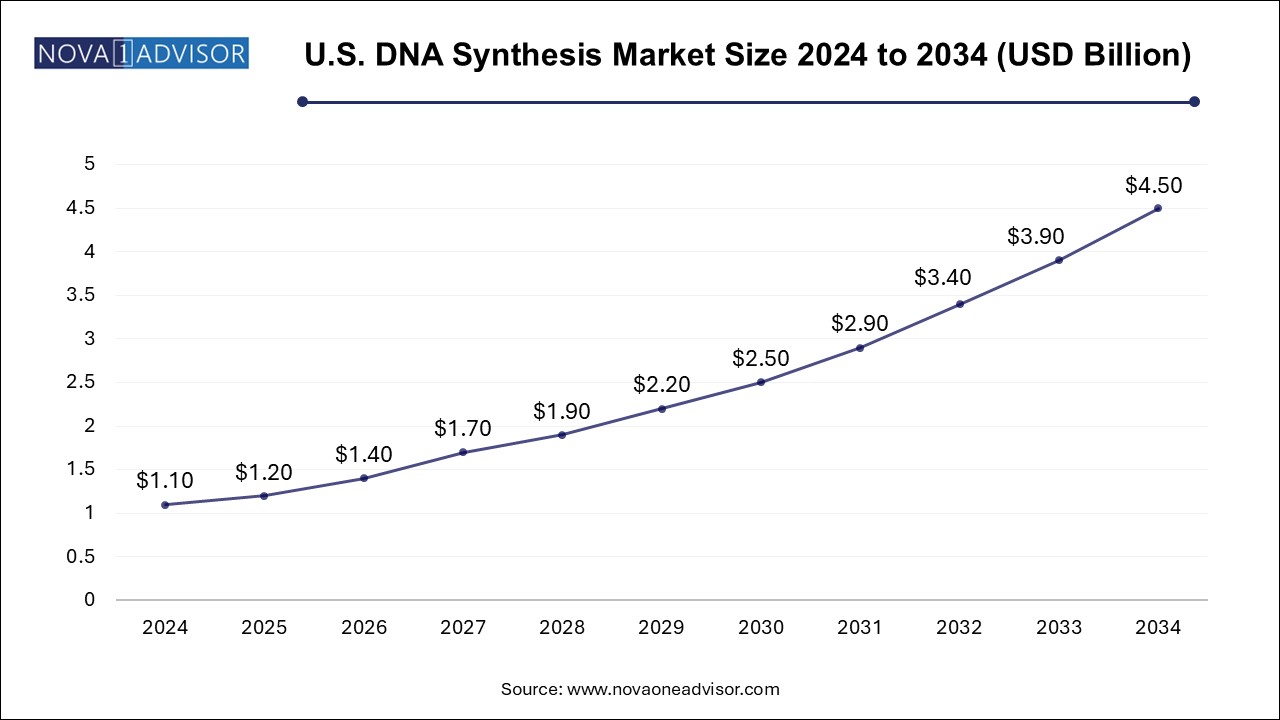

U.S. DNA synthesis market Size and Growth 2025 to 2034

The U.S. DNA synthesis market size is evaluated at USD 1.1 billion in 2024 and is projected to be worth around USD 4.5 billion by 2034, growing at a CAGR of 13.66% from 2025 to 2034.

North America leads the global DNA synthesis market, accounting for the largest revenue share in 2024. The region’s dominance is underpinned by the presence of major biotech hubs in the U.S., cutting-edge research institutions, favorable regulatory policies, and a well-established healthcare infrastructure. The strong concentration of top-tier companies—such as Thermo Fisher Scientific, Integrated DNA Technologies (IDT), and Twist Bioscience—further enhances the region’s leadership. Moreover, federal initiatives like the U.S. Synthetic Biology Roadmap and funding from the NIH and DARPA have bolstered public-private collaborations, particularly in biosecurity, synthetic vaccine development, and genomics research.

In contrast, Asia Pacific is the fastest-growing region, fueled by rising investments in life sciences, expanding biotech startups, and government-led initiatives for genomics and personalized medicine. Countries like China, South Korea, and India are investing heavily in building infrastructure for synthetic biology and molecular diagnostics. For example, China's focus on genetic innovation under its “Made in China 2025” strategy includes establishing domestic DNA synthesis capabilities. Additionally, cost-effective manufacturing and growing talent pools in the region are attracting outsourcing from global pharmaceutical companies, providing fertile ground for rapid market expansion.

Market Overview

The DNA synthesis market is emerging as a cornerstone of modern biotechnology, empowering critical applications in genomics, synthetic biology, diagnostics, therapeutics, and industrial biology. At its core, DNA synthesis involves the artificial creation of DNA sequences through chemical or enzymatic methods, enabling researchers and industries to design, replicate, and manipulate genetic material with extraordinary precision. From fundamental academic research to biopharmaceutical innovations, the use of synthesized DNA has become central to enabling next-generation solutions in healthcare, agriculture, and bioengineering.

The evolution of DNA synthesis technologies over the past decade has significantly accelerated the pace of innovation. Once restricted by technical complexity and prohibitive costs, DNA synthesis is now more accessible, accurate, and scalable. Companies offer a spectrum of synthesis services—from short oligonucleotides used in PCR and gene editing tools like CRISPR, to large-scale gene libraries used for industrial-scale synthetic biology and vaccine design. Custom synthesis services have become highly sought after, especially for complex and tailored research applications that require gene optimization, codon alterations, and sequence screening.

Additionally, the rise of personalized medicine, mRNA-based therapeutics, and precision agriculture are expanding the utility of synthesized DNA. The growing collaboration between academic institutions, contract research organizations (CROs), and biopharmaceutical companies has further stimulated demand. Moreover, synthetic biology ventures are driving interest in designing novel metabolic pathways and microbial factories for biofuels, enzymes, and other sustainable bioproducts.

In sum, the DNA synthesis market is characterized by high growth potential, continuous innovation, and broadening adoption across multiple sectors. With increasing automation, error-reduction techniques, and shorter lead times, the market is poised to transform how biological systems are engineered and leveraged.

Major Trends in the Market

-

Adoption of Enzymatic DNA Synthesis (EDS): EDS is gaining traction as a cleaner, faster, and more sustainable alternative to traditional phosphoramidite chemistry-based synthesis.

-

Boom in Synthetic Biology Startups: Venture capital investment in synthetic biology, particularly for bio-manufacturing and gene editing, has driven up demand for custom gene libraries and long DNA constructs.

-

Rising Use of DNA Synthesis in Vaccine Development: Especially after the success of mRNA vaccines for COVID-19, synthetic genes have become pivotal in rapid-response vaccine platforms.

-

Miniaturization and Automation of Synthesis Platforms: Integrated microfluidics and lab-on-a-chip devices are reducing costs and scaling DNA synthesis throughput.

-

Increased Demand for CRISPR Guide RNAs and Donor Templates: The expansion of genome editing in therapeutic and agricultural research is fueling synthesis of short and modified oligonucleotides.

-

Shift Toward Cloud-Based DNA Ordering and Bioinformatics Integration: Digital DNA design and synthesis platforms offer cloud-based gene optimization and order management.

-

Academic-Industry Collaborations: Universities and biotech firms are increasingly collaborating to co-develop DNA synthesis protocols and pipelines for translational applications.

Report Scope of DNA Synthesis Market

| Report Coverage |

Details |

| Market Size in 2025 |

USD 4.16 Billion |

| Market Size by 2034 |

USD 15.0 Billion |

| Growth Rate From 2025 to 2034 |

CAGR of 15.31% |

| Base Year |

2024 |

| Forecast Period |

2025-2034 |

| Segments Covered |

Service Type, Length, Application, End-use, Region |

| Market Analysis (Terms Used) |

Value (US$ Million/Billion) or (Volume/Units) |

| Regional scope |

North America; Europe; Asia Pacific; Latin America; MEA |

| Key Companies Profiled |

Thermo Fisher Scientific, Inc; Twist Bioscience; BIONEER CORPORATION; Eton Bioscience, Inc.; LGC Biosearch Technologies; IBA Lifesciences GmbH; Eurofins Scientific; Integrated DNA Technologies, Inc.; Quintara Biosciences; GenScript |

Key Market Driver: Rising Demand for Precision Medicine and Genetic Therapies

One of the most influential growth drivers of the DNA synthesis market is the surging demand for precision medicine, particularly in oncology, rare diseases, and inherited disorders. Synthesized DNA is a fundamental component in developing patient-specific diagnostics, biomarkers, and therapeutic solutions. In cancer care, for example, synthesized gene fragments are used to track tumor mutations and design targeted therapies based on a patient’s genomic profile.

This demand has escalated further with the advent of nucleic acid therapeutics such as antisense oligonucleotides, siRNA, and mRNA. Custom DNA synthesis services now provide tailored sequences for therapeutic development, enabling rapid prototyping of gene-based drug candidates. With FDA approvals increasing for gene therapies and the integration of genetic screening in clinical workflows, the need for high-fidelity, scalable DNA synthesis has become indispensable to the drug development pipeline.

Key Market Restraint: Technical Limitations and Error Rates in Long DNA Constructs

Despite technological advances, error-prone synthesis of long DNA sequences remains a key bottleneck in the market. While short oligonucleotides can be synthesized with high accuracy, extending this precision to sequences longer than 1500 nucleotides introduces challenges such as base misincorporation, truncation, and unwanted mutations. These errors necessitate additional steps like cloning, sequencing, and correction—thereby increasing time and cost.

The complexity is further exacerbated in applications like gene libraries, where sequence diversity must be precisely maintained. While enzymatic synthesis methods promise improvement, they are still under optimization and not yet as mature or commercially scalable as chemical synthesis. This technical limitation restricts wider use in industrial biomanufacturing and synthetic genome assembly, particularly for companies that depend on flawless sequence fidelity.

Key Market Opportunity: Expansion in Agricultural Biotechnology and Environmental Applications

As synthetic biology moves beyond medical applications, agricultural and environmental sectors offer immense untapped opportunities for the DNA synthesis market. Genetically modified crops designed through custom gene synthesis are being explored for enhanced yield, pest resistance, and climate resilience. Moreover, soil microbiomes are being engineered using synthetic DNA to improve nutrient absorption and drought tolerance.

Environmental applications include the use of genetically engineered microbes, created through synthesized gene clusters, to degrade plastic waste, capture carbon dioxide, and treat wastewater. These areas are poised for exponential growth as governments and environmental agencies adopt bio-based strategies to combat climate change. DNA synthesis vendors that can offer scalable, cost-efficient solutions for large gene libraries and pathway optimization stand to gain significantly in this evolving ecosystem.

DNA Synthesis Market By Service Type Insights

The Oligonucleotide synthesis dominated the DNA synthesis market in 2024, accounting for a large volume of applications in PCR, NGS, CRISPR, and diagnostics. These short DNA strands (typically <150 nucleotides) are indispensable tools in molecular biology workflows. Standard oligonucleotide synthesis, often delivered in bulk, meets the high-throughput needs of academic research labs and diagnostics companies. These are used daily in assays like RT-PCR, especially in infectious disease testing and cancer mutation profiling.

The fastest-growing segment, however, is custom gene synthesis, due to its critical role in vaccine design, synthetic biology, and cell line development. Custom gene synthesis allows clients to design de novo DNA sequences with optimal codon usage and regulatory elements tailored for specific host organisms. It supports complex research projects, including protein engineering and metabolic pathway construction. Companies such as GenScript and Twist Bioscience have expanded their offerings to include gene-to-protein services, further amplifying the appeal of this segment.

DNA Synthesis Market By End-use Insights

The Biopharmaceutical and diagnostics companies dominate the end-use landscape, as they are the primary drivers of innovation in personalized medicine, gene therapy, and companion diagnostics. These companies require high-quality, reproducible DNA synthesis services to support everything from early-stage drug discovery to commercial manufacturing. Synthesized DNA is integrated into cell lines, therapeutic plasmids, and diagnostic kits, all of which form the backbone of modern precision healthcare.

Meanwhile, contract research organizations (CROs) are witnessing the fastest growth due to their expanding role in outsourced biotech R&D. As pharmaceutical companies streamline internal operations, they increasingly rely on CROs for synthetic biology services, gene optimization, and custom construct synthesis. CROs also benefit from flexibility and faster turnaround times, making them attractive partners for early-stage startups and academic institutions lacking synthesis infrastructure.

DNA Synthesis Market By Length Insights

The Oligonucleotide synthesis of less than 50 nucleotides remains the most widely used length category, particularly due to its relevance in qPCR primers, CRISPR guide RNAs, and hybridization probes. These sequences are cost-effective and are often required in large volumes across repetitive experiments in research, diagnostics, and forensic applications.

On the other hand, the fastest-growing category is gene synthesis of more than 1500 nucleotides, driven by increasing demand for entire gene cassettes used in metabolic engineering, vaccine candidates, and therapeutic constructs. Long genes, sometimes exceeding 2500 nucleotides, are essential in constructing biosynthetic gene clusters for biomanufacturing or in generating chimeric antigen receptors (CARs) for immunotherapies. As synthesis fidelity and delivery timelines improve, this segment is expected to grow rapidly, supported by robust demand from synthetic biology startups and pharma R&D.

DNA Synthesis Market By Application Insights

Research and development applications currently dominate the DNA synthesis market, accounting for a significant share of oligonucleotide synthesis. Within this, PCR and CRISPR-based genome editing are primary consumers. PCR primers and guide RNAs are required in high volumes for genetic screening, cloning, and functional validation studies. These applications span academic research labs, pharmaceutical R&D, and biotech innovation hubs, reflecting the foundational role of DNA synthesis in genetic research.

However, therapeutics represents the fastest-growing application segment, driven by the growing pipeline of gene and nucleic acid-based therapies. RNAi and antisense oligonucleotide-based drugs are gaining regulatory approvals, while synthetic DNA is being used to produce therapeutic vectors and plasmids. Notably, several mRNA vaccines and DNA-based vaccine platforms, such as those used for COVID-19 and Zika virus, rely on synthesized genetic material for rapid deployment. With increased funding for gene therapy and advances in in vivo delivery technologies, this application segment is expected to expand at a significant CAGR.

Some of the prominent players in the DNA synthesis market include:

DNA Synthesis Market Recent Developments

-

In March 2025, Twist Bioscience launched its Twist Express Genes service, offering same-day shipping for high-fidelity custom gene synthesis, targeting synthetic biology startups and academic researchers.

-

GenScript announced in February 2025 the opening of its new gene synthesis production facility in Singapore, aiming to reduce lead times for customers across the Asia Pacific region.

-

Integrated DNA Technologies (IDT) introduced PrimeTime DNA Assembly kits in January 2025, designed for modular assembly of long genes and gene clusters with enhanced sequence accuracy.

-

In December 2024, Thermo Fisher Scientific entered into a partnership with biotech startup Arzeda to supply synthetic genes for industrial enzyme development, further expanding its presence in sustainable biomanufacturing.

-

Evonetix, a UK-based enzymatic synthesis technology innovator, raised $35 million in October 2024 to advance its desktop DNA printer for decentralized gene synthesis applications.

Segments Covered in the Report

This report forecasts revenue growth at country levels and provides an analysis of the latest industry trends in each of the sub-segments from 2021 to 2034. For this study, Nova one advisor, Inc. has segmented the DNA synthesis market

By Service Type

- Oligonucleotide Synthesis

-

- Standard Oligonucleotide Synthesis

- Custom Oligonucleotide Synthesis

-

- Custom Gene Synthesis

- Gene Library Synthesis

By Length

- Oligonucleotide Synthesis

-

- Less than 50 nt

- 51-100 nt

- 101-150 nt

- More than 150 nt

-

- Less than 500 nt

- 501-1000 nt

- 1001-1500 nt

- 1501-2000 nt

- 2001-2500 nt

- More than 2500 nt

By Application

-

- Oligonucleotide Synthesis

-

-

- PCR

- NGS

- CRISPR

- Cloning and Mutagenesis

- Others

-

-

- Synthetic Biology

- Vaccine Development

- Genetic Engineering

- Others

-

- RNAi Therapies

- Antisense Oligonucleotide-based Therapies

- Others

By End-use

- Biopharmaceutical and Diagnostics Companies

- Academic and Research Institutes

- Contract Research Organizations

By Regional

- North America

- Europe

- Asia Pacific

- Latin America

- Middle East and Africa (MEA)